Professional Documents

Culture Documents

Loan - Roi W.E.F 01.08.2018

Loan - Roi W.E.F 01.08.2018

Uploaded by

James MurrayCopyright:

Available Formats

You might also like

- NPK (10.26.26) PDFDocument1 pageNPK (10.26.26) PDFJames MurrayNo ratings yet

- International Sales Commission Agreement TemplateDocument6 pagesInternational Sales Commission Agreement TemplateJames MurrayNo ratings yet

- Kapil Bhaskar Chapter 1 To DownloadDocument16 pagesKapil Bhaskar Chapter 1 To DownloadJames Murray100% (1)

- GGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroDocument3 pagesGGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroAzman Bin KadirNo ratings yet

- Ms. Deepika Lohani (Future)Document1 pageMs. Deepika Lohani (Future)Ishika TiwariNo ratings yet

- Avinash Ramesh ManureDocument2 pagesAvinash Ramesh ManureshrutaviNo ratings yet

- Policy Document-2311101123865200000Document4 pagesPolicy Document-2311101123865200000Jainam ShahNo ratings yet

- Anand PRDocument4 pagesAnand PRPradeep B RNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedDocument1 pagePrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - Endorsedalwinks39No ratings yet

- Marmalade PDFDocument3 pagesMarmalade PDFEmily PolancoNo ratings yet

- Sachin Chandrakant Pethkar PDFDocument2 pagesSachin Chandrakant Pethkar PDFAnonymous JJjuAmoNo ratings yet

- Com - Hdfcergo CRIPC 2311205143629000000Document3 pagesCom - Hdfcergo CRIPC 2311205143629000000Parul SinghNo ratings yet

- Proposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car PackageDocument2 pagesProposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car Packagekrishna11143No ratings yet

- Insurance PDFDocument4 pagesInsurance PDFBala SubramaniyamNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedPRINT BAZARNo ratings yet

- Shatadru DeyDocument1 pageShatadru DeyDev JyotiNo ratings yet

- Car InsuranceDocument2 pagesCar InsuranceTarun KumarNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleManoj KumarNo ratings yet

- Trial BalanceDocument1 pageTrial Balanceaidilghost111No ratings yet

- Arrangement Architecture v12.0Document72 pagesArrangement Architecture v12.0Bhavapriya100% (1)

- Quotepdf20230309 144954Document1 pageQuotepdf20230309 144954Lochan PhogatNo ratings yet

- Trade Maestro InsDocument2 pagesTrade Maestro InsGourav KalaNo ratings yet

- 2312203292091300000Document2 pages2312203292091300000JB MotorsNo ratings yet

- Compact Pile Construction Quote Reliance As Per Renewal-1Document2 pagesCompact Pile Construction Quote Reliance As Per Renewal-1Pankaj SinghNo ratings yet

- Motor Insurance - Goods Carrying Comprehensive PolicyDocument3 pagesMotor Insurance - Goods Carrying Comprehensive PolicyPawan KumarNo ratings yet

- Lakshmi IndustriesDocument11 pagesLakshmi IndustriesSridhar GandikotaNo ratings yet

- Confirmation of JUMP! On Demand Lease Agreement ModificationDocument1 pageConfirmation of JUMP! On Demand Lease Agreement ModificationnicholasiraNo ratings yet

- Insured & Vehicle DetailsDocument2 pagesInsured & Vehicle DetailsJoydev GangulyNo ratings yet

- Stock STMT Jss 072023Document6 pagesStock STMT Jss 072023SAMIR SAIKHNo ratings yet

- Circuit City Liquidation AgreementDocument58 pagesCircuit City Liquidation Agreementmetue100% (7)

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedulenishigandha2108No ratings yet

- Lap keu-MNC INVESTAMA 31 December 2020-6-8Document3 pagesLap keu-MNC INVESTAMA 31 December 2020-6-8Amel GpNo ratings yet

- Ratio Calculation of Business Loan LeverageDocument5 pagesRatio Calculation of Business Loan LeverageMahesh RajpurohitNo ratings yet

- CRM StatementofAccountDocument1 pageCRM StatementofAccountRahul E ChoudharyNo ratings yet

- NexonDocument1 pageNexonS W AkramNo ratings yet

- Mahogany Bullet Payment Plan Dec 2018Document1 pageMahogany Bullet Payment Plan Dec 2018prajjal111No ratings yet

- Compact Pile Construction Quote Tata With Basic Cover With 75od-3Document2 pagesCompact Pile Construction Quote Tata With Basic Cover With 75od-3Pankaj SinghNo ratings yet

- Repayment Schedule 08-24-38Document3 pagesRepayment Schedule 08-24-38Harish KumarNo ratings yet

- Broker - Policy DetailsDocument2 pagesBroker - Policy DetailsVenkatesh EESHANNo ratings yet

- 2 - Dhanlakshmi Fashion Application 2022Document10 pages2 - Dhanlakshmi Fashion Application 2022slvengineeringinds2022No ratings yet

- Annexure IIDocument9 pagesAnnexure IIPratik RajNo ratings yet

- Mr. Siva Kishore Ganji 01Document1 pageMr. Siva Kishore Ganji 01Siva KishoreNo ratings yet

- Hyosung GT250R: Bank Processing Fees and Other Charges Including in Down PaymentDocument1 pageHyosung GT250R: Bank Processing Fees and Other Charges Including in Down PaymentMohd SaalimNo ratings yet

- Additional Tutorial 1 STDocument1 pageAdditional Tutorial 1 STloy zihongNo ratings yet

- SARA NAVIDANJUM MAGDUM eDocument2 pagesSARA NAVIDANJUM MAGDUM esaraNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Subhadip Magma Final QTDocument2 pagesSubhadip Magma Final QTdip0013No ratings yet

- December-22 (T A)Document1 pageDecember-22 (T A)SAMIK NAGNo ratings yet

- Soa Abahmpl 000000750155 20122023 1715745Document3 pagesSoa Abahmpl 000000750155 20122023 1715745patelbhavesh724No ratings yet

- Mr. PRAGEESH PDocument2 pagesMr. PRAGEESH Ppp.prathyushNo ratings yet

- POS-Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPOS-Private Car Package Policy: Certificate of Insurance Cum Policy SchedulePriyanshu SharmaNo ratings yet

- Sr. No. Company Designation Period Type of Company Avg. TurnoverDocument3 pagesSr. No. Company Designation Period Type of Company Avg. TurnoverAnuj HoodaNo ratings yet

- 7.4 Motor Spares Ltd-Lease Identification, Journal Entries and DisclosureDocument5 pages7.4 Motor Spares Ltd-Lease Identification, Journal Entries and DisclosureSesethuNo ratings yet

- TW Disbursement MemoDocument2 pagesTW Disbursement MemoRahul SharmaNo ratings yet

- United India Insurance Company Limited: This Document Is Digitally SignedDocument2 pagesUnited India Insurance Company Limited: This Document Is Digitally SignedMohit KachhwahaNo ratings yet

- Project LEAP - Purchase Report: Lead Sourcing InformationDocument4 pagesProject LEAP - Purchase Report: Lead Sourcing InformationPradeep B RNo ratings yet

- T10 Tutorial SolutionsDocument4 pagesT10 Tutorial SolutionsAnathi AnathiNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy ScheduleImran AliNo ratings yet

- Mr. RAVINDRA GANGARAM PRAJAPATIDocument2 pagesMr. RAVINDRA GANGARAM PRAJAPATInawaz_khan500No ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument4 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy SchedulerahulsolankimiNo ratings yet

- P If C 0: Certificate of Insurance Cum Policy Schedule Policy No. 2317 1012 2378 9101 000Document5 pagesP If C 0: Certificate of Insurance Cum Policy Schedule Policy No. 2317 1012 2378 9101 000kalamjoyreangNo ratings yet

- Sourajit Dutta SbiDocument2 pagesSourajit Dutta SbiDev JyotiNo ratings yet

- DL 10 Ce 7887Document1 pageDL 10 Ce 7887BOC ClaimsNo ratings yet

- Notice To Creditors Re ApplicationDocument2 pagesNotice To Creditors Re ApplicationJames MurrayNo ratings yet

- Unclaimed Accounts Identified As Per Senior Citizen Welfare Fund Rules 2016Document10 pagesUnclaimed Accounts Identified As Per Senior Citizen Welfare Fund Rules 2016James MurrayNo ratings yet

