Professional Documents

Culture Documents

Unit 27:-Interest Rate Risk Management: No Comments

Unit 27:-Interest Rate Risk Management: No Comments

Uploaded by

Kaushik RoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 27:-Interest Rate Risk Management: No Comments

Unit 27:-Interest Rate Risk Management: No Comments

Uploaded by

Kaushik RoyCopyright:

Available Formats

Unit 27:-Interest Rate Risk Management

October 17, 2016

| No Comments

Interest rate risk is the exposure of a bank’s financial condition to adverse movements in

interest rates.

Gap: The gap is the difference between the amount of assets and liabilities on which the

interest rates are reset during a given period.

Interest rate risk refers to volatility in Net Interest Income (NiI) or in variations in Net

Interest Margin (NIM)

The degree of basis risk is fairly high in respect of banks that create composite assets out

of composite liabilities.

The risk that the interest rate of different assets and liabilities may change in different

magnitudes is called basis risk.

When assets and liabilities fall due to repricing in different periods, they can create a

mismatch. Such a mismatch or gap may lead to gain or loss depending upon how interest

rate in the market tend to move.

The degree of basis risk is fairly high in respect of banks that create composite assets out

of composite liabilities

When the variation in market interest rate causes the Nil to expand, the banks have

experienced a favourable basis shift and if the interest rate movement causes the Nil to

contract, the basis has moved against the bank.

An yield curve is a line on a graph plotting the yield of all maturities of a particular

instrument

Price risk occurs when assets are sold before their maturity dates.

The price risk is closely associated with the trading book which is created for making

profit out of short-term movements in interest rates.

Uncertainty with regard to interest rate at which the future cash flows can be reinvested is

called reinvestment risk.

When the interest rate goes up, the bonds price decreases

When the interest rate declines the bond price increases resulting in a capital gain but the

realised compound yield decreases because of lower coupon reinvestment income.

Duration is a measure of the percentage change in the economic value of a position that

will occur, given a small change in the level of interest rates.

Higher duration implies that a given change in the level of interest rates will have a larger

impact on economic value.

Interest Rate Sensitive Gap: Interest Rate Sensitive Assets(RSA) – Interest Rate

Sensitive Liabilities (RSL).

Positive Gap or Asset Sensitive Gap – RSA – RSL > 0 & Negative Gap or Liability

Sensitive – RSA – RSL < 0

You might also like

- Marketing Plan of A Real Estate ProjectDocument22 pagesMarketing Plan of A Real Estate Projectciyakapoor86% (7)

- Pop - A Aj GowerDocument2 pagesPop - A Aj GowerScavat NgwaneNo ratings yet

- India Capability Presentation 11 Feb 2020 PDFDocument15 pagesIndia Capability Presentation 11 Feb 2020 PDFArfat ShaikhNo ratings yet

- Sample Mortgage ContractDocument5 pagesSample Mortgage ContractJennevy Aivee Barretto Lomibao100% (1)

- BRM Session 8 Interest Rate RiskDocument31 pagesBRM Session 8 Interest Rate RiskSrinita MishraNo ratings yet

- Interest Rate Risk Management: Learning OutcomesDocument16 pagesInterest Rate Risk Management: Learning OutcomesAnil ReddyNo ratings yet

- UNIT 4 Market Risk Mgmt.Document4 pagesUNIT 4 Market Risk Mgmt.Ajay Prakash VermaNo ratings yet

- Financial Markets and Institutions Unit 3Document9 pagesFinancial Markets and Institutions Unit 3Nitin PanwarNo ratings yet

- Unit 5 Level and Structure of Interest RatesDocument28 pagesUnit 5 Level and Structure of Interest Ratesshree ram prasad sahaNo ratings yet

- Interest Rate Risk: Prof Mahesh Kumar Amity Business SchoolDocument110 pagesInterest Rate Risk: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- FINS3630: UNSW Business SchoolDocument32 pagesFINS3630: UNSW Business SchoolcarolinetsangNo ratings yet

- Part 4Document26 pagesPart 4Silvia SlavkovaNo ratings yet

- Bond Valuation & Analysis: Concept of Bond Types of Bonds The Yield CurveDocument28 pagesBond Valuation & Analysis: Concept of Bond Types of Bonds The Yield CurvexpertshanNo ratings yet

- Chapter 7 - Risks of Financial Inter MediationDocument69 pagesChapter 7 - Risks of Financial Inter MediationVu Duy AnhNo ratings yet

- Chapter 6 Interest Rates and Bond ValuationDocument14 pagesChapter 6 Interest Rates and Bond ValuationPatricia CorpuzNo ratings yet

- Wealth ManagementDocument10 pagesWealth Managementmaitree sanghaniNo ratings yet

- Overview of Fixed-Income Portfolio ManagementDocument11 pagesOverview of Fixed-Income Portfolio ManagementkypvikasNo ratings yet

