Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsTABLE 3: Procedure in Criminal Cases

TABLE 3: Procedure in Criminal Cases

Uploaded by

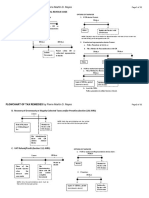

JP JimenezThe document outlines the procedure for criminal cases in the Philippines. It shows that criminal actions must be approved by revenue or customs officials. Cases are first filed with the Regional Trial Court (RTC) which can hear original jurisdiction local tax collection cases under 300k/400k or appellate cases from the Metropolitan Trial Court (MTC). Adverse RTC decisions can be appealed within 15 days to the Court of Tax Appeals (CTA) division or en banc. Subsequent appeals involve motions for reconsideration or new trial to the CTA or petitions for review to the Supreme Court within 15 days of a denial or adverse decision.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Modes of Appeal TableDocument3 pagesModes of Appeal TablemarydalemNo ratings yet

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Outline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancDocument1 pageOutline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancRaymond RogacionNo ratings yet

- Jurisdiction of The Court of Appeals: Decision by MTCDocument16 pagesJurisdiction of The Court of Appeals: Decision by MTCJoh SuhNo ratings yet

- TreeDocument1 pageTreeEricaNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- Court of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionDocument7 pagesCourt of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionClarisse ZaplanNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- CHART F JURISDICTION AND PROCEDURE LABOR ARBITER RevDocument2 pagesCHART F JURISDICTION AND PROCEDURE LABOR ARBITER RevAthena BlakeNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- Taxation Law - CTADocument7 pagesTaxation Law - CTARia Kriselle Francia PabaleNo ratings yet

- Tax Report HandoutDocument4 pagesTax Report HandoutJune FourNo ratings yet

- Diagram Appeals OverviewDocument2 pagesDiagram Appeals OverviewRen Concha100% (2)

- Annex A Table of RemediesDocument10 pagesAnnex A Table of RemediesAkiko AbadNo ratings yet

- Tax Remedies and Tax Assessment in General and PrescriptionDocument34 pagesTax Remedies and Tax Assessment in General and PrescriptionipbsalanguitNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Procedure in Tax Civil Cases - CTADocument1 pageProcedure in Tax Civil Cases - CTAJezreel CastañagaNo ratings yet

- Modes of AppealDocument2 pagesModes of AppealAra Lim100% (1)

- QUESTION: Appeals Abandonment of A Perfected Appeal (2009) No - XI.E. The Filing of A Motion For TheDocument9 pagesQUESTION: Appeals Abandonment of A Perfected Appeal (2009) No - XI.E. The Filing of A Motion For TheBrian YuiNo ratings yet

- Table of Remedies LumberaDocument30 pagesTable of Remedies LumberaVenTenNo ratings yet

- REMEDIESDocument9 pagesREMEDIESJOBELLE VILLANUEVANo ratings yet

- City of Manila V Grecia CuerdoDocument3 pagesCity of Manila V Grecia Cuerdoaspiringlawyer1234No ratings yet

- Development Bank of The Philippines vs. CADocument2 pagesDevelopment Bank of The Philippines vs. CAJANNNo ratings yet

- Modes of AppealDocument5 pagesModes of AppealearlcaezarrosarioNo ratings yet

- Hernando CIR v. PBCDocument11 pagesHernando CIR v. PBCDanielle AndrinNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Civil Procedure in A Nutshell III: Execution (See Properties Exempt From Execution)Document1 pageCivil Procedure in A Nutshell III: Execution (See Properties Exempt From Execution)Louie VergaraNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- 4 Commissioner - of - Internal - Revenue - v. - CTA (RESOLUTION)Document6 pages4 Commissioner - of - Internal - Revenue - v. - CTA (RESOLUTION)ervingabralagbonNo ratings yet

- Cir V. Team Sual Corporation: Doctrine/SDocument3 pagesCir V. Team Sual Corporation: Doctrine/SDaLe AparejadoNo ratings yet

- CIR Vs PAL - ConstructionDocument8 pagesCIR Vs PAL - ConstructionEvan NervezaNo ratings yet

- Rem Part IiDocument7 pagesRem Part IiVIctor AlfilerNo ratings yet

- Constitutionality or An OrdinanceDocument2 pagesConstitutionality or An OrdinanceBINAYAO NAIZA MAENo ratings yet

- 9 Control Sheet - AppealsDocument2 pages9 Control Sheet - AppealsUsman Ahmed ManiNo ratings yet

- Cta 2D CV 11066 M 2023apr27 AssDocument5 pagesCta 2D CV 11066 M 2023apr27 AssFirenze PHNo ratings yet

- Rule 37 New Trial or Reconsideration New TrialDocument4 pagesRule 37 New Trial or Reconsideration New TrialAiza CabenianNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Taganito Vs CIR RefundDocument4 pagesTaganito Vs CIR RefundhenzencameroNo ratings yet

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesDocument4 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesMariko IwakiNo ratings yet

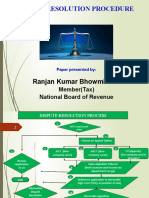

- Dispute Resolution Procedure: Ranjan Kumar BhowmikDocument10 pagesDispute Resolution Procedure: Ranjan Kumar Bhowmikmir makarim ahsanNo ratings yet

- Assessment FlowchartDocument6 pagesAssessment FlowchartJess SerranoNo ratings yet

- Remedies of A TaxpayerDocument1 pageRemedies of A TaxpayerPrincess Mae SamborioNo ratings yet

- Taxation Law ReviewerDocument2 pagesTaxation Law ReviewerGolden LightphNo ratings yet

- Refundable Input VAT On Capital Goods Purchases P443,447,184.50Document4 pagesRefundable Input VAT On Capital Goods Purchases P443,447,184.50DarkSlumberNo ratings yet

- 166919-2012-Lascona Land Co. Inc. v. Commissioner ofDocument7 pages166919-2012-Lascona Land Co. Inc. v. Commissioner ofBeatrice AquinoNo ratings yet

- CIR v. Phil. Global Communications, IncDocument3 pagesCIR v. Phil. Global Communications, IncGain DeeNo ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Dispute Reseloution ProcedureDocument4 pagesDispute Reseloution Procedureaminalex122No ratings yet

- MasterSheet11 Appeals SirTariqTunio STTDocument2 pagesMasterSheet11 Appeals SirTariqTunio STTKamran MehboobNo ratings yet

- SM DigestDocument4 pagesSM Digestapril75No ratings yet

- Petitioner Vs Vs Respondents: Special First DivisionDocument6 pagesPetitioner Vs Vs Respondents: Special First DivisionMaria Rebecca Chua OzaragaNo ratings yet

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- 10) Visayas Geothermal Power Company Vs CIR, G.R. No. 205279, April 26, 2017Document7 pages10) Visayas Geothermal Power Company Vs CIR, G.R. No. 205279, April 26, 2017Raimer Gel CaspilloNo ratings yet

- Part III Tax 2 Study GuideDocument24 pagesPart III Tax 2 Study GuideTeacherEliNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- SB CrimDocument2 pagesSB CrimJP JimenezNo ratings yet

- Political Law Review Questions 4Document3 pagesPolitical Law Review Questions 4JP JimenezNo ratings yet

- Remedial Law Review Suppletory NotesDocument3 pagesRemedial Law Review Suppletory NotesJP JimenezNo ratings yet

- L/Epublic of Tije Tlbilippines: Tjjaguio LcitpDocument12 pagesL/Epublic of Tije Tlbilippines: Tjjaguio LcitpJP JimenezNo ratings yet

- Corporate TaxpayerDocument1 pageCorporate TaxpayerJP JimenezNo ratings yet

- 4A Special DCDocument1 page4A Special DCJP JimenezNo ratings yet

- 5 Passive IncomeDocument3 pages5 Passive IncomeJP Jimenez100% (1)

- 4B & 4C Special RFC & NRFCDocument2 pages4B & 4C Special RFC & NRFCJP JimenezNo ratings yet

