Professional Documents

Culture Documents

Reliance Power IPO Angel BRKNG

Reliance Power IPO Angel BRKNG

Uploaded by

Anish NairOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reliance Power IPO Angel BRKNG

Reliance Power IPO Angel BRKNG

Uploaded by

Anish NairCopyright:

Available Formats

TM

Angel Broking

Service Truly Personalized India Research

Reliance Power Neutral

Girish P Solanki Rationale for our Neutral view

Tel: 022 - 4040 3800 Ext: 319 Reliance Power’s projects to be one of the largest in India: The upcoming

E-mail: girish.solanki@angeltrade.com 13 power projects by Reliance Power (RPL) are expected to have a combined

Reena Walia planned installed capacity of 28,200MW, which will be one of the largest power

generation portfolios under development in India.

Tel: 022 - 4040 3800 Ext: 331

E-mail: reena.walia@angeltrade.com Pan-India presence

RPL plans to develop 28,200MW of power projects on a pan-India scale.

Highest contribution of power will be in West India (12,220MW) followed by

Issue Open: 15 January 2008 North India (9,080MW), South India (4,000MW) and the North-Eastern states

(2,900MW).

Issue Close: 18 January 2008

Strategic location of the projects: Majority of RPL’s projects are located in the

North, West and North-Eastern regions of India. These are expected to cater to

the significant unmet demand for power in these regions. The power projects

Issue Details are also located either close to its fuel source or load center, which will help

Face Value: Rs10 enhance RPL’s efficiency.

Present Equity Capital: Rs2,000cr

Execution risks: RPL’s projects under development have a long gestation

period. Most of the projects are expected to be commissioned in or after

FY2010. Projects could get delayed due to unforeseen engineering problems,

Post Issue Equity Capital: Rs2,260cr unanticipated cost increase, delay in obtaining property rights, fuel supply,

government approvals or termination of a project’s development. Considering all

Total Issue size (shares): 26cr this, we believe that execution risks cannot be ruled out.

Issue size (amt): Rs10,374cr – 11,544cr

(Including promoters contribution of 3.2cr We have a Neutral view on the Issue. We believe that the pricing of the Issue

shares) is a bit aggressive even though the business prospects are expected to be

robust over the next several years for RPL, with an expected generation

Issue Price : Price Band of Rs405-450

capacity of 5,500MW by 2012 and 28,200MW by 2016. Further, valuations

should be seen considering the fact that currently RPL hardly has any capacity

Promoters holding pre-issue: 100% which is operating. The company’s first power plant will get operational only by

March 2010. This is assuming there are no execution delays.

Promoters holding post-issue: 89.9%

As for relative valuations, RPL is being priced at a ‘considerable’ premium to

NTPC, which already has an installed capacity of 27,000MW, good execution

capabilities and a proven track record. Our calculations indicate that by FY2012,

Book Building of the Net Issue four of RPL’s announced projects would be fully operational with a capacity of

5,500MW. Assuming an optimistic PLF of 80%, potential revenues could be in

QIBs Up to 60% the vicinity of Rs8,500cr, which could help the company report an EPS of

Non-Institutional At least 10% Rs6-7. Also, the Book Value in FY2012 (sans dilutions) would be Rs60-65 per

share, which implies that the P/BV at the upper end of the price band would be

Retail* At least 30% 7-7.5x.

Mutual Funds 5% of QIB

Nonetheless, considering the buoyancy in the capital markets, especially the

*Retail participants will get a discount of primary market, we expect the IPO to receive good investor response along

Rs20 from issue price with follow-up appetite for the Issue on listing. Also, while further dilutions by the

promoters in the future is a very high probability, which over a period of time

Post Issue Shareholding Pattern would lead to significant Book Value accretion, we believe the same is already

Promoters Group 89.9%

priced in.

MF/Banks/Indian

10.1%

FIs/Public & Others

January 11, 2008 1

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Company overview

Reliance Power (RPL) is part of the Reliance ADA Group and was established to develop,

construct and operate power projects in India and abroad. RPL is in the process of developing 13

medium and large sized power projects, which will create a combined planned installed capacity of

28,200MW and will be one of the largest portfolios of power generation assets under development

in India. The upcoming 13 power projects will be diverse in terms of geographical location, fuel

type and source, and off-take. RPL’s installed capacities will be spread across the states in India

with capacity of 12,220MW in West India, 9,080MW in North India, 2,900MW in North-East India

and 4,000MW in the South. These include seven coal-fired projects of around 14,620MW, which

will be fueled by reserves from the captive mines and supplies from India and abroad. Out of the

total 13 projects, RPL has placed orders for two gas-fired projects of 10,280MW capacity, which is

expected to be fueled from reserves from the Krishna-Godavari basin (KG Basin), and four

hydroelectric projects of 3,300MW capacity. The power generated by these projects would be sold

under a combination of long and short-term power purchase agreements (PPAs) to state-owned,

private distribution companies and industrial consumers.

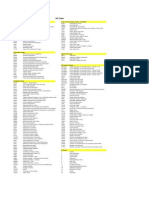

Exhibit 1: Objects of the Issue

Objects Amount (Rs cr)

Part finance construction and development of new projects 8,642

600MW Rosa Phase I 393.2

600MW Rosa Phase II 615.0

300MW Butibori 411.5

3,960MW Sasan 5,461.4

1,200MW Shahapur Coal 1,145.8

400MW Urthing Sobla 615.8

General Corporate Expenses {-}

Issue Expenses {-}

Total Proceeds {-}

Source: RHP

RPL is raising funds to develop 13 power generation projects that are currently under various

stages of development. The company has already commenced construction of the Rosa Phase I.

Exhibit 2: Projects at a glance

Project break-up Capacity (MW) Type Location Commission

Rosa Phase I 600 Coal-fired Uttar Pradesh March 2010

Rosa Phase II 600 Coal-fired Uttar Pradesh Sept 2010

Butibori 300 Coal-fired Maharashtra June 2010

Sasan 3,960 UMPP, coal-fired April 2016

Shahapur 4,000 Coal-fired (1,200MW) Maharashtra Dec 2011

Gas-fired (2,800MW) March 2011

Urthing Sobla 400 Hydroelectric Uttarakhand March 2014

Dadri 7,480 Gas-fired Uttar Pradesh Under Dev.

MP Power 3,960 Coal-fired Under Dev.

Krishnapatnam 4,000 UMPP, Coal-fired Andhra Pradesh Under Dev.

Siyom 1,000 Hydroelectric Under Dev.

Tato II 700 Hydroelectric Under Dev.

Kalai II 1,200 Hydroelectric Under Dev.

Source: RHP

January 11, 2008 2

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Competitive strengths

RPL’s power projects to be one of the largest in India: The upcoming 13 power projects

would have a combined planned installed capacity of 28,200MW and will bee one of the largest

power generation portfolios under development in India. This upcoming portfolio of 13 power

projects includes:

Exhibit 3: Pan India presence

Source: Company

RPL plans to develop 28,200MW of power projects on a pan-India basis. Highest contribution of

power will lie in West India (12,220MW) followed by North India (9,080MW), South India

(4,000MW) and North-East India (2,900MW).

Strategic location of projects: Majority of RPL’s projects are located in the North, West and

North-East parts of India. These are expected to cater to the significant un-met demand for

power in these regions. Further, the proposed power projects are located either close to their

fuel source or load center, which is expected to improve RPL’s efficiency.

Diversified portfolio of power projects: The upcoming power projects are diverse in terms of

geographic location, off-take, fuel type and source. These include seven coal-fired projects

(14,620MW), two gas-fired projects (10,280MW) and four run-of-the-river hydroelectric projects

(3,300MW). RPL plans to source coal from captive mines and supplies from India and abroad.

