Professional Documents

Culture Documents

NM de 08102016

NM de 08102016

Uploaded by

Md Rasel Uddin ACMAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NM de 08102016

NM de 08102016

Uploaded by

Md Rasel Uddin ACMACopyright:

Available Formats

ODDS ‘N’ SODS SILVER WHEATON

A surprise at ‘Camp Nowhere’ / 4

Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM

Boosts gold stream from Vale’s Salobo / 16

BALMORAL RESOURCES VTEM™ | ZTEM™ | Gravity | Magnetics

Adds to land position in the Abitibi / 3

905 841 5004 | geotech.ca

AUGUST 15-21, 2016 / VOL. 102 ISSUE 27 / GLOBAL MINING NEWS · SINCE 1915 / $3.99 / WWW.NORTHERNMINER.COM

Odin Mining to buy Sandstorm

CEO discusses

Ecuador Gold and Copper impact of

rising gold

ECUADOR | Both juniors comfortable with the improving mining jurisdiction prices

STREAMING

| Company

has US$110M in capital

BY MATTHEW KEEVIL

mkeevil@northernminer.com

VANCOUVER

F or streaming financiers like

Sandstorm Gold (TSX: SSL;

NYSE-MKT: SAND), this

year’s rising precious metal prices

are a double-edged sword. The com-

pany’s existing streams, royalties

and equity holdings have become

more valuable, but closing deals

has become more competitive, as

reborn equity markets offer min-

ing companies alternative capital.

On Aug. 3, Sandstorm reported

its second-quarter results, which

are headlined by operating cash

flow of nearly US$9 million and

net income of US$5.2 million. The

company reported gold-equivalent

sales of 12,500 oz., at average cash

costs of US$261 per attributable

See SANDSTORM / 2

PM40069240

Inspecting drill collars at the Santa Barbara gold-copper prospect, part of Ecuador Gold and Copper’s Condor property in Ecuador, from left (in orange vests): Marshall

Koval, Odin Mining’s president and CEO, and Odin directors John Youle and Diego Benalcazar. ODIN MINING

“WE’RE REALLY GOOD AT PORPHYRY mina expertise — as well as the

BY TRISH SAYWELL financial capacity and technical

tsaywell@northernminer.com COPPER DEPOSITS, AND THE FACT THAT ability — that’s going to be brought

THERE ARE PORPHYRY TARGETS MEANS to bear on these projects, and that’s

I

what these projects need. That’s the

n a friendly all-share deal that WE’RE REALLY COMFORTABLE WITH THE rationale for this deal.”

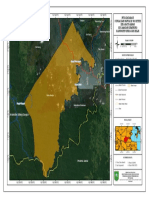

knits together assets in southern GEOLOGY.” Condor’s flagship asset, Santa

Ecuador, Odin Mining and Ex- Barbara, is a gold-copper porphyry

ploration (TSXV: ODN), a junior MARSHALL KOVAL deposit that contains most of the

PRESIDENT AND CEO, ODIN MINING

that counts mining entrepreneur resources that have been defined

Ross Beaty as its largest share- so far at the project. In addition

holder, is acquiring Ecuador Gold projects in the world nearing pro- new life and fresh vision into the to Santa Barbara, Condor hosts

and Copper (TSXV: EGX), whose duction. Mirador, formerly owned company, restart exploration work copper-molybdenum porphyry

Condor project contains millions by EcuaCorriente, is now owned and find a strategic partner,” which mineralization at the El Hito de-

of ounces of gold and is just 25 by a China’s CRCC-Tongguan In- has culminated in the transaction posit; intermediate sulphidation

km south of Lundin Gold’s (TSX: vestment, a joint venture between with Odin Mining. epithermal gold-bearing diatremes,

LUG: US-OTC: LUG) Fruta del Tongling Nonferrous Metals Group “We have proved up 8 million oz. volcaniclastics and breccia bodies

Norte project, one of the largest and China Railway Construction gold resources but now, in order at the Los Cuyes, Emma and Sole-

and highest grade undeveloped Corporation. to take them to the next level, we dad deposits; and the intermediate

gold projects in the world. Over the last two decades, US$50 need a partner with serious techni- sulphidation, narrow-vein epith-

Ecuador Gold and Copper’s con- million has been spent on explora- cal and financial capacity, and we ermal system in the Chinapintza

cessions in southeastern Ecuador tion across Ecuador Gold and Cop- found that with Odin Mining,” he deposit, north of Santa Barbara.

— containing six deposits — are per’s 82.8 sq. km property, says Heye says in an interview, noting that (Chinapintza was discovered by

also situated 50 km south of the Daun, the company’s president and Odin’s management team stems TVX Gold, a mining company

Mirador copper-gold project, one CEO, who joined the management from Beaty’s Lumina Copper group

of the few new sizeable copper team about a year ago “to breathe of companies. “Odin has the Lu- See ECUADOR / 2

CAMECO: CUTS PRODUCTION AMID WEAK URANIUM PRICES / 11

1 2 3 4 5 11 13 14 16_AUGUST15_Main .indd 1 2016-08-09 8:08 PM

2 AUGUST 15–21, 2016 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

Odin Mining to buy Ecuador Gold and Copper

ECUADOR From 1 on mining law reforms to attract

investment to mining sector, and

founded by Brazilian former bil- Ecuadorian President Rafael Correa

lionaire Eike Batista.) has expressed support for develop-

Excluding Chinapintza, the Con- ing the country’s mining industry.)

dor project has an indicated resource “Over the last decade Colom-

of 447.3 million tonnes grading 0.55 bia has attracted large amounts of

gram gold per tonne for 8 million money into mining — some say at

oz. gold and an inferred resource of least US$30 billion — and it’s been

197.6 million tonnes grading 0.40 one of the outstanding stars for

gram gold for 2.6 million oz. gold. foreign direct investment in South

Marshall Koval, Odin Mining’s America,” Daun says. “Ecuador

president and CEO, tells The North- recognizes this, and they’re trying

ern Miner in an interview that in to put in place the right fiscal and

addition to the resources already regulatory framework to attract

defined at Condor, the geology of similar quantums of investment.”

the area offers a lot of upside. In April, Ecuador opened up new

“There is significant exploration mining concessions to foreign in-

potential within the property that vestment for the first time, he notes.

they control,” he says. “Over the last “Everybody says it’s a rapidly im-

several years they haven’t been able proving jurisdiction and we can back

to do much in the way of exploration, up what Lundin has been saying

so one of the things we’re looking The core shack at Ecuador Gold and Copper’s Condor gold-silver project in Ecuador. ODIN MINING publicly, which is that the govern-

at is completing a review of all the ment has become supportive and

geological potential of the property Copper’s f lagship Santa Barbara done everything it can to rectify

and focus on additional exploration. deposit, which the company also

“ODIN HAS THE LUMINA EXPERTISE — AS what had previously been considered

We will continue to do some work discovered itself, is sometimes com- WELL AS THE FINANCIAL CAPACITY AND a difficult jurisdiction for foreign

on Santa Barbara as well. pared with AngloGold Ashanti’s TECHNICAL ABILITY — THAT’S GOING mining companies.”

“We’re really good at porphyry (NYSE: AU) La Colosa gold project Odin Mining’s Koval, agrees.

copper deposits, and the fact that in Colombia, Daun says. La Colosa, TO BE BROUGHT TO BEAR ON THESE “We’re way more comfortable with

there are porphyry targets means AngloGold’s largest greenfield dis- PROJECTS, AND THAT’S WHAT THESE Ecuador since they improved the

we’re really comfortable with the covery, sits in the Andean region fiscal regime and the Ministry of

geology,” he continues, adding that of Tolima, 14 km from the town of PROJECTS NEED. THAT’S THE RATIONALE Mines and Energy has done a good

Odin’s vice-president of exploration Catamarca. FOR THIS DEAL.” job to help bring the investment cli-

and development, Diego Benalcazar, “La Colosa has received hundreds mate forward,” he says. “Ecuador is

HEYE DAUN

used to be involved in the Condor of millions of dollars of investment PRESIDENT AND CEO, ECUADOR GOLD AND COPPER

coming along, and hopefully they’ll

project before Ecuador Gold and and the project now has what I be- continue to make these improve-

Copper’s ownership. “He knows this lieve is 24 million oz. of low-grade ments.”

property very well, so we’re pretty gold resource, and it’s defined as a were spent building and operating uador from long-term and patient Under the terms of the statu-

comfortable with it.” world-class copper-gold deposit,” mines in Africa for the likes of Rio investors. “EGX has a controlling tory plan of arrangement, Odin

In addition to a management Daun says. “Some people say Santa Tinto (LSE: RIO), AngloGold and group of Ecuadorean shareholders shareholders would own 65% of

team with deep experience, Odin Barbara has the potential to be an- Gold Fields. He also has experience with deep and well-established local the company and shareholders of

brings to the table an operating other La Colosa.” in mining project finance and port- relationships,” Daun says. “They Ecuador Gold and Copper would

history in Ecuador dating to 1987. But of course that will require folio management with Nedbank are local investors who have been own 35%. On a fully diluted basis,

In 1994, the company identified more time and money, and is an and Old Mutual. funding the company throughout the transaction represents a pre-

the Cangrejos area in the Andean exercise the Namibian-born mining “Most porphyry deposits require the recent mining downturn, with mium to Ecuador Gold and Copper’s

foothills of El Oro province in south- engineer is well qualified for. The heavy capital investment in explo- a lot of commitment and long-term shareholders of 89%, based on the

western Ecuador as the source of the former president and co-founder ration and development,” he says. vision.” company’s 20-day, volume-weighted

Biron alluvial gold deposit, which of Auryx Gold Corp. co-led that “That form of capital investment is As for investing in Ecuador, he average share price. If approved,

produced 69,000 oz. gold. Its Can- company through the initial public not easily raised by a junior. Odin says, the government hopes to emu- Odin would have 204 million shares

grejos project is 30 km southeast of offering process, successive capital has the fundraising ability to take late Colombia’s success in attracting outstanding and 211 shares on a fully

the port city of Machala and 40 km raising and project development, these projects to the next level, so foreign investment into its mining diluted basis. Odin would have a

from Puerto Bolivar, a deepwater culminating in the $160-million sale it made perfect sense.” sector and is taking steps to improve $198-million market capitalization

commercial port. to B2Gold (TSX: BTO; NYSE-MKT: Ecuador Gold and Copper says it its regulations. (The government has based on the company’s closing share

Meanwhile, Ecuador Gold and BTG). The first 10 years of his career has a deep pool of support in Ec- hired Wood Mackenzie to advise price on Aug. 2. TNM

Sandstorm CEO discusses impact of rising gold prices

SANDSTORM From 1

oz. gold.

Sandstorm is now debt free and

has US$110 million in available

capital to pursue opportunities.

“It’s clear that rising gold prices

have increased the equity capital

available to mining companies,”

Sandstorm president and CEO No-

lan Watson said during a conference

call. He says this is “a good thing

for us,” since it also leads to higher

cash flows and higher exploration

spending.

“The number of companies

in desperate need of fixing their

balance sheets has decreased,” he “OUR GROWTH

added. “There are still people look-

ing at streaming deals to remedy OVER THE NEXT

debt problems, however, and we THREE YEARS DOES

also see opportunities in terms of

project financing to build mines. NOT REQUIRE NEW

That’s a scenario that we may not MINES.”

have seen 12 months ago.”

