Professional Documents

Culture Documents

Asia Breathes A Sigh of Relief

Asia Breathes A Sigh of Relief

Uploaded by

Chi-Chu TschangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asia Breathes A Sigh of Relief

Asia Breathes A Sigh of Relief

Uploaded by

Chi-Chu TschangCopyright:

Available Formats

NEWS

036

HOUSING alization of Fannie and

CRISIS Freddie was just what

the Asians wanted.

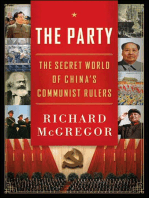

Chinese bankers felt the

bonds “were like Treasuries,” says Yi

Xianrong, a researcher at the Chi-

nese Academy of Social Sciences, so

there was no question the U.S. had to

intervene. “We never had any doubt”

Washington would come to the rescue,

Zhou

Xiaochuan, says Ha Keun Cheol, economist in

governor of Seoul with the Bank of Korea.

the People’s

Bank of China Nowhere to run

Now that Treasury Secretary Henry

Paulson has made his move, will Asia’s

asia breathes

bankers be more comfortable with

relying so much on Fannie and Freddie

paper? The Sept. 7 intervention likely

makes their debt a safer option—and

A sigh of relief

central banks may have little choice.

“Those trade surpluses are U.S.-

dollar-denominated,” and as many

European economies weaken, the euro

The effective nationalization of Fannie and Freddie isn’t a very attractive alternative, says

Goldman Sachs analyst Roy Ramos. For

reassures governments holding tons of their paper Asian bankers, “there’s only so much

you can do” to diversify away from the

greenback, Ramos says.

That’s not to say there’s no downside

By Bruce Einhorn lion.) Deepening problems at the two for Asia. The U.S. housing crisis is still

Hong Kong enterprises spurred urgent phone calls real, and the economy is struggling.

American home buyers to Washington. Chinese banks “were Already Chinese exports are slowing

haven’t been the only ones probably facing significant losses,” says as American consumers close their

counting on the supposed reliability of Logan Wright, an analyst with Stone & wallets. Continuing weakness in the

Fannie Mae and Freddie Mac. The two McCarthy Research. U.S. might further hurt Asia’s exports—

companies’ bonds have become favor- This summer, the foreigners started which could, of course, slow growth

ites of Asian governments looking for pulling back. In July, the Bank of China, in their foreign reserves and make big

somewhere to put the dollars generated a state-controlled commercial bank, investments in U.S. debt less necessary.

by big trade surpluses with the U.S. trimmed its holdings of the agencies’ For now, though, Asia’s central

Until recently, it made sense. The mar- debt by selling or choosing not to roll banks are emerging as winners. “They

ket was booming, yields were slightly over $4.6 billion of their bonds. After have nothing to complain about—

better than plain-vanilla Treasuries, increasing by an average of $22 billion a they’re made whole,” says Edwin M.

and everyone assumed Washington month in the first half of Truman, an econo-

backed the mortgage companies. 2007, central bank hold- mist who headed the

As the U.S. housing crisis deepened ings of Fannie and Fred- Foreign Funds Fed’s international

and Fannie and Freddie started sink- die securities in Federal finance division from

Top five non-U.S. holders of

ing, though, foreign bankers wanted Reserve custody fell by 1977 to 1998. “The

Fannie and Freddie debt*

assurances that their assumption $27 billion from mid-July fact of the matter is,

was correct. “Treasury saw foreign through early September, BILLIONS

if Fannie and Freddie

governments getting the willies,” says according to Brad Setser, China $376 can’t pay, you and I

one Senate aide. Especially those in a former Treasury Dept. Japan $228 will.” ^

Asia: Four of the top five international official and now a fellow –With Theo Francis

Russia $75

holders of Fannie and Freddie paper are at the Council on Foreign in Washington,

Nir Elias/AP Photo

Asian. Chinese hold $376 billion, Japa- Relations. “The threat South Korea $63 Chi-Chu Tschang in

nese have $228 billion, South Koreans of a central bank buyers’ Taiwan $55 Beijing, Moon Ihlwan

$63 billion, and Taiwanese $55 bil- strike was real,” he says. * As of June 30, 2007 in Seoul, and Hiroko

lion. (Russia is No. 3, with $75 bil- The effective nation- Data: Treasury Dept. (U.S.) Tashiro in Tokyo

BUSINESSWEEK I SE PTE M B E R 22, 2008

You might also like

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (20)

- TPS ChristopherFritze Jan16Document13 pagesTPS ChristopherFritze Jan16IrmaNo ratings yet

- IM - Tea To EgyptDocument25 pagesIM - Tea To EgyptBadar Qureshi100% (1)

