Professional Documents

Culture Documents

Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar Dwivedi

Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar Dwivedi

Uploaded by

prabhatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar Dwivedi

Certificate No. Last Updated On Name and Address of The Employer Name and Address of The Employee Govt Ayurvedic College Dr. Prabhat Kumar Dwivedi

Uploaded by

prabhatCopyright:

Available Formats

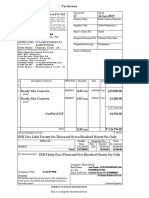

"FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary

Certificate No. Last updated on

Name and address of the Employer Name and Address of the Employee

GOVT AYURVEDIC COLLEGE Dr. Prabhat Kumar Dwivedi

KADAMKUAN, PATNA, 800003, BIHAR,

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No. provided

by the Employer (If Available.)

PANNOTREQD PTNG00252A AEOPD2397F 67

CIT(TDS) Assessment Year Period

2017-2018 From To

01/04/2016 31/03/2017

Summary of amount paid/ credited and tax deducted at source thereon in respect of the employee

Quarter Receipt Numbers of original quarterly Amount paid/ Amount of tax deducted Amount of tax

statements of TDS under sub-section (3) credited (Rs.) deposited/remitted (Rs.)

of section 200.

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Total 72611.00 72611.00

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

S. No. Tax Deposited in Book identification number (BIN)

respect of the dedutee (Rs.)

Receipt numbers of DDO Sequence Date on transfer Status of

Form No.24G Number in Form No. voucher (dd/mm/yyyy) matching with

24G Form No. 24G

1 2500.00

2 2500.00

3 2500.00

4 2500.00

5 2500.00

6 2500.00

7 2500.00

8 2500.00

9 2500.00

10 2500.00

11 2500.00

12 45111.00

Total 72611.00.00

ZENTDS - A KDK Software Product

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

S. No. Tax Deposited in Challan identification number (CIN)

respect of the deductee (Rs.)

BSR Code of the Bank Date on which tax Challan Serial Number Status of

Branch deposited matching with

(dd/mm/yyyy) OLTAS

Total NIL

Verification

I son of working in the capacity of do hereby certify that a

sum of Rs. 72611.00 [Rupees Seventy two Thousand six hundred eleven Only. ] has been deducted and deposited to the credit of the Central

Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents,

TDS statements, TDS deposited and other available records.

Place PATNA

Date Signature of person responsible for deduction of tax

Designation: Full Name:

ZENTDS - A KDK Software Product

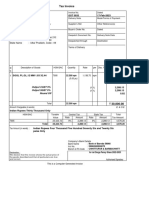

Form 16 - PART B (Annexure)

Deductor Name GOVT AYURVEDIC COLLEGE TAN: PTNG00252A Period

Employee Dr. Prabhat Kumar Dwivedi Emp. PAN: AEOPD2397F 01/04/2016 31/03/2017

Employee Ref. No. Assessment Year 2017-2018

Details of Salary paid and any other income and tax deducted

1. Gross Salary

(a) Salary as per provisions contained in sec.17(1) 906300.00

(b) Value of perquisites u/s 17(2) (as per Form No.12BA, wherever NIL

applicable)

(c) Profits in lieu of salary under section 17(3)(as per Form NIL

No.12BA, wherever applicable)

(d) Total 906300.00

2. Less: Allowance to the extent exempt u/s 10

Allowance

1. Transport Allowance 12000.00

2. Medical Allowance NIL

Total 12000.00

3. Balance(1-2) 894300.00

4. Deductions :

(a) Entertainment allowance NIL

(b) Tax on employment 2000.00

5. Aggregate of 4(a) and (b) 2000.00

6. Income chargeable under the head 'salaries' (3-5) 892300.00

7. Add: Any other income reported by the employee

Income

1. Income From House Property 0

2. INTEREST 0

Total 0

8. Gross total income (6+7) 892300.00

9. Deductions under Chapter VIA

(A) Sections 80C, 80CCC and 80CCD(1) Gross Amount Deductible amount

(a) Section 80C 179313.00 150000.00

(1) G.P.F. 30000.00

(2) GIS 1440.00

(3) Life Insurance Premium 87873.00

(4) P P F 60000.00

(b) Section 80CCC NIL NIL

(c) Section 80CCD(1) NIL NIL

(B) Other sections (e.g. 80E, 80G etc.) under Chapter VI-A.