In early July, Sandstorm closed NOLAN WATSON

PRESIDENT AND CEO,

a US$57.5-million, bought-deal

SANDSTORM GOLD

financing wherein it issued 12.9 mil- Yamana Gold’s Chapada gold-copper mine in Brazil, where Sandstorm Gold holds a copper stream agreement. SANDSTORM GOLD

lion shares at U$4.45 each. Watson

said the equity was raised to fund Salobo copper-gold mine in Brazil. or two development-stage assets to gold-equivalent production should scale approach.”

a potential deal that the company Meanwhile, Osisko Gold Royalties the pipeline. total between 43,000 oz. and 50,000 BMO Capital Markets analyst An-

would not have had enough capital (TSX: OR; NYSE: OR) is on the hunt “Precious metal companies have oz. this year, and it expects annual drew Kaip said that Sandstorm “has

to complete. He said negotiations are for deals with $424 million in cash, much greater access to equity capital production will hit 65,000 oz. by improved liquidity and enhanced

ongoing, but that the opportunity and Franco-Nevada (TSX: FNV; in this environment,” he continued. 2020. transactional capacity following

is “not exclusive to Sandstorm.” NYSE: FNV) finished the second “We still see some deal flow on the The company’s shares have traded quarter-end.”

And there is plenty of competition quarter with US$226 million in base metal side, where prices have in a 52-week range of $2.82 to $7.92, Watson added that “gold appears

in the streaming and royalty space, cash, and no debt. not recovered to the same degree. and closed at $7.71 at press time. to finally be making a robust move

given the wealth of capital among “Our growth over the next three The equity available to those com- Sandstorm has 150 million shares higher … it trades like a currency,

the major players. years does not require new mines,” panies has not rebounded much, outstanding for a $1-billion market and so the value is set by supply-

For example, Silver Wheaton Watson pointed out. “We want to so they still look to monetize pre- capitalization. demand fundamentals that are

(TSX: SLW; NYSE: SLW) recently ensure the majority of our net asset cious metal by-product credits. Scotiabank said in an Aug. 4 dictated by a narrative about what

offered Brazil’s Vale (NYSE: VALE) value continues to be in this low- We’re looking at a couple of these trading note that Sandstorm could is happening in the world. We are

US$800 million to buy another risk profile. We do believe in this potential deals.” face less competition from the larger hearing more and more that there

25% gold stream from the miner’s market, however. We can add one Sandstorm said its attributable streaming firms due to its “smaller- is risk everywhere people look.” TNM

1 2 3 4 5 11 13 14 16_AUGUST15_Main .indd 2 2016-08-09 8:08 PM

GLOBAL MINING NEWS THE NORTHERN MINER / AUGUST 15–21, 2016 3

Balmoral Resources CEO Darin Wagner (left) at the Martiniere gold project, 110 km west of Matagami in Quebec. BALMORAL RESOURCES

Balmoral stakes more ground

near Detour Trend in the Abitibi

QUEBEC GOLD | New Hwy 810 property is 15 km north of Hecla’s Casa Berardi gold mine

with the way things have been over Martiniere and Fenelon proper- will” have debt, he says.

BY TRISH SAYWELL

tsaywell@northernminer.com the last four or five years with the “THERE ARE SOME ties, we also acquired a regional (Wagner’s other accomplishments

UPSIDES OF THE

B

downturn, they eventually did, so [magnetic and electromagnetic] include cofounding West Timmins

almoral Resources (TSX: BAR; the time to act was now,” he says. DOWNTURN — airborne and geological data set that Mining, which was sold to Lakeshore

US-OTC: BALMF) founder “There are some upsides of the stretched from north of the Detour Gold for $424 million.)

Darin Wagner has had his downturn — opportunities become OPPORTUNITIES Trend project area to the south of So far, 51% of the holes drilled

eye on the Hwy 810 property for available that wouldn’t necessarily BECOME AVAILABLE Casa Berardi,” he says. “We’ve had a into the Martiniere system have

years now as part of a corporate otherwise.” number of these other areas — like returned intercepts grading greater

effort to plant the junior explorer’s The property also happens to sit 18 THAT WOULDN’T Highway 810 — that we’ve kept an than 10 grams gold per tonne. The

flag over greater parcels of Quebec’s km south of Selbaie — a mine that NECESSARILY eye on, and in some cases we’ve highest-grade sample came from

rich Abitibi greenstone belt. before it closed churned out 53 mil- added a few small properties.” the Bug Lake footwall zone, mea-

“The Abitibi hosts the second- lion tonnes of ore (at average grades OTHERWISE.” As the name suggests, the prop- suring 9.71 grams gold over 0.6

largest accumulation of high-grade of 1% copper, 1.9% zinc, 41 grams DARIN WAGNER erty boasts excellent access via an metre. The Martiniere gold system

gold deposits on the planet, so it silver per tonne and 0.6 gram gold) FOUNDER, PRESIDENT AND CEO, extensive logging road network is 45 km east of Detour Gold’s

remains a primary focus of mergers — and 100 km west of Glencore’s BALMORAL RESOURCES connected to regional Hwy 810, (TSX: DGC) open-pit gold mine

and acquisitions activity in the gold (LSE: GLEN) Bracemac-MacLeod which cuts north–south through the in Ontario.

sector,” says Wagner, a geologist and deposit in the Mattagami volcano- property. The company uses Hwy 810 Ninety-five percent of the drilling

the company’s president and CEO. genic massive sulphide (VMS) camp. Like Balmoral’s Detour Trend to access its Detour Trend project. at Martiniere is less than 250 me-

The 250 sq. km Hwy 810 property “The property straddles the project to the north, historic ex- Initial testing on the property tres deep. The fully owned system

the company staked in early August Mattagami domain, which has VMS ploration on the Hwy 810 property is likely to take place next winter is open at depth and spans at least

is 35 km south of its Bug Lake and deposits, and the domain that hosts seems to have focused on the area’s and will not affect the company’s 4 by 2 km.

Martiniere West gold deposits (part Casa Berardi, which is what we liked base metal potential, and only minor 2016 exploration plans. “The op- The company has also discovered

of Balmoral’s larger Detour Trend about it,” Wagner says. “It has a little effort was spent on the structurally portunity was too good to pass up, the Grasset deposit on its Martiniere

project in northwestern Quebec), of both — there are clear indications controlled gold targets similar to De- but we don’t want it to distract us property, 37 km from the project’s

and just 15 km northeast of Hecla of both styles of mineralization — tour, Casa Berardi and Martiniere. from our other work,” he says. “It’s main gold deposits, which contains

Mining’s (NYSE: HL) Casa Berardi, but we’d say the gold mineralization Wagner notes that the acquisition a 2017 project for us.” nickel, copper, cobalt and platinum.

an underground gold mine that probably outweighs the base metal partly came from regional compila- The company has two drills work- Grasset has an indicated resource

produced 127,900 oz. gold last year. potential. Still, you can’t ignore the tion work that used the company’s ing on Martiniere, and the first set of 3.5 million tonnes grading 1.7%

“There were a couple of bigger fact that there was a 53-million- proprietary airborne and geological of 2016 results should be out in the nickel-equivalent at a 1% nickel-

blocks at Hwy 810 that we thought tonne base metal deposit sitting in databases. next couple of weeks. Drilling would equivalent cut-off grade, for 136.28

would eventually come open, and your backyard.” “In 2010, when we bought the continue through to October and million lb. nickel equivalent. In-

possibly into November, weather ferred resources add 91,100 tonnes

permitting. The $5-million drill grading 1.2% nickel equivalent for

program this year (20,000 metres), 2.39 million contained lb. nickel

is completely funded and the com- equivalent.

pany should exit 2016 with more Over the last year, Balmoral’s

than $10 million in the treasury, shares have traded in a range of 33¢

which Wagner says is more than to $1.09. At press time the company

the company has ever spent in a traded at $1.05.

single year. Balmoral has 125 million shares

The company has no debt. outstanding for a $131-million mar-

“We never have and we never ket capitalization. TNM

Global Leader

Your Technical Services Partner in Geochemistry and Metallurgy

For more information, scan this QR

code or visit www.alsglobal.com

Phone: +1 604-984-0221

RIGHT SOLUTIONS RIGHT PARTNER

Drillers at Balmoral Resources’ Martiniere gold property in Quebec. BALMORAL RESOURCES

1 2 3 4 5 11 13 14 16_AUGUST15_Main .indd 3 2016-08-09 8:08 PM

4 AUGUST 15–21, 2016 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

GLOBAL MINING NEWS · SINCE 1915

E D I T O R IA L O P- E D

Sake and

www.northernminer.com

Gold gains appeal in

UK as interest rates rescue

GROUP PUBLISHER/

PUBLISHER:

hit 322-year low ODDS ‘N’ SODS | A chance encounter

Anthony Vaccaro, CFA, MBA in the Barren Lands

avaccaro@northernminer.com BREXIT FALLOUT | Bullion prices in sterling

EDITOR-IN-CHIEF: up 44% over last 12 months BY DARIN WAGNER THE NUMBER OF

O

John Cumming, MSC (GEOL)

Special to The Northern Miner

BODIES ON THE

O

jcumming@northernminer.com

ne of the features of the gold bull

EDITOR, SPECIAL PROJECTS: run from 2001 to 2011 was the ne of the great parts of

Alisha Hiyate, BA (POLI SCI, HIST)

ahiyate@northernminer.com divergence in enthusiasm for gold our business is the places DOCK GREW AS

SENIOR STAFF WRITER:

on either side of the Atlantic. Gold bugs we go and the interesting THE CREW WOKE

Trish Saywell, BA, MA, MSC (JOUR) taking in the gold price in U.S. dollars were people we meet. UP AND CAME TO

tsaywell@northernminer.com in full frenzy in North and South America, In the early ’90s, when dia-

WESTERN EDITOR: while our mining cousins in the U.K. and mond ma nia swept t hrough SEE WHAT THE

Matthew Keevil, BA (ECON AND POLI SCI) BY JOHN CUMMING continental Europe, looking at the often Canada, I was a field geologist EXCITEMENT WAS

mkeevil@northernminer.com jcumming@northernminer.com flat gold price in pounds and euros, were for “Mother C” — or Cominco.

STAFF WRITERS: more cool to gold’s appeal, and focused After a couple of years of tell- ABOUT.

Lesley Stokes, BSC (GEOL)

lstokes@northernminer.com

instead on building base metal giants like ing us that Cominco wasn’t a

Glencore and BHP Billiton. diamond company, even as the

Salma Tarikh, BSC (PSYCH), MA (JOUR)

starikh@northernminer.com

Well, this scenario has certainly changed for U.K. investors discoveries in the Lac de Gras

and miners in 2016’s gold run, with gold-price gains in pounds area of the Northwest Territories and the SBX-11 radio signals in

COPY EDITOR:

Isa Cunanan, BSC exceeding gains in U.S. dollars, and only accelerating after the drew worldwide attention, senior the evenings.

(Health Sci. and Prof. Writing Comm.) surprise Brexit vote on June 23. management finally decided we Along with some of the best

icunanan@northernminer.com For instance, in the last 60 days, the gold price in U.S. dollars is should try our hand at it. northern lights I have seen in

PRODUCTION EDITOR: up 4.9% to US$1,335 per oz., while in British pounds it is up 14.6% We teamed up with “Big Brother” my career, one of the truly great

David Perri, BA to £1,022 per oz. gold. Going back a year, the gold price in U.S. Teck and acquired a vast land things about that project was the

dperri@northernminer.com

dollars is up 20.9%, while in U.K. pounds it is up a full 44.5%, with package on the extreme eastern fishing. The lake was wide and

WEB EDITOR:

Adrian Pocobelli, MA (ENGL)

the first divergence in November 2015 and the second, massive edge of the Slave Province in loaded with char and grayling,

apocobelli@northernminer.com divergence happening, of course, at the end of June 2016 with the Northwest Territories from and it took little effort to catch

ADVERTISING:

Brexit vote result. Gerle Gold, a Vancouver-based a few. It thus became a bit of a

Joe Crofts The Brexit vote gave the U.K. pound the distinction of being junior company. We joked that habit to get up early each morn-

(416) 510-6816 2016’s worst performing major currency among 31 global peers we were a decade walk from ing and, often with the camp

jcrofts@northernminer.com by early July, with more than a 12% decline — surpassing even where the heart of the action cook, go out to the end of our

Michael Winter the Argentine and Mexican pesos on the downside. (The Japanese was at that stage, but we were “geo-special” dock and catch

(416) 510-6772

mwinter@northernminer.com

yen, Brazilian real and Russian ruble were the best performers.) In “in the business of diamond a couple of fish to have with

early July, the U.K. pound hit a 31-year low of US$1.2798 on new exploration.” breakfast.

