Professional Documents

Culture Documents

Project About Banking

Project About Banking

Uploaded by

Abhay YadavCopyright:

Available Formats

You might also like

- CH 11 MasteryDocument11 pagesCH 11 Mastery1anthonyanthony7No ratings yet

- Raymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)Document338 pagesRaymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)leonardo soteldo100% (2)

- Homeopatie: Share Your ThoughtsDocument1 pageHomeopatie: Share Your ThoughtsMircea Eugen Moldovan0% (1)

- Extrajudicial Settlement of Estate SAMPLE PROBLEMDocument4 pagesExtrajudicial Settlement of Estate SAMPLE PROBLEMJheng Jingco100% (1)

- Marketing Report GilletteDocument17 pagesMarketing Report GilletteQueenie Marie Obial AlasNo ratings yet

- Tcus Trust Capital Units Blue Border EditableDocument1 pageTcus Trust Capital Units Blue Border EditablejoeNo ratings yet

- Online Resrvation SystemDocument1 pageOnline Resrvation SystemKavya sreeNo ratings yet

- C++ Project On Restaurant Billing7Document1 pageC++ Project On Restaurant Billing7AJ SEB MR7No ratings yet

- WWW Slideshare NetDocument8 pagesWWW Slideshare NetAnkur VermaNo ratings yet

- Kapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirDocument1 pageKapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirIsti HaryantoNo ratings yet

- Inventory Systems: FollowDocument1 pageInventory Systems: FollowMelusi DocNo ratings yet

- Rates Analysis For Calculating Material and Labour For Building WorksDocument1 pageRates Analysis For Calculating Material and Labour For Building WorksHscl PulivendulaNo ratings yet

- 勤說Document1 page勤說WONG EVELYNE JADENo ratings yet

- Compare Contrast Essay FinalDocument1 pageCompare Contrast Essay FinalNakı Dilber BüyükdağNo ratings yet

- Business Studies Class 12th Marketing Management Project - Fruit Juice - PDFDocument1 pageBusiness Studies Class 12th Marketing Management Project - Fruit Juice - PDFmake yourself fit0% (1)

- WWW Slideshare NetDocument5 pagesWWW Slideshare NetOumeyr CheemahNo ratings yet

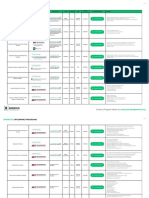

- Full Time Program: ProgrammeDocument2 pagesFull Time Program: ProgrammesimspuneNo ratings yet

- How To Prepare Table Topics Speech: UploadDocument5 pagesHow To Prepare Table Topics Speech: UploadArvinNo ratings yet

- Chap 9Document1 pageChap 9Phu Nguyen NhutNo ratings yet

- WWW Sims FalultyDocument2 pagesWWW Sims FalultysimspuneNo ratings yet

- WWW Slideshare Net Mobile Daniholic Earth Science Teaching GuideDocument29 pagesWWW Slideshare Net Mobile Daniholic Earth Science Teaching GuideKc S Enriquez100% (1)

- Sebit Company Profile - BETT - May2022Document34 pagesSebit Company Profile - BETT - May2022Nadia HamidiNo ratings yet

- Sebit Company Profile - BETT - May2022Document34 pagesSebit Company Profile - BETT - May2022Nadia HamidiNo ratings yet

- Assignment Format For MBA StudentsDocument1 pageAssignment Format For MBA StudentsNyi Nyi WinNo ratings yet

- Training and Development in Axis BankDocument1 pageTraining and Development in Axis BankVidyashree PNo ratings yet

- Enactus Wyższa Szkoła Zarządzania I Bankowości W Poznaniu - WSZiB W PoznaniuDocument6 pagesEnactus Wyższa Szkoła Zarządzania I Bankowości W Poznaniu - WSZiB W Poznaniukoizak3No ratings yet

- Project On Accountancy Class 11-12Document1 pageProject On Accountancy Class 11-12Krishna BambaNo ratings yet

- Daily Lesson Plan: DateDocument1 pageDaily Lesson Plan: DateNoor MashitahNo ratings yet

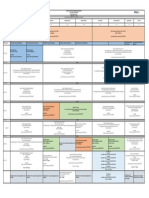

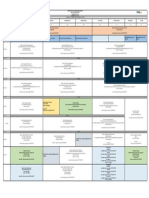

- PGDM Sem 2-BatchDocument1 pagePGDM Sem 2-BatchAbhishek GuptaNo ratings yet

- PGDM Sem 3-Batch 2020-22-TT 29 SepDocument1 pagePGDM Sem 3-Batch 2020-22-TT 29 SepAmit ChakrabortyNo ratings yet

- Classroom Management PowerPoint PresentationDocument1 pageClassroom Management PowerPoint PresentationMark Anthony B. Aquino100% (1)

- Curriculum-RoadmapDocument1 pageCurriculum-Roadmapmr ethanbennett0602No ratings yet

- Subject: Subject Title:: Info. Tech. Computer Application and Networking VisionDocument5 pagesSubject: Subject Title:: Info. Tech. Computer Application and Networking VisionLizNo ratings yet