- Labor Cases - AppealsDocument7 pagesLabor Cases - AppealsJP JimenezNo ratings yet

- MCQ - Taxation Law ReviewDocument24 pagesMCQ - Taxation Law ReviewphiongskiNo ratings yet

- Supreme Court: Baguio CityDocument17 pagesSupreme Court: Baguio CityJP JimenezNo ratings yet

- List of Accredited Bond Companies For Makati RTCDocument1 pageList of Accredited Bond Companies For Makati RTCJP JimenezNo ratings yet

- Accredited Bonding Company by SC (Civil Cases)Document70 pagesAccredited Bonding Company by SC (Civil Cases)JP JimenezNo ratings yet

TABLE 3: Procedure in Criminal Cases

TABLE 3: Procedure in Criminal Cases

Uploaded by

JP Jimenez0 ratings0% found this document useful (0 votes)

11 views1 pageThe document outlines the procedure for criminal cases in the Philippines. It shows that criminal actions must be approved by revenue or customs officials. Cases are first filed with the Regional Trial Court (RTC) which can hear original jurisdiction local tax collection cases under 300k/400k or appellate cases from the Metropolitan Trial Court (MTC). Adverse RTC decisions can be appealed within 15 days to the Court of Tax Appeals (CTA) division or en banc. Subsequent appeals involve motions for reconsideration or new trial to the CTA or petitions for review to the Supreme Court within 15 days of a denial or adverse decision.

Original Description:

2018 Bar Exams

Original Title

Tax Matrx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the procedure for criminal cases in the Philippines. It shows that criminal actions must be approved by revenue or customs officials. Cases are first filed with the Regional Trial Court (RTC) which can hear original jurisdiction local tax collection cases under 300k/400k or appellate cases from the Metropolitan Trial Court (MTC). Adverse RTC decisions can be appealed within 15 days to the Court of Tax Appeals (CTA) division or en banc. Subsequent appeals involve motions for reconsideration or new trial to the CTA or petitions for review to the Supreme Court within 15 days of a denial or adverse decision.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageTABLE 3: Procedure in Criminal Cases

TABLE 3: Procedure in Criminal Cases

Uploaded by

JP JimenezThe document outlines the procedure for criminal cases in the Philippines. It shows that criminal actions must be approved by revenue or customs officials. Cases are first filed with the Regional Trial Court (RTC) which can hear original jurisdiction local tax collection cases under 300k/400k or appellate cases from the Metropolitan Trial Court (MTC). Adverse RTC decisions can be appealed within 15 days to the Court of Tax Appeals (CTA) division or en banc. Subsequent appeals involve motions for reconsideration or new trial to the CTA or petitions for review to the Supreme Court within 15 days of a denial or adverse decision.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

TABLE 3: Procedure in Criminal Cases

Filing of Criminal Actions must

be approved by the

Commissioner of Internal

Revenue or Commissioner of

Customs

RTC in the exercise of ORIGINAL

Jurisdiction [note: in LOCAL TAX

COLLECTION cases, when the RTC in the exercise of

claim does not exceed 300K APPELLATE Jurisdiction

(400K in MM), the claim should

be filed in MTC

Within 15 days from receipt of Within 15 days from receipt of

adverse decision of RTC, File adverse decision of RTC, File

NOTICE OF APPEAL with the PETITION FOR REVIEW under

CTA DIVISION RULE 43 with CTA EN BANC

Within 15 days from receipt of

Within 15 days from Adverse

Adverse Decision of the CTA

Decision of CTA en banc, File a

Div, File Motion for

PETITION FOR REVIEW ON

Reconsideration or Motion for

CERTIORARI under RULE 45

New Trial with same CTA

with the SUPREME COURT

Division (prerequisite) p486

Within 15 days from Denial of

MR or MNT, File PETITION FOR

REVIEW under RULE 43 with the

CTA EN BANC P483 (CTA en

banc may extend time for filing)

Within 15 days from Adverse

Decision of CTA en banc, File a

PETITION FOR REVIEW ON

CERTIORARI under RULE 45

with the SUPREME COURT

You might also like

- Modes of Appeal TableDocument3 pagesModes of Appeal TablemarydalemNo ratings yet

