Professional Documents

Culture Documents

Bajaj Fin-May16 19

Bajaj Fin-May16 19

Uploaded by

Rejo JohnOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bajaj Fin-May16 19

Bajaj Fin-May16 19

Uploaded by

Rejo JohnCopyright:

Available Formats

Stock Update

Strong performance yet again

Key points

Bajaj Finance

Strong Operating performance: For Q4FY19,

Reco: Buy | CMP: Rs3,112 Bajaj Finance (BFL) posted strong operating

performance with the net interest income (NII)

Company details

growing by 50.2% y-o-y to Rs 3394 crore on

back of healthy Loan book growth and AUM

Price target: Rs3,600 expansion.

Market cap: Rs179,841 cr Opex to Income (C/I, Calc.) was rationalized

52-week high/low: Rs3162 / 1873 further, strongly aided by a continued focus on

expanding fee revenue pool and better cost

NSE volume: (No of shares) 14.1 lakh

management. As a result of the same, the C/I

BSE code: 500034 ratio for the quarter declined to 34.6% (down

485BPS y-o-y and 19BPS q-o-q). Operating

NSE code: BAJFINANCE

expenses kept under control resulted in pre-

Sharekhan code: BAJFINANCE provisioning profit (PPOP, Calc) rising by 62%

y-o-y to Rs 2220 crore, and up 6.4% q-o-q.

Free float: (No of shares) 25.9 cr

Provisions (as per ECL basis) jumped by 80%

y-o-y to Rs 409 crore, but had come off by

Shareholding pattern 9.2% from Rs 450 crore, seen in Q3 FY19.

The company has migrated to IND-AS based

accounting and hence has restated prior period

numbers as per the new accounting standards.

Hence, the figures (especially Provisions etc

which are now under the ECL basis) are not

Public

Promoter strictly comparable on a yoy basis. As a result

44.8%

55.2% of higher topline, and contained provisions,

the Net profit for the quarter stood at Rs 1176.1

crore, being up by 57.3% YoY and 11% q-o-q.

Strong credit rating, diversified borrowing

help improve NIMs (Calc.) in an adverse

climate: BFL has consistently maintained a

Price chart strong credit rating which helps it maintain

3600

attractive Cost of Funds (CoF), thereby

maintaining healthy NIMs even in an adverse

3250

rate environment. The company has also been

2900 diversifying its borrowing mix to augment its

margins. Consolidated borrowings were of Rs

2550

1,01,588 crore with a mix of 37: 50: 13 between

2200 banks, money markets and deposits as of 31

1850 Mar 2019. We believe deposit accretion is an

important step in this direction, and hence,

1500

as on Q4 FY19, the deposits book stood at Rs

Nov-18

Jan-19

Jan-19

May-19

Feb-19

Jun-18

Sep-18

Mar-19

Mar-19

Aug-18

Jul-18

Jul-18

Apr-19

Oct-18

Oct-18

Dec-18

13,193 crore, up by 69% YoY. Further diversifying

its borrowing mix, BFL is also exploring the

Price performance Foreign Currency borrowing route and therein

has received a long-term issuer credit rating of

(%) 1m 3m 6m 12m “BBB-“with a stable outlook which is equivalent

Absolute -0.6 17.2 28.3 58.1 to India’s sovereign rating assigned by S&P

Global Ratings.

Relative to Sensex 4.1 13.0 21.6 49.6

May 16, 2019 2

Sharekhan Stock Update

Healthy business growth, prudent ALM quarter, Bajaj Finance witnessed stable asset

management: BFL witnessed healthy traction quality as its GNPA ratio stood at 1.54% (was

in loan growth, with AUM growth of 41% to 1.55% in Q3 FY19) while NNPA ratio stood at

Rs 115,888 crore and Net Interest Margins 0.63% (flat on sequential basis). Coming on

(NIMs; Calc.) increasing by 60BPS to 12.0% for back of a scorching AUM growth pace of

FY19. Despite a tough liquidity environment, 40+%, stable asset quality, on a low base is a

the company has added receivables of Rs commendable performance.

8386 crore (was Rs 9,867 crore in Q3 FY19).

