Professional Documents

Culture Documents

Template CH 13

Template CH 13

Uploaded by

Fitri Yulianti0 ratings0% found this document useful (0 votes)

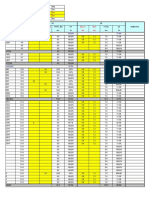

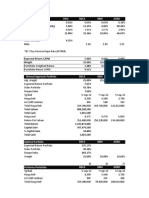

6 views7 pagesThis document contains historical return data for two stocks (A and B) from 2007-2011, and four other stocks (Loon, UFO, SOP, LOL) from 2005-2009. It also shows potential portfolio allocations and calculations for expected return, standard deviation, and other risk measures for combinations of these stock weights.

Original Description:

excel

Original Title

Template Ch 13

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains historical return data for two stocks (A and B) from 2007-2011, and four other stocks (Loon, UFO, SOP, LOL) from 2005-2009. It also shows potential portfolio allocations and calculations for expected return, standard deviation, and other risk measures for combinations of these stock weights.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views7 pagesTemplate CH 13

Template CH 13

Uploaded by

Fitri YuliantiThis document contains historical return data for two stocks (A and B) from 2007-2011, and four other stocks (Loon, UFO, SOP, LOL) from 2005-2009. It also shows potential portfolio allocations and calculations for expected return, standard deviation, and other risk measures for combinations of these stock weights.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

Year Stock A returns Stock B Returns

2007 10.30% 10.71%

2008 -0.10% 25.00%

2009 23.30% 0.38%

2010 2.20% 26.20%

2011 14.00% 11.52%

Expected Return

Standard Deviation

Portfolio

Correlation

Covariance

Weights

Stock A Stock B Portfolio Standard deviation

100% 0% %

90% 10%

80% 20%

70% 30%

60% 40%

50% 50%

40% 60%

30% 70%

20% 80%

10% 90%

0% 100%

Year Loon UFO SOP LOL

2005 11.10% 17.38% 23.42% 1.48%

2006 -11.29% -2.29% -7.31% 9.73%

2007 21.72% 15.53% 8.26% -1.08%

2008 16.38% 32.33% 14.28% 18.46%

2009 12.36% -7.85% 9.47% 13.29%

Expected Return

Standard Deviation

Stock Weights

Loon 25%

UFO 25%

SOP 25%

LOL 25%

Sum weights

Expected Return

Standard Deviation

Risk Free

7%

7%

7%

7%

7%

You might also like

- ARN Transfer FormDocument2 pagesARN Transfer FormSaurav PrakashNo ratings yet

- Leveraged Buyout (LBO)Document17 pagesLeveraged Buyout (LBO)Subhash MsNo ratings yet

- Week07 Exercises Amparo 180318Document7 pagesWeek07 Exercises Amparo 180318JosephAmparoNo ratings yet

- Activitats 10Document10 pagesActivitats 10Christian Callado RosiñaNo ratings yet

- S CurveDocument1 pageS CurveNCL Builders and Construction SupplyNo ratings yet

- Alkem Labs: Inputs Share Price CalculationDocument3 pagesAlkem Labs: Inputs Share Price CalculationAryaman JunejaNo ratings yet

- Excel Stock and Bond PortfolioDocument7 pagesExcel Stock and Bond Portfolioapi-27174321No ratings yet

- WACC EstimationsDocument7 pagesWACC Estimationsak kancharapuNo ratings yet

- Year Nominal Return Inflation Real Rate of Return VarianceDocument14 pagesYear Nominal Return Inflation Real Rate of Return VarianceKunal NakumNo ratings yet

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Activity Qty UM Unit Rate Amount % WT Duration 1 2 3 4 5Document5 pagesActivity Qty UM Unit Rate Amount % WT Duration 1 2 3 4 5Maureen GarridoNo ratings yet

- Putu Ariesta Gita Wilarani - MektanDocument6 pagesPutu Ariesta Gita Wilarani - MektanPutu Ariesta Gita Wilarani 32No ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Asset X Asset Y: Year Cash Flow Value Rate of Return Year Cash Flow Value Rate of ReturnDocument6 pagesAsset X Asset Y: Year Cash Flow Value Rate of Return Year Cash Flow Value Rate of ReturnMika NomiyaNo ratings yet

- S-Curve Product AdoptionDocument4 pagesS-Curve Product AdoptionSheryll de GuzmanNo ratings yet

- Year Liquid Assets Inc/ Dec Inc/Dec % Index Current Assets Inc/DecDocument12 pagesYear Liquid Assets Inc/ Dec Inc/Dec % Index Current Assets Inc/DecgokilnathNo ratings yet

- Bond Duration - Price Sensitivity Using DurationDocument3 pagesBond Duration - Price Sensitivity Using Durationapi-3763138No ratings yet

- 02 IGSYC & Spot Rate 28 Februari 2019 - 2Document1 page02 IGSYC & Spot Rate 28 Februari 2019 - 2Rio AnthonyNo ratings yet

- Solución Clasificacion de SueloDocument17 pagesSolución Clasificacion de SueloRuben David González PerezNo ratings yet

- The Stoploss and Re Entry MethodDocument3 pagesThe Stoploss and Re Entry MethodbooleanNo ratings yet

- Loader 100.0% 71.0%: Rain Hours Prediciton Hrs Slippery Hours Prediction HrsDocument4 pagesLoader 100.0% 71.0%: Rain Hours Prediciton Hrs Slippery Hours Prediction Hrstaufiq kurniawanNo ratings yet

- Tugas 8-20 Kelompok 3Document4 pagesTugas 8-20 Kelompok 3Akuw AjahNo ratings yet

- Session 3 Security - Market - IndicesDocument14 pagesSession 3 Security - Market - Indicessiddhant hingoraniNo ratings yet

- Jaciel AvaliaçaoDocument1 pageJaciel AvaliaçaoSandro Ribeiro PiresNo ratings yet

- Tugas Chapter 8: Essential of Financial Management, 4rd Edition. Brighmam, E.F., Dan Houston, J.F. (2018)Document4 pagesTugas Chapter 8: Essential of Financial Management, 4rd Edition. Brighmam, E.F., Dan Houston, J.F. (2018)Muhtar RasyidNo ratings yet

- Tugas Chapter 8: Essential of Financial Management, 4rd Edition. Brighmam, E.F., Dan Houston, J.F. (2018)Document4 pagesTugas Chapter 8: Essential of Financial Management, 4rd Edition. Brighmam, E.F., Dan Houston, J.F. (2018)Muhtar RasyidNo ratings yet

- ST Lecture 4&5 WorkingsDocument15 pagesST Lecture 4&5 WorkingsSunnie SongNo ratings yet

- Cost of CapitalDocument11 pagesCost of CapitalkarunNo ratings yet

- Portfolio Component Portfolio Characteristics Weight of A Weight of B Expected Return Standard DeviationDocument2 pagesPortfolio Component Portfolio Characteristics Weight of A Weight of B Expected Return Standard DeviationLindsay MartinNo ratings yet

- CombinepdfDocument2 pagesCombinepdfAizon SusulanNo ratings yet

- How To Pricing LoansDocument2 pagesHow To Pricing LoansMatNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- sAqhzUBlYY4 EN CreditMigratoinMarkov02Document4 pagessAqhzUBlYY4 EN CreditMigratoinMarkov02ziad saberiNo ratings yet

- Hola Kola FinancialsDocument6 pagesHola Kola Financialsmaize33No ratings yet

- Product Number Product Description Cost Per Piece Yearly Usage Yearly Turnover % of The Yearly TurnoverDocument13 pagesProduct Number Product Description Cost Per Piece Yearly Usage Yearly Turnover % of The Yearly TurnoverTulasi sharmaNo ratings yet

- ACYFMG2 Quiz 2 QuestionsDocument41 pagesACYFMG2 Quiz 2 QuestionsArnold BernasNo ratings yet

- Capm QuestionsDocument6 pagesCapm QuestionsyenNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- Investment Management ProjectDocument12 pagesInvestment Management ProjectArchana ChapatwalaNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Parcial Modulo IDocument5 pagesParcial Modulo ILEONARDO FRANCO HORA OSORIONo ratings yet

- Beta Portofolio Saham PCA Kel 4 - 121022Document63 pagesBeta Portofolio Saham PCA Kel 4 - 121022Muhibbuddin NoorNo ratings yet

- Book 2Document4 pagesBook 2Adam MiyaraNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- ACF - Capital StructureDocument8 pagesACF - Capital StructureAmit JainNo ratings yet

- Astral Poly: Inputs Share Price CalculationDocument3 pagesAstral Poly: Inputs Share Price CalculationAryaman JunejaNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Corridas Por Fora - Lado Corridas Por Fora - Lado: /gringo/ /gringoDocument1 pageCorridas Por Fora - Lado Corridas Por Fora - Lado: /gringo/ /gringoFernandoNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- S-Curve Product AdoptionDocument6 pagesS-Curve Product AdoptionEntraspace ConsultantNo ratings yet

- PLQ PQ CAQ QS Vert PCQ NPDQ IndDocument7 pagesPLQ PQ CAQ QS Vert PCQ NPDQ IndbryanbreguetNo ratings yet

- Kuwait GDP (2005 To 2009) Comparative Analysis: StateDocument15 pagesKuwait GDP (2005 To 2009) Comparative Analysis: StatekalidheloNo ratings yet

- Biocon: Inputs Share Price CalculationDocument5 pagesBiocon: Inputs Share Price CalculationAryaman JunejaNo ratings yet

- Price R 1 6 1 100 2 8 2 100 3 9.5 3 100 4 10.5 4 100 5 11 5 100 Coupon (Annual, %) Maturity (Years) B (Discount Factor)Document11 pagesPrice R 1 6 1 100 2 8 2 100 3 9.5 3 100 4 10.5 4 100 5 11 5 100 Coupon (Annual, %) Maturity (Years) B (Discount Factor)Archit PateriaNo ratings yet

- International Cost Comparisons: Total Costs of Ring-Yarn 2006Document15 pagesInternational Cost Comparisons: Total Costs of Ring-Yarn 2006pradeepchaturvediNo ratings yet

- Efficient Portfolio Case SolutionDocument4 pagesEfficient Portfolio Case SolutionMuhammad AqibNo ratings yet

- Final Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsDocument3 pagesFinal Exam For Corporate Finance Module - Term 16.2.A Part 1: Short-Answer QuestionsHuân NguyễnNo ratings yet

- IACA Aircraft Ground Damage 2009Q3 CauseDocument1 pageIACA Aircraft Ground Damage 2009Q3 CauseAnonymous ib89TVNo ratings yet

- Working Capital Management: Industry AnalysisDocument78 pagesWorking Capital Management: Industry AnalysisSushant SharmaNo ratings yet