Professional Documents

Culture Documents

Thesis Guide

Thesis Guide

Uploaded by

Glennizze GalvezCopyright:

Available Formats

You might also like

- Sample GoalsDocument2 pagesSample GoalsChris HendersonNo ratings yet

- Why The Study of Business Is So ImportantDocument3 pagesWhy The Study of Business Is So ImportantAnita KhanNo ratings yet

- Inland Bank Case AnalysisDocument8 pagesInland Bank Case AnalysisAna EnriquezNo ratings yet

- Service RecoveryDocument12 pagesService RecoveryHeavy Gunner100% (3)

- Uploads - Year 2 Maths Spr001 Reading and Writing Numbers in Words Lesson Plan (For Trainees)Document2 pagesUploads - Year 2 Maths Spr001 Reading and Writing Numbers in Words Lesson Plan (For Trainees)Erika Jane-Kai100% (2)

- PES201 Soft Skill PDFDocument12 pagesPES201 Soft Skill PDFAlisha AgarwalNo ratings yet

- Deaconess-Glover - Group 3 V2Document14 pagesDeaconess-Glover - Group 3 V2Mridul Vijay100% (1)

- A Study On Difficulties of Borrowers of Card Sme Thrift Bank Inc. in Using The Konek2card App From Selected Barangays of Agoncillo Batangas 1Document105 pagesA Study On Difficulties of Borrowers of Card Sme Thrift Bank Inc. in Using The Konek2card App From Selected Barangays of Agoncillo Batangas 1Prince Vincent AlcedoNo ratings yet

- Manuscript Final ThesisDocument60 pagesManuscript Final ThesisEya VillapuzNo ratings yet

- Case Digest BankingDocument35 pagesCase Digest BankingEKANG0% (1)

- THESIS DWCC UlitDocument28 pagesTHESIS DWCC UlitJay-R NuestroNo ratings yet

- Report On Debt ManagementDocument79 pagesReport On Debt ManagementSiddharth Mehta100% (1)

- Enterprises in Concepcion Uno, Marikina City: Basis For Improved Profitability"Document24 pagesEnterprises in Concepcion Uno, Marikina City: Basis For Improved Profitability"Allen ArcenasNo ratings yet

- Research Proposal On The Linkage Between Debt and Economic Growth in NigeriaDocument10 pagesResearch Proposal On The Linkage Between Debt and Economic Growth in Nigeriagemresearchcenter100% (1)

- Title Topic For Business Research For EditingDocument11 pagesTitle Topic For Business Research For EditingKrishna Aimee BayNo ratings yet

- College Students' Knowledge of Personal FinanceDocument30 pagesCollege Students' Knowledge of Personal FinanceKatherine Sauer100% (1)

- Public Sector EthicsDocument15 pagesPublic Sector EthicsJones Lyndon Crumb DamoNo ratings yet

- EJMCM - Volume 7 - Issue 10 - Pages 2585-2596Document12 pagesEJMCM - Volume 7 - Issue 10 - Pages 2585-2596Sukanta100% (1)

- BudolDocument2 pagesBudolShaun GatdulaNo ratings yet

- RRL I. Definition of E-BankingDocument7 pagesRRL I. Definition of E-BankingRhona BasongNo ratings yet

- Labrel-Collective Bargaining Agreement (Coverage)Document44 pagesLabrel-Collective Bargaining Agreement (Coverage)dave_88opNo ratings yet

- How Does Advertising Impact Consumer BehaviorDocument16 pagesHow Does Advertising Impact Consumer BehaviorÃtïkûr Rãhmâñ ShàónNo ratings yet

- Small Business Financial Management Practices in North AmericaDocument7 pagesSmall Business Financial Management Practices in North AmericaAshan WeerasingheNo ratings yet

- AtkinsonDocument14 pagesAtkinsonadamNo ratings yet

- Introduction To Credit ManagementDocument48 pagesIntroduction To Credit ManagementHakdog KaNo ratings yet

- Business To Consumer Marketing - Internet SalesDocument4 pagesBusiness To Consumer Marketing - Internet SalesGillie CaparasNo ratings yet

- Upland Poverty in Nepal - PaperDocument23 pagesUpland Poverty in Nepal - PaperADB Poverty ReductionNo ratings yet

- Research Paper in EconDocument14 pagesResearch Paper in EconSharlaine AndalNo ratings yet

- Personal Finance Assignment Title 3Document3 pagesPersonal Finance Assignment Title 3Smith TimilehinNo ratings yet

- The Effect of Credit Card UsageDocument21 pagesThe Effect of Credit Card UsageNoor OsamaNo ratings yet

- Case Digest - Special Project ObliconDocument8 pagesCase Digest - Special Project ObliconDianne MadridNo ratings yet

- Proposal PUPIANDocument7 pagesProposal PUPIANFlint Osric Teves GorospeNo ratings yet

- Effective Interest RateDocument4 pagesEffective Interest RateJoseph WongNo ratings yet

- A Study On The Sales PromotionalDocument66 pagesA Study On The Sales PromotionalkalaivaniNo ratings yet

- De La Salle UniversityDocument4 pagesDe La Salle UniversityRonn Robby RosalesNo ratings yet

- Debit and Credit Card Usage: Literature ReviewDocument6 pagesDebit and Credit Card Usage: Literature ReviewAdnan Akram0% (1)

- Business Research On Consumer Buying Behavior After The Implementation of Sin Tax Law in The PhilippinesDocument41 pagesBusiness Research On Consumer Buying Behavior After The Implementation of Sin Tax Law in The PhilippinesMajoy Mendoza100% (2)

- Online Shopping PrefernceDocument7 pagesOnline Shopping PrefernceTrisha Mae Burce Solmerano0% (1)

- Emprical Analysis of Gulu Municipal L.RDocument31 pagesEmprical Analysis of Gulu Municipal L.ROdoch WalterNo ratings yet

- DBP and ChinaBankDocument12 pagesDBP and ChinaBankraizel romeroNo ratings yet

- Extinguishment of ObligationsDocument89 pagesExtinguishment of ObligationsLLYOD FRANCIS LAYLAYNo ratings yet

- 5.3 Break-Even Analysis Test PDFDocument2 pages5.3 Break-Even Analysis Test PDFGermanRobertoFong100% (1)

- WENPHIL CORPORATION vs. ALMER R. ABING and ANABELLE M. TUAZONDocument11 pagesWENPHIL CORPORATION vs. ALMER R. ABING and ANABELLE M. TUAZONRaquel DoqueniaNo ratings yet

- CCABEG Case Studies Professional Accountants in BusinessDocument17 pagesCCABEG Case Studies Professional Accountants in BusinessEnoiu DianaNo ratings yet

- Factors in Increased Globalization: Threats To National SovereigntyDocument4 pagesFactors in Increased Globalization: Threats To National SovereigntydarlenerosalesNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- What Is Political BehaviorDocument16 pagesWhat Is Political Behaviornazia_malikNo ratings yet

- The Effect of Marketing Mix On Organizations Performance: October 2019Document11 pagesThe Effect of Marketing Mix On Organizations Performance: October 2019BrilliantNo ratings yet

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDocument46 pagesCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNo ratings yet

- Concepts of Value and ReturnDocument38 pagesConcepts of Value and ReturnVaishnav KumarNo ratings yet

- FinmanDocument3 pagesFinmanKaren LaccayNo ratings yet

- Teacher's E-Loan: Macondray Finance CorporationDocument40 pagesTeacher's E-Loan: Macondray Finance CorporationKristina OrmacidoNo ratings yet

- Factors Influencing The Adaptation of Online Banking - Docx 2Document48 pagesFactors Influencing The Adaptation of Online Banking - Docx 2CHARRYSAH TABAOSARESNo ratings yet

