Professional Documents

Culture Documents

L-Hedge Accounting Example - Lecture Illustration

L-Hedge Accounting Example - Lecture Illustration

Uploaded by

Manraj LidharCopyright:

Available Formats

You might also like

- Assignment 1Document10 pagesAssignment 1Manraj Lidhar100% (5)

- Solnik & McLeavey - Global Investments 6th EdDocument8 pagesSolnik & McLeavey - Global Investments 6th Edhotmail13No ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNo ratings yet

- Foreign Currency TransactionDocument60 pagesForeign Currency TransactionJoemar Santos TorresNo ratings yet

- Hrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverDocument5 pagesHrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverManraj LidharNo ratings yet

- L Tutorial QuestionDocument2 pagesL Tutorial QuestionManraj LidharNo ratings yet

- Exercise Advanced Accounting SolutionsDocument14 pagesExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- SOAL LATIHAN MK - AKL - FC TransactionsDocument4 pagesSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- WWW - Rba.gov - Au: The Current Exchange Rate Is 0.6810Document3 pagesWWW - Rba.gov - Au: The Current Exchange Rate Is 0.6810Zoe RogersNo ratings yet

- IMF KvotaDocument1 pageIMF KvotapakompakomNo ratings yet

- Selected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamDocument4 pagesSelected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamAdam Khaleel0% (1)

- Carmel Highlands Homes Market Action Report For Real Estate Sales August 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales August 2011Rebekah SchroederNo ratings yet

- Collapsing Dow Jones: IndiaDocument6 pagesCollapsing Dow Jones: IndiaPriyanka PaulNo ratings yet

- QUIZ AdvanceDocument1 pageQUIZ AdvanceFenny MarietzaNo ratings yet

- ch12 - F MDocument8 pagesch12 - F MAhmed Osama ElgebalyNo ratings yet

- Pra UAS PA 2 CBDocument3 pagesPra UAS PA 2 CBStefi Yunia SuwarlanNo ratings yet

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Second Preliminary Examination Masters Technological Institute of Mindanao A.Y. 2013-2014Document1 pageSecond Preliminary Examination Masters Technological Institute of Mindanao A.Y. 2013-2014Robert Jayson UyNo ratings yet

- September Sales ReportDocument2 pagesSeptember Sales ReportCourier JournalNo ratings yet

- Ohio Company Was Formed On July 1 2005 It WasDocument1 pageOhio Company Was Formed On July 1 2005 It WasM Bilal SaleemNo ratings yet

- Advanced Accounting ProblemsDocument4 pagesAdvanced Accounting ProblemsAjay Sharma0% (1)

- Final ExamDocument18 pagesFinal ExamHarryNo ratings yet

- Ias 21 PDFDocument1 pageIas 21 PDFPervaiz AkhterNo ratings yet

- Classroom Exercise On Bonds PayableDocument4 pagesClassroom Exercise On Bonds PayablesamuelpingolNo ratings yet

- Exchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesDocument22 pagesExchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesSourav PaulNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- TB CLDocument2 pagesTB CLObe AbsinNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales July 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales July 2011Nicole TruszkowskiNo ratings yet

- 2014 Y12 Chapter 5 - CDDocument22 pages2014 Y12 Chapter 5 - CDtechnowiz11No ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales October 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales October 2011Nicole TruszkowskiNo ratings yet

- Bcom 3Document26 pagesBcom 3Nayan MaldeNo ratings yet

- As A Preliminary To Requesting Budget Estimates of SalesDocument4 pagesAs A Preliminary To Requesting Budget Estimates of SalesChiodos OliverNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For August 2011Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For August 2011Rebekah SchroederNo ratings yet

- Bond Amortization Methods & Journal EntriesDocument14 pagesBond Amortization Methods & Journal EntriesDishani MaityNo ratings yet

- Soal Asis 3 - Jordy - AJPDocument1 pageSoal Asis 3 - Jordy - AJPJordy TangNo ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNo ratings yet

- Conversion of Bonds The December 31 2010 Balance Sheet of PDFDocument1 pageConversion of Bonds The December 31 2010 Balance Sheet of PDFAnbu jaromiaNo ratings yet

- P.P (!qi) 2Document12 pagesP.P (!qi) 2sayamaizaaNo ratings yet

- Soal Special Edition Akuntansi Keuangan Menengah IIDocument2 pagesSoal Special Edition Akuntansi Keuangan Menengah IIZephyra ViolettaNo ratings yet

