Professional Documents

Culture Documents

1 Crore 10 Million Refer To Annexure For Details of Instruments & Bank Facilities

1 Crore 10 Million Refer To Annexure For Details of Instruments & Bank Facilities

Uploaded by

Siddhartha SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Crore 10 Million Refer To Annexure For Details of Instruments & Bank Facilities

1 Crore 10 Million Refer To Annexure For Details of Instruments & Bank Facilities

Uploaded by

Siddhartha SinghCopyright:

Available Formats

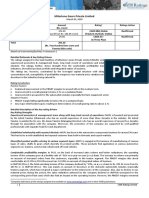

Current 2018 (History) 2017 2016 2015 Start of 2015

Outstanding

Instrument Type Rating Date Rating Date Rating Date Rating Date Rating Rating

Amount

Commercial

ST 3000.00 CRISIL A1+ 27-10-17 CRISIL A1+ -- -- --

Paper

Short Term

ST 21-09-17 CRISIL A1+ 28-12-16 CRISIL A1+ 02-12-15 CRISIL A1+ CRISIL A1+

Debt

Annexure - Rating History for last 3 Years Magma Fincorp

Rating Action

Rs.3000 Crore Commercial Paper (Enhanced From Rs.2000

CRISIL A1+ (Reaffirmed)

Crore)

1 crore = 10 million

Refer to annexure for Details of Instruments & Bank Facilities

Detailed Rationale

CRISIL has reaffirmed its 'CRISIL A1+' rating on the commercial paper of Magma Fincorp Ltd (Magma Fincorp; part of the

Magma group).

The rating continues to reflect the Magma group's diversified business profile with presence across the gamut of retail

financing asset classes, adequate capitalisation, and experienced and competent management team. These strengths are

partially offset by average, albeit improving, asset quality and profitability.

Analytical Approach

CRISIL has combined the business and financial risk profiles of Magma Fincorp and Magma Housing Finance Ltd (Magma

Housing; 'CRISIL A1+'). The companies, together referred to as the Magma group, have a common senior management

team and integrated operations, and are both strategically important for business growth.

Key Rating Drivers & Detailed Description

Strengths

* Diversified business profile with presence across the gamut of retail financing asset classes

The group is among the established asset financing non-banking financial companies (NBFCs) with a sizeable presence in

rural and semi-urban areas and a track record of over 25 years. It has a competitive market position with loan assets under

management (AUM) of Rs 15,555 crore as on March 31, 2018. Its portfolio is diversified across product segments. It has a

significant presence in the passenger car and utility vehicle finance segment (32% of AUM as on March 31, 2018), where it

mainly caters to the self-employed and commercial-operator segments. It also provides construction equipment (9%) and

commercial vehicle (8%) finance to small entrepreneurs and small road transport operators, a significant proportion of

whom are first-time buyers. The group also has a considerable presence in tractor financing (18%) and has diversified into

mortgage financing (17%), small and medium enterprise (SME) financing (13%), and used commercial vehicles financing.

Though growth slowed in the past few years due to continued macroeconomic challenges, it is expected to revive from

fiscal 2019 and loan AUM is likely to reach Rs 18,000 crore by March 2019. Higher yielding segments such as pre-owned

vehicles, light commercial vehicles, SMEs, and affordable housing are expected to drive the growth in loan AUM over the

next few years. The group is likely to benefit from its diversified product suite and large presence in rural and semi-urban

areas and maintain its competitive market position over the medium term.

* Adequate capitalisation

Capitalisation is adequate with a adjusted networth of Rs 2093 crore as on March 31, 2018 (Rs 1919 crore as on March 31,

2017) against loan AUM of Rs 15,555 crore (Rs 16,101 crore). Tier-I and overall capital adequacy ratios (CARs) were

moderate at 17.3% and 20.7%, respectively, as on March 31, 2018 (15.4% and 20.4%, respectively, as on March 31, 2017).

CRISIL, in its analysis of capitalisation, factors in the total outside liabilities, including the extent of off-balance-sheet

assigned or securitised loans, in addition to on-balance-sheet liabilities. External liabilities (including principal outstanding

on off-balance-sheet securitisation and assignment transactions) declined to 6.4 times the networth as on March 31, 2018,

from 7.4 times a year earlier. Magma Housing's networth, Tier-I, and overall CAR were adequate at Rs 288 crore, 28.3%,

and 28.8%, respectively, as on March 31, 2018 (Rs 268 crore, 22.6%, and 23.2%, respectively, as on March 31, 2017). The

group strengthened its capital position by raising equity of Rs 500 crore in the first quarter of fiscal 2019 to support growth

plans. Capital position is expected to remain adequate over the medium term.