The company also plans to source gas from the KG Basin through RNRL and others. The

hydroelectric projects will be run-of-the-river projects, out of which three will be located in

Arunachal Pradesh and one will be in Uttarakhand. With this diverse portfolio of power projects,

RPL seeks to de-risk its business model. RPL will sell its power to state-owned and private

distribution companies and industrial consumers.

Concerns

Execution risk: RPL’s projects under development have a long gestation period. Most of the

projects are expected to be commissioned in or after FY2010. Projects could get delayed due to

unforeseen engineering problems, unanticipated cost increase, delay in obtaining property

rights, fuel supply, government approvals or termination of a project’s development. Considering

all of this, we believe that execution risks cannot be ruled out.

Business is subject to government regulation: RPL’s business is subject to government

norms and regulations and any changes in these could disrupt/delay the company’s plans and

impact its business performance. In order to conduct its business, RPL will have to obtain

various licenses, permits and approvals, indicating a pipeline of government clearances that

could potentially delay procedures.

January 11, 2008 3

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Industry overview

India is currently facing a demand-supply gap in power. This gap has been increasing, leading

to increased power shortages.

Exhibit 4: Power – Demand-Supply Scenario in India

Fiscal Peak Deficit (MW)

2001-02 10,293

2002-03 9,945

2003-04 9,508

2004-05 10,254

2005-06 11,463

2006-07 13,897

April-September 2007 12,409

Source: CEA, Power Scenario at a glance, October 2007

Peak demand deficit between April - September 2007 stood at 12,409MW. Peak deficit varies

across India ranging from 5.8% of peak demand requirements in the South to 26.5% of peak

demand requirement in the West.

Exhibit 5: Demand - Supply gap of Electricity in India

750,000

690,587

700,000

631,757

650,000

591,373

600,000 559,264

MU

545,983 624,495

550,000 522,537

578,819

500,000 548,115

519,398

497,890

450,000 483,350

400,000

2001-02 2002-03 2003-04 2004-05 2005-06 2006-07

Demand Supply

Source: CEA, Power Scenario at a glance, October 2007

Installed generation capacity

According to the Ministry of Power, India has an installed generation capacity of about

1,35,782MW as of September 30, 2007. Despite the economic liberalisation policies that have

been in existence since 1992 and focused on the Power sector, the Indian Power sector has

failed to grow at the required pace to meet the shortage of power in the country..

Exhibit 6: Overall capacity

13 5 , 7 8 2

14 00 00

12 5 , 0 0 0

12 00 00

10 0 , 0 0 0

10 00 00 9 0 ,0 0 0

8 5 ,5 0 0 8 5 ,0 0 0

8 0 ,0 0 0

8 00 00 6 8 ,0 0 0

MW

6 00 00

4 00 00

2 00 00

0

19 92 19 97 20 02 2 00 3 2 00 4 2 00 5 2 00 6 2 00 7

Source: Ministry of Power

January 11, 2008 4

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Exhibit 7: Per capita consumption of Energy

20,000 18,408

16,000 14,240

Kwh/Year

12,000

8,231 8,459

7,442 6,756

8,000 6,425

4,000 2,340 1,684

618

0

n

om

s

y

ce

a

na

l

n

tio

a

te

zi

an

ad

pa

di

ra

ta

an

gd

ra

hi

m

In

an

Ja

S

C

de

in

Fr

er

d

C

K

G

Fe

te

d

ni

te

an

U

ni

si

U

us

R

Source: Company, World Energy Outlook, 2006; Human Development Report 2007-08

Per capita consumption of energy in India is only 618Kwh/year, which indicates low

penetration and provides significant opportunities for future growth. Currently, over 400 million

in India do not have access to electricity. This provides immense scope for growth for the

Power sector in India. The Government of India has set a target to achieve per capita

electricity consumption of 1,000Kwh/year by 2012. To achieve this target large investments

are required to flow into the sector.

Outlook and Valuation

We have a Neutral view on the issue. This is in keeping with the view that while RPL’s

business growth prospects remain robust for the next several years with expected generation

capacity of 5,500MW by 2012 and 28,200MW by 2016, pricing of the Issue is a bit aggressive.