- Banking The Unbanked: Native American BankDocument4 pagesBanking The Unbanked: Native American BankjjNo ratings yet

- TTMYGH - Horse, Pig, Helmet, Man, WomanDocument36 pagesTTMYGH - Horse, Pig, Helmet, Man, WomanZerohedgeNo ratings yet

- Erie, Matthew. 2016. "Sharia, Charity, and Minjian Autonomy in Muslim China Gift Giving in ADocument14 pagesErie, Matthew. 2016. "Sharia, Charity, and Minjian Autonomy in Muslim China Gift Giving in Abilal.salaamNo ratings yet

- The Secret History of The Banking Crisis ToozeDocument8 pagesThe Secret History of The Banking Crisis ToozeHeinzNo ratings yet

- Vol.10 Issue 36 January 6-19, 2018Document82 pagesVol.10 Issue 36 January 6-19, 2018Thesouthasian TimesNo ratings yet

- 2015 03 23 Wall Street Journal EuropeDocument32 pages2015 03 23 Wall Street Journal EuropeEmma FrostNo ratings yet

- US, China and ThucydidesDocument10 pagesUS, China and ThucydidesABRAHAM ALBERT DIAZNo ratings yet

- Act ch01 l02 EnglishDocument3 pagesAct ch01 l02 EnglishLinds RiveraNo ratings yet

- Thank You For Calling MoodyDocument6 pagesThank You For Calling MoodySakshi KaleNo ratings yet

- Everything Under The Heavens How The Past Helps Shape China's Push For Global PowerDocument2 pagesEverything Under The Heavens How The Past Helps Shape China's Push For Global PowermevlanNo ratings yet

- China, The Yuan and The Imf: Double or Quits?: Special IssueDocument8 pagesChina, The Yuan and The Imf: Double or Quits?: Special IssueTania AcostaNo ratings yet

- The Broyhill Letter (Q1-11)Document7 pagesThe Broyhill Letter (Q1-11)Broyhill Asset ManagementNo ratings yet

- Greenspan InterviewDocument5 pagesGreenspan InterviewZerohedge100% (1)

- A Crisis of Beliefs: Investor Psychology and Financial FragilityFrom EverandA Crisis of Beliefs: Investor Psychology and Financial FragilityRating: 3 out of 5 stars3/5 (1)

- 2021.05 IceCap Global OutlookDocument25 pages2021.05 IceCap Global OutlookZerohedge100% (4)

- Cultural COmpetence PDFDocument8 pagesCultural COmpetence PDFGlo EstradaNo ratings yet

- Valley Journal, November 2008Document1 pageValley Journal, November 2008christophermullallyNo ratings yet

- AmericanProspect 1998 TheIMFandtheAsianFlu March-April1998Document8 pagesAmericanProspect 1998 TheIMFandtheAsianFlu March-April1998Abdurrohim NurNo ratings yet

- US An Asian PowerDocument6 pagesUS An Asian PowerRojakman Soto TulangNo ratings yet

- DiversityDocument7 pagesDiversityozcandogan0058No ratings yet

- Zhu Changhong of SAFE China Currency Reserve CIODocument6 pagesZhu Changhong of SAFE China Currency Reserve CIOUzair UmairNo ratings yet

- J.P.Morgan, The Panic of 1907,: & The Federal Reserve ActDocument4 pagesJ.P.Morgan, The Panic of 1907,: & The Federal Reserve ActNguyễn ThươngNo ratings yet

- Its A Wonderful LifeDocument7 pagesIts A Wonderful LifeAndrew KisteNo ratings yet

- GMO White Paper ChinaDocument12 pagesGMO White Paper ChinaZerohedge100% (2)

- Resrep 09316Document10 pagesResrep 09316kaushal yadavNo ratings yet

- Us Yield CurveDocument6 pagesUs Yield Curvealiimrandar6939No ratings yet

- How Federal Regulators Lenders and Wall Street Caused The Housing CrisisDocument66 pagesHow Federal Regulators Lenders and Wall Street Caused The Housing CrisisDeontosNo ratings yet

- Bloodied But UnbowedDocument3 pagesBloodied But UnbowedChi-Chu TschangNo ratings yet

- SPC AsiaDocument5 pagesSPC AsiaChetan PujaraNo ratings yet

- The First 50 For Ben's No One Saw It Coming Jan 2010Document2 pagesThe First 50 For Ben's No One Saw It Coming Jan 2010vaidynathNo ratings yet

- Reasons For Global RecessionDocument10 pagesReasons For Global RecessionRavi Gopal MenonNo ratings yet

- The Stony Brook Press - Volume 30, Issue 10Document32 pagesThe Stony Brook Press - Volume 30, Issue 10The Stony Brook PressNo ratings yet

- China Flexes Muscles With Us As Biggest Creditor: Wikileaks: Reuters 2/17/2011Document5 pagesChina Flexes Muscles With Us As Biggest Creditor: Wikileaks: Reuters 2/17/201183jjmackNo ratings yet

- India and China Brothers BrothersDocument9 pagesIndia and China Brothers BrothersRahul KumarNo ratings yet

- Volume 1 12 The Dollar's Descent Orderly or Not October 30 2009Document12 pagesVolume 1 12 The Dollar's Descent Orderly or Not October 30 2009Denis OuelletNo ratings yet

- China An Opportunity or A Threat To Asea PDFDocument9 pagesChina An Opportunity or A Threat To Asea PDFAbdullah HussainNo ratings yet

- 1008 三孩政策落实受阻Document1 page1008 三孩政策落实受阻amelieNo ratings yet

- Intevju Robert Aliber PDFDocument4 pagesIntevju Robert Aliber PDFalpar7377No ratings yet

- Hayman July 07Document5 pagesHayman July 07grumpyfeckerNo ratings yet

- Panicof 1Document20 pagesPanicof 1ZerohedgeNo ratings yet

- Why Banke... R Westley - Mises DailyDocument3 pagesWhy Banke... R Westley - Mises DailysilberksouzaNo ratings yet

- BkRevArt WesselDocument11 pagesBkRevArt WesselDwight MurpheyNo ratings yet

- Michael Hudson - Debtor Nation Interview in Acres USA MagazineDocument9 pagesMichael Hudson - Debtor Nation Interview in Acres USA MagazinedocdumpsterNo ratings yet

- Sas Apr Draft 2Document24 pagesSas Apr Draft 2api-3704527No ratings yet

- 2022 05 Sanction-Proofing China (Nikkei)Document5 pages2022 05 Sanction-Proofing China (Nikkei)Alexei ReyesNo ratings yet

- Financing Small Business Creation: The Case of Chinese and Korean Immigrant EntrepreneursDocument16 pagesFinancing Small Business Creation: The Case of Chinese and Korean Immigrant EntrepreneursSaravanakkumar KRNo ratings yet

- COMMENTARY - Living The American Dream - PETER M. SUZUKI - ABA Journal, #11, 85, Pages 73-, 1999 Nov - American Bar Association (ISSN 0747-0088) - 10.2307 - 27841281 - Anna's ArchiveDocument2 pagesCOMMENTARY - Living The American Dream - PETER M. SUZUKI - ABA Journal, #11, 85, Pages 73-, 1999 Nov - American Bar Association (ISSN 0747-0088) - 10.2307 - 27841281 - Anna's ArchiveKarla JuricNo ratings yet

- Vincent P. Carosso Investment Banking in America - A History (2022, HarvardDocument590 pagesVincent P. Carosso Investment Banking in America - A History (2022, HarvardjcNo ratings yet

- Open Source in ChinaDocument51 pagesOpen Source in ChinaBen Croxogod100% (1)

- May06 NBDocument28 pagesMay06 NBstevens106No ratings yet

- The Euro-Dollar Market Friedman Principles - Jul1971Document9 pagesThe Euro-Dollar Market Friedman Principles - Jul1971Deep. L. DuquesneNo ratings yet

- Rapport-Marco-Polo-Hunter-Famille-Biden (1) (1) - Pages-20Document5 pagesRapport-Marco-Polo-Hunter-Famille-Biden (1) (1) - Pages-20cofutefNo ratings yet

- Building Savings One Bond at A TimeDocument20 pagesBuilding Savings One Bond at A TimeSarika AbbiNo ratings yet

- We Explained How A Central Bank Has An Important RoleDocument1 pageWe Explained How A Central Bank Has An Important Roletrilocksp SinghNo ratings yet

- A New Washington Consensus'Document7 pagesA New Washington Consensus'akashNo ratings yet

- American and Chinese Monetary PolicyDocument5 pagesAmerican and Chinese Monetary PolicyadrienSassiNo ratings yet

- Olympic Tix On The FritzDocument1 pageOlympic Tix On The FritzChi-Chu TschangNo ratings yet

- Bottlenecks in ToylandDocument1 pageBottlenecks in ToylandChi-Chu TschangNo ratings yet

- Got MilkDocument2 pagesGot MilkChi-Chu TschangNo ratings yet

- China's Post-Game Reality CheckDocument2 pagesChina's Post-Game Reality CheckChi-Chu TschangNo ratings yet

- Private Banking, Chinese-StyleDocument2 pagesPrivate Banking, Chinese-StyleChi-Chu TschangNo ratings yet

- Praying For Success in ShanghaiDocument3 pagesPraying For Success in ShanghaiChi-Chu TschangNo ratings yet

- Bloodied But UnbowedDocument3 pagesBloodied But UnbowedChi-Chu TschangNo ratings yet

- Floating Cars That Fight Beijing GridlockDocument1 pageFloating Cars That Fight Beijing GridlockChi-Chu TschangNo ratings yet

- The Great Wallet Snaps ShutDocument2 pagesThe Great Wallet Snaps ShutChi-Chu TschangNo ratings yet

- Real Estate A Spreading SinkholeDocument1 pageReal Estate A Spreading SinkholeChi-Chu TschangNo ratings yet

- Supreme Court: Republic of The Philippines Manila Third DivisionDocument22 pagesSupreme Court: Republic of The Philippines Manila Third DivisionneichusNo ratings yet

- Energy-Policy Framework Conditions For Electricity Markets and Renewable EnergiesDocument394 pagesEnergy-Policy Framework Conditions For Electricity Markets and Renewable EnergiesDetlef LoyNo ratings yet

- Deglobalization and and Globalization: A Retrospective by Walden BelloDocument14 pagesDeglobalization and and Globalization: A Retrospective by Walden BellodahlsagucioNo ratings yet

- ValueXVail 2013 - Aaron EdelheitDocument20 pagesValueXVail 2013 - Aaron EdelheitVitaliyKatsenelsonNo ratings yet

- Crisis in Sri Lanka PDFDocument16 pagesCrisis in Sri Lanka PDFyoma100% (1)

- Pakistan - Position Paper - UNHRCDocument1 pagePakistan - Position Paper - UNHRCihabNo ratings yet

- Globalization and Its DiscontentsDocument4 pagesGlobalization and Its Discontentsrubel86No ratings yet

- Study of Performance & Correlation of EURUSD With The Cross Currency Pairs of EuroDocument74 pagesStudy of Performance & Correlation of EURUSD With The Cross Currency Pairs of EuroSuneesh Lazar0% (1)

- List of DC Multiverse WorldsDocument50 pagesList of DC Multiverse WorldsCarl Hewett100% (2)

- "The Shaleman Cometh: How The U.S. Energy Culture Is Changing The World," by J. C. Whorton, Jr.Document40 pages"The Shaleman Cometh: How The U.S. Energy Culture Is Changing The World," by J. C. Whorton, Jr.The International Research Center for Energy and Economic Development (ICEED)No ratings yet

- How The Credit Crunch Finally Arrived in IrelandDocument12 pagesHow The Credit Crunch Finally Arrived in IrelandUzma AliNo ratings yet

- Stress Testing For Bangladesh Private Commercial BanksDocument11 pagesStress Testing For Bangladesh Private Commercial Banksrubayee100% (1)

- HE Byssey: Defending The BankDocument8 pagesHE Byssey: Defending The BankPaul BucciNo ratings yet

- Structured Finance in IndiaDocument7 pagesStructured Finance in Indiaanjali_parekh37No ratings yet

- Review of BooksDocument297 pagesReview of Booksbingo2008No ratings yet

- Gudmundsdóttir, D. G. 2013. The Impact of Economic Crisis On HappinessDocument19 pagesGudmundsdóttir, D. G. 2013. The Impact of Economic Crisis On HappinessAntonio Casado da RochaNo ratings yet

- Republic of South KoreaDocument2 pagesRepublic of South KoreaVictor Alberto ZAMORA TORRESNo ratings yet

- The Foreign Trade RegimeDocument6 pagesThe Foreign Trade RegimeRishika JaiswalNo ratings yet

- Reading - Rise and Fall of A Business PDFDocument1 pageReading - Rise and Fall of A Business PDFdadaaucoeurNo ratings yet

- Bankruptcy of Lehman Brothers Is TheDocument11 pagesBankruptcy of Lehman Brothers Is Themanas_samantaray28No ratings yet

- Fidel V. RamosDocument13 pagesFidel V. RamosClaire Elizabeth Abuan CacapitNo ratings yet

- Asian Financial Crisis ReportDocument12 pagesAsian Financial Crisis ReportNeha KumariNo ratings yet

- Global Financial CrisisDocument5 pagesGlobal Financial CrisisClaudia Carrera CalvoNo ratings yet

- Hyman Minsky's Theory of Capitalist DevelopmentDocument11 pagesHyman Minsky's Theory of Capitalist DevelopmentEmre100% (1)

- Europe's Debt Crisis, Coordination Failure, and International EffectsDocument38 pagesEurope's Debt Crisis, Coordination Failure, and International EffectsADBI PublicationsNo ratings yet

- Central Banks Balance SheetDocument13 pagesCentral Banks Balance SheetLiana AntonelaNo ratings yet