Professional Documents

Culture Documents

Income Tax Calculation For The Year 2018-2019.: Government Junior College, Chirala

Income Tax Calculation For The Year 2018-2019.: Government Junior College, Chirala

Uploaded by

ShaikvaahidhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculation For The Year 2018-2019.: Government Junior College, Chirala

Income Tax Calculation For The Year 2018-2019.: Government Junior College, Chirala

Uploaded by

ShaikvaahidhaCopyright:

Available Formats

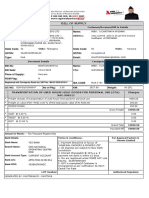

INCOME TAX CALCULATION FOR THE YEAR 2018-2019.

01 Name of the Employee Srimat. K.V. LAKSHMI

02. Designation & PAN No. J.L. in History, ACPPK4385D

03. Name of the Office GOVERNMENT JUNIOR COLLEGE,CHIRALA.

04. Gross Salary 16,86,695

05. H.R.A. Exempted:

i) Actual HRA Receive

ii) Rent paid in Excess of 10%of(Pay+DA) Own House Own House

iii) 40% of salary

06. Net Salary Income (4 – 5) 16,86,695

Less Standard Deduction 40,000

Net Income from salary 16,46,695

07. Deductions

a) Profession Tax (U/S 16(iii) 2,400

b) Interest on H. L. (U/S 24(L) (vi)

c) Medical Re-imbursement, if any

TOTAL 2,400 (-) 2,400

08. Gross Total Income (6-7) 16,44,295

09. Deductions under Chapter VI-A

A) Savings (U/S 80 ) (Max. Rs.1,00,000)

i) G.S.L.I.

ii) L.I.C.(SSS)

iii) L.I.C. Personal

iv) Tuition Fee

Any other

Postal Boand 1,50,000

T O T A L (U/S 80 C) (-) 1,50,000

14,94,295

ix) 80 E Interest on Edn. Loan.

B) Infrastructure Bonds

C) Mediclaim Insurance (80-D)

D)Expenditure on PHC Dependent (80DD)

E) Exp. on Medical Treatment (80DDB)

F) Donations 80 G i) C.M. Relief Fund 1,100

ii) Sainik Welfare

iii) Other Donations

G) Deductions to PHC employees (80 U) (-)1,100

T O T A L (Chapter VI – A)

10. Taxable Income (8 – 9) 14,93,195

11. Taxable Total Income

FOR GOVERNMENT SERVANT

Up to Rs. 2,50,000 2,50,000 Nill

2,50,001 to 5,00,000 (5%) 2,50,000 12,500

Rs. 5,00,001/- to 10,00,000/- (20%) 5,00,000 1,00,000

Above Rs.10,00,000/- (30%) 4,93,195 1,47,960

12. Tax Rebate (Below 3,50,000 Income Rs.2500

13. Tax on Total Income 2,60,460 2,60,460

14. Surcharge (2% Education Cess)

Secondary & Higher Education (Cess1%) 10,418 10,418

Health(Cess1% )

15. NET TAX PAYABLE 2,70,878

Tax paid: Q1 March 18 to May 18 Rs. 60,000

Q2 June18 to August18 Rs. 60,000

Q3 Sept18 to Nov18 Rs. 60,000

Q4 Dec to Jan Rs. 40,000

In Feb Rs. 52,000

Total 2,72,000

Refund 1,122

Signature of the D.D.O., Signature

Smt. K.V. LAKSHMI, J.L. IN HISTORY

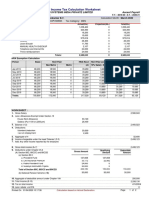

MONTH & PAY D.A., H.R.A. TOTAL LIC GS P.T. I.T. SW/cmr

YEAR

Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs. Rs.

Mar., 18 87,130 21002 12634 1,20,766 200 20,000

Apr., 18 89,290 21522 12947 1,23,759 200 20,000

May 18 89,290 21522 12947 1,23,759 200 20,000

June 18 89,290 21522 12947 1,23,759 200 20,000

July 18 89,290 21522 12947 1,23,759 200 20,000

Aug., 18 89,290 21522 12947 1,23,759 200 20,000

Sep., 18 89,290 21522 12947 1,23,759 200 20,000 500

Oct., 18 89,290 22926 12947 1,25,163 200 20,000

Nov., 18 89,290 22926 12947 1,25,163 200 20,000 500

Dec., 18 89,290 22926 12947 1,25,163 200 20,000 100

Jan., 19 89,290 22926 12947 1,25,163 200 20,000

Feb., 19 89,290 22926 12947 1,25,163 200 52,000

DA Arrear 25,429 --- 25,429 --- --- ---

DA Arrear 20,745 --- 20,745 --- --- ---

PRC Arrear 21190 68980 61216 151386

---

Total 10,90,510 3,79,918 2,16,267 16,86,695 2,400 2,72,000 1100

SIGNATURE OF THE D.D.O. SIGNATURE OF THE EMPLOYEE

Pay: Rs.

Spl.Pay Rs.

D.A., Rs.

Total Rs. 10% = Rs. 40% = Rs.

House Rent Paid =

You might also like

- BOSTS192004731Document2 pagesBOSTS192004731Chaitu Rishan100% (1)

- Tax 2Document128 pagesTax 2valentine mutunga0% (3)

- Order Receipt #7484079 - DigiCert PDFDocument1 pageOrder Receipt #7484079 - DigiCert PDFSeptian NugrahaNo ratings yet

- Bill Tracker Excel TemplateDocument1 pageBill Tracker Excel TemplatePro ResourcesNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- ACCO 30033 Exercise 5 GOVACCDocument2 pagesACCO 30033 Exercise 5 GOVACCMika MolinaNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Method of Calculation of Relief U/s 89 (I)Document3 pagesMethod of Calculation of Relief U/s 89 (I)ssvrNo ratings yet

- Income Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Document8 pagesIncome Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Katari SasidharNo ratings yet

- It FormDocument13 pagesIt FormMani Vannan JNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- Problem1.1: Particulars 2006 Rs 2007 Rs Particulars 2006 Rs 2007 RsDocument3 pagesProblem1.1: Particulars 2006 Rs 2007 Rs Particulars 2006 Rs 2007 RsShyam ShankarNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776No ratings yet

- Unit II - Fund Flow & Cash FlowDocument71 pagesUnit II - Fund Flow & Cash FlowParag PardeshiNo ratings yet

- Cash CountDocument2 pagesCash CountvonnevaleNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- 2016-17 ItDocument36 pages2016-17 ItKingKamalNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Document5 pagesComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- Form16_PDF2023-2024-2Document2 pagesForm16_PDF2023-2024-2akamitfearless71No ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- PROJECT REPORT ON HitachiDocument11 pagesPROJECT REPORT ON HitachiRaju SvNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document10 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- TAX Quiz 2Document10 pagesTAX Quiz 2Ednalyn CruzNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- 3jun24 - Intercompany Transaction - EquipmentDocument16 pages3jun24 - Intercompany Transaction - Equipmentsisilia rachelNo ratings yet

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27No ratings yet

- I JT Statement For F.Y 2022-23Document7 pagesI JT Statement For F.Y 2022-23Sasidhar KatariNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- ITForm16 33204617654Document2 pagesITForm16 33204617654smhathrasjunctionNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- 2018 Mayors Budget Release Copy 072717Document55 pages2018 Mayors Budget Release Copy 072717kristin frechetteNo ratings yet

- REV AFAR2 - Partnership (Operation)Document10 pagesREV AFAR2 - Partnership (Operation)Richard LamagnaNo ratings yet

- Tax SimulatorDocument10 pagesTax SimulatorAnil KesarkarNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Salary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)Document15 pagesSalary Extract of The Year 2020-21: Name: Ashwin Loyal Mendonca Designation: Pan: Address: Salary (RS) Deductions (RS)sharathNo ratings yet

- SOL MANUAL TAX SHORT QUIZ XXXXXDocument1 pageSOL MANUAL TAX SHORT QUIZ XXXXXJohn Alpon CatudayNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- DR AlliDocument20 pagesDR AlliDr K. Mamatha Prof & Hod FMTNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Bill From 08-Aug-2018 To 25-Aug-2018: JiopayDocument9 pagesBill From 08-Aug-2018 To 25-Aug-2018: Jiopaykrishan chaturvediNo ratings yet

- Transfers/Payments History DetailsDocument1 pageTransfers/Payments History DetailsMirela NegoitaNo ratings yet

- Allard, Sebastien: SubscriberDocument3 pagesAllard, Sebastien: SubscriberDanielle YoderNo ratings yet

- ASSESSMENT - Franchise Accounting (ACCSPEC)Document1 pageASSESSMENT - Franchise Accounting (ACCSPEC)Ryan CapistranoNo ratings yet

- The Potential Impact of Digital Currencies On TheDocument13 pagesThe Potential Impact of Digital Currencies On TheKingsley AddaeNo ratings yet

- New Rekening Koran Online 216801010479506 2023-03-01 2023-03-31 00313019Document11 pagesNew Rekening Koran Online 216801010479506 2023-03-01 2023-03-31 00313019dodimaryono22No ratings yet

- Traffic Jams - No End in SightDocument3 pagesTraffic Jams - No End in SightphuongthaospkNo ratings yet

- Account Statement From 14 Sep 2017 To 14 Mar 2018Document3 pagesAccount Statement From 14 Sep 2017 To 14 Mar 2018shiva534No ratings yet

- Canara BankDocument18 pagesCanara BankKripa Mary JosephNo ratings yet

- All Tally TheoryDocument21 pagesAll Tally Theoryvijay024088% (17)

- Statement 28949Document4 pagesStatement 28949niyameddinagayev53No ratings yet

- Accounts G11 Term 1 2009Document2 pagesAccounts G11 Term 1 2009chicochaxNo ratings yet

- Chartering AbbreviationsDocument2 pagesChartering AbbreviationsOwen PerrinNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhNo ratings yet

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinNo ratings yet

- QAd Cex HKC MP 88 P UgDocument3 pagesQAd Cex HKC MP 88 P Ugrozy kumariNo ratings yet

- CCAI THC Tariff Updated As On 17 Oct 12Document6 pagesCCAI THC Tariff Updated As On 17 Oct 12Thavasi NadarNo ratings yet

- Golden Rules For Types of AccountsDocument4 pagesGolden Rules For Types of AccountsABDUL FAHEEMNo ratings yet

- Statement of Account: State Bank of IndiaDocument3 pagesStatement of Account: State Bank of IndiaARJUN RAWATNo ratings yet

- Agoda BID440798965Document1 pageAgoda BID440798965Murali Dev RajNo ratings yet

- Government Sponsored Students Fees StructureDocument4 pagesGovernment Sponsored Students Fees StructureMuthike WachiraNo ratings yet

- Travel Itinerary: EiygfvDocument3 pagesTravel Itinerary: EiygfvJustine PaoloNo ratings yet

- Postgraduate Orthopaedics Application Form Newcastle 2019Document1 pagePostgraduate Orthopaedics Application Form Newcastle 2019Alex ChowNo ratings yet

- Your Booking at Hotel Templetree Is Confirmed!Document3 pagesYour Booking at Hotel Templetree Is Confirmed!Rajesh MukkavilliNo ratings yet

- 1600 FinalDocument4 pages1600 FinalReese QuinesNo ratings yet

- ONGTENGCO Vs CIRDocument1 pageONGTENGCO Vs CIRRex RegioNo ratings yet

- Start Here: Click ConsultingDocument10 pagesStart Here: Click ConsultingNyasha MakoreNo ratings yet