- Financial Literacy The Case of PolandDocument17 pagesFinancial Literacy The Case of PolandCarlo CalmaNo ratings yet

- Victorias Planters Vs Victorias Milling CoDocument5 pagesVictorias Planters Vs Victorias Milling CoJec Luceriaga BiraquitNo ratings yet

- 8 Reasons Why Businesses Fail Without Proper Accounting ProceduresDocument2 pages8 Reasons Why Businesses Fail Without Proper Accounting Proceduresnurul aminNo ratings yet

- Module 6 Decision-Making PDFDocument10 pagesModule 6 Decision-Making PDFMahua Adak MandalNo ratings yet

- North Sea Continental Shelf CaseDocument6 pagesNorth Sea Continental Shelf CaseHyrl LimNo ratings yet

- A Launch Management System Contains The Following StepsDocument20 pagesA Launch Management System Contains The Following StepsTed Mauricio100% (1)

- The One Child PolicyDocument6 pagesThe One Child PolicyKaira SyNo ratings yet

- Problems Encountered and Level of Customer Satisfaction On The Use of Mobile Banking Application of Selected Consumers in City of San FernandoDocument17 pagesProblems Encountered and Level of Customer Satisfaction On The Use of Mobile Banking Application of Selected Consumers in City of San FernandoHazel Andrea Garduque LopezNo ratings yet

- (BAAC3161) Academic Performance of BSA Students and Their Qualifying Examination Result Correlational StudyDocument17 pages(BAAC3161) Academic Performance of BSA Students and Their Qualifying Examination Result Correlational Studykarl cruzNo ratings yet

- Importance of Financial Aspect in Business PlanningDocument2 pagesImportance of Financial Aspect in Business PlanningclsNo ratings yet

- Asian Economic Integration Report 2021: Making Digital Platforms Work for Asia and the PacificFrom EverandAsian Economic Integration Report 2021: Making Digital Platforms Work for Asia and the PacificNo ratings yet

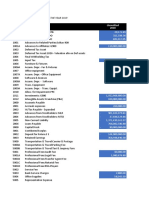

- Unaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncDocument18 pagesUnaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncGlennizze GalvezNo ratings yet

- Accountancy Student: Froilan Arlando BandulaDocument5 pagesAccountancy Student: Froilan Arlando BandulaGlennizze GalvezNo ratings yet

- Entrep 4 Week: What I KnowDocument9 pagesEntrep 4 Week: What I KnowGlennizze GalvezNo ratings yet

- Assets: Balance Sheet As of September 31, 2020Document91 pagesAssets: Balance Sheet As of September 31, 2020Glennizze GalvezNo ratings yet

- SynthesisDocument2 pagesSynthesisGlennizze GalvezNo ratings yet

- Body Composition: BenefitsDocument8 pagesBody Composition: BenefitsGlennizze GalvezNo ratings yet

- Maxims of CommunicationDocument1 pageMaxims of CommunicationGlennizze GalvezNo ratings yet

- Chapter 14 - Bus Com Part 1 - Afar Part 2-1Document4 pagesChapter 14 - Bus Com Part 1 - Afar Part 2-1Glennizze GalvezNo ratings yet

- PurposiveDocument1 pagePurposiveGlennizze GalvezNo ratings yet

- January 2019: Sun Mon Tue Wed Thu Fri SatDocument12 pagesJanuary 2019: Sun Mon Tue Wed Thu Fri SatGlennizze GalvezNo ratings yet

- 3.2.9 Process FlowchartDocument4 pages3.2.9 Process FlowchartGlennizze GalvezNo ratings yet

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- University of Perpetual Help System DALTA: Las Piñas CampusDocument65 pagesUniversity of Perpetual Help System DALTA: Las Piñas CampusGlennizze Galvez100% (1)

- Accountancy Student: Froilan Arlando BandulaDocument5 pagesAccountancy Student: Froilan Arlando BandulaGlennizze GalvezNo ratings yet

- Fun BoothDocument2 pagesFun BoothGlennizze GalvezNo ratings yet

- Chapter 16 - Bus Com Part 3 - Afar Part 2-1Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2-1Glennizze GalvezNo ratings yet

- Accountants National Capital Region (NFJPIA-NCR) Is A Duly: Ngarap Tungo SA Kilang LaDocument4 pagesAccountants National Capital Region (NFJPIA-NCR) Is A Duly: Ngarap Tungo SA Kilang LaGlennizze GalvezNo ratings yet

- Accountancy Student: Froilan Arlando BandulaDocument5 pagesAccountancy Student: Froilan Arlando BandulaGlennizze GalvezNo ratings yet

- Systems Analysis and Design: Course DescriptionDocument3 pagesSystems Analysis and Design: Course DescriptionGlennizze GalvezNo ratings yet

- Bio Plants SurveyDocument1 pageBio Plants SurveyGlennizze GalvezNo ratings yet

- Critical Questions: 1. What Is More Potent Strategy To Use? Customer Driven or Customer Driving Market?Document2 pagesCritical Questions: 1. What Is More Potent Strategy To Use? Customer Driven or Customer Driving Market?Glennizze GalvezNo ratings yet

- As A Temporary Investment of Excess Cash As Part of A Long-Term Risk-Adjusted Portfolio As A Strategic InvestmentDocument41 pagesAs A Temporary Investment of Excess Cash As Part of A Long-Term Risk-Adjusted Portfolio As A Strategic InvestmentGlennizze GalvezNo ratings yet

- CV For Internship PDFDocument5 pagesCV For Internship PDFGlennizze GalvezNo ratings yet

- Swot Analysis: Republic of The Philippines Department of Education National Capital Region Division of City Las PiñasDocument1 pageSwot Analysis: Republic of The Philippines Department of Education National Capital Region Division of City Las Piñasdona manuela elementary schoolNo ratings yet

- Gui817 JMS PDFDocument10 pagesGui817 JMS PDFPhilBoardResultsNo ratings yet

- DLP WEEK 1 Appied EconomicsDocument4 pagesDLP WEEK 1 Appied Economicsmarco regis100% (1)

- Advanced Research Methodology 2Document18 pagesAdvanced Research Methodology 2Raquibul Hassan100% (1)

- Top Challenge: To Shine All Four Searchlights On To The Texts That I Read Target: Be Able ToDocument2 pagesTop Challenge: To Shine All Four Searchlights On To The Texts That I Read Target: Be Able Toapi-177614684No ratings yet

- Agile Quality AssuranceDocument269 pagesAgile Quality Assurancevijaysudhakar100% (1)

- Reading Comprehension Critical Thinking Grade 1Document6 pagesReading Comprehension Critical Thinking Grade 1Tanya FloreaNo ratings yet

- IATA 2012 Training CatalogueDocument128 pagesIATA 2012 Training CatalogueJayant Gogte100% (2)

- Strama PaperDocument36 pagesStrama PaperHavana100% (2)

- Counseling PDFDocument1 pageCounseling PDFapi-351362934No ratings yet

- Oxford Studies in Metaphysics - Volume 3 - Oxford University Press, USA PDFDocument310 pagesOxford Studies in Metaphysics - Volume 3 - Oxford University Press, USA PDFDiego Velazquez100% (2)

- Miller Daniel Poverty MoralityDocument20 pagesMiller Daniel Poverty MoralityjuanitalalocaNo ratings yet

- Resume Grading Rubric - Polytech CollegeDocument1 pageResume Grading Rubric - Polytech CollegeRoSeeksTruthNo ratings yet

