Professional Documents

Culture Documents

Tax Computation - 2019 PDF

Tax Computation - 2019 PDF

Uploaded by

Jurex JustinianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Computation - 2019 PDF

Tax Computation - 2019 PDF

Uploaded by

Jurex JustinianCopyright:

Available Formats

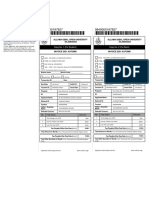

How to compute your

COMPONENTS: LEGEND:

Monthly Basic Salary (MBS) : 25,000 A – Annual Basic Salary Income (MBS x 12)

Bonus below 90K : 50,000 B – Provisional Income (Overtime, Taxable

Bonus above 90K :0 Allowances, Differentials et. al)

Provisional Income : 35,000 C – 13th and 14th Month Pay and Other

Bonuses in excess of 90,000

1. Gross Taxable Income (GTI) D – Mandatory (Statutory) Contributions

(SSS, HDMF & PhilHealth)

A + B + C = GTI E – Tax Rate on Taxable Income

300,000 + 35,000 + 0 = 335,000

2. Mandatory Deductions (D) ANNUALIZED TAX TABLE 2018-2022

SSS – 581.30 Annual Taxable Incom e Tax Rate

HDMF – 100

PH – 343.75 0 - 250,000 0%

TOTAL – 1,025.05 Over 250,000 - 400,000 20% o f the excess o ver 250,000

1,025.05 x 12 = 12,300.60 Over 400,000 - 800,000 30,000 + 25% o f the excess o ver 400,000

Over 800,000 - 2,000,000 130,000 + 30% o f the excess o ver 800,000

3. Net Taxable Income (NTI)

Over 2,000,000 - 5,000,000 490,000 + 32% o f the excess o ver 2,000,000

Over 5,000,000 1,450,000 + 35% o f the excess o ver 5,000,000

GTI – D = NTI

335,000 – 12,300.60 = 322,699.40

4. Annual Withholding Tax (AWT) using the new

annual tax table

NTI - E = AWT

322,699 – 250,000 = 72,699 x 20% = 14,540

5. Divide annual income tax by 28 pay periods

AWT / 28 = Estimated Semi-Monthly Withholding Tax

14,540 / 28 = 519

Note: Withholding tax may vary depending on the actual income received within the calendar year

6. Multiply the semi-monthly withholding tax by 2

TAX FOR 13TH MONTH PAY = Estimated Semi-Monthly Withholding Tax x 2

519 x 2 = 1,038

Note: 13th Month Pay is considered as two (2) pay periods that is why the multiplier is 2

Call Us!

Talk to your HR team for your questions or inquiries or you may reach out to your

respective District HRs or email us at payrollmatters@ngcp.ph.

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- The Complete Breakout Trader Day Trading John Connors PDFDocument118 pagesThe Complete Breakout Trader Day Trading John Connors PDFKaushik Matalia83% (12)

- Chart of Accounts For A Merchandising BusinessDocument3 pagesChart of Accounts For A Merchandising BusinessJosh LeBlanc100% (5)

- The Stabdford Bank GameDocument101 pagesThe Stabdford Bank Gamekonstantinos10No ratings yet

- CPA Question - CHPT 16 AnswersDocument22 pagesCPA Question - CHPT 16 Answersrohaanali222No ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- Group Activity 2 Answer KeyDocument4 pagesGroup Activity 2 Answer Keykrisha milloNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Unit 6-Computation of Total Income and Tax LiabilityDocument23 pagesUnit 6-Computation of Total Income and Tax LiabilityDisha GuptaNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- GeneralPrinciples Incometax Tabag 51 224Document28 pagesGeneralPrinciples Incometax Tabag 51 224John Carlo Dela CruzNo ratings yet

- RTP NOV 2022 Important PointsDocument4 pagesRTP NOV 2022 Important PointsDaniel TerstegenNo ratings yet

- Annual Compensation and Business TaxesDocument21 pagesAnnual Compensation and Business TaxesRyDNo ratings yet

- Problems and Solutions On Advance Tax: Problem No. 1Document8 pagesProblems and Solutions On Advance Tax: Problem No. 1NishantNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Cae05-Chapter 10 Income Tax Problem DiscussionDocument37 pagesCae05-Chapter 10 Income Tax Problem Discussioncris tellaNo ratings yet

- Written Report Week 8 Income TaxDocument16 pagesWritten Report Week 8 Income Taxdevy mar topiaNo ratings yet

- TaxationDocument8 pagesTaxationPeligrino MacNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- 92 08 DeductionsDocument18 pages92 08 DeductionsNikkoNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- TAX Quiz 2Document10 pagesTAX Quiz 2Ednalyn CruzNo ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (31)

- Presentation 1Document16 pagesPresentation 1RenzNo ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Minimum Corporate Income Tax 3Document5 pagesMinimum Corporate Income Tax 3NaikNo ratings yet

- FunaccDocument11 pagesFunaccCanceran CarolynNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Other Taxpayers ProblemsDocument12 pagesOther Taxpayers ProblemsRaiNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- PAS 12 - Income Tax - AssignmentDocument8 pagesPAS 12 - Income Tax - Assignmentviva nazarenoNo ratings yet

- TDS Calculation on Salary FinalDocument2 pagesTDS Calculation on Salary FinalKowsar HossainNo ratings yet

- MCQs All Sets F 1Document46 pagesMCQs All Sets F 1PSK WRITINGSNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Individual Income Tax May 2020Document6 pagesIndividual Income Tax May 2020ziikerr99No ratings yet

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Week 8 - TDocument6 pagesWeek 8 - TataseskiNo ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 8 - Capital Structure PT 1Document32 pages8 - Capital Structure PT 1Rohan SinghNo ratings yet

- Palmer Cook Productions Manages and Operates Two Rock Bands TheDocument1 pagePalmer Cook Productions Manages and Operates Two Rock Bands TheLet's Talk With HassanNo ratings yet

- Study of Organisational Structure Syndicate BankDocument48 pagesStudy of Organisational Structure Syndicate BankJissy Shravan50% (2)

- J Senior Premium Rate Card 2022Document4 pagesJ Senior Premium Rate Card 2022dsesrNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- Midland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoyDocument13 pagesMidland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoymariliamonfardineNo ratings yet

- Drills Notes Receivable To Discounting of ReceivableDocument3 pagesDrills Notes Receivable To Discounting of ReceivableVincent AbellaNo ratings yet

- FM CH3Document47 pagesFM CH3Dalia ElarabyNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Assignment # 4Document4 pagesAssignment # 4Butt ArhamNo ratings yet

- IBDP Mathematics Topic 1 To Topic 4 Revision WorksheetDocument42 pagesIBDP Mathematics Topic 1 To Topic 4 Revision Worksheetq9zfyx5wzfNo ratings yet

- Factors Influencing Corporate GovernanceDocument5 pagesFactors Influencing Corporate GovernanceShariq Ansari M100% (2)

- USAID Credit Scoring Systems HandbookDocument79 pagesUSAID Credit Scoring Systems HandbookNinjee BoNo ratings yet

- Ago Sonara IMEX2022Document5 pagesAgo Sonara IMEX2022ivana LahameuNo ratings yet

- Practice Question 2 RPGT & RPC Oct 2022Document1 pagePractice Question 2 RPGT & RPC Oct 2022FeahRafeah KikiNo ratings yet

- Financial Statement Analysis Indigo: Prof. Seshadev SahooDocument22 pagesFinancial Statement Analysis Indigo: Prof. Seshadev SahooAbhishek MishraNo ratings yet

- C5 Sa PIjm 8 W6 HH6 IrDocument7 pagesC5 Sa PIjm 8 W6 HH6 Irarun royNo ratings yet

- The Austerity Delusion (Krugman)Document11 pagesThe Austerity Delusion (Krugman)phdpolitics1No ratings yet

- Agreement Between Film Producers and DistributorsDocument6 pagesAgreement Between Film Producers and DistributorsjabalinsukanyaNo ratings yet

- TG1628 Kotak Life InsuranceDocument2 pagesTG1628 Kotak Life InsuranceAnandKumarPNo ratings yet

- #1prepare Trail Balance: (1) NAME Under Name DR CR Total 22010 0 22010 0Document3 pages#1prepare Trail Balance: (1) NAME Under Name DR CR Total 22010 0 22010 0kingmib1No ratings yet

- Credit Note-Dlf PowerDocument1 pageCredit Note-Dlf PowerRs TiwariNo ratings yet

- Concepts of Cash Flow Statement - MCQs With AnswersDocument4 pagesConcepts of Cash Flow Statement - MCQs With AnswersLakshmi NarasaiahNo ratings yet

- Financial Analysis (HDFC BANK)Document136 pagesFinancial Analysis (HDFC BANK)palmeet73% (62)

- Final March 2024 Business TimetableDocument20 pagesFinal March 2024 Business Timetablebriansirma58No ratings yet

- BAED-BFIN2121 Business Finance: Home BAED-BFIN2121-2122S Week 9: Long Quiz Long Quiz 002Document13 pagesBAED-BFIN2121 Business Finance: Home BAED-BFIN2121-2122S Week 9: Long Quiz Long Quiz 002Luisa RadaNo ratings yet

- Spa MacatulaDocument2 pagesSpa MacatulaJerson MadronaNo ratings yet