- CH 14Document2 pagesCH 14vivienNo ratings yet

- Notes ReceivableDocument1 pageNotes ReceivableEllenor Del RosarioNo ratings yet

- NUMERICALSDocument2 pagesNUMERICALSManoj KumarNo ratings yet

- Bonds Payable 1Document2 pagesBonds Payable 1els emsNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2011Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- Total Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inDocument5 pagesTotal Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inFolk BluesNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiNo ratings yet

- Quiz 5Document1 pageQuiz 5AlexNo ratings yet

- Problem Set 5Document2 pagesProblem Set 5Roger Mario LopezNo ratings yet

- Nautical Has Two Classes of Stock Authorized 10 Par PreferredDocument1 pageNautical Has Two Classes of Stock Authorized 10 Par Preferredtrilocksp SinghNo ratings yet

- Chapter Six: Accounting and Reporting For Foreign Currency TransactionDocument10 pagesChapter Six: Accounting and Reporting For Foreign Currency Transactionliyneh mebrahituNo ratings yet

- WTE - July 2011Document8 pagesWTE - July 2011Don SheaNo ratings yet

- 240 Assignment 1 For PostingDocument4 pages240 Assignment 1 For PostingpearlydawnNo ratings yet

- Recitation Session1& 2Document6 pagesRecitation Session1& 2chris sakettNo ratings yet

- Assignment Hedge AccountingDocument4 pagesAssignment Hedge AccountingJuvy DimaanoNo ratings yet

- She QuizDocument2 pagesShe QuizRonnelson PascualNo ratings yet

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationFrom EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo ratings yet

- L FinancialinstrumentsDocument38 pagesL FinancialinstrumentsManraj LidharNo ratings yet

- Course OutlineDocument15 pagesCourse OutlineManraj LidharNo ratings yet

- Lecture Notes - Hedge AccountingDocument5 pagesLecture Notes - Hedge AccountingManraj LidharNo ratings yet

- NotesDocument4 pagesNotesManraj LidharNo ratings yet

- L Tutorial QuestionDocument2 pagesL Tutorial QuestionManraj LidharNo ratings yet

- Department of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Document8 pagesDepartment of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Manraj LidharNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementManraj LidharNo ratings yet

- College of Business, Hospitality and Tourism Studies: Question PaperDocument4 pagesCollege of Business, Hospitality and Tourism Studies: Question PaperManraj LidharNo ratings yet

- Acc 811 PaperDocument15 pagesAcc 811 PaperManraj LidharNo ratings yet

- HRM 703 Human Resource Management & DevelopmentDocument4 pagesHRM 703 Human Resource Management & DevelopmentManraj LidharNo ratings yet

- Question Paper: InstructionsDocument5 pagesQuestion Paper: InstructionsManraj LidharNo ratings yet

- Brunswikian Lens Model - TanjaDocument7 pagesBrunswikian Lens Model - TanjaManraj LidharNo ratings yet

- HRM 703 Ii, 2012Document7 pagesHRM 703 Ii, 2012Manraj LidharNo ratings yet

- A Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionDocument20 pagesA Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionManraj LidharNo ratings yet

- MGT 704 - T2-2010Document3 pagesMGT 704 - T2-2010Manraj LidharNo ratings yet

L-Hedge Accounting Example - Lecture Illustration

L-Hedge Accounting Example - Lecture Illustration

Uploaded by

Manraj LidharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L-Hedge Accounting Example - Lecture Illustration

L-Hedge Accounting Example - Lecture Illustration

Uploaded by

Manraj LidharCopyright:

Available Formats

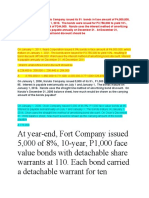

ACC702 International Corporate Reporting – Example [Hedge Accounting]

Melbourne Ltd manufactures electric cars. On 4 June 2011 Melbourne Ltd enters into

a non-cancellable purchase commitment with Miami Ltd for the supply of batteries,

with those batteries to be shipped on 30 June 2011. The total contract price was

US$3,000,000 and the full amount was due for payment on 30 August 2011.

Because of concerns about movements in foreign exchange rates, on 4 June 2011 Oz

Ltd entered into a forward rate contract on US dollar with a foreign exchange broker

so as to receive US$3,000,000 on 30 August 2011 at a forward rate of $A1.00 = US$0.78

We will assume that Melbourne Ltd prepares monthly financial statements and that

it elects to treat the hedge as a cash flow hedge. Further, we will assume that

Melbourne Ltd elect, pursuant to IAS39, to adjust the cost of the inventory as a result

of the hedging transaction.