- Bosiet With CA Ebs Huet With CA Ebs and Foet With CA Ebs Rev 0 Amendment 8 Available From 1st November 2018Document78 pagesBosiet With CA Ebs Huet With CA Ebs and Foet With CA Ebs Rev 0 Amendment 8 Available From 1st November 2018James MurrayNo ratings yet

- YajnaprocedureDocument15 pagesYajnaprocedureJames Murray0% (1)

- Nri News Bulletin June 18Document10 pagesNri News Bulletin June 18James MurrayNo ratings yet

- Nri News Bulletin May 18 AdvDocument11 pagesNri News Bulletin May 18 AdvJames MurrayNo ratings yet

- NPK (10.26.26) PDFDocument1 pageNPK (10.26.26) PDFJames MurrayNo ratings yet

- Tantric Mantra Book PDFDocument68 pagesTantric Mantra Book PDFJames Murray100% (3)

- Chakras and Beeja MantrasDocument1 pageChakras and Beeja MantrasJames MurrayNo ratings yet

- Mantra Rahasya DR Narayan Datt ShrimaliDocument384 pagesMantra Rahasya DR Narayan Datt ShrimaliJames Murray100% (1)

- Chakras and Beeja MantrasDocument57 pagesChakras and Beeja MantrasGeorgegeorgeb100% (2)

- Band On 10Document1 pageBand On 10James MurrayNo ratings yet

- Chakras and Beeja MantrasDocument57 pagesChakras and Beeja MantrasGeorgegeorgeb100% (2)

- 3 100e Unersal Silicone Tds enDocument1 page3 100e Unersal Silicone Tds enJames MurrayNo ratings yet

- 1 100e Universal Silicone Tds enDocument1 page1 100e Universal Silicone Tds enJames MurrayNo ratings yet

- 2 100e Universal Licone Tds enDocument1 page2 100e Universal Licone Tds enJames MurrayNo ratings yet

- GR1 HSE Improvement Workshop M & P 07-02-2015Document12 pagesGR1 HSE Improvement Workshop M & P 07-02-2015James MurrayNo ratings yet

- Indictment: United States District Court District of New JerseyDocument12 pagesIndictment: United States District Court District of New JerseyAsbury Park PressNo ratings yet

- New Microsoft PowerPoint PresentationDocument7 pagesNew Microsoft PowerPoint PresentationNeha SinghalNo ratings yet

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15Document39 pagesTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15polkadots93980% (5)

- CWTS2 Community Devt Program ProposalDocument5 pagesCWTS2 Community Devt Program Proposaljennifer.jasmin.phdNo ratings yet

- Supply and Demand AnalysisDocument17 pagesSupply and Demand AnalysisMelody Zulueta ManicdoNo ratings yet

- Operations and Production Management MGMT 405 Answer Set 1Document3 pagesOperations and Production Management MGMT 405 Answer Set 1Anissa Negra AkroutNo ratings yet

- 20120523145043619Document106 pages20120523145043619WisconsinOpenRecordsNo ratings yet

- The US ECONOMYDocument2 pagesThe US ECONOMYVALERIA PATRICIA MURILLO MENDIETANo ratings yet

- StudentMoneyReceipt 16511049Document1 pageStudentMoneyReceipt 16511049Chowdhury ImamNo ratings yet

- Sem 3 - Intermediate-Macroeconomics - Part 1Document4 pagesSem 3 - Intermediate-Macroeconomics - Part 1Maverick SinghNo ratings yet

- Reksadana SahamDocument25 pagesReksadana SahamAbdul RahmanNo ratings yet

- NATL Sugar LyleDocument7 pagesNATL Sugar Lyleakshay87kumar8193100% (2)

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- 1 Application For Outward Remittance or ExchangeDocument1 page1 Application For Outward Remittance or Exchangecharleyho@hotmail.comNo ratings yet

- Biotechusa KFT Beu24008891Document1 pageBiotechusa KFT Beu24008891peicivek5No ratings yet

- Draft Bill-12012022Document2 pagesDraft Bill-12012022xidaNo ratings yet

- Screenshot 2023-01-25 at 10.58.10 PMDocument6 pagesScreenshot 2023-01-25 at 10.58.10 PMgarv dasedaNo ratings yet

- Dirrectory of Appropriate Tech InstitutionsDocument40 pagesDirrectory of Appropriate Tech InstitutionspitufitoNo ratings yet

- HDB Resale Transactions - Dec 08Document4 pagesHDB Resale Transactions - Dec 08pinkcoralNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byVidhyarthi PhotocopyNo ratings yet

- Broken Hill Prospecting IGR FINAL1Document49 pagesBroken Hill Prospecting IGR FINAL1Mauricio ASNo ratings yet

- Adelphia Forensic Presentation FinalDocument25 pagesAdelphia Forensic Presentation FinalHary JoeNo ratings yet

- Pengaruh Tingkat Penerapan Teknologi Pengelolaan Tanaman Terpadu (PTT) Terhadap Efisiensi Teknis Usahatani Padi PDFDocument12 pagesPengaruh Tingkat Penerapan Teknologi Pengelolaan Tanaman Terpadu (PTT) Terhadap Efisiensi Teknis Usahatani Padi PDFAgung SetiawanNo ratings yet

- NARS Nurses Assigned in Rural ServiceDocument2 pagesNARS Nurses Assigned in Rural ServiceTycoonVanrod Falculan PaasNo ratings yet

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- ISPSC 5-Yr Devt Plan PDFDocument65 pagesISPSC 5-Yr Devt Plan PDFUaenuj JulianNo ratings yet

- Air Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionDocument3 pagesAir Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionJenny ThuNo ratings yet

- Automotive in Myanmar PDFDocument17 pagesAutomotive in Myanmar PDFtnaingooNo ratings yet

- Nca LFP NMCDocument2 pagesNca LFP NMCDaniel Hilario PintoNo ratings yet

Loan - Roi W.E.F 01.08.2018

Loan - Roi W.E.F 01.08.2018

Uploaded by

James MurrayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan - Roi W.E.F 01.08.2018

Loan - Roi W.E.F 01.08.2018

Uploaded by

James MurrayCopyright:

Available Formats

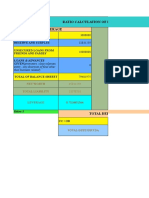

RATE OF INTEREST ON LOANS AND ADVANCES W.E.F 01.08.

2018

INTEREST

Sr. RATE OF

CATEGORY SCHEME TABLE

No. INTEREST

CODE

1 Unsecured Loans

3311 3311 17.00

2 a) Consumer Loan 3381 3381 17.00

Consumer Loan with collateral security of

b) 3383 3383 14.75

immovable properties / vehicles / Autorickshaw

3 Swarna Gouri 3060/1460 10.90

Gold Loan against Gold Ornaments/Gold Bonds 3060 12.75

Loan 3060

Overdraft against Gold Ornaments/Gold Bonds 1460 12.75

Loan against Govt. securities and Bonds/LIC/NSC 3396 3396 11.00

4 Overdraft against Govt. securities and

1430 1430 11.00

Bonds/LIC/NSC

HOUSING LOAN

5

10.40

a) Griha Samriddhi 3333 3333

10.15

b) Existing Housing Loan 3331 3331

c) Housing Loan - At Non Metro Areas 3330 3330 10.15

6 BCB Top Up Loan 3332 3332 11.90

7 Griha Shobha Loan 3337 3337 12.90

8 Vehicle Loans

a BCB Pushpak Plus + 3349 3349 11.40

New Vehicle 3344 12.75

3344

Personal Use

Used Vehicle 3345 3345 14.25

Pushpak Vehicle

b

Loan for New Vehicle

3346 3346 13.25

Commercial use

Used Vehicle 3347 3347 14.75

BCB Auto Plus

c 3348 3348 12.60

d Autorickshaw / 3 wheeler Loan 3341 3341 14.25

e Vehicle loan for Personal Use 3342 3342 13.25

Vehicle loan for Commercial Use (Other than

f 3343 3343 14.75

Autorickshaw / 3wheeler Loan)

With

Gestation 3361 3361

period 11.90

9

VIDYA VAHINI LOANS Without

Gestation 3362 3362

period 11.75

10 Loan / Overdraft against deposits

a) BDD 3391 3391 11.90

b) Against Self Deposit 3392 1.00+ A

c) Against Deposit in the name of Third Parties 3393 1.50 + A

d) Overdraft Against Self Deposits 1410 1.00+ A

e) Overdraft Against Third Party Deposits 1411 1.50 + A

f) Drawals Against Suvidha 1480 1.00+ A

11 Loan / OD against Shares / Debentures 14.75

12 a) Loan to Doctors and Nursing Home / Hospitals 3371 3371 13.90

b) BCB Medi- Overdraft (Secured Overdraft Limit) 1340 1340 13.90

c) Loan to Self Employed – Professionals 3372 3372 13.50

13a Business Loans 3351 3351 13.90

Term Loan 3355 3355

b Bharat Vanita Udyami

Cash Credit limit 1311 1311 11.11

Term Loan 3356 3356

c Bharat MSME

Cash Credit 1312 1312 11.50

Term Loan 3357 3357

d Bharat Aahaar Loan

11.90

Cash Credit 1313 1313

Asset Backed Loan

14 3354 3354 13.00

15 Business Plus 3358 3358

12.90

16 Mortgage Loan 3250 3250

13.90

Cash Credit Limit

1310 13.90

1310

17

Ad- Hoc Cash credit Limit ROI +2%

18 Vyapar Overdraft Limit 1490 1490 13.90

19 Dhanvarsha Overdraft Limit 1330 1330 13.90

BCB Dropline Overdraft Limit (New Scheme w.e.f

20 5.01.19) 1331 1331 13.90

Rent – A – Loan 3338 3338 13.90

21

Loans to Commercial Real Estate Sector 3352 3352 16.50

22 Cash Credit to Commercial Real Estate Sector 1320 1320 16.50

Purchase and Discounting of Cheque / Bills /

Unsecured Multani Hundies / Demand draft (Other

23 than sanctioned limit) 18.00

Borrower

Discounting of LC (Inland) 9.50

24 Non Borrower

25 Excess Drawals 21.00

Clean Overdraft Limits /Temporary Overdraft (TOD) /

26 Clearing House Balance / Return of Inward Clearing

21.00

Cheques for want of Funds / Drawals against

Cheques sent for collection

Interest on outstanding debit balance (day wise

product) in Cash Credit limits /VODs/ Dhanvarsha/

27 Medi OD during the period from validity of expiry

date of limits till date of sanction of renewal / ROI + 2%

conversion.

Interest on outstanding debit balance (day wise

product) in Cash Credit limits / VOD /Dhanvarsha/

Medi OD for the period when there is no Drawing

Power on account of non submission of monthly ROI + 2%

28 statements of Stocks, Debtors and Creditors

(irrespective of the fact that whether the limit is

within the validity Period or not)

29 PRE-SHIPMENT & POST SHIPMENT FINANCE IN INR 10.00

LIBOR

30 PRE-SHIPMENT (PCFC) & POST SHIPMENT (PSFC)

+3.00%

** Existing BPLR @ 13.50%

You might also like

- NPK (10.26.26) PDFDocument1 pageNPK (10.26.26) PDFJames MurrayNo ratings yet

- International Sales Commission Agreement TemplateDocument6 pagesInternational Sales Commission Agreement TemplateJames MurrayNo ratings yet

- Kapil Bhaskar Chapter 1 To DownloadDocument16 pagesKapil Bhaskar Chapter 1 To DownloadJames Murray100% (1)

- GGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroDocument3 pagesGGBP Case Study Series - Brazil - Low Carbon City Development Program Rio de JaneiroAzman Bin KadirNo ratings yet

- Ms. Deepika Lohani (Future)Document1 pageMs. Deepika Lohani (Future)Ishika TiwariNo ratings yet

- Avinash Ramesh ManureDocument2 pagesAvinash Ramesh ManureshrutaviNo ratings yet

- Policy Document-2311101123865200000Document4 pagesPolicy Document-2311101123865200000Jainam ShahNo ratings yet

- Anand PRDocument4 pagesAnand PRPradeep B RNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedDocument1 pagePrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - Endorsedalwinks39No ratings yet

- Marmalade PDFDocument3 pagesMarmalade PDFEmily PolancoNo ratings yet

- Sachin Chandrakant Pethkar PDFDocument2 pagesSachin Chandrakant Pethkar PDFAnonymous JJjuAmoNo ratings yet

- Com - Hdfcergo CRIPC 2311205143629000000Document3 pagesCom - Hdfcergo CRIPC 2311205143629000000Parul SinghNo ratings yet

- Proposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car PackageDocument2 pagesProposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car Packagekrishna11143No ratings yet

- Insurance PDFDocument4 pagesInsurance PDFBala SubramaniyamNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedule - EndorsedPRINT BAZARNo ratings yet

- Shatadru DeyDocument1 pageShatadru DeyDev JyotiNo ratings yet

- Car InsuranceDocument2 pagesCar InsuranceTarun KumarNo ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleManoj KumarNo ratings yet

- Trial BalanceDocument1 pageTrial Balanceaidilghost111No ratings yet

- Arrangement Architecture v12.0Document72 pagesArrangement Architecture v12.0Bhavapriya100% (1)

- Quotepdf20230309 144954Document1 pageQuotepdf20230309 144954Lochan PhogatNo ratings yet

- Trade Maestro InsDocument2 pagesTrade Maestro InsGourav KalaNo ratings yet

- 2312203292091300000Document2 pages2312203292091300000JB MotorsNo ratings yet

- Compact Pile Construction Quote Reliance As Per Renewal-1Document2 pagesCompact Pile Construction Quote Reliance As Per Renewal-1Pankaj SinghNo ratings yet

- Motor Insurance - Goods Carrying Comprehensive PolicyDocument3 pagesMotor Insurance - Goods Carrying Comprehensive PolicyPawan KumarNo ratings yet

- Lakshmi IndustriesDocument11 pagesLakshmi IndustriesSridhar GandikotaNo ratings yet

- Confirmation of JUMP! On Demand Lease Agreement ModificationDocument1 pageConfirmation of JUMP! On Demand Lease Agreement ModificationnicholasiraNo ratings yet

- Insured & Vehicle DetailsDocument2 pagesInsured & Vehicle DetailsJoydev GangulyNo ratings yet

- Stock STMT Jss 072023Document6 pagesStock STMT Jss 072023SAMIR SAIKHNo ratings yet

- Circuit City Liquidation AgreementDocument58 pagesCircuit City Liquidation Agreementmetue100% (7)

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument3 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy Schedulenishigandha2108No ratings yet

- Lap keu-MNC INVESTAMA 31 December 2020-6-8Document3 pagesLap keu-MNC INVESTAMA 31 December 2020-6-8Amel GpNo ratings yet

- Ratio Calculation of Business Loan LeverageDocument5 pagesRatio Calculation of Business Loan LeverageMahesh RajpurohitNo ratings yet

- CRM StatementofAccountDocument1 pageCRM StatementofAccountRahul E ChoudharyNo ratings yet

- NexonDocument1 pageNexonS W AkramNo ratings yet

- Mahogany Bullet Payment Plan Dec 2018Document1 pageMahogany Bullet Payment Plan Dec 2018prajjal111No ratings yet

- Compact Pile Construction Quote Tata With Basic Cover With 75od-3Document2 pagesCompact Pile Construction Quote Tata With Basic Cover With 75od-3Pankaj SinghNo ratings yet

- Repayment Schedule 08-24-38Document3 pagesRepayment Schedule 08-24-38Harish KumarNo ratings yet

- Broker - Policy DetailsDocument2 pagesBroker - Policy DetailsVenkatesh EESHANNo ratings yet

- 2 - Dhanlakshmi Fashion Application 2022Document10 pages2 - Dhanlakshmi Fashion Application 2022slvengineeringinds2022No ratings yet

- Annexure IIDocument9 pagesAnnexure IIPratik RajNo ratings yet

- Mr. Siva Kishore Ganji 01Document1 pageMr. Siva Kishore Ganji 01Siva KishoreNo ratings yet

- Hyosung GT250R: Bank Processing Fees and Other Charges Including in Down PaymentDocument1 pageHyosung GT250R: Bank Processing Fees and Other Charges Including in Down PaymentMohd SaalimNo ratings yet

- Additional Tutorial 1 STDocument1 pageAdditional Tutorial 1 STloy zihongNo ratings yet

- SARA NAVIDANJUM MAGDUM eDocument2 pagesSARA NAVIDANJUM MAGDUM esaraNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Subhadip Magma Final QTDocument2 pagesSubhadip Magma Final QTdip0013No ratings yet

- December-22 (T A)Document1 pageDecember-22 (T A)SAMIK NAGNo ratings yet

- Soa Abahmpl 000000750155 20122023 1715745Document3 pagesSoa Abahmpl 000000750155 20122023 1715745patelbhavesh724No ratings yet

- Mr. PRAGEESH PDocument2 pagesMr. PRAGEESH Ppp.prathyushNo ratings yet

- POS-Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPOS-Private Car Package Policy: Certificate of Insurance Cum Policy SchedulePriyanshu SharmaNo ratings yet

- Sr. No. Company Designation Period Type of Company Avg. TurnoverDocument3 pagesSr. No. Company Designation Period Type of Company Avg. TurnoverAnuj HoodaNo ratings yet

- 7.4 Motor Spares Ltd-Lease Identification, Journal Entries and DisclosureDocument5 pages7.4 Motor Spares Ltd-Lease Identification, Journal Entries and DisclosureSesethuNo ratings yet

- TW Disbursement MemoDocument2 pagesTW Disbursement MemoRahul SharmaNo ratings yet

- United India Insurance Company Limited: This Document Is Digitally SignedDocument2 pagesUnited India Insurance Company Limited: This Document Is Digitally SignedMohit KachhwahaNo ratings yet

- Project LEAP - Purchase Report: Lead Sourcing InformationDocument4 pagesProject LEAP - Purchase Report: Lead Sourcing InformationPradeep B RNo ratings yet

- T10 Tutorial SolutionsDocument4 pagesT10 Tutorial SolutionsAnathi AnathiNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy ScheduleImran AliNo ratings yet

- Mr. RAVINDRA GANGARAM PRAJAPATIDocument2 pagesMr. RAVINDRA GANGARAM PRAJAPATInawaz_khan500No ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument4 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy SchedulerahulsolankimiNo ratings yet

- P If C 0: Certificate of Insurance Cum Policy Schedule Policy No. 2317 1012 2378 9101 000Document5 pagesP If C 0: Certificate of Insurance Cum Policy Schedule Policy No. 2317 1012 2378 9101 000kalamjoyreangNo ratings yet

- Sourajit Dutta SbiDocument2 pagesSourajit Dutta SbiDev JyotiNo ratings yet

- DL 10 Ce 7887Document1 pageDL 10 Ce 7887BOC ClaimsNo ratings yet

- Notice To Creditors Re ApplicationDocument2 pagesNotice To Creditors Re ApplicationJames MurrayNo ratings yet

- Unclaimed Accounts Identified As Per Senior Citizen Welfare Fund Rules 2016Document10 pagesUnclaimed Accounts Identified As Per Senior Citizen Welfare Fund Rules 2016James MurrayNo ratings yet

- Bosiet With CA Ebs Huet With CA Ebs and Foet With CA Ebs Rev 0 Amendment 8 Available From 1st November 2018Document78 pagesBosiet With CA Ebs Huet With CA Ebs and Foet With CA Ebs Rev 0 Amendment 8 Available From 1st November 2018James MurrayNo ratings yet

- YajnaprocedureDocument15 pagesYajnaprocedureJames Murray0% (1)

- Nri News Bulletin June 18Document10 pagesNri News Bulletin June 18James MurrayNo ratings yet

- Nri News Bulletin May 18 AdvDocument11 pagesNri News Bulletin May 18 AdvJames MurrayNo ratings yet

- NPK (10.26.26) PDFDocument1 pageNPK (10.26.26) PDFJames MurrayNo ratings yet

- Tantric Mantra Book PDFDocument68 pagesTantric Mantra Book PDFJames Murray100% (3)

- Chakras and Beeja MantrasDocument1 pageChakras and Beeja MantrasJames MurrayNo ratings yet

- Mantra Rahasya DR Narayan Datt ShrimaliDocument384 pagesMantra Rahasya DR Narayan Datt ShrimaliJames Murray100% (1)

- Chakras and Beeja MantrasDocument57 pagesChakras and Beeja MantrasGeorgegeorgeb100% (2)

- Band On 10Document1 pageBand On 10James MurrayNo ratings yet

- Chakras and Beeja MantrasDocument57 pagesChakras and Beeja MantrasGeorgegeorgeb100% (2)

- 3 100e Unersal Silicone Tds enDocument1 page3 100e Unersal Silicone Tds enJames MurrayNo ratings yet

- 1 100e Universal Silicone Tds enDocument1 page1 100e Universal Silicone Tds enJames MurrayNo ratings yet

- 2 100e Universal Licone Tds enDocument1 page2 100e Universal Licone Tds enJames MurrayNo ratings yet

- GR1 HSE Improvement Workshop M & P 07-02-2015Document12 pagesGR1 HSE Improvement Workshop M & P 07-02-2015James MurrayNo ratings yet

- Indictment: United States District Court District of New JerseyDocument12 pagesIndictment: United States District Court District of New JerseyAsbury Park PressNo ratings yet

- New Microsoft PowerPoint PresentationDocument7 pagesNew Microsoft PowerPoint PresentationNeha SinghalNo ratings yet

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15Document39 pagesTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15polkadots93980% (5)

- CWTS2 Community Devt Program ProposalDocument5 pagesCWTS2 Community Devt Program Proposaljennifer.jasmin.phdNo ratings yet

- Supply and Demand AnalysisDocument17 pagesSupply and Demand AnalysisMelody Zulueta ManicdoNo ratings yet

- Operations and Production Management MGMT 405 Answer Set 1Document3 pagesOperations and Production Management MGMT 405 Answer Set 1Anissa Negra AkroutNo ratings yet

- 20120523145043619Document106 pages20120523145043619WisconsinOpenRecordsNo ratings yet

- The US ECONOMYDocument2 pagesThe US ECONOMYVALERIA PATRICIA MURILLO MENDIETANo ratings yet

- StudentMoneyReceipt 16511049Document1 pageStudentMoneyReceipt 16511049Chowdhury ImamNo ratings yet

- Sem 3 - Intermediate-Macroeconomics - Part 1Document4 pagesSem 3 - Intermediate-Macroeconomics - Part 1Maverick SinghNo ratings yet

- Reksadana SahamDocument25 pagesReksadana SahamAbdul RahmanNo ratings yet

- NATL Sugar LyleDocument7 pagesNATL Sugar Lyleakshay87kumar8193100% (2)

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- 1 Application For Outward Remittance or ExchangeDocument1 page1 Application For Outward Remittance or Exchangecharleyho@hotmail.comNo ratings yet

- Biotechusa KFT Beu24008891Document1 pageBiotechusa KFT Beu24008891peicivek5No ratings yet

- Draft Bill-12012022Document2 pagesDraft Bill-12012022xidaNo ratings yet

- Screenshot 2023-01-25 at 10.58.10 PMDocument6 pagesScreenshot 2023-01-25 at 10.58.10 PMgarv dasedaNo ratings yet

- Dirrectory of Appropriate Tech InstitutionsDocument40 pagesDirrectory of Appropriate Tech InstitutionspitufitoNo ratings yet

- HDB Resale Transactions - Dec 08Document4 pagesHDB Resale Transactions - Dec 08pinkcoralNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byVidhyarthi PhotocopyNo ratings yet

- Broken Hill Prospecting IGR FINAL1Document49 pagesBroken Hill Prospecting IGR FINAL1Mauricio ASNo ratings yet

- Adelphia Forensic Presentation FinalDocument25 pagesAdelphia Forensic Presentation FinalHary JoeNo ratings yet

- Pengaruh Tingkat Penerapan Teknologi Pengelolaan Tanaman Terpadu (PTT) Terhadap Efisiensi Teknis Usahatani Padi PDFDocument12 pagesPengaruh Tingkat Penerapan Teknologi Pengelolaan Tanaman Terpadu (PTT) Terhadap Efisiensi Teknis Usahatani Padi PDFAgung SetiawanNo ratings yet

- NARS Nurses Assigned in Rural ServiceDocument2 pagesNARS Nurses Assigned in Rural ServiceTycoonVanrod Falculan PaasNo ratings yet

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- ISPSC 5-Yr Devt Plan PDFDocument65 pagesISPSC 5-Yr Devt Plan PDFUaenuj JulianNo ratings yet

- Air Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionDocument3 pagesAir Pollution Biodegradable Drought Energy-Saving Environment-Friendly Global Warming Landfill Natural Resources Toxic Chemicals Water ConsumptionJenny ThuNo ratings yet

- Automotive in Myanmar PDFDocument17 pagesAutomotive in Myanmar PDFtnaingooNo ratings yet

- Nca LFP NMCDocument2 pagesNca LFP NMCDaniel Hilario PintoNo ratings yet