- PGDM Sem 2-Batch 2020-22-TTDocument1 pagePGDM Sem 2-Batch 2020-22-TTAbhishek GuptaNo ratings yet

- IE Brown Executive MBA BrochureDocument8 pagesIE Brown Executive MBA BrochureUjwal TickooNo ratings yet

- Mbaex Admission Brochure 2024-25Document6 pagesMbaex Admission Brochure 2024-25scientist xyzNo ratings yet

- AI in Education Map Mar 11, 2024Document1 pageAI in Education Map Mar 11, 2024margreen5No ratings yet

- Urine Culture TestDocument1 pageUrine Culture TestLab TichNo ratings yet

- OUTCOMES-BASED EDUCATION - authorSTREAM DocumentedDocument3 pagesOUTCOMES-BASED EDUCATION - authorSTREAM DocumentedK wongNo ratings yet

- Matric CertificateDocument1 pageMatric CertificateNazia ahmedNo ratings yet

- Generic College System Architecture-ConceptualDocument2 pagesGeneric College System Architecture-ConceptualAzimuddin MunshiNo ratings yet

- Perkenalan Jurusan - Sistem Informasi - 2021 - R3Document37 pagesPerkenalan Jurusan - Sistem Informasi - 2021 - R3Sylvia SihombingNo ratings yet

- MBA or PGDM Which Is BetterDocument3 pagesMBA or PGDM Which Is BetterasiapacificNo ratings yet

- 2019-Elt-Oxford University Press Catalog PDFDocument52 pages2019-Elt-Oxford University Press Catalog PDFJuan Jose Avila100% (2)

- HKUST Digital MBA For Global Leaders BrochureDocument3 pagesHKUST Digital MBA For Global Leaders BrochureSylvian Shooi Yang HwaNo ratings yet

- Lkis School Learning Action Cell 2023-2024 - 1Document19 pagesLkis School Learning Action Cell 2023-2024 - 1Jeklenn QuirobinNo ratings yet

- LAC Plan: Phase Activities Persons Involve Time Frame Resources Success Indicator Fund Source of FundDocument1 pageLAC Plan: Phase Activities Persons Involve Time Frame Resources Success Indicator Fund Source of FundShring HighbNo ratings yet

- Visual Resume TemplateDocument1 pageVisual Resume Templatehabib luqmanNo ratings yet

- Nabi Junjungan Kita MuhammadDocument1 pageNabi Junjungan Kita MuhammadDeni MaulanaNo ratings yet

- Sample of A Logbook For Bachelor of Science in Computer Science, SofDocument1 pageSample of A Logbook For Bachelor of Science in Computer Science, SofLwazi NjabuloNo ratings yet

- EMERITUS Online Certificate Diploma Programs Calendar 2021Document18 pagesEMERITUS Online Certificate Diploma Programs Calendar 2021ankitjain06No ratings yet

- TE AI DS Curriculum (1)Document3 pagesTE AI DS Curriculum (1)ShahuNo ratings yet

- (Executive) : MBA - Open For AllDocument1 page(Executive) : MBA - Open For AllsimspuneNo ratings yet

- ECI PMP Class 1 - OverviewDocument12 pagesECI PMP Class 1 - OverviewStephen BurganNo ratings yet

- Ilp Form 11Document7 pagesIlp Form 11api-640000441No ratings yet

- Blended Learning FrameworkDocument2 pagesBlended Learning FrameworkMark SymesNo ratings yet

- Action Plan Data Management and Information Systems Support SY 2019-2020Document4 pagesAction Plan Data Management and Information Systems Support SY 2019-2020Nhey TolentinoNo ratings yet

- Accounting For Partnership and CorporatDocument1 pageAccounting For Partnership and Corporatretuyasheena16No ratings yet

- WWW Scribd Com Document 571749888 Field Project 1st Year 1Document12 pagesWWW Scribd Com Document 571749888 Field Project 1st Year 1devanshtiwari287No ratings yet

- HolonIQ 2021 Global Learning Landscape PosterDocument1 pageHolonIQ 2021 Global Learning Landscape PosterCarlos David Campos GonzálezNo ratings yet

- Placements Report 2022-TcpaDocument10 pagesPlacements Report 2022-TcpaDamon SalvatoreNo ratings yet

- Action Plan in Ict School Year 2021-2022Document3 pagesAction Plan in Ict School Year 2021-2022ERWIN MORGIANo ratings yet

- WWW Studocu Com in Document Kurukshetra-University Mba-Finance Summer-Internship-Project-Hdfc-Bankpdf 22246003Document1 pageWWW Studocu Com in Document Kurukshetra-University Mba-Finance Summer-Internship-Project-Hdfc-Bankpdf 22246003Prajwal PotphodeNo ratings yet

- Madeline Prebe - Ilp Teacher Leadership ProjectDocument4 pagesMadeline Prebe - Ilp Teacher Leadership Projectapi-417446088No ratings yet

- Home LoanDocument2 pagesHome LoanRoshan LewisNo ratings yet

- Tourism at The Crossroads Challenges To Developing Countries by The New World Trade OrderDocument69 pagesTourism at The Crossroads Challenges To Developing Countries by The New World Trade OrderEquitable Tourism Options (EQUATIONS)No ratings yet