- Gowthami.D: AddressDocument2 pagesGowthami.D: AddresssrividhyaNo ratings yet

- MA & PHD Evaluation Form PDFDocument2 pagesMA & PHD Evaluation Form PDFBechir SaoudiNo ratings yet

- BCS HEQ FeesDocument4 pagesBCS HEQ FeeshighgrainNo ratings yet

- Choate Rosemary HallDocument1 pageChoate Rosemary HallHelen BennettNo ratings yet

- Eecs 314 Homework SolutionsDocument6 pagesEecs 314 Homework Solutionsppuylstif100% (1)

- Financial Literacy PresentationDocument10 pagesFinancial Literacy Presentationbalachandrannairp1953No ratings yet

- Formal and InformalDocument17 pagesFormal and InformalMehwish AslamNo ratings yet

- Medical CertificateDocument1 pageMedical CertificateQadir RafiqueNo ratings yet

- Edexcel Set 3 Foundation GCSE Math Paper 1Document19 pagesEdexcel Set 3 Foundation GCSE Math Paper 1tmnvdy6kt5No ratings yet

- Hannah Berk: Professional ExperienceDocument1 pageHannah Berk: Professional ExperienceAnonymous kE9KoTF2UGNo ratings yet

- Test of Interactive English: Teachers' InformationDocument22 pagesTest of Interactive English: Teachers' InformationKaokao Teh TarikNo ratings yet

- Female Data Entry Engineer CV/Resume SampleDocument2 pagesFemale Data Entry Engineer CV/Resume Samplemahmoud_elnaggar_5No ratings yet

- Ideas For The Mixed Up ChameleonDocument3 pagesIdeas For The Mixed Up ChameleonRutypablo100% (1)

Thesis Guide

Thesis Guide

Uploaded by

Glennizze GalvezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesis Guide

Thesis Guide

Uploaded by

Glennizze GalvezCopyright:

Available Formats

University of Perpetual Help System Dalta Page |

Las Piñas Campus i

CREDIT CARD DEBT MANAGEMENT PRACTICES OF

SELECTED PROFESSIONALS IN LAS PIÑAS CITY: AN

ASSESSMENT AND IMPROVEMENT FRAMEWORK FOR

CREDIT CARD DEBT MANAGEMENT

An Accounting Technology Research

Presented to the Faculty of the

College of Business Administration and Accountancy

University of Perpetual Help System DALTA, Las Piñas City

In Partial Fulfillment

Of the Requirements for the Degree

Bachelor of Science in Accounting Technology

Bulan, Cyramil Jade C.

Mercado, Mary Rose D.

Pascual, Mark Vincent C.

Payopas, SharaLouiecy C.

October 2018

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus ii

APPROVAL SHEET

This undergraduate thesis entitled “CREDIT CARD DEBT

MANAGEMENT PRACTICES OF SELECTED PROFESSIONALS IN LAS

PIÑAS CITY: AN ASSESSMENT AND IMPROVEMENT FRAMEWORK FOR

CREDIT CARD DEBT MANAGEMENT” prepared and submitted by Cyramil

Jade C. Bulan, Mary Rose D. Mercado, Mark Vincent C. Pascual, and

Shara Louiecy C. Payopas in partial fulfillment of the requirements for the

degree of Bachelor of Science in Accounting Technology has been

examined and recommended for acceptance and approval for pre-oral

defense/ final oral defense.

RYAN JAY CARASCO, CPA AMIR T. AUDITOR, CPA, MSA

Thesis Adviser Thesis Instructor

ORAL EXAMINATION COMMITTEE

Approved by Oral Examination Committee with the grade of ____.

RAQUEL A ALBAN, CPA ANTONIO V. MAICO JR. CPA

Panel Member Panel Member

DR. LORNA C. CONDES

Chair Panel

Accepted in partial fulfillment of the requirements for the degree of Bachelor

of Science in Accounting Technology.

LETICIA C. GAMAD, MBA, MAED, DBA

OIC Dean, College of Business Administration and Accountancy

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus iii

ACKNOWLEDGEMENT

The researchers would like to express their deepest

appreciation and utmost gratitude to the people who provided

support and assistance for the improvement of this humble piece of

work. The researchers would like to give thanks to the following

people who gave their time and efforts in making this study possible:

LETICIA C. GAMAD, MBA, MAED, CFNP, DBA, College of

Business Administration and Accountancy of University of Perpetual

Help System DALTA Las Piñas City, for the support that motivated

the researchers to do well while writing the thesis paper.

MR. AMIR T. AUDITOR, CPA, MSA for sharing his

knowledge to give the researchers a better understanding to the

topic of the study, and giving his time to proofread the research

drafts.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus iv

MR. RYAN JAY J. CARASCO, CPA the researchers’

adviser, for giving support and guidance for the whole research

process.

BETINA T. CONDE, PHD, the researchers’ grammarian who

not only checked the study, but give valuable suggestions to

enhance the paper.

Dr. LORNA C. CONDES, the researcher’s statistician for the

inspiration, understanding, and unselfish devotion to share his

mathematical expertise as well as the correction of mistakes.

TO RESPONDENTS, for their willing to participate and time

to answer the questionnaires despite of having busy schedule.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus v

TO FAMILIES AND FRIENDS, for the understanding and

unconditional support, both financial and emotionally. They are the

reason why the researchers completed all the requirements and;

And most of all TO ALMIGHTY GOD, for the wisdom and

perseverance that He bestowed upon the researchers before,

during, and after the completion of the study.

ABSTRACT

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus vi

Name of : University of Perpetual Help System

Institution DALTA

Address : Pamplona, Las Piñas City

Title : CREDIT CARD DEBT MANAGEMENT

PRACTICES OF SELECTED

PROFESSIONALS IN LAS PIÑAS

CITY: AN ASSESSMENT AND

IMPROVEMENT FRAMEWORK FOR

CREDIT CARD DEBT MANAGEMENT

Authors : Cyramil Jade C. Bulan

Mary Rose D. Mercado

Mark Vincent C. Pascual

Shara Louiecy C. Payopas

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus vii

Degree : Bachelor of Science in Accounting

Technology

Date Completed : October 2018

This study indicates the best credit card management

practices on selected professionals in Las Pinas City in terms of

different variables like Credit Worthiness, Ability to Pay, Credit Limit,

Interest and Rewards and Satisfactory on Credit Company. This

study was conducted to help users of credit cards on how to manage

their credit card debt to improve their ability to pay and also giving

new ideas on assessing credit card practices.

The survey questionnaire was used to gather necessary data.

It was distributed to 285 professionals who uses credit cards in Las

Pinas City who were available during the time the questionnaires

were being distributed. The respondents were asked to answer

necessary information and questions indicated in the questionnaire.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus viii

The researchers discovered from the conclusion that the

variable the respondents considered the most in terms of credit card

management practices is “Ability to Pay” which is interpreted as

“Highly Practiced”. It also revealed that “Credit Worthiness”, “Credit

Limit” “Interest and Rewards”, and “Satisfactory of Credit Card

Company” got a verbal interpretation of “Moderately practiced”. As a

result, there is no significant differences debt management practiced

by the respondents, as well as in their profile variables.

