Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsPolicy Comparison

Policy Comparison

Uploaded by

garimaThe document outlines electric vehicle policies across several Indian states. It discusses plug-in hybrid and battery electric vehicle policies under the FAME program, providing purchase incentives and target electrical ranges. It also lists specific EV policies for states like Delhi, Karnataka, Kerala, Telangana, Maharashtra, Uttar Pradesh, and Gujarat which include subsidies, tax exemptions, scrapping incentives, and requirements for corporate and government fleets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Mercedes-Benz E-Class Petrol Workshop Manual PDFDocument2 pagesMercedes-Benz E-Class Petrol Workshop Manual PDFthabani jefftey mleya0% (3)

- Tesla (TSLA) Full Operating Model + Reverse DCFDocument7 pagesTesla (TSLA) Full Operating Model + Reverse DCFDon JuanNo ratings yet

- Porsche Cayenne Turbo S 2013 - Derivação Dos Positivos - Diagrama Elétrico PDFDocument8 pagesPorsche Cayenne Turbo S 2013 - Derivação Dos Positivos - Diagrama Elétrico PDFWiterMarcos100% (1)

- Innovation Landscape brief: Electric-vehicle smart chargingFrom EverandInnovation Landscape brief: Electric-vehicle smart chargingNo ratings yet

- Tesla Strategic Management PresentationDocument19 pagesTesla Strategic Management Presentationapi-323493188No ratings yet

- Research Paper Battery Electric VehiclesDocument9 pagesResearch Paper Battery Electric Vehiclesapi-30670742950% (2)

- MH EV Policy Presentation - 13 JulyDocument10 pagesMH EV Policy Presentation - 13 JulyGaurav satraNo ratings yet

- Crest20 Evpolicy22 2009Document16 pagesCrest20 Evpolicy22 2009juitprashantNo ratings yet

- Infrastructure and Energy Digest August 2020 1Document12 pagesInfrastructure and Energy Digest August 2020 1ELP LawNo ratings yet

- 2021 06 23 GR GujaratE VehiclePolicy 2021Document7 pages2021 06 23 GR GujaratE VehiclePolicy 2021MAKZYS khanNo ratings yet

- AP Electric Vehicle PolicyDocument26 pagesAP Electric Vehicle Policy9052359751No ratings yet

- Intra-State Availability Based Tariff (ABT)Document15 pagesIntra-State Availability Based Tariff (ABT)dahigaonkarNo ratings yet

- Loksabhaquestions Annex 1715 AU1145Document8 pagesLoksabhaquestions Annex 1715 AU1145Pramod HansNo ratings yet

- State Trading Corporation Anuradhapura (Site - Thanthirimale)Document4 pagesState Trading Corporation Anuradhapura (Site - Thanthirimale)Saman KumarasingheNo ratings yet

- Dr. Ashok Jhunjhunwala IIT MadrasDocument10 pagesDr. Ashok Jhunjhunwala IIT Madrasjoycool100% (1)

- Scheme For Promotion of Electric Vehicles in The StateDocument4 pagesScheme For Promotion of Electric Vehicles in The Statepratik rathodNo ratings yet

- Tamil NaduDocument3 pagesTamil Naduanshulmishra713No ratings yet

- Faq PDFDocument9 pagesFaq PDFAnonymous HqwS65vtJNo ratings yet

- Report (Electrification in India)Document22 pagesReport (Electrification in India)Anshul TembhareNo ratings yet

- Bses Delhi Tariff - Schedule - FY - 2020 - 21Document10 pagesBses Delhi Tariff - Schedule - FY - 2020 - 21Pankaj KumarNo ratings yet

- Maharshtra EV PolicyDocument14 pagesMaharshtra EV PolicyVishal DesignNo ratings yet

- Science & Technology Policy Brief: Electric VehiclesDocument6 pagesScience & Technology Policy Brief: Electric VehiclesAshutosh SonkarNo ratings yet

- Project RBS Synopsis PDFDocument3 pagesProject RBS Synopsis PDFJEEVANT DEO 19M18 BhjNo ratings yet

- Amendments To Delhi EV PolicyDocument4 pagesAmendments To Delhi EV PolicyAshok SinhaNo ratings yet

- BRPL Tariff Schedule 2019 20Document10 pagesBRPL Tariff Schedule 2019 20Atul SharmaNo ratings yet

- Abc AbtDocument37 pagesAbc AbtVarada TambeNo ratings yet

- Porter's Diamond For Public Transport Industry:: Strategy, Structure and RivalryDocument3 pagesPorter's Diamond For Public Transport Industry:: Strategy, Structure and RivalrySATYA SHANKER KARINGULANo ratings yet

- Investment OpportunitiesDocument18 pagesInvestment OpportunitiesSatish Babu JettyNo ratings yet

- SIP Case Study 1 (ISHAAN SHUKLA)Document4 pagesSIP Case Study 1 (ISHAAN SHUKLA)akansh malhotraNo ratings yet

- Press Release MNREDocument5 pagesPress Release MNREDebarshi BaruahNo ratings yet

- Tentative Ownership Cost Calculator (EV V/S ICE Vehicles) For Home ChargingDocument4 pagesTentative Ownership Cost Calculator (EV V/S ICE Vehicles) For Home ChargingjitendraNo ratings yet

- Indian Electric Vehicle Infrastructure Market: State of TheDocument23 pagesIndian Electric Vehicle Infrastructure Market: State of TheANURAN GAYALINo ratings yet

- E Bus Case Study Kolkata ClarificationsDocument7 pagesE Bus Case Study Kolkata ClarificationsKhushalNo ratings yet

- Allowa Nces: (Irem Vol-I Chap. Vii para 701-712)Document14 pagesAllowa Nces: (Irem Vol-I Chap. Vii para 701-712)Indrasen DewanganNo ratings yet

- Tata Capital: Reaching New Heights. by Doing What's RightDocument17 pagesTata Capital: Reaching New Heights. by Doing What's RightSirsanath BanerjeeNo ratings yet

- Unit 6 EHV-1Document26 pagesUnit 6 EHV-1Tushar BarkadeNo ratings yet

- Kcci Oerc Order Power Tarrif 2024Document3 pagesKcci Oerc Order Power Tarrif 2024Sanjay GuptaNo ratings yet

- Tariff Schedule 2020-21Document9 pagesTariff Schedule 2020-21Yuva RajNo ratings yet

- Analysis of Charging Station Development in IndiaDocument13 pagesAnalysis of Charging Station Development in Indiasree haritha pNo ratings yet

- Electric Vehicle ScenarioDocument3 pagesElectric Vehicle ScenarioChinmay VSNo ratings yet

- IJISET - V1 - I10 - 94 (Generation Cost Calculation For 660 MW Thermal Power Plants - IJISET) PDFDocument5 pagesIJISET - V1 - I10 - 94 (Generation Cost Calculation For 660 MW Thermal Power Plants - IJISET) PDFMiguel Perez100% (1)

- Ahd Tariff Schedule TPL D A Tariff Order For Fy 2023 24 Dtd. 31.03.23 TariffDocument18 pagesAhd Tariff Schedule TPL D A Tariff Order For Fy 2023 24 Dtd. 31.03.23 Tariffcyberking998No ratings yet

- EOI PM KUSUM Component A 01.04.2022Document71 pagesEOI PM KUSUM Component A 01.04.2022Pooja Narveer RaoNo ratings yet

- bank Tie up with insurance companyDocument3 pagesbank Tie up with insurance companydetix97225No ratings yet

- Electric VehicleDocument13 pagesElectric VehicleAnubhav NagarNo ratings yet

- Solar DataDocument4 pagesSolar Datashaikhsharukh519No ratings yet

- Subject-Draft Bihar Electric Vehicle Policy 2019Document4 pagesSubject-Draft Bihar Electric Vehicle Policy 2019eee sasaramNo ratings yet

- Electric Vehicle Policy in IndiaDocument8 pagesElectric Vehicle Policy in IndiaPranjul ShuklaNo ratings yet

- State Wise EV Policies and IncentivesDocument30 pagesState Wise EV Policies and IncentivesRahulNo ratings yet

- Interest Subvention: Type IncentivesDocument9 pagesInterest Subvention: Type Incentivesblessycjn.velcitiNo ratings yet

- FAMEDocument3 pagesFAMELe JhandNo ratings yet

- Govt Producer Letter MNREDocument5 pagesGovt Producer Letter MNREKopal ShrivastavaNo ratings yet

- Tariff Schedule Fy 2019-20Document8 pagesTariff Schedule Fy 2019-20Sharma ShiviNo ratings yet

- CFA StruDocument1 pageCFA StruR & DNo ratings yet

- Hand Book EV Engineering FundamentalsDocument192 pagesHand Book EV Engineering FundamentalsbhukthaNo ratings yet

- Electric VehicleDocument13 pagesElectric VehicleNitin KurerNo ratings yet

- v3624773 ScheduleDocument1 pagev3624773 ScheduleHrishikesh BasakNo ratings yet

- Ha Red A 787986240Document30 pagesHa Red A 787986240tarun_aggarwaly5712No ratings yet

- Unit 1 Introduction Electric Vehicle: Department of Mechanical EngineeringDocument67 pagesUnit 1 Introduction Electric Vehicle: Department of Mechanical EngineeringPraveen RathodNo ratings yet

- Policies On Solar PowerDocument16 pagesPolicies On Solar PowerSandeep Guha NiyogiNo ratings yet

- Sr. No. Category Fixed Charges Energy Charges Domestic: AnnexureDocument5 pagesSr. No. Category Fixed Charges Energy Charges Domestic: AnnexureAam aadmiNo ratings yet

- Opportunities For Power Utilities With Electrification of TransportDocument5 pagesOpportunities For Power Utilities With Electrification of TransportAshish JainNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- Deployment of Hybrid Renewable Energy Systems in MinigridsFrom EverandDeployment of Hybrid Renewable Energy Systems in MinigridsNo ratings yet

- EV Charger Price ListDocument5 pagesEV Charger Price ListSoud AbdallahNo ratings yet

- Volkswagen 2007-2013 Revised CAL ID and CVN DataDocument8 pagesVolkswagen 2007-2013 Revised CAL ID and CVN DataDanyBobNo ratings yet

- Patente Chasis Motor Marca Modelo AÑODocument17 pagesPatente Chasis Motor Marca Modelo AÑOChristopher ParedesNo ratings yet

- VW T4 Westfalia CaliforniaCoach Manual English 1998 PDFDocument45 pagesVW T4 Westfalia CaliforniaCoach Manual English 1998 PDFFranz SchuierNo ratings yet

- Costruzione Dell OST Ampo: Mold ConstructionDocument40 pagesCostruzione Dell OST Ampo: Mold ConstructionАлександар ДимитријевићNo ratings yet

- Car PricesDocument6 pagesCar PricesSampath DayarathneNo ratings yet

- A Case Study Ofyy8uojDocument2 pagesA Case Study Ofyy8uojSujan DevkotaNo ratings yet

- Towards The Ultimate Eco-Car: Hybrid As The Core Technology: Piet Steel Driving Sustainability 08Document30 pagesTowards The Ultimate Eco-Car: Hybrid As The Core Technology: Piet Steel Driving Sustainability 08paparezaNo ratings yet

- Vehicle To GridDocument7 pagesVehicle To GridSurajRGuptaNo ratings yet

- STNK Kendaraan TruckDocument4 pagesSTNK Kendaraan TruckTriNo ratings yet

- TranspondersDocument2 pagesTranspondersCarlos Rosales GuzmanNo ratings yet

- CATALOG Engine MountingDocument10 pagesCATALOG Engine MountingAgus WahyudiNo ratings yet

- Catalog: Catalog de Elemente de Caroserie, Optice Si Electrice. Heavy Duty Body Parts and Lamps CatalogueDocument83 pagesCatalog: Catalog de Elemente de Caroserie, Optice Si Electrice. Heavy Duty Body Parts and Lamps CatalogueСергей ТищенкоNo ratings yet

- Cruce de Referencias Transponder-CtaDocument1 pageCruce de Referencias Transponder-CtaGregori LoayzaNo ratings yet

- Spatial and Temporal Model For Electric Vehicle Rapid Charging DemandDocument5 pagesSpatial and Temporal Model For Electric Vehicle Rapid Charging Demandanup chauhanNo ratings yet

- BRAKE PAK CatalogoDocument413 pagesBRAKE PAK CatalogoCarlos Augusto Montoya CocaNo ratings yet

- Suggestion For Tesla, Inc. Business Model CanvasDocument3 pagesSuggestion For Tesla, Inc. Business Model CanvasJackie LouNo ratings yet

- Toyota Global Hybrid Roll OutDocument2 pagesToyota Global Hybrid Roll OutshahraashidNo ratings yet

- Engine Controls (Powertrain Management) - FUSIONrDocument7 pagesEngine Controls (Powertrain Management) - FUSIONrRafael MejiaNo ratings yet

- Lista Great Wall: WHATSAPP +56 9 8406 2423 31-Mar-21Document141 pagesLista Great Wall: WHATSAPP +56 9 8406 2423 31-Mar-21Cristian PaltaNo ratings yet

- Volkswagen Could Topple Tesla As The Leader in Evs by 2025 GloballyDocument6 pagesVolkswagen Could Topple Tesla As The Leader in Evs by 2025 GloballynikhileshNo ratings yet

- Review Paper of Electric VehiclesDocument4 pagesReview Paper of Electric VehiclesEditor IJTSRDNo ratings yet

- Auto Express - Issue 1800-4-10 October 2023Document84 pagesAuto Express - Issue 1800-4-10 October 2023Silvina PANo ratings yet

- Mercedes BenzDocument16 pagesMercedes BenzRahul Bansal100% (1)

- WORKING DOC EV Extrication UPDATED 140822Document29 pagesWORKING DOC EV Extrication UPDATED 140822Syahrir ShahNo ratings yet

Policy Comparison

Policy Comparison

Uploaded by

garima0 ratings0% found this document useful (0 votes)

10 views3 pagesThe document outlines electric vehicle policies across several Indian states. It discusses plug-in hybrid and battery electric vehicle policies under the FAME program, providing purchase incentives and target electrical ranges. It also lists specific EV policies for states like Delhi, Karnataka, Kerala, Telangana, Maharashtra, Uttar Pradesh, and Gujarat which include subsidies, tax exemptions, scrapping incentives, and requirements for corporate and government fleets.

Original Description:

Original Title

Policy Comparison.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines electric vehicle policies across several Indian states. It discusses plug-in hybrid and battery electric vehicle policies under the FAME program, providing purchase incentives and target electrical ranges. It also lists specific EV policies for states like Delhi, Karnataka, Kerala, Telangana, Maharashtra, Uttar Pradesh, and Gujarat which include subsidies, tax exemptions, scrapping incentives, and requirements for corporate and government fleets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views3 pagesPolicy Comparison

Policy Comparison

Uploaded by

garimaThe document outlines electric vehicle policies across several Indian states. It discusses plug-in hybrid and battery electric vehicle policies under the FAME program, providing purchase incentives and target electrical ranges. It also lists specific EV policies for states like Delhi, Karnataka, Kerala, Telangana, Maharashtra, Uttar Pradesh, and Gujarat which include subsidies, tax exemptions, scrapping incentives, and requirements for corporate and government fleets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

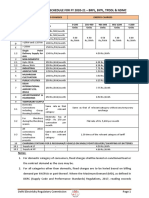

2 Wheelers

Plug-in Hybrid BEV

Policy (Start/Stop, Motor alone capable to (Powered exclusively by Motor,

propel, Electric Regenerative Sys) Electric Regenerative optional)

FAME (FY’16-FY’19) 1. Target Electrical Range – 10KM 1. Target Electrical Range – 55KM

2. Scooters: 13000/- (Advance 2. Scooters: 7500/- (Conventional

Battery) Battery)

3. Motor Cycle: 15000/- (Advance & 17000/- (Advance Battery)

Battery) 3. Motor Cycle: 9600/-

(Conventional Battery)

& 23000/- (Advance Battery)