- Fin552 - GP AssignmentDocument45 pagesFin552 - GP AssignmentWAN NUR AYUNI ISNINNo ratings yet

- Assignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyDocument22 pagesAssignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyAn NguyenthenamNo ratings yet

- Executive Summary: Have It Your WayDocument45 pagesExecutive Summary: Have It Your WayMela De Guzman CabandingNo ratings yet

- Subject: Financial Management: Indira Institute of Management, PuneDocument23 pagesSubject: Financial Management: Indira Institute of Management, PunePrasad RandheNo ratings yet

- Toaz - Info HR Contacts Details Rajasthan PRDocument27 pagesToaz - Info HR Contacts Details Rajasthan PRSATISH WORDBOXNo ratings yet

- Caveats FlowDocument10 pagesCaveats FlowsubhadraamNo ratings yet

- Scaling Up Community-DrivenDocument43 pagesScaling Up Community-DrivenJonah R. MeranoNo ratings yet

- AMP Brochure 2022-23Document24 pagesAMP Brochure 2022-23Rahul SinghNo ratings yet

- CHAPTER 9 LESSON 1 NewDocument3 pagesCHAPTER 9 LESSON 1 NewLogan NagelNo ratings yet

- Financial Services: Topic: Tax Aspects of LeasingDocument10 pagesFinancial Services: Topic: Tax Aspects of LeasingSri NilayaNo ratings yet

- Tofan Arkitect - Prezentare en 01.Document8 pagesTofan Arkitect - Prezentare en 01.Bogdan TofanNo ratings yet

- Reg. No(s) Name (S) Title(s) : A Study On Sales Promotional Activities in Footwear IndustryDocument3 pagesReg. No(s) Name (S) Title(s) : A Study On Sales Promotional Activities in Footwear IndustryNaresh KumarNo ratings yet

- VP Financial Planning Analysis in USA Resume John EffreinDocument2 pagesVP Financial Planning Analysis in USA Resume John EffreinJohnEffrein2No ratings yet

- Rashid Jooma-Health Care Financing in PakistanDocument13 pagesRashid Jooma-Health Care Financing in Pakistansikander jalalNo ratings yet

- Post Fin301 - Fin 301 Unit 7 QuizDocument2 pagesPost Fin301 - Fin 301 Unit 7 Quizteacher.theacestudNo ratings yet

- LR 2433Document2 pagesLR 2433mnitoo193No ratings yet

- BDD Redevelopment - EnggDocument13 pagesBDD Redevelopment - Enggbalaeee123No ratings yet

- Jaiib Questions Accounting & Finance Module D - Cont... : InvestmentsDocument4 pagesJaiib Questions Accounting & Finance Module D - Cont... : InvestmentsBiswajit DasNo ratings yet

- WELFARE FACILITY PROVIDED TO EMPLOYEES BY BANK OF INDIA Project ReportDocument41 pagesWELFARE FACILITY PROVIDED TO EMPLOYEES BY BANK OF INDIA Project Reportkamdica77% (13)

- POSTIONAL - StockMockDocument46 pagesPOSTIONAL - StockMockSathishkumar TvsNo ratings yet

- Time Value of Time Value of MoneyDocument57 pagesTime Value of Time Value of MoneymomindkhanNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Analytical Tools (Strat Plan) - 1Document16 pagesAnalytical Tools (Strat Plan) - 1Low El LaNo ratings yet

Project About Banking

Project About Banking

Uploaded by

Abhay YadavCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project About Banking

Project About Banking

Uploaded by

Abhay YadavCopyright:

Available Formats

Search Upload Login Signup

Home Explore Presentation Courses PowerPoint Courses by LinkedIn Learning

7 people clipped this slide Recommended

PowerPoint: From Outline to

Presentation

Online Course - LinkedIn Learning

Train the Trainer

Online Course - LinkedIn Learning

Teaching Techniques:

Creating Effective Learning

Assessments

Online Course - LinkedIn Learning

Banking ppt

Rahul Mailcontractor

Business studies for 11th

class CBSE

Max Monu

11 of 52 Banking system ppt

Lohith Lohi

209,338

Project about banking views

Share Like Download ...

Types of banks

17somya

parthiban40

Follow

The AI Rush

Jean-Baptiste Dumont

Published on Mar 9, 2013

10 Comments 119 Likes Statistics Notes AI and Machine Learning

Demystified by Carol Smith

at Midwest UX 2017

Share your thoughts… Post Carol Smith

10 facts about jobs in the

future

Hilda Ellison

Pew Research Center's Internet

Want to earn $4000/m? Of course you do. Learn how when you join today! ■■■ & American Life Project

http://ishbv.com/ezpayjobs/pdf

4 days ago

pfaenden

DOWNLOAD FULL BOOKS, INTO AVAILABLE FORMAT

.........................................................................................................................

.........................................................................................................................