Index Terms – Debt Management,

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus ix

TABLE OF CONTENTS

TITLE PAGE i

APPROVAL SHEET ii

ACKNOWLEDGEMENT iii

ABSTRACT vi

TABLE OF CONTENTS ix

LIST OF TABLES xii

LIST OF FIGURES xvii

LIST OF APPENDICES xviii

CHAPTER

1 The Problem and Its Background

Introduction 1

Background of the study 2

Theoretical Framework 3

Conceptual Framework 4

Statement of the Problem 7

Hypothesis 9

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus x

Scope and Limitation of the Study 10

Significance of the Study 10

Definition of Terms 10

Review of Related Literature and Studies 12

2 Methodology

Research Method 25

Population of the Study 26

Sampling Design 26

Respondent of the Study 26

Data Gathering Instruments 27

Validation of the Study 28

Data Gathering Procedures 28

Data Collection 29

Data Analysis 30

3 Results and Discussion

Profile of the Respondents 31

Information on Credit Card Usage 39

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xi

Extent of Debt Management Practiced by Credit 48

Card Users

Significant Difference in Debt Management Practiced 61

By Credit Card Users when group according to profile

4 Summary and Findings, Conclusions and

Recommendations

Summary of Findings 128

Conclusion 210

Recommendations 211

References 215

List of Website 217

Curriculum Vitae 260

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xii

LIST OF TABLES

Table Page

1.1 Age of Respondents 31

1.2 Gender of Respondents 33

1.3 Civil Status of Respondents 34

1.4 Occupational Sector of Respondents 35

1.5 Monthly Salary of Respondents 36

1.6 Total Credit Limit of Respondents 38

2.1 Number of Credit Cards 40

2.2 Frequency on Using Credit Card 41

2.3 Reason to Apply for Credit Card 42

2.4 Amount of Payment Using Credit Card Monthly 44

2.5 Reason to Use Credit Card 45

2.6 Length of Credit Card Usage 47

3.1 Credit Worthiness 49

3.2 Ability to Pay 51

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xiii

3.3 Credit Limit 53

3.4 Interest and Rewards 56

3.5 Satisfactory of Credit Card Company 59

4.1 Significance of the study according to the 62

Presence of External Audit

4.1.1 Differences in the extent of practice for credit 63

worthiness in regard to age group

4.2 Differences in the extent of practice for ability to 64

pay in regard to age group

4.2.1 Post Hoc Analysis of the Significant Difference 66

4.3 Differences in the extent of practice for credit 67

limit in regard to age group

4.3.1 Post Hoc Analysis of the Significant Difference 69

4.3.2 Post Hoc Analysis of the Significant Difference 70

4.4 Differences in the extent of practice for Interest 71

and Reward in regard to age group

4.5 Differences in the extent of practice for 73

satisfactory of credit company in regard to age

group

4.5.1 Post Hoc Analysis of the Significant Difference 75

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xiv

4.5.2 Post Hoc Analysis of the Significant Difference 76

4.6 Differences in the extent of practice for credit 77

worthiness in regard to gender

4.7 Differences in the extent of practice for ability to 79

pay in regard to gender

4.7.1 Post Hoc Analysis of the Significant Difference 80

4.8 Differences in the extent of practice for credit 81

limit in regard to gender

4.8.1 Post Hoc Analysis of the Significant Difference 82

4.9 Differences in the extent of practice for interest 83

and rewards in regard to gender

4.10 Differences in the extent of practice for 85

satisfactory of credit company in regard to

gender

4.11 Differences in the extent of practice for credit 86

worthiness in regard to civil status

4.12 Differences in the extent of practice for ability to 88

pay in regard to civil status

4.12.1 Post Hoc Analysis of the Significant Difference 89

4.13 Differences in the extent of practice for credit 90

limit in regard to civil status

4.14 Differences in the extent of practice for interest 91

and rewards in regard to civil status

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xv

4.15 Differences in the extent of practice for 93

satisfactory of credit company in regard to civil

status

4.16 Differences in the extent of practice for credit 94

worthiness in regard to occupational sector

4.17 Differences in the extent of practice for ability to 96

pay in regard to occupational sector

4.18 Differences in the extent of practice for credit 97

limit in regard to occupational sector

4.18.1 Post Hoc Analysis of the Significant Difference 99

4.19 Differences in the extent of practice for interest 100

and rewards in regard to occupational sector

4.19.1 Post Hoc Analysis of the Significant Difference 101

4.20 Differences in the extent of practice for 102

satisfactory of credit company in regard to

occupational sector

4.20.1 Post Hoc Analysis of the Significant Difference 104

4.20.2 Post Hoc Analysis of the Significant Difference 105

4.20.3 Post Hoc Analysis of the Significant Difference 106

4.21 Differences in the extent of practice for 107

creditworthiness in regard to monthly salary

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xvi

4.22 Differences in the extent of practice for ability to 108

pay in regard to monthly salary

4.22.1 Post Hoc Analysis of the Significant Difference 109

4.23 Differences in the extent of practice for credit 111

limit in regard to monthly salary

4.23.1 Post Hoc Analysis of the Significant Difference 112

4.24 Differences in the extent of practice for interest 114

and rewards in regard to monthly salary

4.25 Differences in the extent of practice for 115

satisfactory of credit company in regard to

monthly salary

4.26 Differences in the extent of practice for credit 117

worthiness in regard to total credit limit

4.27 Differences in the extent of practice for ability to 118

pay in regard to total credit limit

4.28 Differences in the extent of practice for credit 119

limit in regard to total credit limit

4.28.1 Post Hoc Analysis of the Significant Difference 121

4.29 Differences in the extent of practice for interest 122

and rewards in regard to total credit limit

4.29.1 Post Hoc Analysis of the Significant Difference 123

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xvii

4.30 Differences in the extent of practice for 125

satisfactory of credit company in regard to total

credit limit

4.30.1 Post Hoc Analysis of the Significant Difference 126

LIST OF FIGURES

FIGURE PAGE

1 Operational Framework 6

2 Credit Card Debt Management Improvement 212

Framework

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus xviii

LIST OF APPENDICES

APPENDIX PAGE

A Letter of Acceptance for Adviser 226

B Letter for Survey for Evaluator 227

(Signed by Amir T. Auditor, CPA, MSA)

C Letter for Survey for Evaluator 228

(Signed by Rachel Alban, CPA)

D Letter for Survey for Evaluator 229

(Signed by Annelen B. Marcos, CPA MBA)

E Sample Survey Instrument 230

F Letter to Respondents 232

G Certificate of Statistician 233

H Certificate of Turnitin 234

I Certificate of Grammarian 240

J Relevant Raw Statistical Result 241

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 1

Chapter 1

The Problem and Its Background

Introduction

Debt can be stressful and this can create more problems

such as health-related complications, strains in relationships, and

even death. That is why one must consider debt management as

an option. Furthermore, debt management is an important aspect

for an individual to focus on building wealth for the betterment of

future security and livelihood (ZAK, 2016). In addition, Guess Post

(2018) stated that debt management is an essential way to

prevent small amount of debt turning into rising financial problem.

According to Hightower (2017), credit card debt is a type of

unsecured debt which means that credit card companies cannot

go after the customers’ assets to pay off what they owe. Because

of this, many of these companies negotiate a settlement with their

customers in order to regain most amount of the debt, if possible.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 2

Credit cards can offer a lot of benefits to those who can

manage them properly and pay bills on time. However, having a

high level of credit card debt means a very bad problem for a credit

card user (Mangis, 2018).

Background of the Study

According to Financial Dictionary (2015), debt

management aims to repay debts in the shortest time possible.

Individuals tend to manage debts either on their own or with the

help of third party. In most countries, there are some organizations

who are offering debt management plans to debtors who cannot

manage a huge amount of debts on their own. According to

Weston (2016), debt management plans help to make payments

more affordable and lower the interest rates. However, O’Shea

(2016) mentioned that it does not mean that the plan will cut the

amount owed, but the lower payments resulted once the credit

counselor has the creditor to agree on lowering the interest rate

or dropping some fees.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 3

According to Ahmad and Omar (2013), credit card users,

especially the younger ones, must be educated on how to handle

credit card debts and obligations in more responsible manner. The

reason for this is to prevent the credit card users from being

victims of insolvency or bankruptcy because of excessive usage

of credit cards. Having a high level of debt is commonly a burden

for an average individual since it strains the individual’s income to

maintain regular payments which leads to bankruptcy if it is not

well-managed.

