Professional Documents

Culture Documents

Remedial Quiz

Remedial Quiz

Uploaded by

Nadine VilloserCopyright:

Available Formats

You might also like

- JAMDocument76 pagesJAMArvin AbyadangNo ratings yet

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- This Study Resource Was: Problem 4-17Document3 pagesThis Study Resource Was: Problem 4-17Jamaica David100% (1)

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- Retirement of A Partner 1Document1 pageRetirement of A Partner 1Vonna TerribleNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- AdFAR.701 - Partnership Accounting - OnlineDocument6 pagesAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocument4 pagesModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNo ratings yet

- Batohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossDocument7 pagesBatohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossivankingbachoNo ratings yet

- Name: Date: Subject: Section and Time:: Problem 1Document16 pagesName: Date: Subject: Section and Time:: Problem 1Marie GarpiaNo ratings yet

- AFAR - 1.0 Ul Cpa Review Center R.D.BalocatingDocument18 pagesAFAR - 1.0 Ul Cpa Review Center R.D.Balocatingfghhnnnjml100% (1)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- Building An Organization Capable of Good Strategy ExecutionDocument11 pagesBuilding An Organization Capable of Good Strategy Executionhendry noven100% (1)

- Digital Marketing Swot AnalysisDocument47 pagesDigital Marketing Swot AnalysisGolamRabbane100% (2)

- Commerce Stage 5 Scope and Sequence 2020Document3 pagesCommerce Stage 5 Scope and Sequence 2020api-505729019No ratings yet

- Quiz in PartnershipDocument13 pagesQuiz in PartnershipDonalyn BannagaoNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument56 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionGwen Cabarse Pansoy100% (1)

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Session 2 - Partnership Operations - Problems January 29, 2016Document10 pagesSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingGennia Mae MartinezNo ratings yet

- Prelim Take-Home ExamDocument8 pagesPrelim Take-Home ExamMelanie SamsonaNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxcNo ratings yet

- Partnership Reviewer 2021Document78 pagesPartnership Reviewer 2021Miquel Villamarin100% (1)

- ILLUSTRATION 3: Held-To-Maturity Investments: Date Interest Received Interest Income Amortization Present ValueDocument1 pageILLUSTRATION 3: Held-To-Maturity Investments: Date Interest Received Interest Income Amortization Present ValueALMA MORENANo ratings yet

- Partnership FormationDocument4 pagesPartnership FormationAlyssa Quiambao50% (2)

- Afar 01 P'ship Formation QuizDocument3 pagesAfar 01 P'ship Formation QuizJohn Laurence Loplop0% (1)

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- Module 3Document6 pagesModule 3trixie maeNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- 8901 - Partnership FormationDocument3 pages8901 - Partnership FormationRica Jane Santos Marcelo100% (1)

- Afar 2 Module CH 4 PDFDocument20 pagesAfar 2 Module CH 4 PDFRazmen Ramirez PintoNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- This Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Document2 pagesThis Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Jamaica DavidNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- This Study Resource Was: Problem 1-PatentDocument6 pagesThis Study Resource Was: Problem 1-PatentJan JanNo ratings yet

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Multiple Choices QuestionsDocument10 pagesMultiple Choices QuestionsChristopher Price0% (1)

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDocument13 pagesA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDanielle Nicole MarquezNo ratings yet

- Partnership Formation and OperationDocument43 pagesPartnership Formation and OperationRay DonovanNo ratings yet

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- FORMATIONDocument2 pagesFORMATIONBianca IyiyiNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- Partnership Operations Enabling AssessmentDocument3 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Set ADocument5 pagesSet ASomersNo ratings yet

- AST MidtermsDocument12 pagesAST MidtermsRica Regoris100% (1)

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- PartnershipDocument4 pagesPartnershipComan Nocat Eam83% (6)

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- Problem Solving: A: Purchasing Which of The Following Statements Is CorrectDocument6 pagesProblem Solving: A: Purchasing Which of The Following Statements Is CorrectActg SolmanNo ratings yet

- SVCC - QUIZ Part 2 Practical PrelimsDocument4 pagesSVCC - QUIZ Part 2 Practical PrelimsJessaNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- Internship Report of IFIC BankDocument40 pagesInternship Report of IFIC BankJāfri WāhidNo ratings yet

- Form B1 DTP Canal Vyara Ghata.Document135 pagesForm B1 DTP Canal Vyara Ghata.Tenderwizard HelpdeskNo ratings yet

- Process CostingDocument13 pagesProcess CostingRajendran KajananthanNo ratings yet

- Accounting ContractDocument4 pagesAccounting ContractLarry NopreNo ratings yet

- Removal P1Document6 pagesRemoval P1hmvhNo ratings yet

- MWW Annual ReportDocument14 pagesMWW Annual ReportMWWNo ratings yet

- Usage: Standardization Is The Process of Developing and Agreeing UponDocument3 pagesUsage: Standardization Is The Process of Developing and Agreeing Uponl1s08mbam0072No ratings yet

- CP575Notice 1687280684508Document3 pagesCP575Notice 1687280684508Кайлие Лйнн СтеинNo ratings yet

- School of Business, Economics and Management Student Name: Alex Nkole MulengaDocument6 pagesSchool of Business, Economics and Management Student Name: Alex Nkole MulengaAlex Nkole MulengaNo ratings yet

- ALTEC - Antonio Pedro Da Costa e Silva LimaDocument13 pagesALTEC - Antonio Pedro Da Costa e Silva LimaAntônio Pedro da Costa e Silva LimaNo ratings yet

- Inclusions, Exclusions and Deductions of Net IncomeDocument5 pagesInclusions, Exclusions and Deductions of Net IncomeMHERITZ LYN LIM MAYOLANo ratings yet

- To, Rakesh Marwah Aditya Dispomed Products Pvt. LTD.: Quotation No.: LBPL/PH/2020/051 Date: 10 Feb 2020Document4 pagesTo, Rakesh Marwah Aditya Dispomed Products Pvt. LTD.: Quotation No.: LBPL/PH/2020/051 Date: 10 Feb 2020rakesh marwahNo ratings yet

- CH 7 Formation of A Company Class 11 BSTDocument12 pagesCH 7 Formation of A Company Class 11 BSTRaman SachdevaNo ratings yet

- ISO 9001-2008 To ISO 9001-2015 Migration Updradation and Transition With MyEasyISO - R00 - 03082017Document5 pagesISO 9001-2008 To ISO 9001-2015 Migration Updradation and Transition With MyEasyISO - R00 - 03082017kaushal_sutariaNo ratings yet

- Training and Development at BPOLANDDocument6 pagesTraining and Development at BPOLANDHimanshu GoyalNo ratings yet

- WIF Operational GuidelinesDocument18 pagesWIF Operational GuidelinesSmriti GargNo ratings yet

- Set A - Costquiz 4Document4 pagesSet A - Costquiz 4Keanne ArmstrongNo ratings yet

- CSF Analysis Telecom IndustryDocument20 pagesCSF Analysis Telecom IndustryAbinash Biswal100% (1)

- 14 Blach Wieczorek-Kosmala Gorczynska Dos Innovations... 02Document17 pages14 Blach Wieczorek-Kosmala Gorczynska Dos Innovations... 02Bachisse Mohamed AmineNo ratings yet

- Unit Ii: Audit of IntangiblesDocument13 pagesUnit Ii: Audit of IntangiblesMarj ManlagnitNo ratings yet

- Bill of LadingDocument28 pagesBill of LadingPankaj KhandelwalNo ratings yet

- Winter Report 69Document21 pagesWinter Report 69Teja YadavNo ratings yet

- BIOCON Case StudyDocument5 pagesBIOCON Case StudyShreya AnturkarNo ratings yet

- Engagement Rankings of The World's Most Valuable BrandsDocument19 pagesEngagement Rankings of The World's Most Valuable BrandsRitu100% (5)

- Continuous Assessment # 1 Case Analysis: Bitstream Subject: People ManagementDocument8 pagesContinuous Assessment # 1 Case Analysis: Bitstream Subject: People ManagementAmrinder SinghNo ratings yet

- Aman Shah (CASE STUDY OF DARAZNP) - 221108 - 055614 - 221109 - 180048Document36 pagesAman Shah (CASE STUDY OF DARAZNP) - 221108 - 055614 - 221109 - 180048Aman ShahNo ratings yet

- Understanding Federal Contracting ProposalsDocument39 pagesUnderstanding Federal Contracting ProposalsMark Aspinall - Good Price CambodiaNo ratings yet

Remedial Quiz

Remedial Quiz

Uploaded by

Nadine VilloserOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Remedial Quiz

Remedial Quiz

Uploaded by

Nadine VilloserCopyright:

Available Formats

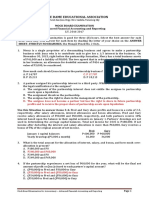

ACCOUNTING FOR PARTNERSHIP

REMEDIAL QUIZ

1. EDNA, FRED and GERRY invest P 40,000, P 30,000, and P 25,000, respectively, in a partnership on June 30, 2017.

They agree to divide net income or loss as follows:

Interest at 10% on beginning capital account balances

Salaries of P 10,000, P 8,000, and P 6,000 respectively to EDNA, FRED and GERRY

Remaining net income or loss divided equally

A minimum of P 15,000 of income guaranteed to GERRY

If the net income for the year ended June 30, 2018, before interest and salary allowances to partners was P 44,000, the net

income credited to EDNA is

A. P 17,500

B. P 16,500

C. P 16,000

D. P 14,000

2. On January 1, 2 017 Klay and Steph formed Splash Brothers Partnership organized to train prospective professional

basketball players on how to shoot 3-pointer with a splash. The articles of co-partnership provide that profit or loss

shall be distributed accordingly:

10% interest on average capital balance

P 50,000 and P 100,000 quarterly salary for Klay and Steph, respectively

The remainder shall be distributed in the ratio of 3:2 for Klay and Steph, respectively.

The following transactions regarding the capital balance of the partners for the year 2017 are provided:

Klay Steph

January 1, 2017 Investment P 1,000,000 P 500,000

March 31, 2017 Investment 100,000

July 1, 2017 Withdrawal (200,000)

September 30, 2017 Withdrawal (200,000)

October 1, 2107 Investment 700,000

If the adjusted capital balance of Klay on December 31, 2017 is P 1,991,500, what is the amount of net income

reported for year 2017?

A. P 1,000,000

B. P 1,500,000

C. P 1,800,000

D. P 2,000,000

3. Partners Francis and Donna share income and loss equally after each has been credited in all circumstances with

annual salary allowances of P 30,000 and P 24,000, respectively. Under this arrangement, in which of the following

circumstances will Francis benefit by P 6,000 more than Donna?

A. Only if the partnership has earnings of P 54,000 or more for the year

B. Only if the partnership does not incur a loss for the year

C. In all earnings or loss situation

D. Only if the partnership has earnings of at least P 6,000 for the year

4. Navarro and Sison formed a partnership on January 2, 2018, and agreed to share income 90% and 10% respectively.

Navarro contributed a capital of P 50,000. Sison contributed no capital but has a specialized expertise and manages

the firm full-time. There were no withdrawals during the year. The partnership agreement provides for the following:

Capital accounts are to be credited annually with interest at 5% of beginning capital.

Sison is to be paid a salary of P 2,000 a month.

Sison is to receive a bonus of 20% of income calculated before deducting his bonus, his salary, and interest on

both capital accounts.

Bonus, interest and Sison’ salary are to be considered partnership expenses.

The partnership’s 2018 income statement follows:

Revenues P 192,900

Expenses (including salary, interest and bonus) 99,400

Net Income P 93,500

Prepared by: Aldrin R. Calimlim,CPA Page 1

Ignoring income tax, what is the amount of bonus to Sison?

A. P 23, 376

B. P 30, 000

C. P 24, 000

D. P 31, 467

5. Rum, Vodka and Whisky are partners with average capital balances in 2017 of P 240,000, P 120,000, and P

80,000 respectively. Partners receive 10% interest on their average capital balances. After deducting salaries

of P 60,000 to Rum and P 40,000 to Vodka, the residual profit or loss is divided equally. In 2017, the

partnership sustained a P 66,000 loss before interest and salaries partners.

By what amount should Rum’s capital account change?

A. P 14,000 increase

B. P 70,000 decrease

C. P 22,000 decrease

D. P 84,000 decrease

6. Princess, Queen, and Royal Guard are partners in a lumber company. Their partnership agreement provides

for the following profit and loss distributions:

Princess, Queen, and Royal Guard are to receive salaries of P 40,000, P 36,000, and P 13,650,

respectively. Princess is to receive a bonus equal to 10% of income before the bonus.

Each partner is to receive 10% interest on the weighted average capital balance.

Withdrawals are considered to be reduction of capital for purposes of interest calculations.

Any remaining profits or losses are to be divided equally among the partners.

Capital balance information for 2017 is as follows:

Princess Queen Royal Guard

Beginning capital balance, Jan.1, 2017 P 10,000 P 6,000 P 40,000

Withdrawal of capital, April 1, 2017 (1,000) --- (2,000)

Capital investment, July 1, 2017 2,000 4,000 15,000

Withdrawal of capital, Oct. 1, 2017 (1,000) (2,000) ---

Assume princess’s share of the allocated profits is to be withdrawn.

How much profit must the partnership earn to allow Princess to withdraw exactly P 61,000 excluding previous

withdrawals?

A. P 61,000

B. P 89,650

C. P 130,000

D. P 96,000

7. You were offered the following profit sharing options:

P 50,000 salary plus 10% residual profit sharing

P 20,000 salary plus 25% bonus after the bonus

Salaries traceable to other partners totalled P 200,000. What is the level of partnership profit in which you would be

indifferent to either option?

A. P 50,000

B. P 110,000

C. P 120,000

D. P 180,000

8. A, B and C are partners with average capital balances during 2018 of P 120,000, P 60,000 and P 40,000, respectively.

Partners receive 10% interest on their average capital balances. After deducting salaries of P 30,000 to A and P 20,000

to C, the residual profit or loss divided equally. In 2019 the partnership sustained a loss of P 33,000 before interest

and salaries to partners. By what amount should A’s account change?

A. P 7,000 increase

B. P 11,000 decrease

C. P 35,000 decrease

Prepared by: Aldrin R. Calimlim,CPA Page 2

D. P 42,000 increase

9. A and B are partners with capital of P 60,000 and P 20,000, respectively. Profits and losses are divided in the ratio of

60:40. A and B decided to form a new partnership with C, who invested land valued at P 15,000 for a 20% capital

interest in the new partnership. C’s cost of land was P 12,000. The partnership elected to use the bonus method to

record the admission of C into the partnership. C’s capital account should be credited for?

A. P 12,000

B. P 15,000

C. P 16,000

D. P 19,000

10. Partner H, I, and J invested P 200,000, P 200,000 and P 100,000, respectively and agreed to share profit in the ratio of

4:4:2, respectively after providing the following:

Salaries of P 50,000 and P 40,000 to H and J, respectively

20% bonus on net income after salaries and bonus

H and J withdrew P 40,000 and P 20,000, respectively, in anticipation of profits. The partners agreed to re-align their

capital balances at the end of every period to their profit sharing ratio. The partnership made P 80,000 net income

during the year. If the original capital balances is to be maintained and the re-alignment is to be made by additional or

cash withdrawal by the partner, which is correct?

A. J shall withdraw P 14,000

B. I shall withdraw P 4,000

C. H shall invest P 6,000

D. H shall withdraw P 4,000

The accounts of partnership of RST at December 31, 2017, are as follows:

Cash P 82,500 Liabilities P 62,500

Non-cash assets 728,750 Loan from S 20,000

Loan to R 15,000 R, Capital 206,250

S, Capital 366,250

T, Capital 171,250

Total P 826,250 Total P 826,250

11. Determine the amount payable to Partner T, if cash is paid just before the start of liquidation on December

31, 2017

A. P 16,750 C. P 16,679

B. P 17,650 D. P 15,560

12. Determine the amount Partner R and Partner S would have received by the time Partner T would have

received a cumulative amount of P 45,000

A. R, P 1,785 and S, P 72,650

B. R, P 1,578 and S, P 70,265

C. R, P 1,875 and S, P 70,625

D. R, P 1,758 and S, P 72,600

On January 1, 2107, the partners CARLO, DIEGO, and EDGAR, who share profits and losses in the ratio of

