Professional Documents

Culture Documents

Corporate Liquidation Questions

Corporate Liquidation Questions

Uploaded by

satya0 ratings0% found this document useful (0 votes)

82 views2 pagesThe document provides information about the liquidation of several companies, including details of assets, liabilities, amounts realized, and liquidator remuneration. The liquidator is required to provide a final statement of accounts in each case summarizing the distribution of assets realized and closing out the company's obligations.

Original Description:

Corporate Liquidation Questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about the liquidation of several companies, including details of assets, liabilities, amounts realized, and liquidator remuneration. The liquidator is required to provide a final statement of accounts in each case summarizing the distribution of assets realized and closing out the company's obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

82 views2 pagesCorporate Liquidation Questions

Corporate Liquidation Questions

Uploaded by

satyaThe document provides information about the liquidation of several companies, including details of assets, liabilities, amounts realized, and liquidator remuneration. The liquidator is required to provide a final statement of accounts in each case summarizing the distribution of assets realized and closing out the company's obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Corporate Liquidation The liquidator was paid remuneration of 3% on amount realized and 2%

on amount paid to unsecured creditors.

(1) A. Ltd. Company with a capital of 8,000 equity shares of Rs.100 each fully The liquidator made a call of Rs.15 per share on partly paid shares. All

called up and 2,000, 7% preference shares of Rs.100 each went into liquidation. shareholders paid the call money except of one shareholders holding 500

There was a calls in arrear of Rs.30,000 in equity share capital. shares.

The creditors of the company were: Required: Liquidator’s final statement of account

Secured creditors Rs.1,00,000

Preferential creditors Rs.40,000 (4) The capital structure of a company was as below:

Unsecured creditors Rs,2,50,000 Equity share capital of Rs.100 each, Rs.90 called up 3,60,000

The amount of assets realized Rs.6,50,000 and the liquidation expenses Less : Calls in arrear 20,000

amounted to Rs.18,000. The liquidator was entitled to remunerations of 2% 3,40,000

each on assets realized and amount distributed to equity shareholders. Add: Calls in advance 30,000

Required: Liquidator’s final statement of account 3,70,000

8% Debentures Rs.1,50,000

(2) XYZ Ltd. Company with a paid up capital of 3,000 ‘A’ Equity shares of 6% Preference Share Rs.1,00,000

Rs.100 each fully paid and 2,000 ‘B’ Equity shares of Rs.100 each Rs.80 Other information:

called and paid up went into voluntary liquidation. The company also had -Amount of Secured creditors Rs.50,000 and Preferential creditors

1,000 , 10% Preference shares of Rs.100 each and 2,000 , 8% Debentures of Rs.20,000.

Rs.100 each. -Total assets realized by liquidator Rs.4,00,000 including assets of Rs.

The creditors of the company consists of Rs.25,000 for Preferential 70,000 in hands of secured creditors.

creditors, Rs.1,20,000 for Unsecured creditors and Rs,80,000 for Secured -Liquidation cost Rs.20,000 and total remuneration received by liquidator

creditors. The assets of the company realized for Rs.520,000. The Rs.11,000 being 2% on assets realized and 4% on amount paid to

liquidator was entitled to a commission of 2% on assets realized and 3% unsecured creditors.

on amount distributed to unsecured creditors. There was Preference -Interest on debenture payable for 6 months.

dividend in arrear for one years. Required: Liquidator’s final statement of account

Required: Liquidator’s final statement of account

(5) The following information are given below:

(3) Balance Sheet of ABC Ltd. Company has been given below: Equity share capital of Rs.100 each Rs.4,00,000

Capital & Liabilities Amount Assets Amount 12% Preference share Rs.1,00,000

Equity share capital: Land and building 3,00,000 8% Debenture Rs.1,80,000

4,000 shares of Rs.100 Plant and machinery 2,00,000 Creditors secured by Land & building Rs.1,00,000

each, Rs.85 called up 3,40,000 Stock 1,20,000 Other liabilities Rs.2,50,000

10% Preference share 1,50,000 Account receivable 2,30,000 Legal expenses Rs.20,000

10% Debentures 1,00,000 Cash at bank 30,000 Liquidator’s remuneration 4% on assets realized and

Account payable 2,00,000 2% on amount paid to unsecured creditors

Secured creditors 70,000 Total assets realized by liquidator Rs.5,30,000 excluding Rs.70,000

Debenture interest payable 20,000 From sales of land & building in hands of secured creditors.

