Professional Documents

Culture Documents

Tax Invoice Inter State

Tax Invoice Inter State

Uploaded by

Dazzling RajputOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Invoice Inter State

Tax Invoice Inter State

Uploaded by

Dazzling RajputCopyright:

Available Formats

Company Name

Company Company Address Line 1 Original for

Logo Company Address Line 1 Receipient

Mobile or Telephone

GSTIN: 26PANCARDNO1Z5

Tax Invoice

Invoice No: Transport Mode:

Invoice date: Vehicle number:

Reverse Charge (Y/N): N Date of Supply:

State: Code Place of Supply

Bill to Party Ship to Party

Name: Name:

Address: Address:

GSTIN: GSTIN:

State: Code State: Code

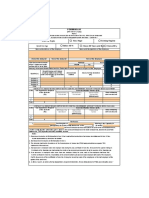

S. IGST

HSN

No Product Description Code Qty Rate Amount Discou

nt Taxable valueRate Amount Total

.

1000 170 170000 0 170000 18 30600 200600

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

Total 1000 170000 0 170000 30600 200600

Total Invoice amount in words Total Amount before Tax 170000

Add: IGST 30600

Total Amount after Tax: 200600

Bank Details GST on Reverse Charge 0

Bank A/C: Ceritified that the particulars given above are true and correct

Bank IFSC: For Company Name

Terms & conditions

Common Seal Authorised signatory

Company Company Name Duplicate for

Logo Company Address Line 1 Transporter

Company Address Line 1

Mobile or Telephone

GSTIN: 26PANCARDNO1Z5

Tax Invoice

Invoice No: Transport Mode:

Invoice date: Vehicle number:

Reverse Charge (Y/N): N Date of Supply:

State: Code Place of Supply

Bill to Party Ship to Party

Name: Name:

Address: Address:

GSTIN: GSTIN:

State: Code State: Code

S. IGST

No Product Description HSN Qty Amount Discou

Rate Taxable value Total

Code nt Rate Amount

.

5 5000 25000 2000 23000 18 4140 27140

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

Total 5 25000 2000 23000 4140 27140

Total Invoice amount in words Total Amount before Tax 23000

Add: IGST 4140

Total Amount after Tax: 27140

Bank Details GST on Reverse Charge 0

Bank A/C: Ceritified that the particulars given above are true and correct

Bank IFSC: For Company Name

Terms & conditions

Common Seal Authorised signatory

Company Triplicate for

Logo Company Name Supplier

Company Address Line 1

Company Address Line 1

Mobile or Telephone

GSTIN: 26PANCARDNO1Z5

Tax Invoice

Invoice No: Transport Mode:

Invoice date: Vehicle number:

Reverse Charge (Y/N): N Date of Supply:

State: Code Place of Supply

Bill to Party Ship to Party

Name: Name:

Address: Address:

GSTIN: GSTIN:

State: Code State: Code

S. IGST

HSN

No Product Description Code Qty Rate Amount Discou

nt Taxable valueRate Amount Total

.

5 5000 25000 2000 23000 18 4140 27140

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

0 0 0 0

Total 5 25000 2000 23000 4140 27140

Total Invoice amount in words Total Amount before Tax 23000

Add: IGST 4140

Total Amount after Tax: 27140

Bank Details GST on Reverse Charge 0

Bank A/C: Ceritified that the particulars given above are true and correct

Bank IFSC: For Company Name

Terms & conditions

Common Seal Authorised signatory

You might also like

- BMI-Africa IRS EIN #Document3 pagesBMI-Africa IRS EIN #Joseph VillarosaNo ratings yet

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

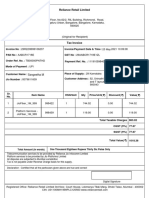

- Reliance Retail Limited: Sangeetha MDocument3 pagesReliance Retail Limited: Sangeetha MHariharan RNo ratings yet

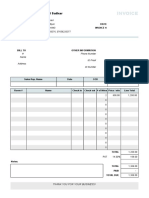

- Free Proforma Invoice TemplateDocument1 pageFree Proforma Invoice TemplateFausto FloresNo ratings yet

- Hotel Bill FormatDocument1 pageHotel Bill Formatabhimanyu mishraNo ratings yet

- Clothing Store Invoice TemplateDocument1 pageClothing Store Invoice TemplateJoby ThomasNo ratings yet

- Cost Estimating Manual for Pipelines and Marine Structures: New Printing 1999From EverandCost Estimating Manual for Pipelines and Marine Structures: New Printing 1999Rating: 5 out of 5 stars5/5 (2)

- Tax Invoice Inter StateDocument4 pagesTax Invoice Inter Statereavanth rathinasamyNo ratings yet

- My Tax 1Document3 pagesMy Tax 1Adi Lakshmi GattiNo ratings yet

- RCM FormatDocument3 pagesRCM FormatjsphdvdNo ratings yet

- Ceritified That The Particulars Given Above Are True and CorrectDocument1 pageCeritified That The Particulars Given Above Are True and CorrectSHRIJITNo ratings yet

- Tax Invoice - Intra StateDocument8 pagesTax Invoice - Intra StateinfooncoNo ratings yet

- Credit NoteDocument1 pageCredit Notesbos1No ratings yet

- Export InvoiceDocument3 pagesExport InvoiceViral BhayaniNo ratings yet

- Debit NoteDocument1 pageDebit Notesbos1No ratings yet

- Credit NoteDocument1 pageCredit NoteShaik NoorshaNo ratings yet

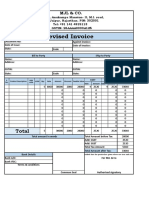

- Revised InvoiceDocument1 pageRevised InvoiceShaik NoorshaNo ratings yet

- Debit NoteDocument1 pageDebit NoteShaik NoorshaNo ratings yet

- GST Debit Note Format in ExcelDocument4 pagesGST Debit Note Format in ExcelVivek PadoleNo ratings yet

- Ceritified That The Particuler Given Above Are Ture and CorrectDocument1 pageCeritified That The Particuler Given Above Are Ture and CorrectTanmay JainNo ratings yet

- Bill of SupplyDocument1 pageBill of Supplysbos1100% (2)

- GST Invoice Format in ExcelDocument4 pagesGST Invoice Format in ExcelvineetyoutNo ratings yet

- GST Credit Note Format in ExcelDocument4 pagesGST Credit Note Format in ExcelSoumya Ghosh0% (1)

- HP Square - 0213 (22-23) (Harsh Priya Constructions)Document1 pageHP Square - 0213 (22-23) (Harsh Priya Constructions)Ravikant MishraNo ratings yet

- Composition Invoice FormatDocument1 pageComposition Invoice FormatArpit100% (1)

- Bill of SupplyDocument1 pageBill of SupplyTajinder SinghNo ratings yet

- Bill of SupplyDocument1 pageBill of SupplyVikrant VermaNo ratings yet

- GST Bill of Supply FormatDocument1 pageGST Bill of Supply FormatArul PrakashNo ratings yet

- Commercial FedexDocument2 pagesCommercial FedexDODI HARIYANTONo ratings yet

- Total: Smart Biomedical ServicesDocument3 pagesTotal: Smart Biomedical ServicesSmart BiomedicalNo ratings yet

- Payment VoucherDocument1 pagePayment VoucherSatyam KesharwaniNo ratings yet

- GST Invoice Format For Composition Scheme DealersDocument1 pageGST Invoice Format For Composition Scheme DealersAnas QasmiNo ratings yet

- Bill 15Document3 pagesBill 15ali baqarNo ratings yet

- Sole Trader Vat TemplateDocument1 pageSole Trader Vat Templateholovah8No ratings yet

- GST Invoice Format (New) in ExcelDocument58 pagesGST Invoice Format (New) in Excelumang24No ratings yet

- Service GST Invoice FormatDocument4 pagesService GST Invoice FormatRahul GoraiNo ratings yet

- Ghana Revenue Authority: Employer'S Monthly Tax Deductions Schedule (P. A. Y. E.)Document6 pagesGhana Revenue Authority: Employer'S Monthly Tax Deductions Schedule (P. A. Y. E.)JoeAlvinNo ratings yet

- 265 Prasad Seeds P LTD Medchal (265)Document1 page265 Prasad Seeds P LTD Medchal (265)krishna makkaNo ratings yet

- Final Debit Note-016Document1 pageFinal Debit Note-016hhhhhhhuuuuuyyuyyyyyNo ratings yet

- New Zealand Tax Invoice TemplateDocument2 pagesNew Zealand Tax Invoice Templatemohamed elmakhzniNo ratings yet

- Income Statement V 1 1Document7 pagesIncome Statement V 1 1Akbar AliNo ratings yet

- Book 1Document1 pageBook 1rajnisilkmills3015No ratings yet

- TA Bill Format Mar 2024Document19 pagesTA Bill Format Mar 2024satoshkumbhar9822No ratings yet

- Hotel Bill Format With Online PaymentDocument2 pagesHotel Bill Format With Online PaymentSufiyan KhedekarNo ratings yet

- PROJECTBDocument16 pagesPROJECTBNukamreddy Venkateswara ReddyNo ratings yet

- Simple Invoice Template Discount Amount Sales ReportDocument3 pagesSimple Invoice Template Discount Amount Sales Reportyasir ChaudhryNo ratings yet

- Foreignlang Quotation SampleDocument1 pageForeignlang Quotation Sample大橋佑輔No ratings yet

- Quote: Your Company NameDocument3 pagesQuote: Your Company NameNikhilNo ratings yet

- InvoiceDocument3 pagesInvoiceIsrael Alberto SanchezNo ratings yet

- Invoice: Hotel SatkarDocument1 pageInvoice: Hotel SatkarNitish jhaNo ratings yet

