Professional Documents

Culture Documents

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Uploaded by

Evelyn ToralvaCopyright:

Available Formats

You might also like

- Advanced Financial Accounting 4Th Edition Pearl Tan Full ChapterDocument61 pagesAdvanced Financial Accounting 4Th Edition Pearl Tan Full Chapterwilliam.rainey525100% (19)

- Institute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalDocument19 pagesInstitute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalNayaz NMNo ratings yet

- Reinsurance ProjectDocument43 pagesReinsurance ProjectAnonymous 4A044t100% (1)

- Risk & ReturnDocument26 pagesRisk & ReturnAmit RoyNo ratings yet

- Optimizador de PortafoliosDocument1 pageOptimizador de PortafoliosLuigiCastroAlvisNo ratings yet

- ER Covariance: Recession 0.33 - 0.07 0.17 Normal 0.33 0.12 0.07 Boom 0.33 0.28 - 0.03Document3 pagesER Covariance: Recession 0.33 - 0.07 0.17 Normal 0.33 0.12 0.07 Boom 0.33 0.28 - 0.03randomNo ratings yet

- German Credit SPD EOD AOD ERD: Preprocessing Stage-MV Handling & FairnessDocument4 pagesGerman Credit SPD EOD AOD ERD: Preprocessing Stage-MV Handling & FairnessNabila HassanNo ratings yet

- Problem7 5Document2 pagesProblem7 5Sunil SharmaNo ratings yet

- Meta/Frf: A Knowledge Based System For Formation EvaluationDocument13 pagesMeta/Frf: A Knowledge Based System For Formation EvaluationTripoli ManoNo ratings yet

- CMT Template EgenDocument110 pagesCMT Template EgenannaNo ratings yet

- Ejemplo Consolidado de GastosDocument2 pagesEjemplo Consolidado de GastosKarla Segovia De PerezNo ratings yet

- Back Test (Intraday EQ)Document3 pagesBack Test (Intraday EQ)Nizar AhammedNo ratings yet

- Taller Auto Part'S Express J.E, C.ADocument4 pagesTaller Auto Part'S Express J.E, C.Ajhopsemar gonzalezNo ratings yet

- PSM PPT Board MeetingDocument22 pagesPSM PPT Board MeetingvisutsiNo ratings yet

- Xva - Ma - D1S1Document30 pagesXva - Ma - D1S1guliguruNo ratings yet

- Seismic Hazard Exposure: Social Indicators Risk IndicatorsDocument2 pagesSeismic Hazard Exposure: Social Indicators Risk IndicatorsSundak HidayatNo ratings yet

- Moneycontrol 1Document1 pageMoneycontrol 1dakshdudeNo ratings yet

- Butterfly Matrix RomgazDocument3 pagesButterfly Matrix RomgazRadu BibireNo ratings yet

- Fd306-I Load Table PDFDocument1 pageFd306-I Load Table PDFMike SmithNo ratings yet

- 34576-Lever Intermittent L2 Report-1-11Document11 pages34576-Lever Intermittent L2 Report-1-11sharanNo ratings yet

- Pulse Amplitude Modulation - 056Document4 pagesPulse Amplitude Modulation - 056RC20 GamerNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Port DrawingsDocument6 pagesPort DrawingsAbobrinhaestrgadaNo ratings yet

- Durability Part ReportDocument8 pagesDurability Part Reportpoochselvam57No ratings yet

- DSP WaveformsDocument16 pagesDSP WaveformsGangireddy SanjeevNo ratings yet

- 1ly-Exit Large Language Models2402.00518Document1 page1ly-Exit Large Language Models2402.00518鄭惠文No ratings yet

- Report Blanks InsulinDocument7 pagesReport Blanks InsulinHelena Muñoz GalanNo ratings yet