- Interest Rate Risk PresentationDocument16 pagesInterest Rate Risk PresentationyolianaaNo ratings yet

- Midterm FM ReviewerDocument11 pagesMidterm FM ReviewerKristine MartinezNo ratings yet

- Interest Rate Risk in Global Market AnalysisDocument4 pagesInterest Rate Risk in Global Market AnalysisAnushree BumbNo ratings yet

- MCB AssignmentDocument13 pagesMCB AssignmentTushar DiwakarNo ratings yet

- Seminar Risk ManagementDocument9 pagesSeminar Risk ManagementDương Nguyễn TùngNo ratings yet

- Definition of 'Amortizing Swap'Document4 pagesDefinition of 'Amortizing Swap'DishaNo ratings yet

- Concept and Types of RiskDocument15 pagesConcept and Types of Riskthaktal_priyaNo ratings yet

- Bond Valuation and Risk Recits NotesDocument6 pagesBond Valuation and Risk Recits NotesNikki AlistadoNo ratings yet

- Treasury Practice ASSET SWAPSDocument3 pagesTreasury Practice ASSET SWAPSkevNo ratings yet

- Investment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualDocument13 pagesInvestment Analysis and Portfolio Management Reilly 10th Edition Solutions Manualmariowoodtncfjqbrow100% (48)

- Investment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualDocument36 pagesInvestment Analysis and Portfolio Management Reilly 10th Edition Solutions Manualamorwe.sudarium.mgy8100% (35)

- Interest Rate Risk New Version 2024Document82 pagesInterest Rate Risk New Version 2024shreyaaamisraNo ratings yet

- Business Finance 1-5Document18 pagesBusiness Finance 1-5haris_ahmed83No ratings yet

- Financial Risk MGTDocument20 pagesFinancial Risk MGTAmmar HassanNo ratings yet

- Interest Rate and Risk PremiumDocument15 pagesInterest Rate and Risk PremiumAlfonso Joel GonzalesNo ratings yet

- Risk and ReturnDocument5 pagesRisk and ReturnMahmudul Hassan HerokNo ratings yet

- CH 19Document34 pagesCH 19ManavAgarwalNo ratings yet

- Introduction To Finance-Risk and Concept of RiskDocument17 pagesIntroduction To Finance-Risk and Concept of RiskBOL AKETCHNo ratings yet

- Swap Risk Management ToolsDocument22 pagesSwap Risk Management ToolsMahveen KhurranaNo ratings yet

- A222 BWBB3193 Topic 03 ALMDocument70 pagesA222 BWBB3193 Topic 03 ALMNurFazalina AkbarNo ratings yet

- Risks Associated With Investing in Bonds PDFDocument2 pagesRisks Associated With Investing in Bonds PDFMohammad TalhaNo ratings yet

- Bonds - 53 SummaryDocument5 pagesBonds - 53 Summarytanya1780No ratings yet

- The Sources of RiskDocument8 pagesThe Sources of RiskDarkknightNo ratings yet

- Mismatch of Assets and Liabilities: ET Nterest NcomeDocument1 pageMismatch of Assets and Liabilities: ET Nterest Ncomeraju vermaNo ratings yet

- July 10, 2019 Lesson Interest RateDocument33 pagesJuly 10, 2019 Lesson Interest RateMarkus Bernabe DaviraNo ratings yet

- 22 Manajemen Risiko Lembaga KeuanganDocument206 pages22 Manajemen Risiko Lembaga Keuanganchocochips_morronNo ratings yet

- 2nd Exam FinmanDocument17 pages2nd Exam FinmanKate AngNo ratings yet

- Interest Rates and Bond Valuation Chapter 6Document29 pagesInterest Rates and Bond Valuation Chapter 6Mariana MuñozNo ratings yet

- Chapter 008Document25 pagesChapter 008Muhammad Bilal TariqNo ratings yet

- FMDocument1 pageFMJayceelyn OlavarioNo ratings yet

- Risk Management NewDocument48 pagesRisk Management Newpawan_preet_kaur_bNo ratings yet

- Chapter Twenty-Two: Managing Interest Rate Risk and Insolvency Risk On The Balance SheetDocument23 pagesChapter Twenty-Two: Managing Interest Rate Risk and Insolvency Risk On The Balance SheetSagheer MuhammadNo ratings yet

- Eco Tes 2Document2 pagesEco Tes 2coki11111No ratings yet

- The Interaction Between Repo and Interest Rate SwapsDocument18 pagesThe Interaction Between Repo and Interest Rate SwapskevNo ratings yet

- Risk and Return AnalysisDocument3 pagesRisk and Return AnalysisDeepak KumarNo ratings yet

- Instructor - Sandesh BangerDocument47 pagesInstructor - Sandesh Bangermpk srihariNo ratings yet

- Risk and Return: Financial ManagementDocument3 pagesRisk and Return: Financial Managementharish chandraNo ratings yet