1.DOWNLOAD FULL. PDF EBOOK here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

1.DOWNLOAD FULL. EPUB Ebook here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

1.DOWNLOAD FULL. doc Ebook here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

1.DOWNLOAD FULL. PDF EBOOK here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

1.DOWNLOAD FULL. EPUB Ebook here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

1.DOWNLOAD FULL. doc Ebook here { https://tinyurl.com/y3nhqquc }

.........................................................................................................................

.........................................................................................................................

......................................................................................................................... ..............

Browse by Genre Available eBooks

......................................................................................................................... Art,

Biography, Business, Chick Lit, Children's, Christian, Classics, Comics, Contemporary,

Cookbooks, Crime, Ebooks, Fantasy, Fiction, Graphic Novels, Historical Fiction,

History, Horror, Humor And Comedy, Manga, Memoir, Music, Mystery, Non Fiction,

Paranormal, Philosophy, Poetry, Psychology, Religion, Romance, Science, Science

Fiction, Self Help, Suspense, Spirituality, Sports, Thriller, Travel, Young Adult,

3 weeks ago

May Macdonald

The #1 Woodworking Resource With Over 16,000 Plans, Download 50 FREE Plans...

★★★ http://ishbv.com/tedsplans/pdf

1 month ago

Kelly Sawyer

Your opinions matter! get paid BIG $$$ for them! START NOW!!.. ◆◆◆

http://ishbv.com/surveys6/pdf

2 months ago

Dorothy Middleton

The #1 Woodworking Resource With Over 16,000 Plans, Download 50 FREE Plans...

▲▲▲ http://ishbv.com/tedsplans/pdf

3 months ago

Show More

Project about banking

1. BANKING“BANKING IS WHAT A BANK DOES”

2. DEFINITION OF BANKING Banking Regulation Act 1949 defines banking as, “ACCEPTING

FOR THE PURPOSE OF LENDING AND INVESTMENT, OF DEPOSITS OF MONEY FROM

THE PUBLIC, REPAYABLE ON DEMAND, ORDER OR OTHERWISE AND WITHDRAWABLE

BY CHEQUE,DRAFT,ORDER OR OTHERWISE”.

3. BANK IS PART OF FINANCIAL SY STEM Financial system is one whichsupplies the

necessary financial inputs for theproduction of goods and services. Economicdevelopment of

any country depends upon theexistence of well organized financial system.

4. Financial systemFinancial assets BFinancial intermediaries A N Financial markets K S

Financial instruments

5. BANKING SY STEM There has been a rapid development in the banking institutions in

various countries. With development, various systems ofbanking have come into existence.

Banks can be classified on the basis of volume of operator, business pattern & areas of

operations.

6. COMMON BANKINGSY STEM BRANCH BANKING UNIT

BANKING CORRESPONDANCE BANKNG DEPOSIT BANKING INVESTMENT

BANKNG MIXED BANKING UNIVERSAL BANKNG

7. CLASSIFICATION OF BANKING Banking institutions are indispensablepart in a modern

developing society. On the basis of functions performedbanks can be classified as follows.

8. BANKING STRUCTURE UNORGANISED ORGANISED COMMERCIAL INDIGENIOUS

BANKS BANKS COPOERATIVE BANKS MONEY REGIONAL LENDERS RURAL BANKS ALL

INDIA FINANCIAL TRADERS INSTITUTION FOREIGN BANKS INDUSTRIAL DEVELOPMENT

BANKS

9. INDIAN BANKING UNIVERSE INDIAN BANKING UNIVERSEPUBLIC FOREIGN

PRIVATESECTOR BANKS BANKS BANKS 41 20 26

10. FUNCTIONS OF COMMERCIAL BANK PRIMARY SECONDARYFUNCTION FUNCTION

11. ADVANCING OFACCEPTANCE OF LOANS & CREDIT DEPOSITS CREATION PRIMARY

FUNCTION DEAING IN INVESTMENT FOREIGN FUNCTION EX-CHANGE

12. SECONDARY FUNCTIONS AGENCY SERVICES GENERAL UTILITY SERVICES

13. C

14. RESERVE BANK OF INDIA RBI was established in 1st April 1935. Present governor is

Duvvuri Subbarao. There are 22 regional offices and most of them in share capital.

15. CENTRAL BANK OF INDIA It was started as shareholders bank with a paid up capital of

5crores. It was privately owned. In 1949, RBI was fully owned by government.

16. FIRST GOVERNOR Sir OSBORNE A. SMITH. [April 1st 1935 to June 30,1937]

(AUSTRALIA).

17. F I R S T I N D I A N G OV E R N O R Sir CHINTAMAN D. DESHMUKA (August11,1943 to

June30,1949).

18. LIST OF GOVERNOR IN RBI HE IS MR.YAGA VENUGOPAL REDDY. HE WAS

ELECTED AS GOVERNOR FROM PERIOD (6TH SEPTEMBER 2003 TO 5TH SEPTEMBER

2008).

19. PRESENT GOVERNOR OF RBI MR.DUVVURI SUBBARAO WAS THE 22ND &

CURRENT GOVERNOR OF RBI. HE ELECTED FOR PERIOD OF (5TH SEPTEMBER 2008

TO 4TH SEPTEMBER 2013).

20. FUNTIONS OF RBI To regulate the issue of bank notes and keep reserves , with a view to

secure monetary stability in India. Generally to operate the currency and credit system of the

country.

21. ORGANISATION CENTRAL BOARD---MUMBAI. LOCAL BOARD----MUMBAI, DELHI,

CHENNAI, KOLKATA.

22. FUNCTION OF CENTRAL BOARD & LOCAL BOARD FUNCTION OF CENTRAL BOARD:

General superintendence and direction of the bank’s affairs. FUNCTIONS OF LOCAL BOARD:

Advise to the Central Board and economic interest of local co-operative indigenous bank.

23. FUNCTIONS OF RBI TRADITIONAL FUNCTION PROMOTIONAL FUNCTION

SUPERVISORY FUNCTION

24. TR A D ITIONA L FU N C TION Monopoly of currency notes issue. Banker to government

(both central &state) Agent & Advisor to Government Banker to Banker’s Act as clearing

house of country Lender of last resort Controller of credit Custodian of foreign exchange

reserves.

25. PROM OTIONA L FU N C TION Promotion of banking habit andexpansion of banking

system Provider refinance for expert promotion Expansion of facilities for provision ofthe

agricultural credit through NABARD Extension of n facilities for SBI Helping Co-Operative

sector Prescribe minimum statutoryrequirement. Innovating new banking

businesstransactions.

26. S U P E RV I S I O RY F U N C T I O N Granting license to banks Inspects and makes

enquiry in varioussection of RBI and banking regulations. Implement deposit insurance

scheme Periodical review of work of thecommercial bank Giving directives to commercial

bank Control non banking finance corporation Ensuring health of financial corporationsystem

through on site & offsiteverification.

27. STATE BANK OF INDIA ACTSAS AGENT OF RESERVEBANK OF INDIA.

28. EVOLUTION OF SBI EVOLUTION OF SBI CAN BE TRACED BACKTO THE FIRST

DECADE ON 19TH CENTURY. IT BEGAN WITH ESTABLISHMENT OFTHE BANK OF

CALCUTTA ON 2ND JUNE 1806. ON 2ND JANUARY 1809 RENAMED AS THEBANK OF

BANGAL.

29. FIRST JOIINT STOCK BANK INBRITISH INDIA ESABLISHEDUNDER THE

SPONSORSHIP OFGOVERNMENT OF BENGAL. FOLLOWED BY BANK OFBENGAL: BANK

OF BOMBAY-15THAPRIL1840 BANK OF MADRAS-1ST JULY1843 THESE THREE

DOMNIATEDMODERN BANKING SCENARIO ININDIA.

30. THREE BANKS WEREAMALGAMATED TO FORM THEIMPERIAL BANK OF INDIA

ON27TH JANUARY 1921. TO SERVE THE ECONOMY INACCORDANCE WITH FIVE

YEARPLAN (1951), THE ALL INDIARURAL CREDIT SURVEYCOMMITTEE PROPOSED

THETALE OVER OF THE IMPERIALBANK OF INDIA.

31. AN ACT WAS PASSEDIN PARLIMENT OF INDIAIN MAY 1955 . AS ARESULT THE

STATE BANKOF INDIA WASESTABLISHED ON 1STJULY 1955.

32. ON 1959 SBI [SUBSIDARYBANKS] ACT WAS PASSED. IT ENABLED THE SBI TOMAKE

EIGHT STATEASSOCIATED BANKS ASITS SUBSIDIARIES.

33. SUBSIDIARIES OF SBI: STATE BANK OF BIKANER & JAIPUR STATE BANK OF

HYDRABAD STATE BANK OF MYSORE STATE BANK OF PATIALA STATE BANK OF

TRAVANGORE

34. P RO D U C T S & S E RV I C E S O F S B I E-TICKETING SBI E-TAX EZTRADE @

SBI RTGS/NEFT E-PAYMENTS FUND TRANSFER THIRD PARTY TRANSFER

DEMAND DRAFT

35. CHEQUE BOOK REQUEST ACCOUNT OPENING REQUEST ACCOUNT

STATEMENT TRANSACTION ENQUIRY DEMAT ACCOUNT DONATION STATE BANK

VIRTUAL CARD GREEN CHANNEL COUNTER KIOSK BANKING SYSTEM

36. RECENT TRENDS RISE OF E- MONEY ELECTRONICCHEQUES PAYMENTS 2009-10

2009-10 65% 35% 2011-12 52% 2011-12 48%

37. RECENT TRENDS IN COMMERCIAL BANKING BANKING SECTOR IS THE HEART

OFECONOMY. IN 1969, 14 BANKS WERENATIONALISED AND FOLLOWED BY 6BANKS IN

1980. BANKING SECTOR WERE FULLYCOMPUTERISED IN 1985. SOME OF THE

RECENT TRENDS ::

38. NET BNKING It is also known as Internet banking or Online Banking. It is the process of

conducting Banking transactions over the internet.

39. MOBILE BANKING It is also known as M- Banking. The customer can operate his account

over the mobile phone.

40. PHONE BANKING The customer can obtain information about his account quickly, but

however deposit and withdrawal cannot be made over the phone. Otherwise the information

about his account can obtain.

41. R E A L T I M E G RO S S SETTLEMENT It is the system of funds transfer from one to

another. The transactions are settled one to one without bunching with any other transactions

.Once processed the payments are final and irrevocable. . Minimum amount of remittance is

Rs.2 lakhs and no upper ceiling is there.

42. NA T I O NA L E L E C T RO N I C FUNDS TRANSFER It is a system of funds transfer. Its

simple, secure, safe, fastest and cost effective pay to transfer of funds. To use this facility they

furnish INDIAN FINANCIAL SYSTEM CODE[IFSC], of the beneficiary and also branch name, full

account number of the beneficiary. It is chargeable.

43. MONEYGRAM MoneyGram is a new internet based remittance product. It is cashless money

transfer. These facilities available to NRIs to remit money to India.

44. XPRESS MONEY X-Press money offered in arrangement with M/s UAE exchange financial

service limited for remitting money to India. Money can be remitted from 180 countries across

the globe.

45. M I N I S T RY O F C O M PA N Y A F FA I R S This facilities is provided by some banks

only. MCA Payments can be done via credit card, internet banking and physical challan

currently.

46. KIOSK BANKING It performs basic banking activities.

47. GREEN CHANNEL COUNTER STATE BANK OF INDIA introduced this services on 1st

July 2010 at 57 pilot branches across country. Through this one can do all works in bank

without using challen.

48. CHEQUE TRUNCATION SY STEM It is a image based clearing system. It is issued u/s 18 of

the payment & settlement system act 2007.

49. THANKS FOR WATCHING…by 3 RD B.COM STUDENTS STAFF ADVISOR

DR.S.KOTHAI.

English Español Português Français Deutsch

About Dev & API Blog Terms Privacy Copyright Support

LinkedIn Corporation © 2019

You might also like

- CH 11 MasteryDocument11 pagesCH 11 Mastery1anthonyanthony7No ratings yet

- Raymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)Document338 pagesRaymond S. Schmidgall, David K. Hayes, Jack D. Ninemeier - Restaurant Financial Basics-Wiley (2002)leonardo soteldo100% (2)

- Homeopatie: Share Your ThoughtsDocument1 pageHomeopatie: Share Your ThoughtsMircea Eugen Moldovan0% (1)

- Extrajudicial Settlement of Estate SAMPLE PROBLEMDocument4 pagesExtrajudicial Settlement of Estate SAMPLE PROBLEMJheng Jingco100% (1)

- Marketing Report GilletteDocument17 pagesMarketing Report GilletteQueenie Marie Obial AlasNo ratings yet

- Tcus Trust Capital Units Blue Border EditableDocument1 pageTcus Trust Capital Units Blue Border EditablejoeNo ratings yet

- Online Resrvation SystemDocument1 pageOnline Resrvation SystemKavya sreeNo ratings yet

- C++ Project On Restaurant Billing7Document1 pageC++ Project On Restaurant Billing7AJ SEB MR7No ratings yet

- WWW Slideshare NetDocument8 pagesWWW Slideshare NetAnkur VermaNo ratings yet

- Kapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirDocument1 pageKapasitas Daya Dukung Tiang Pancang Berdasarkan Data SondirIsti HaryantoNo ratings yet

- Inventory Systems: FollowDocument1 pageInventory Systems: FollowMelusi DocNo ratings yet

- Rates Analysis For Calculating Material and Labour For Building WorksDocument1 pageRates Analysis For Calculating Material and Labour For Building WorksHscl PulivendulaNo ratings yet

- 勤說Document1 page勤說WONG EVELYNE JADENo ratings yet

- Compare Contrast Essay FinalDocument1 pageCompare Contrast Essay FinalNakı Dilber BüyükdağNo ratings yet

- Business Studies Class 12th Marketing Management Project - Fruit Juice - PDFDocument1 pageBusiness Studies Class 12th Marketing Management Project - Fruit Juice - PDFmake yourself fit0% (1)

- WWW Slideshare NetDocument5 pagesWWW Slideshare NetOumeyr CheemahNo ratings yet

- Full Time Program: ProgrammeDocument2 pagesFull Time Program: ProgrammesimspuneNo ratings yet

- How To Prepare Table Topics Speech: UploadDocument5 pagesHow To Prepare Table Topics Speech: UploadArvinNo ratings yet

- Chap 9Document1 pageChap 9Phu Nguyen NhutNo ratings yet

- WWW Sims FalultyDocument2 pagesWWW Sims FalultysimspuneNo ratings yet

- WWW Slideshare Net Mobile Daniholic Earth Science Teaching GuideDocument29 pagesWWW Slideshare Net Mobile Daniholic Earth Science Teaching GuideKc S Enriquez100% (1)

- Sebit Company Profile - BETT - May2022Document34 pagesSebit Company Profile - BETT - May2022Nadia HamidiNo ratings yet

- Sebit Company Profile - BETT - May2022Document34 pagesSebit Company Profile - BETT - May2022Nadia HamidiNo ratings yet

- Assignment Format For MBA StudentsDocument1 pageAssignment Format For MBA StudentsNyi Nyi WinNo ratings yet

- Training and Development in Axis BankDocument1 pageTraining and Development in Axis BankVidyashree PNo ratings yet

- Enactus Wyższa Szkoła Zarządzania I Bankowości W Poznaniu - WSZiB W PoznaniuDocument6 pagesEnactus Wyższa Szkoła Zarządzania I Bankowości W Poznaniu - WSZiB W Poznaniukoizak3No ratings yet

- Project On Accountancy Class 11-12Document1 pageProject On Accountancy Class 11-12Krishna BambaNo ratings yet

- Daily Lesson Plan: DateDocument1 pageDaily Lesson Plan: DateNoor MashitahNo ratings yet

- PGDM Sem 2-BatchDocument1 pagePGDM Sem 2-BatchAbhishek GuptaNo ratings yet

- PGDM Sem 3-Batch 2020-22-TT 29 SepDocument1 pagePGDM Sem 3-Batch 2020-22-TT 29 SepAmit ChakrabortyNo ratings yet

- Classroom Management PowerPoint PresentationDocument1 pageClassroom Management PowerPoint PresentationMark Anthony B. Aquino100% (1)

- Curriculum-RoadmapDocument1 pageCurriculum-Roadmapmr ethanbennett0602No ratings yet

- Subject: Subject Title:: Info. Tech. Computer Application and Networking VisionDocument5 pagesSubject: Subject Title:: Info. Tech. Computer Application and Networking VisionLizNo ratings yet

- PGDM Sem 2-Batch 2020-22-TTDocument1 pagePGDM Sem 2-Batch 2020-22-TTAbhishek GuptaNo ratings yet

- IE Brown Executive MBA BrochureDocument8 pagesIE Brown Executive MBA BrochureUjwal TickooNo ratings yet

- Mbaex Admission Brochure 2024-25Document6 pagesMbaex Admission Brochure 2024-25scientist xyzNo ratings yet

- AI in Education Map Mar 11, 2024Document1 pageAI in Education Map Mar 11, 2024margreen5No ratings yet

- Urine Culture TestDocument1 pageUrine Culture TestLab TichNo ratings yet

- OUTCOMES-BASED EDUCATION - authorSTREAM DocumentedDocument3 pagesOUTCOMES-BASED EDUCATION - authorSTREAM DocumentedK wongNo ratings yet

- Matric CertificateDocument1 pageMatric CertificateNazia ahmedNo ratings yet

- Generic College System Architecture-ConceptualDocument2 pagesGeneric College System Architecture-ConceptualAzimuddin MunshiNo ratings yet

- Perkenalan Jurusan - Sistem Informasi - 2021 - R3Document37 pagesPerkenalan Jurusan - Sistem Informasi - 2021 - R3Sylvia SihombingNo ratings yet

- MBA or PGDM Which Is BetterDocument3 pagesMBA or PGDM Which Is BetterasiapacificNo ratings yet

- 2019-Elt-Oxford University Press Catalog PDFDocument52 pages2019-Elt-Oxford University Press Catalog PDFJuan Jose Avila100% (2)

- HKUST Digital MBA For Global Leaders BrochureDocument3 pagesHKUST Digital MBA For Global Leaders BrochureSylvian Shooi Yang HwaNo ratings yet

- Lkis School Learning Action Cell 2023-2024 - 1Document19 pagesLkis School Learning Action Cell 2023-2024 - 1Jeklenn QuirobinNo ratings yet

- LAC Plan: Phase Activities Persons Involve Time Frame Resources Success Indicator Fund Source of FundDocument1 pageLAC Plan: Phase Activities Persons Involve Time Frame Resources Success Indicator Fund Source of FundShring HighbNo ratings yet

- Visual Resume TemplateDocument1 pageVisual Resume Templatehabib luqmanNo ratings yet

- Nabi Junjungan Kita MuhammadDocument1 pageNabi Junjungan Kita MuhammadDeni MaulanaNo ratings yet

- Sample of A Logbook For Bachelor of Science in Computer Science, SofDocument1 pageSample of A Logbook For Bachelor of Science in Computer Science, SofLwazi NjabuloNo ratings yet

- EMERITUS Online Certificate Diploma Programs Calendar 2021Document18 pagesEMERITUS Online Certificate Diploma Programs Calendar 2021ankitjain06No ratings yet

- TE AI DS Curriculum (1)Document3 pagesTE AI DS Curriculum (1)ShahuNo ratings yet

- (Executive) : MBA - Open For AllDocument1 page(Executive) : MBA - Open For AllsimspuneNo ratings yet

- ECI PMP Class 1 - OverviewDocument12 pagesECI PMP Class 1 - OverviewStephen BurganNo ratings yet

- Ilp Form 11Document7 pagesIlp Form 11api-640000441No ratings yet

- Blended Learning FrameworkDocument2 pagesBlended Learning FrameworkMark SymesNo ratings yet

- Action Plan Data Management and Information Systems Support SY 2019-2020Document4 pagesAction Plan Data Management and Information Systems Support SY 2019-2020Nhey TolentinoNo ratings yet

- Accounting For Partnership and CorporatDocument1 pageAccounting For Partnership and Corporatretuyasheena16No ratings yet

- WWW Scribd Com Document 571749888 Field Project 1st Year 1Document12 pagesWWW Scribd Com Document 571749888 Field Project 1st Year 1devanshtiwari287No ratings yet

- HolonIQ 2021 Global Learning Landscape PosterDocument1 pageHolonIQ 2021 Global Learning Landscape PosterCarlos David Campos GonzálezNo ratings yet

- Placements Report 2022-TcpaDocument10 pagesPlacements Report 2022-TcpaDamon SalvatoreNo ratings yet

- Action Plan in Ict School Year 2021-2022Document3 pagesAction Plan in Ict School Year 2021-2022ERWIN MORGIANo ratings yet

- WWW Studocu Com in Document Kurukshetra-University Mba-Finance Summer-Internship-Project-Hdfc-Bankpdf 22246003Document1 pageWWW Studocu Com in Document Kurukshetra-University Mba-Finance Summer-Internship-Project-Hdfc-Bankpdf 22246003Prajwal PotphodeNo ratings yet

- Madeline Prebe - Ilp Teacher Leadership ProjectDocument4 pagesMadeline Prebe - Ilp Teacher Leadership Projectapi-417446088No ratings yet

- Home LoanDocument2 pagesHome LoanRoshan LewisNo ratings yet

- Tourism at The Crossroads Challenges To Developing Countries by The New World Trade OrderDocument69 pagesTourism at The Crossroads Challenges To Developing Countries by The New World Trade OrderEquitable Tourism Options (EQUATIONS)No ratings yet

- Fin552 - GP AssignmentDocument45 pagesFin552 - GP AssignmentWAN NUR AYUNI ISNINNo ratings yet

- Assignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyDocument22 pagesAssignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyAn NguyenthenamNo ratings yet

- Executive Summary: Have It Your WayDocument45 pagesExecutive Summary: Have It Your WayMela De Guzman CabandingNo ratings yet

- Subject: Financial Management: Indira Institute of Management, PuneDocument23 pagesSubject: Financial Management: Indira Institute of Management, PunePrasad RandheNo ratings yet

- Toaz - Info HR Contacts Details Rajasthan PRDocument27 pagesToaz - Info HR Contacts Details Rajasthan PRSATISH WORDBOXNo ratings yet

- Caveats FlowDocument10 pagesCaveats FlowsubhadraamNo ratings yet

- Scaling Up Community-DrivenDocument43 pagesScaling Up Community-DrivenJonah R. MeranoNo ratings yet

- AMP Brochure 2022-23Document24 pagesAMP Brochure 2022-23Rahul SinghNo ratings yet

- CHAPTER 9 LESSON 1 NewDocument3 pagesCHAPTER 9 LESSON 1 NewLogan NagelNo ratings yet

- Financial Services: Topic: Tax Aspects of LeasingDocument10 pagesFinancial Services: Topic: Tax Aspects of LeasingSri NilayaNo ratings yet

- Tofan Arkitect - Prezentare en 01.Document8 pagesTofan Arkitect - Prezentare en 01.Bogdan TofanNo ratings yet

- Reg. No(s) Name (S) Title(s) : A Study On Sales Promotional Activities in Footwear IndustryDocument3 pagesReg. No(s) Name (S) Title(s) : A Study On Sales Promotional Activities in Footwear IndustryNaresh KumarNo ratings yet

- VP Financial Planning Analysis in USA Resume John EffreinDocument2 pagesVP Financial Planning Analysis in USA Resume John EffreinJohnEffrein2No ratings yet

- Rashid Jooma-Health Care Financing in PakistanDocument13 pagesRashid Jooma-Health Care Financing in Pakistansikander jalalNo ratings yet

- Post Fin301 - Fin 301 Unit 7 QuizDocument2 pagesPost Fin301 - Fin 301 Unit 7 Quizteacher.theacestudNo ratings yet

- LR 2433Document2 pagesLR 2433mnitoo193No ratings yet

- BDD Redevelopment - EnggDocument13 pagesBDD Redevelopment - Enggbalaeee123No ratings yet

- Jaiib Questions Accounting & Finance Module D - Cont... : InvestmentsDocument4 pagesJaiib Questions Accounting & Finance Module D - Cont... : InvestmentsBiswajit DasNo ratings yet

- WELFARE FACILITY PROVIDED TO EMPLOYEES BY BANK OF INDIA Project ReportDocument41 pagesWELFARE FACILITY PROVIDED TO EMPLOYEES BY BANK OF INDIA Project Reportkamdica77% (13)

- POSTIONAL - StockMockDocument46 pagesPOSTIONAL - StockMockSathishkumar TvsNo ratings yet

- Time Value of Time Value of MoneyDocument57 pagesTime Value of Time Value of MoneymomindkhanNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Analytical Tools (Strat Plan) - 1Document16 pagesAnalytical Tools (Strat Plan) - 1Low El LaNo ratings yet