- 1 Individual: Project at A Glance - Top SheetDocument10 pages1 Individual: Project at A Glance - Top SheetDigital InfotechNo ratings yet

- Tax Invoice SampleDocument1 pageTax Invoice SampleRahul DeyNo ratings yet

- List of Jute Bag Requirement: State Name of Firm Address Town / City Pin Code Sr. NoDocument16 pagesList of Jute Bag Requirement: State Name of Firm Address Town / City Pin Code Sr. Nohemant vijayNo ratings yet

- Bhu BillDocument2 pagesBhu BillJameel SonsNo ratings yet

- Payment Voucher TemplateDocument4 pagesPayment Voucher TemplateAbrisam Reynand AbdullahNo ratings yet

- Stock Trading. VipulbhaiDocument11 pagesStock Trading. Vipulbhaivipul patelNo ratings yet

- Necesarul de Capital: Nr. Denumirea Echipamentului Unit - de Masura CantitateDocument15 pagesNecesarul de Capital: Nr. Denumirea Echipamentului Unit - de Masura CantitateGalinschii AndreiNo ratings yet

- Pg-VAT Control Accounts Reconcilation SpreadsheetDocument3 pagesPg-VAT Control Accounts Reconcilation SpreadsheetraziNo ratings yet

- Tanesco Dodoma - Cisco SwitchesDocument1 pageTanesco Dodoma - Cisco SwitchesWiley PearsonNo ratings yet

- GST Invoice Format in Excel To Sell Goods On MRP Including TaxesDocument1 pageGST Invoice Format in Excel To Sell Goods On MRP Including TaxesRAHULNo ratings yet

- Zerodha Profit CalculatorDocument4 pagesZerodha Profit CalculatorvvpvarunNo ratings yet

- Creative Creations: Book No. Sl. No. DatedDocument3 pagesCreative Creations: Book No. Sl. No. Datedccakshay12234No ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- GST Tax Invoice Format For Goods - TeachooDocument2 pagesGST Tax Invoice Format For Goods - TeachooKansal AbhishekNo ratings yet

- Sri Venkateswara Pranadana TrustDocument2 pagesSri Venkateswara Pranadana Trustraom_2No ratings yet

- Private Foundations Tax GuideDocument48 pagesPrivate Foundations Tax GuideKyu Chang HanNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- Fresh: Commission/Incentive Approval ReportDocument2 pagesFresh: Commission/Incentive Approval ReportRohit ChhabraNo ratings yet

- Quotation Format For Manpower Supply 01Document2 pagesQuotation Format For Manpower Supply 01muralimustikovela58No ratings yet

- Tax267 Ex3Document4 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet

- FIREEYE Supplier Request FormDocument3 pagesFIREEYE Supplier Request FormArunNo ratings yet

- Tax SyllabusDocument22 pagesTax SyllabusJulius AlcantaraNo ratings yet

- 7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestDocument2 pages7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestHarleneNo ratings yet

- CIR Vs John GotamcoDocument2 pagesCIR Vs John GotamcoKristine Joy TumbagaNo ratings yet

- Perfoma InvoiceDocument1 pagePerfoma InvoiceashishNo ratings yet

- Sri Sai Electricals: Tax Invoice Cash/CreditDocument2 pagesSri Sai Electricals: Tax Invoice Cash/CreditKesava KumarNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationHusnain AfzalNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Sample Payroll System Codes Via Visual Fox ProDocument6 pagesSample Payroll System Codes Via Visual Fox ProDiana Hermida100% (1)

- Medical Insurance Policy ParentsDocument1 pageMedical Insurance Policy Parentssivavm4No ratings yet

- Form 16 in Excel Format For Ay 2021 22 Fy 2020 21Document9 pagesForm 16 in Excel Format For Ay 2021 22 Fy 2020 21Tapas GhoshNo ratings yet

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- PFM S-22Document2 pagesPFM S-22Rana Sunny KhokharNo ratings yet

- Guidelines To Plan & Claim FBPDocument9 pagesGuidelines To Plan & Claim FBPPrasannaNo ratings yet

- Cir VS SutterDocument2 pagesCir VS SutterjhammyNo ratings yet

- Computation - Suraj ShahDocument3 pagesComputation - Suraj ShahSUJIT SINGHNo ratings yet

- Autobiography of A BycycleDocument1 pageAutobiography of A BycycleAlok RajaNo ratings yet

- Calibehr Business Support Services Pvt. LTD.: ITC Park 6th Floor Tower No.8 CBD Belapur Navi MumbaiDocument1 pageCalibehr Business Support Services Pvt. LTD.: ITC Park 6th Floor Tower No.8 CBD Belapur Navi MumbaiRram NagarNo ratings yet

- Republic v. Razon and Jai Alai CorporationDocument3 pagesRepublic v. Razon and Jai Alai CorporationYanz RamsNo ratings yet