* Experienced and competent management team

The group is making significant investments in people, infrastructure, systems, and processes to support growth plans and

has hired experienced professionals to head the asset-backed financing and mortgage financing businesses. Senior

management personnel have been in the industry for more than a decade, and have extensive experience in their

functional areas.

Weakness

* Average, albeit improving, asset quality

Gross non-performing assets (NPAs) stood at 7.0% as on March 31, 2018, against a comparable number of 8.8% as on

March 31, 2017. The improvement in asset quality was driven by change in business model. The branch team is

responsible for both origination and collection up to 60 days past due in the asset financing business. Sale of distressed

assets to asset reconstruction companies (ARCs) at the end of fiscal 2017, along with favourable monsoon, resulted in

higher recovery from loans overdue by more than 60 days. Delinquencies in SME and mortgage financing businesses

remained stable through fiscal 2018. Asset quality should improve over the medium term, considering the better

performance of loans originated under the revised business model. Asset quality in the SME and mortgage financing

businesses, nevertheless, remains a monitorable, given the low seasoning of these loans.

* Modest, albeit rising, earnings

Return on managed assets (RoMA1), at 1.3% for fiscal 2018, was lower than the industry average of 1.8%. However, it has

improved significantly from 0.9-1.0% in the past few years, driven by an increase in net interest margin following an

increase in proportion of high yielding assets and reduction in slippages to NPAs. Credit cost has reduced considerably

following a reduction in gross NPAs. Operating expense as a percentage of loan AUM, however, increased on account of

additional investments in people, processes, and infrastructure for growth and marginal reduction in loan AUM.

Profitability is expected to improve over the medium term with increase in revenue and better operating efficiency. Ability

to improve profitability to the industry average level by maintaining net interest margin at the current level and keeping

credit cost under control remains critical and is a key rating monitorable.

You might also like

- Recovery Moodys 2017Document60 pagesRecovery Moodys 2017DavidDelgadoVaqueroNo ratings yet

- Jay Z Credit ReportDocument18 pagesJay Z Credit ReportJ0hn75% (4)

- Total Return SwapDocument6 pagesTotal Return Swapmpweb20100% (2)

- ICARE Preweek RFBT Preweek 2Document12 pagesICARE Preweek RFBT Preweek 2john paulNo ratings yet

- Cannu Vs Galang DigestDocument1 pageCannu Vs Galang DigestAgatha Faye Castillejo100% (2)

- FRIA CasesDocument24 pagesFRIA CasesDakila MaloyNo ratings yet

- TM International Logistics Limited: Summary of Rated InstrumentsDocument7 pagesTM International Logistics Limited: Summary of Rated InstrumentsSunny SkNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- Northern Arc Capital - R-01072019Document10 pagesNorthern Arc Capital - R-01072019vaibhav khandelwalNo ratings yet

- Edelweiss Financial Services Limited: Summary of Rated InstrumentsDocument9 pagesEdelweiss Financial Services Limited: Summary of Rated Instrumentslekha1997No ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Outlook Publishing (India) Private Limited: Summary of Rated InstrumentsDocument7 pagesOutlook Publishing (India) Private Limited: Summary of Rated InstrumentsKetan BhoiNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- BPR Infrastructure Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating ActionDocument7 pagesBPR Infrastructure Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating ActionNithinNo ratings yet

- Name: Mohit Marhatta Roll No: B19148 Section: C Selected Company: VRL Logistics LimitedDocument9 pagesName: Mohit Marhatta Roll No: B19148 Section: C Selected Company: VRL Logistics LimitedMOHIT MARHATTANo ratings yet

- Triveni TurbineDocument6 pagesTriveni TurbinevikasNo ratings yet

- Deccan Cements - Rating Rationale PDFDocument6 pagesDeccan Cements - Rating Rationale PDFAkashNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- Toyota Indus Motors FOFDocument43 pagesToyota Indus Motors FOFAli HasanNo ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- Ambit Strategy AccountingThematic BewareoftheZoneofDarkness 16dec2016Document62 pagesAmbit Strategy AccountingThematic BewareoftheZoneofDarkness 16dec2016Kapil AroraNo ratings yet

