Professional Documents

Culture Documents

FINC+220+Syllabus Spring+2019+ (1 4 19)

FINC+220+Syllabus Spring+2019+ (1 4 19)

Uploaded by

mzhao8Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINC+220+Syllabus Spring+2019+ (1 4 19)

FINC+220+Syllabus Spring+2019+ (1 4 19)

Uploaded by

mzhao8Copyright:

Available Formats

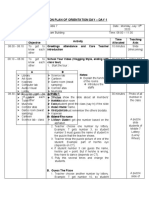

Course Real Estate Finance Number/Section FINC 220

TR 3:30 – 4:45pm; Hariri

Semester/Year Spring 2019 Schedule

230

Instructor Matthew L. Cypher

mlc239@georgetown.edu

Phone 202-687-2653 E-mail

M 3:30 - 5:00pm; or by

Offices Hariri 401 Office Hours

Appt.

Course Description:

This course provides an introduction to the world of income-producing real estate investments with a

particular focus on answering the question, “What is the real estate asset worth?” Lectures will consider

the thought process and mechanics implicit to establishing an asset’s value via proforma statement

construction and discounted cash flow methodology. The course will provide an introductory

understanding of Argus and Excel and the manner that these tools are utilized to financially model

returns. Students will then apply this fundamental level of understanding to an office asset located at

2233 Wisconsin Avenue, NW Washington, DC. Known as the Real Estate Laboratory, students will

interact directly with the physical asset and surrounding submarket to assess the impact on the building’s

value. Finally, guest speakers will frequent the class and introduce students to the many other facets of

real estate one can consider as part of a career in the space.

Course Objectives:

• Obtain a fundamental understanding of real estate valuation.

• Introduction to Argus and Excel-based financial modeling for real estate.

• Garner a strong understanding of the physical asset and the manner it relates to the financial asset

through use of the Real Estate Laboratory at 2233 Wisconsin Avenue, NW.

• Develop a broader understanding and appreciation for the real estate profession through

interaction with guest speakers.

Pre-requisite Coursework:

FINC 211 – Business Financial Management

Required Materials:

• Ling & Archer, Real Estate Principles: A Value Approach, 5th Edition, New York, McGraw-Hill

Education, 2018.

• Segel, A., Vogel, Jr., J & Strope, L. (2014) Bonnie Road. Harvard Business School. Product

Number: 9-813-186. (Coursepack - https://hbsp.harvard.edu/import/596309)

• Segel, A. (2014). Real Estate Finance: A Technical Note Based on “Bonnie Road.” Harvard

Business School. Product Number: 9-803-030.

FINC 220 – Real Estate Finance (1_4_19)

• Articles/handouts posted to Canvas prior to class. Current real estate topics and associated

articles will be discussed during class periodically so pay close attention to Canvas for their

posting.

• Students will also be required to obtain the trial version of Argus that is available via a CD

provided by Professor Cypher.

Grading Framework:

Bonnie Road 15%

Homework Assignments 10%

Mid-Term Exam 20%

2233 Wisconsin Avenue Valuation Project 20%

Final Exam 25%

Class Participation 10%

• Bonnie Road Case – This case study will require that students work in groups of two to develop a

written deliverable and accompanying financial model to be submitted via a Canvas portal. The case

will be discussed on 4/2.

• Homework – Five homework assignments will be provided to reinforce the in-class instruction.

Homework assignments will focus on the topics of cash flow construction, unleveraged valuation,

Argus, leveraged valuation & income tax. These are individual assignments.

• Mid-Term Exam – A mid-term exam will cover topics learned through the midpoint of the class.

• 2233 Wisconsin Avenue Valuation Project – Students will be split into groups and required to

perform a physical and financial analysis of 2233 Wisconsin Avenue, NW that will result in a

valuation assessment along with an investment memorandum citing the risks and attributes of the

investment. This process will closely simulate that of a live acquisition with availability of all source

documents and access to associated real estate professionals.

• Final Exam – A cumulative final exam will cover the classroom lectures and readings from the entire

semester.

• Class Participation – The success of this class is based in part on the level of student participation.

Those students who consistently participate throughout the class will be rewarded with this portion of

the grade. We have high expectations regarding student participation, so active engagement

throughout the entire class is expected to earn a high score in this grading component. Participation

can also take the form of providing thoughtful articles that I can share with the class or other

interesting ideas or concepts that may be shared outside of the classroom setting. While we will not

limit computer usage, please refrain from surfing the Internet during class out of respect for your

fellow students, us and the work we put into delivering useful content to you.

FINC 220 – Real Estate Finance (1_4_19)

Teaching Assistant: Peter Hagerty (ph526@georgetown.edu)

Groups: You will need to establish two groups for this course. Group #1 consists of two people and will

be responsible for the Bonnie Road Case Study. Group #2 consists of four people and will be responsible

for the 2233 Wisconsin Avenue Valuation Project. Please work to establish these groups as soon as

practical. A list of groups and members will be due by 2/7.

Financial Calculator: It is expected that each student possess a financial calculator and is able to

perform basic DCF calculations (IRR, PV, mortgage calcs such as Pmt).

Extra Credit: Students will receive one additional percentage point on their mid-term exam grade for

attending the Real Estate Luminaries event. (4/11/18).

Student GPA: The level of each student grade point average has been in process since you were a

freshman. If you are a graduating senior, please do not contact me at the end of the semester and ask for

your grade to be improved so that you can receive higher academic honors at graduation. It puts me in an

unfair position as the professor for one of your final classes and I will not make adjustments unless there

is an error on my part.

Mid-term Exam: Make-up mid-term exams are not permitted. Any student unable to take the mid-term

will allocate the same percentage grade from the final exam to the mid-term component of the overall

course.

Academic Integrity:

Students are expected to adhere to the highest standards of academic integrity. It is your responsibility to

know the Honor Code and what constitutes a violation. Information about Georgetown’s Honor System

can be obtained at www.georgetown.edu/honor.

You should re-familiarize yourself with the Honor Code by reviewing the Honor Council Document

“What is Plagiarism?” (www.georgetown.edu/honor/plagiarism.html).

Please be aware that professors are obligated to report any suspected violations of the Honor System to

the Honor Council. The following notes concerning the Honor Code apply to this class:

1. Collaboration on the homework assignments is permissible.

2. Cheating on exams (in whatever form) is expressly prohibited by the Code.

3. On the group project (2233 Wisconsin Avenue Valuation Project), collaboration among group

members is required and discussion of the projects across groups is also permitted though each

group is expected to submit a deliverable that is independent of other groups.

4. If data is gathered from any source (web, library, etc.) for the 2233 Wisconsin Avenue project,

you must properly cite your sources.

FINC 220 – Real Estate Finance (1_4_19)

Course Schedule:

Class Date Topics Covered Required Reading/Assignments Due

1 1/10 Introduction to the Course; What is RE? L&A: Chapter #1

Lynn: “Fundamentals of RE Investment”

Hudson-Wilson et al: “Why Real Estate?”

2 1/15 RE Fundamentals; Why Invest in RE?

Career Paths in Real Estate (Supplementary

Reading)

Legal & Regulatory Determinants of

3 1/17 L&A: Chapters #2 & #4

Value

4 1/22 Real Estate Leases L&A: Chapter #22

5 1/24 Income Statement Construction L&A: Chapter #8 (191-199 only)

6 1/29 Income Statement Construction 2900 Adams Mill Road Excel File

Pro Forma Statement Construction

7 1/31 Argus Cash Flow Analysis

Homework Due

8 2/5 Argus Cash Flow Analysis

L&A: Chapter #8 (199-216 only)

9 2/7 Income Approach to Value Argus Homework Due

Groups due to Peter Hagerty

10 2/12 Income Approach to Value L&A: Chapter #8 (199-216 only)

L&A: Chapters #6 & #7

11 2/14 Sales Comparison Approach to Value

Unleveraged Valuation Homework Due

Legal Documents and the Acquisition

Process & Mid-term Review L&A: Chapter #3

12 2/21

Jim Hurley (B’01), Principal, Artemis Deal Offering Memorandum

Real Estate

13 2/26 Mid-Term Exam

14 2/28 Real Estate Finance L&A: Chapters #9, #16 & #17

15 3/12 Real Estate Finance L&A: Chapters #9, #16 & #17

Class does not meet during normal

16 3/14 Leveraged Valuation Homework Due

period due to 2233 property tour

Property Tour of 2233 Wisconsin

3/15 (10am

Avenue (Building Owner - Larry Botel 2233 Wisconsin Offering Memorandum

– 12pm)

B’88 - will lead tour)

17 3/19 Real Estate Income Taxation Readings: TBD

Readings: TBD

18 3/21 Excel Financial Analysis in Real Estate

Income Taxation Homework Due

Steven Ujvary (C’04), SVP,

19 3/26 Excel Homework Due

Acquisitions, Starwood Capital Group

Susan Swanezy (F’81), Principal,

20 3/28

Hodes Weill Associates

21 4/2 Bonnie Road Case Study Discussion Bonnie Road Case Deliverables Due

22 4/4 Value-Add Investment Analysis Readings: TBD

FINC 220 – Real Estate Finance (1_4_19)

David Hammerman (B’11), VP,

23 4/9

Fortress Investment Group

24 4/11 Real Estate Luminaries Event

Brian Milberg (B’00), Senior Partner,

25 4/16

Sitex Group

26 4/23 Real Estate Investment Trusts Keybanc REIT Primer

27 4/25 Real Estate Investment Trusts Keybanc REIT Primer

28 4/30 Introduction to Real Estate Joint Ventures Readings: TBD

4:00 – 6:00pm (location TBD) Please triple

5/7 Final Exam check again Registrar’s website to confirm

day/time above.

Please know that as a faculty member I am committed to supporting survivors of sexual misconduct, including relationship

violence, sexual harassment and sexual assault. However, university policy also requires me to report any disclosures about

sexual misconduct to the Title IX Coordinator, whose role is to coordinate the University’s response to sexual misconduct.

Georgetown has a number of fully confidential professional resources who can provide support and assistance to survivors of

sexual assault and other forms of sexual misconduct. These resources include:

Jen Schweer, MA, LPC

Associate Director of Health Education Services for Sexual Assault Response and Prevention

(202) 687-0323

jls242@georgetown.edu

Erica Shirley, Trauma Specialist

Counseling and Psychiatric Services (CAPS)

(202) 687-6985

els54@georgetown.edu

More information about campus resources and reporting sexual misconduct can be found at http://sexualassault.georgetown.edu.

FINC 220 – Real Estate Finance (1_4_19)

You might also like

- Bonnie Road ModelDocument14 pagesBonnie Road Modelmzhao8100% (1)

- Project Proposal - Community ServiceDocument6 pagesProject Proposal - Community ServiceBenjie Modelo Manila87% (23)

- Wild West Book Fair Classroom Wish List Board InstructionsDocument6 pagesWild West Book Fair Classroom Wish List Board Instructionsapi-370312819No ratings yet

- Course Outline FINA 320 WINTER 2022Document6 pagesCourse Outline FINA 320 WINTER 2022ChrisNo ratings yet

- ACC 215 23654 F19 GallettaDocument4 pagesACC 215 23654 F19 GallettaArgëtim SelaNo ratings yet

- GB212 Syllabus FA.18 Sec. 3 and 4 R4Document8 pagesGB212 Syllabus FA.18 Sec. 3 and 4 R4Aamir Khan50% (2)

- Society DLP For Demo FinalDocument4 pagesSociety DLP For Demo FinalJoiemmy Sumedca Bawengan GayudanNo ratings yet

- ACC 211 Fall 2018Document6 pagesACC 211 Fall 2018许之晟No ratings yet

- Rsm321 Course Outline Fall 2020Document11 pagesRsm321 Course Outline Fall 2020Michelle LiuNo ratings yet

- MGMT E-2740 Fall 2020 SyllabusDocument4 pagesMGMT E-2740 Fall 2020 SyllabusEthanNo ratings yet

- AP Chem Ion Answer KeyDocument2 pagesAP Chem Ion Answer Keymzhao8No ratings yet

- Teachers' Manual: American Invitational Mathematics ExaminationDocument22 pagesTeachers' Manual: American Invitational Mathematics Examinationivaldezt100% (1)

- Performance Indicators PresentationDocument57 pagesPerformance Indicators PresentationRayan Castro100% (2)

- Fina 210 AA V3 Winter 2021 Course OutlineDocument4 pagesFina 210 AA V3 Winter 2021 Course OutlinepopaNo ratings yet

- MBA 543 Real Estate Financing and Investment Syllabus Spring 2024Document3 pagesMBA 543 Real Estate Financing and Investment Syllabus Spring 2024Hean PengcheangNo ratings yet

- CMP 822 SS21 Syllabus Published 1.9.2021Document17 pagesCMP 822 SS21 Syllabus Published 1.9.2021Aditya TawareNo ratings yet

- Urpl-Gp 2639 001Document6 pagesUrpl-Gp 2639 001galileaaddisonNo ratings yet

- Res 3400 SyllDocument6 pagesRes 3400 SyllJay REyNo ratings yet

- LLB 226 e - Learning Property Law II PDFDocument136 pagesLLB 226 e - Learning Property Law II PDFJohn StanleyNo ratings yet

- LLAW - JDOC6227 - Examiner ReportDocument2 pagesLLAW - JDOC6227 - Examiner Reportho576464No ratings yet

- MGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14Document20 pagesMGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14smey0% (1)

- Chong Yit Shang, BTQS2054 RQS3S1 G4Document161 pagesChong Yit Shang, BTQS2054 RQS3S1 G4JUN KAI YUNo ratings yet

- Course Outline ACCT 0104 Introduction To Financial Accounting CP-1Document12 pagesCourse Outline ACCT 0104 Introduction To Financial Accounting CP-1thejiannaneptuneNo ratings yet

- FINA 3710-91 CO F21 Abdool - Version2Document4 pagesFINA 3710-91 CO F21 Abdool - Version2Imran AbdoolNo ratings yet

- ACCO 420 Outline W2024Document7 pagesACCO 420 Outline W2024bushrasaleem5699No ratings yet

- FINA3030 Course Outline - 20220105Document4 pagesFINA3030 Course Outline - 20220105Marcus WongNo ratings yet

- Syllabus MGMT212 Business Law 2021Document5 pagesSyllabus MGMT212 Business Law 2021Wrestling TalkNo ratings yet

- FIN 5411 - Financial Management - Spring 2021 - Akashi HongoDocument5 pagesFIN 5411 - Financial Management - Spring 2021 - Akashi HongoLimSiEianNo ratings yet

- IS574 01 Syllabus Fall 2016 0905Document6 pagesIS574 01 Syllabus Fall 2016 0905PUSHPU SINGHNo ratings yet

- R2B10020 ProjectsDocument11 pagesR2B10020 ProjectsGCR BDNo ratings yet

- 2020summer-2510 - CourseOutline-Post v3.2Document14 pages2020summer-2510 - CourseOutline-Post v3.2Ahmed AdamjeeNo ratings yet

- Syllabus - Construction Budgets and Financial ManagementDocument7 pagesSyllabus - Construction Budgets and Financial ManagementJeremy ChangNo ratings yet

- RSM222.f22.CourseOutline v3 2022-09-05Document9 pagesRSM222.f22.CourseOutline v3 2022-09-05Kirsten WangNo ratings yet

- S Ection Requirements Allocated Marks For Each Section (First Marker) Allocated Marks For Each Section (Second Marker)Document19 pagesS Ection Requirements Allocated Marks For Each Section (First Marker) Allocated Marks For Each Section (Second Marker)Youssef ZohdiNo ratings yet

- Course Out Acco440 Winter 2017Document6 pagesCourse Out Acco440 Winter 2017Jax TellerNo ratings yet

- Len Lin - Syllabus - Intro To Real Estate IDocument3 pagesLen Lin - Syllabus - Intro To Real Estate IH KraftNo ratings yet

- ADMS2610 SyllabusDocument12 pagesADMS2610 SyllabusFinchley SangNo ratings yet

- Unit Guide: Vcalint001 Vcal - Victorian Certificate of Applied Learning (Intermediate)Document4 pagesUnit Guide: Vcalint001 Vcal - Victorian Certificate of Applied Learning (Intermediate)Nancy HaddadNo ratings yet

- Course Capital BDocument2 pagesCourse Capital BKazi HasanNo ratings yet

- FINA 3710 SyllabusDocument4 pagesFINA 3710 SyllabusroBinNo ratings yet

- ISIT212-Corporate Network Planning and DesignDocument7 pagesISIT212-Corporate Network Planning and DesignjadelamannaNo ratings yet

- 4FA3 W21 Wang 1Document9 pages4FA3 W21 Wang 1Alyssa PerzyloNo ratings yet

- Unit Guide: Vcalsen001 Vcal - Victorian Certificate of Applied Learning (Senior)Document4 pagesUnit Guide: Vcalsen001 Vcal - Victorian Certificate of Applied Learning (Senior)Nancy HaddadNo ratings yet

- Angelo DelZotto School of Construction ManagementDocument21 pagesAngelo DelZotto School of Construction ManagementKavan PathakNo ratings yet

- Course OutlineDocument8 pagesCourse OutlinealyssacharlesNo ratings yet

- CE 3010 Syllabus - Summer 2022Document6 pagesCE 3010 Syllabus - Summer 2022Engr. Waqas AhmedNo ratings yet

- BUS 100 AB8 Course Syllabus TemplateDocument9 pagesBUS 100 AB8 Course Syllabus TemplateJimmy LiaoNo ratings yet

- Family Law Part 24Document4 pagesFamily Law Part 24Charlo ChalloNo ratings yet

- BU.241.610. - Real Estate Investment and Development - Page 1 of 6Document6 pagesBU.241.610. - Real Estate Investment and Development - Page 1 of 6Md ShadabNo ratings yet

- CRP 13Document98 pagesCRP 13Abinaya AbishanNo ratings yet

- FinanceDocument11 pagesFinanceArr ZoneNo ratings yet

- B Tech CSE - Summer Internship Project Instructions 2019Document24 pagesB Tech CSE - Summer Internship Project Instructions 2019Ganesh PrajapatNo ratings yet

- Capstone Project Instructions and Guidelines - BBA - 2020 BatchDocument4 pagesCapstone Project Instructions and Guidelines - BBA - 2020 BatchSwethaNo ratings yet

- UT Dallas Syllabus For Fin6321.001.11s Taught by George DeCourcy (Gad075000)Document4 pagesUT Dallas Syllabus For Fin6321.001.11s Taught by George DeCourcy (Gad075000)UT Dallas Provost's Technology GroupNo ratings yet

- SME2031 Princ. of Micro Joglekar F2020Document3 pagesSME2031 Princ. of Micro Joglekar F2020Claudia HaddadNo ratings yet

- Handbook: Accounting and Finance Research Project LSBM307Document21 pagesHandbook: Accounting and Finance Research Project LSBM307kavitaNo ratings yet

- MTH 103 PublicFinanceSyllabusDocument3 pagesMTH 103 PublicFinanceSyllabusTawiah ErnestNo ratings yet

- AEM4670 - 5670 Syllabus2022 Spring - TKD EditsDocument4 pagesAEM4670 - 5670 Syllabus2022 Spring - TKD EditsJess ZNo ratings yet

- Dipasri FIN321 Syllabus Fall 2013 MW1130amDocument4 pagesDipasri FIN321 Syllabus Fall 2013 MW1130amJGONo ratings yet

- ACCT 6301: Accounting Analysis Section 701 FALL 2020 SyllabusDocument10 pagesACCT 6301: Accounting Analysis Section 701 FALL 2020 SyllabusMike Oshaunessy BaconNo ratings yet

- FINA3020 IntlFin SyllabusDocument4 pagesFINA3020 IntlFin SyllabusKa Ki LauNo ratings yet

- Mini Capstone Final Project Implementation and AssessmentDocument8 pagesMini Capstone Final Project Implementation and AssessmentSodium ChlorideNo ratings yet

- Guidance For DS Teachers 2024 v2 (Updated 02 Feb 2024)Document10 pagesGuidance For DS Teachers 2024 v2 (Updated 02 Feb 2024)Katherin Sánchez SierraNo ratings yet

- COMM 1B03 F2019 Course Outline July 26 Cossa RitaDocument7 pagesCOMM 1B03 F2019 Course Outline July 26 Cossa RitaDwayne ShawNo ratings yet

- Using Factors To Explain Risk in Crypto Assets 3Document10 pagesUsing Factors To Explain Risk in Crypto Assets 3mzhao8No ratings yet

- Georgetown University Public Real Estate Fund Valuation ModelDocument35 pagesGeorgetown University Public Real Estate Fund Valuation Modelmzhao8No ratings yet

- New - Review Questions For FinalDocument6 pagesNew - Review Questions For Finalmzhao8No ratings yet

- Real Estate Acquisition Process From A Legal Perspective 2 21Document11 pagesReal Estate Acquisition Process From A Legal Perspective 2 21mzhao8No ratings yet

- All A Is Ordering The OrdersDocument24 pagesAll A Is Ordering The Ordersmzhao8No ratings yet

- CMBX 11 PresentationDocument6 pagesCMBX 11 Presentationmzhao8No ratings yet

- Lecture 5 - OptimizationDocument6 pagesLecture 5 - Optimizationmzhao8No ratings yet

- Phat Workout Log TemplateDocument16 pagesPhat Workout Log Templatemzhao8No ratings yet

- Sheiko Program SpreadsheetsDocument80 pagesSheiko Program Spreadsheetsmzhao8No ratings yet

- CMBS Sears GraphicDocument1 pageCMBS Sears Graphicmzhao8No ratings yet

- Peter Linneman, PH D: Chapter 14, Figure 14.2 CMBS Pool Default Dynamics ($ in Millions)Document2 pagesPeter Linneman, PH D: Chapter 14, Figure 14.2 CMBS Pool Default Dynamics ($ in Millions)mzhao8No ratings yet

- AP Chemistry Calendar Fall 2013Document9 pagesAP Chemistry Calendar Fall 2013mzhao8No ratings yet

- Pricing Decisions and Cost ManagementDocument29 pagesPricing Decisions and Cost Managementmzhao8No ratings yet

- Explanation of Gain or Loss On The Sale of Fixed AssetsDocument2 pagesExplanation of Gain or Loss On The Sale of Fixed Assetsmzhao8No ratings yet

- Ramayana Quiz NotesDocument7 pagesRamayana Quiz Notesmzhao8100% (1)

- Team Charter 201Document2 pagesTeam Charter 201mzhao8No ratings yet

- AVB GraphDocument26 pagesAVB Graphmzhao8No ratings yet

- Atlassian Pty LTD - 3-Statement Projection ModelDocument27 pagesAtlassian Pty LTD - 3-Statement Projection Modelmzhao8No ratings yet

- Chapter 2 Notes - Atoms, Molecules and IonsDocument4 pagesChapter 2 Notes - Atoms, Molecules and Ionsmzhao8No ratings yet

- CMBS Loan Level Data TemplateDocument13 pagesCMBS Loan Level Data Templatemzhao8No ratings yet

- APUSH Chapter 1 Full Note Guide (Summer Reading)Document7 pagesAPUSH Chapter 1 Full Note Guide (Summer Reading)mzhao8No ratings yet

- Gifted and Talented Brochure PDFDocument2 pagesGifted and Talented Brochure PDFKennanNo ratings yet

- Soal Uh 2 Pra Midle Test Ganjil B. Inggris KLS 8Document6 pagesSoal Uh 2 Pra Midle Test Ganjil B. Inggris KLS 8Winda NurmalaNo ratings yet

- Shivaji ScriptDocument84 pagesShivaji Scriptprasad100% (1)

- Bahria University: Project Management (MSPM)Document2 pagesBahria University: Project Management (MSPM)faisal_ahsan7919No ratings yet

- Lesson Plan For Orientation Day Middle 7Document8 pagesLesson Plan For Orientation Day Middle 7SasmiNo ratings yet

- McGill Daily, Feb. 2009 (Read in Fullscreen)Document24 pagesMcGill Daily, Feb. 2009 (Read in Fullscreen)Will Vanderbilt95% (21)

- Classroom Observation FormDocument2 pagesClassroom Observation FormNette de GuzmanNo ratings yet

- 3rd Year Course OutlineDocument19 pages3rd Year Course OutlineMiliyon Tilahun100% (3)

- DLL Mathematics 5 q2 w5Document5 pagesDLL Mathematics 5 q2 w5John Giles Jr.No ratings yet

- Moon Phases Lesson PlanDocument3 pagesMoon Phases Lesson Planapi-618137934No ratings yet

- The Effect of Bullying To The Academic Performance of The Learner - FinalDocument11 pagesThe Effect of Bullying To The Academic Performance of The Learner - Finaldesiree dulawanNo ratings yet

- Entry Into Monash With HKDSEDocument6 pagesEntry Into Monash With HKDSEMonash UniversityNo ratings yet

- Che 381 N 2011915200Document3 pagesChe 381 N 2011915200trienphatphanNo ratings yet

- Goetschius, Percy - The Material Used in Musical CompositionDocument294 pagesGoetschius, Percy - The Material Used in Musical CompositionEdward CoxNo ratings yet

- Mid-Year Review and Assessment of Individual Performance Commitment For Teacher I-IiiDocument1 pageMid-Year Review and Assessment of Individual Performance Commitment For Teacher I-IiiRaiza Lainah Laurente MianoNo ratings yet

- Theory of Writing Assignment 1Document2 pagesTheory of Writing Assignment 1api-644151178No ratings yet

- Affective Verbs PDFDocument1 pageAffective Verbs PDFapi-89010664No ratings yet

- UT Dallas Syllabus For Stat6337.501.08f Taught by Michael Baron (Mbaron)Document6 pagesUT Dallas Syllabus For Stat6337.501.08f Taught by Michael Baron (Mbaron)UT Dallas Provost's Technology GroupNo ratings yet

- Edu 214 Lesson PlanDocument4 pagesEdu 214 Lesson Planapi-481114098No ratings yet

- IGCSE BrochureDocument20 pagesIGCSE BrochureFirat DagasanNo ratings yet

- Learning DisabilitiesDocument21 pagesLearning Disabilitiesapi-296310601No ratings yet

- Sasha Sproge SiestaDocument3 pagesSasha Sproge Siestaapi-263381597No ratings yet

- 11 Klas Anglijska Mova Nerisjan 2019 PDFDocument192 pages11 Klas Anglijska Mova Nerisjan 2019 PDFeugene hojkoNo ratings yet

- Root - LPDocument4 pagesRoot - LPNicole CaraitNo ratings yet

- Practice Test For FCEDocument5 pagesPractice Test For FCEnita_lamadrilenyNo ratings yet