Professional Documents

Culture Documents

Indian Energy Exchange Limited

Indian Energy Exchange Limited

Uploaded by

hamsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Energy Exchange Limited

Indian Energy Exchange Limited

Uploaded by

hamsCopyright:

Available Formats

Indian Energy Exchange Limited

Corporate Identification Number: L74999DL2007PLC277039

Registered Office: Unit No. 3, 4, 5 & 6, Fourth Floor, TDI Centre Plot No. 7, District Centre, Jasola, New Delhi 110 025

Tel.: +91 (11) 4300 4000; Fax: +91 (11) 4300 4015; E-mail: compliance@iexindia.com;

Website: www.iexindia.com; Contact Person: Mr. Vineet Harlalka, CFO, Company Secretary and Compliance Officer

POST-BUYBACK PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF ELIGIBLE SHAREHOLDERS/

BENEFICIAL OWNERS OF EQUITY SHARES OF INDIAN ENERGY EXCHANGE LIMITED

This post-buyback public announcement (the “Post Buyback Public Announcement”) is being made pursuant to the provisions of Regulation 24(vi) of the

Securities and Exchange Board of India (Buy Back of Securities) Regulations, 2018 (the “Buyback Regulations”). This Post Buyback Public Announcement

should be read in conjunction with the Public Announcement dated February 1, 2019 which was published on February 4, 2019 (the “Public Announcement”) and

the Letter of Offer dated March 11, 2019 (the “Letter of Offer”). The terms used but not defined in this Post Buyback Public Announcement shall have the same

meaning as assigned to such terms in the Public Announcement and the Letter of Offer.

1. THE BUYBACK

1.1 Indian Energy Exchange Limited (“Company”) had announced the Buyback of not exceeding 37,29,729 (Thirty Seven Lakhs Twenty Nine Thousand Seven

Hundred Twenty Nine) fully paid-up equity shares of face value of `1 each (“Equity Shares”) from all the existing shareholders / beneficial owners of Equity

Shares as on the record date (i.e. Friday, February 15, 2019), on a proportionate basis, through the “Tender Offer” route at a price of `185 (Rupees One

Hundred Eighty Five only) per Equity Share payable in cash for an aggregate consideration not exceeding `69,00,00,000 (Rupees Sixty Nine Crores Only)

(“Buyback Offer Size”). The Buyback Offer Size represents 24.97% of the aggregate of the fully paid-up share capital and free reserves, as per the audited

financial statements of the Company for the financial year ended March 31, 2018 and is within the statutory limits of 25% of the aggregate of the fully paid-up

share capital and free reserves as per the audited accounts of the Company for the financial year ended March 31, 2018. The number of Equity Shares bought

back in the Buyback constitutes 1.25% of the post-Buyback equity share capital of the Company.

1.2 The Company has adopted the ‘Tender Offer’ route for the purpose of Buyback. The Buyback was implemented using the “Mechanism for acquisition of shares

through Stock Exchange pursuant to Tender-Offers under Takeovers, Buyback and Delisting” notified by SEBI vide circular CIR/CFD/POLICYCELL/1/2015

dated April 13, 2015 read with SEBI circular CFD/DCR2/CIR/P/2016/131 dated December 9, 2016 (“SEBI Circulars”) and notice issued by BSE Limited bearing

number 20170202-34 dated February 2, 2017, each as may be amended from time to time.

1.3 The Buyback Offer opened on Friday, March 22, 2019 and closed on Thursday, April 4, 2019.

2. DETAILS OF BUYBACK

2.1 The total number of Equity Shares bought back under the Buyback Offer are 37,29,729 (Thirty Seven Lakhs Twenty Nine Thousand Seven Hundred Twenty

Nine) Equity Shares at a price of `185 (Rupees One Hundred Eighty Five only) per Equity Share.

2.2 The total amount utilized in the Buyback of Equity Shares is `68,99,99,865 (Rupees Sixty Eight Crores Ninety Nine Lakhs Ninety Nine Thousand Eight Hundred

and Sixty Five Only) excluding Transaction Costs.

