Professional Documents

Culture Documents

Scheme NPS Lite May 2019

Scheme NPS Lite May 2019

Uploaded by

Ayanendu SanyalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheme NPS Lite May 2019

Scheme NPS Lite May 2019

Uploaded by

Ayanendu SanyalCopyright:

Available Formats

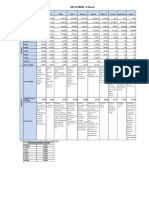

NPS SCHEME - SWAVALAMBAN

Particulars SBIPF LICPF UTIRSL KOTAK PF

Assets (Rs in crore ) 1,453.59 1,013.29 994.42 54.31

Scheme Inception Date 16-Sep-10 4-Oct-10 4-Oct-10 30-Jan-12

31-May-19 23.6804 23.4798 23.4563 20.4710

NAV

52 Week High 23.6804 23.4798 23.4563 20.4710

52 Week Low 20.8887 20.6531 20.7585 18.2212

3 Months 5.52% 5.87% 5.43% 5.43%

6 Months 7.48% 7.58% 7.23% 7.42%

RETURNS

1 Year 12.58% 12.91% 12.28% 11.58%

2 Years 7.92% 8.18% 7.97% 7.59%

3 Years 9.60% 9.77% 9.61% 9.13%

5 Years 10.41% 10.27% 10.31% 10.12%

Since Inception 10.40% 10.36% 10.35% 10.26%

8.17 % G- Sec 2044, 8.17% G-SEC 2044, 6.68% GSEC 2031, 8.24% G- Sec 2033

8.32% Goi 2032, 9.23% G-SEC 2043, 8.17% GSEC 2044, 8.28% G- Sec 2027

9.23% Gsc 2043, 7.73% G-SEC 2034, 7.59% GSEC 2029, GS CG 8.24% 2027

8.28% Goi 2027, 8.28% G-SEC 2027, 8.28% GOI 2027, 9.23% 8.33% G-SEC 2026

Top 5 Holdings

9.20% Goi 2030 9.20% G-SEC 2030 GSEC 2043 9.23% G Sec 2043

PORTFOLIO

Weigtage of top 5

16.38 17.24 14.19 17.41

Holdings,%

Government Govt. Sec, Banks, Activities of splzed

Sector,Banking Banks, Other credit granting, inst granting,

Finance Finance Housing credit Other Credit

Top 3 Sectors

Sector,Financial Institutions Granting

Institutions Other financial

service activities

* Scheme Returns for more than 01 year are annualised

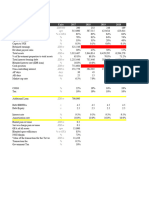

SCHEME BENCHMARK RETURN

3 month 6.18%

6 month 7.94%

1 year 13.05%

2 years 7.58%

3 years 9.23%

5 years 10.13%

You might also like

- Calculating Midpoint of Salary RangeDocument14 pagesCalculating Midpoint of Salary RangeMohamad BukhariNo ratings yet

- Mckinsey'S 7S Framework: Presented By: Group 3Document13 pagesMckinsey'S 7S Framework: Presented By: Group 3chitrang_609216236No ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Gov't's Position On Termination of PDS Agreement and Way ForwardDocument9 pagesGov't's Position On Termination of PDS Agreement and Way Forwardmyjoyonline.com0% (1)

- Case Study TescoDocument25 pagesCase Study TescoMimi Afzan AfzaNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- SchemeTaxSaver TierIIDocument1 pageSchemeTaxSaver TierIIAnjali DahiyaNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- Rate Chart - 19.10.22Document1 pageRate Chart - 19.10.22rime.samimahmudkhanNo ratings yet

- Building ModelDocument4 pagesBuilding Modelqxcars1No ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Life Insurance Update For November 2023Document6 pagesLife Insurance Update For November 2023rajautoprincNo ratings yet

- Property Valuation Analysis: Building I Want 160Document21 pagesProperty Valuation Analysis: Building I Want 160yhcdyhdNo ratings yet

- ICICI Prudential MF Head Start 15012024Document6 pagesICICI Prudential MF Head Start 15012024LAKHAN TRIVEDINo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- ICICI Prudential MF Head Start - 03082022Document2 pagesICICI Prudential MF Head Start - 03082022shailendra kumarNo ratings yet

- Training and DevelopmentDocument12 pagesTraining and Developmentprashanth AtleeNo ratings yet

- FM Exam PracticeDocument12 pagesFM Exam Practicejyotiguptapr7991No ratings yet

- ICICI Prudential MFDocument2 pagesICICI Prudential MFDOLLY KHAPRENo ratings yet

- JULY 2009: Monthly UpdateDocument33 pagesJULY 2009: Monthly UpdatepuneetggNo ratings yet

- Meezan Bank Installments Calculation & RequirementsDocument2 pagesMeezan Bank Installments Calculation & RequirementsImran JavedNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Life Insurance Update For October 2023Document6 pagesLife Insurance Update For October 2023gupta_pankajkr5626No ratings yet

- FD Vs Debt Fund SelectorDocument4 pagesFD Vs Debt Fund SelectorAbhay MishraNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Private Equity Real Estate Exam SolutionDocument10 pagesPrivate Equity Real Estate Exam SolutionangadNo ratings yet

- Titan DCF Valuation ModelDocument21 pagesTitan DCF Valuation ModelPrabhdeep DadyalNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- Contoh DCF ValuationDocument17 pagesContoh DCF ValuationArie Yetti NuramiNo ratings yet

- Accfinm - 165-175 Final OutputDocument19 pagesAccfinm - 165-175 Final OutputShenedy Lauresta QuizanaNo ratings yet

- Irr On Project and Irr On Equity: by Krigan CapitalDocument6 pagesIrr On Project and Irr On Equity: by Krigan CapitalAziz SaputraNo ratings yet

- FD Vs Debt FundDocument4 pagesFD Vs Debt FundCharan RoyNo ratings yet

- Income Distribution - Month Ended Sep 30, 2020Document3 pagesIncome Distribution - Month Ended Sep 30, 2020AamirNo ratings yet

- DTTC - Trần Gia BửuDocument29 pagesDTTC - Trần Gia BửuGia BửuNo ratings yet

- ANBIMA Ranking RF - Hibridos - 1121Document46 pagesANBIMA Ranking RF - Hibridos - 1121RoseAna CordelNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- MRG Invesments DataDocument10 pagesMRG Invesments DataNirmal KumarNo ratings yet

- Income Distribution - Month Ended Aug 31, 2020Document3 pagesIncome Distribution - Month Ended Aug 31, 2020M Ramzan khanNo ratings yet

- Invest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundDocument12 pagesInvest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundRinku MishraNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- SBI Large & Midcap Fund - Regular Plan - Growth (Document1 pageSBI Large & Midcap Fund - Regular Plan - Growth (kprdeepakNo ratings yet

- Hero Model - Equivalue 2Document48 pagesHero Model - Equivalue 2Neha RadiaNo ratings yet

- Tata SteelDocument2 pagesTata Steelapurv chauhanNo ratings yet

- 1 - Simple InterestDocument2 pages1 - Simple InterestKristine T. CastroNo ratings yet

- Meezan Bank Car Ijarah Rental Caculation: Booking PeriodDocument1 pageMeezan Bank Car Ijarah Rental Caculation: Booking PeriodMuhammad UsmanNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- Audit Cash CycleDocument13 pagesAudit Cash CycleNik Nurul Ain Ehzani100% (3)

- Chapter 21 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document50 pagesChapter 21 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Mobilink, Pakistan - FullDocument23 pagesMobilink, Pakistan - FullInnocent HarryNo ratings yet

- Advance AccountingDocument39 pagesAdvance Accountinganna rodriguezNo ratings yet

- MaiDocument106 pagesMaideepakmukhiNo ratings yet

- Assignment 2Document3 pagesAssignment 2Mak Chee KinNo ratings yet

- Non Governmental Organisation (NGO)Document12 pagesNon Governmental Organisation (NGO)Tausif ZahirNo ratings yet

- Management Is Universal Process and PhenomenonDocument2 pagesManagement Is Universal Process and PhenomenonAriel Ceria RiotocNo ratings yet

- Project On Apex BankDocument32 pagesProject On Apex BankRishi Agarwal75% (4)

- Hartalega ArDocument160 pagesHartalega ArBenjamin WoNgNo ratings yet

- Civil 12 2016Document81 pagesCivil 12 2016mohamed ismailNo ratings yet

- Occidental Sells North Sea Fields For $1.35 Billion - LA Times, May 09, 1991Document3 pagesOccidental Sells North Sea Fields For $1.35 Billion - LA Times, May 09, 1991The Toxic TrinityNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Vadilal (Vadilal Industries Limited) From A Small Outlet in Ahmedabad Over 80Document3 pagesVadilal (Vadilal Industries Limited) From A Small Outlet in Ahmedabad Over 80David ScottNo ratings yet

- Zee Entertainment Enterprises LimitedDocument34 pagesZee Entertainment Enterprises LimitednavjotNo ratings yet

- DB EM Currency HandbookDocument132 pagesDB EM Currency Handbookshih_kaichihNo ratings yet

- Toyota Finall Accounts ProjectDocument13 pagesToyota Finall Accounts ProjectAreej JehanNo ratings yet

- Module 1 Auditing ConceptsDocument21 pagesModule 1 Auditing ConceptsDura LexNo ratings yet

- ATP Digest - Gatchalian Vs CIRDocument1 pageATP Digest - Gatchalian Vs CIRLawrence RiodequeNo ratings yet

- Brand Management Week 2Document47 pagesBrand Management Week 2Yudhistira AdiNo ratings yet

- Costing and Pricing ConsultanciesDocument17 pagesCosting and Pricing ConsultanciesFred Raphael IlomoNo ratings yet

- Auditing AC410 Unit 1Document3 pagesAuditing AC410 Unit 1JaySmithNo ratings yet

- Tariq GlassDocument6 pagesTariq Glassfatima shakeelNo ratings yet

- 1 - 1st September 2007 (010907)Document4 pages1 - 1st September 2007 (010907)Chaanakya_cuimNo ratings yet

- Statement 1568002244543Document10 pagesStatement 1568002244543krishna aNo ratings yet

- DCPL Trans 3654 (Macmet)Document2 pagesDCPL Trans 3654 (Macmet)Aishwarya GantaitNo ratings yet