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Outline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancDocument1 pageOutline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancRaymond RogacionNo ratings yet

- Jurisdiction of The Court of Appeals: Decision by MTCDocument16 pagesJurisdiction of The Court of Appeals: Decision by MTCJoh SuhNo ratings yet

- TreeDocument1 pageTreeEricaNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- Court of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionDocument7 pagesCourt of Tax Appeals (Cta) Division: General/Civil Matters Appellate JurisdictionClarisse ZaplanNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- CHART F JURISDICTION AND PROCEDURE LABOR ARBITER RevDocument2 pagesCHART F JURISDICTION AND PROCEDURE LABOR ARBITER RevAthena BlakeNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- Taxation Law - CTADocument7 pagesTaxation Law - CTARia Kriselle Francia PabaleNo ratings yet

- Tax Report HandoutDocument4 pagesTax Report HandoutJune FourNo ratings yet

- Diagram Appeals OverviewDocument2 pagesDiagram Appeals OverviewRen Concha100% (2)

- Annex A Table of RemediesDocument10 pagesAnnex A Table of RemediesAkiko AbadNo ratings yet

- Tax Remedies and Tax Assessment in General and PrescriptionDocument34 pagesTax Remedies and Tax Assessment in General and PrescriptionipbsalanguitNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Procedure in Tax Civil Cases - CTADocument1 pageProcedure in Tax Civil Cases - CTAJezreel CastañagaNo ratings yet

- Modes of AppealDocument2 pagesModes of AppealAra Lim100% (1)

- QUESTION: Appeals Abandonment of A Perfected Appeal (2009) No - XI.E. The Filing of A Motion For TheDocument9 pagesQUESTION: Appeals Abandonment of A Perfected Appeal (2009) No - XI.E. The Filing of A Motion For TheBrian YuiNo ratings yet

- Table of Remedies LumberaDocument30 pagesTable of Remedies LumberaVenTenNo ratings yet

- REMEDIESDocument9 pagesREMEDIESJOBELLE VILLANUEVANo ratings yet

- City of Manila V Grecia CuerdoDocument3 pagesCity of Manila V Grecia Cuerdoaspiringlawyer1234No ratings yet

- Development Bank of The Philippines vs. CADocument2 pagesDevelopment Bank of The Philippines vs. CAJANNNo ratings yet

- Modes of AppealDocument5 pagesModes of AppealearlcaezarrosarioNo ratings yet

- Hernando CIR v. PBCDocument11 pagesHernando CIR v. PBCDanielle AndrinNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Civil Procedure in A Nutshell III: Execution (See Properties Exempt From Execution)Document1 pageCivil Procedure in A Nutshell III: Execution (See Properties Exempt From Execution)Louie VergaraNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- 4 Commissioner - of - Internal - Revenue - v. - CTA (RESOLUTION)Document6 pages4 Commissioner - of - Internal - Revenue - v. - CTA (RESOLUTION)ervingabralagbonNo ratings yet

- Cir V. Team Sual Corporation: Doctrine/SDocument3 pagesCir V. Team Sual Corporation: Doctrine/SDaLe AparejadoNo ratings yet

- CIR Vs PAL - ConstructionDocument8 pagesCIR Vs PAL - ConstructionEvan NervezaNo ratings yet

- Rem Part IiDocument7 pagesRem Part IiVIctor AlfilerNo ratings yet

- Constitutionality or An OrdinanceDocument2 pagesConstitutionality or An OrdinanceBINAYAO NAIZA MAENo ratings yet

- 9 Control Sheet - AppealsDocument2 pages9 Control Sheet - AppealsUsman Ahmed ManiNo ratings yet

- Cta 2D CV 11066 M 2023apr27 AssDocument5 pagesCta 2D CV 11066 M 2023apr27 AssFirenze PHNo ratings yet

- Rule 37 New Trial or Reconsideration New TrialDocument4 pagesRule 37 New Trial or Reconsideration New TrialAiza CabenianNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Rules On Appeals-Rule 40, 41, 42, 43, 45Document1 pageRules On Appeals-Rule 40, 41, 42, 43, 45Jm CruzNo ratings yet

- Taganito Vs CIR RefundDocument4 pagesTaganito Vs CIR RefundhenzencameroNo ratings yet

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesDocument4 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 8: Taxpayer'S RemediesMariko IwakiNo ratings yet

- Dispute Resolution Procedure: Ranjan Kumar BhowmikDocument10 pagesDispute Resolution Procedure: Ranjan Kumar Bhowmikmir makarim ahsanNo ratings yet

- Assessment FlowchartDocument6 pagesAssessment FlowchartJess SerranoNo ratings yet

- Remedies of A TaxpayerDocument1 pageRemedies of A TaxpayerPrincess Mae SamborioNo ratings yet

- Taxation Law ReviewerDocument2 pagesTaxation Law ReviewerGolden LightphNo ratings yet

- Refundable Input VAT On Capital Goods Purchases P443,447,184.50Document4 pagesRefundable Input VAT On Capital Goods Purchases P443,447,184.50DarkSlumberNo ratings yet

- 166919-2012-Lascona Land Co. Inc. v. Commissioner ofDocument7 pages166919-2012-Lascona Land Co. Inc. v. Commissioner ofBeatrice AquinoNo ratings yet

- CIR v. Phil. Global Communications, IncDocument3 pagesCIR v. Phil. Global Communications, IncGain DeeNo ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Dispute Reseloution ProcedureDocument4 pagesDispute Reseloution Procedureaminalex122No ratings yet

- MasterSheet11 Appeals SirTariqTunio STTDocument2 pagesMasterSheet11 Appeals SirTariqTunio STTKamran MehboobNo ratings yet

- SM DigestDocument4 pagesSM Digestapril75No ratings yet

- Petitioner Vs Vs Respondents: Special First DivisionDocument6 pagesPetitioner Vs Vs Respondents: Special First DivisionMaria Rebecca Chua OzaragaNo ratings yet

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- 10) Visayas Geothermal Power Company Vs CIR, G.R. No. 205279, April 26, 2017Document7 pages10) Visayas Geothermal Power Company Vs CIR, G.R. No. 205279, April 26, 2017Raimer Gel CaspilloNo ratings yet

- Part III Tax 2 Study GuideDocument24 pagesPart III Tax 2 Study GuideTeacherEliNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- SB CrimDocument2 pagesSB CrimJP JimenezNo ratings yet

- Political Law Review Questions 4Document3 pagesPolitical Law Review Questions 4JP JimenezNo ratings yet

- Remedial Law Review Suppletory NotesDocument3 pagesRemedial Law Review Suppletory NotesJP JimenezNo ratings yet

- L/Epublic of Tije Tlbilippines: Tjjaguio LcitpDocument12 pagesL/Epublic of Tije Tlbilippines: Tjjaguio LcitpJP JimenezNo ratings yet

- Corporate TaxpayerDocument1 pageCorporate TaxpayerJP JimenezNo ratings yet

- 4A Special DCDocument1 page4A Special DCJP JimenezNo ratings yet

- 5 Passive IncomeDocument3 pages5 Passive IncomeJP Jimenez100% (1)

- 4B & 4C Special RFC & NRFCDocument2 pages4B & 4C Special RFC & NRFCJP JimenezNo ratings yet

- Labor Cases - AppealsDocument7 pagesLabor Cases - AppealsJP JimenezNo ratings yet

- MCQ - Taxation Law ReviewDocument24 pagesMCQ - Taxation Law ReviewphiongskiNo ratings yet

- Supreme Court: Baguio CityDocument17 pagesSupreme Court: Baguio CityJP JimenezNo ratings yet

- List of Accredited Bond Companies For Makati RTCDocument1 pageList of Accredited Bond Companies For Makati RTCJP JimenezNo ratings yet

- Accredited Bonding Company by SC (Civil Cases)Document70 pagesAccredited Bonding Company by SC (Civil Cases)JP JimenezNo ratings yet