PRODUCTION MANAGER:

Jessica Jubb

concerns over U.K. real estate values, and consumer confidence Thus we packed our kits out of On one particular sunny morn-

(416) 510-5213 level plunged the most in 21 years. (Ten years ago, the pound was Yellowknife, took the 3.5-hour ing the cook and I were sitting

jjubb@glacierbizinfo.com worth US$2.) f light to what by anyone’s defi- on the dock catching breakfast

CIRCULATION/CUSTOMER SERVICE: By early August, the U.K.’s largest bank HSBC was warning the nition is the middle of nowhere when we noticed something way

Laura Arnold pound could trade as low as US$1.10 by the end of 2017, and the (and then some) and set up our out on the lake that seemed to be

(416) 510-6789, ext. 43564

(Toll free) 1-888-502-3456

euro could strengthen to parity with the pound by then. HSBC’s camp on the shores of Clinton- headed our way. This was odd

northernminer2@northernminer.com analysts say the exchange rate would need to weaken to prevent the Colden La ke, and began the as there were no other camps,

SUBSCRIPTION SALES:

U.K.’s current-account deficit — already one of the largest in the daily chore of digging ice-cream outfitters or bodies in this re-

Dan Bond developed world — from blowing out. pails full of dirt in a search for gion that we were aware of, and

(416) 510-6741 Indeed, many financial experts now say a weaker currency is diamond indicator minerals. from a distance it was hard to

(Toll free) 1-888-502-3456, ext. 43715

dbond@northernminer.com

desperately needed for the U.K. economy to get through the post- We had helicopter support to tell what it was.

Brexit economic turmoil, even if there won’t be a true current- move us from “target” (read: mag- O ver t he nex t 45 mi nutes

REPRINTS:

(416) 510-6768

account crisis. netic blob) to “target” (read: the object on the horizon got

moliveira@northernminer.com In early August the Bank of England’s Monetary Policy roundish magnetic anomaly). closer and closer, and the num-

ADDRESSES: Committee responded to fears of a homemade, Brexit-induced Our only contact with the out- ber of bodies on the dock grew,

Toronto Head Office: recession in the U.K. with more stimulus measures, including side world was a weekly supply as the crew woke up and came

38 Lesmill Road, Unit 2 cutting interest rates from 0.5% to 0.25%. It’s the first rate cut since flight that brought the necessities to s e e w hat t he e xc itement

Toronto, ON, M3B 2T5

(416) 510-6768

March 2009, and the lowest rate in the bank’s 322-year history. As of life — beer, bacon and TP — was about.

tnm@northernminer.com recently as early 2008, rates were above 5%.

Western Bureau: With no clear post-Brexit plans yet emerging, more interest rate

303 West 5th Avenue cuts may be on the way, though bank governor Mark Carney said

Vancouver, BC, V5Y 1J6 he “isn’t a fan” of negative interest rates. It’s a 180-degree change

(604) 688-9908

from a year ago, when people were expecting rates to gradually rise.

SUBSCRIPTION RATES: Rolling these macroeconomic factors together, it’s all a positive

Canada:

C$120.00 one year; sign for U.K. gold investors, who may finally catch up with and

5% G.S.T. to CDN orders. even surpass the zeal of their gold bug cousins in the Americas.

7% P.S.T. to BC orders As a sign of the newly buoyant precious metals market in the

13% H.S.T. to ON, NF orders

14% H.S.T. to PEI orders

U.K., the Royal Mint recently tabled superb annual financial results

15% H.S.T. to NB, NS orders for 2015–2016, which it described as “the highest revenue in the

U.S.A.: 1,100-year history of the organization in financial terms.”

US$120.00 one year

Foreign:

The Royal Mint’s annual revenue soared 39% to £360.6 million,

US$157.00 one year with revenue growth of at least 17% delivered by all three of its

GST Registration # 809744071RT001 businesses: circulating coin, commemorative coin and bullion.

(ISSN 0029-3164)

Operating profit was up 19% to £13.1 million — the highest since

CANADA POST: the company was vested in January 2010.

Return undeliverable

Canadian addresses to

In its bullion business, revenue shot up 64% to £185.6 million,

Circulation Dept. with the mint stating that among its precious metal trading

c/o The Northern Miner activities, “it is the company’s increased share of the U.S. silver

38 Lesmill Road, Unit 2

Toronto, ON M3B 2T5

market that is at the core of this growth.” TNM

Publication Mail Agreement #40069240

Periodicals Postage Rates paid at

Niagara Falls, NY, 14304.

U.S. office of publication 2424 Niagara Falls

Blvd, Niagara Falls, N.Y. 14304.

U.S. POSTMASTER:

send address corrections to:

Northern Miner Box 1118

Niagara Falls, N.Y. 14304.-7118

DEPARTMENTS

Careers. . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Mining Jobs. . . . . . . . . . . . . . . . . . . . . . . . 15

Editorial. . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Professional Directory. . . . . . . . . . . . . . . 12

Metal Prices. . . . . . . . . . . . . . . . . . . . . . . . . 7 Stock Tables. . . . . . . . . . . . . . . . . . . . . . 6-10

THE NORTHERN MINER is published weekly

by BIG Mining L.P., a division of Glacier Media

Inc., a leading Canadian media company with COMPANY INDEX

interests in business-to-business information AngloGold Ashanti. . . . 2,3 Franco-Nevada. . . . . . . . . . 2 Premier Gold Mines. . . . 14

services. From time to time we make our

subscription list available to select companies B2Gold. . . . . . . . . . . . . . . . . 2 Goldcorp. . . . . . . . . . . . . . 16 Primero Mining. . . . . . . . 16

and organizations whose products or services Balmoral Resources. . . . . . 3 Lundin Gold. . . . . . . . . . . . 1 Sandstorm Gold. . . . . . . . . 1

may interest you. If you do not wish your contact Barrick Gold. . . . . . . . . . . 14 Mirasol Resources. . . . . . 13 Silver Wheaton. . . . . . . 2,16

information to be made available, please contact Cameco. . . . . . . . . . . . . . . 11 Odin Mining and Explora- Vale. . . . . . . . . . . . . . . . . 2,16

us by one of the following methods: Phone:

1-888-502-3456; Fax: (416) 447-7658; Mail to: Detour Gold. . . . . . . . . . . . 3 tion. . . . . . . . . . . . . . . . . . . . 1 Yamana Gold . . . . . . . 13,14 The late Mike Casselman, senior geologist for Cominco and co-leader of the

Privacy Officer, The Northern Miner, 38 Lesmill Ecuador Gold and Copper.1 Osisko Gold Royalties. . . . 2 Doyle Lake project expedition at Clinton-Colden Lake, N.W.T. CREDIT: DARIN WAGNER

Road, Unit 2, Toronto, ON M3B 2T5.

1 2 3 4 5 11 13 14 16_AUGUST15_Main .indd 4 2016-08-09 8:08 PM

GLOBAL MINING NEWS THE NORTHERN MINER / AUGUST 15–21, 2016 5

Cominco and Teck’s “Camp Nowhere” diamond exploration camp beside Clinton-Colden Lake, N.W.T., in

The author Darin Wagner at the Doyle Lake diamond project near Clinton-Colden Lake in the Northwest

1993. CREDIT: DARIN WAGNER

Territories in 1993. CREDIT: DARIN WAGNER

Finally the object resolved itself was adamant that he needed to

into a single body in a kayak as move on and get back on sched-

it drifted into camp. The pilot ule if he was going to complete

was a somewhat haggard-looking his trip and get to his extraction

fellow of East Asian background point on time.

and he shakily made his way out So we loaded him down with

of the kayak, onto the dock and supplies, a recharged battery for

in broken English explained his his radio and shotgun shells for

story. his gun, as he had used the last

Our new guest was an air traf- ones to chase away the bear who

fic controller from Tokyo. For had raided his cache.

the last three years he had been By mid-morning he was on his

coming to Canada on his vacation way again across the lake, slowly

to take month-long kayak trips receding into the horizon just as

through the North to enjoy the he had appeared.

silence and solitude of the Arctic, Unfortunately nobody I have

which was such a stark contrast reached out to has any pictures

to the stress, noise and hustle of of the fellow. I think we were all

his home. so blown away by him being out

UNFORTUNATELY A BEAR HAD MADE

SHORT WORK OF HIS LAST SUPPLY

CACHE, NOT ONLY CLEARING OUT

THE FOOD, BUT ALSO THE BATTERIES The Aerodat geophysical crew at the Cominco-Teck diamond exploration camp on Clinton-Colden Lake in the Northwest Territories

in 1993. CREDIT: DARIN WAGNER.

FOR HIS RADIO TO ALERT THE TOUR

OPERATOR.

Over the course of a much ap- there that we failed to document

preciated breakfast, he went on it on film.

to explain — which for him took We didn’t see him again but did

some serious effort — that he hear from the tour operator that

worked with a tour operator who he had completed his journey.

had laid out a series of food and That should be the end of the

supply caches for him in advance, story, but about a week after

and that this trip was to be his Christmas that year, a small box

longest yet at six weeks. arrived in the office from our

Unfortunately a bear had made new friend in Tokyo with a note

short work of his last supply cache, of thanks, Christmas wishes and

not only clearing out the food, but a very nice bottle of sake.

also the batteries for his radio to So even in the middle of no-

alert the tour operator. where, our careers provide us the

Thus he had been overjoyed opportunities to make a difference

when he spotted our camp on the for someone and to make a new

horizon and had come almost a friend. Even if they are a bit crazy.

day out of his way to reach us.

He had been running on fumes, — Darin Wagner is president and

fish and canned beans for the CEO of Balmoral Resources, a

last 10 days. Canadian junior gold and base

We offered to let him stay in metals explorer active primarily A Teck senior geologist laying under his chopper flag to escape from the bugs while waiting for a helicopter at day’s end. CREDIT: DARIN

the camp to recover a bit but he in Quebec. WAGNER

Published by:

MAKE SENSE OF THE MINING INDUSTRY

Mining Explained is a 164-page reference manual (written in layman’s language) that includes the following chapters:

Basic Geology • Ore Deposits • High-Tech Prospecting Sampling & Drilling • Mining Methods • Processing Ore • Mining &

the Environment • The Mining Team • The Business of Mining • Feasibility: Does it Pay? • Metal Markets • Making Sense

of the Numbers • Investing in Mining • Glossary of Mining Terms

Order Your Call 1-888-502-3456

Now Copy Today! or email info@northernminer.com

Available

in Spanish

1 2 3 4 5 11 13 14 16_AUGUST15_Main .indd 5 2016-08-09 8:08 PM

6 AUGUST 15–21, 2016 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

M A R K E T N EWS

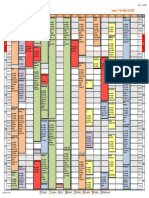

TORONTO STOCK EXCHANGE / AUGUST 1–5

Disappointing employment numbers and a 2020.) With the extra stream, Silver Wheaton for the first phase of Karnalyte’s potash proj- announced that mining entrepreneur Frank

widening trade gap kept Canada’s bench- forecasts that attributable gold production in ect in Wynyard, Sask. The talks ended after Giustra had stepped down from the board of

mark index relatively flat at 14,648.77, up 2016 will be 305,000 oz., up from 265,000 oz. Karnalyte and GSFC couldn’t agree on terms directors. Giustra had served as a director

just 0.5% from the previous trading week. previously. Over the next five years, Silver of the transaction, including governance mat- since September 2013. Endeavour operates

Statistics Canada reported that the country’s Wheaton says its average attributable gold ters and how Karnalyte’s secondary minerals, five mines in Côte d’Ivoire (Agbaou and

unemployment rate in July increased to 6.9%, production (including 2016) would be 330,000 including magnesium, would be developed Ity), Burkina Faso (Karma), Mali (Tabakoto)

up from 6.8% in June, as full-time employ- oz. a year. Silver Wheaton president and CEO to help Karnalyte shareholders benefit from and Ghana (Nzema). It expects to produce

ment fell by 71,400 jobs, the largest drop in Randy Smallwood said the company “did untapped assets. between 575,000 and 610,000 oz. gold this

full-time positions in five years. Meanwhile, not hesitate at the opportunity” to increase Endeavour Mining’s shares fell $2.66 to year at all-in sustaining costs of US$870 to

Canada’s merchandise trade deficit increased its exposure to the mine, which has “one of $22.71. The West Africa-focused gold producer US$920 per oz. gold. TNM

to $3.63 billion in June — the largest trade the lowest copper cash costs in the world, 50

deficit on record — and up from $3.5 billion years of mine life on reserves alone, and what

the previous month. The Canadian dollar we believe to be substantial exploration and TSX GREATEST PERCENTAGE CHANGE

TSX GREATEST VALUE CHANGE

ended at US75.96¢. On the mining front, expansion potential.” VOLUME WEEK VOLUME WEEK

the S&P/TSX Capped Diversified Metals & Shares of Karnalyte Resources fell 95¢, (000s) HIGH LOW CLOSE CHANGE (000s) CLOSE CHANGE

Mawson West MWE 1021 0.01 0.01 0.01 + 100.0 Silver Wheaton SLW 9194 37.93 + 1.48

Mining Index fell 2.5% to 671.50, and the or 42% to $1.30, on news that negotiations Stonegate Agri ST 107 0.02 0.02 0.02 + 33.3 Franco-Nevada FNV 1833 101.57 + 0.90

S&P/TSX Global Gold Index lost 0.3% to had ended with Gujarat State Fertilizers & Nthn Dynasty NDM 7614 0.93 0.67 0.93 + 32.9 First Majestic FR 7215 23.46 + 0.82

273.06. Spot gold fell 1.1% to US$1,335.40 Chemicals for a US$700-million financing Freegold Vent FVL 930 0.25 0.20 0.25 + 19.5 Potash Corp SK POT 20425 21.08 + 0.73

per oz. gold. Silver Bear Rs SBR 1799 0.39 0.29 0.35 + 19.0 New Gold NGD 11284 7.33 + 0.55

IAMGOLD IMG 16816 7.28 + 0.54

The first trading week of August saw Silver Heron Res

Redhawk Res

HER

RDK

1047

78

0.17

0.08

0.14

0.06

0.17

0.07

+ 17.9

+ 16.7 Orocobre ORL 336 4.49 + 0.40

TSX MOST ACTIVE ISSUES

Wheaton post the largest gain, jumping $1.48

Potash Ridge PRK 5723 0.32 0.24 0.29 + 16.0 MAG Silver MAG 1020 20.87 + 0.37

to $37.93 per share. The streaming company VOLUME WEEK

Silver Bull Re SVB 2074 0.28 0.21 0.26 + 15.9 North Am Pall PDL 38 5.77 + 0.37

(000s) HIGH LOW CLOSE CHANGE

announced that it is acquiring more gold equal Rio Novo Gold RN 133 0.28 0.22 0.28 + 14.6 Teck Res TCK.A 15 21.00 + 0.35

Endeavour Mng EDV 1905 22.71 - 2.66

to 25% of the life-of-mine gold production B2Gold BTO 25418 4.49 3.98 4.38 + 0.29 Anglo Pac Grp

Karnalyte Res

APY

KRN

1

1120

0.75

2.30

0.00

0.78

0.75

1.30

- 50.0

- 42.2 Karnalyte Res KRN 1120 1.30 - 0.95

Kinross Gold K 25206 7.23 6.65 6.95 + 0.20

from Vale’s Salobo mine in Brazil, which First Quantum FM 23621 11.62 10.86 11.47 + 0.18 Vista Gold VGZ 1329 2.28 1.54 1.57 - 25.2 Labrador Iron LIF 1164 14.05 - 0.91

Vale says is the largest copper deposit in the Yamana Gold YRI 23419 7.79 7.36 7.44 - 0.03 Metalore Res MET 8 2.50 1.90 1.90 - 24.0 Anglo Pac Grp APY 1 0.75 - 0.75

country. The acquisition comes along with half Teck Res TCK.B 21604 20.97 19.44 20.93 + 0.12 Primero Mng P 6916 3.06 2.25 2.29 - 22.9 Primero Mng P 6916 2.29 - 0.68

of the gold production at Salobo that Silver Potash Corp SK POT 20425 21.11 19.93 21.08 + 0.73 Rubicon Mnrls RMX 5673 0.09 0.06 0.06 - 15.4 Silver Std Res

Detour Gold

SSO

DGC

4645 17.54

4863 33.50

- 0.68

- 0.64

Goldcorp G 20349 23.85 22.82 22.98 - 0.35 Kerr Mines KER 1286 0.14 0.11 0.12 - 14.8

Wheaton already is entitled to, bringing the Barrick Gold ABX 19937 29.97 27.79 27.97 - 0.54 Turquoise HIl TRQ 6841 4.68 4.05 4.13 - 11.2 HudBay Mnls HBM 10618 5.89 - 0.62

total amount to 75%. (Salobo could produce Eldorado Gold ELD 19084 5.74 5.19 5.25 - 0.10 Avalon Adv Mat AVL 1687 0.23 0.20 0.20 - 11.1 Richmont Mines RIC 1315 13.92 - 0.61

300,000 oz. gold a year between 2016 and IAMGOLD IMG 16816 7.64 6.63 7.28 + 0.54 Dundee Prec Mt DPM 2132 4.10 3.44 3.50 - 10.9 Metalore Res MET 8 1.90 - 0.60

TSX VENTURE EXCHANGE / AUGUST 1–5

The S&P/TSX Venture Composite In- 26 million shares traded, before closing 10.5 million and 6.2 million shares, for a one share and a warrant. Each warrant

dex gained 10.52 points, or 1.3%, to an up 30¢, or 34.5%, to 1.17¢ per share. On 29.6% and 17.4% stake in the company. is exercisable within 24 months for 50¢

806.69-point close. A strong U.S. jobs re- July 21, the company announced plans to HTI plans to change its name to Leagold per share, and subject to acceleration if

port for July drove spot gold prices down increase its $16-million private placement Mining, pending an annual general meet- the volume-weighted average price of the

US$15.28, or 1.1%, to US$1,336 per oz. gold, to $27 million, with the issue of 33.8 million ing in August. company’s shares stand at 80¢ or greater

as expectations mount for the U.S. Federal units at 80¢ per unit. Each unit consists of Shares of Blue Sky Uranium rose 24¢, or for 10 straight trading days. Blue Sky is

Reserve to raise interest rates this year. one share and one-half warrant, with each 100%, to 48¢ after announcing a $2.5-mil- exploring its 5000 sq. km land package in

Comex copper dropped 3.2% to US$2.15 whole warrant exercisable within 36 months lion private placement of up to 6.5 million the Patagonia region of southern Argentina

per lb. copper. at $1.10 per share. units at 38¢ per unit, which consists of for uranium deposits. TNM

Shares of Ascot Resources rose 65¢, or HTI Ventures was a front-runner in the

52%, to $1.90 — its highest value since No- greatest percentage change category, with

vember 2007. The junior explorer recently shares gaining 292% to 49¢. On July 25, the TSX-V GREATEST PERCENTAGE CHANGE

TSX-V GREATEST VALUE CHANGE

closed a $20-million private placement company announced plans to increase its VOLUME WEEK VOLUME WEEK

with mining and exploration financier Eric private placement to 100 million shares at (000s) HIGH LOW CLOSE CHANGE (000s) CLOSE CHANGE

Sprott. The investment gives Sprott 12.9% of 35¢ per share due to excess demand. The Barksdale Cap BRO.H 108 0.05 0.00 0.05 + 900.0 Chesapeake Gld CKG 346 6.05 + 0.80

Ascot’s outstanding shares on a non-diluted inactive explorer was overhauled in July by Am Manganese AMY 18662 0.14 0.03 0.10 + 185.7 Ascot Res AOT 1250 2.45 + 0.64

Galway Mtls GWM 4321 0.46 0.17 0.46 + 170.6 Till Capital TIL 8 4.70 + 0.49

basis, and 18.2% on a partly diluted basis. mining and exploration financiers Frank Redzone Res REZ 58 0.32 0.00 0.32 + 166.7 Abitibi Royalt RZZ 100 8.26 + 0.44

The financing is comprised of 17.4 million Giustra and Neil Woodyer, who acquired NV Gold NVX 545 0.40 0.10 0.21 + 121.1 Galway Mtls GWM 4321 0.46 + 0.29

units consisting of one share and one-half Prism Res PRS 39 0.23 0.00 0.22 + 120.0 Orex Mnrls REX 1256 1.06 + 0.24

warrant, at $1.15 per unit. Each warrant is TSX-V MOST ACTIVE ISSUES Cerro Mng CRX.H 100 0.01 0.01 0.01 + 100.0 Sirios Res SOI 5200 0.71 + 0.24

Cdn Arrow CRO 3221 0.02 0.01 0.01 + 100.0

exercisable within 24 months at $1.50 per VOLUME WEEK

Mukuba Res MKU.H 78 0.01 0.00 0.01 + 100.0

K92 Mng Inc

Ecuador Gold

KNT

EGX

4412

849

2.14

0.60

+

+

0.21

0.20

unit. Ascot is in the midst of a 60,000-me- (000s) HIGH LOW CLOSE CHANGE Baroyeca Go&Si BGS 476 0.01 0.01 0.01 + 100.0 Redzone Res REZ 58 0.32 + 0.20

tre drill program at its flagship gold-silver Am Manganese AMY 18662 0.14 0.03 0.10 + 0.07 New Destiny Mg NED 1021 0.02 0.01 0.02 - 90.6 Anfield Nickel ANF 1040 1.58 - 0.22

Premier project, 20 km northeast of Stewart, Canamex Res CSQ 14963 0.08 0.04 0.07 + 0.03 Worldwide Res WR.H 8 0.01 0.00 0.01 - 66.7 Brazil Res BRI 2733 2.69 - 0.19

Metanor Res MTO 11972 0.11 0.09 0.11 + 0.02 AM Gold AMG 33 0.20 0.12 0.12 - 41.0

B.C. The project hosts the historic Premier Cascadero Copp CCD 10380 0.17 0.13 0.15 unch 0.00 Lago Dourado SDL 39 0.29 0.00 0.17 - 40.4

Kennady Diam KDI 221 3.90 - 0.17

Orla Mng Ltd OLA 215 0.68 - 0.15

mine, which saw production of 2.1 million First Mg Fin FF 9994 1.25 1.06 1.12 - 0.06 Q-Gold Res QGR 489 0.08 0.05 0.05 - 37.5 New Destiny Mg NED 1021 0.02 - 0.15

oz. gold and 44.2 million oz. silver, out of Noram Vent NRM 9635 0.13 0.11 0.12 unch 0.00 Red Tiger Mng RMN 94 0.10 0.07 0.07 - 35.0 Atacama Pac Gd ATM 1066 0.75 - 0.13

