Professional Documents

Culture Documents

The Following Information Has Been Extracted From The Balance Sheets of P Ltd. and S Ltd. As On 31st March, 2012

The Following Information Has Been Extracted From The Balance Sheets of P Ltd. and S Ltd. As On 31st March, 2012

Uploaded by

Prem Suthar0 ratings0% found this document useful (0 votes)

8 views10 pagesP Ltd. takes over S Ltd. on April 1, 2012. P Ltd. issues 3.5 million equity shares to S Ltd.'s equity shareholders and issues preference shares with a 10% premium to S Ltd.'s preference shareholders. S Ltd.'s debentures will be converted into equal number and value of 10% debentures of P Ltd. The balance sheets of P Ltd. and S Ltd. as of March 31, 2012 are provided. You are asked to show P Ltd.'s balance sheet assuming the amalgamation is a merger or purchase.

Original Description:

amalgamation

Original Title

pppp3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentP Ltd. takes over S Ltd. on April 1, 2012. P Ltd. issues 3.5 million equity shares to S Ltd.'s equity shareholders and issues preference shares with a 10% premium to S Ltd.'s preference shareholders. S Ltd.'s debentures will be converted into equal number and value of 10% debentures of P Ltd. The balance sheets of P Ltd. and S Ltd. as of March 31, 2012 are provided. You are asked to show P Ltd.'s balance sheet assuming the amalgamation is a merger or purchase.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views10 pagesThe Following Information Has Been Extracted From The Balance Sheets of P Ltd. and S Ltd. As On 31st March, 2012

The Following Information Has Been Extracted From The Balance Sheets of P Ltd. and S Ltd. As On 31st March, 2012

Uploaded by

Prem SutharP Ltd. takes over S Ltd. on April 1, 2012. P Ltd. issues 3.5 million equity shares to S Ltd.'s equity shareholders and issues preference shares with a 10% premium to S Ltd.'s preference shareholders. S Ltd.'s debentures will be converted into equal number and value of 10% debentures of P Ltd. The balance sheets of P Ltd. and S Ltd. as of March 31, 2012 are provided. You are asked to show P Ltd.'s balance sheet assuming the amalgamation is a merger or purchase.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 10

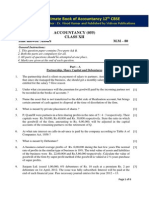

Amalgamation and External Reconstruction:

Problem and Solution # 1.

The following information has been extracted from

the balance sheets of P Ltd. and S Ltd. as on 31st

March, 2012:

P Ltd. takes over S Ltd. on 1st April, 2012, and

discharges consideration for the business as

follows:

ADVERTISEMENTS:

(i) Issued 35 lakh fully paid equity shares of Rs 10 each at

par to the equity shareholders of S Ltd.

(ii) Issued fully paid 12% preference shares of Rs 10 each to

discharge the preference shareholders of S Ltd. at a

premium of 10%.

It is agreed that the debentures of S Ltd. will be converted

into equal number and amount of 10% debentures of P Ltd.

ADVERTISEMENTS:

You are required to show the balance sheet of P

Ltd. assuming that:

(i) The amalgamation is in the nature of merger, and

(ii) The amalgamation is in the nature of purchase.

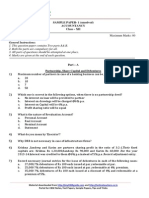

Amalgamation and External Reconstruction:

Problem and Solution # 2.

On 31st March, 2012, Thin Ltd. was absorbed by Thick Ltd.,

the latter taking over all the assets and liabilities of the

former at book values. The consideration for the business

was fixed at Rs 40 crore to be discharged by the transferee

company in the form of its fully paid equity shares of Rs 10

each, to be distributed among the shareholders of the

transferor company, each shareholder getting two shares

for every share held in the transferor company.

The balance sheets of the two companies as on 31st

March, 2012 stood as under:

ADVERTISEMENTS:

Amalgamation expenses amounting to Rs 10 lakh

were paid by Thick Ltd. You are required to:

(i) Show the necessary ledger accounts in the books of Thin

Ltd.,

(ii) Show the necessary journal entries in the books of Thick

Ltd., and

ADVERTISEMENTS:

(iii) Prepare the balance sheet of Thick Ltd. after the

amalgamation.

Amalgamation and External Reconstruction:

Problem and Solution # 3.

White Ltd. agreed to acquire the business of Green

Ltd. as on March 31, 2012. The summarised balance

sheet of Green Ltd. at that date was as follows:

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- AccountDocument67 pagesAccountchamalix100% (1)

- Their Position On That Date Was As FollowsDocument36 pagesTheir Position On That Date Was As FollowsKenneth NevalgaNo ratings yet

- Their Position On That Date Was As FollowsDocument36 pagesTheir Position On That Date Was As FollowsKenneth NevalgaNo ratings yet

- Top 25 Problems On Dissolution of A Partnership Firm PDFDocument1 pageTop 25 Problems On Dissolution of A Partnership Firm PDFDaniza Rose AltoNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Problem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsDocument9 pagesProblem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsRafidul IslamNo ratings yet

- AmalgamationDocument6 pagesAmalgamationअक्षय गोयलNo ratings yet

- Class 12 Accountancy Question PaperDocument5 pagesClass 12 Accountancy Question Papernatkaryash3No ratings yet

- Merger AcquistionDocument37 pagesMerger AcquistionManjari KumariNo ratings yet

- Partnership Formation and OperationsDocument6 pagesPartnership Formation and Operationsrodel100% (2)

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Home Assinment 2021-22new Microsoft Office Word DocumentDocument4 pagesHome Assinment 2021-22new Microsoft Office Word DocumentGanesh AdhalraoNo ratings yet

- Company Act PresentationDocument84 pagesCompany Act PresentationRajeev Verma100% (1)

- Acc Sample Paper 3 Typed by DhairyaDocument5 pagesAcc Sample Paper 3 Typed by DhairyaMaulik ThakkarNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- FR QuestionsDocument12 pagesFR Questionsram_eiNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32muhammadxiaullahgNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- Group II AccountsDocument14 pagesGroup II AccountsPardeep GuptaNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- Holding Companies: Problems and Solutions - AccountingDocument17 pagesHolding Companies: Problems and Solutions - AccountingVaibhav MaheshwariNo ratings yet

- 03 - Accounts - Prelims 1Document7 pages03 - Accounts - Prelims 1Pawan TalrejaNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Remedial Exam On Partnership and Corporation ADocument4 pagesRemedial Exam On Partnership and Corporation Abinibining piaNo ratings yet

- Financial Accounting I SemesterDocument25 pagesFinancial Accounting I SemesterBhaskar KrishnappaNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocument3 pagesGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916No ratings yet

- Dissolution of Partnership Additional Questions 50 To 53Document6 pagesDissolution of Partnership Additional Questions 50 To 53Ayan NaikNo ratings yet

- NAS 23 QuestionsDocument9 pagesNAS 23 Questionsmagratidipesh395No ratings yet

- Sem V AssignmentDocument4 pagesSem V Assignmentpritika mishraNo ratings yet

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDocument12 pagesNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyNo ratings yet

- 9 Partnership Question 3Document5 pages9 Partnership Question 3kautiNo ratings yet

- Attempt All QuestionsDocument5 pagesAttempt All QuestionsApurva SrivastavaNo ratings yet

- Accounting I Com 2Document6 pagesAccounting I Com 2Mozam MushtaqNo ratings yet

- Final Ca: MAY '19 Financial ReportingDocument13 pagesFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNo ratings yet

- Practice Exam CADocument23 pagesPractice Exam CAParneet Kaur SethiNo ratings yet

- Suggested Answers Global Financial Reporting StandardsDocument49 pagesSuggested Answers Global Financial Reporting StandardsNagabhushanaNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & AccountancyhareshNo ratings yet

- Public Sector Organisations - Government Owned Private Sector Organisations - Private Parties OwnedDocument4 pagesPublic Sector Organisations - Government Owned Private Sector Organisations - Private Parties OwnedAdit BhatiaNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Half Yearly 2022 XIIDocument6 pagesHalf Yearly 2022 XIIPooja PanjwaniNo ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Accountancy-SQP Term2Document8 pagesAccountancy-SQP Term2radhikaNo ratings yet

- 12 Amalgamation NotesDocument12 pages12 Amalgamation NoteskautiNo ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Acc217 Quation and AnswersDocument27 pagesAcc217 Quation and AnswersLeroyNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet