Professional Documents

Culture Documents

CP AR

CP AR

Uploaded by

Andrew Benedict Pardillo0 ratings0% found this document useful (0 votes)

34 views12 pagesPw

Original Title

CpAR

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPw

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

34 views12 pagesCP AR

CP AR

Uploaded by

Andrew Benedict PardilloPw

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 12

TAX.Preweek

Excel Professional Services, Inc.

Management Firm cf Professional Review and Training Center (PRTC)

(Luzon) Manila 7339344/7347902 * Galamba, Laguna (049) 5453807

ayes) Bacolod City (034) 4348214 * Cebu Cy ne

Wr ~ Siindlaisos €Sgayon Be'Gro tity (388) 3085073 Daves Cay Lose SBEOBEE

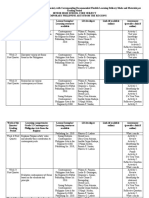

TAXATION ; GPA REVIEW sta

‘since 1977

<_MAY 2014

NCIP! non

4.” Which ofthe following statements is true?)

2. Powerto tax involves power to destioy

b. In ‘taxpayer's. suit, the government can me

fexpavers not demanding receipts from ousiness

Dovtle taxation is resurted to by taxng autherity

to increase tay collection

4d. Power of taxation is absolute or withoyt limitations

2. Why tax credit Is alowed to Be aval

taxpayers? .

2. To pfovide incentive thus inducing these taxpayers

to report income derived ‘rom abread

b. To provide relief from she burden of taxation

In compliance with commitment to inte:national

agreement

4d. For citizen doing business outside the Philippines to

become competitive

1d of by certain

3. The Taguig City intentionsily made. its local taxes iower

than that of Makati City In order to attract investors,

Which of the following statements is correct?

2. This 16 not violative on the rule on uniformity in

taxation; ‘

b. This is violative of the equal protection clause of

{the Philippine Const.tution ; i

c. This is violative of the delegated power of taxation

under the Local Government Code;

d. This will be subject to review by Congress of the

Philippines.

4, One of the following is not a corstitutionat imitation on

taxing power:

a. That the money cultected on a tax’ levied for a

public purpose shall Le paid out for such purpose

only;

'b. Exemption from taxes of the income and assets of,

educational institutions includes grants,

‘endowments or donations; i

‘c.Nonsimprisonment for non-payment of a debt or

poll tax; -

4d, Non-impairment of she Supréme Court jurisdiction

In tax cases. :

5. The following, except ore, are basic. principles of &

sound tax system:

1a, It should be capable of being effectively enforces;

b. It should be progressive;

c. Sources of revenue must be sufficient*to meet

government expenditures and other public needs;

d, It should be exercised to pimote public welfare.

6 Theasturedeowtax tomaiver de

or iy in nature e benal nature

B. Poficain nature, Pefalin ebpracter

Tax exemption is made different from tax amnesty:

2, It isa privilege or freedom from tax burden;

b. It allows immunity from all criminal,

i ational Government ;

to, be used f€r public

purpose. 100,000

11/15/2013 To his brother _ on

' account of marriage

fon 11/18/2012 $,000

'ba3.000

The gift tax payable on 11/15/2013 donation is:

a, P1,909 ‘e. 1,800

b. Pigo <. P800

‘ESTATETAX :

32, Which of the following is not a part.of the gross estate?

‘a. Conjugal property ‘ ‘

b. Community property

. ExCusive property cf the decedent

di. Exclusive property cf the surviving spouse

34, Which ‘of the following ropéities is exempt from

estate tax because of. nciprocity? {

a. Patent of a non-resicent alien-decedent exercised

‘i the Philippines

b. Forpign shares of stock of @ non-resident alien

decedent (60% of business in the Philipoines).

€. Bank deposit of @ non-resident alien devedert in a

35. Which Sf the following préperties shall be excluded

from the gross estate of a decedent?

a. Proceeds of life insurance policy on the Mfe of the

decedent payable to his youngest daughter

The transmission of the inheritance from the

decedent to the fiduclary heir

. Both (3) and (b)

J. Neither (a) nor (b) .

36. Who among the following transferors is not liable for

estate ‘tax on the property transferred during Nis

1a. The testator who bequesths p-operty to hs heirs in

a last will and testament executed and probated

during his lifetime

b. The donor who reserves his right to amend or

evoke tne donation of property in favor of the

donee

The sone of an apipointes' property who is

required, under a power of appointment to transfer

such property upon deat’ to his eldest child

d. The transferor of personel property who sold it for

Ingurticient consideration

Which of the following properties constitutes the

common property of the spouses under a regime of

Conjuget Partnership of Gains?

2. Land inherited during the marrage

Di Fruits of land inherited

Jewelry inherited during the marriage

J. Building donated before marriage

38.Kim Pang, a Chinese billionaire and a Canadian

resident, cied and left assets in China valued at P80

bilicn ard in the Philippines assets valued at P20

lon. For Prilippine estate tax purposes the allowable

deductions for expenses, losses, indebtedness, and

+ taxes, property previously taved, transters for public

use, and the share of his surviving spouse in: ther

conjugal partnership amounted to PIS billion. Pang's

‘gies estate for Philippine estate tax purposes is

2. P20 bilo, ‘. P100 billion.

b. PS billion

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CPAR-Quarter 1-Module 2Document50 pagesCPAR-Quarter 1-Module 2Andrew Benedict Pardillo78% (83)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cup 1Document82 pagesCup 1Andrew Benedict PardilloNo ratings yet

- Yan Hain Nanangonon Ko PirikoDocument16 pagesYan Hain Nanangonon Ko PirikoAndrew Benedict PardilloNo ratings yet

- Melc Cpar Q1Document4 pagesMelc Cpar Q1Andrew Benedict Pardillo100% (3)

- Filipino: Activity SheetsDocument6 pagesFilipino: Activity SheetsAndrew Benedict Pardillo100% (1)

- Cash and Accounts Receivable PDFDocument11 pagesCash and Accounts Receivable PDFAndrew Benedict PardilloNo ratings yet

- Business Law and TaxationDocument21 pagesBusiness Law and TaxationAndrew Benedict PardilloNo ratings yet

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- Img 011Document2 pagesImg 011Andrew Benedict PardilloNo ratings yet

- RR No. 6-2018Document2 pagesRR No. 6-2018Andrew Benedict PardilloNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet