Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

55 viewsTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Uploaded by

Piyush AmbastaDocuments

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Marine Insurance Law PDFDocument651 pagesMarine Insurance Law PDFDaman Waruwu100% (2)

- Business Plan Sample BeautyDocument13 pagesBusiness Plan Sample BeautyLina Ali Abdul100% (4)

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- FTP 1 AaDocument8 pagesFTP 1 AaYash RankaNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Orion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Document2 pagesOrion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Amarjeet GuptaNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Advanced AccountingDocument68 pagesAdvanced AccountingOsamaNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Company Accounts, Cost and Management AccountingDocument10 pagesCompany Accounts, Cost and Management AccountingmeetwithsanjayNo ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Inp 2205 - Advance Accounting - Question PaperDocument10 pagesInp 2205 - Advance Accounting - Question PaperAnshit BahediaNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- FM MTP Question Paper Nov 19Document6 pagesFM MTP Question Paper Nov 19sriramakrishnajayamNo ratings yet

- UntitledDocument18 pagesUntitledAlok TiwariNo ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Corporate Strategic Financial Decisions 120675525Document17 pagesCorporate Strategic Financial Decisions 120675525Anushka GuptaNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- Business Law RTP of IcaiDocument66 pagesBusiness Law RTP of IcaitpsbtpsbtpsbNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- HRD Pragati 25-8-2009Document80 pagesHRD Pragati 25-8-2009Vinod ShelakeNo ratings yet

- IC Approved Application For Bond 9.11.2019Document4 pagesIC Approved Application For Bond 9.11.2019Violiza Mae RequirosoNo ratings yet

- Power Purchase AgreementDocument22 pagesPower Purchase Agreementdark webNo ratings yet

- CONTINGENT CONTRACTS VincyDocument5 pagesCONTINGENT CONTRACTS Vincyvincy gladisNo ratings yet

- MCQ For InsuranceDocument33 pagesMCQ For InsuranceAmi MehtaNo ratings yet

- 03 - Condition of Tendering - 593.plumbing & SanitaryDocument5 pages03 - Condition of Tendering - 593.plumbing & SanitaryMohd AlfitriNo ratings yet

- Ricky Sharma ResumeDocument6 pagesRicky Sharma ResumeMasood KhanNo ratings yet

- Risk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha KathiraveluDocument26 pagesRisk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha Kathiraveludavid AbotsitseNo ratings yet

- Norway Registration Scheme For EU/EEA/EFTA CountriesDocument5 pagesNorway Registration Scheme For EU/EEA/EFTA Countriesramona_paula_8No ratings yet

- Bora TicketgDocument5 pagesBora TicketgAnthony BauerNo ratings yet

- Week 42 ClassifiedsDocument3 pagesWeek 42 ClassifiedsChronicleExpressNo ratings yet

- 1252Document3 pages1252Eong Huat Corporation Sdn BhdNo ratings yet

- FL13-004 DicDocument4 pagesFL13-004 DicJimNo ratings yet

- Estate Tax SyllabusDocument7 pagesEstate Tax SyllabuscuteangelchenNo ratings yet

- Asigurarea de Malpraxis Domeniul Medical VITALIS: Ratele Urmatoare: Nr. 6,06Document4 pagesAsigurarea de Malpraxis Domeniul Medical VITALIS: Ratele Urmatoare: Nr. 6,06Chertes Y VasileNo ratings yet

- Revision WorksheetDocument2 pagesRevision WorksheetRavi UdeshiNo ratings yet

- University of Sydney: 1.5 Years Full TimeDocument5 pagesUniversity of Sydney: 1.5 Years Full TimeKinza FaisalNo ratings yet

- Suffolk Times Classifieds and Service Directory: Sept. 14, 2017Document13 pagesSuffolk Times Classifieds and Service Directory: Sept. 14, 2017TimesreviewNo ratings yet

- Conditions PrecedentDocument4 pagesConditions PrecedentMdms PayoeNo ratings yet

- Detecting Medical Identity TheftDocument2 pagesDetecting Medical Identity TheftGeorge F. Indest IIINo ratings yet

- Make A Fortune in The Insurance ProfessionDocument118 pagesMake A Fortune in The Insurance Professionldubetnt100% (3)

- Annual Statistical Report of Egyptian Insurance Market 2010 - 2011Document50 pagesAnnual Statistical Report of Egyptian Insurance Market 2010 - 2011Mohammed RagabNo ratings yet

- Ift Question PapersDocument5 pagesIft Question Paperssathishsep18No ratings yet

- ClassXI Sample Question Paper.2729a049Document4 pagesClassXI Sample Question Paper.2729a049Shrey GoelNo ratings yet

- Domingo Vs DomingoDocument4 pagesDomingo Vs DomingoReyshanne Joy B MarquezNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Uploaded by

Piyush Ambasta0 ratings0% found this document useful (0 votes)

55 views7 pagesDocuments

Original Title

54567bosmtpipccp5q

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDocuments

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

55 views7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accounting

Uploaded by

Piyush AmbastaDocuments

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

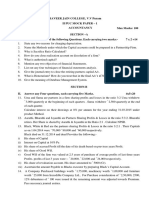

Test Series: March, 2019

MOCK TEST PAPER - 1

INTERMEDIATE (IPC): GROUP – II

PAPER – 5 : ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any five questions from the remaining six questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

(Time allowed: Three hours) (Maximum Marks: 100)

1. (a) Mohan Ltd. is in a dispute involving allegation of infringement of patents by a competitor

company who is seeking damages of a huge sum of Rs. 900 lakhs. The directors are of the

opinion that the claim can be successfully resisted by the company.

How would you deal with the same in the annual accounts of the Mohan Ltd. as per provisions of

AS 29?

(b) Explain the concept of ‘weighted average number of equity shares outstanding during the period’.

State how would you compute, based on AS-20, the weighted average number of equity shares

in the following case:

No. of shares

1 April, 2016

st Balance of equity shares 7,20,000

31st August, 2016 Equity shares issued for cash 2,40,000

1st February, 2017 Equity shares bought back 1,20,000

31st March, 2017 Balance of equity shares 8,40,000

(c) Omega Limited has borrowed a sum of US $ 10,00,000 at the beginning of Financial Year 2016 -

17 for its residential project at 4 %. The interest is payable at the end of the Financial Year. At

the time of availment exchange rate was Rs. 56 per US $ and the rate as on 31st March, 2017

was

Rs. 62 per US $. If Omega Limited borrowed the loan in India in Indian Rupee equivalent, the

pricing of loan would have been 10.50%.

You are required to compute Borrowing Cost and exchange difference for the year ending

31st March, 2017 as per applicable Accounting Standards.

(d) A Ltd. sold machinery having WDV of Rs. 40 lakhs to B Ltd. for Rs. 50 lakhs and the same

machinery was leased back by B Ltd. to A Ltd. The lease back is operating lease. You are

required to comment on the accounting treatment as per AS 19 in the following situations:

(i) Sale price of Rs. 50 lakhs is equal to fair value.

(ii) Fair value is Rs. 45 lakhs and sale price is Rs. 38 lakhs.

(iii) Fair value is Rs. 40 lakhs and sale price is Rs. 50 lakhs.

(iv) Fair value is Rs. 46 lakhs and sale price is Rs. 50 lakhs

(v) Fair value is Rs. 35 lakhs and sale price is Rs. 39 lakhs. (4 x 5 = 20 Marks)

2. The following was the Balance Sheet of Omega Ltd. as on 31 st March, 2018.

Equity & Liabilities Rs. Lakhs Assets Rs. Lakhs

Share Capital: Fixed Assets 14,000

1

© The Institute of Chartered Accountants of India

Equity shares of Rs. 10 each Fully Paid Up 8,000 Investments 3,000

10% Redeemable Pref. Shares of Rs. 10 2,500 Cash at Bank 1,650

each Fully Paid Up

Reserves & Surplus Other Current Assets 8,250

Capital Redemption Reserve 1,000

Securities Premium 800

General Reserve 6,000

Profit & Loss Account 300

Secured Loans:

9% Debentures 5,000

Current Liabilities:

Trade Payables 2,300

Sundry Provisions 1,000

26,900 26,900

On 1st April, 2018 the Company redeemed all its Preference Shares at a Premium of 10% and bought

back 15% of its Equity Shares at Rs. 20 per Share. In order to make cash available, the Company sold

all the Investments for Rs. 3,150 lakhs and raised a Bank Loan amounting to Rs. 400 lakh on the

Security of the Company’s Plant.

You are required to

(i) pass journal entries for the above and

(ii) prepare the Company’s Balance sheet immediately thereafter. (16 Marks)

3. L, M and N share profits and losses in the ratio of 5:3:2. Their firm was dissolved due to misconduct of

M and their balance sheet on that date was as under:

Balance Sheet as at 31-3-2018

Liabilities Rs. Assets Rs.

Capital Accounts : Land and Building 2,00,000

L 3,00,000 Plants 2,00,000

M 2,00,000 Trade receivables 1,00,000

N 1,00,000 6,00,000 Inventories 1,50,000

Current Accounts: Cash 1,00,000

L 50,000 Current Account:

M 30,000 80,000 N 50,000

Trade payables 1,20,000

8,00,000 8,00,000

The whole business of the firm was sold to Preet Limited, on that day on the following terms:

(i) Preet Limited will issue the following securities in consideration for transfer of business:

10,000 equity shares @ Rs. 15 each, 15,000 preference shares @ Rs. 15 each; and 20,000

debentures @ Rs. 14.725.

(ii) The agreed value of assets and liabilities of partnership firm are as follows:

Land & Building – Rs. 3,00,000, Plants – Rs. 1,50,000, Inventory – Rs. 1,40,000, Trade

Receivables – Rs. 97,500, and Trade Payables – Rs. 1,18,000.

2

© The Institute of Chartered Accountants of India

It was mutually decided that preference shares and debentures will be distributed in profit sharing ratio

and cash brought in by the partner (if any) will be shared equally by the remaining partners before

distribution of equity shares. Equity shares are distributed on residual basis at the end.

You are required to prepare Realization Account, Cash Account, Partners’ Current and Capital

Accounts at the time of closing the books of the firm. (16 Marks)

4. (a) XYZ is having its Branch at Kolkata. Goods are invoiced to the branch at 20% profit on sale.

Branch has been instructed to send all cash daily to head office. All expenses are paid by head

office except petty expenses which are met by the Branch Manager.

From the following particulars, you are required to prepare branch account in the books of Head

Office.

(Rs.) (Rs.)

Stock on 1st April 2017 30,000 Discount allowed to

(invoice price) debtors 160

Sundry Debtors on 1st April, 2017 18,000 Expenses paid by head office:

Cash in hand as on 1st April, 2017 800 Rent 1,800

Office furniture on 1st April, 2017 3,000 Salary 3,200

Goods invoiced from the head office Stationery & Printing 800

(invoice price) 1,60,000

Goods returned to Head Office 2,000 Petty expenses paid by the 600

branch

Goods returned by debtors 960 Depreciation to be provided on

Cash received from debtors 60,000 branch furniture at 10% p.a.

Cash Sales 1,00,000 Stock on 31st March, 2018

Credit sales 60,000 (at invoice price) 28,000

(b) Ganesh Ltd. has head office at Delhi (India) and branch at New York. New York branch is an integral

foreign operation of Ganesh Ltd. New York branch furnishes you with its trial balance as on

31st March, 2018 and the additional information given thereafter:

Dr. ($) Cr. ($)

Stock on 1st April, 2017 300 –

Purchases and sales 800 1,500

Sundry Debtors and creditors 400 300

Bills of exchange 120 240

Sundry expenses 1,080 –

Bank balance 420 –

Delhi office A/c – 1,080

3,120 3,120

The rates of exchange may be taken as follows:

➢ on 1.4.2017 @ Rs. 40 per US $

➢ on 31.3.2018 @ Rs. 42 per US $

➢ average exchange rate for the year @ Rs. 41 per US $.