- Benefiis & Ypes of RisksDocument1 pageBenefiis & Ypes of Risksindu_prasad_1No ratings yet

- General Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)Document14 pagesGeneral Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)RoelienNo ratings yet

- Risk ManagementDocument8 pagesRisk ManagementAkash GuptaNo ratings yet

- Fundamentals of Interest RatesDocument5 pagesFundamentals of Interest RatesHunter FaughnanNo ratings yet

- How Do Regular Treasury Bonds WorkDocument3 pagesHow Do Regular Treasury Bonds WorkiluvparixitNo ratings yet

- Yield CurveDocument9 pagesYield Curvejackie555No ratings yet

- Risk Associated With Investing in Fixed Income SecuritiesDocument28 pagesRisk Associated With Investing in Fixed Income SecuritiesviolettaNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Fire InsuranceDocument9 pagesFire InsuranceshreyaNo ratings yet

- Dividend Policy and Firm ValueDocument40 pagesDividend Policy and Firm ValueDamilola iloriNo ratings yet

- Obligation Request: Lgu TaytayDocument2 pagesObligation Request: Lgu TaytayAvt ChoraleAssociation TaytayPalawanNo ratings yet

- Economics Sample Paper 1Document8 pagesEconomics Sample Paper 1Rijvan AggarwalNo ratings yet

- Trading Clearing and Settlement in Derivatives MarketDocument34 pagesTrading Clearing and Settlement in Derivatives Marketsacos16074No ratings yet

- Investing in CryptocurrencyDocument25 pagesInvesting in CryptocurrencyNikola AndricNo ratings yet

- Magic Mix Illustration For Mr. Tushar N Patel (Age 27) : Proposed InsuranceDocument7 pagesMagic Mix Illustration For Mr. Tushar N Patel (Age 27) : Proposed Insurancejdchandrapal4980No ratings yet

- Case StudiesDocument36 pagesCase StudiesValeria Lanata0% (1)

- Chapter 8 Prob SolutionsDocument9 pagesChapter 8 Prob SolutionsManoj GirigoswamiNo ratings yet

- Makalah Kelompok 6 Management GDocument11 pagesMakalah Kelompok 6 Management GArdha NayakaNo ratings yet

- Statement For A/c XXXXXXXXX3479 For The Period 09-Nov-2022 To 08-Feb-2023Document21 pagesStatement For A/c XXXXXXXXX3479 For The Period 09-Nov-2022 To 08-Feb-2023TG HALLI-3163 PLANNING BWSSBNo ratings yet

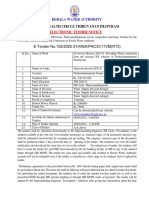

- E-Tender No.102/2020-21/KWA/PHC/D1/TVM (RT3) : Public Health Circle ThiruvananthapuramDocument2 pagesE-Tender No.102/2020-21/KWA/PHC/D1/TVM (RT3) : Public Health Circle ThiruvananthapuramsmithNo ratings yet

- Jindal Photo Annual Report 2021Document96 pagesJindal Photo Annual Report 2021ShafarudinNo ratings yet

- Relative Strength Index PDFDocument3 pagesRelative Strength Index PDFAnton Husen PurboyoNo ratings yet

- NFTP PresentationDocument32 pagesNFTP PresentationDeepti MangalNo ratings yet

- Chapter 14.ADocument28 pagesChapter 14.AtawfiqhanifmawaniNo ratings yet

- Lehman Brother Ethical DilemmaDocument3 pagesLehman Brother Ethical DilemmaVenkatesh KamathNo ratings yet

- Islamic Trade Finance Group-7 FinalDocument11 pagesIslamic Trade Finance Group-7 FinalKaushik HazarikaNo ratings yet

- FAOP61629Document3 pagesFAOP61629nikhil.21072No ratings yet

- Louetta Mallard - TransUnion Personal Credit Report - 20170923-1 PDFDocument7 pagesLouetta Mallard - TransUnion Personal Credit Report - 20170923-1 PDFLouetta mallardNo ratings yet

- How To Use BDO Nomura Online Trading Platform PDFDocument20 pagesHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNo ratings yet

- A Summer Training Project Report ON "Cash Flow Management of BSNL"Document51 pagesA Summer Training Project Report ON "Cash Flow Management of BSNL"Neha VidhaniNo ratings yet

- Tina 2020 W2 PDFDocument1 pageTina 2020 W2 PDFgary haysNo ratings yet

- PAYTIPPERY209Document1 pagePAYTIPPERY209puppygirl.ash13yNo ratings yet

- Teoría y Política Monetaria: ITAM 201Document22 pagesTeoría y Política Monetaria: ITAM 201dafreeNo ratings yet

- BRD - Loan & Loan RepaymentDocument8 pagesBRD - Loan & Loan RepaymentSunisha YadavNo ratings yet