Professional Documents

Culture Documents

Gold and Inflation

Gold and Inflation

Uploaded by

Rich GrossCopyright:

Available Formats

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- 3-20-12 Fed Liquidity: Good As GoldDocument4 pages3-20-12 Fed Liquidity: Good As GoldThe Gold SpeculatorNo ratings yet

- 8-22-11 Breakout in Precious MetalsDocument4 pages8-22-11 Breakout in Precious MetalsThe Gold SpeculatorNo ratings yet

- The Feds March MadnessDocument1 pageThe Feds March Madnessrichardck61No ratings yet

- Will Gold Continue To Shine?: MarketDocument6 pagesWill Gold Continue To Shine?: MarketdpbasicNo ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Outlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Document16 pagesOutlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Khalid S. AlyahmadiNo ratings yet

- All That Glitters... The Financial Market Implications of Competitive DevaluationDocument12 pagesAll That Glitters... The Financial Market Implications of Competitive DevaluationJohn ButlerNo ratings yet

- ETFS Outlook September 2016 - in Sync Gold and The USDDocument3 pagesETFS Outlook September 2016 - in Sync Gold and The USDAnonymous Ht0MIJNo ratings yet

- 5 ThingsDocument8 pages5 Thingsmetal312100% (2)

- Us Interest RatesDocument3 pagesUs Interest Ratesapi-301070912No ratings yet

- Review & Focus: The Currencies at A GlanceDocument4 pagesReview & Focus: The Currencies at A GlanceSanjay SilwadiyaNo ratings yet

- Handout UTBP - LUMS Sep'10Document13 pagesHandout UTBP - LUMS Sep'10ahmad_shahzadNo ratings yet

- Exchange Rate DeterminationDocument2 pagesExchange Rate DeterminationafniNo ratings yet

- Why Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyDocument5 pagesWhy Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyAREPALLY NAVEEN KUMARNo ratings yet

- Impact of Fed Rate Hike: On Emerging EconomiesDocument11 pagesImpact of Fed Rate Hike: On Emerging EconomiesPrateek TaoriNo ratings yet

- Kimberly Amadeo: Money SupplyDocument3 pagesKimberly Amadeo: Money SupplytawandaNo ratings yet

- 1-23-12 More QE On The WayDocument3 pages1-23-12 More QE On The WayThe Gold SpeculatorNo ratings yet

- VBDDocument10 pagesVBDLuvuyo MemelaNo ratings yet

- Currency Moves & Central Bank PolicyDocument21 pagesCurrency Moves & Central Bank PolicyPablo OrellanaNo ratings yet

- Currency WarDocument8 pagesCurrency WarrahulNo ratings yet

- AssetClasses 2018Document3 pagesAssetClasses 2018Ankur ShardaNo ratings yet

- Will It Work? MaybeDocument13 pagesWill It Work? MayberiteshvijhNo ratings yet

- Currencies - Seven Charts You Should SeeDocument7 pagesCurrencies - Seven Charts You Should SeePete DonnesNo ratings yet

- Bob Chapman Crisis of Fiat Currencies US Dollar Surpluses Converted Into Gold 22 11 10Document4 pagesBob Chapman Crisis of Fiat Currencies US Dollar Surpluses Converted Into Gold 22 11 10sankaratNo ratings yet

- Economics Report: Us Currency Valuation Against Other CurrenciesDocument16 pagesEconomics Report: Us Currency Valuation Against Other CurrenciesKumar SunnyNo ratings yet

- U.S. Monetary Policy and The Path To Normalization: James BullardDocument29 pagesU.S. Monetary Policy and The Path To Normalization: James Bullardrichardck61No ratings yet

- Market OutlookDocument12 pagesMarket Outlookwaseem1986No ratings yet

- Flash Crash - Gold, Silver & BondsDocument9 pagesFlash Crash - Gold, Silver & BondsQ0pazNo ratings yet

- US Dollar vs. Euro: Research ProjectDocument6 pagesUS Dollar vs. Euro: Research ProjectJust_denverNo ratings yet

- When Will China's Bubble Burst Andy Xie - Former Chief Asia Economist - Morgan StanleyDocument2 pagesWhen Will China's Bubble Burst Andy Xie - Former Chief Asia Economist - Morgan StanleyteslaaaNo ratings yet

- Analyze Trend of Rupee VS DollarDocument7 pagesAnalyze Trend of Rupee VS DollardeomathewsNo ratings yet

- (Uts Macroeconomics II) Depreciation of Indonesian Rupiah To Us DollarDocument7 pages(Uts Macroeconomics II) Depreciation of Indonesian Rupiah To Us DollardayangNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Economics 101Document19 pagesEconomics 101tawhid anamNo ratings yet

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61No ratings yet

- Pre Draft Gold SolutionDocument6 pagesPre Draft Gold Solutionapi-232344608No ratings yet

- 2012-06-04 LPL CommentaryDocument3 pages2012-06-04 LPL CommentarybgeltmakerNo ratings yet

- TSW Journal Nov-Dec 2010Document16 pagesTSW Journal Nov-Dec 2010SchoolofWashingtonNo ratings yet

- Depreciation of Rupee-ModifiedDocument16 pagesDepreciation of Rupee-ModifiedmonoramNo ratings yet

- Dollar Collapse InevitableDocument6 pagesDollar Collapse InevitablesmcjgNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- Running Head: Reminbi Peg and Its Impact On World TradeDocument11 pagesRunning Head: Reminbi Peg and Its Impact On World TraderjbrowneiiiNo ratings yet

- Munich Presentation 2013Document48 pagesMunich Presentation 2013weissincNo ratings yet

- 4.0 Setting ER & Factors Effecting ERDocument7 pages4.0 Setting ER & Factors Effecting ERMuhammad SeyamNo ratings yet

- Global Money Notes #30: SingularityDocument18 pagesGlobal Money Notes #30: Singularitymike liangNo ratings yet

- BD21096 Assignment 7Document5 pagesBD21096 Assignment 7Shubham TapadiyaNo ratings yet

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalNo ratings yet

- Questioning USD As Global Reserve CurrencyDocument8 pagesQuestioning USD As Global Reserve CurrencyVincentiusArnoldNo ratings yet

- Why We Need A Stable Currency and Financial Standard (D Popa)Document2 pagesWhy We Need A Stable Currency and Financial Standard (D Popa)Ping LiNo ratings yet

- Prof. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeDocument8 pagesProf. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeThavam RatnaNo ratings yet

- Newly Observed Financial WordsDocument5 pagesNewly Observed Financial WordsProkash MondalNo ratings yet

- What IsDocument2 pagesWhat IsKhan Erum AfreenNo ratings yet

- "Essentials of Baking and Finance ": US Dollar & Crude OilDocument9 pages"Essentials of Baking and Finance ": US Dollar & Crude Oilejaz_balti_1No ratings yet

- FTCOM Articles Oct11Document15 pagesFTCOM Articles Oct11Jody BuiNo ratings yet

- Report On PesoDocument10 pagesReport On PesoAerish RioverosNo ratings yet

- Scotia Mocatta - Gold 2012 Forecast 11-01-11Document13 pagesScotia Mocatta - Gold 2012 Forecast 11-01-11Bullwinkle2No ratings yet

- Asset Allocation: Fall 2010: Olume CtoberDocument30 pagesAsset Allocation: Fall 2010: Olume Ctoberrichardck50No ratings yet

- Chetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Document5 pagesChetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Karthik SoundarajanNo ratings yet

- Pheasant Tail Tutorial - ManualDocument17 pagesPheasant Tail Tutorial - ManualGabriel I Askew100% (1)

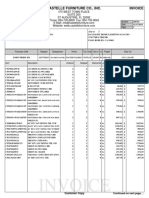

- Invoice: Castelle Furniture Co., Inc. InvoiceDocument4 pagesInvoice: Castelle Furniture Co., Inc. InvoiceNathaly LeivaNo ratings yet