8.6 million tonnes, from intermittent op- Nrthn Iron NFE 9302 0.06 0.03 0.04 - 0.01 Baja Mng BAJ 112 0.02 0.01 0.01 - 33.3 Brixton Mtls BBB 543 0.87 - 0.13

MX Gold MXL 8131 0.26 0.23 0.25 + 0.02

erations between 1918 and 1996. Integra Gold ICG 7475 0.96 0.86 0.90 + 0.02

Adex Mining ADE 2584 0.02 0.01 0.01 - 33.3 Flinders Res FDR 199 0.48 - 0.12

Ross River RRM.H 3171 0.02 0.01 0.01 - 33.3 Lago Dourado SDL 39 0.17 - 0.12

Mineral bank First Mining Finance saw Nexus Gold NXS 6695 0.10 0.05 0.09 + 0.04 Stratabd Mnr SB 703 0.02 0.01 0.01 - 33.3 Avino Silver ASM 326 3.45 - 0.10

U.S. MARKETS / AUGUST 1–5

U.S. equities gained during the first week of costs of US$1,114 per oz., which is up US$38 period last year, due to higher silver and gold income totalled US$24 million, or 6¢ per share,

August, helped by a positive jobs report, as per oz. from the earlier year, partly due to production. Silver output rose 71% to 4.2 compared to last year’s loss of US$26.6 mil-

companies reported earnings with mixed higher sustaining capital and lower sales. million oz., while gold output jumped 41% to lion, or 7¢ per share. Cash, equivalents, and

results. The Dow Jones Industrial Average Cash, equivalents and restricted cash ended 62,965 oz. gold. This helped drive down cash short-term investments were US$159 million,

rose 0.6% to 18,543.53 and the S&P 500 Index June at US$625.5 million. costs, after by-product credits, to US$3.80 up US$25 million over the first quarter, but

climbed 0.4% to 2,182.87. The Nasdaq gained A day later, Iamgold said a contractor died per oz. silver and US$601 per oz. gold. Net below last year’s US$190 million. TNM

1.1% to finish at 5,221.12. The September con- in a bus accident, involving two Iamgold buses

tract for crude oil jumped 4.3% to US$41.80 that were moving staff from the Essakane

per barrel, while spot gold fell 1.1%, or US$15, mine in Burkina Faso. Seven other employees U.S. GREATEST PERCENTAGE CHANGE

U.S. GREATEST VALUE CHANGE

to US$1,335.40 per oz. gold. received medical treatment for injuries. VOLUME WEEK VOLUME WEEK

The U.S. economy created 255,000 jobs Hecla Mining shares added a cent to finish (000s) HIGH LOW CLOSE CHANGE (000s) CLOSE CHANGE

Natural Res Pt* NRP 597 28.84 23.92 27.47 + 12.7 NACCO Ind* NC 135 60.52 + 4.25

in July, beating analysts’ expectations of at US$6.50 on 44.3 million shares traded. The Mechel* MTL 738 1.65 1.55 1.58 + 8.2 Natural Res Pt* NRP 597 27.47 + 3.09

180,000. The jobless rate remained at 4.9%. miner reported record second-quarter sales NACCO Ind* NC 135 61.05 53.51 60.52 + 7.6 Sibanye Gold* SBGL 6005 19.94 + 1.29

The economy added 292,000 jobs in June, of US$171.3 million, up 64% from the same IAMGOLD* IAG 54101 5.87 5.06 5.54 + 7.2 Silver Wheaton* SLW 29079 28.81 + 0.94

instead of the previously reported 287,000, Sibanye Gold* SBGL 6005 20.64 18.77 19.94 + 6.9 First Majestic* AG 22290 17.83 + 0.49

Vale* VALE.P 40014 4.95 4.36 4.91 + 6.5

and 24,000 positions in May, instead of 11,000. Vale* VALE 142638 6.07 5.39 6.02 + 4.7

Buenaventura*

Newmont Mng*

BVN

NEM

6990 15.13

35563 44.43

+ 0.48

+ 0.43

Iamgold gained 37¢ to finish at US$5.54 per U.S. MOST ACTIVE ISSUES Vedanta* VEDL 836 10.17 9.23 10.11 + 4.0 Potash Corp SK* POT 54807 16.01 + 0.41

share, as 54.1 million shares changed hands. VOLUME WEEK Endeavr Silver* EXK 13763 5.30 4.69 5.04 + 3.9 Vedanta* VEDL 836 10.11 + 0.39

On Aug. 3, it reported adjusted second-quarter (000s) HIGH LOW CLOSE CHANGE Silver Wheaton* SLW 29079 29.59 27.88 28.81 + 3.4 IAMGOLD* IAG 54101 5.54 + 0.37

earnings of US$5.9 million, or 1¢ per share, Vale* VALE 142638 6.07 5.39 6.02 + 0.27 Primero Mng* PPP 10852 2.41 1.70 1.75 - 23.6 MartinMarietta* MLM 3181 198.31 - 4.34

Freeport McMo* FCX 135463 13.04 11.88 12.23 - 0.73 Turquoise HIl* TRQ 16740 3.57 3.07 3.14 - 11.8 Black Hills* BKH 2163 61.02 - 2.03

compared to an 8¢-per-share adjusted loss a Barrick Gold* ABX 81087 22.94 21.07 21.24 - 0.62 HudBay Mnls* HBM 1541 5.10 4.45 4.48 - 10.4 Chevron* CVX 40680 100.51 - 1.97

year ago. Analysts on average had expected Kinross Gold* KGC 71334 5.56 5.03 5.28 + 0.11 Freeport McMo* FCX 135463 13.04 11.88 12.23 - 5.6 United States S* X 56055 26.49 - 1.00

a 2¢-per-share adjusted loss. Revenue grew Alcoa* AA 63272 10.60 10.20 10.50 - 0.12 Alamos Gold* AGI 5365 9.72 8.75 8.89 - 4.8 Agrium* AGU 3629 89.91 - 0.85

nearly 3% to US$232.5 million, despite slightly United States S* X 56055 27.35 25.10 26.49 - 1.00 Dominion Diam* DDC 1011 9.44 8.67 8.85 - 3.7 Freeport McMo* FCX 135463 12.23 - 0.73

Potash Corp SK* POT 54807 16.15 15.24 16.01 + 0.41 United States S* X 56055 27.35 25.10 26.49 - 3.6 Barrick Gold* ABX 81087 21.24 - 0.62

lower sales of 187,000 oz., helped by a higher IAMGOLD* IAG 54101 5.87 5.06 5.54 + 0.37 McEwen Mng* MUX 16238 4.65 4.18 4.28 - 3.6 Primero Mng* PPP 10852 1.75 - 0.54

realized price of US$1,269 per oz. gold. Produc- Yamana Gold* AUY 49883 5.95 5.58 5.65 - 0.06 Black Hills* BKH 2163 63.87 60.72 61.02 - 3.2 HudBay Mnls* HBM 1541 4.48 - 0.52

tion totalled 197,000 oz. at all-in sustaining Hecla Mining* HL 44335 6.73 6.08 6.50 + 0.01 Barrick Gold* ABX 81087 22.94 21.07 21.24 - 2.8 Alamos Gold* AGI 5365 8.89 - 0.45

6_AUGUST15_MarketNews.indd 6 2016-08-09 8:13 PM

GLOBAL MINING NEWS · SINCE 1915 THE NORTHERN MINER / AUGUST 15–21, 2016 7

M E TA L S , M I N I N G A N D M O N EY M A R K E T S

SPOT PRICES COURTESY OF SCOTIABANK PRODUCER AND DEALER PRICES TSX WARRANTS

Tuesday, August 9, 2016 Thermal Coal CAPP: US$39.50 per short ton Alamos Gold (AGI.WT) - Wt buys sh @ $28.47 to Aug 30/18 Osisko Mining Inc. J (OSK.WT) - 20 Wt buys sh @ $3 to Aug

Precious Metals Price (US$/oz.) Change Coal: Central Appalachia, 12,500 Btu, 1.2 S02-R,W: Alamos Gold (AGI.WT.A) - Wt buys sh @ $10.00 to Jan 7/19 25/18

Gold 1332.90 -25.25 US$41.10 Coeur Mining (CDM.WT) - Exercisable on a cashless basis. See Primero Mining Corp (P.WT.C) - Wt buys sh @ $3.35 to Jun

Silver $19.70 -1.01 Coal: Powder River Basin, 8,800 Btu, 0.8 S02-R, W: US$8.70 TSX Bulletin 2013-0377 for calculation. To Apr 16/17 24/18

Platinum $1143.00 -7.00 Coal: CME Group Central Appalachian Futures Sept. 2016: Continental Gold Inc. (CNL.WT.A) - Wt buys sh @ $4.75 to Nov Quest Rare Minerals (QRM.WT) - Wt buys sh @ $0.4 to Jul

Palladium $692.00 -21.00 US$39.50 Oct. 2016: US$39.75 26/17 17/17

Cobalt: US$12.13/lb. Dalradian Resources (DNA.WT.A) - Wt buys sh @ $1.5 to Jul RTG Mining (RTG.WT) - Wt buys sh @ $1.5 to Jun 04/17

Base Metals Price (US$/tonne) Change Copper: US$2.18/lb. 31/17 Sandstorm Gold (SSL.WT.A) - Wt buys sh @ US$4 to Oct 19/15

Nickel $10780.00 +20.00 Copper: CME Group Futures Sept. 2016: US$2.15/lb.; Oct. Franco Nevada (FNW.WT.A) - Wt buys sh @ $75 to Jun 16/17 (SSL.WT.B) - Wt buys sh @ US$14 to Sep 07/17

2016: US$2.15/lb GoGold Resources Inc. (GGD.WT) - Wt buys sh @ $1.7 to Jun Sandstorm Gold (SSL.WT.A) - Wt buys sh @ US$5 to Oct 19/15

Copper $4776.50 -31.00

Ferro-Chrome: US$1.94/kg 7/18 (SSL.WT.B) - Wt buys sh @ US$14 to Sep 07/17

Lead $1807.50 +13.50

Zinc $2273.00 -4.00 Ferro Titanium: US$3.80/kg Gran Colombia Gold (GCM.WT.A) - Wt buys sh @ $3.25 to Mar

FerroTungsten: US$26.87/kg 18/19

Ferrovanadium: US$19.33/kg HudBay Minerals (HBM.WT) - Wt buys sh @ $15 to Jul 20/18 TSX VENTURE WARRANTS

LME WAREHOUSE LEVELS Iridium: NY Dealer Mid-mkt US$575/tr oz. Lithium Americas Corp (LAC.WT) - One Warrant to purchase

one common share of the Issuer at $0.90 until expiry Atlantic Gold (AGB.WT) - Wt buys sh @ $0.6 to Aug 20/18

Iron Ore 62% Fe CFR China-S: US$61.40/tonne

Lydian International Limited (LYD.WT) - One Warrant to pur- Brazil Resources (BRI.WT) - Wt buys sh @ $0.75 to Dec 31/18

Metal stocks (in tonnes) held in London Metal Exchange ware- Iron Ore Fines: US$54.72/tonne

chase one additional ordinary share of the Issuer at $0.36 per Cornerstone Capital Resources (CGP.WT.S) - Wt buys sh @ $0.35

houses at opening, August 8, 2016 (change from August 8, Iron Ore Pellets: US$78.52/tonne

share until expiry to Apr 07/19

2016 in brackets): Lead: US$0.81/lb.