2.3 The Registrar to the Buyback i.e. Karvy Fintech Private Limited (formerly, KCPL Advisory Services Private Limited) (the “Registrar”) considered 18,292 valid

bids for 4,72,98,160 (Four Crore Seventy Two Lakhs Ninety Eight Thousand One Hundred and Sixty) Equity Shares in response to the Buyback, resulting in the

subscription of approximately 12.68 times the maximum number of Equity Shares proposed to be bought back. The details of valid bids received by the Registrar

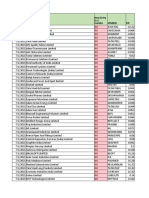

in the Buyback Offer# are as follows:

Category of Investor No. of Equity Shares No. of Valid Total Equity Shares % Response

reserved in the Buyback Bids Validly Tendered

General category 31,70,269 642 4,54,01,972 1,432.12

Reserved category 5,59,460 17,650 18,96,188 338.93

Total 37,29,729 18,292 4,72,98,160 1268.14

#As per the minutes of acceptance dated April 8, 2019 received from Karvy Fintech Private Limited (formerly, KCPL Advisory Services Private Limited).

Note: Out of 18,96,188 Equity Shares validly tendered by Small Shareholders, a total of 5,59,460 Equity Shares have been accepted in full including Equity

Shares accepted based on their entitlement and additional Equity Shares tendered which have been accepted on a proportionate basis. As regards Equity

Shares tendered by Shareholders in the General Category, the validly tendered Equity Shares as per the entitlement have been accepted and the additional

Equity Shares tendered by them over and above their Buyback Entitlement, have been accepted on a proportionate basis. Accordingly, out of 4,54,01,972 Equity

Shares validly tendered by the Shareholders in General Category, 31,70,269 Equity Shares have been accepted for the Buyback Offer.

2.4 All valid bids have been considered for the purpose of Acceptance in accordance with the Buyback Regulations, Public Announcement and the Letter of

Offer. The communication of acceptance / rejection has been dispatched (through e-mail and/or physical mode) by the Registrar to the Buyback to respective

Shareholders on or around April 12, 2019.

2.5 The settlement of all valid bids was completed by the Clearing Corporation on April 10, 2019. For the Equity Shares accepted under the Buyback, the Eligible

Shareholder will receive funds payout in their settlement bank account from the Clearing Corporation. If the Eligible Shareholder bank account details were

not available or if the funds transfer instruction were rejected by RBI/respective bank, due to any reason, then such funds were transferred to the concerned

Shareholder Broker for onward transfer to their respective Eligible Shareholder.

2.6 The Equity Shares accepted under the Buyback have been transferred to the Company’s demat escrow account on April 10, 2019. The unaccepted Equity

Shares shall be returned to respective Shareholder/Shareholder Brokers / custodians by the Clearing Corporation on or before April 15, 2019. Pursuant to the

LODR Amendment, the Equity Shares held in physical form by the Eligible Shareholders, have not been considered for the Buyback.

2.7 The extinguishment of 37,29,729 Equity Shares accepted under the Buyback has been completed on April 11, 2019. The Company and its directors accept full

responsibility for the information contained in this Post Buyback Public Announcement and also accept responsibility for the obligations of the Company laid

down under the Buyback Regulations.

3. CAPITAL STRUCTURE AND SHAREHOLDING PATTERN

3.1 The capital structure of the Company, pre and post-Buyback Offer is as under:

(Equity Shares have a face value of ` 1 each)

Particulars Pre-Buyback Post-Buyback#

No. of Equity Shares Amount (` in lakhs) No. of Equity Shares Amount (` in lakhs)

Authorized share capital 40,25,00,000 4,025.00 40,25,00,000 4,025.00

Issued, subscribed and paid-up 30,32,86,240 3,032.86 29,95,56,511 2,995.57

share capital

#Post extinguishment of 37,29,729 Equity Shares

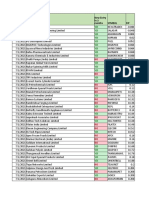

3.2. The details of the Shareholders / beneficial owners from whom Equity Shares exceeding 1% of the total Equity Shares bought back have been accepted for

Buyback Offer are as mentioned below:

S. Name of the Shareholder No. of Equity Equity Shares accepted Equity Shares accepted as

No. Shares accepted as a % of total Equity a % of total post-Buyback

under the Buyback Shares bought back Equity Shares

1. TVS Shriram Growth Fund 1B LLP 3,25,269 8.72 0.11

2. DCB Power Ventures Limited 3,25,269 8.72 0.11

3. Rural Electrification Corporation Limited 2,28,789 6.13 0.08

4. TVS Shriram Growth Fund 1B LLP 1,66,919 4.48 0.06

5. Agri Power and Engineering Solutions Private Limited 1,66,585 4.47 0.06

6. Pabrai Investment Fund 3 Limited 1,62,760 4.36 0.05

7. Vantage Equity Fund 1,30,227 3.49 0.04

8. IIFL Special Opportunities Fund - Series 4 1,22,120 3.27 0.04

9. Dhandho Holdings LP 1,13,755 3.05 0.04

10. IIFL Special Opportunities Fund - Series 2 1,10,946 2.97 0.04

11. Siguler Guff NJDM Investment Holdings Limited 1,00,971 2.71 0.03

12. The Pabrai Investment Fund II LP 82,555 2.21 0.03

13. IIFL Special Opportunities Fund - Series 5 77,824 2.09 0.03

14. SBI Life Insurance Company Limited 75,152 2.01 0.03

15. India Whizdom Fund 59,058 1.58 0.02

16. The Pabrai Investment Fund IV LP 58,225 1.56 0.02

17. Dhandho India Zero Fee Fund L.P 55,611 1.49 0.02

18. SG BRIC III Trading LLC 53,646 1.44 0.02

19. IIFL Special Opportunities Fund 50,437 1.35 0.02

20. IIFL Special Opportunities Fund - Series 3 49,869 1.34 0.02

21. Dhandho India Zero Fee Fund Offshore Limited 43,328 1.16 0.01

22. SBI Magnum Multicap Fund 41,812 1.12 0.01

23. Dhandho Holdings Qualified Purchaser LP 41,536 1.11 0.01

24. India Small and Mid Cap Gems Fund 38,725 1.04 0.01

3.3. The shareholding pattern of the Company pre-Buyback (as on Record Date i.e. Friday, February 15, 2019) and post-Buyback, is as under:

Particulars Pre-Buyback Post-Buyback#

No. of Equity Shares % of the existing equity No. of Equity % of the post-Buyback

share capital Shares equity share capital

Promoters Nil N.A. Nil N.A.

Foreign Investors (including Non Resident 11,62,74,168 38.34%

Indians, FPIs and Foreign Mutual Funds)

Financial Institutions / Banks / Mutual Funds 3,82,18,877 12.60% 29,95,56,511 100.00%

promoted by Banks / Institutions

Others (public, public bodies corporate etc.) 14,87,93,195 49.06%

Total 30,32,86,240 100.00% 29,95,56,511 100.00%

#Post extinguishment of 37,29,729 Equity Shares

4. MANAGER TO THE BUYBACK OFFER

IIFL HOLDINGS LIMITED

10th Floor, IIFL Centre, Kamala City, Senapati Bapat Marg, Lower Parel (West), Mumbai 400 013

Contact Person: Mr. Sachin Kapoor/ Ms. Nishita Mody, Tel: +91 (22) 4646 4600, Fax: +91 (22) 2493 1073

Email: iex.buyback@iiflcap.com, Website: www.iiflcap.com

SEBI Registration Number: MB/INM000010940

Validity Period: Permanent Registration

CIN: L74999MH1995PLC093797

5. DIRECTORS’ RESPONSIBILITY

As per Regulation 24(i)(a) of the Buyback Regulations, the Board of Directors of the Company accept full responsibility for the information contained in this Post-Buyback

Public Announcement and confirm that the information in this Post-Buyback Public Announcement contains true, factual and material information and does not contain any

misleading information.

For and on behalf of

the Board of Directors of Indian Energy Exchange Limited

Sd/- Sd/- Sd/-

Satyanarayan Goel Mahendra Singhi Vineet Harlalka

Managing Director and Chief Executive Officer Non-Executive Director CFO, Company Secretary and Compliance Officer

DIN: 02294069 DIN: 00243835 Membership Number: A16264

Date: April 11, 2019

Place: New Delhi

You might also like

- The Growing Importance of Fund Governance - ILPA Principles and BeyondDocument3 pagesThe Growing Importance of Fund Governance - ILPA Principles and BeyondErin GriffithNo ratings yet

- GICS Sector Classification HandbookDocument26 pagesGICS Sector Classification HandbookAndrewNo ratings yet

- POSTOff ADVDocument1 pagePOSTOff ADVPrakash MishraNo ratings yet

- Post Buyback Public Announcement For The Attention of Equity Shareholders/ Beneficial Owners of Equity Shares of Coral India Finance and Housing LimitedDocument1 pagePost Buyback Public Announcement For The Attention of Equity Shareholders/ Beneficial Owners of Equity Shares of Coral India Finance and Housing LimitedJeetSoniNo ratings yet

- Buy-Back of SharesDocument11 pagesBuy-Back of Sharesatul486100% (3)

- 2023 - Hedge Funds, NAV and TaxationDocument54 pages2023 - Hedge Funds, NAV and TaxationChriselle D'souzaNo ratings yet

- On Buy Back of ShareDocument30 pagesOn Buy Back of Shareranjay260No ratings yet

- General Instructions For Filling Up The ApplicationDocument3 pagesGeneral Instructions For Filling Up The Applicationanuj kumarNo ratings yet

- Far410 Chapter 4 EquityDocument34 pagesFar410 Chapter 4 EquityAQILAH NORDINNo ratings yet

- MeaningDocument19 pagesMeaningSrusti ParekhNo ratings yet

- Post Buy Back Offer (Company Update)Document2 pagesPost Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Shares and DebenturesDocument22 pagesShares and DebenturesDivisha AgarwalNo ratings yet

- Share Valuation - 1 PDFDocument7 pagesShare Valuation - 1 PDFbonnie.barma2831100% (1)

- Buy Back of SharesDocument40 pagesBuy Back of Sharesshrey1240% (1)

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- Buyback (Suraj JK)Document30 pagesBuyback (Suraj JK)Siddharth BhagatNo ratings yet

- Reen HOE PtionDocument4 pagesReen HOE Ptionsanjana sethNo ratings yet

- 1341 Hao TianDocument8 pages1341 Hao TianTommy ChengNo ratings yet

- Financial Year Ended270820211623Document6 pagesFinancial Year Ended270820211623SOMNATH DHEMARENo ratings yet

- Chapter 2 - Shares and Share Capital: Assets/Liabilities Amount (INR)Document7 pagesChapter 2 - Shares and Share Capital: Assets/Liabilities Amount (INR)Daksh GandhiNo ratings yet

- The Law of Corporate Finance & Securities RegulationDocument26 pagesThe Law of Corporate Finance & Securities Regulationchandni.ambaniandassociatesNo ratings yet

- Assignment 01Document13 pagesAssignment 01javieriakhan674No ratings yet

- DIL Limited: Public AnnouncementDocument1 pageDIL Limited: Public AnnouncementKamlesh MahajanNo ratings yet

- Shares and DebenturesDocument20 pagesShares and DebenturesVíshál RánáNo ratings yet

- Buy Back of Share CapitalDocument27 pagesBuy Back of Share CapitalaveyibanayihaiNo ratings yet

- Chapter 2 - Shares and Share CapitalDocument10 pagesChapter 2 - Shares and Share CapitalDaksh GandhiNo ratings yet

- Corpo Lecture With Exercises BDocument10 pagesCorpo Lecture With Exercises BFatima GuevarraNo ratings yet

- Buy Back of SharesDocument16 pagesBuy Back of SharesKritika KapoorNo ratings yet

- Handout On Chapter 12 Corporations PDFDocument9 pagesHandout On Chapter 12 Corporations PDFJeric TorionNo ratings yet

- F) Maintenance of CapitalDocument2 pagesF) Maintenance of CapitalMK YEENo ratings yet

- Acyfar - SheDocument69 pagesAcyfar - ShelayssliliaNo ratings yet

- Chapter 10 Equity Part 2Document27 pagesChapter 10 Equity Part 2LEE WEI LONGNo ratings yet

- D0683SP Ans2Document18 pagesD0683SP Ans2Tanmay SanchetiNo ratings yet

- Question Bank - Third Sem B.com Computer Applications & TaxationDocument47 pagesQuestion Bank - Third Sem B.com Computer Applications & TaxationsnehaNo ratings yet

- Tybcom - Share NotesDocument749 pagesTybcom - Share NotesManojj21No ratings yet

- Buy BackDocument3 pagesBuy BackSouvik BhowalNo ratings yet

- Share Capital and SharesDocument8 pagesShare Capital and SharesmathibettuNo ratings yet

- Tus NewDocument21 pagesTus NewAnket SharmaNo ratings yet

- Birla MedspaDocument4 pagesBirla MedspaGaurav SharmaNo ratings yet

- CH 1 - Issue of SharesDocument44 pagesCH 1 - Issue of Shares21BCO097 ChelsiANo ratings yet

- Amity University Rajasthan: Brief Description On SharesDocument7 pagesAmity University Rajasthan: Brief Description On SharesSahida ParveenNo ratings yet

- Buy Back of SharesDocument17 pagesBuy Back of SharesMegha KorlurNo ratings yet

- Rights Issue My NotesDocument5 pagesRights Issue My Notesfriendsforever3405No ratings yet

- Nature of Treasury SharesDocument4 pagesNature of Treasury SharesMae SampangNo ratings yet

- Company Acc Unit 4Document33 pagesCompany Acc Unit 4Megha DevanpalliNo ratings yet

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Document10 pages1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatNo ratings yet

- Answer Paper 4Document18 pagesAnswer Paper 4SomeoneNo ratings yet

- Corporate Law PSDA: Submitted ToDocument7 pagesCorporate Law PSDA: Submitted ToharshkumraNo ratings yet

- 67187bos54090 Cp10u2Document45 pages67187bos54090 Cp10u2Ashutosh PandeyNo ratings yet

- SPCM Unit 3 Bba II TMV NotesDocument11 pagesSPCM Unit 3 Bba II TMV NotesRaghuNo ratings yet

- UNIT 4: Company Accounts-Share CapitalDocument13 pagesUNIT 4: Company Accounts-Share CapitalpraveentyagiNo ratings yet

- DividendDocument28 pagesDividendJagadish TangiralaNo ratings yet

- Corpo LectureDocument7 pagesCorpo LectureFrancesca HernandezNo ratings yet

- PartiesDocument23 pagesPartieslakshaycool.upesNo ratings yet

- Schedule 17 Significant Accounting Policies 1. General Basis of PreparationDocument6 pagesSchedule 17 Significant Accounting Policies 1. General Basis of PreparationDuma DumaiNo ratings yet

- Cre MemoDocument9 pagesCre MemoAayush SoniNo ratings yet

- Share Capital, Share and MembershipDocument17 pagesShare Capital, Share and Membershipakashkr619No ratings yet

- Blaine Kitchenware Inc PDFDocument13 pagesBlaine Kitchenware Inc PDFpatriciolivares3009No ratings yet

- Lesson 4 Shareholders Rights and ResponsibilitiesDocument13 pagesLesson 4 Shareholders Rights and ResponsibilitiesNazia SyedNo ratings yet

- C31 Yyvjwn4scfo7w8oo.2Document12 pagesC31 Yyvjwn4scfo7w8oo.2Shehani ThilakshikaNo ratings yet

- Company AccountsDocument41 pagesCompany AccountsNisarga T DaryaNo ratings yet

- Why Inflation Matters ?: Rohit ChauhanDocument9 pagesWhy Inflation Matters ?: Rohit ChauhanhamsNo ratings yet

- Som Distilleries & Breweries LimitedDocument7 pagesSom Distilleries & Breweries LimitedhamsNo ratings yet

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageDocument13 pagesHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsNo ratings yet

- Date Mcap Rank Quality Momentu M RankDocument23 pagesDate Mcap Rank Quality Momentu M RankhamsNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- Sumitomo Chemicals: CRAMS Offers Strong Visibility AheadDocument7 pagesSumitomo Chemicals: CRAMS Offers Strong Visibility AheadhamsNo ratings yet

- Yes Yes Yes Yes Yes Yes YesDocument5 pagesYes Yes Yes Yes Yes Yes YeshamsNo ratings yet

- Investment Banking: Kotak Mahindra Capital Company LimitedDocument3 pagesInvestment Banking: Kotak Mahindra Capital Company LimitedhamsNo ratings yet

- No No No No No No No No No No No No No No NoDocument3 pagesNo No No No No No No No No No No No No No NohamsNo ratings yet

- Index 12jul2021Document76 pagesIndex 12jul2021hamsNo ratings yet

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESDocument6 pagesDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsNo ratings yet

- AIR INDIA - Concessionary FareDocument2 pagesAIR INDIA - Concessionary FarehamsNo ratings yet

- Top50 Quality Jul21Document12 pagesTop50 Quality Jul21hamsNo ratings yet

- Oppositional Defiant Disorder: A Case of Platinum MetallicumDocument6 pagesOppositional Defiant Disorder: A Case of Platinum MetallicumhamsNo ratings yet

- Australian Flora and FaunaDocument12 pagesAustralian Flora and FaunahamsNo ratings yet

- Suspected COVID 19 Patients in Emergency Department: HRCT Chest and CO-RADS Classification System, A Pictorial ReviewDocument5 pagesSuspected COVID 19 Patients in Emergency Department: HRCT Chest and CO-RADS Classification System, A Pictorial ReviewhamsNo ratings yet

- Broyhill Portfolio Update 2020.Q3 PDFDocument49 pagesBroyhill Portfolio Update 2020.Q3 PDFhamsNo ratings yet

- Renewal Notice PrintDocument1 pageRenewal Notice PrinthamsNo ratings yet

- MH-weekly VCP - RANGE V2, Technical Analysis ScannerDocument6 pagesMH-weekly VCP - RANGE V2, Technical Analysis ScannerhamsNo ratings yet

- Top50-Quality-Jul21 - 601 - 1100Document12 pagesTop50-Quality-Jul21 - 601 - 1100hamsNo ratings yet

- Australian Flora and FaunaDocument12 pagesAustralian Flora and FaunahamsNo ratings yet

- MSG - 30 - 25177 - E-Calendar For The Academic Year 2021-22Document1 pageMSG - 30 - 25177 - E-Calendar For The Academic Year 2021-22hamsNo ratings yet

- Mi - ST - ATH: Invest in This Smallcase HereDocument1 pageMi - ST - ATH: Invest in This Smallcase HerehamsNo ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Simplified Business Plan On GOAT Production: By: Maisara P MarfilDocument8 pagesSimplified Business Plan On GOAT Production: By: Maisara P MarfilMoris MarfilNo ratings yet

- Examining The Effectiveness of Fundamental Analysis in A Long-Term Stock PortfolioDocument9 pagesExamining The Effectiveness of Fundamental Analysis in A Long-Term Stock PortfolioBlue BeansNo ratings yet

- Exchange Rate BasicsDocument33 pagesExchange Rate BasicsYNo ratings yet

- 1.what Is GDR?Document2 pages1.what Is GDR?btamilarasan88No ratings yet

- Thebullishtrader Candlestick PatternDocument30 pagesThebullishtrader Candlestick PatternAdvick Manis100% (2)

- Economic Diversification in BotswanaDocument6 pagesEconomic Diversification in BotswanaKgotla MmusiNo ratings yet

- LN06Brooks671956 02 LN06Document61 pagesLN06Brooks671956 02 LN06nightdazeNo ratings yet

- Ba 7026 BFSMDocument4 pagesBa 7026 BFSMRamalingam ChandrasekharanNo ratings yet

- ICB Structure and CodesDocument11 pagesICB Structure and CodesSuhailNo ratings yet

- Financial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsDocument22 pagesFinancial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsMOVIEZ FUNDANo ratings yet

- CBCS 3.3.1 Indian Financial System 2020Document2 pagesCBCS 3.3.1 Indian Financial System 2020Bharath MNo ratings yet

- Securities Regulation Code CA51025 PDFDocument31 pagesSecurities Regulation Code CA51025 PDFKiana FernandezNo ratings yet

- Module 3 Financial Statements Anlysis NotesDocument38 pagesModule 3 Financial Statements Anlysis NotesmercyvienhoNo ratings yet

- FINMARDocument28 pagesFINMARrou ziaNo ratings yet

- T7 - ABFA1153 (Extra)Document3 pagesT7 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Chapter 17. Multinational Cost of Capital and Capital StructureDocument26 pagesChapter 17. Multinational Cost of Capital and Capital StructureFaiz1000100% (11)

- AFM Mock C - Answers S22Document19 pagesAFM Mock C - Answers S22chamundihariNo ratings yet

- Chapter 15 EquityDocument67 pagesChapter 15 EquityRiska Novitasari100% (1)

- Capital Structure and LeverageDocument8 pagesCapital Structure and LeverageasunaNo ratings yet

- Introduction To Financial EngineeringDocument11 pagesIntroduction To Financial EngineeringjoysamuelNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- Tests of The CAPM and The Fama-French MethodologyDocument23 pagesTests of The CAPM and The Fama-French MethodologyjamilkhannNo ratings yet

- Topic 2: The Philippine Financial SystemDocument5 pagesTopic 2: The Philippine Financial SystemTherese PacuñoNo ratings yet

- Chapter 14 - AnswerDocument24 pagesChapter 14 - AnswerAgentSkySky100% (1)

- Bounty Farms - Financial Data - Sheridan PawlowskiDocument6 pagesBounty Farms - Financial Data - Sheridan Pawlowskiapi-344403060No ratings yet

- Project On Pepsico PerformanceDocument68 pagesProject On Pepsico Performancerahul mehtaNo ratings yet

- Tugas 2 Analisis Informasi Keuangan PDFDocument4 pagesTugas 2 Analisis Informasi Keuangan PDFIkhwan AkhirudinNo ratings yet