Professional Documents

Culture Documents

Test Bank Chapter 3 Cost Volume Profit A

Test Bank Chapter 3 Cost Volume Profit A

Uploaded by

Karlo D. ReclaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Bank Chapter 3 Cost Volume Profit A

Test Bank Chapter 3 Cost Volume Profit A

Uploaded by

Karlo D. ReclaCopyright:

Available Formats

PROBLEM NO.

3-CASH TO ACCRUAL

The income statement of Cagayan Corporation for 2010 included the following

items:

Interest income P2,101,000

Salaries expense 1,650,000

Insurance expense 277,200

The following balances have been excerpted from Cagayan Corporation’s

statements of financial position:

12/31/2009 12/31/2010

Accrued interest receivable P165,000 P200,200

Accrued salaries payable 92,400 195,800

Prepaid insurance 33,000 24,200

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. The cash received for the interest during 2010 was

a. P1,900,800 b. P2,101,000 c. P2,065,800 d. P2,136,200

2. The cash paid for salaries during 2010 was

a. P1,753,400 b. P1,557,600 c. P1,546,600 d. P1,845,800

3. The cash paid for insurance premiums during 2010 was

a. P253,000 b. P286,000 c. P244,200 d. P268,400

PROMLEM 11-5

Cash Flows from Operating, Investing, & Financing Activities

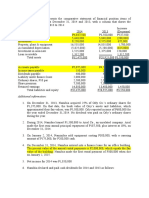

The worksheet below presents the comparative statements of financial position

items of NAMIBIA COMPANY at December 31, 2012 and 2011, with a column that

shows the increase (decrease) from 2011 to 2012:

INCREASE

2012 2011 (DECREASE)

Cash P4,037,500 P3,500,000 P537,500

Accounts receivable 5,640,000 5,840,000 (200,000)

Inventories 9,250,000 8,575,000 675,000

Property, plant, & equipment 16,535,000 14,835,000 1,700,000

Accumulated depreciation (5,825,000) (5,200,000) (625,0000

Investment in associate 1,525,000 1,375,000 150,000

Loan receivable 1,312,500 1,312,500

Total assets P32,475,000 P28,925,000 3,550,000

Accounts payable P5,075,000 P4,775,000 P300,000

Income taxes payable 150,000 250,000 (100,000)

Dividends payable 400,000 500,000 (100,000)

Liability under finance lease 2,000,000 2,000,000

Ordinary shares, P10 par 2,500,000 2,500,000

Share premium 7,500,000 7,5000

Retained earnings 14,850,000 13,400,000 1,450,000

Total liabilities and equity P32,475,000 P28,925,000 P3,550,000

Additional Information:

1. On December 31, 2011, Namibia acquired 25% of Orly Co.’s ordinary shares

for P1,375,000. On that date, the book value of Orly’s assets and

liabilities, which approximated their fair values, was P5,500,000. Orly

reported income of P600,000 for the year ended December shares during the

year.

2. During 2012, Namibia loaned P1,500,000 to Ariel Co., an unrelated company.

Ariel made the first semi-annual principal repayment of P187,500, plus

interest at 10%, on December 31,2012.

3. On January 2, 2012 Namibia sold equipment costing P300,000, with a

carrying amount of P175,000, for P200,000 cash.

4. On December 31, 2012, Namibia entered into a finance lease for an office

building. The present value of the annual rental payment is P2,000,000, which

equals the fair value of the building. Namibia made the first rental payment

of P300,000 when due on January 2,2013.

5. Net income for 2012 was P1,850,000

6. Namibia declared and paid cash dividends for 2012 and 2011 as follows:

Declared Paid Amount

2011 Dec. 15,2011 Feb. 20, 2012 P500,000

2012 Dec. 15, 2012 Feb. 20, 2013 400,000

Based on the preceding information, determine the following:

1. Net cash provided by the operating activities

a. P2,025,000 b. P 2,150,000 c.P2,175,000 d.P2,000,000

2. Net cash used in investing activities

a. P962,500 b. P1,300,000 c. P1,262,500 d. P1,112,500

3. Net cash used in financing activities

a. P500,000 b.350,000 c. P800,000 d. P900,000

PROBLEM 11-6

Cash Flows from Operating, Investing, & Financing Activities

The schedule below shows that account balances of LESOTHO CO. at the

beginning and end of the year December 31, 2012:

