Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsCorporate Landowners (Stock Distribution Option)

Corporate Landowners (Stock Distribution Option)

Uploaded by

Yasser MambuaySection 31 of RA 6657 allows corporate landowners to voluntarily transfer ownership of their agricultural landholdings to qualified beneficiaries through one of two options: 1) Transfer landownership to the Philippine government or beneficiaries, subject to conditions agreed upon and DAR confirmation, or 2) Give beneficiaries the right to purchase stock in proportion to the land's value relative to total corporate assets, under agreed terms. The section also ensures workers' compensation is not reduced and that beneficiaries have audit, board representation, and equal stock rights. Land or approved stock plans must be implemented within two years or land becomes subject to compulsory coverage.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- People vs. Romy Lim DigestDocument4 pagesPeople vs. Romy Lim DigestEmir Mendoza80% (5)

- Korea Technologies Co v. Lerma DigestDocument3 pagesKorea Technologies Co v. Lerma Digestdenver41No ratings yet

- Agrarian LawDocument3 pagesAgrarian Lawsofia monghitNo ratings yet

- Agra - BarteDocument2 pagesAgra - BartearlynretardoNo ratings yet

- Agl ReviewerDocument20 pagesAgl ReviewerGelli TabiraraNo ratings yet

- Mercado, Floriemae S. BSA 2 Exercise 10Document6 pagesMercado, Floriemae S. BSA 2 Exercise 10Floriemae MercadoNo ratings yet

- Agrarian Law and Social Legislation: Fortunato, Julienne LDocument4 pagesAgrarian Law and Social Legislation: Fortunato, Julienne LjulyenfortunatoNo ratings yet

- F. Variations in Land AcquisitionDocument17 pagesF. Variations in Land AcquisitionPat EspinozaNo ratings yet

- Title Ix Merger and ConsolidationDocument3 pagesTitle Ix Merger and ConsolidationMeAnn TumbagaNo ratings yet

- Holders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationDocument5 pagesHolders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationIraNo ratings yet

- Articles of Association As Per New Companies Act 2013Document14 pagesArticles of Association As Per New Companies Act 2013greeshmaNo ratings yet

- Merger and ConsolidationDocument3 pagesMerger and ConsolidationJohanna Raissa CapadaNo ratings yet

- Articles of AssociationDocument24 pagesArticles of AssociationChidananda SwaroopNo ratings yet

- Land Acquisition and Distribution A. Noc/Vos - Chapters 4-5, DAR AO 7, s.2011Document6 pagesLand Acquisition and Distribution A. Noc/Vos - Chapters 4-5, DAR AO 7, s.2011dollyccruzNo ratings yet

- Hacienda LuisitaDocument2 pagesHacienda LuisitaglaiNo ratings yet

- Corporation Class Dec 12 2019Document12 pagesCorporation Class Dec 12 2019vinaNo ratings yet

- Articles of AssociationDocument11 pagesArticles of AssociationxoxoxNo ratings yet

- Preference Redeemable SharesDocument14 pagesPreference Redeemable SharesColin TanNo ratings yet

- Samridhi Foundation Draft AoaDocument10 pagesSamridhi Foundation Draft AoaPawan KumarNo ratings yet

- Articles of AssociationDocument17 pagesArticles of AssociationMohamad Khairul DaimNo ratings yet

- Articles of Association of - Private LimitedDocument10 pagesArticles of Association of - Private LimitedSatish V MadalaNo ratings yet

- Title X Appraisal RightDocument26 pagesTitle X Appraisal RightMaryjane De GuzmanNo ratings yet

- Law RevalidaDocument13 pagesLaw RevalidaAlliyah NasuenNo ratings yet

- The Corporation Code of The Philippines Section 6. Classification of SharesDocument4 pagesThe Corporation Code of The Philippines Section 6. Classification of SharesLovely ZyrenjcNo ratings yet

- The Companies Act, 1956Document14 pagesThe Companies Act, 1956C A Sumit DasNo ratings yet

- Further, That There Shall Always Be A Class or Series ofDocument8 pagesFurther, That There Shall Always Be A Class or Series ofwingpa delacruzNo ratings yet

