Professional Documents

Culture Documents

R, Arbqrql (, Sail (: 3Fltf, (

R, Arbqrql (, Sail (: 3Fltf, (

Uploaded by

Nitesh ChaudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R, Arbqrql (, Sail (: 3Fltf, (

R, Arbqrql (, Sail (: 3Fltf, (

Uploaded by

Nitesh ChaudharyCopyright:

Available Formats

t

t 1[ f*xtruliertPrarsi"e(*fl I TCls Recfinriliatil:* Am{ysis::*d, C'tu-rcctixlfl EnBb}imG :iY$teril

hffik&Fdffia

TDS CPC, Aaykar Bhawan, Sector - 3, Vaishali, Ghaziabad, U.P. ' 201010

3flTf,{ siti"i, terr -r, teffi, arBqrql(, sail{ $*?r-201010

Tetephone: 0120-1811600 (Totl Free): 18001030311 fu:0120-1811600 (dd fr1: TOOruSOSl+

Website:.lll):l.i::.,..1rL!!rllr...(li) .iti Email ID: L:i!l.rll.t:.t.!,!.1..!:,) i.rl'.r..i..i1r....(.1.11..l-t

:rrq-+-t erffi+qq 1961 fr trRT 200A *', sTdrfi q{

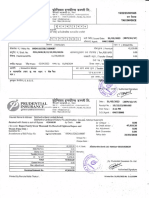

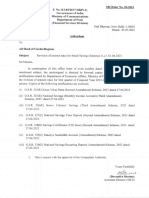

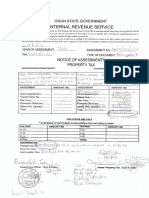

INTINIATION U/S 2OOA OF THE INCO1VIE TAX ACT, 1961

llllillililiillilillillililllllllifi liiilllilllililllllllllfr lililllillll

Name & Address ars sif{ Tdr

DPDO JHUNJHUNU

Principal Officer

NEAR PEERU SINGH CIRCLE

RAILWAY ROAD

JHUNJHUNU - 333OOI. RAJASTHAN

Ph. No.: 8058272597

Communication Reference No. TAN Statement Type F.Y. Quarter

rd dEt {'Eqr ta lr+rq q-rr ffiq E* ffi

TDS/ 1 8 I 9/24QlD I t0OO33467 346 JPRDO3468D Regular 2018-19 Q4

TDS Form Number Token Number Date of Filing of Regular Statement Order Pass Date

dr+rs srf +. ztd-d F,drtr Erqr ffir 3r-raai 41 iaTrl

0309xxxxxxx.{570 07-May-2019 20-May-2019

24Q

This is to give you a norice that a sum of Rs. 36.30.860.00 ( including inte rest ) has been determined to be payable by you in respect of statement

filed by you as above

The sum has been determined u/s 2004 ofthe Income Tax Act. 1961 in respect ofthe TDS statement as considered above. The details

ofdefaults

2.

given in the .Justification Report' which is available in your account on TRACES (1!\uf .t.1se[c;i8!.]!). The brief summary of sum payable

are

is mentioned as belou on sample basis:

claimed tns'l

| ** | | n-o,-t | 'Interest / others' I I

I I I tns.l I in the statement (Rs') I I

I r lshon Pavment I o.oo I o oo I u'w I

I : lshonDeduction/Collection l:S,OO,OS0.::1 0.00 1 35.6U.UU6.IJl

l"l,;;;;;;..*,,, |

I : I lnt.r.rr on pxymcnts default tL/s

I rt.t |Inlerestonshonpayment

I I

| 0.00|

| 000|

I

I

uut)I

I

I :tui I lnrerest on late paymenl I 0.001 o'00

| o uul

+ on deduction/collection default u/s I

|I I lT:':.

l,orrrAr/"o6c{7) I| II II I

I

I +tal IInterestonshondeduction/collection | 70.770.00| 0ou| /u'//uuuI

I +rUr l lnterest on late deduction/collection I O.Oo l 0 0o l u uu

l

I s llate Filine fee u/s ll-lE | 0.00 | 0 00 | u uo I

I PaYable tRs.) | J6J'J'u50":r i

I Rounding-Off (to the nearest multiple of ten rupees) (Rs.) | J'71 |

J. The defaults at S1. No. 1 and 2 in the table above are on account of the fact that you have either not deducted or not paid or after so deducting,

failed to pay the whole or any part of the ta\ as per the Income Tax Act, 1961 . Ybu are requested to pay the default amount as per Sl. No. I ' 2,