- Ila Prakash Mehta 5062771-2Document35 pagesIla Prakash Mehta 5062771-2Aditya MehtaNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument26 pagesMacroeconomics 12th Edition Michael Parkin Solutions ManualDanielCarterrdcz100% (56)

- Struktur Organisasi BTN KCS Makassar TMT Januari 2022Document1 pageStruktur Organisasi BTN KCS Makassar TMT Januari 2022sriwahyuningsih7656No ratings yet

- Arid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherDocument9 pagesArid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherNoor MughalNo ratings yet

- Alltro Resume (2) FDocument2 pagesAlltro Resume (2) FYogendra Prawin KumarNo ratings yet

- 07pa Aa 3 2 PDFDocument6 pages07pa Aa 3 2 PDFMarcelo Varejão CasarinNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13th EditionDocument6 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13th EditionJamesJohnsonqxcej100% (28)

- Door - Wilcon Depot IncDocument3 pagesDoor - Wilcon Depot IncSofiaJabadanEspulgarNo ratings yet

- MGT 303: Operations Management Problems, Activites, and DiscussionsDocument4 pagesMGT 303: Operations Management Problems, Activites, and DiscussionsKim HyunaNo ratings yet

- Malala Yosafzai: A Young Education Activist Form PakistanDocument3 pagesMalala Yosafzai: A Young Education Activist Form PakistanHumberto Valeriano100% (1)

- Construction Assign 3Document14 pagesConstruction Assign 3Sharjeel AliNo ratings yet

- Teks Moderator TVD 4 Nov 2022Document2 pagesTeks Moderator TVD 4 Nov 2022Aditya NugrohoNo ratings yet

- 03.00 - Welding Tables With Rotating Function enDocument1 page03.00 - Welding Tables With Rotating Function enMeisam Hosseinpour LahiciNo ratings yet

- Assignment 4Document3 pagesAssignment 4Ravi KumarNo ratings yet

- Bain D'huil DelonghiDocument90 pagesBain D'huil DelonghiBELHAJ YosriNo ratings yet

- Exclusive 3 BHK: Kokapet - HyderabadDocument17 pagesExclusive 3 BHK: Kokapet - HyderabadSubhaani ShaikNo ratings yet

- AP Macro WorkbookDocument346 pagesAP Macro WorkbookLynn Hollenbeck Breindel100% (5)

- Atlas Copco India LTD.: Gas Process ApplicationDocument4 pagesAtlas Copco India LTD.: Gas Process ApplicationAmit SurtiNo ratings yet

- General Ledger ListingDocument1 pageGeneral Ledger ListingNursyakira HasmiezaNo ratings yet

- Companies 3 PDF FreeDocument11 pagesCompanies 3 PDF Free2020dlb121685No ratings yet

- The Role of The Service Sector in The Indian Economy: Dr.D.AmuthaDocument10 pagesThe Role of The Service Sector in The Indian Economy: Dr.D.AmuthaHitesh ManglaniNo ratings yet

- Pressure Welded Steel GratingsDocument1 pagePressure Welded Steel GratingsMD Abu Bakar SiddiqueNo ratings yet

- Prac2 1Document17 pagesPrac2 1Joana Marie SaperaNo ratings yet

- Schindler 3300 XL MRL Elevator BrochureDocument20 pagesSchindler 3300 XL MRL Elevator Brochureعلي جعبريNo ratings yet

- Module 9 Part 3 - Joint Cost and By-Products Sample ProblemsDocument28 pagesModule 9 Part 3 - Joint Cost and By-Products Sample ProblemsMarjorie NepomucenoNo ratings yet

- Choke and Kill Armor CK XX Armor CK Xx10k Armor QaDocument1 pageChoke and Kill Armor CK XX Armor CK Xx10k Armor Qaclaudio godinezNo ratings yet

Gold and Inflation

Gold and Inflation

Uploaded by

Rich GrossOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold and Inflation

Gold and Inflation

Uploaded by

Rich GrossCopyright:

Available Formats

Monday Morning Outlook

Fed Ignores Gold, Targets Higher Inflation, and Plays With Fire To view this article, Click Here

Brian S. Wesbury - Chief Economist

Robert Stein, CFA - Senior Economist

Date: 10/18/2010

In the early 1900s, economist Irving Fisher proposed a commodity rule to guide monetary policy. His idea was to create a stable

value for the dollar by using monetary policy to keep a basket of commodity prices stable.

Maintaining a stable value for money is one of the most important tasks a government has. Cost overruns are commonplace

during inflationary times. And someone who invests millions to produce a good in one country, expecting to export it to

another, can see all his plans ruined because currency values change.

Many have followed in Fisher’s footsteps. Jack Kemp, Jude Wanniski, and the reliably-thoughtful Steve Forbes have proposed

targeting the price of gold. Senator Connie Mack pushed a proposal to focus exclusively on price stability (using multiple

signals like the dollar, CPI, gold, and other commodities). But the Federal Reserve resisted all of these ideas…every last one of

them.

Now the Fed is considering a price target that would generate higher inflation. In recent communiqués and speeches, the Fed

has let it be known that it wants to target an inflation rate of 2%. According to the London Financial Times, Chicago Fed

President Charles Evans backs a plan in which “the Fed would promise to generate enough extra inflation to make the price

level the same as if prices had risen by 2 percent a year since December 2007, which was the peak of the last business cycle

according to the NBER. As soon as the Fed reached that goal it would abandon the price level target and go back to targeting

inflation of about 2 percent a year.”

So after years of resisting a target of stable prices, the Fed is now promoting actual inflation. Part of this is because the Fed

thinks the economy is in trouble. The Fed has expanded its balance sheet by $1.4 trillion and yet the money supply and bank

assets are not rising apace. At the same time, the Fed and most politicians want faster economic growth.

Unfortunately, the Fed is myopic when it comes to the economy. It only sees money, when there are other things going on. The

Fed is pumping money in with one hand, while the banking regulators are raising capital standards and marking assets down in

value with the other. At the same time, government spending and regulation is retarding growth, which offsets the impact of

easy money.

Nonetheless, many economic indicators show Fed policy is having an impact. Nominal GDP is rising again, up 3.9% in the past

year and 4.3% at an annual rate in the past two quarters. Gold and other commodity prices are up substantially, while the value

of the dollar has fallen sharply. The models of Fisher, Forbes, Mack, Kemp, and Wanniski are all screaming – “stop, enough

already!” And, the First Trust model of using nominal GDP as a target for the federal funds rate is suggesting that a zero percent

interest rate is too low.

If the Fed would have listened to gold (or the nominal GDP model) over the past 15 years, the US would probably not be in the

mess it is in today. Gold prices fell from $400 per ounce to $255 an ounce between 1996 and 1999. This signaled deflation, but

the Fed chose to ignore the signal and raised interest rates anyway in 1998 and 1999. Deflation, recession and a stock market

crash were the result.

In the wake of the stock market crash, the Fed started cutting rates because it feared deflation. Gold started to rise and by late

2003 it was back above $400/oz. But the Fed held rates at 1% anyway, which created a housing bubble. When that bubble burst,

the Fed started cutting rates again and gold prices have now moved to more than $1300/oz. At this point, one would think the

Fed would pause before pumping even more money into the system and targeting higher inflation.

But it isn’t. The Fed continues to hold interest rates at zero, proposes another round of “quantitative easing” and plans to target

2% inflation. All because it won’t listen to gold and it’s unable to see that banks are afraid to use the money the Fed is pumping

in because, down the road, the Fed will be forced to take it out or face serious inflation.

That’s what gold is saying. By signaling that it won’t quit anytime soon, the Fed is trying to force banks to change their

behavior. If it works, look out for inflation to reach multiples of 2% in the years ahead. The Fed hasn’t been successful yet,

when it ignores gold and commodity prices.

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- 3-20-12 Fed Liquidity: Good As GoldDocument4 pages3-20-12 Fed Liquidity: Good As GoldThe Gold SpeculatorNo ratings yet

- 8-22-11 Breakout in Precious MetalsDocument4 pages8-22-11 Breakout in Precious MetalsThe Gold SpeculatorNo ratings yet

- The Feds March MadnessDocument1 pageThe Feds March Madnessrichardck61No ratings yet

- Will Gold Continue To Shine?: MarketDocument6 pagesWill Gold Continue To Shine?: MarketdpbasicNo ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Outlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Document16 pagesOutlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Khalid S. AlyahmadiNo ratings yet

- All That Glitters... The Financial Market Implications of Competitive DevaluationDocument12 pagesAll That Glitters... The Financial Market Implications of Competitive DevaluationJohn ButlerNo ratings yet

- ETFS Outlook September 2016 - in Sync Gold and The USDDocument3 pagesETFS Outlook September 2016 - in Sync Gold and The USDAnonymous Ht0MIJNo ratings yet

- 5 ThingsDocument8 pages5 Thingsmetal312100% (2)

- Us Interest RatesDocument3 pagesUs Interest Ratesapi-301070912No ratings yet

- Review & Focus: The Currencies at A GlanceDocument4 pagesReview & Focus: The Currencies at A GlanceSanjay SilwadiyaNo ratings yet

- Handout UTBP - LUMS Sep'10Document13 pagesHandout UTBP - LUMS Sep'10ahmad_shahzadNo ratings yet

- Exchange Rate DeterminationDocument2 pagesExchange Rate DeterminationafniNo ratings yet

- Why Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyDocument5 pagesWhy Stagflation (Probably) Won't Reoccur: Economic Growth Inflation Demand Market EconomyAREPALLY NAVEEN KUMARNo ratings yet

- Impact of Fed Rate Hike: On Emerging EconomiesDocument11 pagesImpact of Fed Rate Hike: On Emerging EconomiesPrateek TaoriNo ratings yet

- Kimberly Amadeo: Money SupplyDocument3 pagesKimberly Amadeo: Money SupplytawandaNo ratings yet

- 1-23-12 More QE On The WayDocument3 pages1-23-12 More QE On The WayThe Gold SpeculatorNo ratings yet

- VBDDocument10 pagesVBDLuvuyo MemelaNo ratings yet

- Currency Moves & Central Bank PolicyDocument21 pagesCurrency Moves & Central Bank PolicyPablo OrellanaNo ratings yet

- Currency WarDocument8 pagesCurrency WarrahulNo ratings yet

- AssetClasses 2018Document3 pagesAssetClasses 2018Ankur ShardaNo ratings yet

- Will It Work? MaybeDocument13 pagesWill It Work? MayberiteshvijhNo ratings yet

- Currencies - Seven Charts You Should SeeDocument7 pagesCurrencies - Seven Charts You Should SeePete DonnesNo ratings yet

- Bob Chapman Crisis of Fiat Currencies US Dollar Surpluses Converted Into Gold 22 11 10Document4 pagesBob Chapman Crisis of Fiat Currencies US Dollar Surpluses Converted Into Gold 22 11 10sankaratNo ratings yet

- Economics Report: Us Currency Valuation Against Other CurrenciesDocument16 pagesEconomics Report: Us Currency Valuation Against Other CurrenciesKumar SunnyNo ratings yet

- U.S. Monetary Policy and The Path To Normalization: James BullardDocument29 pagesU.S. Monetary Policy and The Path To Normalization: James Bullardrichardck61No ratings yet

- Market OutlookDocument12 pagesMarket Outlookwaseem1986No ratings yet

- Flash Crash - Gold, Silver & BondsDocument9 pagesFlash Crash - Gold, Silver & BondsQ0pazNo ratings yet

