Professional Documents

Culture Documents

Equitas MSE Product Snap

Equitas MSE Product Snap

Uploaded by

Aadityaa Pawar0 ratings0% found this document useful (0 votes)

34 views2 pagesEquitas Small Finance Bank offers several housing and property loan products including:

1) Housing loans from 50K to 3Cr for micro, general, and affordable housing. General and affordable housing loans require income tax returns while micro housing loans are based on assessed income.

2) Loans against property from 50K to 3Cr as micro, general, or business loans based on assessed income without tax returns, or as salaried or business loans from 5L to 3Cr based on declared income with tax returns.

3) Interest rates vary from 10-24% depending on the loan type and applicant's income proof.

Connectors receive a payout of 0.50% of disbur

Original Description:

Medium & Small Industries Finance Offers

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEquitas Small Finance Bank offers several housing and property loan products including:

1) Housing loans from 50K to 3Cr for micro, general, and affordable housing. General and affordable housing loans require income tax returns while micro housing loans are based on assessed income.

2) Loans against property from 50K to 3Cr as micro, general, or business loans based on assessed income without tax returns, or as salaried or business loans from 5L to 3Cr based on declared income with tax returns.

3) Interest rates vary from 10-24% depending on the loan type and applicant's income proof.

Connectors receive a payout of 0.50% of disbur

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

34 views2 pagesEquitas MSE Product Snap

Equitas MSE Product Snap

Uploaded by

Aadityaa PawarEquitas Small Finance Bank offers several housing and property loan products including:

1) Housing loans from 50K to 3Cr for micro, general, and affordable housing. General and affordable housing loans require income tax returns while micro housing loans are based on assessed income.

2) Loans against property from 50K to 3Cr as micro, general, or business loans based on assessed income without tax returns, or as salaried or business loans from 5L to 3Cr based on declared income with tax returns.

3) Interest rates vary from 10-24% depending on the loan type and applicant's income proof.

Connectors receive a payout of 0.50% of disbur

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

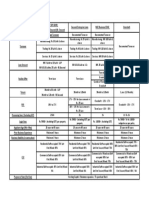

EQUITAS SMALL FINANCE BANK

Product

HOUSING LOAN

LOAN AGAIST PROPERTY

HOUSING LOAN – (Loan Amount 50 K to 3 Cr)

Micro Hosuing General Hosuing Affordable

•50K to 5 L •5L to 25 L Housing

•Without ITR - On •Wihout ITR - On •5L to 3 Cr

Assessed Income base Assessed Income Base •With ITR

LOAN AGAINST PROPERTY (Loan Amount 50 K to 3 Cr)

• Micro- LAP --> 50K to 5L

Assessed • General- LAP --> 5L to 10 L

Income Base

(Wihout ITR) • Business Loan -->10L to 25 L

• Salaried LAP --> 5 Lto 50 L

Declared

Income (With • Business Loan --> 10L to 3 Cr)

ITR)

ROI Assessed (Without ITR) Declared (With ITR)

MLAP SLAP Product

(23 & 24 %) (for Salaried)

(14 % & 15 %)

GLAP/BL

GHF

(Assessed)

12.50% - 13 %

(18%)

BLProduct for (Self Affordable Hosuing

Employed) Loan

(13%) (10%)

MHF

(14%)

Other Details of Product

No Login fees while Login the case

Processing fee is vary as per product and Profile

In Declared income, we have various surrogate program for example– Banking Surrogate, LIP,

Low LTV etc… apart from net profit method

Product for Commercial Property Purchase

Product for Self Employed Professional

Legal Documentation

Ownership Document (Sale Deed, Deed of Assignment, etc.)

Chain Document of the Title (Previous chain document)

Revenue Documents (7/12, Property card, etc.)

Possession Document (Tax Receipt, EB, etc.)

Approved Plan Blue Print (Mandatory for Home loan)

Connector Payout

PAYOUT GRID

0.50% of disbursed amount between Rs.5 L - 20 L

0.75% of disbursed amount above Rs. 20 L

You might also like

- Test Bank For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument18 pagesTest Bank For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa368777821No ratings yet

- Quick Analysis Worksheet v5.1 - Rental Property - CharaDocument6 pagesQuick Analysis Worksheet v5.1 - Rental Property - CharaCCerberus24No ratings yet

- QS Pitch Deck New 2020Document27 pagesQS Pitch Deck New 2020Aadityaa Pawar100% (2)

- CAT 561 Pipe LayerDocument4 pagesCAT 561 Pipe LayerAadityaa PawarNo ratings yet

- Tourism Study Shirdi SaibabaDocument11 pagesTourism Study Shirdi SaibabaAadityaa PawarNo ratings yet

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocument108 pagesFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- Derivatives - Sumitomo CrisisDocument11 pagesDerivatives - Sumitomo CrisisRupal100% (1)

- MSE Product One PagerDocument1 pageMSE Product One PagerVinod MNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- Financial Benchmarks Cheat SheetDocument1 pageFinancial Benchmarks Cheat SheetMawuena GagakumaNo ratings yet

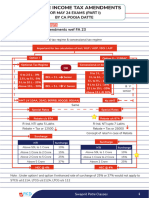

- IT Amendments For May 24 (Part 1) - 1Document22 pagesIT Amendments For May 24 (Part 1) - 1Siddhi ShahNo ratings yet

- FS Flip Calculator Free V1.3Document5 pagesFS Flip Calculator Free V1.3karlmehu28No ratings yet

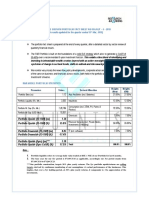

- OLD NEW: Purely Self-EmployedDocument13 pagesOLD NEW: Purely Self-EmployedkeyelNo ratings yet

- TP Link Partner Program FlyerDocument2 pagesTP Link Partner Program FlyerRodrigo SenadorNo ratings yet

- FA Ready RecknorDocument10 pagesFA Ready RecknorKaushik ArNo ratings yet

- DPR Existing Individual More Than 1 CRDocument57 pagesDPR Existing Individual More Than 1 CRarzNo ratings yet

- Basic Cocepts 1Document1 pageBasic Cocepts 1ap.quatrroNo ratings yet

- Priority-Q-A-18 12 22Document64 pagesPriority-Q-A-18 12 22specilist officer marketingNo ratings yet

- Tax Rates For Mutual Fund Investors As Per The Finance Act, 2017 - SNAPSHOTDocument5 pagesTax Rates For Mutual Fund Investors As Per The Finance Act, 2017 - SNAPSHOTAkshayKumarNo ratings yet

- Crop LoanDocument3 pagesCrop LoanRamana GNo ratings yet

- Businesses and Their CostsDocument21 pagesBusinesses and Their CostsZenedel De JesusNo ratings yet

- Chapter 5 - The Demand For Labor - Spring 2024Document45 pagesChapter 5 - The Demand For Labor - Spring 2024rrrrokayaaashrafNo ratings yet

- CIV4041F Presentation Eng Economics and Project Appraisal - 2022 PDFDocument29 pagesCIV4041F Presentation Eng Economics and Project Appraisal - 2022 PDFGOATNo ratings yet

- Merak Fiscal Model Library: Colombia Association (2002)Document2 pagesMerak Fiscal Model Library: Colombia Association (2002)Libya TripoliNo ratings yet

- Zylog SystemsDocument2 pagesZylog SystemsGirish RamachandraNo ratings yet

- 3 - Topic3 Financial and Operating Leveraging-EditedDocument44 pages3 - Topic3 Financial and Operating Leveraging-EditedCOCONUTNo ratings yet

- Franchise - ModelDocument4 pagesFranchise - ModelLokesh JainNo ratings yet

- CASE 1: Considering M&A Deal Between Colour Group and Green/YellowDocument7 pagesCASE 1: Considering M&A Deal Between Colour Group and Green/YellowThủy Thiều Thị HồngNo ratings yet

- Net Present Value and Other Investment RulesDocument30 pagesNet Present Value and Other Investment RulesSyedAunRazaRizviNo ratings yet

- Merak Fiscal Model Library: Algeria R/T (2005)Document3 pagesMerak Fiscal Model Library: Algeria R/T (2005)Libya TripoliNo ratings yet

- Net Present Value and Other Investment RulesDocument34 pagesNet Present Value and Other Investment Ruleskristina niaNo ratings yet

- GCEMP 2021 PPT Participants Part2Document40 pagesGCEMP 2021 PPT Participants Part2Deepu Mannatil50% (2)

- NOTES Income Taxation Cheat SheetDocument2 pagesNOTES Income Taxation Cheat SheetMARGARETTE ANGULONo ratings yet

- CB Chapter 15 AnswerDocument5 pagesCB Chapter 15 AnswerSim Pei YingNo ratings yet

- Undergrad Review in Income TaxationDocument17 pagesUndergrad Review in Income TaxationJamesNo ratings yet

- Interest Rate: Head OfficeDocument19 pagesInterest Rate: Head Officeapi-19792705No ratings yet