DEBITS Dec.31,2012 Dec. 31, 2011

Cash and cash equivalents P666,000 P150,000

Investments in trading securities 30,000 120,000

Accounts receivable 444,000 300,000

Inventories 873,000 900,000

Prepaid insurance 7,500 6,000

Land and Building 585,000 585,000

Equipment 933,000 510,000

Discount on bonds payable 25,500 27,000

Treasury shares 15,000 30,000

Cost of goods sold 1,617,000

Selling and general expenses 861,000

Income taxes 105,000

Unrealized loss on trading securities 12,000

Loss on sale of equipment 3,000

Total debits P6,177,000 P2,628,000

CREDITS

Allowance for bad debts P24,000 P15,000

Accumulated depreciation- Building 78,750 67,500

Accumulated depreciation- Equipment 137,250 82,500

Accounts payable 165,000 180,000

Notes payable-current 210,000 60,000

Accrued expense payable 54,000 26,100

Income tax payable 105,000 30,000

Unearned revenue 3,000 27,000

Notes payable-noncurrent 120,000 180,000

Bonds payable 750,000 750,000

Deferred tax liability 141,000 159,900

Ordinary shares, P10 par 1,078,200 600,000

Retained earnings appropriated for treasury 15,000 30,000

shares

Retained earnings appropriated for possible 114,000 69,000

building expansion

Unappropriated retained earnings 103,800 336,000

Share premium 348,000 15,000

Sales 2,694,000

Gain on sales of trading securities 36,000

Total credits P6,117,000 P2,628,000

Additional information:

a. All purchases and sales were on account.

b. Equipment with an original cost of P45,000 was sold for P21,000

c. Selling and general expense include the following:

Building depreciation P11,250

Equipment depreciation 75,750

Bad debt expense 9,000

Interest expense 54,000

d. A six-month note payable for P150,000was issued in connection with the

purchase of new equipment.

e. The noncurrent note payable requires the payment of P60,000 per year,

plus interest.

f. Treasury shares were sold for P3,000 more than their cost.

g. During the year, a 30% stock dividend was declared and issued. At that

time, there were 60,000 of P10 par ordinary shares outstanding.

However, 600 of these shares were held as treasury shares at that time

and were prohibited from participating in the stock dividend. Market

value of ordinary shares was P50 per shares when the stock dividend was

declared.

h. Equipment was overhauled, extending its useful life, at a cost of

P18,000. The cost was debited to equipment.

Based on the given data, calculate the following:

1. Net income for 2012

a. P135,000 b. P150,900 c. P130,500 d. P132,000

2. Cash dividend declared and paid during 2012

a. P24,000 b. P156,000 c. P22,200 d. P0

3. Proceeds from the issuance of ordinary shares during the year

a. P300,000 b. P330,000 c. P630,000 d. P808,200

4. Proceeds from the sale of trading securities

a. P78,000 b. P114,000 c. P126,000 d. P42,000

5. Accumulated depreciation of old equipment

a. P21,000 b. P45,000 c. P24,000 d. P42,000

6. Cash paid for purchase of equipment

a. P150,000 b. P318,000 c. P450,000 d. P300,000

7. Proceeds from the sale of treasury shares

a. P18,000 b. P15,000 c. P12,000 d. P30,000

8. Net cash provided by the operating activities

a. P135,000 b. P261,000 c. P249,000 d. P276,900

9. Net cash used in investing activities

a. P318,000 b. P297,000 c. P183,000 d. P279,000

10. Net cash provided by the financing activities

a. P564,000 b. P561,000 c. P546,000 d. P318,000

You might also like

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- Weirich7e CasesDocument18 pagesWeirich7e Casescuwekaza0% (1)

- AP-03 Audit of Intangible AssetsDocument11 pagesAP-03 Audit of Intangible AssetsMitch MinglanaNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Sol. Man. - Chapter 10 - Cash To Accrual Basis of Acctg.Document7 pagesSol. Man. - Chapter 10 - Cash To Accrual Basis of Acctg.KATHRYN CLAUDETTE RESENTE100% (1)

- Aa1 PDFDocument218 pagesAa1 PDFJohn Brian D. SorianoNo ratings yet

- (Problems) - Audit of Other Income StatementsDocument8 pages(Problems) - Audit of Other Income StatementsapatosNo ratings yet

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- FSDocument11 pagesFSKarlo D. Recla100% (1)

- How To Setup Absence ManagementDocument16 pagesHow To Setup Absence ManagementEngOsamaHelalNo ratings yet

- AACRMF Model County Personnel Policy (2017)Document27 pagesAACRMF Model County Personnel Policy (2017)Marine GlisovicNo ratings yet

- Far Quiz 2 Final W AnswersDocument6 pagesFar Quiz 2 Final W AnswersGia HipolitoNo ratings yet

