Professional Documents

Culture Documents

Trai Phieu 7

Trai Phieu 7

Uploaded by

NguyenCopyright:

Available Formats

You might also like

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- IMP Imexpharm ReportDocument24 pagesIMP Imexpharm Reportloc1409No ratings yet

- Warmaster Ancient PDFDocument22 pagesWarmaster Ancient PDFjaime100% (2)

- 1400 Hoi Vien Benh Vien Quoc Te 2011 TPHCM PDFDocument202 pages1400 Hoi Vien Benh Vien Quoc Te 2011 TPHCM PDFSai Gon Nhân Điện100% (1)

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenNo ratings yet

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenNo ratings yet

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenNo ratings yet

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenNo ratings yet

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenNo ratings yet

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenNo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenNo ratings yet

- Research: State Bank of IndiaDocument7 pagesResearch: State Bank of IndiatihadaNo ratings yet

- Solid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedDocument4 pagesSolid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedRalph SuarezNo ratings yet

- SageOne Investor Memo May 2023Document9 pagesSageOne Investor Memo May 2023debarkaNo ratings yet

- Bank Central Asia TBK: 9M20 Review: Solid Capital and PPOPDocument7 pagesBank Central Asia TBK: 9M20 Review: Solid Capital and PPOPHamba AllahNo ratings yet

- BCG India Economic Monitor Dec 2020Document42 pagesBCG India Economic Monitor Dec 2020akashNo ratings yet

- PNJ 20240506 BuyDocument11 pagesPNJ 20240506 Buydhhung92No ratings yet

- Third Quarter 2007 Financial Review: Comerica IncorporatedDocument34 pagesThird Quarter 2007 Financial Review: Comerica Incorporatedmdv31500No ratings yet

- HTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFDocument33 pagesHTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFAbhinav VermaNo ratings yet

- TCBS Vietnam Investment Channels Update 3M2023Document14 pagesTCBS Vietnam Investment Channels Update 3M2023ÁnhTâmNo ratings yet

- Banking Sector 210202Document15 pagesBanking Sector 210202Brian StanleyNo ratings yet

- ValuationDocument4 pagesValuationRhea Mae CarantoNo ratings yet

- 2020-IBG-ARDocument148 pages2020-IBG-ARcathyandre2007No ratings yet

- Equitas Small Finance Bank Company UpdateDocument10 pagesEquitas Small Finance Bank Company Updatefinal bossuNo ratings yet

- Equity Market Update - December 2022Document32 pagesEquity Market Update - December 2022YasahNo ratings yet

- Complete Investment ProjectDocument115 pagesComplete Investment ProjectOyebola Akin-DeluNo ratings yet

- Union Bank of India: Performance HighlightsDocument7 pagesUnion Bank of India: Performance HighlightsKarthik SpNo ratings yet

- Complete Investment ProjectDocument113 pagesComplete Investment ProjectBashar DaoudNo ratings yet

- Gundlach Pres June 2017Document57 pagesGundlach Pres June 2017Zerohedge100% (6)

- Kotak Mahindra Bank: CMP: INR1060 TP: INR1,220 (+15%)Document12 pagesKotak Mahindra Bank: CMP: INR1060 TP: INR1,220 (+15%)suprabhattNo ratings yet

- Bond MKT 2024Document16 pagesBond MKT 2024Dương Quốc Đạt 12A1No ratings yet

- 2021 Outlook ENG OfficialDocument143 pages2021 Outlook ENG OfficialHa TrinhNo ratings yet

- Revising Estimates On Normalized Loan Growth Outlook Maintain BUY RatingDocument6 pagesRevising Estimates On Normalized Loan Growth Outlook Maintain BUY RatingJM CrNo ratings yet

- 2018 Roche RD ReportDocument27 pages2018 Roche RD ReportsyedNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- Listed Banks Earnings jump 95_ YoYDocument5 pagesListed Banks Earnings jump 95_ YoYM Ali MerchantNo ratings yet

- GGP Ackman Presentation Ira Sohn Conf 5-26-10Document89 pagesGGP Ackman Presentation Ira Sohn Conf 5-26-10fstreet100% (2)

- 2020 11 18 PH e Ssi PDFDocument8 pages2020 11 18 PH e Ssi PDFJNo ratings yet

- Bank Central Asia TBK: Loan Restructuring To Suppress NIMDocument6 pagesBank Central Asia TBK: Loan Restructuring To Suppress NIMValentinus AdelioNo ratings yet

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeBEACH SCUBA DETECTINGNo ratings yet

- Alpha ChartDocument2 pagesAlpha ChartLuan Nguyen100% (1)

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeEdner PatricNo ratings yet

- FlowsDocument8 pagesFlowsJaredNo ratings yet

- Tracking Performance of Small Finance Banks Against Financial Inclusion GoalsDocument30 pagesTracking Performance of Small Finance Banks Against Financial Inclusion GoalsNeelanjan MaitiNo ratings yet

- Five Key QuestionsDocument12 pagesFive Key QuestionsInternational Business TimesNo ratings yet

- Quality Valuation: Update Harga: Real-TimeDocument13 pagesQuality Valuation: Update Harga: Real-TimeambarNo ratings yet

- $1M Today 12.5 15.5% 20 YearsDocument4 pages$1M Today 12.5 15.5% 20 Yearsanna_meenaNo ratings yet

- Complete Investment ProjectDocument113 pagesComplete Investment ProjectAli IqbalNo ratings yet

- Corporate Factbook Altria - MODocument9 pagesCorporate Factbook Altria - MOTom RobertsNo ratings yet

- Solution Workshop #2Document12 pagesSolution Workshop #2ScribdTranslationsNo ratings yet

- Time Value of Money FV Solution (1 Solution)Document6 pagesTime Value of Money FV Solution (1 Solution)Manroop SinghNo ratings yet

- Axis Bank - LKP - 29.10.2020 PDFDocument12 pagesAxis Bank - LKP - 29.10.2020 PDFVimal SharmaNo ratings yet

- Factsheet Enf Apr-2024 enDocument2 pagesFactsheet Enf Apr-2024 enquangdatphungNo ratings yet

- Indian Overseas Bank: Performance HighlightsDocument6 pagesIndian Overseas Bank: Performance HighlightsHarshil MathurNo ratings yet

- 2024 05 03 PH e RrhiDocument9 pages2024 05 03 PH e Rrhiphilnabank1217No ratings yet

- Chapter 7 SwapsDocument22 pagesChapter 7 Swapsashutoshusa20No ratings yet

- What Is A Swap?: Scenario 1Document4 pagesWhat Is A Swap?: Scenario 1Mian ZainNo ratings yet

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Document12 pagesRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinNo ratings yet

- Power Pack BankingDocument26 pagesPower Pack BankingDev DugarNo ratings yet

- Fintech Barometer - Report by DLAI and CRIFDocument37 pagesFintech Barometer - Report by DLAI and CRIFsalgiashrenikNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenNo ratings yet

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenNo ratings yet

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenNo ratings yet

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenNo ratings yet

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenNo ratings yet

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenNo ratings yet

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenNo ratings yet

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenNo ratings yet

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenNo ratings yet

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenNo ratings yet

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenNo ratings yet

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenNo ratings yet

- 2018-04-23 The New Yorker PDFDocument92 pages2018-04-23 The New Yorker PDFNguyen100% (2)

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenNo ratings yet

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenNo ratings yet

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenNo ratings yet

- Energy From The Desert Ed-5 2015 LR PDFDocument171 pagesEnergy From The Desert Ed-5 2015 LR PDFNguyenNo ratings yet

- STIBET Applicationform U Ko-LaDocument3 pagesSTIBET Applicationform U Ko-LaNguyenNo ratings yet

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenNo ratings yet

- Volunteers in Arts and Culture Organizations in Canada in 2007Document26 pagesVolunteers in Arts and Culture Organizations in Canada in 2007NguyenNo ratings yet

- Tong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFDocument160 pagesTong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFNguyenNo ratings yet

- ACTA Maradero OrtegDocument42 pagesACTA Maradero OrtegSIKIUNo ratings yet

- Danh Sach Khach Hang Gui Tien Ngan Hang Vietcombank HCMDocument4 pagesDanh Sach Khach Hang Gui Tien Ngan Hang Vietcombank HCMNguyễn Thành LongNo ratings yet

- Buenaventura DurrutiDocument4 pagesBuenaventura Durrutis_th_s2952No ratings yet

- Civil War DBQDocument10 pagesCivil War DBQKevin Earlie100% (1)

- 3.31 Paraphrase Exercise-EchoDocument4 pages3.31 Paraphrase Exercise-EchoLSHJechoNo ratings yet

- Combined Footing Design in Ramamrutham Text BookDocument6 pagesCombined Footing Design in Ramamrutham Text BookSai Kiran Chowdary KakarlaNo ratings yet

- Speech To The Troops at TilburyDocument14 pagesSpeech To The Troops at TilburyAmmi Sirhc TeeNo ratings yet

- Đề Thi Học Kì 2 Tiếng Anh Lớp 7Document26 pagesĐề Thi Học Kì 2 Tiếng Anh Lớp 7BaotanNo ratings yet

- Im1023 - Ket Qua Giua KyDocument14 pagesIm1023 - Ket Qua Giua Ky0931414100azzaNo ratings yet

- Sopping Wet: County Soaked by Heavy DownpoursDocument28 pagesSopping Wet: County Soaked by Heavy DownpoursSan Mateo Daily JournalNo ratings yet

- DS Tiêm Mũi 2 ASTRA 21 H TươngDocument22 pagesDS Tiêm Mũi 2 ASTRA 21 H TươngNguyễn FourNo ratings yet

- The Battle For SyriaDocument1 pageThe Battle For Syriadruwid6No ratings yet

- Vaishnava Song Book-HindiDocument149 pagesVaishnava Song Book-Hindisulabhseth100% (1)

- Corinth Interpretive CenterDocument2 pagesCorinth Interpretive CenterBob AndrepontNo ratings yet

- B 0156 Celeski Special Air Warfare and The Secret War in Laos Air Commandos 1964 1975Document518 pagesB 0156 Celeski Special Air Warfare and The Secret War in Laos Air Commandos 1964 1975Anonymous Fsbwpsbjr100% (1)

- AfghanistanDocument31 pagesAfghanistanAakashParanNo ratings yet

- Response To Casablanca - Student PaperDocument3 pagesResponse To Casablanca - Student Paperljwolf_400216787No ratings yet

- Fighting For The Blue: The Wallace-Taylor-Williams Boys of IndianaDocument6 pagesFighting For The Blue: The Wallace-Taylor-Williams Boys of IndianaKraig McNuttNo ratings yet

- The Marines in Vietnam 1954-1973 An Anthology and Annotated BibliographyDocument389 pagesThe Marines in Vietnam 1954-1973 An Anthology and Annotated BibliographyBob Andrepont100% (5)

- Aircraft Manual IndexDocument41 pagesAircraft Manual IndexGhribi100% (2)

- Library of Congress - Pinkerton RecordsDocument53 pagesLibrary of Congress - Pinkerton RecordsBenson GreenNo ratings yet

- Child Soldiers PowerpointDocument13 pagesChild Soldiers Powerpointapi-310029384No ratings yet

- Cartas Gabriela-Victoria OcampoDocument95 pagesCartas Gabriela-Victoria OcampoArhanko100% (2)

- Frank Jesse DissertationDocument4 pagesFrank Jesse DissertationWhereCanIBuyResumePaperDesMoines100% (1)

- No. Name Fname Gfname Request - NoDocument24 pagesNo. Name Fname Gfname Request - Nohailomasegede27No ratings yet

- Battle of Cerro GordoDocument3 pagesBattle of Cerro GordoEUTOPÍA MÉXICONo ratings yet

- Night at The Museum Project ProposalDocument3 pagesNight at The Museum Project Proposalapi-270016009No ratings yet

- Dpe Thana CodeDocument14 pagesDpe Thana Codebiswajit_bplNo ratings yet

Trai Phieu 7

Trai Phieu 7

Uploaded by

NguyenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trai Phieu 7

Trai Phieu 7

Uploaded by

NguyenCopyright:

Available Formats

Fixed-Income Research

Weekly report May 28th, 2018

Fixed-Income Report Round-up

Wining rates decreased by 1bp for all tenors.

Yield curve shifted downward minimally.

Interbank rates extended its slight uptrend.

May 20th – 24th/2019

Yield Curve

In this issue

5.3

Round up

Bond market 4.8

Interest rates 4.3

3.8

3.3

2.8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

VND 3,400 bn was mobilized this week. VND 46,445 bn was traded on the

secondary market.

Le Thu Ha Yield curve shifted downward minimally. According to Bloomberg data, 1Y, 2Y, 3Y,

+84 24 3936 6990 (ext. 7182) 5Y, 7Y, 10Y and 15Y bond yields posted at 3.258% (-1 bps), 3.475% (-0.2 bps), 3.59% (-2.7

bps), 3.855% (-2.7 bps), 4.287% (+1.7 bps), 4.765% (-2.5 bps), 5.137% (-0.6 bps), respectively.

ltha_ho@vcbs.com.vn

Interbank rates extended its slight uptrend. In details, ON – 3M rates posted at

3.138%, 3.237%, 3.306%, 3.513% and 4.075%, respectively according to Bloomberg data.

Dang Khanh Linh

Foreign investors net sell roughly VND 130.96 bn this week.

+84 24 3936 6990 (ext. 7183)

SBV net injected VND 4,907 bn via OMO channel.

dklinh@vcbs.com.vn

VCBS Commentary May 27th – May 31st

Till now, we do not foresee chance that bond yield will tick up strongly. Instead, it is

likely that bond yields will experience a minor change.

We believe in the upcoming period, interbank rate will move in a tight band around

See Disclaimer at Page 5 this present level. No liquidity tense shall be recorded.

Macroeconomic, Fixed-Income,

Financial and Corporation

Information updated at

www.vcbs.com.vn/vn/Services/AnalysisResearch

Research Department VCBS Page | 0

Fixed-Income Report

Bond Market

Primary Market

Wining rates decreased by 1bp for all winning tenors

VND 3,400 bn was mobilized this VND 3,400 bn was mobilized this week from ST. Therein, ST planned to issue VND 500

week. bn at 7Y; VND 1,000 bn at 10Y; VND 1,000 bn at 15Y plus VND 1,500 bn at 20Y bond.

The registered volume to offering volume ratio for 7Y, 10Y, 15Y & 20Y tenors were 1.30,

4.05, 4.83 and 4.34 times respectively, which showed that investors’ sentiment was more

optimistic. The average register to offering ratio was 3.63 times. Besides, the total wining to

offering ratio was 85% with 15Y, 20Y tenor were issued successfully, while the auction for

7Y tenor failed. Wining rate for 10Y, 15Y and 20Y tenors decreased by 1bp each tenor

compared to the previous session and stood at 4.71%, 5.05% and 5.68%, respectively.

VBSP and VDB did not mobilize bond this week.

Winning rates GB Auction results Vol (VND bn)

8.50% 12000

7.50% 10000

6.50% 8000

5.50% 6000

4.50% 4000

3.50% 2000

2.50% 0

May 02- May 04

May 14- May 18

May 28- June 01

Nov 12- Nov 16

Nov 26- Nov 30

Oct 29-Nov 02

Sep 17- Sep 21

Feb 11- Feb 15

Apr 08 - Apr 12

Apr 22 - Apr 26

Aug 06 - Aug 10

Aug 20 - Aug 24

Mar 11- Mar 15

Mar 25- Mar 29

June 11 - June 15

June 25 - June 29

Oct 01- Oct 05

Oct 15- Oct 19

Jan 07- Jan 11

Jan 21- Jan 25

May 13 - May 17

Sep 04 - Sep 09

Jul 09 - Jul 13

Jul 23 - Jul 27

Feb 25- Mar 01

Dec 10- Dec 14

Dec 24- Dec 28

Volume 5Y 7Y 10Y 15Y 20Y 30Y

Source: HNX, VCBS

Secondary Market

Outright trading increased strongly.

VND 46,445 bn (+35.48%) was VND 46,445 bn (+35.48%) was traded on the secondary market. Average trading volume

traded on the secondary market. each session rebounded to VND 9,289 bn (+35.48% wow) thanks to outright values

increasing sharply this week. In detail, Outright and repo values were at VND 27,420 bn

(+43.46% wow) and VND 19,025 bn (+25.42% wow), respectively. Regarding outright,

ST-Bond kept dominating trading volume with 85.80%. Remarkably, this week a large

proportion of bond trading (29.26%) belonged to short-term bond (<5year) followed by

long-term bond (>10 year) (22.73%).

Yield curve shifted downward minimally. According to Bloomberg data, 1Y, 2Y, 3Y,

5Y, 7Y, 10Y and 15Y bond yields posted at 3.258% (-1 bps), 3.475% (-0.2 bps), 3.59% (-

2.7 bps), 3.855% (-2.7 bps), 4.287% (+1.7 bps), 4.765% (-2.5 bps), 5.137% (-0.6 bps),

respectively.

Research Department VCBS Page | 1

Fixed-Income Report

Yield Curve

5.3

4.8

4.3

3.8

3.3

2.8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

According to Vietnam’s Foreign Investment Agency, Vietnam has attracted foreign

investment of USD 16.74 bn from the beginning of the year, the largest five month inflow

since 2016. This is a positive sign showed that Vietnam is still attractive country for

foreign inflows.

Till now, we do not foresee chance that bond yield will tick up strongly. Instead, it is likely

that bond yields will experience a minor change.

Foreign investors net sell roughly Foreign investors net sell roughly VND 130.96 bn this week. This week, foreign did not

VND 130.96 bn this week. show a clear trend. Therein, foreign recorded net sell value at almost all tenors.

Foreign Investment in the secondary market 2018-2019

Net position (Unit: bn.VND)

Apr 02- Apr 06

Apr 16- Apr 20

July 09- July 13

July 23- July 27

Apr 08- Apr 12

Apr 22- Apr 26

May 14- May 18

May 28- June 01

June 11- June 15

June 25- June 29

Aug 06- Aug 10

Aug 20- Aug 24

Oct 01- Oct 05

Oct 15- Oct 19

Nov 12- Nov 16

Nov 26- Nov 30

Dec 10- Dec 14

Dec 21- Dec 28

Jan 07- Jan 11

Jan 21- Jan 25

Apr 30- May 04

Sep 04- Sep 07

Sep 17- Sep 21

Feb 11- Feb 15

Oct 29- Nov 02

Feb 25- Mar 01

Mar 11- Mar 15

Mar 25- Mar 29

May 05 - May 10

May 20 - May 24

Source: HNX, VCBS

INTEREST RATE

Interbank Rates

Interbank rates extended its slight uptrend. In details, ON – 3M rates posted at

Interbank rates extended its slight

3.138%, 3.237%, 3.306%, 3.513% and 4.075%, respectively according to Bloomberg

uptrend. data.

Research Department VCBS Page | 2

Fixed-Income Report

Interbank rates

4.3

3.5

2.7

ON 1W 2W 1M 3M

This week Last week Last month

Source: Bloomberg, VCBS

At the present, we do not expect the factor which can make liquidity less ample in the

context of slow credit growth and no strong pressure on exchange rate. We believe that in

the upcoming period, interbank rate will move in a tight band around this present level.

No liquidity tense shall be recorded.

Open Market Operation

SBV net injected VND 4,907 bn via

SBV net injected VND 4,907 bn via OMO channel. SBV continuously offer VND 1,000

OMO channel.

bn of Reverse Repo each session this week, but there was no wining volume recorded. In

this week, outstanding for Reverse Repo declined to VND 0 bn. For Outrights, VND 48,725

bn of SBV bills matured this week while about VND 43.720 bn bills of 7 days at rate of 3%

were absorb by some financial institutions.

Reverse Repo SBV-Bill Oustanding

180

250

x VND 1,000 bn

x VND 1,000bn

160

140 200

120

100 150

80

60 100

40

50

20

- -

Mar-17

Sep-17

Mar-18

Sep-18

Mar-19

May-17

May-18

Jul-17

Nov-17

Jan-18

Jul-18

Nov-18

Jan-19

Feb-17

Feb-18

Feb-19

Oct-17

Dec-17

Oct-18

Dec-18

Apr-17

Jun-17

Aug-17

Apr-18

Jun-18

Aug-18

Apr-19

Source: Bloomberg, VCBS

END.

Research Department VCBS Page | 3

Fixed-Income Report

APPENDICES

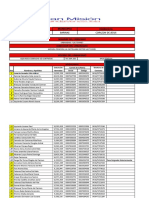

Bond Auctions

Offering Registering Winning Register to Winning rate Winning/

Auction date Tenor volume volume volume Offering Ratio (%) Offering Issuer

ST bills

Government and government-backed bonds

22-May-19 7Y 500 651 - 1.30 0 0.00% ST

22-May-19 10Y 1,000 4,050 900 4.05 4.71 90.00% ST

22-May-19 15Y 1,000 4,830 1,000 4.83 5.05 100.00% ST

22-May-19 20Y 1,500 6,510 1,500 4.34 5.68 100.00% ST

Secondary Market

Week 13 May – 17 May Week 20 May – 24 May

Issuer Value Value share Value Value share

Outright

ST 16,041 85.80% 24,977 91.09%

VDB 2,055 10.99% 2,338 8.53%

VBSP 600 3.21% 105 0.38%

Others - 0.00% - 0.00%

Subtotal (1) 18,696 100.00% 27,420 100.00%

Repo

Repo 15,169 41.56% 19,025 51.04%

Reserve Repo 21,327 58.44% 18,247 48.96%

Subtotal (2) 36,496 100.00% 37,272 100.00%

ST bills

Outright

Repo

Subtotal (3)

Total (1)+(2)+(3) 55,192 64,692

Open Market Operation

Reverse Repo Outright (SBV Bills)

Date Due Offer Balance Outstanding Due Offer Balance Outstanding

12/10- 12/14 68,313 60,033 (8,280) 60,033 0 0 0 28,960

12/17- 12/21 60,033 52,799 (7,234) 52,799 25,960 0 (25,960) 3,000

12/24- 12/28 52,799 51,064 (1,735) 51,064 3,000 0 (3,000) 0

01/02- 01/05 29,048 30,640 6,574 57,638 0 0 0 0

01/07- 01/11 52,656 47,823 (4,803) 52,835 0 0 0 0

01/14- 01/18 47,853 52,815 4,962 52,815 0 0 0 0

01/21 - 01/25 52,814.9 100335.8 47,520.9 100,335.8 0 0 0 0

01/28 – 02/01 0 52,284 52,284 152,619 0 0 0 0

02/11 - 02/15 32,035 13,796.10 (18,239) 134,380 0 0 0 0

02/18 - 02/22 134,380 28,681 (105,699) 28,681 0 0 0 0

02/25 - 03/01 28,681 18,971 (9,709) 18,972 0 0 0 0

03/04 - 03/08 18971 13961 (5010) 13,961 0 0 0 0

03/11 – 03/15 13,961 7,587 (6,374) 7,588 0 17,000 17,000 17,000

03/18 - 03/22 7,587 2,728 (4,859) 2,728 17,000 37,500 20,500 37,500

03/25 - 03/29 2,728 1,635 (1,094) 1,635 37,500 4,900 (32,600) 4,900

04/01 - 04/05 1,635 196 (1,439) 196 300 5,200 4,900 -

04/08 - 04/12 195.6 0 (195.6) 0 17,001 10199.7 (6,801.3) 10,199.7

04/15 - 04/19 0 0 0 0 10,199.7 4,999.8 (5,199.9) 4,999.8

05/06 - 05/10 514.6 0 (514.6) 0 49,998.4 25,887 (24,111.4) 25,887

05/13 - 05/17 0 97.85 97.85 97.85 25887 48725 22838 48725

05/20 - 05/24 97.85 0 (97.85) 0 48725 43719.7 (5005.3) 43719.7

Research Department VCBS Page | 4

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The VCBS analysts

exert their best efforts to obtain the most accurate and timely information available from various sources, including information pertaining to market

prices, yields and rates. All information stated in the report has been collected and assessed as carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at the date of

publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to buy or sell or any actions

related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that VCBS belongs to or is related to (thereafter,

VCBS), provide no warranty or undertaking of any kind in respect to the information and materials found on, or linked to the report and no obligation to

update the information after the report was released. VCBS does not bear any responsibility for the accuracy of the material posted or the information

contained therein, or for any consequences arising from its use, and does not invite or accept reliance being placed on any materials or information so

provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized representative of

VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha Dang Khanh Linh

Head of Research Senior Analyst - Economic research Analyst - Economic research

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn dklinh@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

th th

Ha Noi Headquarter Floor 12 & 17 , Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-28)-3820 8116 Ext:104/106

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City. Tel: (+84-236) 3888 991 ext: 801/802

Nam Sai Gon Transaction Unit Floor 3rd, V6 Tower, Plot V, Him Lam Urban Zone, 23 Nguyen Huu Tho Street, Tan Hung Ward, District No. 7, Ho Chi Minh City

Tel: (84-28)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi. Tel: (+84-24) 3726 5551

Tay Ho Transaction Unit 1st & 3rd Floor, 565 Lac Long Quan Street, Tay Ho District, Hanoi. Tel: (+84-24) 2191048 (ext: 100)

Hoang Mai Transaction Unit 1st Floor Han Viet Building, 203 Minh Khai Street, Hai Ba Trung District, Hanoi. Tel: (+84-24) 3220 2345

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City.Tel: (+84-292) 3750 888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province. Tel: (+84-254) 351 3974/75/76/77/78

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office Floor 1st & 2nd, 79 Hung Dao Vuong, Trung Dung Ward, Bien Hoa City, Dong Nai Province. Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City. Tel: (+84-225) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-274) 3855 771

Research Department VCBS Page | 5

You might also like

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- IMP Imexpharm ReportDocument24 pagesIMP Imexpharm Reportloc1409No ratings yet

- Warmaster Ancient PDFDocument22 pagesWarmaster Ancient PDFjaime100% (2)

- 1400 Hoi Vien Benh Vien Quoc Te 2011 TPHCM PDFDocument202 pages1400 Hoi Vien Benh Vien Quoc Te 2011 TPHCM PDFSai Gon Nhân Điện100% (1)

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenNo ratings yet

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenNo ratings yet

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenNo ratings yet

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenNo ratings yet

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenNo ratings yet

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenNo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenNo ratings yet

- Research: State Bank of IndiaDocument7 pagesResearch: State Bank of IndiatihadaNo ratings yet

- Solid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedDocument4 pagesSolid, Stable and Consistent: BOC Hong Kong (Holdings) LimitedRalph SuarezNo ratings yet

- SageOne Investor Memo May 2023Document9 pagesSageOne Investor Memo May 2023debarkaNo ratings yet

- Bank Central Asia TBK: 9M20 Review: Solid Capital and PPOPDocument7 pagesBank Central Asia TBK: 9M20 Review: Solid Capital and PPOPHamba AllahNo ratings yet

- BCG India Economic Monitor Dec 2020Document42 pagesBCG India Economic Monitor Dec 2020akashNo ratings yet

- PNJ 20240506 BuyDocument11 pagesPNJ 20240506 Buydhhung92No ratings yet

- Third Quarter 2007 Financial Review: Comerica IncorporatedDocument34 pagesThird Quarter 2007 Financial Review: Comerica Incorporatedmdv31500No ratings yet

- HTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFDocument33 pagesHTTPS:/WWW - Pnbmetlife.com/documents/met Invest - ULIP - Aug18 - tcm47-66816 PDFAbhinav VermaNo ratings yet

- TCBS Vietnam Investment Channels Update 3M2023Document14 pagesTCBS Vietnam Investment Channels Update 3M2023ÁnhTâmNo ratings yet

- Banking Sector 210202Document15 pagesBanking Sector 210202Brian StanleyNo ratings yet

- ValuationDocument4 pagesValuationRhea Mae CarantoNo ratings yet

- 2020-IBG-ARDocument148 pages2020-IBG-ARcathyandre2007No ratings yet

- Equitas Small Finance Bank Company UpdateDocument10 pagesEquitas Small Finance Bank Company Updatefinal bossuNo ratings yet

- Equity Market Update - December 2022Document32 pagesEquity Market Update - December 2022YasahNo ratings yet

- Complete Investment ProjectDocument115 pagesComplete Investment ProjectOyebola Akin-DeluNo ratings yet

- Union Bank of India: Performance HighlightsDocument7 pagesUnion Bank of India: Performance HighlightsKarthik SpNo ratings yet

- Complete Investment ProjectDocument113 pagesComplete Investment ProjectBashar DaoudNo ratings yet

- Gundlach Pres June 2017Document57 pagesGundlach Pres June 2017Zerohedge100% (6)

- Kotak Mahindra Bank: CMP: INR1060 TP: INR1,220 (+15%)Document12 pagesKotak Mahindra Bank: CMP: INR1060 TP: INR1,220 (+15%)suprabhattNo ratings yet

- Bond MKT 2024Document16 pagesBond MKT 2024Dương Quốc Đạt 12A1No ratings yet

- 2021 Outlook ENG OfficialDocument143 pages2021 Outlook ENG OfficialHa TrinhNo ratings yet

- Revising Estimates On Normalized Loan Growth Outlook Maintain BUY RatingDocument6 pagesRevising Estimates On Normalized Loan Growth Outlook Maintain BUY RatingJM CrNo ratings yet

- 2018 Roche RD ReportDocument27 pages2018 Roche RD ReportsyedNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- Listed Banks Earnings jump 95_ YoYDocument5 pagesListed Banks Earnings jump 95_ YoYM Ali MerchantNo ratings yet

- GGP Ackman Presentation Ira Sohn Conf 5-26-10Document89 pagesGGP Ackman Presentation Ira Sohn Conf 5-26-10fstreet100% (2)

- 2020 11 18 PH e Ssi PDFDocument8 pages2020 11 18 PH e Ssi PDFJNo ratings yet

- Bank Central Asia TBK: Loan Restructuring To Suppress NIMDocument6 pagesBank Central Asia TBK: Loan Restructuring To Suppress NIMValentinus AdelioNo ratings yet

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeBEACH SCUBA DETECTINGNo ratings yet

- Alpha ChartDocument2 pagesAlpha ChartLuan Nguyen100% (1)

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeEdner PatricNo ratings yet

- FlowsDocument8 pagesFlowsJaredNo ratings yet

- Tracking Performance of Small Finance Banks Against Financial Inclusion GoalsDocument30 pagesTracking Performance of Small Finance Banks Against Financial Inclusion GoalsNeelanjan MaitiNo ratings yet

- Five Key QuestionsDocument12 pagesFive Key QuestionsInternational Business TimesNo ratings yet

- Quality Valuation: Update Harga: Real-TimeDocument13 pagesQuality Valuation: Update Harga: Real-TimeambarNo ratings yet

- $1M Today 12.5 15.5% 20 YearsDocument4 pages$1M Today 12.5 15.5% 20 Yearsanna_meenaNo ratings yet

- Complete Investment ProjectDocument113 pagesComplete Investment ProjectAli IqbalNo ratings yet

- Corporate Factbook Altria - MODocument9 pagesCorporate Factbook Altria - MOTom RobertsNo ratings yet

- Solution Workshop #2Document12 pagesSolution Workshop #2ScribdTranslationsNo ratings yet

- Time Value of Money FV Solution (1 Solution)Document6 pagesTime Value of Money FV Solution (1 Solution)Manroop SinghNo ratings yet

- Axis Bank - LKP - 29.10.2020 PDFDocument12 pagesAxis Bank - LKP - 29.10.2020 PDFVimal SharmaNo ratings yet

- Factsheet Enf Apr-2024 enDocument2 pagesFactsheet Enf Apr-2024 enquangdatphungNo ratings yet

- Indian Overseas Bank: Performance HighlightsDocument6 pagesIndian Overseas Bank: Performance HighlightsHarshil MathurNo ratings yet

- 2024 05 03 PH e RrhiDocument9 pages2024 05 03 PH e Rrhiphilnabank1217No ratings yet

- Chapter 7 SwapsDocument22 pagesChapter 7 Swapsashutoshusa20No ratings yet

- What Is A Swap?: Scenario 1Document4 pagesWhat Is A Swap?: Scenario 1Mian ZainNo ratings yet

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Document12 pagesRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinNo ratings yet

- Power Pack BankingDocument26 pagesPower Pack BankingDev DugarNo ratings yet

- Fintech Barometer - Report by DLAI and CRIFDocument37 pagesFintech Barometer - Report by DLAI and CRIFsalgiashrenikNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenNo ratings yet

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenNo ratings yet

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenNo ratings yet

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenNo ratings yet

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenNo ratings yet

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenNo ratings yet

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenNo ratings yet

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenNo ratings yet

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenNo ratings yet

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenNo ratings yet

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenNo ratings yet

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenNo ratings yet

- 2018-04-23 The New Yorker PDFDocument92 pages2018-04-23 The New Yorker PDFNguyen100% (2)

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenNo ratings yet

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenNo ratings yet

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenNo ratings yet

- Energy From The Desert Ed-5 2015 LR PDFDocument171 pagesEnergy From The Desert Ed-5 2015 LR PDFNguyenNo ratings yet

- STIBET Applicationform U Ko-LaDocument3 pagesSTIBET Applicationform U Ko-LaNguyenNo ratings yet

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenNo ratings yet

- Volunteers in Arts and Culture Organizations in Canada in 2007Document26 pagesVolunteers in Arts and Culture Organizations in Canada in 2007NguyenNo ratings yet

- Tong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFDocument160 pagesTong Hop 100 Topics Cho Ielts Speaking by Ngocbach PDFNguyenNo ratings yet

- ACTA Maradero OrtegDocument42 pagesACTA Maradero OrtegSIKIUNo ratings yet

- Danh Sach Khach Hang Gui Tien Ngan Hang Vietcombank HCMDocument4 pagesDanh Sach Khach Hang Gui Tien Ngan Hang Vietcombank HCMNguyễn Thành LongNo ratings yet

- Buenaventura DurrutiDocument4 pagesBuenaventura Durrutis_th_s2952No ratings yet

- Civil War DBQDocument10 pagesCivil War DBQKevin Earlie100% (1)

- 3.31 Paraphrase Exercise-EchoDocument4 pages3.31 Paraphrase Exercise-EchoLSHJechoNo ratings yet

- Combined Footing Design in Ramamrutham Text BookDocument6 pagesCombined Footing Design in Ramamrutham Text BookSai Kiran Chowdary KakarlaNo ratings yet

- Speech To The Troops at TilburyDocument14 pagesSpeech To The Troops at TilburyAmmi Sirhc TeeNo ratings yet

- Đề Thi Học Kì 2 Tiếng Anh Lớp 7Document26 pagesĐề Thi Học Kì 2 Tiếng Anh Lớp 7BaotanNo ratings yet

- Im1023 - Ket Qua Giua KyDocument14 pagesIm1023 - Ket Qua Giua Ky0931414100azzaNo ratings yet

- Sopping Wet: County Soaked by Heavy DownpoursDocument28 pagesSopping Wet: County Soaked by Heavy DownpoursSan Mateo Daily JournalNo ratings yet

- DS Tiêm Mũi 2 ASTRA 21 H TươngDocument22 pagesDS Tiêm Mũi 2 ASTRA 21 H TươngNguyễn FourNo ratings yet

- The Battle For SyriaDocument1 pageThe Battle For Syriadruwid6No ratings yet

- Vaishnava Song Book-HindiDocument149 pagesVaishnava Song Book-Hindisulabhseth100% (1)

- Corinth Interpretive CenterDocument2 pagesCorinth Interpretive CenterBob AndrepontNo ratings yet

- B 0156 Celeski Special Air Warfare and The Secret War in Laos Air Commandos 1964 1975Document518 pagesB 0156 Celeski Special Air Warfare and The Secret War in Laos Air Commandos 1964 1975Anonymous Fsbwpsbjr100% (1)

- AfghanistanDocument31 pagesAfghanistanAakashParanNo ratings yet

- Response To Casablanca - Student PaperDocument3 pagesResponse To Casablanca - Student Paperljwolf_400216787No ratings yet

- Fighting For The Blue: The Wallace-Taylor-Williams Boys of IndianaDocument6 pagesFighting For The Blue: The Wallace-Taylor-Williams Boys of IndianaKraig McNuttNo ratings yet

- The Marines in Vietnam 1954-1973 An Anthology and Annotated BibliographyDocument389 pagesThe Marines in Vietnam 1954-1973 An Anthology and Annotated BibliographyBob Andrepont100% (5)

- Aircraft Manual IndexDocument41 pagesAircraft Manual IndexGhribi100% (2)

- Library of Congress - Pinkerton RecordsDocument53 pagesLibrary of Congress - Pinkerton RecordsBenson GreenNo ratings yet

- Child Soldiers PowerpointDocument13 pagesChild Soldiers Powerpointapi-310029384No ratings yet

- Cartas Gabriela-Victoria OcampoDocument95 pagesCartas Gabriela-Victoria OcampoArhanko100% (2)

- Frank Jesse DissertationDocument4 pagesFrank Jesse DissertationWhereCanIBuyResumePaperDesMoines100% (1)

- No. Name Fname Gfname Request - NoDocument24 pagesNo. Name Fname Gfname Request - Nohailomasegede27No ratings yet

- Battle of Cerro GordoDocument3 pagesBattle of Cerro GordoEUTOPÍA MÉXICONo ratings yet

- Night at The Museum Project ProposalDocument3 pagesNight at The Museum Project Proposalapi-270016009No ratings yet

- Dpe Thana CodeDocument14 pagesDpe Thana Codebiswajit_bplNo ratings yet