- Magnolia Martinique - R - 03082017Document7 pagesMagnolia Martinique - R - 03082017Bhavin SagarNo ratings yet

- Financial Management: Assignment IiDocument8 pagesFinancial Management: Assignment Iisridhar mohantyNo ratings yet

- Majesco Software and Solutions India Private Limited: Summary of Rated InstrumentsDocument7 pagesMajesco Software and Solutions India Private Limited: Summary of Rated InstrumentsJatin SoniNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocument7 pagesEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNo ratings yet

- 4Q17 Caterpillar Inc. ResultsDocument29 pages4Q17 Caterpillar Inc. ResultsDurai NaiduNo ratings yet

- Electromech Material R 08022018Document8 pagesElectromech Material R 08022018amol_patil51429514No ratings yet

- Comparative Analysis of Mutual Fund Schemes and Major Investment AvenuesDocument52 pagesComparative Analysis of Mutual Fund Schemes and Major Investment AvenuesPrithvi Raj SinghNo ratings yet

- Medreich LimitedDocument7 pagesMedreich LimitedAnishNo ratings yet

- Business Finance AssignmentDocument16 pagesBusiness Finance AssignmentGannaNo ratings yet

- Dharmesh Textiles Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDocument7 pagesDharmesh Textiles Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionJeffNo ratings yet

- Piramal Enterprises - MOStDocument8 pagesPiramal Enterprises - MOStdarshanmadeNo ratings yet

- IVC Logistics - Rating Rationale - Jun19Document4 pagesIVC Logistics - Rating Rationale - Jun19BaniNo ratings yet

- Ayushman Merchants Private Limited: Summary of Rated InstrumentsDocument6 pagesAyushman Merchants Private Limited: Summary of Rated InstrumentsJeffNo ratings yet

- Dewan Housing Finance Corporation Limited: Summary of Rating ActionDocument7 pagesDewan Housing Finance Corporation Limited: Summary of Rating ActionJawahar MNo ratings yet

- Creditaccess Grameen Limited: Ratings Reaffirmed Summary of Rating ActionDocument9 pagesCreditaccess Grameen Limited: Ratings Reaffirmed Summary of Rating ActionDhrubajyoti DattaNo ratings yet

- SECTION E - 23 ArchidplyDocument24 pagesSECTION E - 23 ArchidplyazharNo ratings yet

- Thyssenkrupp Industries PDFDocument7 pagesThyssenkrupp Industries PDFBinoy MtNo ratings yet

- Ultramarine & Pigments LTD: Summary of Rated InstrumentsDocument7 pagesUltramarine & Pigments LTD: Summary of Rated Instrumentsjanmejay26No ratings yet

- Group 12 FA AssignmentDocument13 pagesGroup 12 FA AssignmentAthul KishanNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Tab India Granites Private Limited-02-07-2020Document6 pagesTab India Granites Private Limited-02-07-2020Puneet367No ratings yet

- Aghara Knitwear Pvt. LTD.: Summary of Rated InstrumentsDocument6 pagesAghara Knitwear Pvt. LTD.: Summary of Rated Instrumentssatvik ahujaNo ratings yet

- Arman F L: Inancial Services TDDocument10 pagesArman F L: Inancial Services TDJatin SoniNo ratings yet

- NIC Asia Bank Limited: Rating RationaleDocument7 pagesNIC Asia Bank Limited: Rating RationaleSujan TumbapoNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- Bata India Limited: Summary of Rating ActionDocument6 pagesBata India Limited: Summary of Rating ActionDhrubajyoti DattaNo ratings yet

- Shivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedDocument6 pagesShivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedvikramNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsAmit BelladNo ratings yet

- J.G. Hosiery - R-03102017Document7 pagesJ.G. Hosiery - R-03102017Mohit GirdherNo ratings yet

- Dixcy March 2020 ICRADocument7 pagesDixcy March 2020 ICRAPuneet367No ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- economic times recoDocument2 pageseconomic times recoptrptrck71No ratings yet

- The DataDocument7 pagesThe DatashettyNo ratings yet

- India Ratings and Research Private Limited: India's Most Respected Credit Rating and Research Agency: India Ratings Affirms Trident's CP at IND A1+'Document5 pagesIndia Ratings and Research Private Limited: India's Most Respected Credit Rating and Research Agency: India Ratings Affirms Trident's CP at IND A1+'Vikrant SadanaNo ratings yet