Theoretical Framework

Credit Theory of money

Credit theory or Debt theory are monetary economic theory

concerning the relationship of money and debt. Credit theories of

money argue that money is best understood as debt even in

systems often understood as using commodity money. The Credit

Theory asserts in short that a sale and purchase is the exchange

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 4

of a commodity for credit. The theory is that it depends on the

debtor on how to pay its own debt (Mitchell-Innes, 2018)

Management Theory

Management theories are concepts surrounding

recommended management strategies, which may include tools

such as frameworks and guidelines that can be implemented in

modern organizations. Management Theory have proven useful in

simplifying the decision making (Jocson, 2011)

Conceptual Framework

The researchers analyzed the concept of ability to pay,

creditworthiness, and credit limit in relation to the assessment of

credit card debt management practices.

The ability to pay is referred to as solvency. It is essential in

order to determine if the credit card user can pay off the debts

with his/her income. If the credit card user becomes insolvent, it

seems that bankruptcy might be the only option but debt

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 5

management could serve as an alternative. Meanwhile,

creditworthiness is based on how an

individual manage his/her credit and debt obligations (Irby, 2018).

And then, the third concept is credit limit. Irby (2018) also defined

it as the maximum outstanding balance that a credit card user can

have at a given time without having a penalty.

The conceptual framework showed the inputs and outputs

of the study, with the aid of the data obtained from the respondents

in the questionnaires, the researchers assessed the demographic

profile, information on credit card usage, credit worthiness, ability

to pay, credit limit, interests and rewards, and satisfactory of credit

company. After analyzing the data, the researches evaluated the

efficiency and effectiveness of debt

management practices in reducing and paying off credit card

debts.

Figure 1

Credit Card Debt Practices Framework

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 6

The analysis was done through the following process: data

collection using questionnaires; clarifying statistical statements;

and data interpretation, findings, conclusions, and

recommendations.

Statement of the Problem

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 7

This study aimed to know the assessment of credit card

debt management practices of selected professionals in Las Piñas

City.

Specifically, it answered the following questions:

1. What is the profile of the respondents in terms of:

1.1 Age;

1.2 Gender;

1.3 Civil status;

1.4 Occupational sector;

1.5 Monthly income/salary;

1.6 Total credit limit?

2. What is the information on credit card usage in terms of:

2.1 Number of credit cards;

2.2 Frequency on using credit card;

2.3 Reason to apply for credit card;

2.4 Amount of payment using credit card monthly;

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 8

2.5 Reason to use credit card;

2.6 Length of credit card usage?

3. What is the extent of debt management practiced by credit

card users in terms of:

3.1 Credit worthiness;

3.2 Ability to pay;

3.3 Credit limit;

3.4 Interests and rewards;

3.5 Satisfactory on credit company?

4. Is there a significant difference in debt management practiced

by credit card users when grouped according to the profile?

Objective of the Study

There were four primary objectives of this study. First was to

determine the profile of the respondents. Second was to

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 9

know the information on credit card usage. Third was to

determine the extent of practice of debt management that are

being practiced by credit card users. Last was to ascertain

the significant difference in the assessment

of credit card debt management practices of selected

professionals in Las Piñas City.

Hypothesis

For the purpose of analyzing data, the following hypothesis

was tested.

Null:

Ho: There is no significant difference in debt management

practiced by credit card users when grouped according to the

profile.

Scope and Limitation

This study primarily focused on the assessment of credit

card debt management practices of selected

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 10

professionals. The researchers made a set of

questionnaires and was validated by the experts. Office

employees are selected as the respondents of the study.

The respondents were limited to two hundred eighty-five

credit card owners residing and working in Las Piñas City.

The credit card owner should be actively using his/her

card for at least one year. The researchers used

ANOVA test in analyzing the data and a convenience

sampling technique to the respondents in the study.

Significance of the Study

This study aims to assess the credit card debt

management practices that will benefit all current and future

credit card users.

This study will seek awareness to the users for them to

come up to the new idea on how to use their credit card properly,

so that they can avoid overspending.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 11

The results of the study will be of great benefit to the

following:

Credit card companies. As a financial institution that

lends money to the individual, this research may serve as

a guide to know the spending pattern of the consumer and

for them to know how they will improve their service to the

clients.

Credit card users. This research may guide them to

manage credit card effectively to avoid overspending and

identify the spending pattern of the credit card owners.

Future credit card users. This research may serve as a

supply of knowledge to the individuals who are interested

in using credit card as a form of payment in their

transactions.

BSA and BSAT students. This research may use as a

source of idea in their academic and research work.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 12

Future researchers. This research may use as a

reference in their research study.

Definition of Terms

Credit card - one of the main topic of this study.

Credit card debt - one of the main topic of this study.

Credit limit - one of the variables of the study to

determine the extent of practice of debt management that

concerned about the credit limit.

Credit score – a topic that was used to discuss the

related literature for this study.

Credit worthiness - one of the variables of the study to

determine the extent of practice of debt management that

concerned about the credit worthiness of credit card user.

Debt management – one of the main topic of this study

which was also used to discuss the related literature.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 13

Interest - one of the variables of the study to determine

the extent of practice of debt management that concerned about

the interest and rewards of credit cards.

Professionals – the respondents which were office

employees working in Las Piñas City.

Satisfactory on credit company - one of the variables of

the study to determine the extent of practice of debt

management that concerned about how satisfied were the credit

card users to their credit companies.

Solvency - one of the variables of the study to determine

the extent of practice of debt management that concerned about

the ability of credit card users to pay off debts.

Reviews of Related Literatures and Studies

To better understanding this research, the following works

of literature and studies discussed: debt management, credit

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 14

score, credit card industry, ways to lessen credit card debt and

credit card misconceptions.

Debt Management

According to Smith (2018), debt is a fact of life for most

nowadays. It is a mean of paying for almost everything, from

daily needs to big and expensive items like cars and houses.

Simply, debt is any amount of money that owed by one person

from another. However, debt management has a distinctive

strategy developed to help a debtor manage their debt. Due to

lack of knowledge or sometimes, the amount of debt

overwhelmed them, the debtors are unable to sufficiently

manage their debt on their own. That is why an outside company

developed a strategy on how to properly manage a debt

(WebFinance Inc, 2018).

According to (Escobar, 2016), there are effective debt

management strategies that can help people on how to manage

debt because debt is part of daily life and it can be necessary

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 15

whether to pay for education, getting a home, buying a car or

expand a business. But in some cases. Debt can easily get

people in trouble if they do not plan and take control over it. In

addition, Irby (2018) stated that there are several ways to

manage debt. First, know the person you owe and the amount

you need to settle. Make a calendar of activity that shows

schedule on when you will pay. This will help you to be more

aware about your debt. Second, settle the amount you need to

pay on time. Settling your bills on time will reduce the amount of

your debt and prevent to have interest. If you have a

smartphone, use its calendar to indicate when you will pay your

debt. This will become an alarm for you to be aware. Third, if you

cannot pay the exact amount on that day, at least pay a

minimum amount. It will keep your debt from growing but it will

let your account in good condition.

According to Guest Post (2018), when it comes to debt

the highest rate of interest are the credit cards. So in deciding

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 16

what debt is to focus on is your credit card, it is a good idea to

pay your credit card debt first. As this is the one that will cost you

the most money. Even if you cannot afford to pay off much of

your debt, you should always make the minimum payment. Once

your biggest payment has been prioritized, go through your debt

list and decide in which order they ought to be paid.

Credit Score

According to Wood (2018), credit score is a three-digit

representation which creditors use to determine the risk of

lending debtors money. This also tells them if the debtor can pay

off any debts he/she accumulates. Zoleta (2018) added that the

credit score ranges from 300 to 850, wherein 850 is the highest

rating. If the credit score is high, this means that the debtor has

sustainable income and good credit history. Majaski (2018)

stated that having a good credit score is important, especially in

certain situations. First is employment. If one is in finance or a

position that requires to handle company’s money, having a bad

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 17

credit means low chance of landing a new job. Second is lower

insurance rates. Bad credit can affect insurance rates and cost a

lot more than having good credit score. Third is qualifying for

rentals. Having poor credit makes a difficulty not just in qualifying

home mortgages, but also in rental opportunities since credit file

shows that one can have risk of not paying rent. Last is utilities.

One cannot get necessary utilities if one has credit problems.

Tan (2017) mentioned that there are factors which are

used in order to calculate credit score. These include: payment

history; the amount of credit that the debtor is still owing; length

of credit history; types of credits used; and new credit which tells

how often does the debtor apply for new credit card or loan.

Credit Card Industry

The credit card industry in the Philippines is continuously

growing because consumers because consumers now a days

are relying on using credit card for transacting and paying their

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 18

bills. Filipino consumers prefer using credit cards rather than

cash because it is more convenient and efficient (Euromonitor

report, 2016). In addition, credit card can be beneficial to the

consumer because it can earn reward in making purchase,

discounts on gas station purchase and even in emergency

situation credit card can be useful (Discover, 2018).

In spite of the popularity of electronic payment, not many

Filipino use credit card as a firm of payment because of the low

banking and credit card penetration rate in the Philippines. Credit

card users are limited mostly to the group of middle class

population in the country (Padillo, 2018).

According to Dela Cruz (2018), credit card companies

offer perks and rewards to market their credit cards. For an

instance, one will get a point in every cent that will be spent

using his/her credit card account. The owner can redeem points

in various things such as gasoline, plane tickets, or store

discounts as long as one pays on time. Some credit card

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 19

companies offer sign-up bonus for those who are in their first

time in getting a credit card as well as cash bank programs

where one can save few percent as a certain purchases

unlimitedly. There is also safety net when the owner loses

his/her card. The bank can block the card from being used within

minutes of securing report. This insurance is far safer than losing

the wallet full of cash. There are banks that offer terms to which

one is only liable for the first 2500-3000 on unauthorized

purchases, so it is hard to lose the bank number because

reporting loss and disputing charges are needed to be done as

soon as possible to prevent the deceiver in making the most out

of the hard-earned money.

Ways to Lessen Credit Card Debt

Credit card is use as a substitute to cash since it is more

convenient in paying goods or services and even for online

purchasing. Consumption becomes easier to individuals because

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 20

they do not need to carry lot of cash that could reduce the risk of

theft. However, the misuse and abuse of credit card can lead to

negative effects like failure to live up the terms of use can result

to penalties (Atienza, 2014).

There are five ways to reduce an individual’s credit card

debt. The first step is to create a budget. List down the monthly

income and expenses on a piece of paper. In this way, an

individual will determine if he/she spends more than he/she

earns. If so, then one must review the list in order to look for

areas where one can easily cut costs. Second is to reduce

monthly bills. In this step, one must review his/her monthly

statements and subscriptions. Think of some ways to reduce

home energy expenses and have money-saving options for

regular monthly services. Third is to cut down on unnecessary

purchases. Cut off some luxuries that can be avoidable such as

fast food expense. Fourth is to rethink entertainment. There are

some entertainment activities that can be done at home, like

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 21

renting DVDs instead of going to expensive movie theaters.

Lastly, reward oneself along the way. Make some goals or

milestones which can serve as progress in order to keep

motivated. However, one must remember that the reward is

within reason (Bakke, 2013). In addition to these, one must have

an emergency fund so when the emergency occurs he/she has

cash to use. Next in line is to avoid unnecessary balance

transfer. Do not miss credit card payment, he/she better pays on

time so one can avoid penalties for being late in payment. It is

also advisable to pay the balance in full every month. One must

also know the signs of credit card debt, avoid cash advances, do

not lend the credit card, understand the credit term and lastly

limit the number of his/her credit card (Irby, 2018).

Credit Card Misconceptions

According to Tepper (2016), everyone knows about credit

card but they do not actually understand. If one got a blind spot,

then he/she might do some unexpected mistakes. Furthermore,

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 22

Steele (2017) cited several misconceptions about how credit

card works. First is paying the balance in full to avoid interest.

From a practical perspective, the debtor does not incur any debt.

However, the bank will still report the current balance as debt,

even before the debtor received the statement. Next is applying

for new credit card will hurt his/her credit score. There are two

things occur which affect the credit score when one is applying

and receiving new credit card. One is a request made for credit

history, and the other is additional credit granted that lower credit

utilization ratio. Lastly, cancelling credit cards will help the card

holder’s credit. This act will work as last resort to prevent from

having more debt, but it will also hurt one’s credit score. Knowing

these facts make the card holder to have better decisions in

using credit cards.

Synthesis

Many people have been considering credit cards as a

convenient way of paying goods and services especially when

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 23

one is financial bind. Aside from this, credit cards are beneficial

in having rewards and discounts upon purchasing certain

products. However, some of the credit card users may not focus

on their debts because they think they only owe so little. Even if

they have a small debt to pay, they still have to keep up with

their payments. On the contrary, if they owe a huge amount of

debt, they need to work hard to pay off that particular obligation

the soonest time possible. In these kind of situations, debt

management is a good option to consider. They must make a list

of their debts and the details, which include the creditor, monthly

payment, total amount of debt, and the due date. By doing this,

they can refer to their list on a periodic basis including the time

they have paid their bills. The debt list can be used to prioritize

the list of debts to pay off.

Gap Analysis

A debt management plan offers a lot of benefits that will

ease one’s credit problems. It combines all your debts into a

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 24

single monthly payment and distribute it to your respective

creditors. This will help you to reduce stress and save you from

hassle. It also helps you to have lower interest rates. Creditors

often agree to suspend or reduce interest when they agree to a

debt management plan. When this happens, more of your money

will be going towards reducing your debt balance. This also

shortens the time it takes you to repay your debt. Debt

management plan ends your stressful collection calls and letters.

It also helps you to have peace of mind, regain confidence and

control over your finances.

Therefore, debt management is an effective way of

settling debts among credit card users. Credit card debts may

cause problem once they are stacked up. However, this may

easily be resolved if the individual is aware of proper debt

management.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 25

Chapter 2

Methodology

This chapter discusses the research methodologies used

to answer the research questions of the study. It defines the

projected research design, the target population, the sample

design, data collection instruments and procedures, and the

techniques for data analysis.

Research Method

The study used the descriptive research method to answer

the research question. Descriptive research is a study designed

to depict the participants in an accurate way. More simply put,

descriptive research is all about describing people who take part

in the study. The descriptive research determines the behavior of

individual in using credit cards. Also, the researchers used

comparative research method to determine if there are significant

difference exist in the assessment of credit card debt

management practices of selected professionals.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 26

Population of the Study

This study covered a total of 285 of credit card user

respondents within Las Pinas City. The researchers gathered

information at a representative sample size for the study, two-

hundred eighty-five credit card users were asked regarding in their

credit card debt management.

Sampling Design

Convenience sampling technique was used in choosing the

respondents for the study. The sampling method is a non-

probability sampling in which the researchers used to gather a

representative from a group.

