Professional Documents

Culture Documents

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

Uploaded by

Teri BuhlCopyright:

Available Formats

You might also like

- Lawsuit Against The LDS ChurchDocument38 pagesLawsuit Against The LDS ChurchThe Salt Lake TribuneNo ratings yet

- Breach of Contract ComplaintDocument21 pagesBreach of Contract ComplaintJeneveth SitoyNo ratings yet

- Superior Court of Justice Commercial List: OntarioDocument9 pagesSuperior Court of Justice Commercial List: OntarioTeri BuhlNo ratings yet

- Mabvax V Barry Honig First - Amended - Complaint - Aug 28 2020Document65 pagesMabvax V Barry Honig First - Amended - Complaint - Aug 28 2020Teri BuhlNo ratings yet

- Business Partner Model - UlrichDocument7 pagesBusiness Partner Model - UlrichDiego Mansilla0% (1)

- AKT - 2019-04-30 - FDD - Xponential FitnessDocument255 pagesAKT - 2019-04-30 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Speech First Asks 7th Circuit To Halt University of Illinois Bias Reporting SystemDocument125 pagesSpeech First Asks 7th Circuit To Halt University of Illinois Bias Reporting SystemThe College FixNo ratings yet

- ToysRUs March 2018Document124 pagesToysRUs March 2018Ben SchultzNo ratings yet

- Robinson Cole Fee App - ImerysDocument55 pagesRobinson Cole Fee App - ImerysKirk HartleyNo ratings yet

- Tzero LawsuitDocument61 pagesTzero LawsuitAnonymous RXEhFb50% (2)

- Fauci DocumentsDocument96 pagesFauci DocumentsVirutron ResearchNo ratings yet

- Feshbach vs. IRS: Appeal RulingDocument25 pagesFeshbach vs. IRS: Appeal RulingTony Ortega100% (1)

- FEC ComplaintDocument12 pagesFEC ComplaintJosh RichardsonNo ratings yet

- Gilbert LLP Notice of Annual Hourly Rate Increase - ImerysDocument2 pagesGilbert LLP Notice of Annual Hourly Rate Increase - ImerysKirk HartleyNo ratings yet

- Nunc Pro Tunc To March 5, 2019Document57 pagesNunc Pro Tunc To March 5, 2019Kirk HartleyNo ratings yet

- Club Pilates - 2017-04-27 - FDD - Xponential FitnessDocument568 pagesClub Pilates - 2017-04-27 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Club Pilates - 2018-04-13 - FDD - Xponential FitnessDocument323 pagesClub Pilates - 2018-04-13 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Livin Stong R Su ComplaintDocument4 pagesLivin Stong R Su Complainttriguy_2010No ratings yet

- Baviera Vs PaglinawanDocument7 pagesBaviera Vs PaglinawanKfMaeAseronNo ratings yet

- Baviera vs. PaglinawanDocument9 pagesBaviera vs. PaglinawanBalboa JapeNo ratings yet

- Metallicus ComplaintDocument51 pagesMetallicus ComplaintfleckaleckaNo ratings yet

- SECv UseeDocument14 pagesSECv UseeThe Dallas Morning NewsNo ratings yet

- Mayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageDocument3 pagesMayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageCalifornia CourtsNo ratings yet

- 55 CV 19 6491Document2 pages55 CV 19 6491voltprinterNo ratings yet

- 2 Conwi vs. Court of Tax AppealsDocument9 pages2 Conwi vs. Court of Tax AppealsAriel Conrad MalimasNo ratings yet

- The Stone-Beattie Studio V CABS, RBZ and Minister of Finance2Document17 pagesThe Stone-Beattie Studio V CABS, RBZ and Minister of Finance2Precious KadodoNo ratings yet

- Ellis v. Grant Thornton LLP, 530 F.3d 280, 4th Cir. (2008)Document18 pagesEllis v. Grant Thornton LLP, 530 F.3d 280, 4th Cir. (2008)Scribd Government DocsNo ratings yet

- By The Board of Directors and Stockholders of RHL Lending Inc. July 15, 2019 Board Resolution No. 2019-012Document17 pagesBy The Board of Directors and Stockholders of RHL Lending Inc. July 15, 2019 Board Resolution No. 2019-012Michael Vincent BautistaNo ratings yet

- Paradise Villa Maui Management - Fraud ComplaintDocument21 pagesParadise Villa Maui Management - Fraud ComplaintMarcus FelkerNo ratings yet

- 15 Land Bank Vs CADocument11 pages15 Land Bank Vs CAJanine RegaladoNo ratings yet

- PLAINTIFFS' ORIGINAL COMPLAINT 26 Eric C BlueDocument19 pagesPLAINTIFFS' ORIGINAL COMPLAINT 26 Eric C BlueEric GreenNo ratings yet

- Brenizer FiledDocument11 pagesBrenizer FiledKhristopher J. BrooksNo ratings yet

- Limkimso June 29, 2022 Account BriefDocument5 pagesLimkimso June 29, 2022 Account Briefmarkus ricoNo ratings yet

- #2credit Transactions - Sy22-23 2s - Lecture Notes - BB PostDocument53 pages#2credit Transactions - Sy22-23 2s - Lecture Notes - BB PostAnton Ric Delos ReyesNo ratings yet

- Case 8:19-bk-10822-CB Doc 37 Filed 03/17/19 Entered 03/17/19 21:24:49Document3 pagesCase 8:19-bk-10822-CB Doc 37 Filed 03/17/19 Entered 03/17/19 21:24:49EvieM.WarnerNo ratings yet

- Attorneys For U.S. Bank National Association, Not Individually, But As Indenture TrusteeDocument11 pagesAttorneys For U.S. Bank National Association, Not Individually, But As Indenture TrusteeChapter 11 DocketsNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Ibl - Gba - A RestDocument35 pagesIbl - Gba - A RestWednesday AbelgasNo ratings yet