Growth was led mainly by the segments of Outlook: BFL appears well set on a strong

Rural B2C business (6% of overall book, up and sustainable path of growth. Despite a

70% yoy), mortgage lending business (29% nascent rural financing book, positives such as

of overall book, up 43% y-o-y) and Consumer an attractive repeat customer base in the core

B2C business (20% of the book, up 49% y-o-y). consumer book, a large SME customer base,

During the quarter, the management adopted a rapidly deepening asset offering profile and

a cautious outlook and chose to grow the book strong pricing power help BFL maintain its

in a calibrated manner, slowing down in areas growth and margins. We believe that over a

where its risk-return didn’t meet its parameters. longer term, the company looks well placed

Notably, BFL continued to witness strong to clock AUM growth of over 35+%. The ability

customer traction, as it booked 1.9 million of BFL to create new product categories,

new loans during the quarter, taking its total leveraging its large customer base and

customer franchise to 34.48 million, up 32% proactive risk management track-record are

y-o-y. This will be positive for sustaining growth key positives to support valuations.

as well as generating cross-sell opportunities Valuation: BFL has yet again delivered strong

for BFL. BFL has continued to manage its ALM performance and we believe it should continue

well and is well covered on ALM to manage to enjoy premium valuations due to its strong

any impact of liquidity hardening and higher positives such as a strong growth outlook,

interest rates on its P&L over short to medium pricing power, impressive operating metrics and

term period. Going forward, we expect annual strong return ratios expected to be maintained

loan growth to be 35+% on 2-3 year CAGR over time (and even likely to improve as asset

basis. heavy business gradually shifts to BHFL) in its

Stable Asset quality is positive, especially favor. We maintain our Buy rating on the stock

seen in backdrop of fast growth: During the with a revised price target (PT) of Rs. 3600.

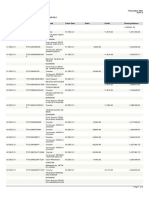

Results Rs cr

Particulars Q4FY19 Q4FY18 YoY% Q3FY19 QoQ%

Interest Income & Fees 5307.7 3487.7 52.2 4982.7 6.5

Interest and Other Charges 1913.2 1227.3 55.9 1785.7 7.1

Net Interest Income 3394.5 2260.4 50.2 3196.9 6.2

Other Income 0.8 3.9 -79.2 2.3 -64.8

Total Income 3395.3 2264.3 49.9 3199.2 6.1

Employee Expense 531.8 390.3 36.3 510.4 4.2

Depreciation & Amortisation Expenses 40.8 29.3 39.3 41.1 -0.6

Other Expenses 601.8 473.3 27.1 561.4 7.2

PPoP 2220.9 1371.4 61.9 2086.4 6.4

Provisions and Loan losses 409.3 227.2 80.1 450.8 -9.2

PBT 1811.6 1144.2 58.3 1635.7 10.8

Tax Expense 635.6 396.6 60.2 576.1 10.3

Profit After Tax 1176.1 747.6 57.3 1059.6 11.0

May 16, 2019 3

Sharekhan Stock Update

Valuations Rs cr

Particulars FY17 FY18 FY19 FY20E FY21E

Net interest income (Rs cr) 5,469 8,272 11,146 12,852 18,806

Net profit (Rs cr) 1,836 2,559 3,922 4,915 6,398

EPS (Rs) 33.6 44.4 68.0 85.2 111.0

PE (x) 90.0 68.1 44.4 35.5 27.2

Book value (Rs/share) 176 284 344 419 517

P/BV (x) 17.2 10.7 8.8 7.2 5.8

RoAE (%) 21.6 19.7 21.7 22.3 23.7

RoAA (%) 3.3 3.3 3.8 3.6 3.5

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

May 16, 2019 4

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Thompson Asset ManagementDocument17 pagesThompson Asset ManagementJessicaNo ratings yet

- Indemnity PPBL V2-Revised22Document1 pageIndemnity PPBL V2-Revised22Veluru ManojNo ratings yet

- Requirement Membership ApplicationDocument7 pagesRequirement Membership ApplicationkezNo ratings yet

- Bajaj Finance: Steady Performance, But Niggles On OutlookDocument6 pagesBajaj Finance: Steady Performance, But Niggles On Outlookvenkatachalapathy.thNo ratings yet

- HDFC Bank: Strong Performance Yet AgainDocument6 pagesHDFC Bank: Strong Performance Yet AgainTotmolNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- VATW Q1FY24 ResultsDocument7 pagesVATW Q1FY24 ResultsVishalNo ratings yet

- UPL ChokseyDocument6 pagesUPL Chokseypranab.gupta.kwicNo ratings yet

- 8 13 2007 (Pioneer In) PAGE Industries Q1FY08 - Pio00522Document7 pages8 13 2007 (Pioneer In) PAGE Industries Q1FY08 - Pio00522api-3740729No ratings yet

- Stock Update: LIC Housing FinanceDocument5 pagesStock Update: LIC Housing Financesaran21No ratings yet

- Kalpataru Power - 1QFY20 Result - EdelDocument14 pagesKalpataru Power - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Bajaj Auto EdelweissDocument10 pagesBajaj Auto Edelweiss251219811No ratings yet

- Kirloskar Oil Engines: Performance HighlightsDocument12 pagesKirloskar Oil Engines: Performance Highlightsjetorres1No ratings yet

- Infosys (Q1 FY23) - YES SecuritiesDocument8 pagesInfosys (Q1 FY23) - YES SecuritiesRojalin SwainNo ratings yet

- Mahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesMahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- AngelBrokingResearch STFC Result Update 3QFY2020Document6 pagesAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNo ratings yet

- Reliance Infrastructure: Negative Other Income A SurpriseDocument5 pagesReliance Infrastructure: Negative Other Income A SurpriseAnkit DuaNo ratings yet

- Research: Cairn India LimitedDocument5 pagesResearch: Cairn India LimitedravustinNo ratings yet

- Sobha DevelopersDocument8 pagesSobha DevelopersDarshan ShettyNo ratings yet

- Shree Cement: Treading Smoothly On The Growth PathDocument6 pagesShree Cement: Treading Smoothly On The Growth Pathanjugadu100% (1)

- Yes SecuritiesDocument7 pagesYes SecuritiesRajesh SharmaNo ratings yet

- Kewal Kiran Clothing: Margins To Remain Stressed, Book OutDocument4 pagesKewal Kiran Clothing: Margins To Remain Stressed, Book OutdarshanmadeNo ratings yet

- AnandRathi On Affle India Pain in Developed Markets Continues MaintainingDocument6 pagesAnandRathi On Affle India Pain in Developed Markets Continues MaintainingamsukdNo ratings yet

- Unichem Lab (UNILAB) : Riding Strong On Base BusinessDocument6 pagesUnichem Lab (UNILAB) : Riding Strong On Base Businesscos.secNo ratings yet

- IVRCL - Q4FY11 Result UpdateDocument3 pagesIVRCL - Q4FY11 Result UpdateSeema GusainNo ratings yet

- Stable Business Restructuring Trigger: NeutralDocument9 pagesStable Business Restructuring Trigger: Neutralarun_algoNo ratings yet

- Intraday Trading Rules, Basics Tips & Strategies by Angel BrokingDocument8 pagesIntraday Trading Rules, Basics Tips & Strategies by Angel Brokingmoisha sharmaNo ratings yet

- Stock Update: Bharti AirtelDocument3 pagesStock Update: Bharti Airtelsaran21No ratings yet

- Finolex Cables: Weak Quarter Headwinds PersistsDocument6 pagesFinolex Cables: Weak Quarter Headwinds PersistsdarshanmadeNo ratings yet

- State Bank of India 4 QuarterUpdateDocument6 pagesState Bank of India 4 QuarterUpdatedarshan pNo ratings yet

- Sona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityDocument9 pagesSona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityVivek S MayinkarNo ratings yet

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDocument8 pagesNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqNo ratings yet

- Spanco Telesystems Initiating Cov - April 20 (1) .Document24 pagesSpanco Telesystems Initiating Cov - April 20 (1) .KunalNo ratings yet

- Centrum Suryoday Small Finance Bank Q3FY23 Result UpdateDocument10 pagesCentrum Suryoday Small Finance Bank Q3FY23 Result UpdateDivy JainNo ratings yet

- Bosch Q1 Result UpdateDocument7 pagesBosch Q1 Result UpdateRatan PalankiNo ratings yet

- Fertilizer Sector: FFBL Result PreviewDocument1 pageFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Bank CIMB Niaga GrowthDocument8 pagesBank CIMB Niaga GrowthOm OlerNo ratings yet

- Teamlease: Near Term Impact To Be ManageableDocument8 pagesTeamlease: Near Term Impact To Be ManageableAnand KNo ratings yet

- Affle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Document8 pagesAffle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Bharti PuratanNo ratings yet

- ICICI Securities LTD ResultDocument8 pagesICICI Securities LTD Resultchandan_93No ratings yet

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFDocument4 pagesGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeNo ratings yet

- ASTRO Financial PositionDocument4 pagesASTRO Financial PositionVISALI A/P MURUGAN STUDENTNo ratings yet

- TVS Motor - 1QFY20 Result - JM FinancialDocument8 pagesTVS Motor - 1QFY20 Result - JM FinancialdarshanmadeNo ratings yet

- GVK Power & Infra (GVKPOW) : Consolidation at Present LevelsDocument8 pagesGVK Power & Infra (GVKPOW) : Consolidation at Present LevelsKaushal KumarNo ratings yet

- Viewpoint: Natco PharmaDocument3 pagesViewpoint: Natco PharmaADNo ratings yet

- Results Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyDocument1 pageResults Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyMeharwal TradersNo ratings yet

- Bajaj Holdings & Investments Limited: Holding A Positive GroundDocument7 pagesBajaj Holdings & Investments Limited: Holding A Positive GroundVivek BansalNo ratings yet