Moreover, valuations must be seen in conjunction with the fact that currently, RPL has hardly

any capacity which is operating. RPL’s first power plant would be getting operational only by

March 2010 assuming there are no execution delays.

On the relative valuations front, RPL is being priced at a ‘considerable’ premium to NTPC,

while the latter already has an installed capacity of 27,000MW and with good execution

capabilities and proven track record. Our calculations indicate that by FY2012, four of the

announced projects would be fully operational with a capacity of 5,500MW. Assuming an

optimistic PLF of 80% the company’s potential revenues could be in the vicinity of Rs8,500cr,

which could help the company report an EPS of Rs6-7. Also, the Book Value in FY2012 (sans

dilutions) would be Rs60-65 per share, which implies that the P/BV at the upper end of the

price band would be 7-7.5x.

Nonetheless, considering the buoyancy in the market, especially the primary market, we

expect the IPO to receive good investor response along with follow-up appetite for the Issue

on listing. Also, while further dilutions by the promoters in the future is a very high probability,

which over a period of time would lead to significant Book Value accretion, we believe the

same is already priced in.

January 11, 2008 5

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Exhibit 8 : Profit and Loss (Stand-alone)

Y/E March FY2005 FY2006 FY2007 1HFY2008

Income

Income from contractual services 0.00 0.00 2.25 0.00

Profit on redemption of Mutual Fund 0.00 0.00 0.00 3.21

Miscellaneous Income 0.00 0.00 0.00 0.02

Net Sales 0.00 0.00 2.25 3.23

Net sales growth

Expenditure break-up

Employee cost 0.00 0.00 0.25 0.00

Admin. and general exp. 0.01 0.11 0.64 1.45

Bank/Corporate guarantee charges 0.00 0.00 0.82 0.00

Depreciation 0.00 0.00 0.00 0.00

Total expenditure 0.01 0.11 1.71 1.45

PBT (0.01) (0.11) 0.54 1.78

Provision for Tax 0.00 0.02 0.38 0.60

Current Tax (Includes FBT) 0.00 0.02 0.38 0.60

Deferred Tax 0.00

PAT (0.01) (0.13) 0.16 1.18

Adj. due to change in accounting policy

Profit on redemption of MF 0.00 0.00 1.68 0.00

Total Adjustments 0.00 0.00 1.68 0.00

Tax impact of adjustments 0.00 0.00 0.57 0.00

Total adjustment after Tax impact 0.00 0.00 1.11 0.00

Net Profit (0.01) (0.13) 1.27 1.18

P&L at the start of the year (0.01) (0.02) (0.15) 1.12

Profit/(Loss) available for appropriation (0.02) (0.15) 1.12 2.30

Balance c/f (0.02) (0.15) 1.12 2.30

Source: RHP

January 11, 2008 6

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Exhibit 9: Balance Sheet (Stand-alone)

Y/E March FY2005 FY2006 FY2007 1HFY2008

Assets

Gross Fixed Assets 0.30 66.77 67.27 67.29

Less: Acc. Depreciation 0.19 0.76 1.00 1.04

Net Fixed Assets 0.11 66.01 66.27 66.25

Capital work in progress 84.20 28.21 35.97 36.92

84.31 94.22 102.24 103.17

Incidental Exp Pending Allocation/Capitalisation 3.88 7.79 16.96 20.83

Investments 0.02 0.01 41.28 1772.77

Current Assets 0.78 0.94 45.05 110.78

Cash and Bank 0.70 0.59 0.78 0.52

Sundry Debtors 0.00 0.00 2.25 0.00

Loans and Advances 0.08 0.35 42.02 110.26

Liabilities and Provisions 88.96 103.06 4.37 0.64

Secured Loans 0.00 0.00 0.00 0.00

Unsecured Loans 0.00 0.00 0.00 0.00

Share Application Money 88.36 102.36 0.00 0.00

Current Liabilities and Provisions 0.60 0.70 4.37 0.64

Networth 0.03 (0.10) 201.16 2006.91

Share Capital 0.05 0.05 200.04 2000.00

Reserves and Surplus (0.02) (0.15) 1.12 6.91

Networth 0.03 (0.10) 201.16 2006.91

Source: RHP

January 11, 2008 7

TM

Angel Broking IPO Note

Service Truly Personalized India Research

Exhibit 10: Cash Flow (Stand-alone)

Y/E March FY2005 FY2006 FY2007 1HFY2008

Cash flow from operating activities

Net Profit/(Loss) before tax (0.01) (0.11) 2.22 1.78

Depreciation 0.00 0.00 0.00 0.00

Operating profit before working capital changes (0.01) (0.11) 2.22 1.78

Changes in trade and other receivables (0.08) (0.25) (3.82) 2.61

Changes in trade and other payables 0.46 0.07 2.72 (4.32)

Cash from/(used) in operations 0.37 (0.29) 1.12 0.07

Income tax paid 0.00 (0.02) (0.38) (0.51)

Net cash from/(used) in operating activities 0.37 (0.31) 0.74 (0.44)

Cash flow from investing activities

Purchase of Fixed Assets (72.05) (13.81) (17.19) (4.80)

Loans and advances to subsidiaries 0.00 0.00 (39.72) (68.09)

Purchase of investments 0.00 0.00 (96.72) (823.76)

Sale of investments 0.00 0.01 55.45 96.84

Net cash from/(used) in investing activities (72.05) (13.80) (98.18) (799.81)

Cash flow from financing activities

Share application money/(adjusted) 72.36 14.00 102.36 0.00

Proceeds from share capital 0.00 0.00 199.99 799.96

Increase/(Decrease) in Unsecured Loans (0.02) 0.00 0.00 0.00

Net cash from financing activities 72.34 14.00 97.63 799.96

Net (Decrease)/ Increase in cash 0.66 (0.11) 0.19 (0.29)

Cash and cash equivalents at the start of the year 0.04 0.70 0.59 0.78

Add: Cash received on amalgamation 0.00 0.00 0.00 0.03

Cash and cash equivalents at the end of the year 0.70 0.59 0.78 0.52

Net (Decrease)/ Increase as above 0.66 (0.11) 0.19 (0.29)

Source: RHP

January 11, 2008 8

TM

Angel Broking IPO Note

Service Truly Personalized India Research

TM

Angel Broking Limited

Research Team Tel: 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose

possession this document may come are required to observe these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to

change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every

effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use

the information as the basis for any claim, demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive

at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the

merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -

futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying

charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its

subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that

may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without

notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of

the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect

to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies

referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

January 11, 2008 9

You might also like

- Kirsten Cookies SolutionDocument8 pagesKirsten Cookies SolutionAnish Nair100% (1)

- Kathryn Jones Presentation KitDocument219 pagesKathryn Jones Presentation KitFeliciana ValenzuelaNo ratings yet

- Sample Deed of Absolute Sale With Right To RepurchaseDocument2 pagesSample Deed of Absolute Sale With Right To RepurchaseNancy Velasco86% (7)

- Study On HRM Practices Followed in Power Generation Sector in IndiaDocument25 pagesStudy On HRM Practices Followed in Power Generation Sector in IndiaSujith ParavannoorNo ratings yet

- Erp Userguide PDFDocument202 pagesErp Userguide PDFjajasemangat100% (1)

- Project On CSR, NTPCDocument36 pagesProject On CSR, NTPCBINAYAK SHANKAR50% (4)

- The Fashion Channel - Case AnalysisDocument7 pagesThe Fashion Channel - Case AnalysisPrakarsh Aren100% (5)

- GST Certificate PDFDocument3 pagesGST Certificate PDFNagabhushanamNo ratings yet

- Orient Power IPO AnalysisDocument5 pagesOrient Power IPO Analysisanimeshsaxena83No ratings yet

- Opinion: CrisilDocument12 pagesOpinion: CrisilarvindNo ratings yet

- Jaiprakash Power Ventures LTDDocument8 pagesJaiprakash Power Ventures LTDMilind DhandeNo ratings yet

- Update Rel PowerDocument4 pagesUpdate Rel PowerAnil SarangNo ratings yet

- National Thermal Power CooperationDocument20 pagesNational Thermal Power CooperationMukesh ManwaniNo ratings yet

- Tata Power - Company UpdateDocument9 pagesTata Power - Company UpdateRojalin SwainNo ratings yet

- CSR 3Document37 pagesCSR 3Balakrishna ChakaliNo ratings yet

- NHPC LTD Ipo NoteDocument11 pagesNHPC LTD Ipo NoteYashManchandaNo ratings yet

- Report and Recommendation of The President To The Board of DirectorsDocument13 pagesReport and Recommendation of The President To The Board of Directorsunsw09No ratings yet

- RPower ReportDocument112 pagesRPower Reportvivek8220No ratings yet

- Reliance Power Annual Report 2008 09Document92 pagesReliance Power Annual Report 2008 09vidhi_153No ratings yet

- 4QFY22Document36 pages4QFY22Rajendra AvinashNo ratings yet

- Orient Green Power Company Limited - Product NoteDocument12 pagesOrient Green Power Company Limited - Product Notemihir_ajNo ratings yet

- Sharing The Spirit of L&T-S&L: Customer Visits Aarohan Awareness Session Adhunik CompletionDocument11 pagesSharing The Spirit of L&T-S&L: Customer Visits Aarohan Awareness Session Adhunik Completionmdutta2kNo ratings yet

- NTPC Overview RAWDocument53 pagesNTPC Overview RAWChinish KalraNo ratings yet

- Project On: "Neyveli Lignite Corporation Limited"Document12 pagesProject On: "Neyveli Lignite Corporation Limited"Jatin NagpalNo ratings yet

- Pid 39 Panchratna 14 Jul-Sep17Document21 pagesPid 39 Panchratna 14 Jul-Sep17pmlprasadNo ratings yet

- NTPC Mckinsey 7s FrameworkDocument27 pagesNTPC Mckinsey 7s Frameworkkanchan20667% (3)

- Adani EnterprisesDocument41 pagesAdani Enterprisesprasad hegde0% (1)

- Lanco May04Document4 pagesLanco May04sdhawal83100% (2)

- Power T&D Reliance PDFDocument63 pagesPower T&D Reliance PDFRonak JajooNo ratings yet

- Project Report On JSPLDocument26 pagesProject Report On JSPLSunny KeshriNo ratings yet

- Reliance Power LTD: Investor PresentationDocument24 pagesReliance Power LTD: Investor PresentationSantanu BiswasNo ratings yet

- PASH Pakistan Strategy (21588)Document21 pagesPASH Pakistan Strategy (21588)Junaid ArsahdNo ratings yet

- Determination of Swap Ratio in Merger: Case of Reliance Natural Resources Ltd. and Reliance Power Ltd. MergerDocument14 pagesDetermination of Swap Ratio in Merger: Case of Reliance Natural Resources Ltd. and Reliance Power Ltd. MergerAswani B RajNo ratings yet

- What Is An IPO..??: Financial Management Project ONDocument19 pagesWhat Is An IPO..??: Financial Management Project ONShashank JainNo ratings yet

- The Insites: Preparing For Next Phase of GrowthDocument10 pagesThe Insites: Preparing For Next Phase of GrowthWatchara WaewdumNo ratings yet

- Business Restructuring - NSPCLDocument12 pagesBusiness Restructuring - NSPCLmayraNo ratings yet

- Institute of Management, Nirma University: Group Assignment-Reliance Power's IPODocument7 pagesInstitute of Management, Nirma University: Group Assignment-Reliance Power's IPOCJKNo ratings yet

- SAPM Project ReportDocument11 pagesSAPM Project ReportHarshit LalNo ratings yet

- Adani Enterprises Initiating CoverageDocument55 pagesAdani Enterprises Initiating CoverageGaurang Shah100% (2)

- Initiating Coverage On JP Associates LTDDocument23 pagesInitiating Coverage On JP Associates LTDVarun YadavNo ratings yet

- 4 Lanco Infratech LimitedDocument4 pages4 Lanco Infratech LimitedRony GhoshNo ratings yet

- CESC Investor Presentation - June 2019Document33 pagesCESC Investor Presentation - June 2019aniket mittalNo ratings yet

- Eden Renewables India Increases Its Portfolio With 1,350 MWP of New Solar Photovoltaic Power PlantsDocument3 pagesEden Renewables India Increases Its Portfolio With 1,350 MWP of New Solar Photovoltaic Power PlantsMini KaurNo ratings yet

- JSW Energy Ipo Note Dec 09 EdelDocument7 pagesJSW Energy Ipo Note Dec 09 EdelanilgrandhiNo ratings yet

- Wind Market AnalysisDocument9 pagesWind Market AnalysisRucha ShirudkarNo ratings yet

- Final Project 2Document79 pagesFinal Project 2Tmesibmcs MandviNo ratings yet

- Orient Green Power: NeutralDocument13 pagesOrient Green Power: NeutralsantheepsNo ratings yet

- Growth Has No Limit at Reliance. I Keep Revising My Vision. Only When You Can Dream It, You Can Do It.Document21 pagesGrowth Has No Limit at Reliance. I Keep Revising My Vision. Only When You Can Dream It, You Can Do It.Sachin SinghNo ratings yet

- Project ReportDocument76 pagesProject Reportsoniyabellani100% (1)

- Reliance Power - "Buy" 5 February, 2010: Stock DetailsDocument14 pagesReliance Power - "Buy" 5 February, 2010: Stock DetailsjournalisNo ratings yet

- Change Management With Implimentation of ErpDocument34 pagesChange Management With Implimentation of ErpBINAYAK SHANKARNo ratings yet

- Bank DPR - Kesari Roller Flour MillDocument38 pagesBank DPR - Kesari Roller Flour Millayushmehar22No ratings yet

- Diversified: Infrastrcutrue, Power, MiningDocument12 pagesDiversified: Infrastrcutrue, Power, Miningjoking_111No ratings yet

- A Project Report On "Financial Statement Analysis" Post Graduate Diploma in Management Narayana Business School, AhmedabadDocument45 pagesA Project Report On "Financial Statement Analysis" Post Graduate Diploma in Management Narayana Business School, AhmedabadSuraj ParmarNo ratings yet

- Shankha Banerjee, 52, MBA - PMDocument10 pagesShankha Banerjee, 52, MBA - PMshankhab_1No ratings yet

- Adani Green Script RsbeditDocument7 pagesAdani Green Script Rsbeditannu priyaNo ratings yet

- Training and DevelopmentDocument72 pagesTraining and DevelopmentSnigdha SinghNo ratings yet

- Rajiv Mishra-India - Pakistan Energy Cooperation - 30.01.2015Document14 pagesRajiv Mishra-India - Pakistan Energy Cooperation - 30.01.2015Utkarsh BenjwalNo ratings yet

- Fast Breeder ReactorsDocument10 pagesFast Breeder Reactorsmahendra3107No ratings yet

- RInfra Investor Presentation December 10Document46 pagesRInfra Investor Presentation December 10Omar 'Metric' JaleelNo ratings yet

- KPI Green Energy LTDDocument16 pagesKPI Green Energy LTDdeepaksinghbishtNo ratings yet

- CC C CDocument6 pagesCC C CfarjanabegumNo ratings yet

- (Stu Z) The - Economist.august.01st August.07th.2009Document9 pages(Stu Z) The - Economist.august.01st August.07th.2009vikashbh043No ratings yet

- Swot Analysis and Strategies Use by NTPC IndustryDocument20 pagesSwot Analysis and Strategies Use by NTPC Industryyadavmihir63No ratings yet

- Knowledge and Power: Lessons from ADB Energy ProjectsFrom EverandKnowledge and Power: Lessons from ADB Energy ProjectsNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- MPP Report FinalDocument22 pagesMPP Report FinalAnish NairNo ratings yet

- The Locked Box MechanismDocument3 pagesThe Locked Box MechanismAnish NairNo ratings yet

- Logical Reasoning Test For Competitive ExamsDocument8 pagesLogical Reasoning Test For Competitive ExamsAnish NairNo ratings yet

- Sap TableDocument82 pagesSap TableGooyong Byeon0% (1)

- REEM Document Submission GuildlinesDocument6 pagesREEM Document Submission GuildlinesJiong SoonNo ratings yet

- Resume AnshDocument3 pagesResume AnshAnshul SharmaNo ratings yet

- Brochure Altanova 1Document11 pagesBrochure Altanova 1IAMATMANo ratings yet

- Environment and Management Assignment On Career Planning Process and Its BenefitsDocument23 pagesEnvironment and Management Assignment On Career Planning Process and Its BenefitsDr. Nimisha NandanNo ratings yet

- Accredited Law Firms & Offices For ALS Apprenticeship Program Office/Organization Address Contact Person/Telephone NoDocument21 pagesAccredited Law Firms & Offices For ALS Apprenticeship Program Office/Organization Address Contact Person/Telephone NoPretzel TsangNo ratings yet

- Test Bank For Principles of Risk Management and Insurance 12th Edition by RejdaDocument10 pagesTest Bank For Principles of Risk Management and Insurance 12th Edition by Rejdajames90% (10)

- Swot Analysis StrengthsDocument2 pagesSwot Analysis StrengthsAmir AmirthalingamNo ratings yet

- PCAB Form NoDocument18 pagesPCAB Form NoRoger E. Lumayag Jr.100% (1)

- Literature Review of CSRDocument5 pagesLiterature Review of CSRAyush GuptaNo ratings yet

- Ybm Brilian Ro JKT 032901005513301 Maker 2024-06-02 201936 2Document4 pagesYbm Brilian Ro JKT 032901005513301 Maker 2024-06-02 201936 2ibadhNo ratings yet

- Offer Letter (TEJ PRATAP)Document7 pagesOffer Letter (TEJ PRATAP)Tej Pratap SinghNo ratings yet

- ShezanDocument36 pagesShezanSehar AliNo ratings yet

- Catalogue Electrical Equipment Ans Products PDFDocument267 pagesCatalogue Electrical Equipment Ans Products PDFgallantprakashNo ratings yet

- An Introduction To Management Consulting: Consultant BootcampDocument8 pagesAn Introduction To Management Consulting: Consultant BootcampJacob CollierNo ratings yet

- Sta Lucia East Commercial Vs Secretary of Labor Digest PDFDocument3 pagesSta Lucia East Commercial Vs Secretary of Labor Digest PDFDanica Irish RevillaNo ratings yet

- Final Test MaturaDocument3 pagesFinal Test MaturaCsabáné Ivony IldikóNo ratings yet

- Vdo SwitchDocument1 pageVdo SwitchjengandxbNo ratings yet

- India Gold Market Innovation and Evolution PDFDocument92 pagesIndia Gold Market Innovation and Evolution PDFPreethu IndhiraNo ratings yet

- Invitation ExhibitorsDocument8 pagesInvitation ExhibitorsNico Rey Yamas RANo ratings yet

- Use of Colors in LogosDocument50 pagesUse of Colors in LogosAlexGLeon100% (1)

- Agricultural Marketing - Agricultural Marketing in IndiaDocument1 pageAgricultural Marketing - Agricultural Marketing in IndiaSandeep MadivalNo ratings yet

- SCM - Objective, Fows, and Decision PhasesDocument8 pagesSCM - Objective, Fows, and Decision PhasesMohd.Nuryadie PashaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRajNo ratings yet

- Perencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiDocument6 pagesPerencanaan Perawatan Rubber Tyred Gantry Menggunakan Metode Reliability Centered Maintenance (RCM) IiUntuk KegiatanNo ratings yet