New York branch account showed a debit balance of Rs. 44,380 on 31.3.2018 in Delhi books and

there were no items pending reconciliation.

3

© The Institute of Chartered Accountants of India

You are asked to prepare trial balance of New York in Rs. in the books of Ganesh Ltd.

(c) A company has its share capital divided into shares of Rs. 10 each. On 1-1-20X1, it granted

5,000 employees stock options at Rs. 50, when the market price was Rs. 140. The options were

to be exercised between 1-3-20X2 to 31-03-20X2. The employees exercised their options for

4,800 shares only; remaining options lapsed.

You are required to pass the necessary journal entries for the year ended 31-3-20X2, with regard

to employees’ stock options. (8 + 4 + 4 = 16 Marks)

5. (a) The following facts have been taken out from the records of City Bank Ltd. as on

31st March, 2017:

Rs. Rs.

Rebate on bill discounted (not due on March 31 st, 2016) 66,400

Discount received 3,00,000

Bill discounted 24,50,000

An analysis of the bills discounted is as follows:

Amount Due date Rate of discount

Rs. 2017

(i) 7,50,000 April 8 12%

(ii) 3,00,000 May 5 14%

(iii) 4,40,000 June 12 14%

(iv) 9,60,000 July 15 15%

You are required to:-

(i) Calculate Rebate on Bill Discounted (not due) on 31 st March, 2017.

(ii) The amount of discount to be credited to the profit and loss account.

(b) Modern Insurance Company’s Fire Insurance division provide the following information, show the

amount of claim as it would appear in the Revenue Account for the year ended 31 st March, 2017.

Direct Business Re-insurance

Rs. Rs.

Claim paid during the year 7,06,000 1,64,000

Claim received 64,000

Claim payable

1st April, 2016 1,64,600 11,600

31st March, 2017 1,75,000 17,400

Claim receivable:

1st April, 2016 - 17,000

31st March, 2017 - 28,400

Expenses of management 69,000

(Includes Rs. 7,600 Surveyor’s fee

and Rs. 8,400 Legal expenses for settlement of claims)

© The Institute of Chartered Accountants of India

(c) F Ltd. finalized their financial statements for the year ending 31 st March, 2017 and got approved

by their approving authority on 30 th June, 2017. A major fire broke out in the night of 31 st May,

2017 destroying factory premises. Loss of property estimated to be Rs. 25 lakhs. You are

required to state how to deal with this information in the annual accounts. (6 + 6 + 4 = 16 Marks)

6. The Balance Sheet of Lion Limited as on 31-03-2018 is given below:

Particulars Note No. Amount

(Rs. in lakh)

Equity & Liabilities

Shareholders' Funds

Shares’ Capital 1 1,400

Reserves & Surplus 2 (522)

Non-Current Liabilities

Long term Borrowings 3 700

Current Liabilities

Trade Payables 4 102

Other Liabilities 5 24

Total 1704

Assets

Non-Current Assets

Property, Plant & Equipment

Tangible Assets 6 750

Current Assets

Current Investments 7 200

Inventories 8 300

Trade Receivables 9 450

Cash & Cash Equivalents 10 4

Total 1704

Notes to Accounts:

Rs. in Lakhs

(1) Share Capital

Authorised :

200 lakh shares of Rs. 10 each 2,000

8 lakh, 8% Preference Shares of Rs. 100 each 800

2,800

Issued, Subscribed and paid up:

100 lakh Equity Shares of Rs. 10 each, full paid up 1,000

4 lakh 8% Preference Shares of Rs. 100 each, fully paid up 400

Total 1400

(2) Reserves and Surplus

Debit balance of Profit & Loss A/c (522)

(3) Long Term Borrowings

6% Debentures (Secured by Freehold Property) 400

5

© The Institute of Chartered Accountants of India

Directors’ Loan 300

700

(4) Trade Payables

Trade payables for Goods 102

(5) Other Current Liabilities

Interest Accrued and Due on 6% Debentures 24

(6) Tangible Assets

Freehold Property 550

Plant & Machinery 200

750

(7) Current Investment

Investment in Equity Instruments 200

(8) Inventories

Finished Goods 300

(9) Trade Receivables

Trade receivables for Goods 450

(10) Cash and Cash Equivalents

Balance with Bank 4

The Board of Directors of the company decided upon the following scheme of reconstruction with the

consent of respective shareholders:

(1) Preference Shares are to be written down to Rs. 80 each and Equity Shares to Rs. 2 each.

(2) Preference Shares Dividend in arrears for 3 years to be waived by 2/3 rd and for balance 1/3rd,

Equity Shares of Rs. 2 each to be allotted.

(3) Debenture holders agreed to take one Freehold Property at its book value of Rs. 300 lakh in part

payment of their holding. Balance Debentures to remain as liability of the company.

(4) Interest accrued and due on Debentures to be paid in cash.

(5) Remaining Freehold Property to be valued at Rs. 400 lakh.

(6) All investments sold out for Rs. 250 lakh.

(7) 70% of Directors' loan to be waived and for the balance, Equity Shares of Rs. 2 each to be

allowed.

(8) 40% of Trade receivables and 80% of Inventories to be written off.

(9) Company's contractual commitments amounting to Rs. 600 lakh have been settled by paying 5%

penalty of contract value.

You are required to:

(a) Pass Journal Entries for all the transactions related to internal reconstruction;

(b) Prepare Capital Reduction Account; and

(c) Prepare notes on Share Capital and Tangible Assets to Balance Sheet, immediately after the

implementation of scheme of internal reconstruction. (16 Marks)

© The Institute of Chartered Accountants of India

7. Answer any four of the following:

(a) ABC Ltd. has entered into a binding agreement with XYZ Ltd. to buy a custom -made machine

amounting to Rs. 4,00,000. As on 31st March, 2016 before delivery of the machine, ABC Ltd. had

to change its method of production. The new method will not require the machine ordered and so

it shall be scrapped after delivery. The expected scrap value is ‘NIL’.

Show the treatment of machine in the books of ABC Ltd.

(b) A liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount

distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The

assets were realized for Rs. 45,00,000 against whic h payment was made as follows:

Liquidation expenses Rs. 50,000

Secured Creditors Rs. 15,00,000

Preferential Creditors Rs. 1,25,000

The amount due to Unsecured Creditors was Rs. 30,00,000. You are asked to calculate the total

remuneration payable to liquidator. Calculation shall be made to the nearest multiple of a rupee.

(c) Explain the nature of Limited Liability Partnership. Who can be a designated partner in a Limited

Liability Partnership?

(d) A company had issued 30,000, 14% convertible debentures of Rs. 100 each on 1st April, 2016.

The debentures are due for redemption on 1 st July, 2018. The terms of issue of debentures

provided that they were redeemable at a premium of 5% and also conferred option to the

debenture holders to convert 20% of their holding into equity shares (Nominal value Rs. 10) at a

price of Rs. 15 per share. Debenture holders holding 2,500 debentures did not exercise the

option. Calculate the number of equity shares to be allotted to the debenture holders exercising

the option to the maximum.

(e) K Ltd. launched a project for producing product X in October, 2016. The Company incurred

Rs. 40 lakhs towards Research and Development expenses upto 31st March, 2018. Due to

prevailing market conditions, the Management came to conclusion that the product cannot be

manufactured and sold in the market for the next 10 years. The Management hence wants to

defer the expenditure write off to future years. Advise the Company as per the applicable

Accounting Standard. (4 x 4 = 16 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Marine Insurance Law PDFDocument651 pagesMarine Insurance Law PDFDaman Waruwu100% (2)

- Business Plan Sample BeautyDocument13 pagesBusiness Plan Sample BeautyLina Ali Abdul100% (4)

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- FTP 1 AaDocument8 pagesFTP 1 AaYash RankaNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Orion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Document2 pagesOrion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Amarjeet GuptaNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Advanced AccountingDocument68 pagesAdvanced AccountingOsamaNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Company Accounts, Cost and Management AccountingDocument10 pagesCompany Accounts, Cost and Management AccountingmeetwithsanjayNo ratings yet

