Professional Documents

Culture Documents

Preference Shares - July 7 2019

Preference Shares - July 7 2019

Uploaded by

Anonymous io6Sv9mF9y0 ratings0% found this document useful (0 votes)

17 views1 pageThe document provides closing market figures and commodity prices for various South African companies and exchange traded products. It includes details such as the closing price, day's price movement, high and low prices for the past 12 months, trading volume, and other financial metrics. The prices shown are in South African cents and represent data from 07 July 2019.

Original Description:

Preference Shares - July 7 2019

Original Title

Preference Shares - July 7 2019

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides closing market figures and commodity prices for various South African companies and exchange traded products. It includes details such as the closing price, day's price movement, high and low prices for the past 12 months, trading volume, and other financial metrics. The prices shown are in South African cents and represent data from 07 July 2019.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 pagePreference Shares - July 7 2019

Preference Shares - July 7 2019

Uploaded by

Anonymous io6Sv9mF9yThe document provides closing market figures and commodity prices for various South African companies and exchange traded products. It includes details such as the closing price, day's price movement, high and low prices for the past 12 months, trading volume, and other financial metrics. The prices shown are in South African cents and represent data from 07 July 2019.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

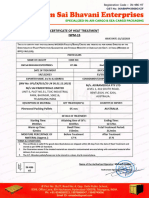

Markets and Commodity figures

07 July 2019

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2000000 0 0 0 0 0 14.3 2100000 1600000 0 0 0 0

KRHALF 800000 0 0 0 0 0 -3 850000 800000 0 0 0 0

KRQRTR 400000 0 0 0 0 0 -0.6 415000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 6.7 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 142290 2190 1.6 142290 142290 0 6.4 152670 129515 22.4 0 0 0.9

AFRICAGOLD 19525 -27 -0.1 19601 19397 1 16.1 20470 15805 136.9 0 0 0

AFRICAPALLAD 21785 274 1.3 21785 21524 1 73.2 22900 6668 2805 0 0 0

AFRICAPLATIN 11277 -264 -2.3 11277 11277 0 -0.1 12711 10111 1881.2 0 0 0

AFRICARHODIU 45934 -789 -1.7 46900 44799 1 52.2 51245 22222 444.1 0 0 0

AGLSBR 18 1 5.9 18 18 0 -35.7 31 13 17 0 0 0

AMIBIG50EX-S 1329 17 1.3 1329 1316 1 -0.1 5644 1195 20.7 0 0 1.2

AMIRLSTTEX-S 3808 0 0 3808 3808 0 -12.2 6900 1998 1 0 0 0

AMSSBP 4 0 0 4 4 0 -86.7 30 4 4 0 0 0

AMSSBQ 12 0 0 12 12 0 -58.6 34 9 12 0 0 0

ANGSBU 6 0 0 6 6 0 -79.3 29 3 6 0 0 0

ANGSBV 6 1 20 6 6 0 -76 25 5 5 0 0 0

ANGSBW 29 1 3.6 29 29 0 0 29 28 28 0 0 0

ASHBURTONGBL 4576 27 0.6 4599 4547 5 8.8 4987 3754 539 0 0 1.4

ASHBURTONINF 2062 6 0.3 2062 2050 81 1.3 2143 1918 329.7 0 0 2.5

ASHBURTONMID 706 -5 -0.7 710 703 16 -1.4 764 651 362.6 0 0 2.4

ASHBURTONTOP 5201 -21 -0.4 5219 5193 39 1 5576 4367 1633.9 0 0 1.5

ASHBURTONWOR 714 5 0.7 714 714 0 4.7 780 603 114.4 0 0 0.5

BHPSBP 14 2 16.7 14 14 0 -54.8 31 11 12 0 0 0

CORE DIVTRAX 2610 -4 -0.2 2621 2595 31 -5.7 3009 2485 296.9 0 0 0.8

CORE EWTOP40 4581 -31 -0.7 4620 4569 1 -4.5 4970 4230 124.8 0 0 1.1

CORE GLPROP 3893 26 0.7 3935 3860 40 12 4075 3330 477.3 0 0 2.7

CORE PREF 946 1 0.1 949 945 42 14.5 965 797 343.4 0 0 8.9

CORE S&P500 4238 4 0.1 4251 4208 55 14.1 4579 3500 818.2 0 0 1.3

CORE SAPY 5157 11 0.2 5176 5126 2 -6.9 5570 4824 161 0 0 6.5

CORE TOP50 2333 -16 -0.7 2345 2333 0 -1.4 2464 2041 1344.4 0 0 1.8

CORESHARESGL 1251 9 0.7 1260 1241 7 12.3 1310 1065 409.2 0 0 0.8

CORESHARESPR 1600 4 0.3 1604 1590 19 -7.7 1750 1500 267.2 0 0 7.3

DOLLARCSTDL 141660 1110 0.8 141880 141660 1 11.9 148350 121525 119.5 0 0 1.4

EXXSBT 11 0 0 11 11 0 -64.5 32 9 11 0 0 0

FSRSBV 16 0 0 16 16 0 -46.7 38 12 16 0 0 0

FSRSBW 26 0 0 26 26 0 -16.1 31 20 26 0 0 0

GFISBR 34 2 6.3 34 34 0 6.3 34 32 32 0 0 0

GFISBU 5 1 25 5 5 0 -84.8 33 2 4 0 0 0

HARSBT 4 0 0 4 4 0 -87.1 31 4 4 0 0 0

HARSBU 11 0 0 11 11 0 -62.1 29 9 11 0 0 0

IMPSBS 11 0 0 11 11 0 -65.6 32 10 11 0 0 0

KIOSBV 7 2 40 7 7 0 -77.4 32 5 5 0 0 0

KIOSBW 23 6 35.3 23 23 0 -28.1 44 16 17 0 0 0

KRCSTDLCRTFC 2050750 -3050 -0.1 2050750 2050750 0 14.5 2123200 1676500 683.2 0 0 0

MTNSBQ 26 0 0 26 26 0 -18.8 34 23 26 0 0 0

NEWFUNDSEQUI 3482 -46 -1.3 3508 3482 0 21.7 3632 2500 186.6 0 0 3

NEWFUNDSGOVI 6615 -26 -0.4 6700 6516 72 9.7 6999 5790 845.1 0 0 8.4

NEWFUNDSILBI 6870 -10 -0.1 6917 6870 1 3.7 6988 6555 61.9 0 0 2.6

NEWFUNDSMAPP 2196 -3 -0.1 2196 2191 1 0.6 2300 1610 39.7 0 0 2.6

NEWFUNDSNEWS 4952 2 0 4952 4952 0 -3.6 5356 4258 38.2 0 0 1.2

NEWFUNDSS&P 3293 17 0.5 3299 3282 0 -12.3 3798 3157 43.3 0 0 4.3

NEWFUNDSSHAR 325 -5 -1.5 325 325 0 0.3 350 227 51.4 0 0 2.4

NEWFUNDSSWIX 1749 -2 -0.1 1750 1749 1 -1.5 1952 1517 17.5 0 0 0.6

NEWFUNDSTRAC 2544 -1 0 2549 2539 54 7.3 2549 2367 211.7 0 0 4.7

NEWGOLD 11206 -214 -1.9 11486 11175 1559 -0.1 12648 10474 12425 0 0 0

NEWGOLDISSUE 18691 -19 -0.1 18851 18675 54 15.6 19398 15111 10847.7 0 0 0

NEWGOLDPLLDM 21776 290 1.3 21776 21480 1 72.9 22838 11564 985.1 0 0 0

NFEQUITYVALU 961 -6 -0.6 961 961 0 -4.7 1038 882 116.2 0 0 2.6

NFLOWVLTLTY 1033 -4 -0.4 1033 1033 0 0.4 1062 907 120.8 0 0 2.3

NFVMDFNSV 976 -3 -0.3 976 976 0 0 997 951 50.8 0 0 0.5

NFVMHIGH 991 -7 -0.7 995 991 0 4.3 1025 917 53.6 0 0 0.1

NFVMMDRT 943 -6 -0.6 943 943 0 0 968 879 52.8 0 0 0.4

NPNSBX 14 0 0 14 14 0 -60 37 14 14 0 0 0

NPNSBY 25 -1 -3.8 25 25 0 -21.9 44 25 26 0 0 0

SATRIX40PRTF 5185 -38 -0.7 5216 5185 96 0.5 5425 4400 8847.3 0 0 1.2

SATRIXDIVIPL 250 -5 -2 257 250 362 4.2 267 226 1719.7 0 0 1.2

SATRIXFINI 1701 -10 -0.6 1715 1694 81 6 1811 1502 789.4 0 0 2.7

SATRIXILBI 589 1 0.2 591 587 16 4.6 601 552 94.2 0 0 1.5

SATRIXINDI 7075 10 0.1 7101 7044 38 -5.3 7900 6090 1966.8 0 0 1.2

SATRIXMMNTM 1052 -8 -0.8 1061 1047 14 10.7 1095 906 19.2 0 0 0.1

SATRIXMSCI 4151 12 0.3 4170 4135 184 12.3 4395 3350 1708.2 0 0 0

SATRIXMSCIEM 4030 10 0.2 4047 4010 16 7.3 4248 3557 537.6 0 0 0

SATRIXNASDAQ 6211 28 0.5 6221 6184 8 16.4 6639 4896 397 0 0 0

SATRIXPRTFL 1587 3 0.2 1592 1581 13 -15.4 1900 1490 240.3 0 0 6.3

SATRIXQLTY 848 -6 -0.7 848 842 3 -1.9 963 780 146.3 0 0 2.8

SATRIXRAFI40 1485 -11 -0.7 1497 1480 27 4.1 1554 1261 1039.4 0 0 1.7

SATRIXRESI 4689 -64 -1.3 4712 4676 3 10.6 5002 3709 398.7 0 0 1.3

SATRIXS&P500 4179 27 0.7 4195 4155 33 16.4 4401 3406 605.1 0 0 0

SATRIXSWIXTO 1103 -1 -0.1 1109 1098 1 -3.3 1252 954 420.8 0 0 1.2

SBKSBP 4 0 0 4 4 0 -84 25 4 4 0 0 0

SBKSBQ 20 2 11.1 20 20 0 -44.4 37 14 18 0 0 0

SGLSBQ 26 3 13 26 26 0 -43.5 63 21 23 0 0 0

SGLSBR 13 1 8.3 13 13 0 -45.8 24 11 12 0 0 0

SGLSBS 29 2 7.4 29 29 0 7.4 29 27 27 0 0 0

SHPSBR 35 2 6.1 35 35 0 9.4 47 22 33 0 0 0

SOLSBR 45 2 4.7 45 45 0 32.4 47 9 43 0 0 0

SOLSBS 33 1 3.1 33 33 0 17.9 34 24 32 0 0 0

STANLIB 5007 4 0.1 5040 4972 6 -7.2 6485 4675 95.6 0 0 6.9

STANLIBBOND 7099 -26 -0.4 7099 7099 0 2.8 7148 6887 7.1 0 0 0

STANLIBG7GOV 7888 15 0.2 7888 7856 0 8.2 8377 6929 7.2 0 0 1.8

STANLIBGLOBA 1955 -1 -0.1 1999 1955 129 9.6 2100 1658 16.1 0 0 5.5

STANLIBMSCI 4149 19 0.5 4149 4122 0 12.3 4545 3473 63.3 0 0 0

STANLIBS&P50 20926 123 0.6 20991 20926 0 16.2 23098 15318 17.7 0 0 0

STANLIBSWIX4 1101 -2 -0.2 1101 1096 3 -3.6 1193 905 1945.3 0 0 1.8

STANLIBTOP40 5187 -22 -0.4 5197 5183 0 0.9 5415 4305 721.6 0 0 1.7

SYGNIAITRIX 2555 11 0.4 2580 2549 34 12 2997 1985 621.6 0 0 0

SYGNIAITRIXG 4013 5 0.1 4036 4013 7 13.6 4201 3400 294.7 0 0 0.7

SYGNIAITRIXS 4266 27 0.6 4268 4246 32 15.1 4612 3505 964 0 0 0.8

SYGNIAITRIXT 5236 -24 -0.5 5238 5236 0 2.3 5420 4218 220.9 0 0 1.4

TOPSBS 5 0 0 5 5 0 -86.1 40 5 5 0 0 0

TOPSBT 21 1 5 21 20 174 -8.7 46 15 20 0 0 0

TOPSBU 13 0 0 13 13 0 -45.8 24 10 13 0 0 0

TOPSBV 24 1 4.3 24 24 0 9.1 24 22 23 0 0 0

TOPSKR 713 59 9 713 713 0 13.7 713 627 654 0 0 0

TOPSKS 896 59 7 896 896 0 10.6 896 810 837 0 0 0

TOPSKX 17 0 0 0 0 0 0 1666 17 17 0 0 0

TOPSKZ 549 58 11.8 552 502 160 0 1170 32 491 0 0 0

WHLSBP 25 -2 -7.4 25 25 0 -13.8 53 19 27 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1355 0 0 0 0 0 0.4 1400 1300 40.7 0 0 7.5

AFRICANOVER 1000 0 0 0 0 0 -4.9 1000 1000 2.8 0 0 0.6

BARWORLD6%PR 123 0 0 0 0 0 1.7 123 123 0.5 0 0 9.8

CAPITEC-P 9951 1 0 10200 9951 0 17.1 10990 8000 90 0 0 8.4

CAXTON-P 19000 0 0 0 0 0 0 19000 16000 9.5 0 0 2.6

DISC-B-P 9599 -1 0 9599 9599 3 16.4 10000 8090 768 0 0 10.5

FIRSTRANDB-P 8400 -40 -0.5 8440 8356 34 5.7 9100 7500 3798 0 0 9

FOSCHINI 126 0 0 0 0 0 1.6 126 124 0.3 0 0 10.3

GRINDRODPREF 8000 250 3.2 8000 8000 2 14.1 9000 6960 573.5 0 0 11.1

IBRDMBLPRF1 101532 32 0 101532 101532 1 0 101748 100279 346.8 0 0 5.5

INVESTEC 8600 0 0 8600 8599 3 17.8 9500 7151 1328.5 0 0 9.8

INVESTECPREF 8850 -450 -4.8 8850 8850 1 -22.4 11100 8850 256.2 0 0 3.5

INVICTA-P 8800 100 1.1 8800 8700 6 12.1 9450 7475 652.5 0 0 12.4

LIBERTY11C 108 0 0 0 0 0 0 145 98 16.2 0 0 10.2

NAMPAK6%PREF 126 0 0 0 0 0 0.8 126 120 0.5 0 0 9.5

NAMPAK6,5%PR 131 0 0 0 0 0 18 131 121 0.1 0 0 9.9

NEDBANKPREF 955 0 0 965 955 336 6.2 985 840 3421.6 0 0 8.8

NETCAREPREF 8150 0 0 8150 8150 2 19 8350 6840 529.8 0 0 10.2

PSGSERV 8325 0 0 0 0 0 17.3 8800 6900 1449.9 0 0 10.1

RECMANDCLBR 1605 6 0.4 1605 1599 7 -17.7 2000 1584 757.9 0 0 0

REXTRFRM 130 0 0 0 0 0 -35 130 121 0.2 0 0 4.6

SASFIN-P 7780 -35 -0.4 7780 7780 0 15.3 8000 6660 140.5 0 0 10.7

INVLTD 1124755 -4183 -0.4 1124755 1124755 0 9.1 1137098 1031139 12.4 0 0 0

UBSNPNEX 76774 -701 -0.9 76774 76774 0 0 109497 42954 774.8 0 0 0

INVLTD 1119377 8757 0.8 1119377 1119377 0 7.8 1137098 1031139 12.2 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBRMII 1695 7 0.4 1695 1690 0 0 1695 1602 337.6 0 0 0

DBSTBXX6 5996 215 3.7 5996 5996 0 0 6956 2915 289.1 0 0 27.6

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

UBSNPNEX 90594 -2951 -3.2 91493 90594 14 0 94794 42954 935.5 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBMSCIAFETN 11325 75 0.7 11325 11325 0 3.4 12250 10745 2250 0 0 0

DBMSCICHETN 7623 88 1.2 7623 7450 1 16 41275 6022 1507 0 0 0

DBMSCIEMETN 6347 22 0.3 6347 6250 0 7 47325 5700 1265 0 0 0

FRKBONDGOLD 1720600 -22900 -1.3 1720600 1720600 0 1.3 1942200 1612300 2434.3 0 0 0

FRSFRPT9JUN1 115500 500 0.4 115500 115500 0 -6.3 138800 110700 846 0 0 0

GOLDCMMDTY-L 17986 -194 -1.1 18079 17939 0 -0.6 20534 16911 181.8 0 0 0

IBLUSDZAROCT 134740 -1916 -1.4 134740 134740 0 3.3 145570 116000 478.3 0 0 0.9

IBSWX40TR2ET 18655 281 1.5 18655 18655 0 -0.8 20256 1 918.7 0 0 0

IBTOP40CLIQU 123962 -74 -0.1 123962 123962 0 4.1 130581 119103 1.2 0 0 0

IBTOP40TR2ET 7360 112 1.5 7360 7360 0 0.1 7819 1 924.1 0 0 0

IBVR1ETN 127893 22 0 127893 127893 10 6.8 127893 119796 2129.1 0 0 0

NEWWAVEETN 11088 66 0.6 11088 11088 0 -6.4 13515 10267 23 0 0 0

NEWWAVEEUROE 1560 -22 -1.4 1565 1554 0 3.2 1706 1422 51.5 0 0 0

NEWWAVEGBPET 1752 -21 -1.2 1752 1752 0 3.6 1911 1615 128.7 0 0 0.1

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Aa 0397a Acc20 Sulzer Rta Instruction ManualDocument141 pagesAa 0397a Acc20 Sulzer Rta Instruction ManualMahmoud KhalafNo ratings yet

- Preference Shares - July 16 2019Document1 pagePreference Shares - July 16 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 18 2019Document1 pagePreference Shares - July 18 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - March 24 2019Document1 pagePreference Shares - March 24 2019Anonymous 7A1d7fjj3No ratings yet

- Preference Shares - March 26 2019Document1 pagePreference Shares - March 26 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 14 2019Document1 pagePreference Shares - April 14 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 4 2019Document1 pagePreference Shares - July 4 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 19 2019Document1 pagePreference Shares - March 19 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 23 2019Document1 pagePreference Shares - July 23 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 14 2019Document1 pagePreference Shares - July 14 2019Anonymous C13oy8No ratings yet

- Preference Shares - July 15 2019Document1 pagePreference Shares - July 15 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 29 2019Document1 pagePreference Shares - July 29 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 2 2019Document1 pagePreference Shares - September 2 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 22 2019Document1 pagePreference Shares - July 22 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 2 2019Document1 pagePreference Shares - June 2 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - May 26 2019Document1 pagePreference Shares - May 26 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 8 2019Document1 pagePreference Shares - July 8 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - June 30 2019Document1 pagePreference Shares - June 30 2019Anonymous gJMNpPtRmXNo ratings yet

- Preference Shares - April 9 2019Document1 pagePreference Shares - April 9 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 4 2019Document1 pagePreference Shares - April 4 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 25 2019Document1 pagePreference Shares - March 25 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 24 2019Document1 pagePreference Shares - July 24 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - July 17 2019Document1 pagePreference Shares - July 17 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 15 2019Document1 pagePreference Shares - September 15 2019Anonymous yid6usiNNo ratings yet

- Preference Shares - April 15 2019Document1 pagePreference Shares - April 15 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - April 10 2019Document1 pagePreference Shares - April 10 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 27 2019Document1 pagePreference Shares - March 27 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 6 2019Document1 pagePreference Shares - June 6 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 21 2019Document1 pagePreference Shares - March 21 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 11 2019Document1 pagePreference Shares - April 11 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 17 2019Document1 pagePreference Shares - March 17 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 1 2019Document1 pagePreference Shares - September 1 2019Anonymous 6g229lSxNo ratings yet

- Preference Shares - July 27 2018Document1 pagePreference Shares - July 27 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - October 3 2019Document1 pagePreference Shares - October 3 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 18 2019Document1 pagePreference Shares - March 18 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 5 2019Document1 pagePreference Shares - August 5 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 19 2019Document1 pagePreference Shares - August 19 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - May 29 2019Document1 pagePreference Shares - May 29 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 26 2019Document1 pagePreference Shares - July 26 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - September 18 2019Document1 pagePreference Shares - September 18 2019Anonymous MPsxhBNo ratings yet

- Metals - March 31 2019Document1 pageMetals - March 31 2019Anonymous 7A1d7fjj3No ratings yet

- Preference Shares - September 9 2019Document1 pagePreference Shares - September 9 2019Lisle Daverin BlythNo ratings yet

- Preference Shares - May 28 2019Document1 pagePreference Shares - May 28 2019Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - April 7 2019Document1 pagePreference Shares - April 7 2019Anonymous TTcQLHBuu4No ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- PreferenceShares - June 26 2017Document1 pagePreferenceShares - June 26 2017Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 28 2019Document1 pagePreference Shares - March 28 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - September 27 2017Document1 pagePreference Shares - September 27 2017Tiso Blackstar GroupNo ratings yet

- PreferenceShares - August 24 2017Document1 pagePreferenceShares - August 24 2017Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 12 2019Document1 pagePreference Shares - August 12 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - August 6 2019Document1 pagePreference Shares - August 6 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - March 11 2019Document1 pagePreference Shares - March 11 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - April 8 2019Document1 pagePreference Shares - April 8 2019Tiso Blackstar GroupNo ratings yet

- Preference Shares - June 3 2019Document1 pagePreference Shares - June 3 2019Lisle Daverin BlythNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - October 17 2018Document1 pagePreference Shares - October 17 2018Tiso Blackstar GroupNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- Preference Shares - October 3 2018Document1 pagePreference Shares - October 3 2018Tiso Blackstar GroupNo ratings yet

- Preference Shares - July 31 2019Document1 pagePreference Shares - July 31 2019Tiso Blackstar GroupNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- Fixed Deposits - July 7 2019Document1 pageFixed Deposits - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Metals - July 7 2019Document1 pageMetals - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Liberty - July 7 2019Document1 pageLiberty - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Fuel Prices - July 7 2019Document1 pageFuel Prices - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Forward Rates - July 7 2019Document2 pagesForward Rates - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Cross Rates - July 7 2019Document1 pageCross Rates - July 7 2019Anonymous io6Sv9mF9yNo ratings yet

- Hand-Held Terminal: (Catalog Number 1747-PT1)Document465 pagesHand-Held Terminal: (Catalog Number 1747-PT1)Daniel LaraNo ratings yet

- Materials Science: Material Selection Classes of Material Properties Properties of MaterialsDocument23 pagesMaterials Science: Material Selection Classes of Material Properties Properties of MaterialsAtul PandeyNo ratings yet

- MAS Running Calculator v2.1Document7 pagesMAS Running Calculator v2.1Ariadna Alegre MirallesNo ratings yet

- Let's Travel - October November 2017Document140 pagesLet's Travel - October November 2017Aryan MahtoNo ratings yet

- Eo Weld Fitting 4100e001Document11 pagesEo Weld Fitting 4100e001sandeepNo ratings yet

- Curriculum Vitae: 1 .Personal DataDocument2 pagesCurriculum Vitae: 1 .Personal DataMamadou Gueye100% (1)

- Borchert Epochs SummaryDocument5 pagesBorchert Epochs SummaryDafri EsfandiariNo ratings yet

- Brno 2dec10 EpmDocument11 pagesBrno 2dec10 EpmManisha GamitNo ratings yet

- Kuraye Akuiyibo Plea AgreementDocument7 pagesKuraye Akuiyibo Plea AgreementEmily BabayNo ratings yet

- Modeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKDocument5 pagesModeling and Simulation PMSG Based On Wind Energy Conversion System in MATLAB/SIMULINKRITWIK MALNo ratings yet

- Future Prospects of Duck Production in Asia PDFDocument14 pagesFuture Prospects of Duck Production in Asia PDFridzwanmsNo ratings yet

- The Latest Thing in Black and White - Smart Colour CapabilityDocument12 pagesThe Latest Thing in Black and White - Smart Colour CapabilityAhmad YousefNo ratings yet

- 520 qs001 - en e PDFDocument36 pages520 qs001 - en e PDFvantiencdtk7No ratings yet

- Unit 1-At6402 Automotive ChassisDocument39 pagesUnit 1-At6402 Automotive ChassisSathis KumarNo ratings yet

- Sari ProjectDocument96 pagesSari ProjectRamesh AnkathiNo ratings yet

- Chapter 2. Zones: City of Grover Beach Zoning Code 2-1 Public Review Draft - June 10, 2011Document14 pagesChapter 2. Zones: City of Grover Beach Zoning Code 2-1 Public Review Draft - June 10, 2011Ranga KrishnanNo ratings yet

- RMC Online Washing System Industrial Gas TurbineDocument3 pagesRMC Online Washing System Industrial Gas TurbinepayamzarNo ratings yet

- Slac Rpms 2022Document5 pagesSlac Rpms 2022JESSA MARIE BARIN50% (2)

- Elena Alina Popa: Key StrengthsDocument3 pagesElena Alina Popa: Key StrengthsElena Alina PopaNo ratings yet

- MeasurIT Flexim ADM6725 Application Hot Buttermilk 0809Document1 pageMeasurIT Flexim ADM6725 Application Hot Buttermilk 0809cwiejkowskaNo ratings yet

- MAKAUT 2020-2021 ODD Sem Theory Exam Schedule - All B.Tech BSC BCA and MTechDocument84 pagesMAKAUT 2020-2021 ODD Sem Theory Exam Schedule - All B.Tech BSC BCA and MTechArpan DasNo ratings yet

- Configuring Intergraph Smart 3D Application Servers and Databases CreationsDocument20 pagesConfiguring Intergraph Smart 3D Application Servers and Databases CreationsAnonymous WCG2HjPybJNo ratings yet

- Numerical Modeling and Optimization of Condensate Banking Treatment in The Hydraulic-Fractured Shale Gas Condensate ReservoirDocument18 pagesNumerical Modeling and Optimization of Condensate Banking Treatment in The Hydraulic-Fractured Shale Gas Condensate ReservoirFredy Andres Narvaez BohorquezNo ratings yet

- Rehabilitation EiaDocument46 pagesRehabilitation EiaTimothy KimemiaNo ratings yet

- Veova10 - MSDSDocument8 pagesVeova10 - MSDSMohamed HalemNo ratings yet

- 3210 HT 21-12-2023 SPLDocument1 page3210 HT 21-12-2023 SPLVishnu Vardhan ANo ratings yet

- Bidding Document Lot 16B. Gondanglegi-Sp. Balekambang (B) - 101-201Document101 pagesBidding Document Lot 16B. Gondanglegi-Sp. Balekambang (B) - 101-201Nusantara GroupNo ratings yet

- Louisiana Man Gets Charges Dismissed For Using FacebookDocument3 pagesLouisiana Man Gets Charges Dismissed For Using FacebookPR.comNo ratings yet

- Chapter 2 Major Components: Page 1 of 28Document28 pagesChapter 2 Major Components: Page 1 of 28joe wiillsonNo ratings yet