Professional Documents

Culture Documents

Silabus Investasi Dan Pasar Modal

Silabus Investasi Dan Pasar Modal

Uploaded by

Ayrin0 ratings0% found this document useful (0 votes)

121 views6 pagesIPM

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIPM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

121 views6 pagesSilabus Investasi Dan Pasar Modal

Silabus Investasi Dan Pasar Modal

Uploaded by

AyrinIPM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 6

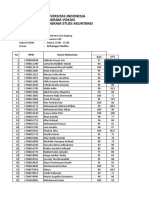

UNIVERSITAS INDONESIA

: FAKULTAS EKONOMI & BISNIS

DEPARTEMEN AKUNTANSI

EKONOM

DAN BISNIS | PROGRAM STUDI S1

SYLLABUS

INVESTASI DAN PASAR MODAL (INVESTMENT AND CAPITAL MARKET}

ECAU609119

(ODD SEMESTER 2017/2018

Nama Pengajar ‘Alamat E-mail

Darminto- A darminto@ui.ac.id

Budi Frensidy / Rahman Untung Budiman -B | Rachman.untung@ul.ac.id / F

He frensidy@gmail.com

Dwi Astuti Rosmianingrum = C ‘miatojkni@yahoo.com

‘Gede Harja Wasistha / Indah Melati - D wasistha@ul.ac.id /

‘Arman Hendiyanto / Helen Riyani Tanzil - E ‘arman@kap-arman.com /

helen_tanzil@acehardware.co.id

Sidharta Utama / Catur Sasongko - F Sidharta.utama@ui.ac.id /

[ 2 ae catur_sasongko76@yahoo.com

Edward Tanujaya- 6 Edward_tanujaya@ yahoo.com

Subject Code ECAU 609119 Et i i

| Subject Title Investment and Capital Market Hi

Credit Value 3 7

Level ae = a

Pre-requisite/ Introduction to Financial Management Z A

Co-requisite/

Exclusion

Role and Purposes | This subject contributes to the achievement of the outcomes of bachelor program by

enabling students to apply technical competence in Finance. Specifically, the subject

enables students to understand the unique nature of financial institutionsand their role in

the financial system; and discuss basic investment analysis for several types of investment

products available in the capital market.

Subject Learning | Upon completion of the subject, students will be able to:

Outcomes ‘2. Understand the unique nature of financial institutions and their role in the financial

system

b. Explain core concepts in finance, including risk, return, risk premium, risk aversion,

efficient diversification, capital asset pricing and arbitrage pricing theory, and the efficient

market hypothesis.

‘Compute mean, variance and covariance and the composition of the optimal risky

portfolio

Explain basic investment analysis for several products available in the capital market,

including bonds, equity and derivative securities

Explain income, asset-based, and market valuation approaches used for investment

decisions

Describe how real estate invest ment objectives are set, how the features of real estate

are analyzed, what determines real estate value and valuation techniques commonly used

to estimate the market value of real estate.

Subject Synopsis/

Indicative Syllabus

Week # ‘Topic

to

"Reading

Materials

1 Investments: Background and Issues

‘© Real Assets versus Financial Assets

‘©The Investment Process

* The Players

* The Money Market

© The Bond Market

© The Equity Market

The Derivative Market

© _ Stock and Bond Market Indexes

‘* Financial Markets and the Economy

Asset Classes and Financial Instruments

a

Securities Markets

‘How Firms Issue Securities

©. Privately Held Firms

© Publicly Traded Companies

© Shelf Registration

© Initial Public Offerings

+ How Securities Are Traded

© Types of Markets

© Types of Orders

© Trading Mechanisms

* Margin Trading

Short Sales

‘© Types of investment Companies

© Mutual Funds

‘© Costs of Investing in Mutual Funds

‘© Exchange-Traded Funds

‘Mutual Funds & Other Investment Companies

‘Mutual Fund Investment Performance

a

2

Bodie Ch. 1 and

Bodie Ch. 3 and |

4

3 Risk and Return: Past and Prologue

Rates of Return

Risk and Return Premiums

The Historical Record

Inflation and Real Rates of Return

Asset Allocation across Risky and Risk-Free

| be

Bodie Ch. 5 and

6

a

Portfolios

Passive Strategies and Capital Market Line

Efficient Diversification

‘* Diversification and Portfolio Risk

‘© Asset Allocation with Two Risky Assets

‘© The Optimal Risky Portfolio with a Risk-Free

Asset

‘* Efficient Diversification with Many Risky

Assets

+ ASingle-index Stock Model

‘© Risk of Long-Term Investments

*

Capital Asset Pricing and Arbitrage Pricing

‘Theory

The Capital Asset Pricing Model (CAPM)

The CAPM and Index Models

‘The CAPM and the Real World

Multifactor Models and the CAPM

Arbitrage Pricing Theory (APT)

Bodie Ch. 7

‘The Efficient Market Hypothesis

© Random Walk and the Efficient Market

Hypothesis (EMH)

‘= Implications of the EMH

‘© Are Markets Efficient? EMH Tests

© Mutual Fund and Analyst Performance

Behavioral Finance and Technical Analysis

© The Behavioral Critique

Support and Resistance Level

Bodie Ch. 8 and

9

Bond Prices and Yields

Bond Characteristics

Bond Pricing,

Bond Yields

Bond Prices Over Time

Default Risk and Bond Pricing

The Yield Curve

Bodie Ch. 10

‘Managing Bond Portfolios

Interest rate Risk

‘© Passive Bond Management

= Convexity

‘© Active Bond Management

Bodie Ch. 11

Group

Assignment

‘Write a paper maximum 15 pages (font 11 Arial

paragraph 1,5). Each group should have

different topics. The topics may cover, but not

limited to, the following list:

‘© Pension Funds in Indonesia vs in Other

Countries or the History of Pension Funds in

Indonesia

Submitted in

Mid-Semester

Exam

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (Bizform) Desain Ruang RapatDocument2 pages(Bizform) Desain Ruang RapatAyrinNo ratings yet

- Net Operating Working CapitalDocument3 pagesNet Operating Working CapitalAyrinNo ratings yet

- Silabus LKAL 2019Document7 pagesSilabus LKAL 2019AyrinNo ratings yet

- Case of Elnusa: Explanation From Bank Mega's POVDocument1 pageCase of Elnusa: Explanation From Bank Mega's POVAyrinNo ratings yet

- Shareholders Accountability: Ownership StructureDocument3 pagesShareholders Accountability: Ownership StructureAyrinNo ratings yet

- Bagian Ayrin Chapt 13 ScottDocument3 pagesBagian Ayrin Chapt 13 ScottAyrinNo ratings yet

- Tanggung Jawab PT Dan Hubungan Pihak KetigaDocument4 pagesTanggung Jawab PT Dan Hubungan Pihak KetigaAyrin0% (1)

- Ak1 Ayrin Udah JadiDocument2 pagesAk1 Ayrin Udah JadiAyrinNo ratings yet

- Analisis Kasus Bank CenturyDocument6 pagesAnalisis Kasus Bank CenturyAyrinNo ratings yet

- Firma - AyrinDocument7 pagesFirma - AyrinAyrinNo ratings yet

- Nama Kelompok AJDDocument4 pagesNama Kelompok AJDAyrinNo ratings yet