- Corporate PowersDocument5 pagesCorporate PowersMichelle0No ratings yet

- Merger and ConsolidationDocument8 pagesMerger and ConsolidationidkdumpagainNo ratings yet

- RSR AOA FinalDocument18 pagesRSR AOA Finaladesh_naharNo ratings yet

- Article of AssociationDocument19 pagesArticle of AssociationDhruvraj SolankiNo ratings yet

- Sec 75-85Document19 pagesSec 75-85Vienne MaceNo ratings yet

- Corporation Sec.75 85Document37 pagesCorporation Sec.75 85iseonggyeong302No ratings yet

- Turner Vs Lorenzo ShippingDocument3 pagesTurner Vs Lorenzo ShippingTrisha CastilloNo ratings yet

- Artilces of AssociationDocument23 pagesArtilces of Associationlivros19900No ratings yet

- Preliminary Determination of Just Compensation: Rule XixDocument5 pagesPreliminary Determination of Just Compensation: Rule Xixlance zoletaNo ratings yet

- Public Agricultural Lands As May Hereafter Be Reserved by The President of The Philippines For Resettlement and SaleDocument5 pagesPublic Agricultural Lands As May Hereafter Be Reserved by The President of The Philippines For Resettlement and SalejamesNo ratings yet

- Article of Association KvellDocument11 pagesArticle of Association KvellCA Sudhanshu JoshiNo ratings yet

- Corporate PowersDocument6 pagesCorporate PowersErikha AranetaNo ratings yet

- Articles of Association AOA For Pvt. Ltd. CompaniesDocument7 pagesArticles of Association AOA For Pvt. Ltd. CompaniesKanika RustagiNo ratings yet

- Presidential Decree No. (27, 175, 410, 892, and 316)Document10 pagesPresidential Decree No. (27, 175, 410, 892, and 316)Romeo A. Garing Sr.100% (2)

- Title 4. Powers of Corporations - RCCDocument5 pagesTitle 4. Powers of Corporations - RCCJezen Esther PatiNo ratings yet

- Section 22. Qualified Beneficiaries. - The Lands Covered by The CARP Shall Be Distributed AsDocument6 pagesSection 22. Qualified Beneficiaries. - The Lands Covered by The CARP Shall Be Distributed AsCeledonio ManubagNo ratings yet

- The Companies Act 1956: Memorandum and Articles of Association OFDocument15 pagesThe Companies Act 1956: Memorandum and Articles of Association OFSudhakar P M StriverNo ratings yet

- Company Regulation SampleDocument13 pagesCompany Regulation SampleJames Oludele Etu67% (3)

- General Powers, Theory of General CapacityDocument5 pagesGeneral Powers, Theory of General CapacityMitchi BarrancoNo ratings yet

- General Powers, Theory of General CapacityDocument5 pagesGeneral Powers, Theory of General CapacityMitchi BarrancoNo ratings yet

- M&A SampleA-eDocument25 pagesM&A SampleA-edearyatuNo ratings yet

- Corporation LawDocument6 pagesCorporation LawStephanie GarciaNo ratings yet

- Title Iv Powers of CorporationsDocument7 pagesTitle Iv Powers of CorporationsSean FrancisNo ratings yet

- Incorporation and Organization of Private CorporationsDocument6 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Revised Corporation Code2Document17 pagesRevised Corporation Code2HyaNo ratings yet

- Article of AssociationDocument15 pagesArticle of AssociationRuchi KatariaNo ratings yet

- Wa0004.Document15 pagesWa0004.Ýøgësh ÑäyãkNo ratings yet

- Nasdaq, Inc. Restricted Stock Unit Award Certificate For Non-U.S. JurisdictionsDocument26 pagesNasdaq, Inc. Restricted Stock Unit Award Certificate For Non-U.S. JurisdictionsShamsher SiddiqueNo ratings yet

- Ra 11953Document3 pagesRa 11953jiezelfloreNo ratings yet

- 1.nationality of CorporationDocument10 pages1.nationality of CorporationMark John Borreros CabanNo ratings yet

- Ra 6657Document3 pagesRa 6657CarljunitaNo ratings yet

- 26 People Vs Calacroso (Mambuay)Document1 page26 People Vs Calacroso (Mambuay)Yasser MambuayNo ratings yet

- CIR Vs Toledo Power Co., 775 SCRA 709Document5 pagesCIR Vs Toledo Power Co., 775 SCRA 709Yasser MambuayNo ratings yet

- Korea Technologies Co V Hon. Alberto LermaDocument8 pagesKorea Technologies Co V Hon. Alberto LermaYasser MambuayNo ratings yet

- Hydro Corporation Filed Before The International Court of ArbitrationDocument9 pagesHydro Corporation Filed Before The International Court of ArbitrationYasser MambuayNo ratings yet

- Manila Electric Co V Pasay Transportation Case DigestDocument2 pagesManila Electric Co V Pasay Transportation Case DigestYasser Mambuay100% (1)

- BF Corporation V Court of AppealsDocument9 pagesBF Corporation V Court of AppealsYasser MambuayNo ratings yet

- Fernandez Law Offices For Petitioner. Francisco Pulido For RespondentsDocument21 pagesFernandez Law Offices For Petitioner. Francisco Pulido For RespondentsYasser MambuayNo ratings yet

- Leung Yee V. F.L Strong Machinery Co. and WilliamsonDocument19 pagesLeung Yee V. F.L Strong Machinery Co. and WilliamsonYasser MambuayNo ratings yet

- Property and Ownership CasesDocument19 pagesProperty and Ownership CasesYasser MambuayNo ratings yet

- Layug V IACDocument1 pageLayug V IACYasser MambuayNo ratings yet

- Layug V IACDocument1 pageLayug V IACYasser MambuayNo ratings yet

- Macariola V Asuncion FactsDocument2 pagesMacariola V Asuncion FactsYasser MambuayNo ratings yet

- Spouses Nonato V. Iac & Investor'S Finance CORP 140 SCRA 255 (1985)Document1 pageSpouses Nonato V. Iac & Investor'S Finance CORP 140 SCRA 255 (1985)Yasser MambuayNo ratings yet

Corporate Landowners (Stock Distribution Option)

Corporate Landowners (Stock Distribution Option)

Uploaded by

Yasser Mambuay0 ratings0% found this document useful (0 votes)

18 views2 pagesSection 31 of RA 6657 allows corporate landowners to voluntarily transfer ownership of their agricultural landholdings to qualified beneficiaries through one of two options: 1) Transfer landownership to the Philippine government or beneficiaries, subject to conditions agreed upon and DAR confirmation, or 2) Give beneficiaries the right to purchase stock in proportion to the land's value relative to total corporate assets, under agreed terms. The section also ensures workers' compensation is not reduced and that beneficiaries have audit, board representation, and equal stock rights. Land or approved stock plans must be implemented within two years or land becomes subject to compulsory coverage.

Original Description:

aaaa

Original Title

3. Corporate Landowners (Stock Distribution Option)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSection 31 of RA 6657 allows corporate landowners to voluntarily transfer ownership of their agricultural landholdings to qualified beneficiaries through one of two options: 1) Transfer landownership to the Philippine government or beneficiaries, subject to conditions agreed upon and DAR confirmation, or 2) Give beneficiaries the right to purchase stock in proportion to the land's value relative to total corporate assets, under agreed terms. The section also ensures workers' compensation is not reduced and that beneficiaries have audit, board representation, and equal stock rights. Land or approved stock plans must be implemented within two years or land becomes subject to compulsory coverage.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views2 pagesCorporate Landowners (Stock Distribution Option)

Corporate Landowners (Stock Distribution Option)

Uploaded by

Yasser MambuaySection 31 of RA 6657 allows corporate landowners to voluntarily transfer ownership of their agricultural landholdings to qualified beneficiaries through one of two options: 1) Transfer landownership to the Philippine government or beneficiaries, subject to conditions agreed upon and DAR confirmation, or 2) Give beneficiaries the right to purchase stock in proportion to the land's value relative to total corporate assets, under agreed terms. The section also ensures workers' compensation is not reduced and that beneficiaries have audit, board representation, and equal stock rights. Land or approved stock plans must be implemented within two years or land becomes subject to compulsory coverage.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

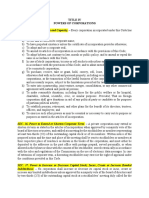

Sec.