- Boi 250108Document5 pagesBoi 250108api-3836349No ratings yet

- IDirect ABFRL Q3FY22Document7 pagesIDirect ABFRL Q3FY22Parag SaxenaNo ratings yet

- Tata Motors LTD: Investment RationaleDocument8 pagesTata Motors LTD: Investment RationaleVARUN SINGLANo ratings yet

- Safari Industries (India) LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesSafari Industries (India) LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Banks - HBL - Valuation Update - TaurusDocument4 pagesBanks - HBL - Valuation Update - Taurusmuddasir1980No ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Alembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Document10 pagesAlembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Ravikiran SuryanarayanamurthyNo ratings yet

- Astra Analyst Report Astmicpr 20110429Document4 pagesAstra Analyst Report Astmicpr 20110429dinnovation5473No ratings yet

- Business Restructuring Led To Negativity Profitability: Result UpdateDocument8 pagesBusiness Restructuring Led To Negativity Profitability: Result UpdateraguramrNo ratings yet

- Aditya Birla Capital: Performance HighlightsDocument3 pagesAditya Birla Capital: Performance HighlightsdarshanmadeNo ratings yet

- Reliance Communication Ltd.Document2 pagesReliance Communication Ltd.ratika_bvpNo ratings yet

- Wipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Document15 pagesWipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Devaansh RakhechaNo ratings yet

- IFCIDocument6 pagesIFCIjass200910No ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Daftar Akun Foto PragaDocument1 pageDaftar Akun Foto PragaM.Aditya FirdausNo ratings yet

- Chapter 6.merchandizing Activities - KSBLDocument22 pagesChapter 6.merchandizing Activities - KSBLSohail AusafNo ratings yet

- AC - BUTU MUHAMMAD MALLAM - FEBRUARY, 2021 - 671968358 - FullStmtDocument6 pagesAC - BUTU MUHAMMAD MALLAM - FEBRUARY, 2021 - 671968358 - FullStmtmuhammad m butuNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweNo ratings yet

- Annual Statistical Report of Egyptian Insurance Market 2010 - 2011Document50 pagesAnnual Statistical Report of Egyptian Insurance Market 2010 - 2011Mohammed RagabNo ratings yet

- Lecture Note-Cash and Cash EquivalentDocument14 pagesLecture Note-Cash and Cash EquivalentLeneNo ratings yet

- Fac4863 104 - 2020 - 0 - BDocument93 pagesFac4863 104 - 2020 - 0 - BNISSIBETINo ratings yet

- Session4 ICFDocument12 pagesSession4 ICFSomyata RastogiNo ratings yet

- The 8 Branches of Accounting: Their Uses and How They WorkDocument11 pagesThe 8 Branches of Accounting: Their Uses and How They WorkMoratuoa MaitseNo ratings yet

- STMT - Ent - Book - 2021-12-07T054024.832Document2 pagesSTMT - Ent - Book - 2021-12-07T054024.832melakuNo ratings yet

- SFM Express Notes by Archana Kaithan Ma'AmDocument124 pagesSFM Express Notes by Archana Kaithan Ma'AmNishu DasNo ratings yet

- Study On Capital MarketsDocument78 pagesStudy On Capital Marketsmanuuu patel0% (1)

- 203A Eng 07 51Document4 pages203A Eng 07 51farithNo ratings yet

- Chp14 StudentDocument72 pagesChp14 StudentChan ChanNo ratings yet

- Class 12 Accounts Notes Chapter 2 Studyguide360Document29 pagesClass 12 Accounts Notes Chapter 2 Studyguide360Ali ssNo ratings yet

- Chap 3 True FalseDocument24 pagesChap 3 True FalseSaadat ShaikhNo ratings yet

- Honnur HSKDocument57 pagesHonnur HSKzeba kousarNo ratings yet

- Actuarial Exam FM Sample Questions 3aDocument0 pagesActuarial Exam FM Sample Questions 3aEsra Gunes YildizNo ratings yet

- Branch Accounting CMADocument41 pagesBranch Accounting CMAyash.sharmaNo ratings yet

- Saunders 7e PPT Chapter01 AccessibleDocument48 pagesSaunders 7e PPT Chapter01 Accessiblemonica ongNo ratings yet

- New Era University: "Banking Industry"Document34 pagesNew Era University: "Banking Industry"Rain LpzNo ratings yet

- Investment PropertyDocument19 pagesInvestment PropertyXyrille ReyesNo ratings yet

- Risk & InsuranceDocument8 pagesRisk & InsuranceAlan100% (2)

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DNo ratings yet

- Topic 02 Accounting Statements and Cash FlowDocument23 pagesTopic 02 Accounting Statements and Cash FlowVictorNo ratings yet

- Emotion Drives Investor DecisionsDocument1 pageEmotion Drives Investor DecisionsTori PatrickNo ratings yet