- 1 Baviera v. PaglinawanDocument14 pages1 Baviera v. PaglinawanDaley CatugdaNo ratings yet

- 15 BPI Investment Corp Vs CA G.R. No. 133632 Feb 2002Document4 pages15 BPI Investment Corp Vs CA G.R. No. 133632 Feb 2002Rodolfo TobiasNo ratings yet

- Coon Ol: Second DivisionDocument19 pagesCoon Ol: Second DivisionRaymond RogacionNo ratings yet

- Complaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkDocument58 pagesComplaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkNeil GillespieNo ratings yet

- Truth in LendingDocument5 pagesTruth in LendingJexelle Marteen Tumibay PestañoNo ratings yet

- Republic of The Philippines Quezon City: Court AppealsDocument38 pagesRepublic of The Philippines Quezon City: Court AppealsHerzl Hali V. HermosaNo ratings yet

- Fisher v. Trinidad, G.R. No. L-17518, 1922Document13 pagesFisher v. Trinidad, G.R. No. L-17518, 1922BREL GOSIMATNo ratings yet

- Fisher v. Trinidad, G.R. No. L-17518, October 30, 1922Document13 pagesFisher v. Trinidad, G.R. No. L-17518, October 30, 1922zacNo ratings yet

- State of Washington V International Global Positioning, Etal 2007Document11 pagesState of Washington V International Global Positioning, Etal 2007believethingsNo ratings yet

- Final Empower Erie - Application To Supplement Exhibits 5.18.20 (L0881763xa35ae)Document92 pagesFinal Empower Erie - Application To Supplement Exhibits 5.18.20 (L0881763xa35ae)edmahonNo ratings yet

- State of Wisconsin V Kyle Rittenhouse: State Brief in Opposition To Mtns For Admission Pro Hac ViceDocument7 pagesState of Wisconsin V Kyle Rittenhouse: State Brief in Opposition To Mtns For Admission Pro Hac VicePatriots Soapbox InternalNo ratings yet

- BPI Investment Corp. V CADocument4 pagesBPI Investment Corp. V CAKate CalansinginNo ratings yet

- Docket #4710 Date Filed: 3/17/2010Document10 pagesDocket #4710 Date Filed: 3/17/2010Chapter 11 DocketsNo ratings yet

- YoungThug LawsuitDocument35 pagesYoungThug Lawsuitmitchell6northamNo ratings yet

- BC V BG (2019) EWFC 7 (28 January 2019)Document24 pagesBC V BG (2019) EWFC 7 (28 January 2019)l.gt.souzaNo ratings yet

- Filename 1Document2 pagesFilename 1ErikNo ratings yet

- CipherDocument2 pagesCipherAnonymous RXEhFb100% (1)

- Union Bank VS TiuDocument18 pagesUnion Bank VS Tiuyellow me yowNo ratings yet

- Bavaria v. PaglinawanDocument7 pagesBavaria v. PaglinawanmarkgwpNo ratings yet

- Sellery Phils. Enterprises Inc. v. CIR (CTA - 3D - CV - 10047)Document20 pagesSellery Phils. Enterprises Inc. v. CIR (CTA - 3D - CV - 10047)carloNo ratings yet

- United States Bankruptcy Court Central District of California Riverside DivisionDocument21 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsNo ratings yet

- Jacobs LawsuitDocument13 pagesJacobs LawsuitJ RohrlichNo ratings yet

- Giudice Doc 109 09-02-2010Document20 pagesGiudice Doc 109 09-02-2010Reality TV ScandalsNo ratings yet

- Teri Buhl V Harvey J. Kesner Summons Complaint 3.24.22 NY State CourtDocument49 pagesTeri Buhl V Harvey J. Kesner Summons Complaint 3.24.22 NY State CourtTeri BuhlNo ratings yet

- Attorney Steven S. Biss Sanctions MotionDocument3 pagesAttorney Steven S. Biss Sanctions MotionTeri BuhlNo ratings yet

- Barry Honig Secret Conspiracy Email With Eloxx Executives $ELOXDocument2 pagesBarry Honig Secret Conspiracy Email With Eloxx Executives $ELOXTeri BuhlNo ratings yet

- DOJ Motion For No Jail AJ Discala Jan 7 2022Document25 pagesDOJ Motion For No Jail AJ Discala Jan 7 2022Teri BuhlNo ratings yet

- TRANSCRIPT of Sanctions Hearing For Bruce Bernstein of XpresSpa $XSPADocument22 pagesTRANSCRIPT of Sanctions Hearing For Bruce Bernstein of XpresSpa $XSPATeri BuhlNo ratings yet

- Barry Honig Email To Phil Frost-Steve Rubin June 2016Document3 pagesBarry Honig Email To Phil Frost-Steve Rubin June 2016Teri BuhlNo ratings yet

- FINRA Settlement Laidlaw & Company For Brokers Market ManipulationDocument8 pagesFINRA Settlement Laidlaw & Company For Brokers Market ManipulationTeri Buhl100% (1)

- Barry Honig V Teri Buhl TRO Motion June 4thDocument2 pagesBarry Honig V Teri Buhl TRO Motion June 4thTeri BuhlNo ratings yet

- Sanctions Order Against Rockmore Capital Bruce Bernstein $XSPADocument2 pagesSanctions Order Against Rockmore Capital Bruce Bernstein $XSPATeri BuhlNo ratings yet

- Andy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanDocument74 pagesAndy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanTeri BuhlNo ratings yet

- MMcap Lawyers Email To Defrancesco's Canadian Lawyer Joe GroiaDocument4 pagesMMcap Lawyers Email To Defrancesco's Canadian Lawyer Joe GroiaTeri BuhlNo ratings yet

- Andy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanDocument74 pagesAndy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanTeri BuhlNo ratings yet

- YesDTC Free Trading Shareholder List - Honig Family Kesner - SEC EvidenceDocument4 pagesYesDTC Free Trading Shareholder List - Honig Family Kesner - SEC EvidenceTeri BuhlNo ratings yet

- MabVax v. Harvey Kesner Draft Copy Aug 2018Document30 pagesMabVax v. Harvey Kesner Draft Copy Aug 2018Teri BuhlNo ratings yet

- John Fife Vs FINRADocument18 pagesJohn Fife Vs FINRATeri BuhlNo ratings yet

- Mabvax Motion To Seal SRF-Harvey Kesner Settlement August 2020Document15 pagesMabvax Motion To Seal SRF-Harvey Kesner Settlement August 2020Teri BuhlNo ratings yet

- MMcap - 1235 Fund Motion To Dismiss Sol Global Investments Lawsuit April 9 2021Document23 pagesMMcap - 1235 Fund Motion To Dismiss Sol Global Investments Lawsuit April 9 2021Teri BuhlNo ratings yet

- Calhoun Letter To Court 11.1.20 Laidlaw Retaliation CaseDocument32 pagesCalhoun Letter To Court 11.1.20 Laidlaw Retaliation CaseTeri BuhlNo ratings yet

- Amended PolarityTE Class Action Lawsuit 2019Document80 pagesAmended PolarityTE Class Action Lawsuit 2019Teri BuhlNo ratings yet

- Riot Securities Class Action Leave To Amend GrantedDocument16 pagesRiot Securities Class Action Leave To Amend GrantedTeri BuhlNo ratings yet

- MTD Decision Robert Ladd CEO MGT CapitalDocument35 pagesMTD Decision Robert Ladd CEO MGT CapitalTeri BuhlNo ratings yet

- Kesner v. Buhl MTD 8.3.20Document28 pagesKesner v. Buhl MTD 8.3.20Teri BuhlNo ratings yet

- Trina Keith v. Harvest Dispensaries Lawsuit 4.23.20Document21 pagesTrina Keith v. Harvest Dispensaries Lawsuit 4.23.20Teri Buhl100% (1)

- Ansell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Document19 pagesAnsell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Teri BuhlNo ratings yet

- Aphria Shareholder Securities Fraud Lawsuit MTD Decision 9.30.20Document20 pagesAphria Shareholder Securities Fraud Lawsuit MTD Decision 9.30.20Teri BuhlNo ratings yet

- Biss Statement To Be Admitted For Pro Hac Vice Sdny 6.30.20Document3 pagesBiss Statement To Be Admitted For Pro Hac Vice Sdny 6.30.20Teri BuhlNo ratings yet

- Aphria Shareholder Fraud Lawsuit MTD Hearing Transcript Feb 2020Document76 pagesAphria Shareholder Fraud Lawsuit MTD Hearing Transcript Feb 2020Teri BuhlNo ratings yet

- Baker Botts Motion For Anti-Slaap Attorney Fees After Notice of Dismissal July 16 2020Document6 pagesBaker Botts Motion For Anti-Slaap Attorney Fees After Notice of Dismissal July 16 2020Teri BuhlNo ratings yet

- Jr2003 001 Turnkey Well EndorsementDocument2 pagesJr2003 001 Turnkey Well Endorsementphsem0% (1)

- Schiederig Et Al-2012-R&D ManagementDocument13 pagesSchiederig Et Al-2012-R&D ManagementNSBMR100% (1)

- Trade and Tourism Demand: A Case of Malaysia: Mohd Hafiz Mohd Hanafiah, Mohd Fauzi Harun and Mohd Raziff JamaluddinDocument4 pagesTrade and Tourism Demand: A Case of Malaysia: Mohd Hafiz Mohd Hanafiah, Mohd Fauzi Harun and Mohd Raziff JamaluddinRezza KanoviNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- Surya Roshni Project MBADocument10 pagesSurya Roshni Project MBAMadhav ReddyNo ratings yet

- Kofax Digital Mailroom Webinar IDC Slides v4Document16 pagesKofax Digital Mailroom Webinar IDC Slides v4hteran28100% (2)

- Tel TST, Tteréi - 9 ? 3 Email: Guw-Ee-Sdgner@Cowd - Gov.In: SH Ttgioffice MemorandumDocument1 pageTel TST, Tteréi - 9 ? 3 Email: Guw-Ee-Sdgner@Cowd - Gov.In: SH Ttgioffice MemorandumFeng YuNo ratings yet

- Dr. Rand Paul's Fall 2019 Edition of "The Waste Report"Document16 pagesDr. Rand Paul's Fall 2019 Edition of "The Waste Report"Senator Rand Paul100% (8)

- MKT 397 Exam 2Document14 pagesMKT 397 Exam 2ncNo ratings yet

- Ocean Carriers PresentationDocument12 pagesOcean Carriers PresentationIvaylo VasilevNo ratings yet

- P2p Risk by DeloitteDocument16 pagesP2p Risk by Deloittevijaya lakshmi Anna Srinivas100% (1)

- Economic History Sara Jiménez September 13th Almudena de Grado Iñigo AzpeitiaDocument5 pagesEconomic History Sara Jiménez September 13th Almudena de Grado Iñigo AzpeitiaIñigo Azpeitia SotoNo ratings yet

- Oracle Fusion Financials Online Training - Oracle Cloud FinanciDocument12 pagesOracle Fusion Financials Online Training - Oracle Cloud Financibgowda_erp1438No ratings yet

- Als Pass 24: Roficiency Ssessment Upplementary HeetDocument2 pagesAls Pass 24: Roficiency Ssessment Upplementary HeetjinxNo ratings yet

- 1848440014Document391 pages1848440014Adelina SecundeNo ratings yet

- USD ETONG Space Capsule House Price ListDocument1 pageUSD ETONG Space Capsule House Price ListJalan Jalan SeruNo ratings yet

- 2022 Top 30 Most Profitable Macedonian CompaniesDocument1 page2022 Top 30 Most Profitable Macedonian CompaniesAleksandar JordanovNo ratings yet

- A Summer Training ReportDocument13 pagesA Summer Training Reportavinash sengarNo ratings yet

- GMS 724 Article11Document12 pagesGMS 724 Article11SVGNo ratings yet

- Final History of Stimulus PackagesDocument3 pagesFinal History of Stimulus PackagesRadu-Emil ŞendroiuNo ratings yet

- John Meewella BioDocument3 pagesJohn Meewella BioJojje OlssonNo ratings yet

- Ba9209 International Business ManagementDocument17 pagesBa9209 International Business ManagementArunEshNo ratings yet

- Fianna Fáil European Election ManifestoDocument20 pagesFianna Fáil European Election ManifestoFFRenewal100% (1)

- DecolonizationDocument8 pagesDecolonizationshayy0803100% (1)

- CAT SpecDocument24 pagesCAT Specdebabrata goswamiNo ratings yet

- Corner of Berkshire & Fairfax Message Board: Hello ShoelessDocument15 pagesCorner of Berkshire & Fairfax Message Board: Hello Shoelessgl101No ratings yet

- Asset Size 31 03 2021 100cr AboveDocument2 pagesAsset Size 31 03 2021 100cr Aboveravi ohlyanNo ratings yet

- ThermodynamicsDocument346 pagesThermodynamicss.ashwin RagavanNo ratings yet

- 45G130R Assypkg-1Document20 pages45G130R Assypkg-1Cesar GarciaNo ratings yet

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

Uploaded by

Teri BuhlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

XpresSpa Market Manipulation Letter To Judge Stanton July 1 2019 $XSPA

Uploaded by

Teri BuhlCopyright:

Available Formats

Case 1:17-cv-08594-LLS Document 170 Filed 07/01/19 Page 1 of 4

Michael J. Maloney

Partner

mmaloney@ckrlaw.com

T +1.212.259.7300

July 1, 2019

VIA ECF and Hand

The Honorable Louis L. Stanton

United States Courthouse

500 Pearl Street

New York, NY 10007-1312

Re: Binn v. Bernstein, et al., Case No. 1:17-cv-08594-LLS

Motion for Preliminary Injunction

Hearing Date: July 1, 2019, at 3:00 p.m.

Dear Judge Stanton,

We represent plaintiffs Moreton Binn and Marisol F, LLC (“Plaintiffs”) in the above-

referenced action. Plaintiffs filed their reply papers in further support of their application for a

preliminary injunction on June 14, 2017. The hearing on the application is currently scheduled

for July 1, 2019 at 3:00 p.m. Plaintiffs write to advise the Court of events relevant to the hearing

on Plaintiffs’ application for a preliminary injunction but which occurred after the submission of

papers on that application. Unless otherwise stated, all capitalized terms have the meanings

assigned to them in Plaintiffs’ prior submissions.

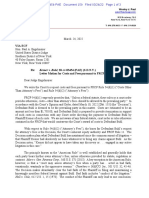

Stock Manipulation During the Week of June 17, 2019;

Efforts to Convert the Rockmore Note into Stock at

Artificially Depressed Prices.

In this action, Plaintiffs filed their reply in further support of their application for a

preliminary injunction on June 14, 2017. The next week, the Defendants engaged in a scheme to

avoid any further rulings of this Court and expropriate the value of the Lease Portfolio for

themselves, a scheme that first came to light by way of extraordinary trading activity in the

Company’s stock.

The Company’s stock has consistently traded below $3.00 since March 2019. On June

25, 2019, the price of the Company’s stock closed at $1.82. Between June 25, 2019 and open of

the market on the morning June 26, 2019, however, the volume of short interest in the

Company’s stock spiked from 1,180 to 2,877,376.

1330 Avenue of the Americas | New York, New York 10019

T +1.212.259.7300 | F +1.212.259.8200

Case 1:17-cv-08594-LLS Document 170 Filed 07/01/19 Page 2 of 4

The Hon. Louis L. Stanton

July 1, 2019

Page 2 of 4

The magnitude of short interest created a short squeeze causing the price of the stock to

skyrocket on June 26, 2019 to as high as 158% from the prior close. That day, the stock closed at

$4.71, representing a gain of 129% from the last close. No news concerning the Company had

been reported on June 26, 2019 and the Company made no filings with the SEC on that day.

At 9:00 a.m. on the next day, June 27, 2019, the Company filed a Form 8-K disclosing

that effective that morning it had entered into agreements with holders of the Convertible Notes,

previously issued by the Company on or about May 15, 2018 and maturing November 2019,

whereby the holders agreed to convert all of the remaining balances of those notes into common

stock by no later than 4:00 p.m. June 28, 2019. As an incentive to convert the remaining balances

before June 28, 2019, the Company provided for a reduced conversion price of $2.48 per share.

Thus, this conversion would be profitable for the holders of the Convertible Notes only if the

price of the stock rose above $2.48 per share.

Before the Company’s filing of the Form 8-K on June 27, 2019, the existence of

negotiations between the Company and the holders of the Convertible Notes concerning a

reduced conversion price constituted material non-public information. After the filing of the

Form 8-K, the activities of the Board of Directors became known to the market and the stock

price fell.

The strong inference here is that one or more of the members of the Board of Directors,

or others acting in concert with them, disclosed and/or traded on material non-public information

before the open of the market on June 26, 2019. Activity from trading forums support the

inference of insider trading. As reported by user “TitoMojito” on the XpresSpa forum on the

trading website stocktwits.com:

$XSPA we fuckin did it boys. Huge shout out to @gstockz who let me

know about this short play real-time yesterday [June 26, 2019]. It was a

nice play to begin with leading into pre-market, but that early morning 8-

K was the icing on the cake. . . .

(Ex. A, hereto).

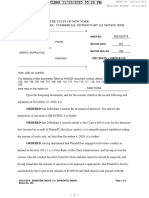

The timing and sequence of fraudulent trading activity during the period June 17, 2019

through June 28, 2019 is readily apparent by the following chart:

1330 Avenue of the Americas | New York, New York 10019

T +1.212.259.7300 | F +1.212.259.8200

Case 1:17-cv-08594-LLS Document 170 Filed 07/01/19 Page 3 of 4

The Hon. Louis L. Stanton

July 1, 2019

Page 3 of 4

XpresSpa (XSPA) ‐ June 17, 2019 thru June 28, 2019

$5.00 3,500,000

8‐K filed

$4.50

3,000,000

$4.00

$3.50 2,500,000

$3.00

2,000,000

$2.50

1,500,000

$2.00

$1.50 1,000,000

$1.00

500,000

$0.50

$‐ 0

Closing Price Short Volume

Defendants Bruce T. Bernstein and Richard K. Abbe, and their business associate Brian

Daly, had a strong motive to disclose the insider information that ultimately led to these stock

price movements. Bernstein, Abbe, and Daly control the Rockmore Note that is secured by the

Company’s Lease Portfolio and Bernstein controls the Company. The TRO entered by this Court

on April 29, 2019 enjoins them from declaring a default under that note and foreclosing on the

Lease Portfolio. But foreclosure of the security interest is not the only means of expropriating the

value of the Company’s asset. By incentivizing the holders the Convertible Notes to convert the

remainder of their debt into common stock, Bernstein, Abbe, and Daly have cleared the decks to

position Rockmore and B3D to expropriate the value of that asset by converting the Rockmore

debt into common stock at artificially depressed prices. On Friday, June 28, 2019, the stock

closed at $1.98.

That is exactly what Bernstein, Abbe, and Daly now seek to do. In the same Form 8-K

filed on June 27, 2019, the Company disclosed for the first time that the it was negotiating with

Daly and B3D to convert up to $3,000,000 of principal and interest of the Rockmore Note into

common stock and warrants. Both the negotiation of an early conversion of the Convertible

Notes and disclosure of material non-public information that would incentives the holders of

those notes to agree to convert presented a motive and opportunity for the Interested Directors to

release material non-public information before issuance of the Form 8-K on the morning of June

27, 2019.

1330 Avenue of the Americas | New York, New York 10019

T +1.212.259.7300 | F +1.212.259.8200

Case 1:17-cv-08594-LLS Document 170 Filed 07/01/19 Page 4 of 4

The Hon. Louis L. Stanton

July 1, 2019

Page 4 of 4

If Bernstein, Abbe, and Daly are permitted to convert $3,000,000 of debt in to common

stock at these prices, i.e., $1.98 per share, they could receive up to 44% or more of common

stock of the Company issued and outstanding after conversion. The Company’s current market

capitalization of only $3.8 million is deceptive because the Lease Portfolio itself has an

estimated market value of between $19 million to $39 million, but the value of this asset has not

been disclosed accurately on the Company’s filings with the SEC.

Shareholder Derivative Action.

Enclosed here in is a copy of a Verified Shareholder Derivative Complaint filed by

Plaintiffs on June 30, 2019 (the “Related Action”) on behalf of nominal defendant XpresSpa

Group, Inc. (the “Company”). (See Ex. B.) In the Related Action, Plaintiffs allege that the

Interested Directors breached their fiduciary duties by, inter alia, intentionally driving down the

share price and market capitalization of the Company in order to engineer a default under the

Rockmore Note or otherwise convert the debt into stock at artificially depressed prices. Plaintiffs

further allege that the Interested Directors violated the securities laws by falsely and deceptively

omitting from the Company’s financial reports the true value of its portfolio of leases to airport

retail concession venues, which has ranged between approximately $19 million to $39 million

during the relevant period (the “Lease Portfolio”).

By way of the Interested Directors’ self-interested actions to drive down the stock price,

the market capitalization of the Company is now $3.8 million and the Interested Directors are

actively seeking to expropriate for themselves the Lease Portfolio’s value of between $19 million

to $39 million.

For the reason set forth above and in Plaintiffs’ previously filed papers, the Court should

grant Plaintiff’s application for a preliminary injunction.

Respectfully,

/s/ Michael James Maloney

Michael James Maloney

cc: All Counsel of Record via ECF

1330 Avenue of the Americas | New York, New York 10019

T +1.212.259.7300 | F +1.212.259.8200

You might also like

- Lawsuit Against The LDS ChurchDocument38 pagesLawsuit Against The LDS ChurchThe Salt Lake TribuneNo ratings yet

- Breach of Contract ComplaintDocument21 pagesBreach of Contract ComplaintJeneveth SitoyNo ratings yet

- Superior Court of Justice Commercial List: OntarioDocument9 pagesSuperior Court of Justice Commercial List: OntarioTeri BuhlNo ratings yet

- Mabvax V Barry Honig First - Amended - Complaint - Aug 28 2020Document65 pagesMabvax V Barry Honig First - Amended - Complaint - Aug 28 2020Teri BuhlNo ratings yet

- Business Partner Model - UlrichDocument7 pagesBusiness Partner Model - UlrichDiego Mansilla0% (1)

- AKT - 2019-04-30 - FDD - Xponential FitnessDocument255 pagesAKT - 2019-04-30 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Speech First Asks 7th Circuit To Halt University of Illinois Bias Reporting SystemDocument125 pagesSpeech First Asks 7th Circuit To Halt University of Illinois Bias Reporting SystemThe College FixNo ratings yet

- ToysRUs March 2018Document124 pagesToysRUs March 2018Ben SchultzNo ratings yet

- Robinson Cole Fee App - ImerysDocument55 pagesRobinson Cole Fee App - ImerysKirk HartleyNo ratings yet

- Tzero LawsuitDocument61 pagesTzero LawsuitAnonymous RXEhFb50% (2)

- Fauci DocumentsDocument96 pagesFauci DocumentsVirutron ResearchNo ratings yet

- Feshbach vs. IRS: Appeal RulingDocument25 pagesFeshbach vs. IRS: Appeal RulingTony Ortega100% (1)

- FEC ComplaintDocument12 pagesFEC ComplaintJosh RichardsonNo ratings yet

- Gilbert LLP Notice of Annual Hourly Rate Increase - ImerysDocument2 pagesGilbert LLP Notice of Annual Hourly Rate Increase - ImerysKirk HartleyNo ratings yet

- Nunc Pro Tunc To March 5, 2019Document57 pagesNunc Pro Tunc To March 5, 2019Kirk HartleyNo ratings yet

- Club Pilates - 2017-04-27 - FDD - Xponential FitnessDocument568 pagesClub Pilates - 2017-04-27 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Club Pilates - 2018-04-13 - FDD - Xponential FitnessDocument323 pagesClub Pilates - 2018-04-13 - FDD - Xponential FitnessFuzzy PandaNo ratings yet

- Livin Stong R Su ComplaintDocument4 pagesLivin Stong R Su Complainttriguy_2010No ratings yet

- Baviera Vs PaglinawanDocument7 pagesBaviera Vs PaglinawanKfMaeAseronNo ratings yet

- Baviera vs. PaglinawanDocument9 pagesBaviera vs. PaglinawanBalboa JapeNo ratings yet

- Metallicus ComplaintDocument51 pagesMetallicus ComplaintfleckaleckaNo ratings yet

- SECv UseeDocument14 pagesSECv UseeThe Dallas Morning NewsNo ratings yet

- Mayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageDocument3 pagesMayaria Cubbage Shapiro: MP19903 Elder Abuse Johnnie D. CubbageCalifornia CourtsNo ratings yet

- 55 CV 19 6491Document2 pages55 CV 19 6491voltprinterNo ratings yet

- 2 Conwi vs. Court of Tax AppealsDocument9 pages2 Conwi vs. Court of Tax AppealsAriel Conrad MalimasNo ratings yet

- The Stone-Beattie Studio V CABS, RBZ and Minister of Finance2Document17 pagesThe Stone-Beattie Studio V CABS, RBZ and Minister of Finance2Precious KadodoNo ratings yet

- Ellis v. Grant Thornton LLP, 530 F.3d 280, 4th Cir. (2008)Document18 pagesEllis v. Grant Thornton LLP, 530 F.3d 280, 4th Cir. (2008)Scribd Government DocsNo ratings yet

- By The Board of Directors and Stockholders of RHL Lending Inc. July 15, 2019 Board Resolution No. 2019-012Document17 pagesBy The Board of Directors and Stockholders of RHL Lending Inc. July 15, 2019 Board Resolution No. 2019-012Michael Vincent BautistaNo ratings yet

- Paradise Villa Maui Management - Fraud ComplaintDocument21 pagesParadise Villa Maui Management - Fraud ComplaintMarcus FelkerNo ratings yet

- 15 Land Bank Vs CADocument11 pages15 Land Bank Vs CAJanine RegaladoNo ratings yet

- PLAINTIFFS' ORIGINAL COMPLAINT 26 Eric C BlueDocument19 pagesPLAINTIFFS' ORIGINAL COMPLAINT 26 Eric C BlueEric GreenNo ratings yet

- Brenizer FiledDocument11 pagesBrenizer FiledKhristopher J. BrooksNo ratings yet

- Limkimso June 29, 2022 Account BriefDocument5 pagesLimkimso June 29, 2022 Account Briefmarkus ricoNo ratings yet

- #2credit Transactions - Sy22-23 2s - Lecture Notes - BB PostDocument53 pages#2credit Transactions - Sy22-23 2s - Lecture Notes - BB PostAnton Ric Delos ReyesNo ratings yet

- Case 8:19-bk-10822-CB Doc 37 Filed 03/17/19 Entered 03/17/19 21:24:49Document3 pagesCase 8:19-bk-10822-CB Doc 37 Filed 03/17/19 Entered 03/17/19 21:24:49EvieM.WarnerNo ratings yet

- Attorneys For U.S. Bank National Association, Not Individually, But As Indenture TrusteeDocument11 pagesAttorneys For U.S. Bank National Association, Not Individually, But As Indenture TrusteeChapter 11 DocketsNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Ibl - Gba - A RestDocument35 pagesIbl - Gba - A RestWednesday AbelgasNo ratings yet

- 1 Baviera v. PaglinawanDocument14 pages1 Baviera v. PaglinawanDaley CatugdaNo ratings yet

- 15 BPI Investment Corp Vs CA G.R. No. 133632 Feb 2002Document4 pages15 BPI Investment Corp Vs CA G.R. No. 133632 Feb 2002Rodolfo TobiasNo ratings yet

- Coon Ol: Second DivisionDocument19 pagesCoon Ol: Second DivisionRaymond RogacionNo ratings yet

- Complaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkDocument58 pagesComplaint To Clifford J. White III, Director, U.S. Trustees Re Judge Jerry FunkNeil GillespieNo ratings yet

- Truth in LendingDocument5 pagesTruth in LendingJexelle Marteen Tumibay PestañoNo ratings yet

- Republic of The Philippines Quezon City: Court AppealsDocument38 pagesRepublic of The Philippines Quezon City: Court AppealsHerzl Hali V. HermosaNo ratings yet

- Fisher v. Trinidad, G.R. No. L-17518, 1922Document13 pagesFisher v. Trinidad, G.R. No. L-17518, 1922BREL GOSIMATNo ratings yet

- Fisher v. Trinidad, G.R. No. L-17518, October 30, 1922Document13 pagesFisher v. Trinidad, G.R. No. L-17518, October 30, 1922zacNo ratings yet

- State of Washington V International Global Positioning, Etal 2007Document11 pagesState of Washington V International Global Positioning, Etal 2007believethingsNo ratings yet

- Final Empower Erie - Application To Supplement Exhibits 5.18.20 (L0881763xa35ae)Document92 pagesFinal Empower Erie - Application To Supplement Exhibits 5.18.20 (L0881763xa35ae)edmahonNo ratings yet

- State of Wisconsin V Kyle Rittenhouse: State Brief in Opposition To Mtns For Admission Pro Hac ViceDocument7 pagesState of Wisconsin V Kyle Rittenhouse: State Brief in Opposition To Mtns For Admission Pro Hac VicePatriots Soapbox InternalNo ratings yet

- BPI Investment Corp. V CADocument4 pagesBPI Investment Corp. V CAKate CalansinginNo ratings yet

- Docket #4710 Date Filed: 3/17/2010Document10 pagesDocket #4710 Date Filed: 3/17/2010Chapter 11 DocketsNo ratings yet

- YoungThug LawsuitDocument35 pagesYoungThug Lawsuitmitchell6northamNo ratings yet

- BC V BG (2019) EWFC 7 (28 January 2019)Document24 pagesBC V BG (2019) EWFC 7 (28 January 2019)l.gt.souzaNo ratings yet

- Filename 1Document2 pagesFilename 1ErikNo ratings yet

- CipherDocument2 pagesCipherAnonymous RXEhFb100% (1)

- Union Bank VS TiuDocument18 pagesUnion Bank VS Tiuyellow me yowNo ratings yet

- Bavaria v. PaglinawanDocument7 pagesBavaria v. PaglinawanmarkgwpNo ratings yet

- Sellery Phils. Enterprises Inc. v. CIR (CTA - 3D - CV - 10047)Document20 pagesSellery Phils. Enterprises Inc. v. CIR (CTA - 3D - CV - 10047)carloNo ratings yet

- United States Bankruptcy Court Central District of California Riverside DivisionDocument21 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsNo ratings yet

- Jacobs LawsuitDocument13 pagesJacobs LawsuitJ RohrlichNo ratings yet

- Giudice Doc 109 09-02-2010Document20 pagesGiudice Doc 109 09-02-2010Reality TV ScandalsNo ratings yet

- Teri Buhl V Harvey J. Kesner Summons Complaint 3.24.22 NY State CourtDocument49 pagesTeri Buhl V Harvey J. Kesner Summons Complaint 3.24.22 NY State CourtTeri BuhlNo ratings yet

- Attorney Steven S. Biss Sanctions MotionDocument3 pagesAttorney Steven S. Biss Sanctions MotionTeri BuhlNo ratings yet

- Barry Honig Secret Conspiracy Email With Eloxx Executives $ELOXDocument2 pagesBarry Honig Secret Conspiracy Email With Eloxx Executives $ELOXTeri BuhlNo ratings yet

- DOJ Motion For No Jail AJ Discala Jan 7 2022Document25 pagesDOJ Motion For No Jail AJ Discala Jan 7 2022Teri BuhlNo ratings yet

- TRANSCRIPT of Sanctions Hearing For Bruce Bernstein of XpresSpa $XSPADocument22 pagesTRANSCRIPT of Sanctions Hearing For Bruce Bernstein of XpresSpa $XSPATeri BuhlNo ratings yet

- Barry Honig Email To Phil Frost-Steve Rubin June 2016Document3 pagesBarry Honig Email To Phil Frost-Steve Rubin June 2016Teri BuhlNo ratings yet

- FINRA Settlement Laidlaw & Company For Brokers Market ManipulationDocument8 pagesFINRA Settlement Laidlaw & Company For Brokers Market ManipulationTeri Buhl100% (1)

- Barry Honig V Teri Buhl TRO Motion June 4thDocument2 pagesBarry Honig V Teri Buhl TRO Motion June 4thTeri BuhlNo ratings yet

- Sanctions Order Against Rockmore Capital Bruce Bernstein $XSPADocument2 pagesSanctions Order Against Rockmore Capital Bruce Bernstein $XSPATeri BuhlNo ratings yet

- Andy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanDocument74 pagesAndy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanTeri BuhlNo ratings yet

- MMcap Lawyers Email To Defrancesco's Canadian Lawyer Joe GroiaDocument4 pagesMMcap Lawyers Email To Defrancesco's Canadian Lawyer Joe GroiaTeri BuhlNo ratings yet

- Andy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanDocument74 pagesAndy and Catherine Defrancesco Personal Guarantee On 1235 Fund LoanTeri BuhlNo ratings yet

- YesDTC Free Trading Shareholder List - Honig Family Kesner - SEC EvidenceDocument4 pagesYesDTC Free Trading Shareholder List - Honig Family Kesner - SEC EvidenceTeri BuhlNo ratings yet

- MabVax v. Harvey Kesner Draft Copy Aug 2018Document30 pagesMabVax v. Harvey Kesner Draft Copy Aug 2018Teri BuhlNo ratings yet

- John Fife Vs FINRADocument18 pagesJohn Fife Vs FINRATeri BuhlNo ratings yet

- Mabvax Motion To Seal SRF-Harvey Kesner Settlement August 2020Document15 pagesMabvax Motion To Seal SRF-Harvey Kesner Settlement August 2020Teri BuhlNo ratings yet

- MMcap - 1235 Fund Motion To Dismiss Sol Global Investments Lawsuit April 9 2021Document23 pagesMMcap - 1235 Fund Motion To Dismiss Sol Global Investments Lawsuit April 9 2021Teri BuhlNo ratings yet

- Calhoun Letter To Court 11.1.20 Laidlaw Retaliation CaseDocument32 pagesCalhoun Letter To Court 11.1.20 Laidlaw Retaliation CaseTeri BuhlNo ratings yet

- Amended PolarityTE Class Action Lawsuit 2019Document80 pagesAmended PolarityTE Class Action Lawsuit 2019Teri BuhlNo ratings yet

- Riot Securities Class Action Leave To Amend GrantedDocument16 pagesRiot Securities Class Action Leave To Amend GrantedTeri BuhlNo ratings yet

- MTD Decision Robert Ladd CEO MGT CapitalDocument35 pagesMTD Decision Robert Ladd CEO MGT CapitalTeri BuhlNo ratings yet

- Kesner v. Buhl MTD 8.3.20Document28 pagesKesner v. Buhl MTD 8.3.20Teri BuhlNo ratings yet

- Trina Keith v. Harvest Dispensaries Lawsuit 4.23.20Document21 pagesTrina Keith v. Harvest Dispensaries Lawsuit 4.23.20Teri Buhl100% (1)

- Ansell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Document19 pagesAnsell, Grimm & Aaron v. High Times Holding, Adam Levin Unpaid Attorney Fees Lawsuit 2019Teri BuhlNo ratings yet

- Aphria Shareholder Securities Fraud Lawsuit MTD Decision 9.30.20Document20 pagesAphria Shareholder Securities Fraud Lawsuit MTD Decision 9.30.20Teri BuhlNo ratings yet

- Biss Statement To Be Admitted For Pro Hac Vice Sdny 6.30.20Document3 pagesBiss Statement To Be Admitted For Pro Hac Vice Sdny 6.30.20Teri BuhlNo ratings yet

- Aphria Shareholder Fraud Lawsuit MTD Hearing Transcript Feb 2020Document76 pagesAphria Shareholder Fraud Lawsuit MTD Hearing Transcript Feb 2020Teri BuhlNo ratings yet

- Baker Botts Motion For Anti-Slaap Attorney Fees After Notice of Dismissal July 16 2020Document6 pagesBaker Botts Motion For Anti-Slaap Attorney Fees After Notice of Dismissal July 16 2020Teri BuhlNo ratings yet

- Jr2003 001 Turnkey Well EndorsementDocument2 pagesJr2003 001 Turnkey Well Endorsementphsem0% (1)

- Schiederig Et Al-2012-R&D ManagementDocument13 pagesSchiederig Et Al-2012-R&D ManagementNSBMR100% (1)

- Trade and Tourism Demand: A Case of Malaysia: Mohd Hafiz Mohd Hanafiah, Mohd Fauzi Harun and Mohd Raziff JamaluddinDocument4 pagesTrade and Tourism Demand: A Case of Malaysia: Mohd Hafiz Mohd Hanafiah, Mohd Fauzi Harun and Mohd Raziff JamaluddinRezza KanoviNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- Surya Roshni Project MBADocument10 pagesSurya Roshni Project MBAMadhav ReddyNo ratings yet

- Kofax Digital Mailroom Webinar IDC Slides v4Document16 pagesKofax Digital Mailroom Webinar IDC Slides v4hteran28100% (2)

- Tel TST, Tteréi - 9 ? 3 Email: Guw-Ee-Sdgner@Cowd - Gov.In: SH Ttgioffice MemorandumDocument1 pageTel TST, Tteréi - 9 ? 3 Email: Guw-Ee-Sdgner@Cowd - Gov.In: SH Ttgioffice MemorandumFeng YuNo ratings yet

- Dr. Rand Paul's Fall 2019 Edition of "The Waste Report"Document16 pagesDr. Rand Paul's Fall 2019 Edition of "The Waste Report"Senator Rand Paul100% (8)

- MKT 397 Exam 2Document14 pagesMKT 397 Exam 2ncNo ratings yet

- Ocean Carriers PresentationDocument12 pagesOcean Carriers PresentationIvaylo VasilevNo ratings yet

- P2p Risk by DeloitteDocument16 pagesP2p Risk by Deloittevijaya lakshmi Anna Srinivas100% (1)

- Economic History Sara Jiménez September 13th Almudena de Grado Iñigo AzpeitiaDocument5 pagesEconomic History Sara Jiménez September 13th Almudena de Grado Iñigo AzpeitiaIñigo Azpeitia SotoNo ratings yet

- Oracle Fusion Financials Online Training - Oracle Cloud FinanciDocument12 pagesOracle Fusion Financials Online Training - Oracle Cloud Financibgowda_erp1438No ratings yet

- Als Pass 24: Roficiency Ssessment Upplementary HeetDocument2 pagesAls Pass 24: Roficiency Ssessment Upplementary HeetjinxNo ratings yet

- 1848440014Document391 pages1848440014Adelina SecundeNo ratings yet

- USD ETONG Space Capsule House Price ListDocument1 pageUSD ETONG Space Capsule House Price ListJalan Jalan SeruNo ratings yet

- 2022 Top 30 Most Profitable Macedonian CompaniesDocument1 page2022 Top 30 Most Profitable Macedonian CompaniesAleksandar JordanovNo ratings yet

- A Summer Training ReportDocument13 pagesA Summer Training Reportavinash sengarNo ratings yet

- GMS 724 Article11Document12 pagesGMS 724 Article11SVGNo ratings yet

- Final History of Stimulus PackagesDocument3 pagesFinal History of Stimulus PackagesRadu-Emil ŞendroiuNo ratings yet

- John Meewella BioDocument3 pagesJohn Meewella BioJojje OlssonNo ratings yet

- Ba9209 International Business ManagementDocument17 pagesBa9209 International Business ManagementArunEshNo ratings yet

- Fianna Fáil European Election ManifestoDocument20 pagesFianna Fáil European Election ManifestoFFRenewal100% (1)

- DecolonizationDocument8 pagesDecolonizationshayy0803100% (1)

- CAT SpecDocument24 pagesCAT Specdebabrata goswamiNo ratings yet

- Corner of Berkshire & Fairfax Message Board: Hello ShoelessDocument15 pagesCorner of Berkshire & Fairfax Message Board: Hello Shoelessgl101No ratings yet

- Asset Size 31 03 2021 100cr AboveDocument2 pagesAsset Size 31 03 2021 100cr Aboveravi ohlyanNo ratings yet

- ThermodynamicsDocument346 pagesThermodynamicss.ashwin RagavanNo ratings yet

- 45G130R Assypkg-1Document20 pages45G130R Assypkg-1Cesar GarciaNo ratings yet