- Audit of Notes Receivable and Related Accounts AudDocument3 pagesAudit of Notes Receivable and Related Accounts AudCJ alandyNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- AppliedDocument5 pagesAppliedvhlast23No ratings yet

- Practice Set Audit - LiabilitiesDocument12 pagesPractice Set Audit - LiabilitiesKayla MirandaNo ratings yet

- Auditing Problem 4Document4 pagesAuditing Problem 4jhobsNo ratings yet

- This Study Resource Was: QuestionsDocument5 pagesThis Study Resource Was: QuestionsXNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- May 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyROMAR A. PIGANo ratings yet

- Notes Quiz PDFDocument2 pagesNotes Quiz PDFkim cheNo ratings yet

- Audit Fot Liability Problem #10Document2 pagesAudit Fot Liability Problem #10Ma Teresa B. CerezoNo ratings yet

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietNo ratings yet

- 4 5 AnswersDocument4 pages4 5 AnswersKesselNo ratings yet

- Module 2 - Misstatements in The Financial StatementsDocument11 pagesModule 2 - Misstatements in The Financial StatementsIvan LandaosNo ratings yet

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocument8 pagesQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexNo ratings yet

- Consideration of Internal Control in A Financial Statements AuditDocument9 pagesConsideration of Internal Control in A Financial Statements AuditJan Danielle AgaloNo ratings yet

- AUDP ROB REV-Correction of Errors Wit Ans KeyDocument12 pagesAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- Chapter 37-Presentation of FsDocument8 pagesChapter 37-Presentation of FsEmma Mariz GarciaNo ratings yet

- Audit of Receivables QuizDocument7 pagesAudit of Receivables QuizJohnel Mislang YangaNo ratings yet

- Franchise QuizDocument3 pagesFranchise QuizDante Nas JocomNo ratings yet

- PDF ReceivablesDocument6 pagesPDF ReceivablesJanine SarzaNo ratings yet

- Correction of ErrorsDocument5 pagesCorrection of ErrorsJohn Carlo DelorinoNo ratings yet

- Auditing Problems Audit of Inventory: Problem 1Document6 pagesAuditing Problems Audit of Inventory: Problem 1Mark Anthony TibuleNo ratings yet

- Property, Plant and Equipment: Ppe - Pas 16 Tangible Assets PurposesDocument5 pagesProperty, Plant and Equipment: Ppe - Pas 16 Tangible Assets PurposesJp Combis0% (1)

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasReznakNo ratings yet

- Audit ProbDocument36 pagesAudit ProbSheena BaylosisNo ratings yet

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburNo ratings yet

- Auditing ProblemsDocument17 pagesAuditing ProblemsMakiri Sajili II50% (2)

- Solved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course HeroDocument5 pagesSolved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course Herojau chiNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Aud Prob Prelim Exam With AnswersDocument11 pagesAud Prob Prelim Exam With AnswersannyeongchinguNo ratings yet

- Documento - MX Ap Receivables Quizzer QDocument10 pagesDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNo ratings yet

- Problem 5: Solution and ExplanationDocument3 pagesProblem 5: Solution and ExplanationjhobsNo ratings yet

- Audit of Invest. in Equity and Debt SecuritiesDocument23 pagesAudit of Invest. in Equity and Debt SecuritiesJoseph SalidoNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- Audit of Cash - IllustrationDocument6 pagesAudit of Cash - IllustrationRNo ratings yet

- Auditing & Assurance 2 Part 6 - Audit of Revenues & A/R - ExercisesDocument6 pagesAuditing & Assurance 2 Part 6 - Audit of Revenues & A/R - ExerciseskmarisseeNo ratings yet

- Ap Prob 7Document3 pagesAp Prob 7jhobsNo ratings yet

- FAR-4210 Investment Property & Other Fund Investments: - T R S A ResaDocument4 pagesFAR-4210 Investment Property & Other Fund Investments: - T R S A ResaEllyssa Ann MorenoNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Use The Following Information For The Next Seven Questions:: Total LiabilitiesDocument7 pagesUse The Following Information For The Next Seven Questions:: Total LiabilitiesRoss John JimenezNo ratings yet

- Audit of Receivables: Cebu Cpar Center, IncDocument10 pagesAudit of Receivables: Cebu Cpar Center, IncEvita Ayne TapitNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- Proof of Cash: Two-Date Bank ReconcilationDocument8 pagesProof of Cash: Two-Date Bank ReconcilationKarlo D. ReclaNo ratings yet

