Professional Documents

Culture Documents

Go Vs Bpi Family Savings Bank, Inc, G.R. No. 187487

Go Vs Bpi Family Savings Bank, Inc, G.R. No. 187487

Uploaded by

Reynaldo Fajardo YuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Go Vs Bpi Family Savings Bank, Inc, G.R. No. 187487

Go Vs Bpi Family Savings Bank, Inc, G.R. No. 187487

Uploaded by

Reynaldo Fajardo YuCopyright:

Available Formats

GO VS BPI FAMILY SAVINGS BANK, INC, G.R. No.

187487

Facts:

BPI Family filed a complaint against petitioners Go Tong Electrical and its President, Go,

seeking that the latter be held jointly and severally liable to it for the payment of their loan

obligation in the aggregate amount of ₱87,086,398.71, inclusive of the principal sum,

interests, and penalties. As alleged by BPI Family, Go Tong Electrical had applied for and

was granted financial assistance by the then Bank of South East Asia (BSA). Subsequently,

DBS Bank of the Philippines, Inc. (DBS) became the successor in interest of BSA. The

application for financial assistance was renewed through a Credit Agreement. Go Tong

Electrical, represented by Go, obtained a loan from DBS in the principal amount of

₱40,491,051.65, for which Go Tong Electrical executed Promissory Note (PN) for the same

amount in favor of DBS, Under the PN’s terms, Go Tong Electrical bound itself to pay a

default penalty interest at the rate of one percent (1%) per month in addition to the

current interest rate. As additional security, Go executed a Comprehensive Surety

Agreement (CSA) covering any and all obligations undertaken by Go Tong Electrical,

including the aforesaid loan. Upon default of petitioners, DBS – and later, its successor-in-

interest, herein BPI Family – demanded payment from petitioners, but to no avail, hence,

the aforesaid complaint.

In their Answer, petitioners argued that Go cannot be held liable under the CSA since there

was supposedly no solidarity of debtors.

The RTC reduced the agreed 20% per annum interest in the PN to 12% per annum interest

for being patently iniquitous and unconscionable.

Issue: Whether or not Go should be held liable and whether or not the 20% interest is

iniquitous and unconscionable.

Ruling:

As established through the CSA, Go had clearly bound himself as a surety to Go Tong

Electrical's loan obligation. Thus, there is no question that Go's liability thereto is solidary

with the former. As provided in Article 2047 of the Civil Code, "the surety undertakes to be

bound solidarily with the principal obligor. That undertaking makes a surety agreement an

ancillary contract as it presupposes the existence of a principal contract. Although the

contract of a surety is in essence secondary only to a valid principal obligation, the surety

becomes liable for the debt or duty of another although it possesses no direct or personal

interest over the obligations, nor does it receive any benefit therefrom. Let it be stressed

that notwithstanding the fact that the surety contract is secondary to the principal

obligation, the surety assumes liability as a regular party to the undertaking," as Go in this

case.

With respect to the interests, Go should be held liable for the twenty percent (20%) per

annum stipulated interest rate as agreed upon in the PN. Said interest rate should be

upheld as this was stipulated by the parties, and the rate cannot be considered

unconscionable. The penalty rate of one percent (1%) per month are upheld.

You might also like

- Iloilo Jar Corporation v. Comglasco Corporation Aguila Glass, G.R. No. 219509, January 18, 2017Document3 pagesIloilo Jar Corporation v. Comglasco Corporation Aguila Glass, G.R. No. 219509, January 18, 2017Emmanuel SilangNo ratings yet

- Test Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFDocument101 pagesTest Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFAnonymous kimbxi4No ratings yet

- HEIRS OF BACUS VS. CA - Docx JAJAJDocument6 pagesHEIRS OF BACUS VS. CA - Docx JAJAJSherwin Anoba CabutijaNo ratings yet

- Trans Industrial Utilities, Inc. v. Metropolitan. Bank & Trust CompanyDocument2 pagesTrans Industrial Utilities, Inc. v. Metropolitan. Bank & Trust CompanyJay jogsNo ratings yet

- Advanced Accounting Chapter 5Document19 pagesAdvanced Accounting Chapter 5Ya Lun100% (1)

- Introduction To Building Economics As Related To ArchitectureDocument9 pagesIntroduction To Building Economics As Related To ArchitectureFeritFazliu100% (1)

- Salvador V AngelesDocument1 pageSalvador V AngelesKoko InfantadoNo ratings yet

- Tenorio v. Manila Railroad Co.: FactsDocument1 pageTenorio v. Manila Railroad Co.: Factssunsetsailor85100% (1)

- Philosophy Lesson Plan - ActivityDocument4 pagesPhilosophy Lesson Plan - ActivitySlaghard AnerajNo ratings yet

- Ridao Vs Handmade Home CreditDocument2 pagesRidao Vs Handmade Home CreditHEART NUQUENo ratings yet

- People v. MagatDocument1 pagePeople v. MagatRidzanna AbdulgafurNo ratings yet

- Soriano Vs LaguardiaDocument3 pagesSoriano Vs LaguardiahiltonbraiseNo ratings yet

- PNB Vs CA G.R. No. 88880Document3 pagesPNB Vs CA G.R. No. 88880Rizchelle Sampang-ManaogNo ratings yet

- 6 GF Equity, Inc. vs. ValenzonaDocument2 pages6 GF Equity, Inc. vs. ValenzonaJemNo ratings yet

- Gumabon v. PNBDocument2 pagesGumabon v. PNBVon Lee De LunaNo ratings yet

- Case Digest 29 Sept 2022Document11 pagesCase Digest 29 Sept 2022Arvy AgustinNo ratings yet

- Casimiro V TandogDocument1 pageCasimiro V TandogMerryl Kristie FranciaNo ratings yet

- CivPro Bar QsDocument12 pagesCivPro Bar Qsralph_atmosfera100% (1)

- 111 - Licaros v. Licaros G.R. No. 150656Document3 pages111 - Licaros v. Licaros G.R. No. 150656Joan Mangampo100% (1)

- Santos Ventura Hocorma Foundation Inc Vs SANTOSDocument1 pageSantos Ventura Hocorma Foundation Inc Vs SANTOSmcris101No ratings yet

- 1981-People v. CuevoDocument10 pages1981-People v. CuevoKathleen Martin100% (1)

- Danilo v. Pedro, G.R. No. 155736, 31 March 2005Document3 pagesDanilo v. Pedro, G.R. No. 155736, 31 March 2005Jan Airah PrincipeNo ratings yet

- People vs. FortesDocument10 pagesPeople vs. FortesMaria Fiona Duran MerquitaNo ratings yet

- Cuizon vs. Court of AppealsDocument3 pagesCuizon vs. Court of AppealsAje EmpaniaNo ratings yet

- Ridao v. Handmade Credit and Loans G.R. No. 236920, (February 3, 2021)Document9 pagesRidao v. Handmade Credit and Loans G.R. No. 236920, (February 3, 2021)RLAMMNo ratings yet

- Yao vs. MatelaDocument2 pagesYao vs. MatelaDongkaeNo ratings yet

- Pan Pacific Service Contractors Inc. vs. Equitable PCIDocument14 pagesPan Pacific Service Contractors Inc. vs. Equitable PCIAaron CariñoNo ratings yet

- Lao V Special Plans PDFDocument18 pagesLao V Special Plans PDFjrNo ratings yet

- Starbright Sales Enterprises, Inc., Petitioner, Philippine Realty Corporation, Msgr. Domingo A. Cirilos, Tropicana Properties and Development Corporation and Standard Realty CORPORATION, RespondentsDocument2 pagesStarbright Sales Enterprises, Inc., Petitioner, Philippine Realty Corporation, Msgr. Domingo A. Cirilos, Tropicana Properties and Development Corporation and Standard Realty CORPORATION, RespondentsPao Infante0% (1)

- People vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedDocument11 pagesPeople vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedFatzie MendozaNo ratings yet

- BPI vs. SarmientoDocument5 pagesBPI vs. SarmientoJeryl Grace FortunaNo ratings yet

- Frank Colmenar vs. Apollo Colmenar Et Al.Document2 pagesFrank Colmenar vs. Apollo Colmenar Et Al.Jamille YapNo ratings yet

- Taxation Digests-3Rd Batch: 1 - PageDocument6 pagesTaxation Digests-3Rd Batch: 1 - PageAdrianAdriaticoNo ratings yet

- Oblicon Prof Crisostomo Uribe 56847af7dfacaDocument74 pagesOblicon Prof Crisostomo Uribe 56847af7dfacafsfssffdsNo ratings yet

- Romero vs. Ca ObliconDocument2 pagesRomero vs. Ca Oblicongrego centillasNo ratings yet

- CEREZOvs. DAVID TUAZON Case DigestDocument6 pagesCEREZOvs. DAVID TUAZON Case DigestChristine Rose Bonilla LikiganNo ratings yet

- Oblicon-Case-List - Docx - HwordDocument17 pagesOblicon-Case-List - Docx - HwordIrish Ann FabrosNo ratings yet

- GO Vs UCPBDocument3 pagesGO Vs UCPBSheila RosetteNo ratings yet

- Mercader v. DBPDocument3 pagesMercader v. DBPReina MarieNo ratings yet

- Clemente V RPDocument2 pagesClemente V RPJean-François DelacroixNo ratings yet

- Lafarge Cement v. Continental Cement - 443 SCRA 522Document6 pagesLafarge Cement v. Continental Cement - 443 SCRA 522alilramones100% (1)

- (G. R. No. L-21489 and L-21628. May 19, 1966.) MIGUEL MAPALO, ET AL., Petitioners, v. MAXIMO MAPALO, ET AL., Respondents. FactsDocument1 page(G. R. No. L-21489 and L-21628. May 19, 1966.) MIGUEL MAPALO, ET AL., Petitioners, v. MAXIMO MAPALO, ET AL., Respondents. FactsPrincess MagpatocNo ratings yet

- Chapter 2: Prescription of Ownership and Other Real Rights: Obligations and Contracts Reviewer - A. RegadoDocument6 pagesChapter 2: Prescription of Ownership and Other Real Rights: Obligations and Contracts Reviewer - A. RegadoAleezah Gertrude RegadoNo ratings yet

- Inestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Document2 pagesInestate Estate of The Lete Ricardo Presbitero, Sr. Vs CA, 217 SCRA 372Gilda P. OstolNo ratings yet

- Clemente v. RepublicDocument2 pagesClemente v. RepublicYvonne MallariNo ratings yet

- Documentary Evidence - Ulep v. DucatDocument2 pagesDocumentary Evidence - Ulep v. DucatDanielle DacuanNo ratings yet

- Buenviaje v. Sps. Salonga, G. R. No. 216023 (2016) - EstradaDocument4 pagesBuenviaje v. Sps. Salonga, G. R. No. 216023 (2016) - EstradaRevina EstradaNo ratings yet

- PCIB vs. Sps. Wilson Dy HongDocument10 pagesPCIB vs. Sps. Wilson Dy HongCzarDuranteNo ratings yet

- Jalandoni v. Economienda 819 S 43 (PERALTA)Document1 pageJalandoni v. Economienda 819 S 43 (PERALTA)lil userNo ratings yet

- Technogas Vs PNB (Dacion en Pago Art.1255)Document1 pageTechnogas Vs PNB (Dacion en Pago Art.1255)piptipaybNo ratings yet

- Case No. 3 Omengan vs. PNB Et - Al, January 23, 2007Document1 pageCase No. 3 Omengan vs. PNB Et - Al, January 23, 2007Eunice EsteraNo ratings yet

- Topic Date: Criminal Procedure 2EDocument3 pagesTopic Date: Criminal Procedure 2EJasenNo ratings yet

- Banco Filipino Savings & Mortgage Bank vs. Navarro, No. L-46591, 152 SCRA 346, July 28, 1987Document7 pagesBanco Filipino Savings & Mortgage Bank vs. Navarro, No. L-46591, 152 SCRA 346, July 28, 1987FarsmileNo ratings yet

- 97 Linear - V - Dolmar GR212327Document2 pages97 Linear - V - Dolmar GR212327Harold James QuindoyNo ratings yet

- Rodzssen Supply v. Far East Bank Gr. 109087 May 9, 2001Document6 pagesRodzssen Supply v. Far East Bank Gr. 109087 May 9, 2001Randy SiosonNo ratings yet

- Consti2 Case Digests - MidtermDocument31 pagesConsti2 Case Digests - MidtermStephanie Rose MarcelinoNo ratings yet

- CIVPRO Mod 1 CompilationDocument33 pagesCIVPRO Mod 1 CompilationKatrina PerezNo ratings yet

- Rodzssen Supply Co., Inc. vs. Far East Bank & Trust Co.Document10 pagesRodzssen Supply Co., Inc. vs. Far East Bank & Trust Co.ericjoe bumagatNo ratings yet

- CD1. 5. Asian Construction and Development Corp vs. Philippine Commercial International Bank GR No. 153827, April 25, 2006Document3 pagesCD1. 5. Asian Construction and Development Corp vs. Philippine Commercial International Bank GR No. 153827, April 25, 2006glenn anayronNo ratings yet

- G.R. No. 200191Document1 pageG.R. No. 200191annaNo ratings yet

- Allied Bank vs. CA, de Guzman, Tanqueco. 284 SCRA 357 (1998)Document2 pagesAllied Bank vs. CA, de Guzman, Tanqueco. 284 SCRA 357 (1998)eUG SACLONo ratings yet

- TML Gasket Vs BPI FamilyDocument2 pagesTML Gasket Vs BPI FamilybidanNo ratings yet

- Lim v. Security Bank DIGESTDocument2 pagesLim v. Security Bank DIGESTKarez Martin100% (1)

- Lecture 5 - CLR1 - To End of PFR - Week FiveDocument139 pagesLecture 5 - CLR1 - To End of PFR - Week FiveReynaldo Fajardo YuNo ratings yet

- Lecture 8 - CLR1 - Property - Week EightDocument153 pagesLecture 8 - CLR1 - Property - Week EightReynaldo Fajardo YuNo ratings yet

- Lecture 6 - CLR1 - Property - Week SixDocument157 pagesLecture 6 - CLR1 - Property - Week SixReynaldo Fajardo YuNo ratings yet

- EFEBRE v. A BROWN COMPANY, GR No. 224973Document2 pagesEFEBRE v. A BROWN COMPANY, GR No. 224973Reynaldo Fajardo YuNo ratings yet

- Regional Trial Court: That On July 1, 2012 in The City of Cagayan de OroDocument2 pagesRegional Trial Court: That On July 1, 2012 in The City of Cagayan de OroReynaldo Fajardo YuNo ratings yet

- RAPE Complaint AffidavitDocument6 pagesRAPE Complaint AffidavitReynaldo Fajardo YuNo ratings yet

- Tax-Deductions-Corporations (Final)Document1 pageTax-Deductions-Corporations (Final)Reynaldo Fajardo YuNo ratings yet

- Taxation Pre-Bar Review 2019 (With Notes)Document15 pagesTaxation Pre-Bar Review 2019 (With Notes)Reynaldo Fajardo YuNo ratings yet

- Philippine Tax Base and Tax Rates (Corporations)Document3 pagesPhilippine Tax Base and Tax Rates (Corporations)Reynaldo Fajardo YuNo ratings yet

- The Executive Power Shall Be Vested in The President of The PhilippinesDocument16 pagesThe Executive Power Shall Be Vested in The President of The PhilippinesReynaldo Fajardo YuNo ratings yet

- D. Executive Department: I. Privileges, Inhibitions and DisqualificationsDocument23 pagesD. Executive Department: I. Privileges, Inhibitions and DisqualificationsReynaldo Fajardo YuNo ratings yet

- Depreciable Amt Capitalizable Cost - Scrap Value: DR 1/estmd Useful LifeDocument1 pageDepreciable Amt Capitalizable Cost - Scrap Value: DR 1/estmd Useful LifeReynaldo Fajardo YuNo ratings yet

- Personal Data SheetDocument5 pagesPersonal Data SheetReynaldo Fajardo YuNo ratings yet

- Motion To DismissDocument10 pagesMotion To DismissReynaldo Fajardo YuNo ratings yet

- Fahrenbach vs. PangilinanDocument1 pageFahrenbach vs. PangilinanReynaldo Fajardo YuNo ratings yet

- JFK Killed Just Days After Shutting Down RothschildDocument12 pagesJFK Killed Just Days After Shutting Down RothschildDomenico Bevilacqua100% (2)

- Manual For Procurement of Goods 2017Document266 pagesManual For Procurement of Goods 2017Latest Laws Team100% (1)

- XXX HO#30 - Civil Law - Credit TransactionsDocument7 pagesXXX HO#30 - Civil Law - Credit TransactionsperlitainocencioNo ratings yet

- Aquiles Riosa v. Tabaco La Suerte CorporationDocument11 pagesAquiles Riosa v. Tabaco La Suerte CorporationJuan GeronimoNo ratings yet

- FinaclemenuandtablesDocument72 pagesFinaclemenuandtablesGeraldine NkankumeNo ratings yet

- Torts 1st Batch of CasesDocument47 pagesTorts 1st Batch of CasesCarla ReyesNo ratings yet

- International Wire Transfer Quick Tips and FAQDocument4 pagesInternational Wire Transfer Quick Tips and FAQEmanuelNo ratings yet

- Issue and Redemption of DebenturesDocument78 pagesIssue and Redemption of DebenturesApollo Institute of Hospital Administration50% (2)

- The Importance of Authenticity With Ron Lieber: TranscriptDocument25 pagesThe Importance of Authenticity With Ron Lieber: Transcriptmoukoudi moukoudi thierryNo ratings yet

- Rate of Return One Project: Engineering EconomyDocument20 pagesRate of Return One Project: Engineering EconomyEmran JanemNo ratings yet

- The YES BANK STORYDocument2 pagesThe YES BANK STORYAyushi SrivastavaNo ratings yet

- Biolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionDocument8 pagesBiolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionghostgripNo ratings yet

- Books of Accounts & Accounting RecordsDocument34 pagesBooks of Accounts & Accounting RecordsCA Deepak Ehn67% (3)

- Judicial and Extrajudicial Foreclosure of MortgageDocument4 pagesJudicial and Extrajudicial Foreclosure of MortgageLiza Rosales100% (1)

- Pico Far East Holdings LimitedDocument8 pagesPico Far East Holdings LimitedValueEdgeNo ratings yet

- Bob RtgsDocument1 pageBob RtgsD J ParmarNo ratings yet

- FWD: Nesl - Request To Authenticate: Nesliu@Nesl - Co.InDocument2 pagesFWD: Nesl - Request To Authenticate: Nesliu@Nesl - Co.InSagar GuptaNo ratings yet

- Ifrs 15Document89 pagesIfrs 15milithebillyNo ratings yet

- DBP Vs CA and Sps. Timoteo and PinedaDocument2 pagesDBP Vs CA and Sps. Timoteo and PinedathesarahkristinNo ratings yet

- Accounting Standards AS 7, 9 and 3: DTRTI LucknowDocument44 pagesAccounting Standards AS 7, 9 and 3: DTRTI LucknowvivekNo ratings yet

- Associated Bank v. CADocument1 pageAssociated Bank v. CAkim_santos_20No ratings yet

- Proof of Claim Form-1Document3 pagesProof of Claim Form-1Anonymous oumGYHOx8No ratings yet

- Challenger AR Complete Low-ResDocument94 pagesChallenger AR Complete Low-ResAaron GohNo ratings yet

- The Indian Banking Sector: Recent Developments, Growth and ProspectsDocument17 pagesThe Indian Banking Sector: Recent Developments, Growth and Prospectsmeiling mizukiNo ratings yet

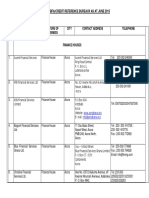

- LICENSED NBFIS As at JUNE 2015Document10 pagesLICENSED NBFIS As at JUNE 2015poseiNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument17 pagesBalance Sheet: Equity and LiabilitiesAbdullah JawadNo ratings yet

- Bharat ElectronicsDocument12 pagesBharat Electronicsnafis20No ratings yet