31 of RA 6657 – Corporate

Landowners (Stock Distribution Option)

SECTION 31. Corporate Landowners. —Corporate landowners may voluntarily transfer

ownership over their agricultural landholdings to the Republic of the Philippines pursuant to

Section 20 hereof or to qualified beneficiaries, under such terms and conditions, consistent with

this Act, as they may agree upon, subject to confirmation by the DAR. Upon certification by the

DAR, corporations owning agricultural lands may give their qualified beneficiaries the right to

purchase such proportion of the capital stock of the corporation that the agricultural land,

actually devoted to agricultural activities, bears in relation to the company’s total assets, under

such terms and conditions as may be agreed upon by them. In no case shall the compensation

received by the workers at the time the shares of stocks are distributed be reduced. The same

principle shall be applied to associations, with respect to their equity or participation.

Corporations or associations which voluntarily divest a proportion of their capital stock, equity

or participation in favor of their workers or other qualified beneficiaries under this section shall

be deemed to have complied with the provisions of the Act: Provided, That the following

conditions are complied with: a) In order to safeguard the right of beneficiaries who own shares

of stocks to dividends and other financial benefits, the books of the corporation or association

shall be subject to periodic audit by certified public accountants chosen by the beneficiaries; b)

Irrespective of the value of their equity in the corporation or association, the beneficiaries shall

be assured of at least one (1) representative in the board of directors, or in a management or

executive committee, if one exists, of the corporation or association; and c) Any shares acquired

by such workers and beneficiaries shall have the same rights and features as all other shares. d)

Any transfer of shares of stocks by the original beneficiaries shall be void ab initio unless said

transaction is in favor of a qualified and registered beneficiary within the same corporation. If

within two (2) years from the approval of this Act, the land or stock transfer envisioned above is

not made or realized or the plan for such stock distribution approved by the PARC within the

same period, the agricultural land of the corporate owners or corporation shall be subject to the

compulsory coverage of this Act.

You might also like

- People vs. Romy Lim DigestDocument4 pagesPeople vs. Romy Lim DigestEmir Mendoza80% (5)

- Korea Technologies Co v. Lerma DigestDocument3 pagesKorea Technologies Co v. Lerma Digestdenver41No ratings yet

- Agrarian LawDocument3 pagesAgrarian Lawsofia monghitNo ratings yet

- Agra - BarteDocument2 pagesAgra - BartearlynretardoNo ratings yet

- Agl ReviewerDocument20 pagesAgl ReviewerGelli TabiraraNo ratings yet

- Mercado, Floriemae S. BSA 2 Exercise 10Document6 pagesMercado, Floriemae S. BSA 2 Exercise 10Floriemae MercadoNo ratings yet

- Agrarian Law and Social Legislation: Fortunato, Julienne LDocument4 pagesAgrarian Law and Social Legislation: Fortunato, Julienne LjulyenfortunatoNo ratings yet

- F. Variations in Land AcquisitionDocument17 pagesF. Variations in Land AcquisitionPat EspinozaNo ratings yet

- Title Ix Merger and ConsolidationDocument3 pagesTitle Ix Merger and ConsolidationMeAnn TumbagaNo ratings yet

- Holders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationDocument5 pagesHolders of Nonvoting Shares Shall Nevertheless Be Entitled To Vote On The Following Matters (A) Amendment of The Articles of IncorporationIraNo ratings yet

- Articles of Association As Per New Companies Act 2013Document14 pagesArticles of Association As Per New Companies Act 2013greeshmaNo ratings yet

- Merger and ConsolidationDocument3 pagesMerger and ConsolidationJohanna Raissa CapadaNo ratings yet

- Articles of AssociationDocument24 pagesArticles of AssociationChidananda SwaroopNo ratings yet

- Land Acquisition and Distribution A. Noc/Vos - Chapters 4-5, DAR AO 7, s.2011Document6 pagesLand Acquisition and Distribution A. Noc/Vos - Chapters 4-5, DAR AO 7, s.2011dollyccruzNo ratings yet

- Hacienda LuisitaDocument2 pagesHacienda LuisitaglaiNo ratings yet

- Corporation Class Dec 12 2019Document12 pagesCorporation Class Dec 12 2019vinaNo ratings yet

- Articles of AssociationDocument11 pagesArticles of AssociationxoxoxNo ratings yet

- Preference Redeemable SharesDocument14 pagesPreference Redeemable SharesColin TanNo ratings yet

- Samridhi Foundation Draft AoaDocument10 pagesSamridhi Foundation Draft AoaPawan KumarNo ratings yet

- Articles of AssociationDocument17 pagesArticles of AssociationMohamad Khairul DaimNo ratings yet

- Articles of Association of - Private LimitedDocument10 pagesArticles of Association of - Private LimitedSatish V MadalaNo ratings yet

- Title X Appraisal RightDocument26 pagesTitle X Appraisal RightMaryjane De GuzmanNo ratings yet

- Law RevalidaDocument13 pagesLaw RevalidaAlliyah NasuenNo ratings yet

- The Corporation Code of The Philippines Section 6. Classification of SharesDocument4 pagesThe Corporation Code of The Philippines Section 6. Classification of SharesLovely ZyrenjcNo ratings yet

- The Companies Act, 1956Document14 pagesThe Companies Act, 1956C A Sumit DasNo ratings yet

- Further, That There Shall Always Be A Class or Series ofDocument8 pagesFurther, That There Shall Always Be A Class or Series ofwingpa delacruzNo ratings yet

- Corporate PowersDocument5 pagesCorporate PowersMichelle0No ratings yet

- Merger and ConsolidationDocument8 pagesMerger and ConsolidationidkdumpagainNo ratings yet

- RSR AOA FinalDocument18 pagesRSR AOA Finaladesh_naharNo ratings yet

- Article of AssociationDocument19 pagesArticle of AssociationDhruvraj SolankiNo ratings yet

- Sec 75-85Document19 pagesSec 75-85Vienne MaceNo ratings yet

- Corporation Sec.75 85Document37 pagesCorporation Sec.75 85iseonggyeong302No ratings yet

- Turner Vs Lorenzo ShippingDocument3 pagesTurner Vs Lorenzo ShippingTrisha CastilloNo ratings yet

- Artilces of AssociationDocument23 pagesArtilces of Associationlivros19900No ratings yet

- Preliminary Determination of Just Compensation: Rule XixDocument5 pagesPreliminary Determination of Just Compensation: Rule Xixlance zoletaNo ratings yet

- Public Agricultural Lands As May Hereafter Be Reserved by The President of The Philippines For Resettlement and SaleDocument5 pagesPublic Agricultural Lands As May Hereafter Be Reserved by The President of The Philippines For Resettlement and SalejamesNo ratings yet

- Article of Association KvellDocument11 pagesArticle of Association KvellCA Sudhanshu JoshiNo ratings yet

- Corporate PowersDocument6 pagesCorporate PowersErikha AranetaNo ratings yet

- Articles of Association AOA For Pvt. Ltd. CompaniesDocument7 pagesArticles of Association AOA For Pvt. Ltd. CompaniesKanika RustagiNo ratings yet

- Presidential Decree No. (27, 175, 410, 892, and 316)Document10 pagesPresidential Decree No. (27, 175, 410, 892, and 316)Romeo A. Garing Sr.100% (2)

- Title 4. Powers of Corporations - RCCDocument5 pagesTitle 4. Powers of Corporations - RCCJezen Esther PatiNo ratings yet

- Section 22. Qualified Beneficiaries. - The Lands Covered by The CARP Shall Be Distributed AsDocument6 pagesSection 22. Qualified Beneficiaries. - The Lands Covered by The CARP Shall Be Distributed AsCeledonio ManubagNo ratings yet

- The Companies Act 1956: Memorandum and Articles of Association OFDocument15 pagesThe Companies Act 1956: Memorandum and Articles of Association OFSudhakar P M StriverNo ratings yet

- Company Regulation SampleDocument13 pagesCompany Regulation SampleJames Oludele Etu67% (3)

- General Powers, Theory of General CapacityDocument5 pagesGeneral Powers, Theory of General CapacityMitchi BarrancoNo ratings yet

- General Powers, Theory of General CapacityDocument5 pagesGeneral Powers, Theory of General CapacityMitchi BarrancoNo ratings yet

- M&A SampleA-eDocument25 pagesM&A SampleA-edearyatuNo ratings yet

- Corporation LawDocument6 pagesCorporation LawStephanie GarciaNo ratings yet

- Title Iv Powers of CorporationsDocument7 pagesTitle Iv Powers of CorporationsSean FrancisNo ratings yet

- Incorporation and Organization of Private CorporationsDocument6 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Incorporation and Organization of Private CorporationsDocument10 pagesIncorporation and Organization of Private CorporationsgerrymanderingNo ratings yet

- Revised Corporation Code2Document17 pagesRevised Corporation Code2HyaNo ratings yet

- Article of AssociationDocument15 pagesArticle of AssociationRuchi KatariaNo ratings yet

- Wa0004.Document15 pagesWa0004.Ýøgësh ÑäyãkNo ratings yet

- Nasdaq, Inc. Restricted Stock Unit Award Certificate For Non-U.S. JurisdictionsDocument26 pagesNasdaq, Inc. Restricted Stock Unit Award Certificate For Non-U.S. JurisdictionsShamsher SiddiqueNo ratings yet

- Ra 11953Document3 pagesRa 11953jiezelfloreNo ratings yet

- 1.nationality of CorporationDocument10 pages1.nationality of CorporationMark John Borreros CabanNo ratings yet

- Ra 6657Document3 pagesRa 6657CarljunitaNo ratings yet

- 26 People Vs Calacroso (Mambuay)Document1 page26 People Vs Calacroso (Mambuay)Yasser MambuayNo ratings yet

- CIR Vs Toledo Power Co., 775 SCRA 709Document5 pagesCIR Vs Toledo Power Co., 775 SCRA 709Yasser MambuayNo ratings yet

- Korea Technologies Co V Hon. Alberto LermaDocument8 pagesKorea Technologies Co V Hon. Alberto LermaYasser MambuayNo ratings yet

- Hydro Corporation Filed Before The International Court of ArbitrationDocument9 pagesHydro Corporation Filed Before The International Court of ArbitrationYasser MambuayNo ratings yet

- Manila Electric Co V Pasay Transportation Case DigestDocument2 pagesManila Electric Co V Pasay Transportation Case DigestYasser Mambuay100% (1)

- BF Corporation V Court of AppealsDocument9 pagesBF Corporation V Court of AppealsYasser MambuayNo ratings yet

- Fernandez Law Offices For Petitioner. Francisco Pulido For RespondentsDocument21 pagesFernandez Law Offices For Petitioner. Francisco Pulido For RespondentsYasser MambuayNo ratings yet

- Leung Yee V. F.L Strong Machinery Co. and WilliamsonDocument19 pagesLeung Yee V. F.L Strong Machinery Co. and WilliamsonYasser MambuayNo ratings yet

- Property and Ownership CasesDocument19 pagesProperty and Ownership CasesYasser MambuayNo ratings yet

- Layug V IACDocument1 pageLayug V IACYasser MambuayNo ratings yet

- Layug V IACDocument1 pageLayug V IACYasser MambuayNo ratings yet

- Macariola V Asuncion FactsDocument2 pagesMacariola V Asuncion FactsYasser MambuayNo ratings yet

- Spouses Nonato V. Iac & Investor'S Finance CORP 140 SCRA 255 (1985)Document1 pageSpouses Nonato V. Iac & Investor'S Finance CORP 140 SCRA 255 (1985)Yasser MambuayNo ratings yet