MBAC Fertilizer (MBC.WT) - Wt buys sh @ $1 to Apr 17/19 Goldstar Minerals Inc (GDM.RT) - 1 Rt to buy sh @ 0.04 ti Aug

Aluminium Alloy 11520 (-80) Magnesium: US$1.99/kg

New Gold A J (NGD.WT.A) - Wt buys sh @ $15 to Jun 28/17 17/16

Aluminium 2259325 (-34475) Manganese: US$1.65/kg

Northern Dynasty Minerals Ltd. J (NDM.WT.A) - Wt buys sh @ Jet Metal (JET.WT) - Wt buys sh @ $0.25 to Sep 16/19

Copper 205025 (-5050) Molybdenum Oxide: US$7.26/lb.

$0.55 to Jul 9/20 Kootenay Silver Inc. (KTN.WT) - Wt buys sh @ $0.55 to Apr

Lead 188175 (+1100) Phosphate Rock: US$115.00/tonne 21/21

Northern Dynasty Minerals Ltd. J (NDM.WT.B) - Wt buys sh @

Nickel 369228 (-3726) Potash: US$269.00/tonne Mission Gold (MGL.WT) - Wt buys sh @ $0.17 to Sep 13/17

$0.55 to Jun 10/21

Tin 5270 (-270) Rhodium: Mid-mkt US$625.00/tr. oz. Monarques Gold (MQR.WT.A) - Wt buys sh @ $0.18 to Dec

Northern Dynasty Minerals Ltd. J (NDM.WT) - Wt buys sh @ $3

Zinc 429425 (-1775) Ruthenium: Mid-mkt US$42.00/tr. oz. 15/17

to Sep 14/17

Silver: Handy & Harman Base: US$19.83 per oz.; Handy & Sunridge Gold (SGC.WT) - Wt buys sh @ $0.35 to Oct 18/17

Oban Mining J (OBM.WT) - Wt buys 20 sh @ $3 to Aug 25/18

Harman Fabricated: US$25.78 per oz. Osisko Gold Royalties (OR.WT) - Wt buys sh @ $36.5 to Feb West African Resources (WAF.WT) - Wt buys sh @ $0.4 to Jan

Tantalite Ore : US$132.01/kg 18/22 17/17

Tin: US$8.24/lb. Osisko Gold Royalties (OR.WT.A) - Wt buys sh @ $19.08 to Feb West Kirkland Mining (WKM.WT) - Wt buys sh @ $0.3 to Apr

Uranium: U3O8, Trade Tech spot price: US$25.90; The UX 26/19 17/19

Consulting Company spot price: US$25.00/lb.

Zinc: US$1.03/lb.

Prices current August 9, 2016 NORTH AMERICAN STOCK EXCHANGE INDICES

52-week

Index Aug 05 Aug 04 Aug 03 Aug 02 Aug 01 High Low

S&P/TSX Composite 14648.77 14528.78 14512.05 14477.01 14582.74 15527.30 12400.15

TSX SHORT POSITIONS TSX VENTURE SHORT POSITIONS S&P/TSXV Composite 806.69 807.42 805.18 805.39 796.17 1050.26 883.52

S&P/TSX 60 850.09 841.99 843.09 840.22 847.40 896.74 709.99

Short positions outstanding as of Jul 18, 2016 (with changes Short positions outstanding as of Jul 18, 2016 (with changes S&P/TSX Global Gold 273.06 279.40 278.57 281.95 273.88 218.90 149.29

from Jul 04, 2016) from Jul 04, 2016) S&P/TSX Metals & Mining 671.50 666.68 669.13 677.42 688.92 954.68 691.69

Largest short positions Largest short positions

Lundin Mng LUN 44627483 -300695 7/4/2016 First Mg Fin FF 6540556 2270220 7/4/2016

Potash Corp SK POT 37038874 2833644 7/4/2016 Westkam Gold WKG 2132000 -3876600 7/4/2016 NEW 52-WEEK HIGHS AND LOWS AUGUST 1–5, 2016

Kinross Gold K 24397756 887217 7/4/2016 Orezone Gold ORE 2122400 423900 7/4/2016

New Gold NGD 23229239 -547706 7/4/2016 Integra Gold ICG 1720832 -47927 7/4/2016 354 New Highs Cerro Grande Great Bear Res* Newmont Mng* Skeena Res

First Quantum FM 20713831 -5394941 7/4/2016 Brazil Res BRI 954746 79146 7/4/2016 Aben Res Chiboug Ind Mn* Great Western* Nicola Mg Inc Skeena Res*

B2Gold BTO 20278539 196030 7/4/2016 Bear Creek Mng BCM 922110 689210 7/4/2016 Aben Res* China Mnls Mng Harmony Gold* Nicola Mg Inc* Sky Ridge*

Gran Colombia GCM 19285800 18423100 7/4/2016 Pure Energy PE 911559 416922 7/4/2016 African Gold CMC Metals Hecla Mining* North Am Ptash* Skyharbour Res

Eldorado Gold ELD 18213852 -1245707 7/4/2016 Gold Reserve GRZ 888900 -700 7/4/2016 Agave Silver CMC Metals* Heron Res* Nrthn Vertex Skyharbour Res*

Agave Silver* Coeur Mng* Hochschild Mg* NSGold Solitario Ex&R

Suncor Energy SU 12310101 -2749539 7/4/2016 Santacruz Silv SCZ 825400 -2159874 7/4/2016 Colombia Crest Nthn Dynasty

Agnico Eagle HTI Ventures Solitario Ex&R*

Goldcorp G 10953117 994285 7/4/2016 Golden Dawn Ml GOM 551800 390300 7/4/2016 Agnico Eagle* Colorado Res Hycroft Mg* Nthn Dynasty*

Scorpio Gold SGN 535000 535000 7/4/2016 Sona Res

Thompson Creek TCM 10684862 1691800 7/4/2016 Aldridge Mnrls Colorado Res* IAMGOLD NV Gold Source Expl

HudBay Mnls HBM 9884344 -1515524 7/4/2016 Pure Gold Mg PGM 480143 126443 7/4/2016 Alexander Nubi Confedertn Mls IAMGOLD* NV Gold*

Southern Silvr

Centerra Gold CG 9173873 6388692 7/4/2016 Algold Res ALG 321369 319065 7/4/2016 Alexco Res Copper Lake Rs IMPACT Silver Odin Mng & Exp

Alexco Res* Copperbank Res Impala Platnm* Odin Mng & Exp* Southern Silvr*

Detour Gold DGC 9093355 -1146313 7/4/2016 Rye Patch Gold RPM 261376 -104352 7/4/2016 Spanish Mtn Gd

Alternative ER Copperbank Res* Independence G Opawica Expl

Barrick Gold ABX 8812523 -54192 7/4/2016 ATAC Res ATC 260500 -39900 7/4/2016 Spanish Mtn Gd*

Am Manganese Cordoba Mnls Independence G* Orex Mnrls

Largest increase in short position Largest increase in short position Am Manganese* Cornerstone Ca Integra Gold Orex Mnrls* Stakeholdr Gld

Gran Colombia GCM 19285800 18423100 7/4/2016 First Mg Fin FF 6540556 2270220 7/4/2016 Amarc Res Cornerstone Ca* Integra Gold* Orezone Gold Stakeholdr Gld*

Centerra Gold CG 9173873 6388692 7/4/2016 Bear Creek Mng BCM 922110 689210 7/4/2016 Amarc Res* Cruz Cap Corp* INV Metals Orezone Gold* Starr Peak Exp*

Alamos Gold AGI 8067270 2847793 7/4/2016 Scorpio Gold SGN 535000 535000 7/4/2016 Amarillo Gold Currie Rose Rs InZinc Mining* Oriental Non F Stillwater Mg*

Potash Corp SK POT 37038874 2833644 7/4/2016 Orezone Gold ORE 2122400 423900 7/4/2016 Americas Silvr Darnley Bay Iron South Mng Oroco Res* Stone Ridge Ex

Pure Energy PE 911559 416922 7/4/2016 Americas Silvr* Darnley Bay* Ivanhoe Mines Orosur Mng Strategic Metl

Mandalay Res MND 2327925 2074225 7/4/2016

AngloGold Ash* Defiance Silvr Ivanhoe Mines* Orvana Mnrls Strategic Res

Largest decrease in short position Largest decrease in short position Apple Cap Inc Defiance Silvr* Jaguar Mng Osisko Gold Stratton Res

Stornoway Diam SWY 311867 -15446928 7/4/2016 Westkam Gold WKG 2132000 -3876600 7/4/2016 Arcus Dev Grp Delrand Res* Jaguar Mng* Osisko Gold* Sultan Mnrls

IAMGOLD IMG 7754674 -6207999 7/4/2016 Santacruz Silv SCZ 825400 -2159874 7/4/2016 Argentum Silvr Dolly Vard Sil K92 Mng Inc Otis Gold Sunvest Mnrls

Dundee Prec Mt DPM 1896413 -5420200 7/4/2016 Strategic Metl SMD 8400 -249600 7/4/2016 Ascot Res Dolly Vard Sil* K92 Mng Inc* Otis Gold* Tanzania Rlty

First Quantum FM 20713831 -5394941 7/4/2016 Alphamin Res AFM 3000 -247000 7/4/2016 Astorius Res DRDGOLD* Kaizen Discvry Pan Am Silver Tanzania Rlty*

Nemaska Lith NMX 431700 -4557800 7/4/2016 Red Pine Expl RPX 165600 -152800 7/4/2016 Atacama Pac Gd* East Africa * Kincora Copper Pan Am Silver* Teck Res

Atico Mng Ecuador Gold Kings Bay Gold Pan Global Res Telson Res

Atico Mng* Ecuador Gold* Kingsmen Res* PanTerra Gold*

Telson Res *

Atlantic Gold Endeavour Mng Klondex Mns Philippine Mtl

Endeavour Mng* Klondike Gold Tembo Gold

Aura Silver Rs Pinecrest Res

Aurcana Corp Endeavr Silver Klondike Silv Pistol Bay Mng Tembo Gold*

Aurcana Corp* Endeavr Silver* Klondike Silv* Pistol Bay Mng* Terraco Gold

DAILY METAL PRICES Aurvista Gold* Eros Res Corp Kootenay Silvr Prism Res Terrax Mnrls

Auryn Res* Eskay Mng Lamelee Iron Prize Mng Terrax Mnrls*

Daily Metal Prices Axiom Mng* Eurasian Mnls Lara Expl Prospero Silvr Teuton Res*

Date Aug 8 Aug 5 Aug 4 Aug 3 Aug 2 Axmin Inc Eurasian Mnls* Lion One Mtls Prospero Silvr* Thompson Creek*

BASE METALS (London Metal Exchange -- Midday official cash/3-month prices, US$ per tonne) Azimut Expl Eureka Res Lion One Mtls* PUF Vent Inc Thor Expl

Al Alloy 1545/1565 1545/1565 1545/1565 1540/1565 1565/1590 B2Gold Everton Res Lions Gate Mtl PUF Vent Inc * Timmins Gold*

Aluminum 1644/1651.50 1627/1637 1615.50/1630 1618/1629.50 1635/1641 B2Gold* Everton Res* Lorraine Coppr Q-Gold Res* Tintina Res*

Copper 4795/4809.50 4792/4810 4786.50/4807 4844/4856 4885/4898 Balmoral Res Evrim Res Lucara Diam Quinto Real TomaGold

Balmoral Res* Excellon Res Luna Gold Rackla Mtls* Torex Gold

Lead 1792/1800 1794/1804 1787/1794.50 1802/1808 1817.50/1828 Barksdale Cap Excellon Res* Luna Gold* Rainforest Res* Torex Gold*

Nickel 10780/10820 10575/10640 10435/10460 10640/10680 10790/10850 Barsele Min* Exeter Res Lundin Mng Randsburg Int* Tower Res*

Tin 18150/18175 18400/18300 17915/17935 18030/17940 17965/17950 Bayhorse Silvr* Exeter Res* Lydian Intl Redstar Gold Treasury Metal

Zinc 2279/2280 2270/2270 2257.50/2259 2265/2266 2280/2280 BCGold Finore Mng Lydian Intl* Redzone Res Trevali Mng

BCGold* Firestone Vent MAG Silver Reunion Gold Trevali Mng*

Bellhaven Cp&G First Majestic Malbex Res* Richmont Mines TriStar Gold

Bellhaven Cp&G* First Majestic* Match Capital Richmont Mines*

PRECIOUS METAL PRICES (London fix, LBMA silver price, US$ per troy oz.) TriStar Gold*

Berkwood Res First Quantum Maya Gold &Sil Rio Silver

Gold AM 1330.00 1362.60 1351.15 1364.40 1358.15 Big North Grap* Fortescue Mtls* MDN Inc RJK Explor Vale*

Gold PM 1336.80 1340.40 1362.75 1358.90 1363.75 Bitterroot Res Fortuna Silvr MDN Inc* Rojo Res* Valterra Res

Silver 19.66 20.22 20.16 20.59 20.71 Bitterroot Res* Fortuna Silvr* Metals X* Rouge Res Walker River

Platinum 1149.00 1146.00 1157.00 1161.00 1175.00 Blue Sky Uran Full Metal Mnl Midas Gold* Roxgold* West Af Res

Buenaventura* Galway Mtls Millrock Res Royal Gold* Williams Creek

Palladium 695.00 699.00 711.00 706.00 720.00

Cache Expl Galway Mtls* Millrock Res* Rupert Res Xtierra

Cache Expl* Genesis Mtls Mineral Mtn San Marco Res* Yellowhead Mng

California Gl* Giyani Gold* Mineral Mtn* Sandspring Res Zincore Mtls

EXCHANGE RATES Canadian Zeol GMV Minerals Mines Manage* Sandspring Res* 14 New Lows

Canadian Zeol* GMV Minerals* Mirasol Res Sandstorm Gold Aida Minerals

Date Aug 05 Aug 04 Aug 03 Aug 02 Aug 01 Canamex Res Gold Fields* Moneta Porcpn Sandstorm Gold* Cameco Corp

US$ in C$ 1.3173 1.3020 1.3067 1.3111 1.3123 Canamex Res* Gold Mtn Mng * Moneta Porcpn* Semafo Cameco Corp*

C$ in US$ 0.7592 0.7681 0.7653 0.7627 0.7619 Canasil Res Gold Reach Res Monster Mng Senator Mnrls Comstock Mtls *

Cancana Res Gold Resource* Monster Mng* Senator Mnrls* Duncan Park H

Exchange rates (Quote Media, August 05, 2016) Canstar Res Golden Arrow Mountain Prov Serengeti Res

DuSolo Fertil*

C$ to AUS C$ to EURO C$ to YEN C$ to Mex Peso C$ to SA Rand Cariboo Rose Golden Arrow* Mountain Prov* Sibanye Gold*

Cartier Res Golden Cariboo Natan Res Silver Bear Rs Gold Mtn Mng *

0.995783 0.6846 77.3040 14.2459 10.4195 Carube Copper* Golden Tag Natural Res Pt* Kazax Mnls

Silver Bull Re

C$ to UK Pound C$ to China Yuan C$ to India Rupee C$ to Swiss Franc C$ to S. Korea Won Cascadero Copp Goldeye Expl Nevada Zinc Silver Bull Re* Peloton Mnrls

0.5808 5.0498 50.7670 0.7445 847.3270 Castle Mtn Mng GoldQuest Mng New Gold Silver Wheaton Skyharbour Res*

US to AUS US to EURO US to YEN US to Mex Peso US to SA Rand Castle Res Goldstream Mnl New Gold* Silver Wheaton* Starr Peak Exp*

1.3121 0.9018 101.8190 18.7535 Cda Zinc Mtls Gowest Gold New Jersey Mng* Silvercorp Met Stone Ridge Ex

US to UK Pound US to China Yuan US to India Rupee US to Swiss Franc US to S. Korea Won Cdn Arrow Gowest Gold* NewCastle Gold* Silvercorp Met* Weststar Res*

Centamin Grande Portage* Newmarket Gold Sirios Res XLI Tech Inc*

0.7651 6.6514 66.8425 0.9807 1115.4500

Centenera Mng Great Bear Res Newmarket Gold* Sirios Res*

CANADIAN GOLD MUTUAL FUNDS

Financial information provided by Fundata Canada Inc. ©Fundata Canada Inc. All rights reserved

Fund Aug 05 ($) Jul 29 ($) Change ($) Change (%) YTDChange (%) MER (%) TotalAssets (M$)

AGF Prec Mtls Fd MF 30.26 30.51 -0.25 -0.82 79.83 2.78 213.50

LEGEND STAFF INVESTMENT POLICY BMO Prec Mtls Fd A 23.43 23.72 -0.28 -1.20 82.40 2.40 79.26

A – Australian Stock Exchange The Northern Miner does not permit any editorial employee to file stories about BMO ZGD 14.15 14.08 0.07 0.47 92.70 0.63 38.10

C – CNSX Canadian National companies in which the writer owns shares. Editorial employees are also not BMO ZJG 11.41 11.52 -0.11 -0.93 106.65 0.60 79.66

Stock Exchange permitted to take part in initial public offerings or to engage in short selling. CIBC Prec Metal Fd A 14.58 14.69 -0.11 -0.78 68.46 2.62 68.81

J – Johannesburg Stock Dyn Prec Metls Fd A 9.18 9.16 0.02 0.22 99.51 2.66 471.14

Exchange Horizons HEP 35.68 1.07 3.06 83.61 0.80

L – London Stock Exchange IGMacGloPrecMetCl A 11.72 11.81 -0.09 -0.76 99.80 2.76 109.60

M – Mexico Stock Exchange CONVERSIONS OF WEIGHTS & MEASURES iShares XGD 17.05 17.10 -0.05 -0.31 95.09 0.61 836.51

N – New York Stock Exchange 1 troy ounce = 31.1 grams 1 gram per (metric) tonne = 0.02917 troy Mac Prec Met Cl A 66.55 67.10 -0.54 -0.81 102.40 2.51 151.26

O – U.S. over-the-counter 1 kilogram = 32.15 troy ounces ounces per (short) ton NB Prec Met Fd Inv 16.70 16.85 -0.15 -0.89 92.70 2.46 46.35

Q – NASDAQ or U.S. OTC 1 kilogram = 2.2046 pounds = 0.03215 troy ounces per (metric) RBC GblPreMetFd A 40.50 41.30 -0.80 -1.94 92.02 2.13 475.31

T – Toronto Stock Exchange 1 (metric) tonne = 1,000 kilograms tonne Sentry Pre Met Fd A 52.84 53.69 -0.85 -1.58 93.18 2.90 271.54

V – TSX Venture Exchange 1 (metric) tonne = 2,204.6 pounds 1 kilometre = 0.6214 miles Sprott Gold&PrMinFdA 51.93 2.27 4.49 92.35 3.19 288.29

X – NYSE Alternext U.S. 1 (short) ton = 2,000 pounds 1 hectare = 2.47 acres Sprott SilverEquCl A 9.01 0.81 9.25 119.85 3.23 81.27

* – Denotes price in U.S.$ 1 (metric) tonne = 1.1023 (short) tons TD PreciousMetalsInv 51.26 51.37 -0.11 -0.21 88.24 2.26 183.88

7_AUGUST15_MMMM.indd 7 2016-08-09 4:20 PM

8 AUGUST 15–21, 2016 / THE NORTHERN MINER WWW.NORTHERNMINER.COM

S T O C K TA B L E S

MINING STOCKS listed on

CANADIAN and U.S. EXCHANGES

TRADING: AUGUST 1–5, 2016

(100s) Week 12-month (100s) Week 12-month (100s) Week 12-month (100s) Week 12-month

Stock Exc Volume High Low Last Change High Low Stock Exc Volume High Low Last Change High Low Stock Exc Volume High Low Last Change High Low Stock Exc Volume High Low Last Change High Low

Aura Mnls T 263 0.27 0.22 0.25 + 0.02 0.31 0.06 Cda Rare Earth V 1063 0.03 0.03 0.03 + 0.01 0.04 0.02 Energy Fuels* X 609 2.29 2.18 2.21 - 0.02 4.41 1.81

A Aura Silver Rs V 616 0.05 0.04 0.05 + 0.01 0.05 0.01 Cda Zinc Mtls V 2218 0.44 0.27 0.39 + 0.10 0.44 0.10 Energy Fuels T 257 2.95 2.83 2.92 + 0.02 5.76 2.47

Abcourt Mines* O 149 0.09 0.07 0.08 - 0.02 0.10 0.02 Auramex Res V 26 0.03 0.00 0.03 + 0.01 0.03 0.01 Cdn Arrow V 3221 0.02 0.01 0.01 + 0.01 0.02 0.01 Entree Gold* X 606 0.31 0.29 0.30 - 0.01 0.40 0.17

Abcourt Mines V 648 0.12 0.11 0.11 - 0.01 0.13 0.03 Aurcana Corp* O 464 0.50 0.37 0.42 + 0.04 0.50 0.07 Cdn Intl Mnrls V 2886 0.06 0.04 0.05 + 0.01 0.13 0.01 Equitas Res V 4177 0.11 0.09 0.09 - 0.01 0.22 0.05

Aben Res* O 257 0.26 0.19 0.25 + 0.07 100.52 0.03 Aurcana Corp V 1397 0.67 0.49 0.55 + 0.06 0.67 0.09 Cdn Metals 811 0.30 0.10 0.30 + 0.14 0.44 0.06 Equitas Res* O 647 0.09 0.07 0.07 - 0.01 0.17 0.02

Aben Res V 647 0.34 0.22 0.32 + 0.10 0.30 0.06 Aureus Mng T 9990 0.09 0.08 0.08 - 0.01 0.55 0.05 Cdn Zinc* Q 435 0.29 0.25 0.28 + 0.01 0.32 0.04 Era Res Inc V 45 0.43 0.31 0.43 + 0.06 0.50 0.09

Aberdeen Intl* O 401 0.14 0.11 0.13 + 0.01 0.16 0.07 Aureus Mng* O 1017 0.07 0.05 0.05 - 0.02 0.31 0.03 Centamin T 345 2.97 2.81 2.82 - 0.07 2.97 1.08 Erdene Res Dev T 491 0.34 0.29 0.32 + 0.02 0.55 0.11

Aberdeen Intl T 1538 0.18 0.16 0.17 + 0.01 0.24 0.10 AuRico Metals * O 668 0.88 0.78 0.79 - 0.08 0.91 0.37 Centaurus Diam* O 109 0.20 0.14 0.19 - 0.02 0.34 0.02 Erdene Res Dev* O 43 0.25 0.22 0.24 + 0.01 0.42 0.08

Abitibi Royalt V 100 8.75 7.50 8.26 + 0.44 9.95 1.53 AuRico Metals T 3927 1.15 1.02 1.03 - 0.10 1.22 0.52 Centerra Gold T 4033 8.06 7.40 7.45 - 0.25 8.67 5.64 Erin Ventures* O 220 0.04 0.04 0.04 + 0.00 0.08 0.03

ABT Holdings* O 4 0.65 0.51 0.51 - 0.09 0.80 0.05 Aurion Res V 968 0.37 0.33 0.34 - 0.02 0.40 0.04 Centurion Mnls V 940 0.10 0.08 0.08 - 0.02 0.18 0.04 Erin Ventures V 574 0.06 0.04 0.06 + 0.01 0.11 0.04