- US Dollar vs. Euro: Research ProjectDocument6 pagesUS Dollar vs. Euro: Research ProjectJust_denverNo ratings yet

- When Will China's Bubble Burst Andy Xie - Former Chief Asia Economist - Morgan StanleyDocument2 pagesWhen Will China's Bubble Burst Andy Xie - Former Chief Asia Economist - Morgan StanleyteslaaaNo ratings yet

- Analyze Trend of Rupee VS DollarDocument7 pagesAnalyze Trend of Rupee VS DollardeomathewsNo ratings yet

- (Uts Macroeconomics II) Depreciation of Indonesian Rupiah To Us DollarDocument7 pages(Uts Macroeconomics II) Depreciation of Indonesian Rupiah To Us DollardayangNo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Economics 101Document19 pagesEconomics 101tawhid anamNo ratings yet

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61No ratings yet

- Pre Draft Gold SolutionDocument6 pagesPre Draft Gold Solutionapi-232344608No ratings yet

- 2012-06-04 LPL CommentaryDocument3 pages2012-06-04 LPL CommentarybgeltmakerNo ratings yet

- TSW Journal Nov-Dec 2010Document16 pagesTSW Journal Nov-Dec 2010SchoolofWashingtonNo ratings yet

- Depreciation of Rupee-ModifiedDocument16 pagesDepreciation of Rupee-ModifiedmonoramNo ratings yet

- Dollar Collapse InevitableDocument6 pagesDollar Collapse InevitablesmcjgNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- Running Head: Reminbi Peg and Its Impact On World TradeDocument11 pagesRunning Head: Reminbi Peg and Its Impact On World TraderjbrowneiiiNo ratings yet

- Munich Presentation 2013Document48 pagesMunich Presentation 2013weissincNo ratings yet

- 4.0 Setting ER & Factors Effecting ERDocument7 pages4.0 Setting ER & Factors Effecting ERMuhammad SeyamNo ratings yet

- Global Money Notes #30: SingularityDocument18 pagesGlobal Money Notes #30: Singularitymike liangNo ratings yet

- BD21096 Assignment 7Document5 pagesBD21096 Assignment 7Shubham TapadiyaNo ratings yet

- The Dollar Milkshake TheoryDocument2 pagesThe Dollar Milkshake TheoryHarushika MittalNo ratings yet

- Questioning USD As Global Reserve CurrencyDocument8 pagesQuestioning USD As Global Reserve CurrencyVincentiusArnoldNo ratings yet

- Why We Need A Stable Currency and Financial Standard (D Popa)Document2 pagesWhy We Need A Stable Currency and Financial Standard (D Popa)Ping LiNo ratings yet

- Prof. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeDocument8 pagesProf. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeThavam RatnaNo ratings yet

- Newly Observed Financial WordsDocument5 pagesNewly Observed Financial WordsProkash MondalNo ratings yet

- What IsDocument2 pagesWhat IsKhan Erum AfreenNo ratings yet

- "Essentials of Baking and Finance ": US Dollar & Crude OilDocument9 pages"Essentials of Baking and Finance ": US Dollar & Crude Oilejaz_balti_1No ratings yet

- FTCOM Articles Oct11Document15 pagesFTCOM Articles Oct11Jody BuiNo ratings yet

- Report On PesoDocument10 pagesReport On PesoAerish RioverosNo ratings yet

- Scotia Mocatta - Gold 2012 Forecast 11-01-11Document13 pagesScotia Mocatta - Gold 2012 Forecast 11-01-11Bullwinkle2No ratings yet

- Asset Allocation: Fall 2010: Olume CtoberDocument30 pagesAsset Allocation: Fall 2010: Olume Ctoberrichardck50No ratings yet

- Chetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Document5 pagesChetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Karthik SoundarajanNo ratings yet

- Pheasant Tail Tutorial - ManualDocument17 pagesPheasant Tail Tutorial - ManualGabriel I Askew100% (1)

- Invoice: Castelle Furniture Co., Inc. InvoiceDocument4 pagesInvoice: Castelle Furniture Co., Inc. InvoiceNathaly LeivaNo ratings yet

- Ila Prakash Mehta 5062771-2Document35 pagesIla Prakash Mehta 5062771-2Aditya MehtaNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument26 pagesMacroeconomics 12th Edition Michael Parkin Solutions ManualDanielCarterrdcz100% (56)

- Struktur Organisasi BTN KCS Makassar TMT Januari 2022Document1 pageStruktur Organisasi BTN KCS Makassar TMT Januari 2022sriwahyuningsih7656No ratings yet

- Arid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherDocument9 pagesArid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherNoor MughalNo ratings yet

- Alltro Resume (2) FDocument2 pagesAlltro Resume (2) FYogendra Prawin KumarNo ratings yet

- 07pa Aa 3 2 PDFDocument6 pages07pa Aa 3 2 PDFMarcelo Varejão CasarinNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13th EditionDocument6 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13th EditionJamesJohnsonqxcej100% (28)

- Door - Wilcon Depot IncDocument3 pagesDoor - Wilcon Depot IncSofiaJabadanEspulgarNo ratings yet

- MGT 303: Operations Management Problems, Activites, and DiscussionsDocument4 pagesMGT 303: Operations Management Problems, Activites, and DiscussionsKim HyunaNo ratings yet

- Malala Yosafzai: A Young Education Activist Form PakistanDocument3 pagesMalala Yosafzai: A Young Education Activist Form PakistanHumberto Valeriano100% (1)

- Construction Assign 3Document14 pagesConstruction Assign 3Sharjeel AliNo ratings yet

- Teks Moderator TVD 4 Nov 2022Document2 pagesTeks Moderator TVD 4 Nov 2022Aditya NugrohoNo ratings yet

- 03.00 - Welding Tables With Rotating Function enDocument1 page03.00 - Welding Tables With Rotating Function enMeisam Hosseinpour LahiciNo ratings yet

- Assignment 4Document3 pagesAssignment 4Ravi KumarNo ratings yet

- Bain D'huil DelonghiDocument90 pagesBain D'huil DelonghiBELHAJ YosriNo ratings yet

- Exclusive 3 BHK: Kokapet - HyderabadDocument17 pagesExclusive 3 BHK: Kokapet - HyderabadSubhaani ShaikNo ratings yet

- AP Macro WorkbookDocument346 pagesAP Macro WorkbookLynn Hollenbeck Breindel100% (5)

- Atlas Copco India LTD.: Gas Process ApplicationDocument4 pagesAtlas Copco India LTD.: Gas Process ApplicationAmit SurtiNo ratings yet

- General Ledger ListingDocument1 pageGeneral Ledger ListingNursyakira HasmiezaNo ratings yet

- Companies 3 PDF FreeDocument11 pagesCompanies 3 PDF Free2020dlb121685No ratings yet

- The Role of The Service Sector in The Indian Economy: Dr.D.AmuthaDocument10 pagesThe Role of The Service Sector in The Indian Economy: Dr.D.AmuthaHitesh ManglaniNo ratings yet

- Pressure Welded Steel GratingsDocument1 pagePressure Welded Steel GratingsMD Abu Bakar SiddiqueNo ratings yet

- Prac2 1Document17 pagesPrac2 1Joana Marie SaperaNo ratings yet

- Schindler 3300 XL MRL Elevator BrochureDocument20 pagesSchindler 3300 XL MRL Elevator Brochureعلي جعبريNo ratings yet

- Module 9 Part 3 - Joint Cost and By-Products Sample ProblemsDocument28 pagesModule 9 Part 3 - Joint Cost and By-Products Sample ProblemsMarjorie NepomucenoNo ratings yet

- Choke and Kill Armor CK XX Armor CK Xx10k Armor QaDocument1 pageChoke and Kill Armor CK XX Armor CK Xx10k Armor Qaclaudio godinezNo ratings yet