Professional Documents

Culture Documents

SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)

SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)

Uploaded by

phaser2k10Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)

SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)

Uploaded by

phaser2k10Copyright:

Available Formats

SAMPLE HOURLY: Personnel Activity Report (Time & Effort Report)

Organization Name: Weekly/Pay Period Ending:

Employee's Name: Total Possible Hours Per Week:

Number of Hours

Employment Activity

Worked

A) Funded by NEA Award #

Regular Hours

Vacation/Sick/Other Leave (allowable if such leave is included in compensation)

SUBTOTAL A:

B) Supported by other NEA Funding. (There can be no overlapping cost among Federal awards.)

Award #:

Award #:

Award #:

SUBTOTAL B:

C) Work not funded by the NEA or other Federal Awards

Regular Hours

Vacation/Sick/Other Leave

SUBTOTAL C:

GRAND TOTAL Hours Worked for the Period (A + B + C)

Employee's Signature and Date:

Supervisor's Signature and Date:

In preparing personnel activity reports, please note the following:

1. The reports must be based on an after-the-fact determination of the employee's actual activities (i.e., these

cannot be estimated in advance). For example, the distribution of time might be determined based on notes

from personal calendars and/or reasonable estimates of time spent on various activities.

2. All of the employee's compensated time must be accounted for in these reports. This would include time

spent on activities in addition to the Arts Endowment-supported project(s), as well as leave

(sick/vacation/holiday), administrative duties, etc. NOTE: For nonprofessional employees, you must also

maintain records indicating the total number of hours worked each day in conformance with the Fair Labor

Standards Act (29 CFR Part 516).

3. The reports must be signed by the employee and a responsible supervisory official.

4. Reports must coincide with one or more pay periods and be used to reconcile salary and fringe benefit costs

to appropriate accounts on a regular (at least monthly) basis.

5. Unless otherwise specified in the award document or if you are on an alternative method of funding, the Arts

Endowment waives the requirement to maintain formal personnel activity reports for organizations receiving an

award of less than $50,000 (or an award given earlier than FY 05 of $25,000 or less).

3/23/10

You might also like

- Tugas Sipi Kelompok 5 - There Be Thieves in Texas!Document25 pagesTugas Sipi Kelompok 5 - There Be Thieves in Texas!wlseptiara100% (2)

- Amazon Stock RSU Global Agreement PDFDocument27 pagesAmazon Stock RSU Global Agreement PDFlindytindylindtNo ratings yet

- Advanced Accounting Vol 2 2014 Edition Baysa-LupisanDocument110 pagesAdvanced Accounting Vol 2 2014 Edition Baysa-LupisanIzzy B100% (4)

- Adjusting Entries Questions and AnswersDocument28 pagesAdjusting Entries Questions and AnswersAnonymous 17L3cj75% (20)

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- Performance Appraisal 2Document15 pagesPerformance Appraisal 2Venna KittuNo ratings yet

- 6 On 2 Off Rotating Shift ScheduleDocument11 pages6 On 2 Off Rotating Shift ScheduleAchmad AlbarNo ratings yet

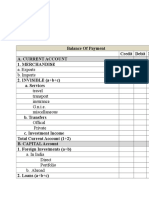

- BOP NumericalsDocument7 pagesBOP NumericalsSushobhan DasNo ratings yet

- Critical Path Method PDFDocument18 pagesCritical Path Method PDFRupesh KaushikNo ratings yet

- Ch1 Automation & Control1Document16 pagesCh1 Automation & Control1Mohamed Sayed AbdoNo ratings yet

- Earned Value CalculationDocument1 pageEarned Value CalculationRupesh KaushikNo ratings yet

- Excel To WBSDocument8 pagesExcel To WBSalfri121No ratings yet

- Project Mobilization ProcessDocument4 pagesProject Mobilization ProcessJoshua ZapateroNo ratings yet

- Requisition FormDocument1 pageRequisition FormAdnan AzharNo ratings yet

- Process Engineer III - V Basic FunctionDocument4 pagesProcess Engineer III - V Basic FunctionmessiNo ratings yet

- Job Description: Project EngineerDocument2 pagesJob Description: Project EngineerRichard GacitúaNo ratings yet

- Project Completion ReportDocument1 pageProject Completion Reportvixit thakurNo ratings yet

- TSPi Workbook 20041202Document37 pagesTSPi Workbook 20041202Knows LeeNo ratings yet

- Senior Technician Maintenance Generic JDDocument4 pagesSenior Technician Maintenance Generic JDFaizan ArshadNo ratings yet

- Performance Management: Observation and Feedback (Coaching)Document12 pagesPerformance Management: Observation and Feedback (Coaching)Mayank GodaraNo ratings yet

- Training Manual 52 Days Tue 2/8/22 Thu 13/10/22Document6 pagesTraining Manual 52 Days Tue 2/8/22 Thu 13/10/22Syazwan HafidziNo ratings yet

- Job Description - Project Engineer ElectricalDocument1 pageJob Description - Project Engineer ElectricalsamveedNo ratings yet

- Human Resource Management Session 3 Job AnalysisDocument31 pagesHuman Resource Management Session 3 Job AnalysisbattlestrokerNo ratings yet

- PETROS Code of Conduct and Business EthicsDocument33 pagesPETROS Code of Conduct and Business EthicsLee Kuok NgeiNo ratings yet

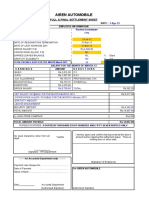

- FULL AND FINAL SETTLEMENT - RachnaDocument3 pagesFULL AND FINAL SETTLEMENT - Rachnapooja sankhalaNo ratings yet

- Disciplinary Proceedings Monitoring System: IntroducingDocument15 pagesDisciplinary Proceedings Monitoring System: IntroducingRumaisa shah100% (1)

- Template - Table of KPI For HR ManagerDocument14 pagesTemplate - Table of KPI For HR ManagerDina Abd Elhamid RadwanNo ratings yet

- Performance AppraisalDocument3 pagesPerformance AppraisalJohny George MalayilNo ratings yet

- DEVSPARK LABS HR PolicyDocument6 pagesDEVSPARK LABS HR Policyfarwa.atif47No ratings yet

- Human Resources: Standard Operating ProcedureDocument11 pagesHuman Resources: Standard Operating ProcedureSreekanth SNo ratings yet

- Control Accounts, Work Packages, Planning PackagesDocument11 pagesControl Accounts, Work Packages, Planning PackageskbaltimoreNo ratings yet

- MISA - Service Manual (9th Edition) en V3Document147 pagesMISA - Service Manual (9th Edition) en V3abdullah zackariahNo ratings yet

- Manpower Requisition Form PDFDocument2 pagesManpower Requisition Form PDFsandhwani38930% (1)

- What This Is: INTRODUCTION: Planning Worksheet For A Review MeetingDocument4 pagesWhat This Is: INTRODUCTION: Planning Worksheet For A Review MeetingRizki ApriliawatiNo ratings yet

- Risk, NPV and IrrDocument22 pagesRisk, NPV and IrrLinda Chow100% (1)

- IT RQ NoSign FinalTemp 13 Dec 03Document1 pageIT RQ NoSign FinalTemp 13 Dec 03Chau NamNo ratings yet

- Sop HRDocument9 pagesSop HRPrecious Mercado QuiambaoNo ratings yet

- PSB Promotion GuidelinesDocument24 pagesPSB Promotion GuidelinesPranav RaiNo ratings yet

- Resignation LettersDocument1 pageResignation Letterssaravanand1983No ratings yet

- Performance EvaluationDocument13 pagesPerformance Evaluationbsh08070No ratings yet

- Flow ChartDocument9 pagesFlow ChartWilliam ProvidoNo ratings yet

- HR Manual 2021 PDFDocument65 pagesHR Manual 2021 PDFekraam mohammedNo ratings yet

- Process of HR Dept.Document5 pagesProcess of HR Dept.VINAY SINGH100% (1)

- Employee Exit ChecklistDocument1 pageEmployee Exit ChecklistQuach Manh ThuongNo ratings yet

- Supervisor'S Guide To The Performance Management AND Appraisal ProcessDocument18 pagesSupervisor'S Guide To The Performance Management AND Appraisal ProcessMasudur RahmanNo ratings yet

- Chur Human Resource ProcessDocument5 pagesChur Human Resource Processvickyanam1978No ratings yet

- Asyad Financial AnalysisDocument9 pagesAsyad Financial AnalysisshawktNo ratings yet

- HR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and AcceptedDocument6 pagesHR Employees and Other Department Managers To Learn Whether Certain Policies and Procedures Are Understood, Practiced and Acceptedzeeshanshani1118No ratings yet

- Project ReportingDocument5 pagesProject ReportingRudolf WindischNo ratings yet

- Handbook 2018Document40 pagesHandbook 2018api-361701088No ratings yet

- Missed Punch FormDocument1 pageMissed Punch FormJoby Mani JimmyNo ratings yet

- Medical Policy - BITS PilaniDocument6 pagesMedical Policy - BITS PilaniSumit SrivastavaNo ratings yet

- Project Execution PlanDocument1 pageProject Execution PlanVirneDalisayNo ratings yet

- QuestionnaireDocument2 pagesQuestionnairemonish_bhutaniNo ratings yet

- Entry Process For New EmployeeDocument2 pagesEntry Process For New EmployeeArpan Gupta100% (1)

- Career Pathways TemplateDocument4 pagesCareer Pathways TemplateFaula Iman SitompulNo ratings yet

- 0815 Fire Employee Evaluation FormDocument9 pages0815 Fire Employee Evaluation FormXavier Noël DushimimanaNo ratings yet

- Internship Evaluation FormDocument3 pagesInternship Evaluation FormSharlene GoticoNo ratings yet

- 4.5 Perform Integrated Change ControlDocument5 pages4.5 Perform Integrated Change ControlDessy AgustinNo ratings yet

- Appraisal ProcessDocument6 pagesAppraisal ProcessSushan GanasanNo ratings yet

- Work Eveluation SheetDocument5 pagesWork Eveluation SheetSagar Paul'gNo ratings yet

- Induction Policy For New Employees 782 205Document12 pagesInduction Policy For New Employees 782 205mehtaNo ratings yet

- Manpower Requisition (Project Cordinator-HQ)Document2 pagesManpower Requisition (Project Cordinator-HQ)ruhul01No ratings yet

- Chapter 3Document14 pagesChapter 3fhagos003No ratings yet

- Chapter Four Payroll in ETHDocument11 pagesChapter Four Payroll in ETHMiki AberaNo ratings yet

- Revoobit - Extended Trial Balance 2022Document3 pagesRevoobit - Extended Trial Balance 2022NURUL AIN EDIANNo ratings yet

- Homo CapensisDocument24 pagesHomo CapensisJoshua Carroll50% (2)

- 50T Drop Table SEC RailwayDocument28 pages50T Drop Table SEC RailwaymailbkraoNo ratings yet

- Audit of LiabDocument9 pagesAudit of LiabCielo Mae Parungo0% (1)

- Vanderbilt Journal of Entertainment Law & Practice. Volume 2, Number 1. Winter, 2000.Document133 pagesVanderbilt Journal of Entertainment Law & Practice. Volume 2, Number 1. Winter, 2000.Steven_Lopez123No ratings yet

- Mythical Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMythical Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000No ratings yet

- Accounts - How To Clear The Historical Balancing AccountDocument2 pagesAccounts - How To Clear The Historical Balancing AccountSatwika AdhiNo ratings yet

- Jurnal Dennys Kumala Arnemy - FAKTOR-FAKTOR YANG MEMPENGARUHI PENERIMAAN OPINI AUDIT GOING CONCERN PADA PERUSAHAAN MANUFAKTUR (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia tahun 2013-2017)Document18 pagesJurnal Dennys Kumala Arnemy - FAKTOR-FAKTOR YANG MEMPENGARUHI PENERIMAAN OPINI AUDIT GOING CONCERN PADA PERUSAHAAN MANUFAKTUR (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia tahun 2013-2017)dennys arnemyNo ratings yet

- 6807-1295 - Mr. Rambabu Prasad GuptaDocument2 pages6807-1295 - Mr. Rambabu Prasad GuptaMahesh SapkotaNo ratings yet

- Case Study 2Document12 pagesCase Study 2IVYAYBSNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- FEMA Overview - Vijay Gupta - June 2019 PDFDocument58 pagesFEMA Overview - Vijay Gupta - June 2019 PDFAsimNo ratings yet

- Unit I Introduction To Marketing FinanceDocument3 pagesUnit I Introduction To Marketing Financerajesh laddhaNo ratings yet

- Nursery Care Corp Vs City of ManilaDocument2 pagesNursery Care Corp Vs City of ManilaCarlu YooNo ratings yet

- Commrev CompilationDocument11 pagesCommrev CompilationAC SubijanoNo ratings yet

- Trial CombineDocument27 pagesTrial CombineJagdish Sharma CANo ratings yet

- Solved Shannon Signs A 100 000 Contract To Develop A Plan ForDocument1 pageSolved Shannon Signs A 100 000 Contract To Develop A Plan ForAnbu jaromiaNo ratings yet

- Chapter - Iii An Introduction To Banking and Banking ServicesDocument28 pagesChapter - Iii An Introduction To Banking and Banking ServicesVijay KumarNo ratings yet

- Carrigan Coglianese 2015 George J. StiglerDocument13 pagesCarrigan Coglianese 2015 George J. StiglerkhaledNo ratings yet

- GST Invoice Format With Bank DetailsDocument24 pagesGST Invoice Format With Bank DetailsTarun GuptaNo ratings yet

- Goods Receipt ReversalDocument6 pagesGoods Receipt ReversalRahul JainNo ratings yet

- Keywords For LICDocument95 pagesKeywords For LICVivek SharmaNo ratings yet

- BADVAC1X - MOD 2 Conso FS Date of AcqDocument6 pagesBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNo ratings yet

- Strategic Pricing: Coordinating The Drivers of ProfitabilityDocument26 pagesStrategic Pricing: Coordinating The Drivers of ProfitabilityBien GolecruzNo ratings yet