Professional Documents

Culture Documents

Form W-2 Tax: Income

Form W-2 Tax: Income

Uploaded by

Luminita Andrei0 ratings0% found this document useful (0 votes)

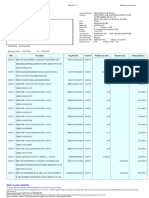

17 views2 pagesThis wage and income transcript is for an individual with social security number XXX-XX-1717 for tax year 2015. It shows that this individual had no wages, income, or tax withholdings reported on their Form W-2 from their employer that year. The transcript contains codes to indicate what types of compensation and withholdings are reported, but all amounts are $0.00, indicating this person did not receive any reported wages or income from this employer in 2015.

Original Description:

hytt

Original Title

Scan1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis wage and income transcript is for an individual with social security number XXX-XX-1717 for tax year 2015. It shows that this individual had no wages, income, or tax withholdings reported on their Form W-2 from their employer that year. The transcript contains codes to indicate what types of compensation and withholdings are reported, but all amounts are $0.00, indicating this person did not receive any reported wages or income from this employer in 2015.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesForm W-2 Tax: Income

Form W-2 Tax: Income

Uploaded by

Luminita AndreiThis wage and income transcript is for an individual with social security number XXX-XX-1717 for tax year 2015. It shows that this individual had no wages, income, or tax withholdings reported on their Form W-2 from their employer that year. The transcript contains codes to indicate what types of compensation and withholdings are reported, but all amounts are $0.00, indicating this person did not receive any reported wages or income from this employer in 2015.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Wage and Income Transcript Page I of2

lH lns

This Product Contains Sensitj,ve Taxpayer Data

Wage and Income Transcript

Request Date: 02-73-20I9

Response Date: 02-73-20L9

Tracking Number: 100428593458

SSN Provided: XXX-XX-l717

Tax Period Requested: December, 2015

Form W-2 Wage and Tax Statement

Employer:

Employer fdenLification Number (trIN) : XXXXX749B

IN

PO BOX

Employee:

Employee's SocjaI Security Number: XXX-XX-1717

ANDR

PO BOX

Srrl.rmi eei nn 'T'rzno.

Amended

document

IaJ:acq- Tinc :nd Ol har /-nmnancrFinn.

evrllysrrre urvrr. $0.00

Eederaf Income Tax Withhe]d: $0.00

Sani: l Ca-rrri +r' ,,Jqes:

-r I^1: $0.00

Sociaf Security Tax WiLhhefd: $0.00

Medicare Wages and Tips: $0.00

Medicare Tax Withheld: $o. oo

JOCra-L SeCUrlty I'aps: $0.00

a I t^a^iad 't'r nc t

$0.00

Dependent Care Benefits: $0.00

Deferrcd Comnensation : $0.00

Nonlaxabfe Comlcat Pay: $0.00

Code "W" Employer Contributions to a Health Savinqs AccounL: $0.00

Code "Y" Deferral-s under a section 409A nonqualified Deferred $0.00

Compensat.ion plan:

Code "2" fncome under section 4O9A on a nonqualified Deferred $0.00

Compensation plan:

Code "R" Employerrs Cont.ribution to MSA: $0.00

.,^d6 rrq,, rmnt n'arI S COntribUtiOn Lv Simnl

tO ufruPf c A.corrnt.u r

s nuuvuff $0.00

Code rrTrr F,xncnseq Tncrrrred for OrrAl

Yuqrr!f,es i f i ad Adan+- i nnq.

nuvyervrrr ! $0.00

Code "V" Income from exercise of non-staLutory stock options: $0.00

"*" Designated Roth Contrlbutions under a Section 401(k) $0.00

"od.

PIan:

Code "BB" Designated Roth Contributions under a Section 403 (b) $0.00

PIan:

Code "DD" Cost of Empfoyer-sponsored Heafth Coveraqe: $0.00

Wage and Income Transcript Page2 of2

Code "EE" Designated ROTH Contributions Under a Governmental $0.00

Section 457 (b) Plan:

Th i rd Parf r; (i nlz D:rr

! qf Tndi nr+nr.

+rrsrvs uv! . Unanswered

Reti-rement Plan fndicator: No Correction

Statutory Employee: No Correction

This Product Contains Sensitive Taxpayer Data

You might also like

- Adp Pay Stub Template 2Document1 pageAdp Pay Stub Template 2enudo Solomon67% (3)

- 16 Crosby and Brinkerhoff - Stakeholder AnalysisDocument7 pages16 Crosby and Brinkerhoff - Stakeholder AnalysisBeverly Abriol100% (1)

- 1120 Sample TranscriptDocument3 pages1120 Sample TranscriptEmily KnightNo ratings yet

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocument14 pagesInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalNo ratings yet

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocument14 pagesInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalNo ratings yet

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- IRS New Tax Return TranscriptDocument6 pagesIRS New Tax Return TranscriptFedSmith Inc.0% (1)

- Manuel Medel Paystubs PDFDocument7 pagesManuel Medel Paystubs PDFSantiago ManuelNo ratings yet

- Pricing StrategiesDocument84 pagesPricing StrategiesKashika Kohli100% (1)

- Look Before You LeverageDocument14 pagesLook Before You LeverageIrfan Mohd100% (3)

- Lesson 3 - THEORIES OF ENTREPRENEURSHIPDocument38 pagesLesson 3 - THEORIES OF ENTREPRENEURSHIPTeacher Flo100% (3)

- Aaron Berg w2Document2 pagesAaron Berg w2kevin kuhnNo ratings yet

- Balance No. Cta. Nombre de La Cuenta Inicial Caja 101-01Document14 pagesBalance No. Cta. Nombre de La Cuenta Inicial Caja 101-01marianaNo ratings yet

- Taxcomp T15038Document1 pageTaxcomp T15038victor.savioNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- Tax Return TranscriptDocument2 pagesTax Return TranscripttravisdemitriusNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument25 pagesNumbers Sheet Name Numbers Table NameDARSH SADANI 131-19No ratings yet

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- IT Saving Declaration - 2109Document2 pagesIT Saving Declaration - 2109bala govindamNo ratings yet

- RwservletDocument1 pageRwservletMilind KhandaveNo ratings yet

- Power Professional 1Document1 pagePower Professional 1Shahid InayetNo ratings yet

- Payslip 1Document4 pagesPayslip 1Leo MagnoNo ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- Disclaimer - : This Spreadsheet Is FreeDocument218 pagesDisclaimer - : This Spreadsheet Is FreePaul BischoffNo ratings yet

- VOID : 7/12/2021 7/18/2021 XXX-XX-4525 Elite Hotline # 800 423-5595 Option 2Document1 pageVOID : 7/12/2021 7/18/2021 XXX-XX-4525 Elite Hotline # 800 423-5595 Option 2Ana Perone MenolascinaNo ratings yet

- One97 Communications Limited: Earnings DeductionsDocument2 pagesOne97 Communications Limited: Earnings Deductionsrusingh932No ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterNo ratings yet

- Payslip - June 15Document1 pagePayslip - June 15bktsuna0201No ratings yet

- S Income Tax Declaration April 2017Document2 pagesS Income Tax Declaration April 2017HanumanthNo ratings yet

- Practica en Aspel-CoiDocument32 pagesPractica en Aspel-CoilizbethNo ratings yet

- 1033553563Document1 page1033553563Virendra Nalawde100% (1)

- Lic PolicyDocument1 pageLic Policyvisupatel26112004No ratings yet

- BD0164 SalarySlipwithTaxDetailsDocument1 pageBD0164 SalarySlipwithTaxDetailskb5452520No ratings yet

- Temple TeDocument1 pageTemple TekishuthebossNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- FAR 4 - FebruaryDocument10 pagesFAR 4 - FebruaryCharles D. FloresNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- billRevisionReport 15045873Document10 pagesbillRevisionReport 15045873Nachiket ChakradevNo ratings yet

- Trial Balance (Classic) : PT TCP Anggiat SitungkirDocument3 pagesTrial Balance (Classic) : PT TCP Anggiat SitungkirIntan HaryaniNo ratings yet

- Health & Glow Private Limited: Earnings DeductionsDocument1 pageHealth & Glow Private Limited: Earnings DeductionsVishal BawaneNo ratings yet

- Miscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post AdjDocument1 pageMiscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post Adjnicole.dimayuga3No ratings yet

- Alkem Laboratories LTD.: Tax Computation For The Month March 2020Document3 pagesAlkem Laboratories LTD.: Tax Computation For The Month March 2020MAHESH A TNo ratings yet

- Binit Salary Slip 2Document1 pageBinit Salary Slip 2Akanksha GuptaNo ratings yet

- Account Summary: There Were N o Transactions in This PeriodDocument1 pageAccount Summary: There Were N o Transactions in This PeriodTricia PingilleyNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Trial BalanceDocument1 pageTrial BalanceKhozimah ZimahNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- 30-Jun-2021-2 (1) - 2-2Document1 page30-Jun-2021-2 (1) - 2-2sattidurgadeviNo ratings yet

- Hensley, - Juan - Jaime SabinesDocument2 pagesHensley, - Juan - Jaime SabinesJuan HensleyNo ratings yet

- Acc 201 4Document6 pagesAcc 201 4Trickster TwelveNo ratings yet

- Confidential PayslipDocument1 pageConfidential PayslipNiteesh KumarNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- AjitDocument1 pageAjitShivaji NikamNo ratings yet

- SARRIDADocument2 pagesSARRIDAmutiya andiniNo ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- GSTR1 03ajdpk8658g1z5 062022Document7 pagesGSTR1 03ajdpk8658g1z5 062022SANJEEV KUMARNo ratings yet

- Read Book Big Magic: Creative Living Beyond Fear Download (PDF)Document5 pagesRead Book Big Magic: Creative Living Beyond Fear Download (PDF)Luminita Andrei0% (6)

- DR Moku PDFDocument1 pageDR Moku PDFLuminita AndreiNo ratings yet

- Kolb 02 PDFDocument40 pagesKolb 02 PDFLuminita AndreiNo ratings yet

- DR Moku PDFDocument1 pageDR Moku PDFLuminita AndreiNo ratings yet

- DR Moku PDFDocument1 pageDR Moku PDFLuminita AndreiNo ratings yet

- Dementia and The BrainDocument13 pagesDementia and The BrainLuminita AndreiNo ratings yet

- Brains PDFDocument16 pagesBrains PDFLuminita AndreiNo ratings yet

- Position of Pakistani Women in 21st Century A Long Way To Go by DR Khalid Manzoor ButtDocument3 pagesPosition of Pakistani Women in 21st Century A Long Way To Go by DR Khalid Manzoor ButtMehak Gul BushraNo ratings yet

- Akp Associates Event Profile FinalDocument27 pagesAkp Associates Event Profile FinalanupkpandaNo ratings yet

- Disbursement Voucher: Department of Agrarian Reform Iv-ADocument36 pagesDisbursement Voucher: Department of Agrarian Reform Iv-AThea TrinidadNo ratings yet

- MonopolyDocument36 pagesMonopolyAbhishek Pratap SinghNo ratings yet

- International Journal of Trend in Scientific Research and Development (IJTSRD)Document8 pagesInternational Journal of Trend in Scientific Research and Development (IJTSRD)Editor IJTSRDNo ratings yet

- Deloitte - Beyond Design Thinking PDFDocument120 pagesDeloitte - Beyond Design Thinking PDFzskebapci100% (1)

- Book Package Details: GSTIN - 07BFGPS7337G1Z4Document1 pageBook Package Details: GSTIN - 07BFGPS7337G1Z4chitti poluriNo ratings yet

- Canadian Securities: Economic PolicyDocument41 pagesCanadian Securities: Economic PolicyNikku SinghNo ratings yet

- Rahul PK Raghu Rake Major ProjectDocument52 pagesRahul PK Raghu Rake Major Projectashi ashiNo ratings yet

- Purchasing FlowchartDocument1 pagePurchasing FlowchartSpex AbrogarNo ratings yet

- Invoice-WH Owner-Dec-18Document8 pagesInvoice-WH Owner-Dec-18Vipul 77No ratings yet

- MoratelindoDocument1 pageMoratelindorikko dwiwijanarkoNo ratings yet

- 3 Nov Seminar ListDocument21 pages3 Nov Seminar ListAbhishek VermaNo ratings yet

- Selangor Times Oct 7-9, 2011 / Issue 43Document24 pagesSelangor Times Oct 7-9, 2011 / Issue 43Selangor TimesNo ratings yet

- Chapter 02 The Dynamic Environment of International TradeDocument5 pagesChapter 02 The Dynamic Environment of International TradeHUỲNH TRẦN THIỆN PHÚCNo ratings yet

- First Fundamental Theorem of Welfare Economics State That "AnyDocument1 pageFirst Fundamental Theorem of Welfare Economics State That "Anyokika clanNo ratings yet

- Analisis Kapasitas Jalur Dan Kecelakaan Kereta ApiDocument9 pagesAnalisis Kapasitas Jalur Dan Kecelakaan Kereta ApiBima AnhasNo ratings yet

- Chapter 21 SolutionsDocument3 pagesChapter 21 SolutionsLiana LianaNo ratings yet

- MalaysiaDocument29 pagesMalaysiaHanna TaganiNo ratings yet

- Comparative Study of Interest Rate of Different BanksDocument8 pagesComparative Study of Interest Rate of Different Banksshanti k mNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceavinashvmNo ratings yet

- Amal BDBL Final 09Document50 pagesAmal BDBL Final 09Amal Kumar PaulNo ratings yet

- Film Budget Template StudioBinderDocument46 pagesFilm Budget Template StudioBinderDavid AzoulayNo ratings yet

- Banking Sustainability For Economic Growth and Socio-Economic Development - Case in VietnamDocument10 pagesBanking Sustainability For Economic Growth and Socio-Economic Development - Case in Vietnamثقتي بك ياربNo ratings yet

- Flipkart Labels 23 Feb 2024 08 17Document50 pagesFlipkart Labels 23 Feb 2024 08 17royalskhatriNo ratings yet

- Financial Market TextBook (Dragged)Document2 pagesFinancial Market TextBook (Dragged)Nick OoiNo ratings yet