Other information:

The respective spot rates, with the spot rates being the exchange rates for immediate

delivery of currencies to be exchanged, are provided below. The forward rates

offered on particular dates, for delivery of US dollar on 30 August 2011 are also

provided. It should be noted that on 30 August 2011, the last day of the forward rate

contract, the spot rate and the forward rate will be the same.

Date Spot rate Forward rates for 30 August

delivery of US$

4 June 2011 $A1.00 = US$0.80 $A1.00 = US$0.78

30 June 2011 $A1.00 = US$0.78 $A1.00 = US$0.76

31 July 2011 $A1.00 = US$0.75 $A1.00 = US$0.74

30 August 2011 $A1.00 = US$0.72 $A1.00 = US$0.72

Required:

Provide the journal entries to account for the hedged item and the hedging

instrument for the months ending 30 June, 31 July and 30 August 2011. No entry

is required on 4 June 2011 as fair value assessed of the forward rate agreement is

assessed as being zero.

You might also like

- Assignment 1Document10 pagesAssignment 1Manraj Lidhar100% (5)

- Solnik & McLeavey - Global Investments 6th EdDocument8 pagesSolnik & McLeavey - Global Investments 6th Edhotmail13No ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNo ratings yet

- Foreign Currency TransactionDocument60 pagesForeign Currency TransactionJoemar Santos TorresNo ratings yet

- Hrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverDocument5 pagesHrm703: Human Resource Management & Development T3 2015 Page 1 Turn OverManraj LidharNo ratings yet

- L Tutorial QuestionDocument2 pagesL Tutorial QuestionManraj LidharNo ratings yet

- Exercise Advanced Accounting SolutionsDocument14 pagesExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- SOAL LATIHAN MK - AKL - FC TransactionsDocument4 pagesSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- WWW - Rba.gov - Au: The Current Exchange Rate Is 0.6810Document3 pagesWWW - Rba.gov - Au: The Current Exchange Rate Is 0.6810Zoe RogersNo ratings yet

- IMF KvotaDocument1 pageIMF KvotapakompakomNo ratings yet

- Selected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamDocument4 pagesSelected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamAdam Khaleel0% (1)

- Carmel Highlands Homes Market Action Report For Real Estate Sales August 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales August 2011Rebekah SchroederNo ratings yet

- Collapsing Dow Jones: IndiaDocument6 pagesCollapsing Dow Jones: IndiaPriyanka PaulNo ratings yet

- QUIZ AdvanceDocument1 pageQUIZ AdvanceFenny MarietzaNo ratings yet

- ch12 - F MDocument8 pagesch12 - F MAhmed Osama ElgebalyNo ratings yet

- Pra UAS PA 2 CBDocument3 pagesPra UAS PA 2 CBStefi Yunia SuwarlanNo ratings yet

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Second Preliminary Examination Masters Technological Institute of Mindanao A.Y. 2013-2014Document1 pageSecond Preliminary Examination Masters Technological Institute of Mindanao A.Y. 2013-2014Robert Jayson UyNo ratings yet

- September Sales ReportDocument2 pagesSeptember Sales ReportCourier JournalNo ratings yet

- Ohio Company Was Formed On July 1 2005 It WasDocument1 pageOhio Company Was Formed On July 1 2005 It WasM Bilal SaleemNo ratings yet

- Advanced Accounting ProblemsDocument4 pagesAdvanced Accounting ProblemsAjay Sharma0% (1)

- Final ExamDocument18 pagesFinal ExamHarryNo ratings yet

- Ias 21 PDFDocument1 pageIas 21 PDFPervaiz AkhterNo ratings yet

- Classroom Exercise On Bonds PayableDocument4 pagesClassroom Exercise On Bonds PayablesamuelpingolNo ratings yet

- Exchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesDocument22 pagesExchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesSourav PaulNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- TB CLDocument2 pagesTB CLObe AbsinNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales July 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales July 2011Nicole TruszkowskiNo ratings yet

- 2014 Y12 Chapter 5 - CDDocument22 pages2014 Y12 Chapter 5 - CDtechnowiz11No ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales October 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales October 2011Nicole TruszkowskiNo ratings yet

- Bcom 3Document26 pagesBcom 3Nayan MaldeNo ratings yet

- As A Preliminary To Requesting Budget Estimates of SalesDocument4 pagesAs A Preliminary To Requesting Budget Estimates of SalesChiodos OliverNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For August 2011Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For August 2011Rebekah SchroederNo ratings yet