Gross amount Qualifying amount Deductible amount

(i) Section 80CCD(1B) NIL NIL NIL

(ii) Section 80CCD(2) NIL NIL NIL

(iii) Section 80CCG NIL NIL NIL

(iv) Section 80D 14818.00 14818.00 14818.00

(v) Section 80DD NIL NIL NIL

(vi) Section 80DDB NIL NIL NIL

ZENTDS - A KDK Software Product

(vii) Section 80E NIL NIL NIL

(viii) Section 80EE NIL NIL NIL

(ix) Section 80G NIL NIL NIL

(x) Section 80GG NIL NIL NIL

(xi) Section 80GGA NIL NIL NIL

(xii) Section 80GGC NIL NIL NIL

(xiii) Section 80TTA NIL NIL NIL

(xiv) Section 80U NIL NIL NIL

(xv) Other NIL NIL NIL

10. Aggregate of deductible amount under Chapter VIA 164818.00

11. Total Income (8-10) 727482.00

12. Tax on total income 70496.00

13. Surcharge NIL

14. Education cess @ 3% (on tax computed at S. No. 12) 2115.00

15. Tax Payable (12+13+14) 72611.00

16. Less: Relief under section 89 (attach details) NIL

17. Tax payable (15-16) 72611.00

Verification

I son of working in the capacity of (designation) do

hereby certify that the information given above is true, complete and correct and is based on the books of account, documents,

TDS statements, TDS deposited and other available records.

Place PATNA

Date Signature of person responsible for deduction of tax

Designation: Full Name:

ZENTDS - A KDK Software Product

ZENTDS - A KDK Software Product

You might also like

- Check - Unit - 554 - October - Renal - Problems V2 PDFDocument26 pagesCheck - Unit - 554 - October - Renal - Problems V2 PDFdragon660% (1)

- Shahzad Haider: Declaration Acknowledgement SlipDocument2 pagesShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderNo ratings yet

- Internship Survival Guide NSHDocument36 pagesInternship Survival Guide NSHRichardNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Form 16 - 1617 PDFDocument3 pagesForm 16 - 1617 PDFAbhilashNo ratings yet

- Shipping & Billing Address: Giraj: Date: 29/03/2023Document2 pagesShipping & Billing Address: Giraj: Date: 29/03/2023Giraj Prasad goyalNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Od 116705815912325000Document1 pageOd 116705815912325000SunnyNo ratings yet

- Tax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Document1 pageTax Invoice: Igst 0% 0.00 CGST 2.5% Sgst/Utgst 2.5% 11.55 11.55Ankit SinghNo ratings yet

- Od 226180983725961000Document2 pagesOd 22618098372596100021Keshav C7ANo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- serviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209Document1 pageserviceCustomerInvoice 2297 2023 06 21 serviceCustomerInvoice-1dfd227a-2297-2b19c693 925c 42ab 8718 6a63c1bb14e2Vp0CohH6dc-4946758209kuldeep singhNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceAshok GuptaNo ratings yet

- Order FL0132916786: Mode of Payment: CODDocument2 pagesOrder FL0132916786: Mode of Payment: CODJagruc MahantNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- B No17 PDFDocument1 pageB No17 PDFFSPL HSENo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAbhishekNo ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Invoice of Realme U1Document1 pageInvoice of Realme U1Shruti SharmaNo ratings yet

- Tax Invoice/Bill of Supply: Shreyash Retail Private LimitedDocument1 pageTax Invoice/Bill of Supply: Shreyash Retail Private LimitedRealme 2 proNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- InvoiceDocument1 pageInvoiceMohan KumarNo ratings yet

- Invoice: Pest Kare (India) PVT - LTDDocument1 pageInvoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- Arul PDFDocument1 pageArul PDFraman73No ratings yet

- EfewaraweDocument1 pageEfewarawesunil kumarNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- Order FL0145254581: Mode of Payment: CODDocument1 pageOrder FL0145254581: Mode of Payment: CODRishi Kumar SinghNo ratings yet

- Invoice Karan MBDocument1 pageInvoice Karan MBRAHUL GUPTANo ratings yet

- InvoiceDocument1 pageInvoicerajkumawat2708No ratings yet

- 93 AvvashyaDocument1 page93 AvvashyaAnonymous rNqW9p3No ratings yet

- Invoice 2Document1 pageInvoice 2anushkaNo ratings yet

- Shipping & Billing Address: Rushali Jhala: Date: 02/12/2022Document2 pagesShipping & Billing Address: Rushali Jhala: Date: 02/12/2022Rushali JhalaNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- 181320250 (2)Document1 page181320250 (2)Maharshi DattaNo ratings yet

- Flight ResearchDocument3 pagesFlight ResearchSamridh MehtaNo ratings yet

- 7479Document1 page7479Prakash RajNo ratings yet

- Inv 000001Document1 pageInv 000001kenishaNo ratings yet

- Tax Invoice: Zoho Technologies Pvt. LTDDocument3 pagesTax Invoice: Zoho Technologies Pvt. LTDSales Sodhani BiotechNo ratings yet

- Shipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Document2 pagesShipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Ishika GhoshNo ratings yet

- Ajio 1706694074008Document1 pageAjio 1706694074008shaelkmr550No ratings yet

- TRACKING#:89761187821: BluedartDocument2 pagesTRACKING#:89761187821: BluedartStone ColdNo ratings yet

- Inv177044538 A16628454 11242022Document2 pagesInv177044538 A16628454 11242022Mariana BejanNo ratings yet

- Tax Invoice Inv1868 CleartaxDocument1 pageTax Invoice Inv1868 CleartaxAditya ShahNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Flipkart Labels 30 Oct 2021-09-43Document2 pagesFlipkart Labels 30 Oct 2021-09-43PROKLEAR NanoNo ratings yet

- Ticket Coimbatore-Hyderabad 22 SepDocument3 pagesTicket Coimbatore-Hyderabad 22 SepHyuNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailssrinivasNo ratings yet

- InvoiceDocument1 pageInvoiceShyam SfdcNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Tax Invoice: Description Amount 33750Document1 pageTax Invoice: Description Amount 33750Dhivya BhaskaranNo ratings yet

- Invoive FormatDocument1 pageInvoive Formatbhaskaraenterprises2019100% (1)

- Shipping & Billing Address: Suraj Sunil Shivade: Date: 23/08/2022Document2 pagesShipping & Billing Address: Suraj Sunil Shivade: Date: 23/08/2022Suraj ShivadeNo ratings yet

- R Shiva Shankar Reddy Form16 PartaDocument2 pagesR Shiva Shankar Reddy Form16 PartaCareersjobs IndiaNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Nano Particle Tracking AnalysisDocument11 pagesNano Particle Tracking AnalysisprabhatNo ratings yet

- Introduction To Chromatography: ComponentsDocument24 pagesIntroduction To Chromatography: ComponentsprabhatNo ratings yet

- Vairagya VivekDocument1 pageVairagya VivekprabhatNo ratings yet

- Dengue WHODocument119 pagesDengue WHOprabhatNo ratings yet

- Fundamentals of RasashastraDocument1 pageFundamentals of RasashastraprabhatNo ratings yet

- DR Prabhat Kumar Dwivedi DrprabhatkdDocument1 pageDR Prabhat Kumar Dwivedi DrprabhatkdprabhatNo ratings yet

- Grade 9: Tle-He Cookery Perform Mise en PlaceDocument8 pagesGrade 9: Tle-He Cookery Perform Mise en PlaceIrine IrineNo ratings yet

- Susten DS For WebDocument1 pageSusten DS For WebkinamedeboNo ratings yet

- De-4-Drydock Defect FormDocument3 pagesDe-4-Drydock Defect Formmaxuya2001No ratings yet

- 460 Lesson PlanDocument5 pages460 Lesson Planapi-237881244No ratings yet

- Violence Against WomenDocument81 pagesViolence Against WomenOxfamNo ratings yet

- Intelidrive Lite 2 5 0 New FeaturesDocument19 pagesIntelidrive Lite 2 5 0 New Featuresluat1983No ratings yet

- Antenatal HandoutDocument16 pagesAntenatal HandoutZahNo ratings yet

- Lec 1 Introduction To Nutrition For HealthDocument26 pagesLec 1 Introduction To Nutrition For HealthSherif AliNo ratings yet

- Mobile Train Radio Communication PPT SlideshareDocument28 pagesMobile Train Radio Communication PPT SlideshareSuchith RajNo ratings yet

- Iep-Case 8Document9 pagesIep-Case 8api-238729229No ratings yet

- Epidural and Combined Spinal-Epidural Anesthesia Techniques - UpToDateDocument54 pagesEpidural and Combined Spinal-Epidural Anesthesia Techniques - UpToDateHugo Robles Gómez100% (1)

- 12.4 Voluntary & Involuntary Action, 12.6 Endocrine System - Google FormsDocument7 pages12.4 Voluntary & Involuntary Action, 12.6 Endocrine System - Google FormsHAJAR LENNo ratings yet

- Peroxide Cure of RubberDocument19 pagesPeroxide Cure of RubberVivek RainaNo ratings yet

- Foothills Boulevard Regional LandfillDocument2 pagesFoothills Boulevard Regional LandfillGage DhansawNo ratings yet

- Tips in Job InterviewDocument9 pagesTips in Job InterviewMerly Relano DemandanteNo ratings yet

- Ariston Gas BoilerDocument8 pagesAriston Gas BoilerMark SmithNo ratings yet

- Topic 8 Cell Respiration and PhotosynthesisDocument12 pagesTopic 8 Cell Respiration and PhotosynthesisCedric Williams100% (1)

- Life Cycle of FunariaDocument3 pagesLife Cycle of FunariaPalash Ghosh100% (1)

- ASTM E 1444 11 MT Magnetic Particle TestingDocument21 pagesASTM E 1444 11 MT Magnetic Particle TestingeliuNo ratings yet

- God's Cure For The World'sDocument9 pagesGod's Cure For The World'svanNo ratings yet

- Msds en Shell Tellus s2 M 68Document15 pagesMsds en Shell Tellus s2 M 68Debora Septania PurbaNo ratings yet

- CEEW CG HighlightsDocument4 pagesCEEW CG HighlightsPrabir Kumar ChatterjeeNo ratings yet

- Articulo 1 Indirect Ecological Interactions in The Rhizosphere PDFDocument28 pagesArticulo 1 Indirect Ecological Interactions in The Rhizosphere PDFRUBEN SANTIAGO ARIAS AGUDELONo ratings yet

- CP 2 Vibration Monitoring and Analysis GuideDocument5 pagesCP 2 Vibration Monitoring and Analysis GuideCristian GarciaNo ratings yet

- All Refrigerator - Tout Réfrigérateur - Toda RefrigeradorDocument18 pagesAll Refrigerator - Tout Réfrigérateur - Toda RefrigeradorEricM80No ratings yet

- Marine Shrimp Culture Research Institute: Department of FisheriesDocument6 pagesMarine Shrimp Culture Research Institute: Department of FisheriesAgus Prihanto PurnomoNo ratings yet

- SonicFill Handpiece Instructions For UseDocument58 pagesSonicFill Handpiece Instructions For UseZulfahmi NurdinNo ratings yet

- Living Magazine doTERRA Spring 2018 Living MagazineDocument29 pagesLiving Magazine doTERRA Spring 2018 Living Magazineczinege_zoltan3079No ratings yet