8,80,000 8,80,000 Required: Liquidator’s final statement of account

Total assets realized excluding cash Rs.4,70,000.

(6) The Balance Sheet of a liquidated company has been given below:

Capital & Liabilities Amount Assets Amount

Share capital: Land & Building 1,50,000

20,000 Equity Share’A’@ Plant & Machine 60,000

Rs.10 each 2,00,000 Stock 80,000

10,000EquityShares‘B’@Rs.10 Debtors 30,000

each Rs.7 paid 70,000 Bank balance 50,000

6% Preference Share 50,000 P/L account 1,00,000

Secured loan (secured by plant

& machine) 50,000

Bank overdraft 90,000

Salary payable 10,000

4,70,000 4,70,000

-The liquidator realized the assets as follows:

Land & Building Rs.1,20,000

Plant & Machine Rs.40,000

Stock and debtors @ 90%

-The liquidator is entitled to a commission of 3% on assets realized

including cash and 2% on amount distributed to equity shareholders.

-The dividend of preference share arrear for one year.

Required: Liquidator’s final statement of account

(7) The following information are given below:

Equity share capital of Rs.100 each Rs.4,00,000

12% Preference share Rs.1,00,000

8% Debenture Rs.1,80,000

Creditors (secured by Land & building) Rs.1,00,000

Other liabilities Rs.2,50,000

Legal expenses Rs.20,000

Liquidator’s remuneration 4% on assets realized and

2% on amount paid to unsecured creditors

Total assets realized by liquidator Rs.5,30,000 excluding Rs.70,000

From sales of land & building in hands of secured creditors.

Required: Liquidator’s final statement of account

You might also like

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Mallet Percussion ApproachDocument3 pagesMallet Percussion Approachjohap7100% (2)

- An Internship Report On GSM Mobile Netwo PDFDocument45 pagesAn Internship Report On GSM Mobile Netwo PDFsatyaNo ratings yet

- Corp Account - Liquidators StatementDocument3 pagesCorp Account - Liquidators StatementAnanth RohithNo ratings yet

- Liquidation of CompaniesDocument4 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- Question SheetDocument2 pagesQuestion SheetHarsh DubeNo ratings yet

- 6 Winding Up of Companies61059595441467158Document11 pages6 Winding Up of Companies61059595441467158Prabin sthaNo ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Problems On Internal ReconstructionDocument7 pagesProblems On Internal Reconstructionlokeshwarareddy1999No ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Financial Accounting & AuditingDocument13 pagesFinancial Accounting & Auditingkashish mehtaNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- AmalDocument7 pagesAmalAkki GalaNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Crash MysoreDocument40 pagesCrash MysoreyashbhardwajNo ratings yet

- BuybackDocument6 pagesBuybacksmit9993No ratings yet

- 1) Pooling of Interest Method: Two Types of MergersDocument7 pages1) Pooling of Interest Method: Two Types of MergersArko GhoshNo ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Problems On Acquisition of BuisinessDocument3 pagesProblems On Acquisition of Buisinessmojesnandas9935No ratings yet

- Bonus Issue PDFDocument6 pagesBonus Issue PDFSinsNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- 3526 - 25114 - Textbooksolution - PDF 3Document108 pages3526 - 25114 - Textbooksolution - PDF 3dhanuka jiNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Valuation of SharesDocument10 pagesValuation of SharesAmira JNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- 3internal Reconstruction 230725 165705Document6 pages3internal Reconstruction 230725 165705Ruchita JanakiramNo ratings yet