Respondent of the Study

The population sample of this study was limited to two

hundred eighty-five respondents in Las Piñas City. The target

respondents were office employees that actively using a credit

card for at least one year.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 27

Data Gathering Instruments

The researchers developed a self-administered

questionnaire to gather information needed for the study with the

guide of thesis instructor. The questionnaire was used to evaluate

the formulated hypothesis and to answer research questions. The

questionnaire was composed of three parts:

The first part was the questions about the demographic

profile of the respondents. It included the age group of the

respondent, gender, civil status, occupational sector, and salary.

The statistical tool used by the researchers was frequency in order

to get the percentage.

The second part provided questions about credit card

usage. It included the number of credit cards, frequency on using

credit card, reason to apply for credit card, amount of payment,

reason to use credit card, and length of credit card usage.

Frequency was also used by the researchers as statistical tool.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 28

The third part presented questions to assess the extent of

debt management practiced by credit card users in terms of credit

worthiness, ability to pay, credit limit, interest and rewards, and

satisfactory on credit company. The factors were measured by

five-point Likert Scale with following information: 1 = Always, 2 =

Sometimes, 3 = Rarely, 4 = Never. The statistical tool that was

used was descriptive analysis, one-way ANOVA, T-test and Post

Hoc Analysist to get the results needed.

Validation of the Instrument

The researchers utilized a self-administered questionnaire

to assess the credit card debt management practices. The survey

questionnaire was validated by the research adviser before it was

distributed to the respondents.

Data Gathering Procedures

First, the researchers utilized a self-administered

questionnaire in order to assess the credit card debt management

practices.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 29

Then, the researchers seek for the target respondents.

Before conducting a survey, the researchers asked for approval

to answer the questionnaire. Once the respondent agreed, the

researchers gave out the questionnaire and allowed the

respondent to fill up independently.

Lastly, the researchers retrieved the questionnaire and

tabulated the results of each survey questions. All information that

had been gathered were organized into tabular form and were

subjected to statistical treatment before they were analyzed and

interpreted.

Data Collection

The researchers collected the data acquired from survey

questionnaires which provided by the respondents. The data

gathered were treated confidentially, hence the respondents could

rest assured that the information coming from them were used for

academic purpose only.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 30

Data Analysis

Data was analyze using descriptive data analysis, One way

ANOVA and T- Test this was used to determine whether there are

any statistically significant differences between the means of two

or more independent. Post Hoc Test was also used to determine

if there is significant difference in a specific group by use of the

relevant computer packages such as Microsoft Office Excel and

Statistical 21 Package for Social Sciences (SPSS) program.

Chapter 3

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 31

Results and Discussions

Based on the data gathered, the following are the results

of the study; said data are presented based on the sequence of

the questions in the Statement of the Problem.

1. Profile of the Respondents

The data in this section contain the gathered basic

information of the respondents and also respondent’s

occupation and salary, and some information about the

credit card holdings

Table 1.1.

Age of Respondents

Age Frequency Percentage

21 – 30 118 41.4%

31 – 40 89 31.2%

41 – 50 63 22.1%

51 – above 15 5.3%

Total 285 100.0%

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 32

1.1.Age

Table 1.1 shows that one hundred eighteen (118) or forty-

one point four percent (41.4%) are twenty-one (21) to thirty (30)

years old, eighty-nine (89) or thirty-one point two percent

(31.2%) are thirty-one (31) to forty (40) years old, sixty-three (63)

or twenty-two point one percent (22.1%) of the respondents are

forty-one (41) to fifty (50) years old, and fifteen (15) or five point

three percent (5.3%) of the respondents are fifty-one (51) years

old and above.

The data show that respondents aged from 21 to 30 years

obtained the highest frequency, while the respondents aged 51

years and above obtained the lowest frequency. According to

Mogo (2018), credit card become more convenient form of

payment at the age of 25.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 33

Table 1.2.

Gender of Respondents

Gender Frequency Percentage

Male 138 48.4%

Female 147 51.6%

Total 285 100.0%

1.1.Gender

Table 1.2 shows that one hundred thirty-eight (138) or

forty-eight point four percent (48.4%) of the respondents are

male, and one hundred forty-seven (147) or fifty-one point six

percent (51.6%) of the respondents are female.

The data show that female respondents obtained the

highest frequency, while the male respondents obtained the

lowest frequency. According to Welsh (2017), female makes a lot

of purchase using credit card.

Table 1.3.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 34

Civil Status of Respondents

Civil Status Frequency Percentage

Single 173 60.7%

Married 112 39.3%

Total 285 100.0%

1.2.Civil Status

Table 1.3 shows that one hundred seventy-three (173) or

sixty point seven percent (60.7%) of the respondents are single,

while one hundred twelve (112) or thirty-nine point three percent

(39.3%) of the respondents are married.

The data show that the respondents who are single

obtained the highest frequency, while the respondents who are

married obtained the lowest frequency. According to Joifin

(2017), single individuals have more freedom in spending

money. They do not have the same level of responsibilities

compared to married individuals.

Table 1.4.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 35

Occupational Sector of Respondents

Occupational Frequency Percentage

Sector

Private 216 75.8%

Government 36 12.6%

Self-employed 33 11.6%

Total 285 100.0%

1.1.Occupational Sector

Table 1.4 shows that two hundred sixteen (216) or seventy-

five point eight percent (75.8%) of the respondents are working on

private sectors, thirty-six (36) or twelve point six percent (12.6%)

of the respondents are working in the government, and thirty-three

(33) or eleven point six percent (11.6%) of the respondents are

self-employed.

The data show that the respondents working on private

sector obtained the highest frequency, while the respondents that

are self-employed obtained the lowest frequency. According to

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 36

Johnson (2018), credit card is used as a form of payment and it

has a lot of benefit.

Table 1.5.

Monthly Salary of Respondents

Monthly Salary Frequency Percentage

₱ 10 000 – 30 000 101 35.4%

₱ 31 000 – 50 000 83 29.1%

₱ 51 000 – 70 000 70 24.6%

₱ 71 000 or above 31 10.9%

Total 285 100.0%

1.1.Monthly Salary

Table 1.5 shows that one hundred one (101) or thirty-five

point four percent (35.4%) of the respondents have monthly salary

of ten thousand pesos (₱ 10 000) to thirty thousand pesos (₱ 30

000), eighty- three (83) or twenty-nine point one percent (29.1%)

of the respondents have monthly salary of thirty-one thousand

pesos (₱ 31 000) to fifty thousand pesos (₱ 50 000), seventy (70)

or twenty-four point six percent (24.6%) of the respondents have

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 37

monthly salary of fifty-one thousand pesos (₱ 51 000) to seventy

thousand pesos (₱ 70 000), and thirty-one (31) or ten point nine

percent (10.9%) of the respondents have monthly salary of

seventy-one thousand pesos (₱ 71 000) and above.

The data show that the respondents who have monthly

salary of ten thousand pesos (₱ 10 000) to thirty thousand pesos

(₱ 30 000) obtained the highest frequency, while the respondents

who have monthly salary of fifty-one thousand pesos (₱ 51 000)

to seventy thousand pesos (₱ 70 000) obtained the lowest

frequency. According to Adrian (2017), having a source of income

is a requirement in having credit card. Many credit card companies

offer a low monthly income requirements.

Table 1.6.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 38

Total Credit Limit of Respondents

Total Credit Limit Frequency Percentage

₱ 51 000 – 100 000 174 61.1%

₱ 10 000 – 50 000 67 23.5%

₱ 101 000 or above 44 15.4%

Total 285 100.0%

1.1. Total Credit Limit

Table 1.6 shows that one hundred seventy four (174) or

sixty-one point one percent (61.1%) of the respondents have

credit limit of ten thousand pesos (₱ 10 000) to fifty thousand

pesos (₱ 50 000), sixty-seven (67) or twenty-three point five

percent (23.5%) of the respondents have credit limit of fifty-one

thousand pesos (₱ 51 000) to one hundred thousand pesos (₱

100 000), and forty-four (44) or fifteen point four percent (15.4%)

of the respondents have credit limit of one hundred one thousand

pesos (₱ 101 000) and above.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 39

The data show that the respondents who have credit limit of

ten thousand pesos (₱ 51 000) to fifty thousand pesos (₱ 100 000)

obtained the highest frequency, while the respondents who have

credit limit of one hundred one thousand pesos (₱ 101 000) and

above obtained the lowest frequency. According to Zoleta (2018),

it depends on the credit score of the consumer how much is the

credit limit.

2. Information on Credit Card Usage

The data in this section contains the information of the

respondents regarding their credit card usage, such as the

number of credit cards, frequency of utilization, amount

spending, reason to apply for credit card and length of card

holding.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 40

Table 2.1.

Number of Credit Cards

Number of Credit Cards Frequency Percentage

1–2 227 79.6%

3–4 47 16.5%

5 – 10 11 3.9%

Total 285 100.0%

2.1.Number of Credit Cards

Table 2.1 shows that two hundred twenty seven (227) or

seventy-nine point six percent (79.6%) of the respondents have

one (1) to two (2) credit cards, forty-seven (47) or sixteen point

five percent (16.5%) of the respondents have three (3) to four (4)

credit cards, and eleven (11) or three point nine percent (3.9%) of

the respondents have five (5) to ten (10) credit cards.

The data show that respondents who have one (1) to two

(2) credit cards obtained the highest frequency, while the

respondents who have five (5) to ten (10) credit cards obtained

the lowest frequency. According to Konsko (2018), having one or

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 41

two credit card is beneficial in order to easily keep track of your

spending.

Table 2.2.

Frequency on Using Credit Card

Frequency on Using Credit Card Frequency Percentage

Everyday 16 5.6%

2 – 6 times a week 57 20.0%

Never 0 0%

Once a month 100 35. 1%

2 – 3 times a month 112 39.3%

Total 285 100.0%

2.2.Frequency on Using Credit Card

Table 2.2 shows that sixteen (16) or five point six percent

(5.6%) of the respondents use credit cards everyday, fifty-seven

(57) or twenty percent (20%) of the respondents use credit cards

two (2) to six (6) times a week, one hundred (100) or thirty-five

point one percent (35.1%) of the respondents use credit cards

once a month, and one hundred twelve (112) or thirty-nine point

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 42

three percent (39.3%) of the respondents use credit cards two (2)

to three (3) times a month.

The data show that respondents who use their credit card

two (2) to three (3) times a month obtained the highest frequency,

while respondents who use credit cards everyday obtained the

lowest frequency. According to Campbell (2018), credit card can

help in emergency situations.

Table 2.3.

Reason to Apply for Credit Card

Reason to Apply for Credit Card Frequency Percentage

Discounts 83 29.1%

Free Gifts 10 3.5%

Convenience as payment 105 36.8%

Other reason(s) 87 30.5%

Total 285 100.0%

2.3.Reason to Apply for Credit Card

Table 2.3 shows that eighty-three (83) or twenty-nine point

one percent (29.1%) of the respondents apply credit card in order

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 43

to get discounts during shopping, ten (10) or three point five

percent (3.5%) of the respondents apply for credit card to get free

gifts, one hundred five (105) or thirty-six point eight percent

(36.8%) of the respondents apply because credit card is

convenient to make payments, and eighty-seven (87) or thirty

point five percent (30.5%) of the respondents have other reasons.

The data show that respondents who apply for credit card

because it is convenient to make payments obtained the highest

frequency, while the respondents who apply for credit card in

order to get free gifts obtained the lowest frequency. According to

Irby (2018), online purchase is more convenient it easier to the

consumer to buy items.

Table 2.4.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 44

Amount of Payment Using Credit Card Monthly

Amount of Payment Using Credit Card Frequency Percentage

Below ₱ 10 000 157 55.1%

₱ 11 000 – 20 000 65 22.8%

₱ 21 000 – 30 000 35 12.3%

₱ 31 000 and above 28 9.8%

Total 285 100.0%

2.4. Amount of Payment Using Credit Card Monthly

Table 2.4 shows that one hundred fifty seven (157)

or fifty-five point one percent (55.1%) of the respondents

spend below ten thousand pesos (₱ 10 000), sixty-five (65)

or twenty-two point eight percent (22.8%) of the

respondents spend eleven thousand pesos (₱ 11 000) to

twenty thousand pesos (₱ 20 000), thirty-five (35) or twelve

point three percent (12.3%) spend twenty-one thousand

pesos (₱ 21 000) to thirty thousand pesos (₱ 30 000), and

twenty-eight (28) or nine point eight percent (9.8%) spend

thirty-one thousand pesos (₱ 31 000) and above.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 45

The data show that respondents who spend below

ten thousand pesos (₱ 10 000) obtained the highest

frequency, while the respondents who spend thirty-one

thousand pesos (₱ 31 000) and above obtained the lowest

frequency. According to Peterson (2018), the willingness to

pay using credit card is depend on the spending habit of

the consumer.

Table 2.5.

Reason to Use Credit Card

Reason to Use Credit Card Frequency Percentage

Travel 64 22.5%

Groceries 96 33.7%

Medical 3 1.1%

Insurance 4 1.4%

Entertainment 11 3.9%

Meals 4 1.4%

Utilities 38 13.3%

Online Shopping 65 22.8%

Total 285 100.0%

2.5. Reason to Use Credit Card

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 46

Table 2.5 shows that sixty-four (64) or twenty-two point five

percent (22.5%) of the respondents use credit card for travel,

ninety-six (96) or thirty-three point seven percent (33.7%) of the

respondents use it for groceries, three (3) or one point one percent

(1.1%) use it for medical purpose, four (4) or one point four percent

(1.4%) use it on insurance, eleven (11) or three point nine percent

(3.9%) of the respondents use it on entertainment, four (4) or one

point four percent (1.4%) use it on paying meals, thirty-eight (38)

or thirteen point three percent (13.3%) use credit card for utilities,

and sixty-five (65) or twenty-two point eight percent (22.8%) of the

respondents use credit card on online shopping.

The data show that respondents who use credit card on

groceries obtained the highest frequency, while the respondents

who use credit card on medical purpose obtained the lowest

frequency. According to Egan (2018), purchase in groceries can

help maximize rewards.

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 47

Table 2.6.

Length of Credit Card Usage

Length of Credit Card Usage Frequency Percentage

1 – 3 years 144 50.5%

4 – 6 years 93 32.6%

More than 7 years 48 16.8%

Total 285 100.0%

2.6.Length of Credit Card Usage

Table 2.6 shows that one hundred forty-four (144) or fifty

point five percent (50.5%) of the participants have been using

credit card for one (1) to three (3) years, ninety-three (93) or thirty-

two point six percent (32.6%) have been using credit card for four

(4) to six (6) years, and forty-eight (48) or sixteen point eight

percent (16.8%) have been using it for more than seven (7) years.

The data show that participants who have been using credit card

for one (1) to three (3) years obtained the highest frequency, while

participants who have been using credit card for more than seven (7)

years obtained the lowest frequency. According to Zoleta (2018),

College of Business Administration and Accountancy

University of Perpetual Help System Dalta Page |

Las Piñas Campus 48

credit companies offer a credit card with the consumer that just