Professional Documents

Culture Documents

Complex Group - Questions: Further Information

Complex Group - Questions: Further Information

Uploaded by

NomanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Complex Group - Questions: Further Information

Complex Group - Questions: Further Information

Uploaded by

NomanCopyright:

Available Formats

Complex Group - Questions

Question 1:

Haan Bhai Kidhar

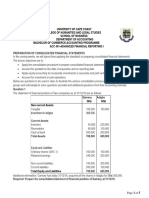

$ 000 $ 000 $ 000

Further Information:

1. Haan Co acquired 60% of the share capital of Bhai Co on 1 January 20X2 and 10% of Kidhar on 1

January 20X3. The cost of the combinations were $142,000 and $43,000 respectively. Bhai Co

acquired 70% of the share capital of Kidhar Co on 1 January 20X3

2. The retained earnings balances of Bhai Co and Kidhar Co were:

January 1 2002 January 1 2002

$ 000 $ 000

Bhai Co 45 60

Kidhar Co 30 40

3. No impairment loss adjustments have been necessary to date.

4. It is the group's policy to value the non-controlling interest at acquisition at its proportionate share of

the fair value of the subsidiary's identifiable net assets.

Required:

Prepare the consolidated statement of financial position for Haan Co and its subsidiaries as at 31

December 20X9.

From the desk of - AMK Page 1

Complex Group - Questions

Question 2:

Bom Diggy Wom

Non-current assets 2,000.00 1,300.00 1,000.00

Investment 2,000.00 700.00 -

Current Assets 5,000.00 1,000.00 500.00

9,000.00 3,000.00 1,500.00

Share capital 4,500.00 1,000.00 300.00

Retained Earning 2,500.00 600.00 200.00

Current Liab 500.00 800.00 1,000.00

Non-current Liabilities 1,500.00 600.00 -

9,000.00 3,000.00 1,500.00

Further information:

1 Bom acquired 80% share of diggy at start of the year when retained earnings of

Diggy were Rs. 300. Fair value of all assets were equal to their carrying amount

except for a piece of land whose fair value exceeds its Carrying amount by Rs. 100

2 Diggy acquired 60% Wom at the mid of the year when retained earnings of Wom

were Rs. 100. Fair value of all assets were equal to their carrying amount.

3 Policy of group is to measure NCI at its proporrtionate share.

Required:

Prepare consolidated statement of financial position.

From the desk of - AMK Page 2

Complex Group - Questions

Question 3:

From the desk of - AMK Page 3

Complex Group - Questions

From the desk of - AMK Page 4

Complex Group - Questions

Question 4:

From the desk of - AMK Page 5

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Fairfax and Thomas Cook India - Private Equity, Permanent Capital and Public MarketsDocument16 pagesFairfax and Thomas Cook India - Private Equity, Permanent Capital and Public Marketsfree meNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Financial Accounting Part 2: Shareholders' Equity - Long QuizDocument7 pagesFinancial Accounting Part 2: Shareholders' Equity - Long QuizGray Javier100% (1)

- ULOa Answer KeyDocument2 pagesULOa Answer KeyAyah LaysonNo ratings yet

- PQ2Document2 pagesPQ2alellieNo ratings yet

- FINECO - 02 - Investments Under CertaintyDocument29 pagesFINECO - 02 - Investments Under CertaintyQuyen Thanh NguyenNo ratings yet

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- ACT1205 Audit of InvestmentDocument7 pagesACT1205 Audit of InvestmentAybe MarceloNo ratings yet

- Treasury SharesDocument4 pagesTreasury SharesEmmanNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityJhelRose Lasquite BrosasNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- Quiz - Chapter 2 - Business Combinations (Part 2)Document4 pagesQuiz - Chapter 2 - Business Combinations (Part 2)Pearly Jean ApuradorNo ratings yet

- Audit of SHEDocument13 pagesAudit of SHEChristian QuintansNo ratings yet

- Exam 4 2 PM Class VERSION 2Document8 pagesExam 4 2 PM Class VERSION 2davidgscottNo ratings yet

- IA2 Shareholders Equity ActivityDocument4 pagesIA2 Shareholders Equity Activitydianarosesarsalejo19No ratings yet

- AP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityDocument12 pagesAP-100Q: Financing Cycle: A S ' E: Udit of Tockholders QuityShiela RengelNo ratings yet

- Exam 4 2 PM Class VERSION 1Document8 pagesExam 4 2 PM Class VERSION 1davidgscottNo ratings yet

- Module 5.3 Advanced Financial ReportingDocument31 pagesModule 5.3 Advanced Financial ReportingRonaly Nario DagohoyNo ratings yet

- Final Exam - Intermediate Accounting 2Document11 pagesFinal Exam - Intermediate Accounting 2Patricia EsplagoNo ratings yet

- 4th Year QuizDocument9 pages4th Year QuizJoshua UmaliNo ratings yet

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- Long Quiz Bam 201 41-60.docx-1Document7 pagesLong Quiz Bam 201 41-60.docx-1Mary Lyn DatuinNo ratings yet

- ULOa Answer KeyDocument2 pagesULOa Answer Keyzee abadillaNo ratings yet

- Prelim Exam - Doc2Document16 pagesPrelim Exam - Doc2alellie100% (1)

- ULOa Answer KeyDocument2 pagesULOa Answer KeyAyah Layson100% (3)

- 12 Business Combination Pt2 PDFDocument1 page12 Business Combination Pt2 PDFRiselle Ann SanchezNo ratings yet

- 12 Business Combination Pt2Document1 page12 Business Combination Pt2Mel paloma0% (1)

- 858 Accounts - Isc SpecimenDocument15 pages858 Accounts - Isc SpecimenUmesh JaiswalNo ratings yet

- Auditing and Assurance Chapter 7 MC QuestionsDocument7 pagesAuditing and Assurance Chapter 7 MC Questionsgilli1trNo ratings yet

- Ap 200Document9 pagesAp 200Christine Jane AbangNo ratings yet

- She HandoutsDocument7 pagesShe HandoutsBrent DumangengNo ratings yet

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- TBchap 014Document96 pagesTBchap 014DemianNo ratings yet

- Audit of Investments - Set BDocument4 pagesAudit of Investments - Set BZyrah Mae Saez0% (1)

- ACC401-Basic Conso-Basic QuestionsDocument5 pagesACC401-Basic Conso-Basic Questionsisaacbediako82No ratings yet

- Accounting For Business Combinations (PRE7) - FINALSDocument3 pagesAccounting For Business Combinations (PRE7) - FINALSMay P. HuitNo ratings yet

- Acc AssignmentDocument5 pagesAcc AssignmentBlen tesfayeNo ratings yet

- 9216 - IFRS 3 Business Combination Stock AcquisitionDocument3 pages9216 - IFRS 3 Business Combination Stock AcquisitionMarianeNo ratings yet

- An Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankDocument32 pagesAn Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankKaren MagsayoNo ratings yet

- Accounts - 12Document8 pagesAccounts - 12Md TariqueNo ratings yet

- Business Combination ActivityDocument5 pagesBusiness Combination ActivityAndy LaluNo ratings yet

- Partnership ReviewDocument5 pagesPartnership ReviewAirille CarlosNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- Illustrative Examples 9Document3 pagesIllustrative Examples 9Banjo A. ReyesNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Pengantar Akuntansi S1Document4 pagesPengantar Akuntansi S1Ela SelaNo ratings yet

- Quiz Busi Combi Problem 2Document2 pagesQuiz Busi Combi Problem 2Gio SantosNo ratings yet

- Advanced Accounting Testbank For Final 6eDocument35 pagesAdvanced Accounting Testbank For Final 6etoto100% (1)

- Handouts 169Document15 pagesHandouts 169Rio Cyrel CelleroNo ratings yet

- PROBLEM 1. A Partial List of The Accounts and Ending Account Balances Taken From The PostDocument4 pagesPROBLEM 1. A Partial List of The Accounts and Ending Account Balances Taken From The Postsunthatburns00No ratings yet

- Quiz Chapter 1 Business Combinations Part 1Document6 pagesQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzNo ratings yet

- Wasting Assets ProblemsDocument1 pageWasting Assets ProblemsRenalyn Ps MewagNo ratings yet

- Uts AklDocument4 pagesUts AklathifaNo ratings yet

- Assignment 2Document3 pagesAssignment 2zhoudong910105No ratings yet

- Quiz Chapter-11 She-Part-2 2021Document5 pagesQuiz Chapter-11 She-Part-2 2021Salma B. AbdullahNo ratings yet

- Advanced Financial Accounting 7e (Baker Lembre King) .Chap009Document74 pagesAdvanced Financial Accounting 7e (Baker Lembre King) .Chap009low profileNo ratings yet

- Financial Status-Siyaram Silk Mills LTD 2011-12Document15 pagesFinancial Status-Siyaram Silk Mills LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- Module 8 - ReviewerDocument8 pagesModule 8 - ReviewerFiona MiralpesNo ratings yet

- Horngrens Accounting 11th Edition Miller Nobles Solutions ManualDocument26 pagesHorngrens Accounting 11th Edition Miller Nobles Solutions ManualColleenWeberkgsq100% (54)

- Funds Analysis, Cash-Flow Analysis, and Financial Planning Funds Analysis, Cash - Flow Analysis, and Financial PlanningDocument59 pagesFunds Analysis, Cash-Flow Analysis, and Financial Planning Funds Analysis, Cash - Flow Analysis, and Financial PlanningRishad kNo ratings yet

- Solutions Manual: Company Accounting 10eDocument114 pagesSolutions Manual: Company Accounting 10eLSAT PREPAU1100% (3)

- Admission of A PartnerDocument23 pagesAdmission of A Partner20CMH35 DHATCHAYAYINI. KNo ratings yet

- Cmals 2010 Retired QuestionsDocument130 pagesCmals 2010 Retired QuestionsShahid Musthafa50% (2)

- Financial Performance of Kumari Bank LimitedDocument24 pagesFinancial Performance of Kumari Bank LimitedAngbuhang Sushil LeembooNo ratings yet

- Chapter 3 MerchandisingDocument17 pagesChapter 3 MerchandisingTsegaye BelayNo ratings yet

- Tutorial 8 Answer PartnershipDocument6 pagesTutorial 8 Answer Partnership璇詠No ratings yet

- XYZ HospitalDocument1 pageXYZ HospitalMSINS SDEDNo ratings yet

- Balance Sheet Quarterly RestatedDocument12 pagesBalance Sheet Quarterly RestatedKhurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- Accounting SolutionsDocument11 pagesAccounting SolutionsKrittima Parn SuwanphorungNo ratings yet

- Annual Report 2023 22Document247 pagesAnnual Report 2023 22matin ajmeriNo ratings yet

- Panduan BIONS DesktopDocument179 pagesPanduan BIONS DesktopBustanul ArkhamNo ratings yet

- IA To Initiate Liquidation-1Document21 pagesIA To Initiate Liquidation-1vaishnavi100% (1)

- Code Bài Material OutsourcingDocument3 pagesCode Bài Material OutsourcingTrịnh Hồng HàNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- PPT-10 REITs - InvITs PresentaionDocument24 pagesPPT-10 REITs - InvITs PresentaionVikas MaheshwariNo ratings yet

- Chapter 12 LiabilitiesDocument5 pagesChapter 12 LiabilitiesAngelica Joy ManaoisNo ratings yet

- Working Capital MGTDocument17 pagesWorking Capital MGTJeffrey MooketsaneNo ratings yet

- Assignment For Finanacial Management IDocument12 pagesAssignment For Finanacial Management IHailu DemekeNo ratings yet

- Strategic Business Analysis-Reporting-Text-3Document6 pagesStrategic Business Analysis-Reporting-Text-3Christine Marie GazaNo ratings yet

- Moniepoint Document 2024-01-26T10 11Document11 pagesMoniepoint Document 2024-01-26T10 11miracleikeaNo ratings yet

- Examiner Report - ASE20104 - January 2019Document13 pagesExaminer Report - ASE20104 - January 2019Aung Zaw Htwe100% (1)