- Bond Amortization Methods & Journal EntriesDocument14 pagesBond Amortization Methods & Journal EntriesDishani MaityNo ratings yet

- Soal Asis 3 - Jordy - AJPDocument1 pageSoal Asis 3 - Jordy - AJPJordy TangNo ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNo ratings yet

- Conversion of Bonds The December 31 2010 Balance Sheet of PDFDocument1 pageConversion of Bonds The December 31 2010 Balance Sheet of PDFAnbu jaromiaNo ratings yet

- P.P (!qi) 2Document12 pagesP.P (!qi) 2sayamaizaaNo ratings yet

- Soal Special Edition Akuntansi Keuangan Menengah IIDocument2 pagesSoal Special Edition Akuntansi Keuangan Menengah IIZephyra ViolettaNo ratings yet

- CH 14Document2 pagesCH 14vivienNo ratings yet

- Notes ReceivableDocument1 pageNotes ReceivableEllenor Del RosarioNo ratings yet

- NUMERICALSDocument2 pagesNUMERICALSManoj KumarNo ratings yet

- Bonds Payable 1Document2 pagesBonds Payable 1els emsNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2011Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- Total Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inDocument5 pagesTotal Points: 20, Time: 20 Min: 2. Define Interlocking Directorates. How Are They Perceived in The SWM and inFolk BluesNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiNo ratings yet

- Quiz 5Document1 pageQuiz 5AlexNo ratings yet

- Problem Set 5Document2 pagesProblem Set 5Roger Mario LopezNo ratings yet

- Nautical Has Two Classes of Stock Authorized 10 Par PreferredDocument1 pageNautical Has Two Classes of Stock Authorized 10 Par Preferredtrilocksp SinghNo ratings yet

- Chapter Six: Accounting and Reporting For Foreign Currency TransactionDocument10 pagesChapter Six: Accounting and Reporting For Foreign Currency Transactionliyneh mebrahituNo ratings yet

- WTE - July 2011Document8 pagesWTE - July 2011Don SheaNo ratings yet

- 240 Assignment 1 For PostingDocument4 pages240 Assignment 1 For PostingpearlydawnNo ratings yet

- Recitation Session1& 2Document6 pagesRecitation Session1& 2chris sakettNo ratings yet

- Assignment Hedge AccountingDocument4 pagesAssignment Hedge AccountingJuvy DimaanoNo ratings yet

- She QuizDocument2 pagesShe QuizRonnelson PascualNo ratings yet

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationFrom EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo ratings yet

- L FinancialinstrumentsDocument38 pagesL FinancialinstrumentsManraj LidharNo ratings yet

- Course OutlineDocument15 pagesCourse OutlineManraj LidharNo ratings yet

- Lecture Notes - Hedge AccountingDocument5 pagesLecture Notes - Hedge AccountingManraj LidharNo ratings yet

- NotesDocument4 pagesNotesManraj LidharNo ratings yet

- L Tutorial QuestionDocument2 pagesL Tutorial QuestionManraj LidharNo ratings yet

- Department of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Document8 pagesDepartment of Management, Industrial Relations and OHS HRM703 - Human Resource Management and Development Final Exam: Trimester I, 2012Manraj LidharNo ratings yet

- Financial StatementDocument2 pagesFinancial StatementManraj LidharNo ratings yet

- College of Business, Hospitality and Tourism Studies: Question PaperDocument4 pagesCollege of Business, Hospitality and Tourism Studies: Question PaperManraj LidharNo ratings yet

- Acc 811 PaperDocument15 pagesAcc 811 PaperManraj LidharNo ratings yet

- HRM 703 Human Resource Management & DevelopmentDocument4 pagesHRM 703 Human Resource Management & DevelopmentManraj LidharNo ratings yet

- Question Paper: InstructionsDocument5 pagesQuestion Paper: InstructionsManraj LidharNo ratings yet

- Brunswikian Lens Model - TanjaDocument7 pagesBrunswikian Lens Model - TanjaManraj LidharNo ratings yet

- HRM 703 Ii, 2012Document7 pagesHRM 703 Ii, 2012Manraj LidharNo ratings yet

- A Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionDocument20 pagesA Conceptual Framework For Not-For-profit Sustainability Renovation or ReconstructionManraj LidharNo ratings yet

- MGT 704 - T2-2010Document3 pagesMGT 704 - T2-2010Manraj LidharNo ratings yet