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Inp 2205 - Advance Accounting - Question PaperDocument10 pagesInp 2205 - Advance Accounting - Question PaperAnshit BahediaNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- FM MTP Question Paper Nov 19Document6 pagesFM MTP Question Paper Nov 19sriramakrishnajayamNo ratings yet

- UntitledDocument18 pagesUntitledAlok TiwariNo ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Corporate Strategic Financial Decisions 120675525Document17 pagesCorporate Strategic Financial Decisions 120675525Anushka GuptaNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocument45 pages1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- Business Law RTP of IcaiDocument66 pagesBusiness Law RTP of IcaitpsbtpsbtpsbNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- HRD Pragati 25-8-2009Document80 pagesHRD Pragati 25-8-2009Vinod ShelakeNo ratings yet

- IC Approved Application For Bond 9.11.2019Document4 pagesIC Approved Application For Bond 9.11.2019Violiza Mae RequirosoNo ratings yet

- Power Purchase AgreementDocument22 pagesPower Purchase Agreementdark webNo ratings yet

- CONTINGENT CONTRACTS VincyDocument5 pagesCONTINGENT CONTRACTS Vincyvincy gladisNo ratings yet

- MCQ For InsuranceDocument33 pagesMCQ For InsuranceAmi MehtaNo ratings yet

- 03 - Condition of Tendering - 593.plumbing & SanitaryDocument5 pages03 - Condition of Tendering - 593.plumbing & SanitaryMohd AlfitriNo ratings yet

- Ricky Sharma ResumeDocument6 pagesRicky Sharma ResumeMasood KhanNo ratings yet

- Risk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha KathiraveluDocument26 pagesRisk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha Kathiraveludavid AbotsitseNo ratings yet

- Norway Registration Scheme For EU/EEA/EFTA CountriesDocument5 pagesNorway Registration Scheme For EU/EEA/EFTA Countriesramona_paula_8No ratings yet

- Bora TicketgDocument5 pagesBora TicketgAnthony BauerNo ratings yet

- Week 42 ClassifiedsDocument3 pagesWeek 42 ClassifiedsChronicleExpressNo ratings yet

- 1252Document3 pages1252Eong Huat Corporation Sdn BhdNo ratings yet

- FL13-004 DicDocument4 pagesFL13-004 DicJimNo ratings yet

- Estate Tax SyllabusDocument7 pagesEstate Tax SyllabuscuteangelchenNo ratings yet

- Asigurarea de Malpraxis Domeniul Medical VITALIS: Ratele Urmatoare: Nr. 6,06Document4 pagesAsigurarea de Malpraxis Domeniul Medical VITALIS: Ratele Urmatoare: Nr. 6,06Chertes Y VasileNo ratings yet

- Revision WorksheetDocument2 pagesRevision WorksheetRavi UdeshiNo ratings yet

- University of Sydney: 1.5 Years Full TimeDocument5 pagesUniversity of Sydney: 1.5 Years Full TimeKinza FaisalNo ratings yet

- Suffolk Times Classifieds and Service Directory: Sept. 14, 2017Document13 pagesSuffolk Times Classifieds and Service Directory: Sept. 14, 2017TimesreviewNo ratings yet

- Conditions PrecedentDocument4 pagesConditions PrecedentMdms PayoeNo ratings yet

- Detecting Medical Identity TheftDocument2 pagesDetecting Medical Identity TheftGeorge F. Indest IIINo ratings yet

- Make A Fortune in The Insurance ProfessionDocument118 pagesMake A Fortune in The Insurance Professionldubetnt100% (3)

- Annual Statistical Report of Egyptian Insurance Market 2010 - 2011Document50 pagesAnnual Statistical Report of Egyptian Insurance Market 2010 - 2011Mohammed RagabNo ratings yet

- Ift Question PapersDocument5 pagesIft Question Paperssathishsep18No ratings yet

- ClassXI Sample Question Paper.2729a049Document4 pagesClassXI Sample Question Paper.2729a049Shrey GoelNo ratings yet

- Domingo Vs DomingoDocument4 pagesDomingo Vs DomingoReyshanne Joy B MarquezNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet