Professional Documents

Culture Documents

AMTs - Individual vs. Corporation

AMTs - Individual vs. Corporation

Uploaded by

Zeyad El-sayedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AMTs - Individual vs. Corporation

AMTs - Individual vs. Corporation

Uploaded by

Zeyad El-sayedCopyright:

Available Formats

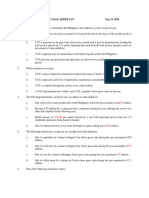

Individual Corporation

Regular Taxable Income Regular Taxable Income before NOL Deduction

+ Tax Preferences + Tax Preference Items

+ (-) Adjustment + (-) Adjustments (Other than ACE and NOL ded)

= Alternative Minimum Taxable Income Pre-ACE Alternative Minimum Taxable Income (AMTI)

- Exemption Amount

+ (-) ACE Adjustment [ 75% X (Pre-ACE AMTI – ACE)]

_________________________________________

- AMT NOL deduction [Limited to 90% of pre-NOL

= Alternative Minimum Tax Base AMTI]

X 26% OR 28% = Alternative Mininmum Taxable Income (AMTI)

________________________________________ - Exemption ($ 40,000 less 25% of AMTI over $

150,000)

= Tentative before Foreign Tax Credit

_______________________________________

AMT Foreign Tax Credit Alternative Minimum Tax Base

____________________________________ X 20% Rate

= Tentative Minimum Tax ____________________________________

Tentative AMT before Foreign Tax Credit

Regular Tax Liability (Reduced by regular tax

foreign Tax Credit) - AMT Foreign Tax Credit

_____________________________________ = Tentative Minimum Tax (TMT)

= AMT (If positive) - Regular Income Tax (Less Regular Yax Foreign

Tax Credit)

_______________________________________

= Alternative Minimum Tax (If positive)

Individual Corporation

Exemption Exemption

AMTI is offset by an exemption. However, the AMT AMTI is offset by a $40,000 exemption.

exemption amount is phased out at the rate of 25% of However, the exemptions is reduced by 25%

AMTI between certain specific levels. of AMTI over $ 150,000, and completely

phased out once AMTI reaches $310,000.

Filing Status AMT Exemption Phase range

Preference Items

Preference Items

1. Same

1. Tax-exemption on private activity

bonds

2. Excess of Accelarted over straight-line 2. Same

depreciation on real property before

1987

3. The excess of 3. Same

4. 7% of the amount of excluded gain 4. The excess of intangible drilling costs

from Sec. 1202 small business stock using a 10 year amortization over 65%

of net oil and gas income

Adjustments

Adjustments

1. (+) Difference between regular tax

depreciation and SLD OVER 40 Yrs 1. ,,,,

(For Real Property placed in service

after 1986 and Before 1999)

2. (+) Difference between regular tax 2. ...

depreciation using 200% declining

balance method and depreciation

using the 150% declining balance

method (For Personal property placed

after 1986)

3. (+) Excess of of stock’s FV over

amount paid upon exercise 3. ..

4. The medical expense deduction 4. ..

5. No ded

6. No

7. No

8. For Long-term

9. The installment method

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Health Insurance ParentsDocument1 pageHealth Insurance ParentsReema Khati67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter Exercises DeductionsDocument11 pagesChapter Exercises DeductionsShaine KeefeNo ratings yet

- Taxation Australia: Assumed Knowledge Quiz Questions and SolutionsDocument38 pagesTaxation Australia: Assumed Knowledge Quiz Questions and SolutionsSteph GonzagaNo ratings yet

- BUKTI GRAND INNA DAIRA PALEMBANG (New)Document2 pagesBUKTI GRAND INNA DAIRA PALEMBANG (New)Richa Fera YulianaNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Trial Balance PD Mitra Des 16 Rev 2018Document1 pageTrial Balance PD Mitra Des 16 Rev 2018Faie RifaiNo ratings yet

- Recharge Amount: Mobile ServicesDocument2 pagesRecharge Amount: Mobile ServiceskrupaNo ratings yet

- GROUP 2 POST RESULTS MAY-23 UpdatedDocument2 pagesGROUP 2 POST RESULTS MAY-23 UpdatedVeena reddyNo ratings yet

- Consti 2Document2 pagesConsti 2Lycv Montederamos AsisNo ratings yet

- Issues and Ethics in Finance (Fin657) Assignment 1Document5 pagesIssues and Ethics in Finance (Fin657) Assignment 1ftnsyzwnyNo ratings yet

- RMC 55-80Document1 pageRMC 55-80matinikkiNo ratings yet

- MessageDocument6 pagesMessageR KumarNo ratings yet

- CIR Vs John GotamcoDocument2 pagesCIR Vs John GotamcoKristine Joy TumbagaNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- Central Coalfields LimitedDocument26 pagesCentral Coalfields Limitedjaio88No ratings yet

- Flow Chart Green Lane Sea ImportDocument2 pagesFlow Chart Green Lane Sea ImportGalih AnggoroNo ratings yet

- JioMart Invoice 16846612550134055ADocument3 pagesJioMart Invoice 16846612550134055AHarshita DidwaniaNo ratings yet

- Monthly Payslip SEP 2022Document1 pageMonthly Payslip SEP 2022Vedant GoelNo ratings yet

- UK Prepaid Cards MarketDocument4 pagesUK Prepaid Cards MarketmikeNo ratings yet

- Taxtation SEM VDocument20 pagesTaxtation SEM VSaurabh Bara100% (1)

- Checking Account StatementDocument6 pagesChecking Account StatementGary VibbertNo ratings yet

- Itad Bir Ruling No. 065-05Document4 pagesItad Bir Ruling No. 065-05msdivergentNo ratings yet

- An Internal and External Environmental Analysis of Paytm, IndiaDocument18 pagesAn Internal and External Environmental Analysis of Paytm, IndiaNitesh Gothe100% (1)

- Stanbic Mini Diclosure Tarrif GuideDocument2 pagesStanbic Mini Diclosure Tarrif GuideOMARYNo ratings yet

- MCQ Pre-Long Exam On Value Added Tax May 19, 2020Document6 pagesMCQ Pre-Long Exam On Value Added Tax May 19, 2020JDR JDRNo ratings yet

- GST Configutation FI - Ver 1.0Document27 pagesGST Configutation FI - Ver 1.0anon_156524868No ratings yet

- Del4259 01 01 2023 CRSDocument43 pagesDel4259 01 01 2023 CRSChandan SharmaNo ratings yet

- Form CDocument2 pagesForm Cnimoakalanka100% (1)

- Commercial Bank Platinum Credit CardDocument2 pagesCommercial Bank Platinum Credit Cardsaraju_felixNo ratings yet

- Gmail - Guest Reservations - Reservation Confirmation #R4448147806Document4 pagesGmail - Guest Reservations - Reservation Confirmation #R4448147806amarenterpries01No ratings yet