Professional Documents

Culture Documents

Problem 8 COST

Problem 8 COST

Uploaded by

Joresol AlorroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 8 COST

Problem 8 COST

Uploaded by

Joresol AlorroCopyright:

Available Formats

Problem 8-1 Problem 8-5

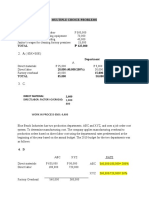

1. Machine related: P 125,000 / 10,000 = P 12.50 1. Overhead rate: P280,000 / P100,000 = 280%

Others: P 295,000 / 25,000 = P 11.80 Job 1001: (P2,000 x 280%) = P5,600

2.Machine Setup: P 50,000 / 1,000 = P 50

Material Handling: P 45,000 / 1,000 = P 45 Job 2002:

Other material related: P 60,000 / 1,200 = P 50 Direct materials P12,000

Machine operation: P 75, 000 / 10,000 = P 7.50 Direct labor 2,000

Other overhead: P 190,000 / 25,000 = P 7.60 Overhead: (P2,000 x 280%) 5,600

Total cost P19,600

Problem 8-2 Unit cost (P19,600 / 50) P 392

1. Product KK Product GG

Direct materials P 100,000 P 310,000 Job 3003:

Direct Labor 50,000 350,000 Direct materials P 8,000

Overhead: Direct labor 4,000

KK: P 1,500,000 / 50,000 x 3,000 = 90,000 Overhead: (P4,000 x 280%) 11,000

GG: P 1,500,000/50,000x47, 000= 1,410,000 Total cost P23,200

Factory Cost P240, 000 P2,070,000 Sales price: (P23,200 x 150%) P34,800

Divided by units produced ÷ 500 ÷ 15,500

Unit Cost P 480 P 133.55 2. Job 1001:

Machine setup: (P20,000 / 200) =P100 x 8 = P 100

2. Product KK Product GG Inspection: (P130,000/6,500)=P20 x22 = 400

Direct materials P 100,000 P 310,000 Material handling: (P80,000 / 8,000)=P10 x30 = 300

Direct Labor 50,000 350,000 Engineering: (P50,000 / 1,000)=P50 x25 = 1,250

Overhead: Total overhead cost P2,050

Setup related:

KK: P 250,000 /200 x120 = 150,000 Job 2002:

GG: P 250,000 /200 x 80 = 100,000 Direct materials P12,000

Design related: Direct labor 2,000

KK: P350,000 /10,000 x6,000 = 210,000 Overhead:

GG: P350,000 /10,000 x4,000= 140,000 Machine setup: (P100 x 10) P1,000

Other: Inspection: (P20 x 15) 300

KK: P900,000 /50,000 x 3,000 = 54,000 Material handling: (P10 x40) 400

GG: P900,000 /50,000x47,000= 846,000 Engineering: (P50 x 50) 2,500 4,200

Factory Cost P 564,000 P1,746,000 Total Cost P18,200

Divided by units produced ÷ 500 ÷ 15,500 Unit cost: (P18,200 /50) P0.02

Unit cost P 1, 128 P 112.65

Job 3003:

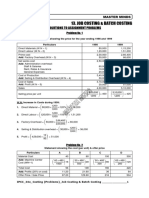

Problem 8-3 Direct materials P 8,000

Multimedia Comfort Type Direct labor 4,000

Keyboards Keyboards Overhead:

1. Machine setup: (P100x14) P1,400

Materials Handling: Inspection: (P20 x 30) 600

MK: (5% x P12,000) P 600 Material handling: (P50 x 50) 2,500

CTK: (5% x 15,400) P 770 Engineering: (P50 x 15) 750 5,250

Machine setup: Total cost P17,250

MK: (P 160 x 45) 7,200 Sales price: (P17,250 x 150%) P25,875

CTK: (P 160 x 25) 4,000

Assembly: Problem 8-6

MK: (P 12 x 400) 4,800 a. Send/ received goods: P25,000 / 500,000 = P 0.05 per kilo

CTK: (P 12 x 700) 8,400 Store goods: P 8,000 / 80,000 = P .10 per cubic foot

Inspection: Move goods: P10,000 / 5,000 = P 2.00 per square foot

MK: (P 5 x 400) 2,000 Identify goods: P 4,000 / 500 = P 8.00 per package

CTK: (P 5 x 700) 3,500

Packaging and shipping: Anson:

MK: ( 10 x 9) 90 Send/ received goods: (40,000 x P0.05) P2,000

CTK: ( 10 x 16) 160 Store goods: ( 3,000 x P1.10) 300

Total overhead costs P 14,690 P 16,830 Move goods: ( 300 x P2.00) 600

2. Identify goods: ( 5 x P8.00) 40

Multimedia Keyboard: P 14,690 /400 = P 36.73 Total P2,940

Comfort Type Keyboard: P 16,830 /700 = P 24.04

Basco:

Problem 8-4 Send/ received goods: (40,000 x P0.05) P2,000

Store goods: ( 2,000 x P1.10) 200

(a.) Materials handling: (P30,000 /1,000) P30 per no. of requisition Move goods: ( 200 x P2.00) 400

Machine setups: (P27,000 /450) P60 per setup Identify goods: ( 20 x P8.00) 160

Quality inspection: (P24,000 /600) P40 per no. of inspection Total P2,760

(b.) Product SS Product HH Casio:

Materials handling: Send/ received goods: (40,000 x P0.05) P2,000

SS: (P30 x 400) P 12,000 Store goods: ( 1,000 x P1.10) 100

HH: (P30 x 600) P 18,000 Move goods: ( 1,000 x P2.00) 2,000

Machine setups: Identify goods: ( 80 x P8.00) 640

SS: (P60 x 150) 9,000 Total P4,740

HH: (P60 x 300) 18,000

Quality inspection: b. Anson: 40,000 x P 0.08 = P3,200

SS: (P 40 x 200) 8,000 Basco: 40,000 x P 0.08 = P3,200

HH: (P40 x 400) 16,000 Casio: 40,000 x P0.08 = P3,200

Total overhead Costs P 29,000 P52,000

c. Anson: P2,940 x 130% = P3,822

Basco: P2,760 x 130% = P3,588

Casio: P4,740 x 130% = P6,162

d. The current pricing plan captures only one dimension of cost casualty,

send/receive goods. Accordingly, the prices charged for warehousing

services are almost independent of the causes of the costs. As indicated

in a comparison of the answers to parts (b) and (c), the existing plan

generates the same price for the three customers whereas an ABC-based

price results in very different prices to be charged to the three

customers.

Problem 8-7 Problem 8-9

1. JOB 456 JOB 789 1a. Budgeted manufacturing overhead rate = Budgeted manufacturing OH

Direct materials P19,400 P119,800 Budgeted direct labor cost

Direct labor 1,500 22,500 = P 3,000,000

Manufacturing overhead: P 600,000

Job 456: P230 x P50 11,500 = P 5 per direct labor cost

Job 789: P230 x P750 172,500

Total manufacturing costs P32,400 P314,800 1b. Mauna Loa African

Divided number of units ÷ 20 ÷ 400 Direct materials P 8.40 P 6.40

Manufacturing cost per unit P 1,620 P 787 Direct labor 0.60 0.60

Manufacturing overhead (0.60x P5.00) 3.00 3.00

2. JOB 456 JOB 789 Total costs P12.00 P10.00

Direct materials P19,400 P119,800

Direct labor 1,500 22,500 Budgeted selling prices per kilo:

Manufacturing overhead: Mauna Loa (P12.00 x 130%) = P15.60

Materials handling: African (P10.00 x 130%) = P13.00

P 0.80 x 1,000; P0.80 x 4,000 800 3,200

Lathe work: 2, total budgeted unit costs per kilo are:

P 0.40 x40,000; P0.40x120,000 16,000 48,000 Mauna Loa African Coffee

Milling: Direct materials P 8.40 P 6.40

P 40 x 300; P 40 x 2,100 12,000 84,000 Direct labor 0.60 0.60

Grinding: Manufacturing overhead:

P1.60 x 1000; P1.60 x 4,000 1,600 6,400 Purchase orders:

Testing: MLC: (4 x P1,000 ÷ 100,000) 0.04

P 30 x 20; P30 x 400 600 12,000 AC: (4 x P1,000 ÷ 2,000) 2.00

Total manufacturing cost P51,900 P295,900 Material handling:

Number of units ÷ 20 ÷ 400 MLC: (30 x P800 ÷ 100,000) 0.24

Unit manufacturing cost P 2,595 P739.75 AC: (12 x P800 ÷ 2,000) 4.80

Quality control:

3. The product cost figures computed in requirement 1 and 2 differ MLC: (10 x P480 ÷ 100,000) 0.04

because: AC: (4 x P480 ÷ 2,000) 0.96

a. The job orders differ in the way the use each of five activity Roasting:

areas, and MLC: (1,000 x P20 ÷ 100,000) 0.20

b. The activity areas differ in their indirect cost allocation bases AC: (20 x P20 ÷ 2,000) 0.20

9 specifically, each are does not use the direct manufacturing Blending:

labor-hours indirect cost allocation base. MLC: (500 x P20 ÷ 100,000) 0.10

AC: (10 x P20 ÷ 2,000) 0.10

Problem 8-8 Packaging:

MLC: (100 x P20 ÷ 100,000) 0.02

a. Umbrellas: P16/ P20 = 80% of an hour; 80x 60minutes= 48 minutes AC: (2 x P20 ÷ 2,000) 0.02

Gazebos: P120/P20 = 6 DLHs Total cost per unit P 9.64 P15.08

Tents: P40 / P10 = 2 DLHs

b. Umbrellas: (P16 x 200,000) P 3,200,000 Problem 8-10

Gazebos: (120x 20,000) 2,400,000

Tents: (P40 x 60,000) 2,400,000 (a) Purchasing: (P240,000 / 1,500) P160 per order

Total overhead cost P8,000,000 Processing: (P1,400,000/1,000,000) P1.40 per liter

Packaging: (P580,000 / 400,000) P1.45 per container

c. Allocation rates: Testing: (P240,000 / 4,000) P60 per test

Quality control: P400,000 / 280,000 = P 1.43 per unit (rounded) Storage: (P180,000 / 18,000) P10 per liter

Setups: P400,000 / 2,000 = P200 per setup Washing: (P560,000 / 800) P700 per batch

Material handling: P 1,200,000/4,000,000= P0.30 per kilo

Equipment orientation: P 6,000,000/2,000,000= P3.00 per kilo MH (b) Paint XX Paint YY

OVERHEAD COST ALLOCATION: Purchasing:

Umbrellas Gazebos Tents (P160 x 800) ; (P160 x 700) P 128,000 P 112,000

Quality control: Processing:

P1.43 x 200,000 P 286,000 (P1.40x 400,000;(P1.40x600,000) 560,000 840,000

P1.43 x 20,000 P 28,600 Packaging:

P1.43 x 60,000 P 85,800 (P1.45x 180,000;(1.45x220,000) 261,000 319,000

Setups: Testing:

P200 x 400 80,000 (P60x2,100); (P60 x1,900) 126,000 114,000

P200 x 800 160,000 Storage:

P200 x 800 160,000 (P10 x10,400); (P10x 7,600) 104,000 76,000

Material handling: Washing:

P0.30x 800,000 240,000 (700x 350); (P700 x450) 245,000 315,000

P0.30x2,000,000 600,000 Total overhead cost: P1,424,000 P1,776,000

P0.30x1,200,000 360,000

Equipment operation: (c) Unit overhead cost: Paint XX (P1,424,000 / 180,000container) = P7.91

P3.00x 400,000 1,200,000 Paint YY (P1,776,000 / 220,000container) = P8.07

P3.00x 800,000 2,400,000

P3.00x 800,000 ________ 2,400,000

Total overhead P1,806,000 P3,188,600 P3,005,800

Number of units ÷ 200,000 ÷ 20,000 ÷ 60,000

Overhead cost per unit P 9.03 P 159.43 P 50.10

Total cost per unit

Direct materials P 8.00 P 80.00 P 8.00

Direct labor 12.00 90.00 30.00

Overhead 9.03 159.43 50.10

Total P 29.03 P 329.43 P 88.10

d. If prices are set based on product costs, activity-based costing would

generate lower process for umbrellas and higher prices for the other

two products.

You might also like

- Manufacturing Overhead - DepartmentalizationDocument6 pagesManufacturing Overhead - DepartmentalizationJosephine Yen100% (1)

- Rizal Module 1Document21 pagesRizal Module 1Joresol Alorro100% (5)

- 6.inventory Control - HW SET # 1Document2 pages6.inventory Control - HW SET # 1Jayanta ChakladerNo ratings yet

- Supply Chain at KoneDocument5 pagesSupply Chain at KoneParag ChaubeyNo ratings yet

- Notes 3Document3 pagesNotes 3Jerome Eziekel Posada PanaliganNo ratings yet

- ST Chapter 1 2Document3 pagesST Chapter 1 2Joresol AlorroNo ratings yet

- Oiler ReviewerDocument6 pagesOiler ReviewerJoresol AlorroNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument12 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AHardin LavistreNo ratings yet

- Module 4.2 Activity-Based Costing ProblemsDocument5 pagesModule 4.2 Activity-Based Costing ProblemsDanica Ramos100% (1)

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Cost Job Order Exercises AnskeyDocument1 pageCost Job Order Exercises AnskeyLizbeth Gangano WalacNo ratings yet

- Cost Job Order Exercises AnskeyDocument1 pageCost Job Order Exercises AnskeyLizbeth Gangano WalacNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Job Order CostingDocument9 pagesAnsay, Allyson Charissa T. - BSA 2 - Job Order Costingカイ みゆきNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Mas Solutions To Problems Solutions 2018 PDFDocument13 pagesMas Solutions To Problems Solutions 2018 PDFMIKKONo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Mas Test Bank SolutionDocument13 pagesMas Test Bank SolutionMark Jonah BachaoNo ratings yet

- Juarez, Jenny Brozas - Activity 2 MidtermDocument4 pagesJuarez, Jenny Brozas - Activity 2 MidtermJenny Brozas JuarezNo ratings yet

- Chapter 4 Job Order Costing and Cost Allocation v2021Document7 pagesChapter 4 Job Order Costing and Cost Allocation v2021Dalia ElarabyNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- CH 44Document4 pagesCH 44Sadia MunawarNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- 4 - Sample Problems - Standard Costing and Variance AnalysisDocument8 pages4 - Sample Problems - Standard Costing and Variance AnalysisJustin AciertoNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Multiple Choice Questions TheoreticalDocument13 pagesMultiple Choice Questions TheoreticalAiraNo ratings yet

- Group-8 F2 CCE-2 CMA Cost SheetDocument12 pagesGroup-8 F2 CCE-2 CMA Cost SheetNAMRATANo ratings yet

- A Case Study in Engineering Economy Palay Buying and Rice SellingDocument6 pagesA Case Study in Engineering Economy Palay Buying and Rice SellingJoshua Quintos OnzaNo ratings yet

- Answer Q5Document2 pagesAnswer Q5calebNo ratings yet

- MAS1Document48 pagesMAS1ryan angelica allanicNo ratings yet

- (M-2) Job, Batch, Operating Costing 4Document13 pages(M-2) Job, Batch, Operating Costing 4Yolo GuyNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Problem 2 - Paper Set - 1: Statement of CostDocument3 pagesProblem 2 - Paper Set - 1: Statement of CostBALAJI DASAPPAJINo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsPremium AccountsNo ratings yet

- Sales Price: (400 Units X P26.50) : PROBLEM 14-3Document2 pagesSales Price: (400 Units X P26.50) : PROBLEM 14-3Gileah Ymalay ZuasolaNo ratings yet

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- MAS Assessment Exam Answer Key SolutionDocument7 pagesMAS Assessment Exam Answer Key SolutionJonalyn JavierNo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Mock Boards Answers AfarDocument5 pagesMock Boards Answers AfarKenneth DiabordoNo ratings yet

- ABS Problems (1-2)Document3 pagesABS Problems (1-2)dewlate abinaNo ratings yet

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- Exercise 1 Case 1 Case 2Document11 pagesExercise 1 Case 1 Case 2Chin FiguraNo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDale MartinNo ratings yet

- Management Accounting: Suggested Answers Final Examination (Transitional Scheme) - Summer 2017Document6 pagesManagement Accounting: Suggested Answers Final Examination (Transitional Scheme) - Summer 2017AbdulAzeemNo ratings yet

- BBA 6thDocument3 pagesBBA 6thFazal Wahab100% (1)

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNo ratings yet

- Principles of DeductionsDocument12 pagesPrinciples of DeductionsJUSTINEJADE PEREZNo ratings yet

- Prelim Exam-Boticario D. (SBA)Document5 pagesPrelim Exam-Boticario D. (SBA)Dominic E. BoticarioNo ratings yet

- Problem 2-14 Product Cost Sunk Cost Direct LaborDocument8 pagesProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeNo ratings yet

- Relevant Costing ActivityDocument3 pagesRelevant Costing ActivityRosario BacaniNo ratings yet

- Using The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptDocument3 pagesUsing The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptRomjan HusainNo ratings yet

- CH 7 SolutionsDocument12 pagesCH 7 SolutionsGabriel PanoNo ratings yet

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadNo ratings yet

- Stat Analysis Module 1Document4 pagesStat Analysis Module 1Joresol AlorroNo ratings yet

- Hbo Module 1Document11 pagesHbo Module 1Joresol Alorro100% (1)

- A. Sources of Measurement DifferencesDocument4 pagesA. Sources of Measurement DifferencesJoresol AlorroNo ratings yet

- Buscom Sample ProbDocument2 pagesBuscom Sample ProbJoresol AlorroNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- Getting Started in Research PaperDocument2 pagesGetting Started in Research PaperJoresol AlorroNo ratings yet

- AA LiabilitiesDocument2 pagesAA LiabilitiesJoresol AlorroNo ratings yet

- PROJECT ProposalDocument4 pagesPROJECT ProposalJoresol Alorro50% (4)

- Galindo Part 1Document10 pagesGalindo Part 1Joresol AlorroNo ratings yet

- Discover MindorDocument49 pagesDiscover MindorJoresol Alorro100% (1)

- Op EdDocument15 pagesOp EdJoresol AlorroNo ratings yet

- Mathematics in NatureDocument6 pagesMathematics in NatureJoresol AlorroNo ratings yet

- Quiz 2Document4 pagesQuiz 2Bảo QuỳnhNo ratings yet

- Oracle SCM Scope Documents1Document5 pagesOracle SCM Scope Documents1raoofNo ratings yet

- Director Supply Chain Manufacturing in USA Resume Elena Rodriguez GarciaDocument4 pagesDirector Supply Chain Manufacturing in USA Resume Elena Rodriguez GarciaElenaRodriguezGarciaNo ratings yet

- Important Questions For Class 11 Business Studies Chapter 10 Internal TradeDocument4 pagesImportant Questions For Class 11 Business Studies Chapter 10 Internal Tradesudipta dasNo ratings yet

- PSCM 430 - Additional NotesDocument60 pagesPSCM 430 - Additional NotesJames Gikingo100% (1)

- Vice President Distribution Supply Chain Logistics in Houston TX Resume Herbert JahnDocument3 pagesVice President Distribution Supply Chain Logistics in Houston TX Resume Herbert JahnHerbertJahnNo ratings yet

- MRP Advantage & DisadvantageDocument2 pagesMRP Advantage & Disadvantagevicky323067% (3)

- Oracle EBS End To End Scenarios For System Integration Testing SITDocument9 pagesOracle EBS End To End Scenarios For System Integration Testing SITqkhan2000No ratings yet

- Material Management and Packaging (Word Format)Document9 pagesMaterial Management and Packaging (Word Format)orly briggsNo ratings yet

- CoordinationinasupplychainDocument53 pagesCoordinationinasupplychainJayaprasannaNo ratings yet

- 03 MFG Inventory Tracker v1Document8 pages03 MFG Inventory Tracker v1vijay sainiNo ratings yet

- Gizmoz Study CaseDocument4 pagesGizmoz Study CaseInge Monica100% (1)

- Non-Negotiable: Mol Triumph 0207E Hamburg Jebel Ali Umm QasrDocument1 pageNon-Negotiable: Mol Triumph 0207E Hamburg Jebel Ali Umm Qasrtaaj77No ratings yet

- Avco FifoDocument1 pageAvco FifoMuhammad TalhaNo ratings yet

- Place DecisionDocument25 pagesPlace DecisionAaron Sabu ThomasNo ratings yet

- Big Data Analytics in Operation ManagementDocument35 pagesBig Data Analytics in Operation ManagementMAHBUB RAFINo ratings yet

- Sales Promotion TechniquesDocument22 pagesSales Promotion Techniquesmahesh sNo ratings yet

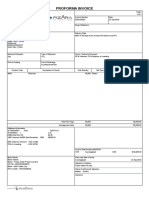

- 002 Proforma Invoice PDFDocument1 page002 Proforma Invoice PDFnadeem2510No ratings yet

- Marginal CostingDocument31 pagesMarginal Costingdivya dharmarajan50% (4)

- Quiz 3Document7 pagesQuiz 3pragadeeshwaran100% (1)

- Answer Tutorial 6-7-JIt, Quality RevisedDocument8 pagesAnswer Tutorial 6-7-JIt, Quality RevisedXinyee LooNo ratings yet

- RFID As An Enabler of Materials Management: The Case of A Four Layer Construction Supply ChainDocument12 pagesRFID As An Enabler of Materials Management: The Case of A Four Layer Construction Supply ChainramkishorecNo ratings yet

- Lesson 6 Operating Management BesDocument5 pagesLesson 6 Operating Management BesMich ValenciaNo ratings yet

- Internal Stock Transfers Monitoring SystemDocument49 pagesInternal Stock Transfers Monitoring SystemMark Lester GatuzNo ratings yet

- Supply Chain MGMT Project1Document40 pagesSupply Chain MGMT Project1arvind_vandanaNo ratings yet

- Infografía Incoterms 2020Document1 pageInfografía Incoterms 2020ANTONELLA DOMINIQUE PINTONo ratings yet

- Role of Visibility in Supply Chain ManagementDocument14 pagesRole of Visibility in Supply Chain ManagementNorman SuliNo ratings yet

- AFAR Self Test - 9004Document4 pagesAFAR Self Test - 9004King MercadoNo ratings yet