- MTM PipelineDocument17 pagesMTM PipelineSutomo RochmandaNo ratings yet

- Main (OB1) PDFDocument2 pagesMain (OB1) PDFDanielSaniNo ratings yet

- SPR 10 Meta Log FRF Formation Factor CalculatorDocument13 pagesSPR 10 Meta Log FRF Formation Factor Calculatorpetroleum737No ratings yet

- Switching Diode: DatasheetDocument7 pagesSwitching Diode: DatasheetClément SaillantNo ratings yet

- CARE GBV - Concept Note Summary Budget TDocument10 pagesCARE GBV - Concept Note Summary Budget TtawandaeltonNo ratings yet

- Lab7 ตั้งฉากDocument3 pagesLab7 ตั้งฉากphye.saichonNo ratings yet

- Base01 PDFDocument1 pageBase01 PDFMario MartinezNo ratings yet

- 6c SMDDocument4 pages6c SMDMindSet MarcosNo ratings yet

- EDF1AS Thru EDF1DS: Miniature Glass Passivated Ultrafast Surface Mount Bridge RectifiersDocument2 pagesEDF1AS Thru EDF1DS: Miniature Glass Passivated Ultrafast Surface Mount Bridge RectifiersCarlosNo ratings yet

- Am ModulationDocument3 pagesAm ModulationSaqib ullahNo ratings yet

- Zener Diode: UDZV SeriesDocument7 pagesZener Diode: UDZV SeriesAsad AhmedNo ratings yet

- HW3 Q1 AnswerDocument6 pagesHW3 Q1 AnswerGautam DugarNo ratings yet

- Marco Vardaro - PHD Thesis - 2018 01 14 (168-192)Document25 pagesMarco Vardaro - PHD Thesis - 2018 01 14 (168-192)mjd rNo ratings yet

- Acetic Isoprophyl Acetic Isoprophyl Acid (XA) Acid (XC) Ether (Y) Ether (Y)Document2 pagesAcetic Isoprophyl Acetic Isoprophyl Acid (XA) Acid (XC) Ether (Y) Ether (Y)Virginia SitompulNo ratings yet

- Example 12.5.1Document2 pagesExample 12.5.1Virginia SitompulNo ratings yet

- Maximum Likelihood Parameter Estimates Using Multiple Stripes Analysis Data Jack Baker July 15, 2011Document4 pagesMaximum Likelihood Parameter Estimates Using Multiple Stripes Analysis Data Jack Baker July 15, 2011Joseph772No ratings yet

- SM 66595 Cost of ProductionDocument1 pageSM 66595 Cost of Productionrize1159No ratings yet

- WK.1 WK.2 WK.3 WK.4 WK.5 WK.6Document48 pagesWK.1 WK.2 WK.3 WK.4 WK.5 WK.6Erwin Macapinlac MabutiNo ratings yet

- Nozzle Analysis - 0713 DischargeDocument4 pagesNozzle Analysis - 0713 DischargeBilal MustafaNo ratings yet

- Nozzle Analysis 0715 - SuctionDocument4 pagesNozzle Analysis 0715 - SuctionBilal MustafaNo ratings yet

- DC-DC Converter YD12 Series Technical Specification V1.0Document6 pagesDC-DC Converter YD12 Series Technical Specification V1.0Asad AhmedNo ratings yet

- Nozzle Analysis P713 SuctionDocument4 pagesNozzle Analysis P713 SuctionBilal MustafaNo ratings yet

- Xn vs 1/f Cuerda gruesa: 1/Fn λn2 1/Fn3 λn3 1/Fn4 1/Fn6 1/Fn7Document3 pagesXn vs 1/f Cuerda gruesa: 1/Fn λn2 1/Fn3 λn3 1/Fn4 1/Fn6 1/Fn7Fabian SosaNo ratings yet

- Sabana 2Document2 pagesSabana 2nestor lara garciaNo ratings yet

- Item Ledger EntriesDocument4 pagesItem Ledger EntriespamungkasNo ratings yet

- Project:-Mixed Use Residence Owner Nigat Tafere Take Off No. 01 Location Addis Ababa Page: - No LXWXH Total Description No LXWXH Total DescriptionDocument24 pagesProject:-Mixed Use Residence Owner Nigat Tafere Take Off No. 01 Location Addis Ababa Page: - No LXWXH Total Description No LXWXH Total DescriptionJoConNo ratings yet

- Fault StudyDocument12 pagesFault StudypasanhesharaNo ratings yet

- 12-Hole Standards InteractiveDocument1 page12-Hole Standards InteractivevikramNo ratings yet

- Scheme of Brokerage: Equity, Futures & Options, Currency & Commodities SegmentDocument3 pagesScheme of Brokerage: Equity, Futures & Options, Currency & Commodities SegmentUmang AgrawalNo ratings yet

- Efe-Ife-Cpm Matrices CalcsDocument21 pagesEfe-Ife-Cpm Matrices Calcssaad bin sadaqatNo ratings yet

- 1/3/2017 1/11/2017 EURAUD H4 Completing D Leg, Bullish Cypher D Leg Completed 2/2/2017 2/3/2017 EURAUD H4 Completing D Leg, Bullish CypherDocument6 pages1/3/2017 1/11/2017 EURAUD H4 Completing D Leg, Bullish Cypher D Leg Completed 2/2/2017 2/3/2017 EURAUD H4 Completing D Leg, Bullish CypherChard CaringalNo ratings yet

- Consumption ReportDocument4 pagesConsumption ReportYani syfaNo ratings yet

- Wa0037.Document1 pageWa0037.Ahsan khanNo ratings yet

- Nozzle Analysis - 0714 SuctionDocument4 pagesNozzle Analysis - 0714 SuctionBilal MustafaNo ratings yet

- Tiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)Document7 pagesTiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)VictoriaSantosNo ratings yet

- Cost of ProductionDocument7 pagesCost of ProductiontotpityiNo ratings yet

- 9-Principles of Insurance and Loss AssessmentDocument29 pages9-Principles of Insurance and Loss Assessmentmayur shettyNo ratings yet

- Commercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDDocument6 pagesCommercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDezinhleNo ratings yet

- An Introduction To ReinsuranceDocument188 pagesAn Introduction To Reinsurancecruzer11290No ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177Document45 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177CassandraHurstqtrk100% (23)

- Investments Test 2 Study GuideDocument30 pagesInvestments Test 2 Study GuideLaurenNo ratings yet

- Tata AIA Life InsuranceDocument3 pagesTata AIA Life InsuranceisoehcouncilNo ratings yet

- Chapter-1 Basics of Risk ManagementDocument22 pagesChapter-1 Basics of Risk ManagementmmkattaNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Insurance Policy BIDocument5 pagesInsurance Policy BILakshav KapoorNo ratings yet

- Plans and ProgramsDocument4 pagesPlans and ProgramsGoyo VitoNo ratings yet

- CAPM HandoutDocument37 pagesCAPM HandoutShashank ReddyNo ratings yet

- Financial MGT Notes de Cours 2012-2013Document102 pagesFinancial MGT Notes de Cours 2012-2013Nino LANo ratings yet

- Insurance Law Review 2015Document43 pagesInsurance Law Review 2015peanut47No ratings yet

- Project Work ON Banking and InsuranceDocument16 pagesProject Work ON Banking and InsuranceAnkita VermaNo ratings yet

- Eclerx Interview Question and AnswersDocument4 pagesEclerx Interview Question and AnswersAbhishek Pawar100% (1)

- Century Royale Brochure Ver 05 (1) - 7-7Document1 pageCentury Royale Brochure Ver 05 (1) - 7-7arunsm1611No ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- A Practical Handbook On Stock Market TradingDocument105 pagesA Practical Handbook On Stock Market TradingSudhanshu SinghNo ratings yet

- FIN301-Financial Report-Aamra Technologies Limited.Document9 pagesFIN301-Financial Report-Aamra Technologies Limited.Neong GhalleyNo ratings yet

- PolicyStatus 109893862Document1 pagePolicyStatus 109893862panwarramesh15830No ratings yet

- Art 6Document14 pagesArt 6Preda AnaNo ratings yet

- Re InsuranceDocument24 pagesRe InsuranceNavali Madugula100% (1)

- F9-Set1 Model AnswerDocument5 pagesF9-Set1 Model AnswerPradeepaa BalajiNo ratings yet

- Financial Derivatives33Document65 pagesFinancial Derivatives33aurorashiva1No ratings yet

- VaR CalculationDocument8 pagesVaR CalculationHuong Dao MaiNo ratings yet

- Senthil Kumar MR IncomeShield 25.04.2019 19.23.38Document3 pagesSenthil Kumar MR IncomeShield 25.04.2019 19.23.38nataraj maxNo ratings yet

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Uploaded by

Evelyn ToralvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Portfolio Optimizer: Optimal Tangency Portfolio Portfolio

Uploaded by

Evelyn ToralvaCopyright:

Available Formats

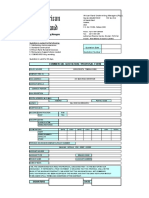

426073022.

xlsx

PORTFOLIO OPTIMIZER

OPTIMAL TANGENCY

Risk Aversion 8 PORTFOLIO PORTFOLIO

Target Return 0.1 (set risk aversion=0 to activate Riskless Err:502

Riskless Rate 0.02 XOM Err:502 Err:502

GE Err:502 Err:502

EXPECTED STANDARD PFE Err:502 Err:502

RETURN DEVIATION WMT Err:502 Err:502

XOM MSFT Err:502 Err:502

GE

PFE Expected Return Err:502 Err:502

WMT Standard Deviation Err:502 Err:502

MSFT

XOM GE PFE WMT MSFT

XOM 1.0000 0.0000 0.0000 0.0000 0.0000

GE 1.0000 0.0000 0.0000 0.0000

CORRELATIONS PFE 1.0000 0.0000 0.0000

WMT 1.0000 0.0000

MSFT 1.0000

EXPECTED RETURN

0.03

0.02

Frontier without Riskless

Asset 1

0.02 Asset 2

Asset 3

Asset 4

Asset 5

0.01 Frontier with Riskless

Tangency Portfolio

Your Portfolio

0.01

0.00

-0.10 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70

STANDARD DEVIATION

Page 1

You might also like

- Advanced Financial Accounting 4Th Edition Pearl Tan Full ChapterDocument61 pagesAdvanced Financial Accounting 4Th Edition Pearl Tan Full Chapterwilliam.rainey525100% (19)

- Institute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalDocument19 pagesInstitute and Faculty of Actuaries: Subject CT5 - Contingencies Core TechnicalNayaz NMNo ratings yet

- Reinsurance ProjectDocument43 pagesReinsurance ProjectAnonymous 4A044t100% (1)

- Risk & ReturnDocument26 pagesRisk & ReturnAmit RoyNo ratings yet

- Optimizador de PortafoliosDocument1 pageOptimizador de PortafoliosLuigiCastroAlvisNo ratings yet

- ER Covariance: Recession 0.33 - 0.07 0.17 Normal 0.33 0.12 0.07 Boom 0.33 0.28 - 0.03Document3 pagesER Covariance: Recession 0.33 - 0.07 0.17 Normal 0.33 0.12 0.07 Boom 0.33 0.28 - 0.03randomNo ratings yet

- German Credit SPD EOD AOD ERD: Preprocessing Stage-MV Handling & FairnessDocument4 pagesGerman Credit SPD EOD AOD ERD: Preprocessing Stage-MV Handling & FairnessNabila HassanNo ratings yet

- Problem7 5Document2 pagesProblem7 5Sunil SharmaNo ratings yet

- Meta/Frf: A Knowledge Based System For Formation EvaluationDocument13 pagesMeta/Frf: A Knowledge Based System For Formation EvaluationTripoli ManoNo ratings yet

- CMT Template EgenDocument110 pagesCMT Template EgenannaNo ratings yet

- Ejemplo Consolidado de GastosDocument2 pagesEjemplo Consolidado de GastosKarla Segovia De PerezNo ratings yet

- Back Test (Intraday EQ)Document3 pagesBack Test (Intraday EQ)Nizar AhammedNo ratings yet

- Taller Auto Part'S Express J.E, C.ADocument4 pagesTaller Auto Part'S Express J.E, C.Ajhopsemar gonzalezNo ratings yet

- PSM PPT Board MeetingDocument22 pagesPSM PPT Board MeetingvisutsiNo ratings yet

- Xva - Ma - D1S1Document30 pagesXva - Ma - D1S1guliguruNo ratings yet

- Seismic Hazard Exposure: Social Indicators Risk IndicatorsDocument2 pagesSeismic Hazard Exposure: Social Indicators Risk IndicatorsSundak HidayatNo ratings yet

- Moneycontrol 1Document1 pageMoneycontrol 1dakshdudeNo ratings yet

- Butterfly Matrix RomgazDocument3 pagesButterfly Matrix RomgazRadu BibireNo ratings yet

- Fd306-I Load Table PDFDocument1 pageFd306-I Load Table PDFMike SmithNo ratings yet

- 34576-Lever Intermittent L2 Report-1-11Document11 pages34576-Lever Intermittent L2 Report-1-11sharanNo ratings yet

- Pulse Amplitude Modulation - 056Document4 pagesPulse Amplitude Modulation - 056RC20 GamerNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Port DrawingsDocument6 pagesPort DrawingsAbobrinhaestrgadaNo ratings yet

- Durability Part ReportDocument8 pagesDurability Part Reportpoochselvam57No ratings yet

- DSP WaveformsDocument16 pagesDSP WaveformsGangireddy SanjeevNo ratings yet

- 1ly-Exit Large Language Models2402.00518Document1 page1ly-Exit Large Language Models2402.00518鄭惠文No ratings yet

- Report Blanks InsulinDocument7 pagesReport Blanks InsulinHelena Muñoz GalanNo ratings yet

- MTM PipelineDocument17 pagesMTM PipelineSutomo RochmandaNo ratings yet

- Main (OB1) PDFDocument2 pagesMain (OB1) PDFDanielSaniNo ratings yet

- SPR 10 Meta Log FRF Formation Factor CalculatorDocument13 pagesSPR 10 Meta Log FRF Formation Factor Calculatorpetroleum737No ratings yet

- Switching Diode: DatasheetDocument7 pagesSwitching Diode: DatasheetClément SaillantNo ratings yet

- CARE GBV - Concept Note Summary Budget TDocument10 pagesCARE GBV - Concept Note Summary Budget TtawandaeltonNo ratings yet

- Lab7 ตั้งฉากDocument3 pagesLab7 ตั้งฉากphye.saichonNo ratings yet

- Base01 PDFDocument1 pageBase01 PDFMario MartinezNo ratings yet

- 6c SMDDocument4 pages6c SMDMindSet MarcosNo ratings yet

- EDF1AS Thru EDF1DS: Miniature Glass Passivated Ultrafast Surface Mount Bridge RectifiersDocument2 pagesEDF1AS Thru EDF1DS: Miniature Glass Passivated Ultrafast Surface Mount Bridge RectifiersCarlosNo ratings yet

- Am ModulationDocument3 pagesAm ModulationSaqib ullahNo ratings yet

- Zener Diode: UDZV SeriesDocument7 pagesZener Diode: UDZV SeriesAsad AhmedNo ratings yet

- HW3 Q1 AnswerDocument6 pagesHW3 Q1 AnswerGautam DugarNo ratings yet

- Marco Vardaro - PHD Thesis - 2018 01 14 (168-192)Document25 pagesMarco Vardaro - PHD Thesis - 2018 01 14 (168-192)mjd rNo ratings yet

- Acetic Isoprophyl Acetic Isoprophyl Acid (XA) Acid (XC) Ether (Y) Ether (Y)Document2 pagesAcetic Isoprophyl Acetic Isoprophyl Acid (XA) Acid (XC) Ether (Y) Ether (Y)Virginia SitompulNo ratings yet

- Example 12.5.1Document2 pagesExample 12.5.1Virginia SitompulNo ratings yet

- Maximum Likelihood Parameter Estimates Using Multiple Stripes Analysis Data Jack Baker July 15, 2011Document4 pagesMaximum Likelihood Parameter Estimates Using Multiple Stripes Analysis Data Jack Baker July 15, 2011Joseph772No ratings yet

- SM 66595 Cost of ProductionDocument1 pageSM 66595 Cost of Productionrize1159No ratings yet

- WK.1 WK.2 WK.3 WK.4 WK.5 WK.6Document48 pagesWK.1 WK.2 WK.3 WK.4 WK.5 WK.6Erwin Macapinlac MabutiNo ratings yet

- Nozzle Analysis - 0713 DischargeDocument4 pagesNozzle Analysis - 0713 DischargeBilal MustafaNo ratings yet

- Nozzle Analysis 0715 - SuctionDocument4 pagesNozzle Analysis 0715 - SuctionBilal MustafaNo ratings yet

- DC-DC Converter YD12 Series Technical Specification V1.0Document6 pagesDC-DC Converter YD12 Series Technical Specification V1.0Asad AhmedNo ratings yet

- Nozzle Analysis P713 SuctionDocument4 pagesNozzle Analysis P713 SuctionBilal MustafaNo ratings yet

- Xn vs 1/f Cuerda gruesa: 1/Fn λn2 1/Fn3 λn3 1/Fn4 1/Fn6 1/Fn7Document3 pagesXn vs 1/f Cuerda gruesa: 1/Fn λn2 1/Fn3 λn3 1/Fn4 1/Fn6 1/Fn7Fabian SosaNo ratings yet

- Sabana 2Document2 pagesSabana 2nestor lara garciaNo ratings yet

- Item Ledger EntriesDocument4 pagesItem Ledger EntriespamungkasNo ratings yet

- Project:-Mixed Use Residence Owner Nigat Tafere Take Off No. 01 Location Addis Ababa Page: - No LXWXH Total Description No LXWXH Total DescriptionDocument24 pagesProject:-Mixed Use Residence Owner Nigat Tafere Take Off No. 01 Location Addis Ababa Page: - No LXWXH Total Description No LXWXH Total DescriptionJoConNo ratings yet

- Fault StudyDocument12 pagesFault StudypasanhesharaNo ratings yet

- 12-Hole Standards InteractiveDocument1 page12-Hole Standards InteractivevikramNo ratings yet

- Scheme of Brokerage: Equity, Futures & Options, Currency & Commodities SegmentDocument3 pagesScheme of Brokerage: Equity, Futures & Options, Currency & Commodities SegmentUmang AgrawalNo ratings yet

- Efe-Ife-Cpm Matrices CalcsDocument21 pagesEfe-Ife-Cpm Matrices Calcssaad bin sadaqatNo ratings yet

- 1/3/2017 1/11/2017 EURAUD H4 Completing D Leg, Bullish Cypher D Leg Completed 2/2/2017 2/3/2017 EURAUD H4 Completing D Leg, Bullish CypherDocument6 pages1/3/2017 1/11/2017 EURAUD H4 Completing D Leg, Bullish Cypher D Leg Completed 2/2/2017 2/3/2017 EURAUD H4 Completing D Leg, Bullish CypherChard CaringalNo ratings yet

- Consumption ReportDocument4 pagesConsumption ReportYani syfaNo ratings yet

- Wa0037.Document1 pageWa0037.Ahsan khanNo ratings yet

- Nozzle Analysis - 0714 SuctionDocument4 pagesNozzle Analysis - 0714 SuctionBilal MustafaNo ratings yet

- Tiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)Document7 pagesTiempo (H) PP (Increm. MM) Intensidad (MM/H) FT FT (Tasa Inf Potencial)VictoriaSantosNo ratings yet

- Cost of ProductionDocument7 pagesCost of ProductiontotpityiNo ratings yet

- 9-Principles of Insurance and Loss AssessmentDocument29 pages9-Principles of Insurance and Loss Assessmentmayur shettyNo ratings yet

- Commercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDDocument6 pagesCommercial Quotation / Proposal Form: African Rand Underwriting Managers (Pty) LTDezinhleNo ratings yet

- An Introduction To ReinsuranceDocument188 pagesAn Introduction To Reinsurancecruzer11290No ratings yet

- Test Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177Document45 pagesTest Bank For Investments 11th Edition Alan Marcus Zvi Bodie Alex Kane Isbn1259277178 Isbn 9781259277177CassandraHurstqtrk100% (23)

- Investments Test 2 Study GuideDocument30 pagesInvestments Test 2 Study GuideLaurenNo ratings yet

- Tata AIA Life InsuranceDocument3 pagesTata AIA Life InsuranceisoehcouncilNo ratings yet

- Chapter-1 Basics of Risk ManagementDocument22 pagesChapter-1 Basics of Risk ManagementmmkattaNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Insurance Policy BIDocument5 pagesInsurance Policy BILakshav KapoorNo ratings yet

- Plans and ProgramsDocument4 pagesPlans and ProgramsGoyo VitoNo ratings yet

- CAPM HandoutDocument37 pagesCAPM HandoutShashank ReddyNo ratings yet

- Financial MGT Notes de Cours 2012-2013Document102 pagesFinancial MGT Notes de Cours 2012-2013Nino LANo ratings yet

- Insurance Law Review 2015Document43 pagesInsurance Law Review 2015peanut47No ratings yet

- Project Work ON Banking and InsuranceDocument16 pagesProject Work ON Banking and InsuranceAnkita VermaNo ratings yet

- Eclerx Interview Question and AnswersDocument4 pagesEclerx Interview Question and AnswersAbhishek Pawar100% (1)

- Century Royale Brochure Ver 05 (1) - 7-7Document1 pageCentury Royale Brochure Ver 05 (1) - 7-7arunsm1611No ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- A Practical Handbook On Stock Market TradingDocument105 pagesA Practical Handbook On Stock Market TradingSudhanshu SinghNo ratings yet

- FIN301-Financial Report-Aamra Technologies Limited.Document9 pagesFIN301-Financial Report-Aamra Technologies Limited.Neong GhalleyNo ratings yet

- PolicyStatus 109893862Document1 pagePolicyStatus 109893862panwarramesh15830No ratings yet

- Art 6Document14 pagesArt 6Preda AnaNo ratings yet

- Re InsuranceDocument24 pagesRe InsuranceNavali Madugula100% (1)

- F9-Set1 Model AnswerDocument5 pagesF9-Set1 Model AnswerPradeepaa BalajiNo ratings yet

- Financial Derivatives33Document65 pagesFinancial Derivatives33aurorashiva1No ratings yet

- VaR CalculationDocument8 pagesVaR CalculationHuong Dao MaiNo ratings yet

- Senthil Kumar MR IncomeShield 25.04.2019 19.23.38Document3 pagesSenthil Kumar MR IncomeShield 25.04.2019 19.23.38nataraj maxNo ratings yet