3(a) & (a)in the table above, within the calendai month of the order pass date. In case of further delay in payment, you are advised to recalculate

the interest under section 201(lA) for Sl. No. 3(a) & a(a) and pay accordingly

3.1 please note that as you pay the defaults at Sl. No. I & 2, the conesponding interest would reduce & the'Interest on Late Payment / Deduction

shall be appropriately calculated

+,+:;i::,--ii- : -. : :.

j

"

You might also like

- Group Project 2 Acc117Document9 pagesGroup Project 2 Acc117Wan Amir Islam100% (1)

- MW Petroleum Corporation (A)Document6 pagesMW Petroleum Corporation (A)AnandNo ratings yet

- The External Rate of Return MethodDocument5 pagesThe External Rate of Return MethodEllen Kay Cacatian80% (5)

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- Airtravel Om26102016 PDFDocument2 pagesAirtravel Om26102016 PDFshankerahulNo ratings yet

- Ajay15 GDocument1 pageAjay15 Gsurendra singh kachhavaNo ratings yet

- Insurance 01665Document4 pagesInsurance 01665scf p. ltd.No ratings yet

- Certificate: of GraduationDocument15 pagesCertificate: of Graduationtrongthanhdl2798No ratings yet

- Itemized Campaign Finance DisclosureDocument30 pagesItemized Campaign Finance DisclosureThe Valley IndyNo ratings yet

- KusmmDocument3 pagesKusmmShanu ShanuNo ratings yet

- Img 20180822 0007Document1 pageImg 20180822 0007N Swamy DivitiNo ratings yet

- TalisayDocument1 pageTalisayJerome GaliciaNo ratings yet

- 911 Taxpayer AssistanceDocument1 page911 Taxpayer Assistanceapi-3826089No ratings yet

- Ajay 15 GDocument1 pageAjay 15 Gsurendra singh kachhavaNo ratings yet

- 6.) Rural Electrification CorporationDocument51 pages6.) Rural Electrification CorporationChirag AgrawalNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024anusha.veldandiNo ratings yet

- Adobe Scan 9 Feb 2024Document2 pagesAdobe Scan 9 Feb 2024anusha.veldandiNo ratings yet

- D-Ireetor: S FfirDocument1 pageD-Ireetor: S FfirAshok BhatNo ratings yet

- Contingent BillDocument2 pagesContingent BillMahindra KumarNo ratings yet

- Img 20211114 0002Document1 pageImg 20211114 0002Ashim PramanikNo ratings yet

- PO Vol1 LegislativeenactmentsDocument182 pagesPO Vol1 LegislativeenactmentsSANATHNo ratings yet

- Companies (Declaration and Payment of Dividend) Rules, 2014Document2 pagesCompanies (Declaration and Payment of Dividend) Rules, 2014Latest Laws TeamNo ratings yet

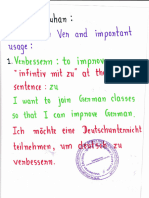

- Verbessern..to ImproveDocument9 pagesVerbessern..to ImprovebptebjyxweNo ratings yet

- ' Ifffi-N N-) - Narnel: Sworil, Sifatehent Tiaailitie$ Iser WorthDocument2 pages' Ifffi-N N-) - Narnel: Sworil, Sifatehent Tiaailitie$ Iser WorthHeinna Alyssa GarciaNo ratings yet

- Hrs E" - Tri: (WithoutDocument4 pagesHrs E" - Tri: (WithoutyatiNo ratings yet

- Photocopy of Valid PRC Id and Current PTR of Professional W 3 Specimen Signature and Dry Seal 1675304025690Document1 pagePhotocopy of Valid PRC Id and Current PTR of Professional W 3 Specimen Signature and Dry Seal 1675304025690sypiojeffreyNo ratings yet

- EMERGODocument1 pageEMERGOAgung KurniawanNo ratings yet

- Lnlres: Do (/BRVL) L'!ilh V EctDocument1 pageLnlres: Do (/BRVL) L'!ilh V EctAshok BhatNo ratings yet

- Addendum To SB Order 04 - 2023 PDFDocument19 pagesAddendum To SB Order 04 - 2023 PDFmanish sainiNo ratings yet

- Img 20210310 0003Document3 pagesImg 20210310 0003pharmafactoryegstore 2021No ratings yet

- Lliletals LNC-: Ot?A 2o (eSODocument2 pagesLliletals LNC-: Ot?A 2o (eSOShienaMaeC.TecsonNo ratings yet

- Latest Had Varnan (Ward No.1 To 19)Document14 pagesLatest Had Varnan (Ward No.1 To 19)Bhaveshkumar SangadaNo ratings yet

- Mech and Electrical Final22-23 - 1-Copy - 0Document85 pagesMech and Electrical Final22-23 - 1-Copy - 0Darshan MaheshwariNo ratings yet

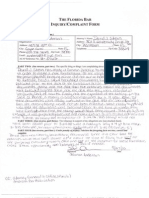

- Florida Bar Complaint - NEWDocument25 pagesFlorida Bar Complaint - NEWShannon Anderson100% (1)

- Coo Inp 030Document1 pageCoo Inp 030varysurabayaNo ratings yet

- Laporan Bulanan Bali Dan PD Kas November21Document10 pagesLaporan Bulanan Bali Dan PD Kas November21Ronie SyahNo ratings yet

- Mby Atp Bacolod 169 CRDocument1 pageMby Atp Bacolod 169 CRmbyedithNo ratings yet

- Charvik Birth CertificateDocument1 pageCharvik Birth CertificateBALKAR SINGHNo ratings yet

- Ffi ( ('I'. : Tet: WWDocument1 pageFfi ( ('I'. : Tet: WWVIETSKY THIẾT KẾNo ratings yet

- It - Altatzt : Ft:LiethDocument4 pagesIt - Altatzt : Ft:LiethKundan kumarNo ratings yet

- Affidavit of DesistanceDocument2 pagesAffidavit of DesistanceChristine NarteaNo ratings yet

- PPV'sDocument43 pagesPPV'sPerfect Kadeweletz0665No ratings yet

- RR No. 20-2020 PDFDocument2 pagesRR No. 20-2020 PDFBobby Olavides SebastianNo ratings yet

- FTDF (' (TD: FR FRDocument3 pagesFTDF (' (TD: FR FRDeepanshu SinghNo ratings yet

- Hafiz AkbarDocument7 pagesHafiz AkbarLosta NataNo ratings yet

- Yi:"lt:ms: Caiibration & ConsuliantsDocument2 pagesYi:"lt:ms: Caiibration & ConsuliantsTsc TechnoNo ratings yet

- Affidavit 1699871483Document14 pagesAffidavit 1699871483namoyuviNo ratings yet

- UQ0538Document2 pagesUQ0538Fulkan HadiyanNo ratings yet

- L': - Benro "Document1 pageL': - Benro "jennilyn pabloNo ratings yet

- Apc Fy - 19-20Document17 pagesApc Fy - 19-20skrai456No ratings yet

- 2018-10-31 - T1 - Transitional Policy For Ongoing Prop (CIRCULAR NO.33 of 2018-19)Document4 pages2018-10-31 - T1 - Transitional Policy For Ongoing Prop (CIRCULAR NO.33 of 2018-19)Mandeep SinghNo ratings yet

- Img 20220921 0001Document1 pageImg 20220921 0001VwairheNo ratings yet

- Rizal CVDocument4 pagesRizal CVCalvin Errol SalasNo ratings yet

- Affidavit 1699195661Document25 pagesAffidavit 1699195661ishare digitalNo ratings yet

- Voucher and VRET Format For Payment 12.06.19Document2 pagesVoucher and VRET Format For Payment 12.06.19RahulNo ratings yet

- BAMS 2nd Year (Main-Supply) Time Table (Dec 2021)Document7 pagesBAMS 2nd Year (Main-Supply) Time Table (Dec 2021)Vikas KeerNo ratings yet

- Q-FT, RRGGF+ Q: Birth A+Document3 pagesQ-FT, RRGGF+ Q: Birth A+Legend AssassinNo ratings yet

- Img 20230419 0001Document1 pageImg 20230419 0001April Thea VillaruzNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024anusha.veldandiNo ratings yet

- Lottery Result Tender DCT8773P19Document50 pagesLottery Result Tender DCT8773P19Dheeraj KapoorNo ratings yet

- Fully Vouched Contingent BillDocument2 pagesFully Vouched Contingent BillVirendra MahalaNo ratings yet

- Case Study Nike IncDocument5 pagesCase Study Nike IncIshita KashyapNo ratings yet

- Corporate Profile: Metropolitan Bank and Trust CompanyDocument54 pagesCorporate Profile: Metropolitan Bank and Trust CompanyAnn Camille Joaquin100% (1)

- Online BankingDocument46 pagesOnline BankingNazmulHasanNo ratings yet

- Loan Classification NotesDocument33 pagesLoan Classification NotesAtia IbnatNo ratings yet

- Mid Term Test 1.4 The Business IntermediateDocument5 pagesMid Term Test 1.4 The Business Intermediateariel blackNo ratings yet

- MBA 543 Real Estate Financing and Investment Syllabus Spring 2024Document3 pagesMBA 543 Real Estate Financing and Investment Syllabus Spring 2024Hean PengcheangNo ratings yet

- Topic 5c - Rental and Royalty IncomeDocument17 pagesTopic 5c - Rental and Royalty IncomeAgnesNo ratings yet

- QBAMCO - It's Time PDFDocument6 pagesQBAMCO - It's Time PDFplato363No ratings yet

- Bank Alfalah Internship ReportDocument35 pagesBank Alfalah Internship ReportTAS_ALPHA100% (1)

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Class 5 Project Selection ExerciseDocument18 pagesClass 5 Project Selection ExerciseVinodshankar BhatNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Short Term Budgeting Lecture Notes 3 CompressDocument30 pagesShort Term Budgeting Lecture Notes 3 CompressGwyneth TorrefloresNo ratings yet

- Agricultural Bank of China Limited SEHK 1288 Financials Balance SheetDocument3 pagesAgricultural Bank of China Limited SEHK 1288 Financials Balance SheetJaime Vara De ReyNo ratings yet

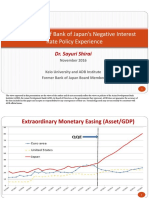

- An Overview of Bank of Japan Negative Interest Rate Policy ExperienceDocument12 pagesAn Overview of Bank of Japan Negative Interest Rate Policy ExperienceADBI Events100% (1)

- DPS Vindh Fee Structure 2019-20Document3 pagesDPS Vindh Fee Structure 2019-20Sudipto De SarkarNo ratings yet

- 07 04Rpt Funding Request SummaryDocument10 pages07 04Rpt Funding Request SummarySri Maharani AndaNo ratings yet

- HBS Table No. 44 Major Monetary Policy Measures - Bank Rate, CRR & SLRDocument7 pagesHBS Table No. 44 Major Monetary Policy Measures - Bank Rate, CRR & SLRSOHAM DEONo ratings yet

- Chapter 5Document41 pagesChapter 5Jan DMAXNo ratings yet

- Evaluation Chapter 11 LBO M&ADocument32 pagesEvaluation Chapter 11 LBO M&AShan KumarNo ratings yet

- Practice 2 - Chapter 14 - Accounting Concepts-1Document6 pagesPractice 2 - Chapter 14 - Accounting Concepts-1Patricia EspinosaNo ratings yet

- DSNHP00197140000690828 2022Document2 pagesDSNHP00197140000690828 2022Vidya SagarNo ratings yet

- Partnership Dissolution QuestionsDocument3 pagesPartnership Dissolution QuestionsArkkkNo ratings yet

- Welete Weldu 1Document19 pagesWelete Weldu 1Kalayu KirosNo ratings yet

- Banking IndustryDocument26 pagesBanking IndustrySaahil BcNo ratings yet

- St. Paul University Surigao Surigao City, Philippines: Results and DiscussionsDocument8 pagesSt. Paul University Surigao Surigao City, Philippines: Results and DiscussionsDianna Tercino IINo ratings yet