Professional Documents

Culture Documents

1Q2018 - Indosat Ooredoo Final

1Q2018 - Indosat Ooredoo Final

Uploaded by

Bayu SaputraCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Delta's 2013 Flight PlanDocument1 pageDelta's 2013 Flight PlanSheryl100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6 Sigma in HotelsDocument8 pages6 Sigma in HotelsSanju Dev100% (1)

- Contemporary Business Environment - Pptxfor MeDocument24 pagesContemporary Business Environment - Pptxfor MeRohit Sharma0% (1)

- MDRT Author IndexDocument4 pagesMDRT Author IndexErwin Dela CruzNo ratings yet

- MSRTC - Online Reservation SystemDocument1 pageMSRTC - Online Reservation Systemgetgaurav100% (1)

- Chi11 LeeDocument16 pagesChi11 LeeJunaid Ahmed NoorNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- Heineken ENG Financial StatementsDocument85 pagesHeineken ENG Financial StatementscrazyscorpionNo ratings yet

- Incentive ProgramDocument5 pagesIncentive ProgramMandy ZimmermanNo ratings yet

- ISO 55000 - What You Need To KnowDocument26 pagesISO 55000 - What You Need To KnowSidney Pereira Junior100% (3)

- Monthly Spotlight BrazilDocument4 pagesMonthly Spotlight BrazilCharlesson1No ratings yet

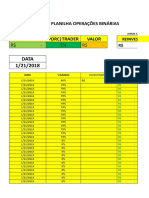

- Querino Dicas Banca Opções BináriasDocument60 pagesQuerino Dicas Banca Opções BináriasLeonardo PinheiroNo ratings yet

- Celebrities in Advertising: Group 1Document24 pagesCelebrities in Advertising: Group 1Mohit LalchandaniNo ratings yet

- Citcon EoIDocument3 pagesCitcon EoIShesh Narayan MishraNo ratings yet

- Chapter 7 - Tendering ProceduresDocument28 pagesChapter 7 - Tendering ProceduresHannan Ruslim100% (1)

- SSAE16 and ISA3402 PDFDocument8 pagesSSAE16 and ISA3402 PDFSarah DchiecheNo ratings yet

- Basilan Estates Vs Cir (1967)Document7 pagesBasilan Estates Vs Cir (1967)RavenFoxNo ratings yet

- Google Analytics - 20090918Document5 pagesGoogle Analytics - 20090918Joel R. KallmanNo ratings yet

- AptitudeDocument21 pagesAptitudeSandeep ReddyNo ratings yet

- Chapter 3 - The Franchisor Business PlanDocument15 pagesChapter 3 - The Franchisor Business PlanGunther100% (1)

- Capital Budgeting Practices in Breverages Industries in NepalDocument4 pagesCapital Budgeting Practices in Breverages Industries in NepalInternational Educational Applied Scientific Research Journal (IEASRJ)No ratings yet

- MJD31 D 90514Document11 pagesMJD31 D 90514MaxNo ratings yet

- Lamplighter MenuDocument2 pagesLamplighter MenulamplightersNo ratings yet

- Kolkata New Metro CorridorDocument7 pagesKolkata New Metro CorridorSandip RayNo ratings yet

- Service Industry in IndiaDocument6 pagesService Industry in Indiadip99No ratings yet

- Some Economic Facts of The Prefabricated HousingDocument20 pagesSome Economic Facts of The Prefabricated Housingchiorean_robertNo ratings yet

- Print Control PageDocument1 pagePrint Control PageAkhil DayalNo ratings yet

- Cost of Goods Sold Assignment Q No. 03 To 09Document7 pagesCost of Goods Sold Assignment Q No. 03 To 09mukarram123100% (2)

- QYB - Set Analysis and AGGR ExercisesDocument15 pagesQYB - Set Analysis and AGGR ExercisesDer Fliegende HolländerNo ratings yet

- Sarathi Banking Academy (Data Interpretation Bar Graph)Document14 pagesSarathi Banking Academy (Data Interpretation Bar Graph)N.KARTHIKEYANNo ratings yet

1Q2018 - Indosat Ooredoo Final

1Q2018 - Indosat Ooredoo Final

Uploaded by

Bayu SaputraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1Q2018 - Indosat Ooredoo Final

1Q2018 - Indosat Ooredoo Final

Uploaded by

Bayu SaputraCopyright:

Available Formats

1Q 2018 Results

in IDR billion

Operating Revenue 7,290 5,692 -21.9% 7,360 5,692 -22.7%

EBITDA 3,100 1,942 -37.3% 2,856 1,942 -32.0%

EBITDA Margin 42.5% 34.1% -8.4ppt 38.8% 34.1% -4.7ppt

Profit Attributable to 46 -506 -1211.4%

174 -506 -390.8%

Owners of the Parent

PT Indosat Tbk. – 1Q 2018 Results | | 3

in IDR billion

-21.9% YoY -22.7% QoQ

7,823

7,290 234 7,453 7,360 QoQ | YoY

217 220 5,692

241

1,060 232 +5.3% | -3.7%

998 1,085

1,375

1,043

-24.1% | +4.5%

6,529 6,151

6,051 5,765 4,417

-23.4% | -27.0%

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

Fixed Voice Fixed Data Cellular

PT Indosat Tbk. – 1Q 2018 Results | | 4

Voice -29.5% -20.8%

SMS -52.7% -30.2% Shifting business model from push marketing

strategy to customer’s demand driven Go-To-

Market Strategy

Data -2.1% -23.2%

VAS 0.0% -30.2%

PT Indosat Tbk. – 1Q 2018 Results | | 5

in million in million

+0.6% YoY -12.7% QoQ

110.2

95.6 96.4 96.1

97.0

13.2

10.0

0.7 0.6

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

-14.1

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

PT Indosat Tbk. – 1Q 2018 Results | | 6

in thousand IDR in IDR in billion minutes in minute/subscriber

(ARPU) (ARPM) (Voice Traffic) (MOU)

57 53

149 150

144 47

131

125 37

29

-42.7% YoY -29.3% QoQ -38.8% YoY -19.1% QoQ

21.7 22.5 20.6 15.3 15.6

17.6 12.4 12.4 11.6 9.4

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

ARPU ARPM Voice Traffic MOU

PT Indosat Tbk. – 1Q 2018 Results | | 7

in TByte In million

+75.7% YoY +10.5% QoQ +25.7% YoY -7.5% QoQ

368,232 73

333,263 67

61

293,225 54 57

246,862

209,591

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

PT Indosat Tbk. – 1Q 2018 Results | | 8

as percentage of revenue

Cost of Service (CoS) 42.6% 39.6% 41.2% 45.8% 50.2%

Personnel 8.2% 7.2% 7.6% 4.0% 10.3%

Marketing 3.6% 4.2% 4.7% 4.6% 3.1%

General and Administration 3.1% 3.2% 3.2% 6.7% 2.2%

Total Operating Expenses 57.5% 54.3% 56.6% 61.2% 65.9%

Depreciation and Amortization 30.5% 28.2% 29.8% 29.9% 36.5%

Total Expenses 88.0% 82.5% 86.4% 91.1% 102.4%

PT Indosat Tbk. – 1Q 2018 Results | | 9

in IDR billion in IDR billion

43.4%

45.7% 38.8%

42.5%

34.1%

-37.3% YoY -32.0% QoQ -20.0% YoY -390.8% YoY

3,574 3,232

3,100 2,856

1,942

217

174

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

EBITDA EBITDA Margin

-506

1Q-16 1Q-17 1Q-18

PT Indosat Tbk. – 1Q 2018 Results | | 10

in IDR billion in IDR billion

1.87 1.65

1.63 1.49

1.49 1.34

-2.0% YoY -0.7% YoY

22,153 19,359 19,571

18,966 17,400 17,283

1Q-16 1Q-17 1Q-18 1Q-16 1Q-17 1Q-18

Gross Debt Gross Debt/EBITDA Net Debt Net Debt/EBITDA

PT Indosat Tbk. – 1Q 2018 Results | | 11

in IDR billion in IDR billion 51.0 in %

23.2

3,752

13.8

8.5 10.5

1,464

1,051 1,008 1,078 1,322

519 622 785

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

-1,335

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18 Capex (Spent) Capex/Revenue

PT Indosat Tbk. – 1Q 2018 Results | | 12

+10.7% YoY +4.9% QoQ

59,023 60,247 61,357 64,375

58,175

5,446 5,533 6,110 7,179 9,019 More than 80% of total sites have

been modernized since 2013 and

31,062

28,510 29,255 29,912 30,179 READY for 4.5G and beyond

technology deployment

24,219 24,235 24,225 23,999 24,294

1Q-17 2Q-17 3Q-17 4Q-17 1Q-18

4G 3G 2G

• 4G coverage has reached 227 cities in Indonesia, 22 cities addition during 1Q 2018.

PT Indosat Tbk. – 1Q 2018 Results | | 13

Consolidated Revenue Growth Low single digit -22.1%

EBITDA Margin Low to Mid 40’s 34.1%

CAPEX ~ IDR 8 trillion IDR 1.3 trillion

(Spent) (Spent)

PT Indosat Tbk. – 1Q 2018 Results | | 15

On September 16, 2014, the South Jakarta Attorney Office (“Kejaksaan

Negeri Jakarta Selatan”), without preliminary notification, executed the

Supreme Court’s Decision on Mr. Indar Atmanto. The execution was

done based on a quotation of the Supreme Court’s Decision, which

states, among others, that (i) Mr. Indar Atmanto is found guilty and

sentenced to eight years imprisonment and charged with penalty of

Rp300,000,000,- (if the penalty is not paid, Mr. Indar Atmanto would

serve an additional six months imprisonment), and (ii) IM2 pay the

losses sustained by the State amounting to Rp1,358,343,346,674,-.

Subsequently, on January 16, 2015, Mr.Indar Atmanto and/or his lawyer

or IM2 received the document on the Supreme Court’s decision

regarding the litigation case. As of the issuance date of the

consolidated financial statements, Mr. Indar Atmanto and IM2 plan to

conduct further legal act by submitting a reconsideration request

peninjauan kembali (”PK”).

On March 16, 2015, Mr. Indar Atmanto’s submission of Judicial Review

[Peninjauan Kembali (”PK”)] was officially registered at the Corruption

Court under No. 08/AKTA.PID.SUS/PK/TPK/2015/PN.Jkt.Pst.

On November 4, 2015, the Supreme Court’s official website announced

that the Judicial Review filed by Mr. Indar Atmanto was rejected based

on Supreme Court’s decision dated October 20, 2015. However, no

detailed information regarding the exact content of such Supreme

Court’s decision was available. As of the issuance date of the interim

consolidated financial statements, the official copy of such Supreme

Court’s decision hasn’t been received.

PT Indosat Tbk. – 1Q 2018 Results | | 18

On 13 March 2018, PEFINDO has affirmed its “idAAA” ratings for PT Indosat Tbk (ISAT) and

its Shelf Registration Bond II Year 2017-2019, Shelf Registration Bond I Year 2014-2016, and

Bond VIII Year 2012. PEFINDO has also affirmed its “idAAA(sy)” ratings for ISAT’s Shelf

Registration Sukuk Ijarah II Year 2017-2019, Shelf Registration Sukuk Ijarah I Year 2014-

2016, and Sukuk Ijarah V Year 2012. The outlook for the corporate rating is “stable”.

On 25 February 2018, Fitch Ratings has affirmed Indonesian telecom operator

PT Indosat Tbk's (Indosat Ooredoo) Long-Term Foreign-and Local-

Currency Issuer Default Rating (IDR) at ‘BBB+’ simultaneously affirmed the foreign-

currency senior unsecured rating at 'BBB+‘. Fitch Ratings has also affirmed Indosat

Ooredoo’s National LongTerm Rating at 'AAA(idn)'. The Outlook is Stable.

On December 8, 2017, S&P Global Ratings raised its long-term corporate credit rating on

Indonesia-based telecommunications operator PT Indosat Tbk. (Indosat) to 'BBB-' from

'BB+'. The outlook is stable. The upgrade reflects their expectation that Indosat will

maintain its solid cash flow adequacy and reduce debt over the next 12-24 months. The

company's steady cash flows, moderate capital spending, and prudent financial policies

should support the improvement. We anticipate that Indosat's ratio of funds from

operations (FFO) to debt will remain above 40% until 2019.

On 12 May 2017, Moody's Investors Service has has upgraded to Baa3 from Ba1 the

issuer rating of Indosat Tbk. (P.T.) (Indosat Ooredoo). The outlook for the rating is stable.

At the same time, Moody's has withdrawn the company's Ba1 Corporate Family Rating.

The rating upgrade reflects the continued strengthening of Indosat Ooredoo's operational

metrics as well as the ongoing stabilization of its financial profile, including lower leverage

levels.

PT Indosat Tbk. – 1Q 2018 Results | | 19

In IDR trillion

4.15

3.66

3.06 3.06

1.31

1.10 1.03

0.81

0.26

0.14 0.28 0.12

2Q - 4Q 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

IDR

USD in IDR

* Excluding obligation under finance lease

PT Indosat Tbk. – 1Q 2018 Results | | 20

in Mhz Number of BTS

Indosat 2 x 12.5 2 x 20.0 2 x 15.0 15.0*

Valid until 2020 2020 2019, 2026, 2019

2028

Telkomsel 2 x 15 2 x 22.5 2 x 15.0 45.0

XL Axiata 2 x 7.5 2 x 22.5 2 x 15.0 -

Hutchison - 2 x 10.0 2 x 15.0 -

Smartfren 2 x 11.0 - - 30.0

* Indosat/IM2: West Java exclude Bogor, Depok & Bekasi

PT Indosat Tbk. – 1Q 2018 Results | | 21

• PT Indosat Tbk ( “Indosat” or “Company” ) cautions investors that certain statements contained in this

document state its management's intentions, hopes, beliefs, expectations, or predictions of the future are

forward-looking statements

• The Company wishes to caution the reader that forward-looking statements are not historical facts and are

only estimates or predictions. Actual results may differ materially from those projected as a result of risks and

uncertainties including, but not limited to:

• The Company’s ability to manage domestic and international growth and maintain a high level of

customer service

• Future sales growth

• Market acceptance of the Company’s product and service offerings

• The Company’s ability to secure adequate financing or equity capital to fund our operations

• Network expansion

• Performance of the Company’s network and equipment

• The Company’s ability to enter into strategic alliances or transactions

• Cooperation of incumbent local exchange carriers in provisioning lines and interconnecting our

equipment

• Regulatory approval processes

• Changes in technology

• Price competition

• Other market conditions and associated risks

• The company undertakes no obligation to update publicly any forward-looking statements, whether as a result

of future events, new information, or otherwise

PT Indosat Tbk. – 1Q 2018 Results | | 22

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Delta's 2013 Flight PlanDocument1 pageDelta's 2013 Flight PlanSheryl100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6 Sigma in HotelsDocument8 pages6 Sigma in HotelsSanju Dev100% (1)

- Contemporary Business Environment - Pptxfor MeDocument24 pagesContemporary Business Environment - Pptxfor MeRohit Sharma0% (1)

- MDRT Author IndexDocument4 pagesMDRT Author IndexErwin Dela CruzNo ratings yet

- MSRTC - Online Reservation SystemDocument1 pageMSRTC - Online Reservation Systemgetgaurav100% (1)

- Chi11 LeeDocument16 pagesChi11 LeeJunaid Ahmed NoorNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- Heineken ENG Financial StatementsDocument85 pagesHeineken ENG Financial StatementscrazyscorpionNo ratings yet

- Incentive ProgramDocument5 pagesIncentive ProgramMandy ZimmermanNo ratings yet

- ISO 55000 - What You Need To KnowDocument26 pagesISO 55000 - What You Need To KnowSidney Pereira Junior100% (3)

- Monthly Spotlight BrazilDocument4 pagesMonthly Spotlight BrazilCharlesson1No ratings yet

- Querino Dicas Banca Opções BináriasDocument60 pagesQuerino Dicas Banca Opções BináriasLeonardo PinheiroNo ratings yet

- Celebrities in Advertising: Group 1Document24 pagesCelebrities in Advertising: Group 1Mohit LalchandaniNo ratings yet

- Citcon EoIDocument3 pagesCitcon EoIShesh Narayan MishraNo ratings yet

- Chapter 7 - Tendering ProceduresDocument28 pagesChapter 7 - Tendering ProceduresHannan Ruslim100% (1)

- SSAE16 and ISA3402 PDFDocument8 pagesSSAE16 and ISA3402 PDFSarah DchiecheNo ratings yet

- Basilan Estates Vs Cir (1967)Document7 pagesBasilan Estates Vs Cir (1967)RavenFoxNo ratings yet

- Google Analytics - 20090918Document5 pagesGoogle Analytics - 20090918Joel R. KallmanNo ratings yet

- AptitudeDocument21 pagesAptitudeSandeep ReddyNo ratings yet

- Chapter 3 - The Franchisor Business PlanDocument15 pagesChapter 3 - The Franchisor Business PlanGunther100% (1)

- Capital Budgeting Practices in Breverages Industries in NepalDocument4 pagesCapital Budgeting Practices in Breverages Industries in NepalInternational Educational Applied Scientific Research Journal (IEASRJ)No ratings yet

- MJD31 D 90514Document11 pagesMJD31 D 90514MaxNo ratings yet

- Lamplighter MenuDocument2 pagesLamplighter MenulamplightersNo ratings yet

- Kolkata New Metro CorridorDocument7 pagesKolkata New Metro CorridorSandip RayNo ratings yet

- Service Industry in IndiaDocument6 pagesService Industry in Indiadip99No ratings yet

- Some Economic Facts of The Prefabricated HousingDocument20 pagesSome Economic Facts of The Prefabricated Housingchiorean_robertNo ratings yet

- Print Control PageDocument1 pagePrint Control PageAkhil DayalNo ratings yet

- Cost of Goods Sold Assignment Q No. 03 To 09Document7 pagesCost of Goods Sold Assignment Q No. 03 To 09mukarram123100% (2)

- QYB - Set Analysis and AGGR ExercisesDocument15 pagesQYB - Set Analysis and AGGR ExercisesDer Fliegende HolländerNo ratings yet

- Sarathi Banking Academy (Data Interpretation Bar Graph)Document14 pagesSarathi Banking Academy (Data Interpretation Bar Graph)N.KARTHIKEYANNo ratings yet