- Advanced AccountingDocument68 pagesAdvanced AccountingOsamaNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Corporate AccountsDocument17 pagesCorporate AccountsSibam BanikNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet

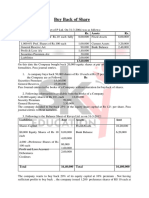

- Buy Back of ShareDocument2 pagesBuy Back of ShareRajesh ChedaNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Orion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Document2 pagesOrion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Amarjeet GuptaNo ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- 12 Accountancy Lyp 2014 Delhi Set2Document11 pages12 Accountancy Lyp 2014 Delhi Set2Ashish GangwalNo ratings yet

- Semester II (Ugcf) 2412091201 ADocument9 pagesSemester II (Ugcf) 2412091201 Aindukush8No ratings yet

- Dissolution of FirmDocument4 pagesDissolution of FirmAMIN BUHARI ABDUL KHADERNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Internal Reconstruction - ProblemsDocument8 pagesInternal Reconstruction - ProblemsNaomi SaldanhaNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Accounting Process CW2Document1 pageAccounting Process CW2satyaNo ratings yet

- JanardanBaral2067BS Jalpariko SangharshaDocument26 pagesJanardanBaral2067BS Jalpariko SangharshasatyaNo ratings yet

- Alchhi TulkeDocument16 pagesAlchhi TulkesatyaNo ratings yet

- Accounting Process HW1Document1 pageAccounting Process HW1satya100% (1)

- BBS 2nd Year English QuestionDocument1 pageBBS 2nd Year English QuestionsatyaNo ratings yet

- Provision For Bad DebtsDocument3 pagesProvision For Bad DebtssatyaNo ratings yet

- Income From EmploymentFormatDocument3 pagesIncome From EmploymentFormatsatyaNo ratings yet

- Some Examples of Journal EntriesDocument5 pagesSome Examples of Journal Entriessatya100% (4)

- Cash Flow Statement FormateDocument3 pagesCash Flow Statement FormatesatyaNo ratings yet

- Maths Worksheets Set 10Document4 pagesMaths Worksheets Set 10satyaNo ratings yet

- Children'S Toys From Africa: Unesco PublicationDocument30 pagesChildren'S Toys From Africa: Unesco PublicationsatyaNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Chapter 07 - Accounts and Notes Receivable. Chapter OutlineDocument6 pagesChapter 07 - Accounts and Notes Receivable. Chapter OutlinesatyaNo ratings yet

- SushmaJoshi2008 ArtMattersDocument122 pagesSushmaJoshi2008 ArtMatterssatyaNo ratings yet

- N) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWDocument28 pagesN) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWsatyaNo ratings yet

- 'Snl-E'Snl: /FTF) Aënf LstfaDocument20 pages'Snl-E'Snl: /FTF) Aënf LstfasatyaNo ratings yet

- Asmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009Document16 pagesAsmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009satyaNo ratings yet

- Celebrating 50 Years of Nepal - Switzerland Development CooperationDocument51 pagesCelebrating 50 Years of Nepal - Switzerland Development CooperationsatyaNo ratings yet

- FD - F) ¿V: /FTF) Aënf LstfaDocument16 pagesFD - F) ¿V: /FTF) Aënf LstfasatyaNo ratings yet

- Rayo Ko SaagDocument20 pagesRayo Ko SaagsatyaNo ratings yet

- Paubha Painti: NG: The Traditional Art of NepalDocument4 pagesPaubha Painti: NG: The Traditional Art of NepalsatyaNo ratings yet

- OLENepal2010 DifferentKindsOfOrchidDocument12 pagesOLENepal2010 DifferentKindsOfOrchidsatyaNo ratings yet

- Sample CementDocument16 pagesSample CementsatyaNo ratings yet

- BBS 1st Year Business English Write To Be Read PDFDocument14 pagesBBS 1st Year Business English Write To Be Read PDFsatya100% (1)

- Endangered Animals of NepalDocument15 pagesEndangered Animals of NepalsatyaNo ratings yet

- 004 - Four Dimensions of Service ManagementDocument7 pages004 - Four Dimensions of Service ManagementAbdoo AbdooNo ratings yet

- Amiram (2012) PDFDocument26 pagesAmiram (2012) PDFFuad BachtiyarNo ratings yet

- Alleima Precision Brochure ENGDocument9 pagesAlleima Precision Brochure ENGR. KurniawanNo ratings yet

- User Guide For Stock Overview (HANA and non-HANA) : SymptomDocument2 pagesUser Guide For Stock Overview (HANA and non-HANA) : SymptomAshok MohanNo ratings yet

- Strangers To Patrons Bishop Damasus andDocument22 pagesStrangers To Patrons Bishop Damasus andValentin RascalNo ratings yet

- Behaviorism and Language LearningDocument8 pagesBehaviorism and Language LearningJonas Nhl100% (1)

- Consumer Perception: A Conceptual FrameworkDocument12 pagesConsumer Perception: A Conceptual FrameworkRustyRamNo ratings yet

- Chapter 03 (Recovered)Document8 pagesChapter 03 (Recovered)PatNo ratings yet

- Embassy ReitDocument386 pagesEmbassy ReitReTHINK INDIANo ratings yet

- Accounting Information Systems The Crossroads of Accounting and It 2nd Edition Kay Solutions ManualDocument24 pagesAccounting Information Systems The Crossroads of Accounting and It 2nd Edition Kay Solutions ManualJohnBrockiosy100% (46)

- Conserve For The BetterDocument8 pagesConserve For The BetterMayRoseLazoNo ratings yet

- Aavani AvittamDocument2 pagesAavani AvittamUmashakti PeethNo ratings yet

- Spirit NazarethDocument4 pagesSpirit NazarethPeter JackNo ratings yet

- Cost Accounting For Ultratech Cement LTD.Document10 pagesCost Accounting For Ultratech Cement LTD.ashjaisNo ratings yet

- John Deere Tractor Service Manual JD S Tm4336Document14 pagesJohn Deere Tractor Service Manual JD S Tm4336oscarNo ratings yet

- 33 The-perils-and-promises-of-integrated-Enterprise-Risk-and-Performance-ManagementDocument7 pages33 The-perils-and-promises-of-integrated-Enterprise-Risk-and-Performance-ManagementDaryan DiazNo ratings yet

- CH 01 PPTaccessibleDocument62 pagesCH 01 PPTaccessibleSaltanat ShamovaNo ratings yet

- Wholesale Fba Brands Sheet 12345Document18 pagesWholesale Fba Brands Sheet 12345you forNo ratings yet

- b2b Social Tech MarketingDocument13 pagesb2b Social Tech MarketingFranz SchreiberNo ratings yet

- The Coop Case StudyDocument11 pagesThe Coop Case Studyanuja bhushan100% (1)

- KSFO Jeppesen 2018Document6 pagesKSFO Jeppesen 2018corina vargas cocaNo ratings yet

- VarmaDocument86 pagesVarmanandy39No ratings yet

- Q3 - W2 - Grade9 - CSS - Carry Out VariationDocument10 pagesQ3 - W2 - Grade9 - CSS - Carry Out VariationREYNALDO R. DE LA CRUZ JR.No ratings yet

- Atlantic BlueDocument70 pagesAtlantic BlueLyubomir IvanovNo ratings yet

- SkyEdge II - Hub Architecture-6 5 7Document5 pagesSkyEdge II - Hub Architecture-6 5 7Jenster ImarcloudNo ratings yet

- Amrita NeurologyDocument2 pagesAmrita NeurologyGautham rajuNo ratings yet

- H.G. Silos, INC.: Bill of MaterialsDocument35 pagesH.G. Silos, INC.: Bill of MaterialsJustine YapNo ratings yet

- Crim Module 9 CasesDocument140 pagesCrim Module 9 CasesMary Ann AmbitaNo ratings yet

- Decorative Textiles 1918Document494 pagesDecorative Textiles 1918Ioana Balint-RădulescuNo ratings yet