Delhi Draft 1. Purchase Incentive For Motor Power > 250 W & Advance

2. Top Up Incentive Battery

3. Scrapping Incentive 1. 50% of incentive offered under

(all incentives applicable at time of FAME

purchase and payable to Auto OEM 2. Top-up incentive for swappable

or dealer) batteries (50% of FAME incentive)

3. Scrapping incentive

Karnataka 1. Exemption of taxes on all electric non-transport and transport vehicles

Kerala 1. e-Scooters with range of 50Km fixed battery & provision of extension of

battery range (additional battery)

2. e-bikes to leverage tourism potential

3. e-mobility zones in tourist areas and technoparks

4. Tax exemptions (state tax & road tax)

Telangana 1. Corporate offices with annual turnover of Rs 100+ Crore operating within

GHMC limits to compulsorily migrate 25% of their employee commuting

fleet to EVs by 2022 and 100% by 2030

2. Exemption of registration charges on personal vehicles purchased till 2025

3. Interest Free loans up to 50% of the cost to all state government

employees for purchase of EVs

4. Only Electric vehicles will be allowed in high traffic density areas, Heritage

zones, IT SEZs and similar EV Zones in Hyderabad by 2025. Same will be

applied to other cities in Telangana State.

5. Free Parking in public parking places and Toll exemption on State

Highways for EVs till 2025

Maharashtra - 1. 15% end user subsidy (max.- Rs.

5000/-) for first 70,000 2 wheelers

2. Exemption from road tax and

registration fee

Uttar Pradesh 1. Interest subsidy in the form of reimbursement of interest of up to 50% of

annual interest on the loan taken to buy land for PEVs (both

manufacturing/ assembly units)

2. Interest subsidy in the form of reimbursement of interest of up to 60% of

annual interest for 7 years on the loan taken for building supporting

infrastructure at the PEV parks

3. The developer shall be eligible for reimbursement of 100% stamp duty

paid on purchase of land for building the PEVM Park

4. Industrial Research subsidy for procurement of plant and machinery for

industrial research, quality improvement and setting up testing labs,

quality certification labs, tool rooms, etc. 5% per annum subsidy in form

of reimbursement on interest on loan taken for the mentioned purpose,

subject to maximum ceiling of INR 1 crore per unit.

5. SGST reimbursement – 90% for SGST reimbursement for MSME and Large

Units for 5years in EV sector, 70% reimbursement to Mega EVMU and

EBUs for 10years.

6. state will exempt SGST on purchase of electric vehicles manufactured

within the state

7. 30% subsidy on road price of EV in form of reimbursement to Individual

families with Single-girl child in the State on purchase of EVs, applicable

over the period of this policy.

Gujarat 1. Rs 10,000 subsidy to 2000 students for purchase of EVs

You might also like

- Mercedes-Benz E-Class Petrol Workshop Manual PDFDocument2 pagesMercedes-Benz E-Class Petrol Workshop Manual PDFthabani jefftey mleya0% (3)

- Tesla (TSLA) Full Operating Model + Reverse DCFDocument7 pagesTesla (TSLA) Full Operating Model + Reverse DCFDon JuanNo ratings yet

- Porsche Cayenne Turbo S 2013 - Derivação Dos Positivos - Diagrama Elétrico PDFDocument8 pagesPorsche Cayenne Turbo S 2013 - Derivação Dos Positivos - Diagrama Elétrico PDFWiterMarcos100% (1)

- Innovation Landscape brief: Electric-vehicle smart chargingFrom EverandInnovation Landscape brief: Electric-vehicle smart chargingNo ratings yet

- Tesla Strategic Management PresentationDocument19 pagesTesla Strategic Management Presentationapi-323493188No ratings yet

- Research Paper Battery Electric VehiclesDocument9 pagesResearch Paper Battery Electric Vehiclesapi-30670742950% (2)

- MH EV Policy Presentation - 13 JulyDocument10 pagesMH EV Policy Presentation - 13 JulyGaurav satraNo ratings yet

- Crest20 Evpolicy22 2009Document16 pagesCrest20 Evpolicy22 2009juitprashantNo ratings yet

- Infrastructure and Energy Digest August 2020 1Document12 pagesInfrastructure and Energy Digest August 2020 1ELP LawNo ratings yet

- 2021 06 23 GR GujaratE VehiclePolicy 2021Document7 pages2021 06 23 GR GujaratE VehiclePolicy 2021MAKZYS khanNo ratings yet

- AP Electric Vehicle PolicyDocument26 pagesAP Electric Vehicle Policy9052359751No ratings yet

- Intra-State Availability Based Tariff (ABT)Document15 pagesIntra-State Availability Based Tariff (ABT)dahigaonkarNo ratings yet

- Loksabhaquestions Annex 1715 AU1145Document8 pagesLoksabhaquestions Annex 1715 AU1145Pramod HansNo ratings yet

- State Trading Corporation Anuradhapura (Site - Thanthirimale)Document4 pagesState Trading Corporation Anuradhapura (Site - Thanthirimale)Saman KumarasingheNo ratings yet

- Dr. Ashok Jhunjhunwala IIT MadrasDocument10 pagesDr. Ashok Jhunjhunwala IIT Madrasjoycool100% (1)

- Scheme For Promotion of Electric Vehicles in The StateDocument4 pagesScheme For Promotion of Electric Vehicles in The Statepratik rathodNo ratings yet

- Tamil NaduDocument3 pagesTamil Naduanshulmishra713No ratings yet

- Faq PDFDocument9 pagesFaq PDFAnonymous HqwS65vtJNo ratings yet

- Report (Electrification in India)Document22 pagesReport (Electrification in India)Anshul TembhareNo ratings yet

- Bses Delhi Tariff - Schedule - FY - 2020 - 21Document10 pagesBses Delhi Tariff - Schedule - FY - 2020 - 21Pankaj KumarNo ratings yet

- Maharshtra EV PolicyDocument14 pagesMaharshtra EV PolicyVishal DesignNo ratings yet

- Science & Technology Policy Brief: Electric VehiclesDocument6 pagesScience & Technology Policy Brief: Electric VehiclesAshutosh SonkarNo ratings yet

- Project RBS Synopsis PDFDocument3 pagesProject RBS Synopsis PDFJEEVANT DEO 19M18 BhjNo ratings yet

- Amendments To Delhi EV PolicyDocument4 pagesAmendments To Delhi EV PolicyAshok SinhaNo ratings yet

- BRPL Tariff Schedule 2019 20Document10 pagesBRPL Tariff Schedule 2019 20Atul SharmaNo ratings yet

- Abc AbtDocument37 pagesAbc AbtVarada TambeNo ratings yet

- Porter's Diamond For Public Transport Industry:: Strategy, Structure and RivalryDocument3 pagesPorter's Diamond For Public Transport Industry:: Strategy, Structure and RivalrySATYA SHANKER KARINGULANo ratings yet

- Investment OpportunitiesDocument18 pagesInvestment OpportunitiesSatish Babu JettyNo ratings yet

- SIP Case Study 1 (ISHAAN SHUKLA)Document4 pagesSIP Case Study 1 (ISHAAN SHUKLA)akansh malhotraNo ratings yet

- Press Release MNREDocument5 pagesPress Release MNREDebarshi BaruahNo ratings yet

- Tentative Ownership Cost Calculator (EV V/S ICE Vehicles) For Home ChargingDocument4 pagesTentative Ownership Cost Calculator (EV V/S ICE Vehicles) For Home ChargingjitendraNo ratings yet

- Indian Electric Vehicle Infrastructure Market: State of TheDocument23 pagesIndian Electric Vehicle Infrastructure Market: State of TheANURAN GAYALINo ratings yet

- E Bus Case Study Kolkata ClarificationsDocument7 pagesE Bus Case Study Kolkata ClarificationsKhushalNo ratings yet

- Allowa Nces: (Irem Vol-I Chap. Vii para 701-712)Document14 pagesAllowa Nces: (Irem Vol-I Chap. Vii para 701-712)Indrasen DewanganNo ratings yet

- Tata Capital: Reaching New Heights. by Doing What's RightDocument17 pagesTata Capital: Reaching New Heights. by Doing What's RightSirsanath BanerjeeNo ratings yet

- Unit 6 EHV-1Document26 pagesUnit 6 EHV-1Tushar BarkadeNo ratings yet

- Kcci Oerc Order Power Tarrif 2024Document3 pagesKcci Oerc Order Power Tarrif 2024Sanjay GuptaNo ratings yet

- Tariff Schedule 2020-21Document9 pagesTariff Schedule 2020-21Yuva RajNo ratings yet

- Analysis of Charging Station Development in IndiaDocument13 pagesAnalysis of Charging Station Development in Indiasree haritha pNo ratings yet

- Electric Vehicle ScenarioDocument3 pagesElectric Vehicle ScenarioChinmay VSNo ratings yet

- IJISET - V1 - I10 - 94 (Generation Cost Calculation For 660 MW Thermal Power Plants - IJISET) PDFDocument5 pagesIJISET - V1 - I10 - 94 (Generation Cost Calculation For 660 MW Thermal Power Plants - IJISET) PDFMiguel Perez100% (1)

- Ahd Tariff Schedule TPL D A Tariff Order For Fy 2023 24 Dtd. 31.03.23 TariffDocument18 pagesAhd Tariff Schedule TPL D A Tariff Order For Fy 2023 24 Dtd. 31.03.23 Tariffcyberking998No ratings yet

- EOI PM KUSUM Component A 01.04.2022Document71 pagesEOI PM KUSUM Component A 01.04.2022Pooja Narveer RaoNo ratings yet

- bank Tie up with insurance companyDocument3 pagesbank Tie up with insurance companydetix97225No ratings yet

- Electric VehicleDocument13 pagesElectric VehicleAnubhav NagarNo ratings yet

- Solar DataDocument4 pagesSolar Datashaikhsharukh519No ratings yet

- Subject-Draft Bihar Electric Vehicle Policy 2019Document4 pagesSubject-Draft Bihar Electric Vehicle Policy 2019eee sasaramNo ratings yet

- Electric Vehicle Policy in IndiaDocument8 pagesElectric Vehicle Policy in IndiaPranjul ShuklaNo ratings yet

- State Wise EV Policies and IncentivesDocument30 pagesState Wise EV Policies and IncentivesRahulNo ratings yet

- Interest Subvention: Type IncentivesDocument9 pagesInterest Subvention: Type Incentivesblessycjn.velcitiNo ratings yet

- FAMEDocument3 pagesFAMELe JhandNo ratings yet

- Govt Producer Letter MNREDocument5 pagesGovt Producer Letter MNREKopal ShrivastavaNo ratings yet

- Tariff Schedule Fy 2019-20Document8 pagesTariff Schedule Fy 2019-20Sharma ShiviNo ratings yet

- CFA StruDocument1 pageCFA StruR & DNo ratings yet

- Hand Book EV Engineering FundamentalsDocument192 pagesHand Book EV Engineering FundamentalsbhukthaNo ratings yet

- Electric VehicleDocument13 pagesElectric VehicleNitin KurerNo ratings yet

- v3624773 ScheduleDocument1 pagev3624773 ScheduleHrishikesh BasakNo ratings yet

- Ha Red A 787986240Document30 pagesHa Red A 787986240tarun_aggarwaly5712No ratings yet

- Unit 1 Introduction Electric Vehicle: Department of Mechanical EngineeringDocument67 pagesUnit 1 Introduction Electric Vehicle: Department of Mechanical EngineeringPraveen RathodNo ratings yet

- Policies On Solar PowerDocument16 pagesPolicies On Solar PowerSandeep Guha NiyogiNo ratings yet

- Sr. No. Category Fixed Charges Energy Charges Domestic: AnnexureDocument5 pagesSr. No. Category Fixed Charges Energy Charges Domestic: AnnexureAam aadmiNo ratings yet

- Opportunities For Power Utilities With Electrification of TransportDocument5 pagesOpportunities For Power Utilities With Electrification of TransportAshish JainNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- Deployment of Hybrid Renewable Energy Systems in MinigridsFrom EverandDeployment of Hybrid Renewable Energy Systems in MinigridsNo ratings yet

- EV Charger Price ListDocument5 pagesEV Charger Price ListSoud AbdallahNo ratings yet

- Volkswagen 2007-2013 Revised CAL ID and CVN DataDocument8 pagesVolkswagen 2007-2013 Revised CAL ID and CVN DataDanyBobNo ratings yet

- Patente Chasis Motor Marca Modelo AÑODocument17 pagesPatente Chasis Motor Marca Modelo AÑOChristopher ParedesNo ratings yet

- VW T4 Westfalia CaliforniaCoach Manual English 1998 PDFDocument45 pagesVW T4 Westfalia CaliforniaCoach Manual English 1998 PDFFranz SchuierNo ratings yet

- Costruzione Dell OST Ampo: Mold ConstructionDocument40 pagesCostruzione Dell OST Ampo: Mold ConstructionАлександар ДимитријевићNo ratings yet

- Car PricesDocument6 pagesCar PricesSampath DayarathneNo ratings yet

- A Case Study Ofyy8uojDocument2 pagesA Case Study Ofyy8uojSujan DevkotaNo ratings yet

- Towards The Ultimate Eco-Car: Hybrid As The Core Technology: Piet Steel Driving Sustainability 08Document30 pagesTowards The Ultimate Eco-Car: Hybrid As The Core Technology: Piet Steel Driving Sustainability 08paparezaNo ratings yet

- Vehicle To GridDocument7 pagesVehicle To GridSurajRGuptaNo ratings yet

- STNK Kendaraan TruckDocument4 pagesSTNK Kendaraan TruckTriNo ratings yet

- TranspondersDocument2 pagesTranspondersCarlos Rosales GuzmanNo ratings yet

- CATALOG Engine MountingDocument10 pagesCATALOG Engine MountingAgus WahyudiNo ratings yet

- Catalog: Catalog de Elemente de Caroserie, Optice Si Electrice. Heavy Duty Body Parts and Lamps CatalogueDocument83 pagesCatalog: Catalog de Elemente de Caroserie, Optice Si Electrice. Heavy Duty Body Parts and Lamps CatalogueСергей ТищенкоNo ratings yet

- Cruce de Referencias Transponder-CtaDocument1 pageCruce de Referencias Transponder-CtaGregori LoayzaNo ratings yet

- Spatial and Temporal Model For Electric Vehicle Rapid Charging DemandDocument5 pagesSpatial and Temporal Model For Electric Vehicle Rapid Charging Demandanup chauhanNo ratings yet

- BRAKE PAK CatalogoDocument413 pagesBRAKE PAK CatalogoCarlos Augusto Montoya CocaNo ratings yet

- Suggestion For Tesla, Inc. Business Model CanvasDocument3 pagesSuggestion For Tesla, Inc. Business Model CanvasJackie LouNo ratings yet

- Toyota Global Hybrid Roll OutDocument2 pagesToyota Global Hybrid Roll OutshahraashidNo ratings yet

- Engine Controls (Powertrain Management) - FUSIONrDocument7 pagesEngine Controls (Powertrain Management) - FUSIONrRafael MejiaNo ratings yet

- Lista Great Wall: WHATSAPP +56 9 8406 2423 31-Mar-21Document141 pagesLista Great Wall: WHATSAPP +56 9 8406 2423 31-Mar-21Cristian PaltaNo ratings yet

- Volkswagen Could Topple Tesla As The Leader in Evs by 2025 GloballyDocument6 pagesVolkswagen Could Topple Tesla As The Leader in Evs by 2025 GloballynikhileshNo ratings yet

- Review Paper of Electric VehiclesDocument4 pagesReview Paper of Electric VehiclesEditor IJTSRDNo ratings yet

- Auto Express - Issue 1800-4-10 October 2023Document84 pagesAuto Express - Issue 1800-4-10 October 2023Silvina PANo ratings yet

- Mercedes BenzDocument16 pagesMercedes BenzRahul Bansal100% (1)

- WORKING DOC EV Extrication UPDATED 140822Document29 pagesWORKING DOC EV Extrication UPDATED 140822Syahrir ShahNo ratings yet