- The Demand For Labor: Mcgraw-Hill/IrwinDocument58 pagesThe Demand For Labor: Mcgraw-Hill/IrwinGunjan PruthiNo ratings yet

- Debt PolicyDocument30 pagesDebt PolicyMai Phạm100% (1)

- ch13Document60 pagesch13Ains M. BantuasNo ratings yet

- Net Present Value and Other Investment RulesDocument34 pagesNet Present Value and Other Investment RulesArviandi AntariksaNo ratings yet

- Capital BudgetingDocument60 pagesCapital BudgetingAce DesabilleNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- IPO Cost Sheet - Format - Reg SDocument8 pagesIPO Cost Sheet - Format - Reg SRanjit SinghNo ratings yet

- Cost of ProductionDocument27 pagesCost of Productionfaisal197No ratings yet

- Company Analysis:: As On Return RelatedDocument3 pagesCompany Analysis:: As On Return RelatedAbhivandana JainNo ratings yet

- Shareholder Value Creation-2Document5 pagesShareholder Value Creation-2tanadof294No ratings yet

- Details of Rooftop Solar - Dec'20Document3 pagesDetails of Rooftop Solar - Dec'20shahnawaz1709No ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- Commission StructureDocument11 pagesCommission Structuredreamz unfulfilledNo ratings yet

- NPV Yang DiperkirakanDocument34 pagesNPV Yang Diperkirakanalda warsidaNo ratings yet

- Set Up A Car Showroom: Requirements Estimate of BusinessDocument4 pagesSet Up A Car Showroom: Requirements Estimate of Businessraviharsha19884495No ratings yet

- CB TechniquesDocument55 pagesCB TechniquesRahul MoreNo ratings yet

- Performance Status of Pos As On 28Th February'2015: Name of Po: Employee Sales Customer Return vs. ResaleDocument1 pagePerformance Status of Pos As On 28Th February'2015: Name of Po: Employee Sales Customer Return vs. ResaleAntora HoqueNo ratings yet

- Income Tax On BusinessDocument17 pagesIncome Tax On BusinesspiyushestartupNo ratings yet

- Kso TugasDocument7 pagesKso TugasRahmat Ramadhan RahmatNo ratings yet

- Questions For Solving Case Study of Anandam MFG CoDocument3 pagesQuestions For Solving Case Study of Anandam MFG CoSubodh Sahastrabuddhe100% (1)

- Chapter 5 and 6 (Cont) : Net Present Value and Other Investment RulesDocument34 pagesChapter 5 and 6 (Cont) : Net Present Value and Other Investment Rulesphuphong777No ratings yet

- R&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Document3 pagesR&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Jaspreet SinghNo ratings yet

- Leverage and Optimal Capital StructureDocument42 pagesLeverage and Optimal Capital StructureInvisible CionNo ratings yet

- 3 Capital Budgeting TechniquesDocument42 pages3 Capital Budgeting TechniquesfnhshafiraNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookAkshay ShaikhNo ratings yet

- Net Present Value and Other Investment Rules: Mcgraw-Hill/IrwinDocument32 pagesNet Present Value and Other Investment Rules: Mcgraw-Hill/IrwinASAD ULLAHNo ratings yet

- Capital Budgeting TechniquesDocument60 pagesCapital Budgeting Techniquesaxl11No ratings yet

- Training Notes - VRMDocument384 pagesTraining Notes - VRMsinghsonalrsbNo ratings yet

- DT Last Day Revision Notes May 2024Document23 pagesDT Last Day Revision Notes May 2024nimisha vermaNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAadityaa PawarNo ratings yet

- Emazing Deals PresentationDocument22 pagesEmazing Deals PresentationAadityaa PawarNo ratings yet

- MURUGAN BROTHERS Bank StatementDocument15 pagesMURUGAN BROTHERS Bank StatementAadityaa PawarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Murugan BrothersDocument1 pageMurugan BrothersAadityaa PawarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- The Messy BurgerDocument1 pageThe Messy BurgerAadityaa PawarNo ratings yet

- Underground Water: Plot at KhadakwadiDocument1 pageUnderground Water: Plot at KhadakwadiAadityaa PawarNo ratings yet

- Murugan Brothers - Cozee Corner Cash Sale and Expense Sheet - Feb 2020Document8 pagesMurugan Brothers - Cozee Corner Cash Sale and Expense Sheet - Feb 2020Aadityaa PawarNo ratings yet

- New Doc 2020-03-11 17.02.30Document5 pagesNew Doc 2020-03-11 17.02.30Aadityaa PawarNo ratings yet

- GPT Proposal ECSDocument4 pagesGPT Proposal ECSAadityaa PawarNo ratings yet

- ECS Customer Support Quotation - GPT - MDocument4 pagesECS Customer Support Quotation - GPT - MAadityaa PawarNo ratings yet

- CE Decl of Conformity Biocan Rapid Test 25feb2020Document3 pagesCE Decl of Conformity Biocan Rapid Test 25feb2020Aadityaa PawarNo ratings yet

- Zomato Order GuideDocument1 pageZomato Order GuideAadityaa PawarNo ratings yet

- Security Training SyllabusDocument9 pagesSecurity Training SyllabusAadityaa Pawar100% (1)

- Nitrile Medical Gloves Specs & ShippingDocument2 pagesNitrile Medical Gloves Specs & ShippingAadityaa PawarNo ratings yet

- Verification of AntecedentsDocument1 pageVerification of AntecedentsAadityaa Pawar100% (1)

- Logistics Cluster SOPDocument5 pagesLogistics Cluster SOPAadityaa PawarNo ratings yet

- Emmergency Door Placard FormDocument1 pageEmmergency Door Placard FormAadityaa PawarNo ratings yet

- Notes On Hector de LeonDocument2 pagesNotes On Hector de LeongoerginamarquezNo ratings yet

- Pas 34Document17 pagesPas 34rena chavezNo ratings yet

- SSRN Id2939649 PDFDocument74 pagesSSRN Id2939649 PDFRaúl NàndiNo ratings yet

- The New Spring For Securitisation 6038574Document92 pagesThe New Spring For Securitisation 6038574Gabriel NgNo ratings yet

- Chapter 1 - Accounting in ActionDocument42 pagesChapter 1 - Accounting in ActionFify AmalindaNo ratings yet

- Compiled Notes I NegoDocument16 pagesCompiled Notes I NegoDeanne ViNo ratings yet

- Math Investment ProblemsDocument6 pagesMath Investment ProblemsAndrea LimuacoNo ratings yet

- ACC208 CH 7 AmalgamationDocument23 pagesACC208 CH 7 AmalgamationSaja AlbarjesNo ratings yet

- Retrenchment Strategies SMDocument13 pagesRetrenchment Strategies SMNarendraNo ratings yet

- Brand Valuation - DamodaranDocument39 pagesBrand Valuation - Damodaranmystique2s100% (2)

- GOLD AND ECONOMIC FREEDOM (Alan Greenspan)Document5 pagesGOLD AND ECONOMIC FREEDOM (Alan Greenspan)L. Crassus100% (5)

- Summary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionDocument7 pagesSummary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionRishabhMishraNo ratings yet

- CAPITAL MARKET-WPS OfficeDocument31 pagesCAPITAL MARKET-WPS OfficeDele AremoNo ratings yet

- MCB Annual Report 2014 PDFDocument344 pagesMCB Annual Report 2014 PDFArham khan0% (1)

- Inbound Logistics Latam 114Document68 pagesInbound Logistics Latam 114Jaime Humberto Arriaga EscutiaNo ratings yet

- Futures and Options: Merits and Demerits: An Assignment By: PUROO SONI (15907)Document15 pagesFutures and Options: Merits and Demerits: An Assignment By: PUROO SONI (15907)Puroo SoniNo ratings yet

- E IBD100908Document24 pagesE IBD100908cphanhuyNo ratings yet

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- Consulation Paper On Review of Delisting Procedure Pursuant To Open OffferDocument18 pagesConsulation Paper On Review of Delisting Procedure Pursuant To Open OffferHuzaifa SalimNo ratings yet

- NSDL IAR New FormatDocument20 pagesNSDL IAR New FormatMansoor Ahmed Siddiqui0% (1)

- Harrod's Sporting GoodsDocument17 pagesHarrod's Sporting GoodsElisabete PadilhaNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- FGN Sukuk Subscription Form 070917Document2 pagesFGN Sukuk Subscription Form 070917OladeleIfeoluwaOlayodeNo ratings yet

- Balance Sheet RatiosDocument30 pagesBalance Sheet Ratiosumar iqbalNo ratings yet

- StopLimit M+Document6 pagesStopLimit M+Quatly QasyahNo ratings yet

- NAS 18 REvenue - NepaliDocument17 pagesNAS 18 REvenue - NepaliNirmal Shrestha100% (2)

- The Karnataka Stamp Act, 1957Document83 pagesThe Karnataka Stamp Act, 1957Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet