Professional Documents

Culture Documents

CA Final IDT Corrigendum May 19

CA Final IDT Corrigendum May 19

Uploaded by

Natasha PrasharOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Final IDT Corrigendum May 19

CA Final IDT Corrigendum May 19

Uploaded by

Natasha PrasharCopyright:

Available Formats

GST main book corrigendum

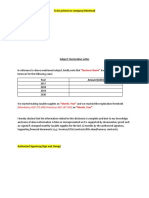

Page No. Particulars Printed (mistake in red colour) Correction (in green colour)

Q10. Wrongly typed Delhi instead of

Silvassa. Provisions and explanation is

If Cars Limited is not a registered person, then the If Cars Limited is not a registered person, then the

correct. This

place of supply of transportation services shall be place of supply of transportation services shall be

86 Question & Answer has been taken

Delhi (location at which such goods are handed Silvassa (location at which such goods are handed

from ICAI IDT Committee BGM. But

over). over).

partly it is typo error from ICAI although

provision is written correctly.

Mr. A Nasik, has Intra State supply of agricultural

Example 4. "Change of opinion" for produce (own effort) Rs. 15 Lacs, Intra State supply

Mr. A Nasik, has Intra State supply of agricultural

Section 23 of CGST Act, 2017. of exempt goods Rs. 10 Lacs & taxable supplies Rs.

produce (own effort) Rs. 15 Lacs, Intra State

From exam point of view, better to 5 Lacs. He is not supposed to take registration since

supply of exempt goods Rs. 10 Lacs & taxable

159 follow ICAI approach. Athough ICAI his aggregate turnover is Rs. 10 Lacs + Rs. 5 Lacs

supplies Rs. 5 Lacs. He is suppose to take

had used "re-seller of agriculture = Rs. 15 Lacs. In computing aggregate turnover,

registration since his aggregate turnover is Rs. 15

produce" in second series of MCQ (1st Intra-State supply of goods agricultural produce

Lacs + 10 Lacs + Rs. 5 Lacs = Rs. 30 Lacs.

Question). grown out of cultivation of land by family members

shall not be included.

Yes, an assessee under the composition scheme

is required to furnish inward supplies including

No. An assessee under the composition scheme is

supplies on which tax is to paid on reverse charge.

not required to furnish details of inward and outward

In case of outward supplies made, composition

supplies. Such assessees are required to file

223 Q2. Correction in answer. dealer need to furnish turnover so that CGST &

quarterly returns in Form GSTR-4 within 18 days

SGST Composition tax liability shall be calculated.

from the end of quarter.

Such assessees are required to file quarterly

returns in Form GSTR-4 within 18 days from the

end of quarter.

In Headline "Import of Services", first Supply from SEZ is ‘import’ and import duty will be Supply from SEZ is ‘import’ and import duty will be

229 bullet point, shift to "Import of Goods" payable. (no changes, just shift in "Import of Goods" payable. (no changes, just shift in "Import of

Headline. headline) Goods" headline)

Would a supplier of OIDAR required to take

Who is non-taxable online recipient? registration in all states in India in GST Act?

A. Bengaluru West and all the officers subordinate A. No. The CBIC has notified the Principal

to him as the officers empowered to grant Commissioner of Central Tax, Bengaluru West

Q4. Who is non-taxable online registration in case of online information and and all the officers subordinate to him as the

233 recipient? Question is replica of Q3., database access or retrieval services provided or officers empowered to grant registration in case

so question is wrong. agreed to be provided by a person located in non- of online information and database access or

taxable territory and received by a non-taxable retrieval services provided or agreed to be

online recipient. provided by a person located in non-taxable

territory and received by a non-taxable online

recipient.

Ignore the answer since amendment effect is not Please refer Question 12 of GST Scanner issued

239 Example inverted duty structure

taken in the month of March 2019, page no. 155

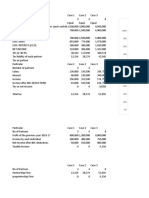

GST Scanner corrigendum

A9. Not included Restaurent supply in Answer Rs. 21,16,000 {Rs. 11,16,000+ Rs.

36 Answer Rs. 11,16,000

value of taxable supply. 10,00,000 (Restaurent Supply)}

Custom main book corrigendum (these corrections are in Chapter 15 FTP, due to additional

amendments issued by ICAI)

Page No. Particulars Printed (mistake in red colour) Correction (in green colour)

MEIS (ICAI had ignored amendments

Rs. 25,000 per consignment shall be entitled for Rs. 5,00,000 per consignment shall be entitled for

161 in module so in book also it was

rewards under MEIS. rewards under MEIS.

ignored)

SEIS (ICAI had ignored amendments Minimum NFE earnings – US $ 15,000 (US $ Minimum NFE earnings – US $ 15,000 (US $

161 in module so in book also it was 10,000 for individual service providers) in preceding 10,000 for individual service providers) in year of

ignored) FY. rendering service .