- 04 Mas - CVPDocument8 pages04 Mas - CVPKarlo D. ReclaNo ratings yet

- Smarts - Fs AnalysisDocument11 pagesSmarts - Fs AnalysisKarlo D. ReclaNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- True or FalseDocument3 pagesTrue or FalseKarlo D. ReclaNo ratings yet

- CWKARLDocument9 pagesCWKARLKarlo D. ReclaNo ratings yet

- Ar ManagementDocument6 pagesAr ManagementKarlo D. ReclaNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- 01 MAS - Management Acctg.Document8 pages01 MAS - Management Acctg.Karlo D. ReclaNo ratings yet

- 02 MAS - Cost ConceptDocument10 pages02 MAS - Cost ConceptKarlo D. ReclaNo ratings yet

- Exam 44Document5 pagesExam 44Karlo D. Recla100% (2)

- 02 MAS - Cost ConceptDocument10 pages02 MAS - Cost ConceptKarlo D. ReclaNo ratings yet

- Test Bank For Managerial Accounting 7thDocument7 pagesTest Bank For Managerial Accounting 7thKarlo D. ReclaNo ratings yet

- Chapter 08Document2 pagesChapter 08Karlo D. ReclaNo ratings yet

- Chapter 08Document2 pagesChapter 08Karlo D. ReclaNo ratings yet

- This Study Resource Was: Bonds PayableDocument8 pagesThis Study Resource Was: Bonds PayableAlexis NievesNo ratings yet

- Annual Report of Rothschild Bank AG - 2008-2009Document64 pagesAnnual Report of Rothschild Bank AG - 2008-2009Mossad NewsNo ratings yet

- 105 10 Walmart Financial StatementsDocument5 pages105 10 Walmart Financial StatementsAhmad IqbalNo ratings yet

- Teacher's Manual - Financial Acctg 2Document233 pagesTeacher's Manual - Financial Acctg 2Adrian Mallari71% (21)

- Audit of ErrorsDocument27 pagesAudit of ErrorsGladys Dumag67% (3)

- Sample Chart of AccountsDocument12 pagesSample Chart of AccountsjeffryNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- Pakistan Gum and Chemicals Limited: Condensed Financial Statements For The 3rd 30, 201 Interim Quarter Ended September 7Document17 pagesPakistan Gum and Chemicals Limited: Condensed Financial Statements For The 3rd 30, 201 Interim Quarter Ended September 7Ameer Hamza ButtNo ratings yet

- RecordManager User GuideDocument96 pagesRecordManager User GuidemandapatiNo ratings yet

- Book 123Document3 pagesBook 123Andres WijayaNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Jones Electrical DistributionDocument12 pagesJones Electrical DistributionJohnNo ratings yet

- Chapter 13 LeaseDocument29 pagesChapter 13 LeaseHammad Ahmad100% (2)

- Procure To Pay-Accounting EntriesDocument5 pagesProcure To Pay-Accounting EntriesNirmala SriramdossNo ratings yet

- ICGFM Compilation Guide To Financial Reporting by GovernmentsDocument58 pagesICGFM Compilation Guide To Financial Reporting by GovernmentsAndy Wynne100% (1)

- Accounting Concepts and ConventionsDocument6 pagesAccounting Concepts and ConventionsAMIN BUHARI ABDUL KHADER100% (6)

- Balance Sheet Items Curr Month Prev Month Prev - YrtotDocument4 pagesBalance Sheet Items Curr Month Prev Month Prev - Yrtotachmad agungNo ratings yet

- Accrual vs. Cash Basis of AccountingDocument1 pageAccrual vs. Cash Basis of AccountingChikeeNo ratings yet

- Almost Everything You Wanted To Know About PtoDocument34 pagesAlmost Everything You Wanted To Know About PtoBhargi111No ratings yet

- DCIB AnnualAuditedAccountsDocument32 pagesDCIB AnnualAuditedAccountsJames WarrenNo ratings yet

- Smalley AuditDocument13 pagesSmalley AuditMNCOOhioNo ratings yet

- Cost Management Cloud: Supply Chain Financial OrchestrationDocument20 pagesCost Management Cloud: Supply Chain Financial Orchestrationhaitham ibrahem mohmedNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- Entrepreneurship: Quarter 2: Module 7 & 8Document15 pagesEntrepreneurship: Quarter 2: Module 7 & 8Winston MurphyNo ratings yet

- Chap 1 - Overview of Malaysian TaxationDocument22 pagesChap 1 - Overview of Malaysian TaxationrajarajeswryNo ratings yet