Acme Res Inc V 5 0.06 0.00 0.06 + 0.01 0.07 0.02 Aurora Gold* O 326 0.01 0.00 0.01 + 0.00 0.02 0.00 Century Global T 2 0.22 0.00 0.22 + 0.01 0.36 0.15 Eros Res Corp V 316 0.21 0.18 0.21 + 0.03 0.21 0.09

Adamera Mnls V 948 0.10 0.09 0.09 + 0.01 0.14 0.01 Aurvista Gold* O 243 0.29 0.22 0.28 + 0.04 0.29 0.02 Cerro Grande* O 26 0.04 0.02 0.04 + 0.02 0.05 0.00 Eros Res Corp V 316 0.21 0.18 0.21 + 0.03 0.21 0.09

Adamera Mnls* O 85 0.08 0.06 0.08 + 0.01 0.10 0.01 Aurvista Gold V 1771 0.38 0.28 0.37 + 0.05 0.39 0.03 Cerro Grande 232 0.06 0.02 0.03 - 0.01 0.06 0.01 Ethos Gold V 130 0.36 0.34 0.35 - 0.01 0.41 0.14

Adex Mining V 2584 0.02 0.01 0.01 - 0.01 0.02 0.01 Auryn Res* O 601 3.18 2.82 2.89 - 0.14 3.18 0.70 Cerro Mng V 100 0.01 0.01 0.01 + 0.01 0.03 0.01 Ethos Gold* O 41 0.27 0.26 0.27 - 0.01 0.32 0.09

Advance Gold V 20 0.08 0.06 0.06 - 0.02 0.10 0.01 Avalon Adv Mat T 1687 0.23 0.20 0.20 - 0.03 0.33 0.10 Chalice Gold M* O 55 0.16 0.16 0.16 - 0.01 0.17 0.08 Eurasian Mnls* X 789 1.37 1.10 1.29 + 0.19 1.37 0.35

African Gold V 1944 0.12 0.09 0.12 + 0.02 0.12 0.03 Avalon Adv Mat* O 340 0.18 0.15 0.16 - 0.00 0.26 0.07 Chalice Gold M T 437 0.21 0.19 0.20 + 0.01 0.21 0.09 Eurasian Mnls V 157 1.75 1.36 1.63 + 0.18 1.75 0.48

African Queen V 2200 0.10 0.06 0.07 - 0.01 0.14 0.01 Avarone Metals 675 0.07 0.06 0.07 - 0.01 0.14 0.02 Champion Bear* O 3 0.06 0.06 0.06 - 0.02 0.08 0.02 Eureka Res V 618 0.17 0.14 0.14 - 0.01 0.17 0.04

Agave Silver* O 99 0.12 0.07 0.10 + 0.03 0.12 0.01 Avino Silver* X 2176 2.80 2.52 2.63 - 0.11 3.14 0.71 Champion Iron* O 26 0.20 0.19 0.19 - 0.01 0.23 0.09 EurOmax Res T 50 0.45 0.42 0.45 + 0.03 0.62 0.21

Agave Silver V 387 0.15 0.10 0.13 + 0.02 0.15 0.01 Avino Silver V 326 3.70 3.29 3.45 - 0.10 4.05 1.03 Champion Iron T 455 0.25 0.23 0.24 - 0.01 0.30 0.11 EurOmax Res* O 18 0.34 0.31 0.34 + 0.00 0.46 0.15

Agnico Eagle T 3244 78.35 74.62 76.22 + 0.24 78.35 27.63 Avnel Gold T 2094 0.39 0.35 0.35 - 0.03 0.39 0.18 Chesapeake Gld V 346 6.24 5.21 6.05 + 0.80 6.50 1.39 Europn Uran Rs V 13 0.22 0.00 0.22 + 0.02 0.27 0.05

Agnico Eagle* N 7911 60.10 57.40 57.92 - 0.22 60.10 21.00 AXE Expl V 766 0.03 0.00 0.03 - 0.01 0.04 0.01 Chesapeake Gld* O 259 4.69 4.04 4.58 + 0.54 5.03 1.05 Eurotin V 8 0.08 0.00 0.08 - 0.01 1.00 0.03

Agrium* N 3629 91.32 87.75 89.91 - 0.85 106.76 79.94 Axiom Mng* O 11 0.23 0.21 0.23 + 0.05 0.23 0.01 Chevron* N 40680 102.10 97.91 100.51 - 1.97 107.58 69.58 Everest Vent V 25 0.71 0.00 0.70 - 0.01 0.95 0.09

Aguila Amer Gd V 291 0.10 0.08 0.08 - 0.01 0.14 0.03 Axmin Inc V 2590 0.10 0.04 0.08 + 0.04 0.09 0.01 Chiboug Ind Mn V 159 0.23 0.15 0.18 + 0.03 0.26 0.03 Everton Res V 4971 0.12 0.06 0.10 + 0.04 0.08 0.01

Aida Minerals 15 0.12 0.00 0.12 - 0.03 0.23 0.08 Axmin Inc* O 222 0.06 0.02 0.06 + 0.04 0.04 0.00 Chiboug Ind Mn* O 27 0.17 0.14 0.17 + 0.07 0.17 0.07 Everton Res* O 1445 0.09 0.04 0.09 + 0.03 0.07 0.00

Alabama Graph* O 72 0.11 0.10 0.11 + 0.00 0.18 0.08 AZ Mining T 1614 1.88 1.62 1.66 - 0.15 1.94 0.22 Chieftain Mtls V 310 0.17 0.14 0.15 + 0.01 0.23 0.03 Evolving Gold 64 0.40 0.35 0.36 + 0.01 0.50 0.04

Alacer Gold T 2752 3.50 3.21 3.28 - 0.05 3.64 2.08 Azarga Uranium* O 45 0.23 0.22 0.22 - 0.00 0.29 0.19 Chilean Metals V 83 0.18 0.15 0.17 + 0.01 0.19 0.02 Evolving Gold* O 27 0.31 0.26 0.28 - 0.02 0.38 0.02

Alamos Gold T 3971 12.70 11.54 11.67 - 0.52 13.65 3.27 Azarga Uranium T 107 0.30 0.00 0.28 - 0.02 0.40 0.26 Chilean Metals* O 53 0.14 0.12 0.13 - 0.01 0.15 0.00 Evrim Res V 863 0.43 0.31 0.39 + 0.07 0.43 0.10

Alamos Gold* N 5365 9.72 8.75 8.89 - 0.45 10.41 2.27 Azimut Expl V 599 0.45 0.38 0.44 + 0.05 0.45 0.10 China Gold Int T 1368 2.54 2.37 2.37 - 0.10 2.72 1.60 Excalibur Res 528 0.11 0.07 0.10 - 0.01 0.11 0.01

Alberta Star* O 9 0.25 0.22 0.25 + 0.02 0.25 0.12 Azincourt Uran* O 43 0.06 0.04 0.06 + 0.02 0.07 0.02 China Mnls Mng* O 10 0.01 0.00 0.01 - 0.01 0.02 0.00 Excalibur Res* O 96 0.09 0.06 0.07 - 0.01 0.09 0.00

Alcoa* N 63272 10.60 10.20 10.50 - 0.12 11.50 6.14 Azteca Gold* O 78 0.00 0.00 0.00 + 0.00 0.01 0.00 CKR Carbon V 902 0.09 0.07 0.08 - 0.01 0.13 0.06 Excellon Res T 2349 1.58 1.25 1.42 + 0.15 1.58 0.20

Alderon Iron* O 18 0.09 0.08 0.09 + 0.01 0.18 0.05 Claim Post Res V 221 0.04 0.03 0.03 + 0.01 0.06 0.01 Excellon Res* O 369 1.22 0.95 1.09 + 0.14 1.22 0.14

Alderon Iron T 271 0.12 0.11 0.12 + 0.01 0.24 0.07 B Clifton Mng* O 259 0.16 0.13 0.16 - 0.00 0.18 0.05 Excelsior Mng* O 188 0.30 0.25 0.29 + 0.01 0.31 0.12

Aldershot Res V 269 0.05 0.04 0.05 + 0.01 0.05 0.01 Cloud Peak En* N 10303 3.89 3.14 3.49 + 0.08 4.79 1.08 Exeter Res T 445 1.94 1.67 1.77 - 0.01 1.94 0.39

Aldever Res* O 19 0.05 0.00 0.05 - 0.00 0.20 0.04 B2Gold* X 21699 3.45 3.13 3.34 + 0.21 3.45 0.60 CMC Metals* O 29 0.13 0.10 0.13 + 0.03 0.11 0.07 Exeter Res* X 1998 1.48 1.30 1.34 - 0.02 1.48 0.29

Aldever Res V 304 0.08 0.06 0.07 - 0.01 0.30 0.06 B2Gold T 25418 4.49 3.98 4.38 + 0.29 4.49 0.86 CMC Metals V 672 0.20 0.13 0.17 + 0.03 0.32 0.05 Expedition Mng* O 40 0.08 0.07 0.08 + 0.01 0.22 0.07

Aldridge Mnrls V 371 0.33 0.28 0.30 + 0.03 0.33 0.12 Bacanora Mnls V 254 1.50 1.41 1.45 - 0.02 2.04 1.17 Coeur Mng* N 26142 16.03 14.88 15.50 + 0.18 16.03 1.62 Explor Res* O 150 0.14 0.10 0.10 - 0.03 0.18 0.03

Alexander Nubi* O 146 0.06 0.05 0.06 + 0.01 0.06 0.03 Baja Mng* O 120 0.01 0.00 0.01 + 0.01 0.03 0.00 Colibri Res V 74 0.22 0.15 0.18 - 0.04 0.22 0.02 Explor Res V 3088 0.17 0.12 0.14 - 0.03 0.24 0.04

Alexander Nubi V 2730 0.11 0.06 0.11 + 0.04 0.11 0.04 Baja Mng V 112 0.02 0.01 0.01 - 0.01 0.03 0.01 Colombia Crest V 2506 0.04 0.02 0.02 - 0.01 0.04 0.01 Fairmont Res V 654 0.16 0.13 0.13 - 0.02 0.23 0.02

Alexandria Min* O 1172 0.09 0.08 0.08 - 0.00 0.10 0.01 Balmoral Res* O 955 0.84 0.71 0.80 + 0.05 0.84 0.23 Colombian Mins V 144 0.21 0.17 0.17 - 0.03 0.23 0.02 Falco Res V 862 1.12 1.00 1.08 + 0.06 1.25 0.21

Alexandria Min V 2845 0.11 0.10 0.11 - 0.01 0.12 0.02 Balmoral Res T 1656 1.09 0.93 1.05 + 0.08 1.09 0.33 Colorado Res* O 412 0.51 0.43 0.47 + 0.01 0.51 0.04 Finore Mng 1203 0.08 0.02 0.08 + 0.06 0.08 0.01

Alexco Res* X 4050 2.20 1.86 2.14 + 0.23 2.20 0.22 Bandera Gold V 632 0.02 0.01 0.02 + 0.01 0.02 0.01 Colorado Res V 2511 0.67 0.54 0.61 + 0.02 0.67 0.05 Firebird Res V 52 0.04 0.00 0.04 + 0.01 0.05 0.01

Alexco Res T 805 2.87 2.44 2.80 + 0.31 2.87 0.35 Bannerman Res* O 66 0.03 0.03 0.03 + 0.01 0.04 0.01 Colt Res* O 170 0.06 0.04 0.04 - 0.00 0.15 0.04 Firestone Vent V 535 0.06 0.05 0.06 + 0.01 0.06 0.01