ICAI example (please correct in

162 question and answer in all places "in in the preceding financial year in the year of rendering service

the preceding financial year"

ABC Ltd. A service exporter of specified service is

Q1. correction in phrase "preceding

having net free foreign earnings of US $ 20,000 ABC Ltd., requires you to compute its duty credit

financial year". Also remove

170 during preceding financial year, requires you to scrip entitlement for the current financial year

"preceding financial year in answer 1st

compute its duty credit scrip entitlement for the under the SEIS.

and 2nd line"

current financial year under the SEIS.

Q4 above amendment correction from Refer page no. 105 of Custom scanner released in

171

Rs. 25,000 to 5,00,000 March 2019

Note:- As advised earlier, please do statutory amendments issued by ICAI (only for custom/FTP) which they left out few in their Study Module (Majority of

amendments in Custom/FTP are taken care by myself & ICAI also). As I said earlier, to sync my book with ICAI Module, I also left out. They issued this in

March. It is only few and will just take half an hour. In custom book, where ever CBEC is written, please correct to "CBIC".

You might also like

- Payslip PendingDocument1 pagePayslip PendingJesna Jesudas0% (1)

- Form of Section 83 (B) Election - Provided by Cooley GODocument4 pagesForm of Section 83 (B) Election - Provided by Cooley GOCooleyGONo ratings yet

- Naresh PayslipDocument1 pageNaresh PayslipBADI APPALARAJUNo ratings yet

- Sa 110Document2 pagesSa 110coolmanzNo ratings yet

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxDocument5 pagesSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxSallu SaleemNo ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- S. No. Questions / Tweets Received Replies: Tweet FaqsDocument9 pagesS. No. Questions / Tweets Received Replies: Tweet FaqsM MangalNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaSuresh TamangNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Idt 5Document5 pagesIdt 5manan agrawalNo ratings yet

- 6.input Tax Credit18Document17 pages6.input Tax Credit18lakshyagupta98284No ratings yet

- Tweet Faqs: S. No. Questions / Tweets Received RepliesDocument9 pagesTweet Faqs: S. No. Questions / Tweets Received RepliesSumeet MehtaNo ratings yet

- GST NotesDocument156 pagesGST NotesNishthaNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- Accounting Ledgers and Entries in GST: CMA Bhogavalli Mallikarjuna GuptaDocument6 pagesAccounting Ledgers and Entries in GST: CMA Bhogavalli Mallikarjuna GuptaRohan KulkarniNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- Bos 63148Document32 pagesBos 63148adityatiwari122006No ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument31 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaFreudestein UditNo ratings yet

- CS Professional DT IDT Most Expected Questions For DECEMBER 2023Document285 pagesCS Professional DT IDT Most Expected Questions For DECEMBER 2023Dhanush GunisettyNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- GST Audit Amendment Notes by Pankaj GargDocument12 pagesGST Audit Amendment Notes by Pankaj GargGopal Airan100% (2)

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- Exam Oriented Book Indirect Taxation: CorrigendumDocument19 pagesExam Oriented Book Indirect Taxation: CorrigendumPrasanna KurraNo ratings yet

- GST MCQs Chapter 9 Registration by Vishal BhattadDocument10 pagesGST MCQs Chapter 9 Registration by Vishal BhattadLucky SrivastavaNo ratings yet

- Audit All Past Suggested Paper ICANDocument280 pagesAudit All Past Suggested Paper ICANMichael AdhikariNo ratings yet

- Most Expected Top 50 GST Questions For CA Inter November 2023 ExamsDocument45 pagesMost Expected Top 50 GST Questions For CA Inter November 2023 ExamsmukhiapurvaNo ratings yet

- Indirect TaxDocument10 pagesIndirect TaxAishwarya TiwariNo ratings yet

- Presentation FOR VCM On "Tally ERP-9 For Effective GST Compliance"Document46 pagesPresentation FOR VCM On "Tally ERP-9 For Effective GST Compliance"Sathish RNo ratings yet

- Amendment in ITC Availment Rule - WEF Oct 2019 - RSVA & CODocument2 pagesAmendment in ITC Availment Rule - WEF Oct 2019 - RSVA & COanon_18081010No ratings yet

- Most Expected GST Questions Part 1 by Ca Vivek GabaDocument25 pagesMost Expected GST Questions Part 1 by Ca Vivek GabaLakshman MurthyNo ratings yet

- Indirect Tax Laws Test 13 CH 13 May 2024 Test Paper 1705656978Document6 pagesIndirect Tax Laws Test 13 CH 13 May 2024 Test Paper 1705656978trishala sharmaNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument36 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Book 2Document34 pagesBook 2Kritika JainNo ratings yet

- Ir546 2022Document20 pagesIr546 2022KayNo ratings yet

- 6.input Tax CreditDocument24 pages6.input Tax CreditBhuvaneswari karuturiNo ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- S B GabhawallaDocument59 pagesS B GabhawallaaksNo ratings yet

- GST Reverse Charge Mechanism Converted MergedDocument20 pagesGST Reverse Charge Mechanism Converted MergedPriyal ShethNo ratings yet

- Imp Que GST by CA Manoj Batra For Nov 20 AttemptDocument261 pagesImp Que GST by CA Manoj Batra For Nov 20 Attemptshri jeetNo ratings yet

- Zero Rated Supplies Under GST: CA Sachin Kumar JainDocument3 pagesZero Rated Supplies Under GST: CA Sachin Kumar Jainparam.ginniNo ratings yet

- 66Document3 pages66ravibhartia1978No ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- Article On Composition Scheme With Case StudyDocument12 pagesArticle On Composition Scheme With Case StudySejal GuptaNo ratings yet

- Return GST IndiaDocument56 pagesReturn GST IndiathecoltNo ratings yet

- Topic 9 - Registration Under GSTDocument4 pagesTopic 9 - Registration Under GSTMehul GuptaNo ratings yet

- Standardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument112 pagesStandardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiavsyamkumarNo ratings yet

- PGBP ALL Adjustments - CA Amit Mahajan (1)Document4 pagesPGBP ALL Adjustments - CA Amit Mahajan (1)Parth SarafNo ratings yet

- GST Divyastra CH 7 Input Tax Credit R 1Document26 pagesGST Divyastra CH 7 Input Tax Credit R 1Sanskar SharmaNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- GST Year End Checklist FY 2022-23-NynDocument4 pagesGST Year End Checklist FY 2022-23-NynCA Rajendra Prasad ANo ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- Exam Practice ReviewDocument9 pagesExam Practice ReviewSafi NurulNo ratings yet

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- Cargo Agent Presentation For GST March 2018Document13 pagesCargo Agent Presentation For GST March 2018rishi pandeyNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- Sa 2 DT NovDocument9 pagesSa 2 DT NovRishabh GargNo ratings yet

- CAF 2 TAX Autumn 2022Document6 pagesCAF 2 TAX Autumn 2022QasimNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- 2015 Bar Questions On Taxation Gen Pri and IncomeDocument2 pages2015 Bar Questions On Taxation Gen Pri and IncomeSheena PalmaresNo ratings yet

- Sarayu Dna Wifi 2021Document1 pageSarayu Dna Wifi 2021AbhijeetNo ratings yet

- Tax267 Ss Feb2022Document10 pagesTax267 Ss Feb20228kbnhhkwppNo ratings yet

- Amazon PurchaseDocument192 pagesAmazon PurchaseSangita JadhavNo ratings yet

- Ein Digital ArtDocument2 pagesEin Digital ArtErik ElseaNo ratings yet

- Transfer by Trustees To Beneficiary: Form No. 4Document1 pageTransfer by Trustees To Beneficiary: Form No. 4Sudeep Sharma0% (1)

- BIR Ruling 05-90Document1 pageBIR Ruling 05-90Andrea RioNo ratings yet

- Medical Premium Receipt SelfDocument1 pageMedical Premium Receipt SelfRakesh AggarwalNo ratings yet

- UntitledDocument3 pagesUntitledBILAL AMSNo ratings yet

- Turnover Declaration LetterDocument3 pagesTurnover Declaration LetterPAULO MORALESNo ratings yet

- EE - Assignment Chapter 7 SolutionDocument7 pagesEE - Assignment Chapter 7 SolutionXuân ThànhNo ratings yet

- S170Document3 pagesS170dssfdNo ratings yet

- Government of Khyber PakhtunkhwaDocument1 pageGovernment of Khyber PakhtunkhwaSSP Traffic AbbottabadNo ratings yet

- Article 18 Pensions and AnnuitiesDocument2 pagesArticle 18 Pensions and AnnuitiesRyand ArmilisNo ratings yet

- Chapter 2 Multiple ChoiceDocument4 pagesChapter 2 Multiple ChoiceLess Balesoro100% (1)

- Tax Incidence On Partnership Fi RMDocument12 pagesTax Incidence On Partnership Fi RMTejas DesaiNo ratings yet

- IM Contest - December DhoomDocument11 pagesIM Contest - December DhoomvasuNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Tally Prime Exercise 3Document9 pagesTally Prime Exercise 3MohanNo ratings yet

- Payslip PIL11250 Feb 2024 1741073480458640214 1706890553675Document1 pagePayslip PIL11250 Feb 2024 1741073480458640214 1706890553675Dipankar BarmanNo ratings yet

- Print Over 80 Pension - Overview - GOV - UKDocument4 pagesPrint Over 80 Pension - Overview - GOV - UKscribd.peworNo ratings yet

- CIR V Enron Subic Power CorporationDocument1 pageCIR V Enron Subic Power CorporationiciamadarangNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and CertificationAlex RichterNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Rheneir MoraNo ratings yet

- Oneplus 9R - Arjun BhallaDocument1 pageOneplus 9R - Arjun BhallaRohan MarwahaNo ratings yet