- Riyan Paper Mill: Summary of Rated InstrumentsDocument6 pagesRiyan Paper Mill: Summary of Rated InstrumentsKNOW INDIANo ratings yet

- Acknit Industries Limited: Summary of Rating ActionDocument7 pagesAcknit Industries Limited: Summary of Rating ActionprasanthNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Fullerton ReportDocument59 pagesFullerton ReportbittugolumoluNo ratings yet

- Principles of Business For CSEC®: 2nd EditionDocument7 pagesPrinciples of Business For CSEC®: 2nd Editionyuvita prasadNo ratings yet

- Provisional Remedies Cases - Rule 58Document336 pagesProvisional Remedies Cases - Rule 58Bianca CezarNo ratings yet

- GMR Infrastructure Limited I. The Name of The Company Is GMR INFRASTRUCTURE LIMITEDDocument15 pagesGMR Infrastructure Limited I. The Name of The Company Is GMR INFRASTRUCTURE LIMITEDAvi Ghosh100% (1)

- Standard Chartered Bank Nepal Limited: Interest RatesDocument1 pageStandard Chartered Bank Nepal Limited: Interest RatesAnish JoshiNo ratings yet

- 2012 Commencement Speech Michael BurryDocument5 pages2012 Commencement Speech Michael BurryJorge PerezNo ratings yet

- Sales Q ADocument109 pagesSales Q APatatas SayoteNo ratings yet

- Urban Poor Dev Naga City Best PracticeDocument8 pagesUrban Poor Dev Naga City Best PracticeJPNo ratings yet

- Republic vs. GrijaldoDocument10 pagesRepublic vs. GrijaldoAnn CatalanNo ratings yet

- Daguhoy Enterprises, Inc. vs. Ponce G.R. No. L-6515, October 18, 1954 96 Phil 15Document2 pagesDaguhoy Enterprises, Inc. vs. Ponce G.R. No. L-6515, October 18, 1954 96 Phil 15Hope Trinity Enriquez100% (1)

- The Republic of Uganda: As BorrowerDocument5 pagesThe Republic of Uganda: As BorrowerBaguma IshaNo ratings yet

- Mode of Payment Person Liable Who FileDocument12 pagesMode of Payment Person Liable Who FileXiaoyu KensameNo ratings yet

- Group 5Document30 pagesGroup 5Mỹ HoàiNo ratings yet

- Ebl Home Credit: Product Program GuideDocument8 pagesEbl Home Credit: Product Program GuideAl Amin GaziNo ratings yet

- Effective January 1, 2018 and Onwards (Republic Act (RA) No. 10963/TRAIN)Document3 pagesEffective January 1, 2018 and Onwards (Republic Act (RA) No. 10963/TRAIN)Deneb DoydoraNo ratings yet

- Condominium AccountingDocument51 pagesCondominium AccountingJamey SimpsonNo ratings yet

- Applicant No. - : (Name in Birth Certificate) Last NameDocument9 pagesApplicant No. - : (Name in Birth Certificate) Last NamepdhgfgbdNo ratings yet

- Wachovia Securities DatabookDocument44 pagesWachovia Securities DatabookanshulsahibNo ratings yet

- Pointers To Review: Personal FinanceDocument2 pagesPointers To Review: Personal FinanceAda Araña DiocenaNo ratings yet

- Customer Satisfaction On Housing Loan in SBI BankDocument43 pagesCustomer Satisfaction On Housing Loan in SBI BankDebjyoti RakshitNo ratings yet

- G.R. No. 157833 October 15, 2007 Bank of The Philippine Islands, Petitioner, GREGORIO C. ROXAS, RespondentDocument7 pagesG.R. No. 157833 October 15, 2007 Bank of The Philippine Islands, Petitioner, GREGORIO C. ROXAS, RespondentJan Carlo Azada ChuaNo ratings yet

- Fannie Mae Appraiser Independence Requirements 10-15-2010Document4 pagesFannie Mae Appraiser Independence Requirements 10-15-2010Frank GregoireNo ratings yet

- Personal Finance Essay - Tashira BryantDocument4 pagesPersonal Finance Essay - Tashira Bryantapi-540946017No ratings yet

- Chapter 12 - AsisDocument8 pagesChapter 12 - AsisArs MoriendiNo ratings yet

- Unit 6: Risk For Financial Institutions and Their ManagementDocument65 pagesUnit 6: Risk For Financial Institutions and Their ManagementDeepak PokhrelNo ratings yet