5:3:2, respectively, decided to liquidate their partnership. On this date the partnership condensed balance sheet

was as follows:

Cash P 50,000 Liabilities P 60,000

Other Assets 250,000 CARLO, Capital 80,000

DIEGO, Capital 90,000

EDGAR, Capital 70,000

Total P 300,000 Total P 300,000

Prepared by: Aldrin R. Calimlim,CPA Page 3

On January 15, 2017, the first cash sale of other assets with a carrying amount of P 150,000 realized P 120,000.

Safe installment payments were made on the same date.

13. How much cash should be distributed to each partner CARLO, DIEGO and EDGAR, respectively?

A. P 15,000; P 51,000; P 44,000

B. P 40,000; P 45,000; P 35,000

C. P 55,000; P 33,000; P 22,000

D. P 60,000; P 36,000; P 24,000

ASSER, JING AND TONY are in the process of liquidating their partnership. They have the following capital

balances and profit or loss percentages:

Capital Balance P/L %

ASSER 5,000 debit 20%

JING 18,000 credit 50%

TONY 6,000 credit 30%

The partnership balance sheet shows cash of P 5,000, non-cash assets of P 14,000, and no liabilities

14. Assuming no liquidation expense, what safe payments could be made?

A. P 5,000 split between JING and TONY by a ratio of 5:3 respectively

B. P 5,000 JING only

C. P 1,000 to ASSER, P 2,500 to JING and P 1,500 to TONY

D. P 18,000 to JING only

Partners DIEGO, ELMO, and FRANCO have capital balances of P 40,000, P 90,000 and P 30,000, respectively,

immediately prior to liquidation. Total remaining assets have a book value of P 160,000, the liabilities having

been paid. Among these remaining assets is a machine with a fair value of P 35,000. the partners split profits

and losses equally. ELMO covets the machine and is willing to accept it for P 35,000 in lieu of cash. The other

partners have no designs on specific assets, only cash in liquidation

15. How much cash in addition to the machine, would first be distributed to ELMO, before any of the other

partners received anything?

A. P 15,000

B. P 50,000

C. P 166,666

D. P 300,000

Partners JOJO and MAR, who share profits and losses equally, decided to incorporate the partnership at

December 31, 2017. The partnership net assets after the following adjustments will be contributed in exchange

for shares of stocks from the corporation.

I. provision of allowance for doubtful accounts, P 3,000

II. adjustment of understated inventory by P 5,000, and

III. recognition of additional depreciation of P 1,000

The corporation’s ordinary share is to have a par value of P 100 each and the partners are to be issued

corresponding shares equivalent to 80% of their adjusted capital balance.

The balance sheet at December 31, 2017 follows:

Cash P 30,000 Liabilities P 43,000

A/R 25,000 Accu. Dep’n 2,000

Inventory 35,000 Jojo, Capital 35,000

Equipment 20,000 Mar, Capital 30,000

Total P 110,000 Total P 110,000

Prepared by: Aldrin R. Calimlim,CPA Page 4

16. Determine the total credit to APIC upon incorporation of the partnership

A. P 6,750

B. P 13,200

C. P 6,000

D. P 66,000

17. The number of ordinary shares issued to partner Mar is

A. 284

B. 300

C. 244

D. 330

18. Katie, Lenie and Minnie decided to liquidate their partnership on July 31, 2017. Their capital balances and

profit and loss ratio on this date, before liquidation, are:

Capital P&L Ratio

Katie P 224,000 25%

Lenie 288,000 30%

Minnie 128,000 45%

The net loss from January 1 to July 31, 2017 is P 48,000. Also, on this date, cash and liabilities are P 136,000

and P 232,000, respectively.

Which of the following is inconsistent with the result of liquidation if Lenie received P 247,000 in full

settlement of her interest in the firm?

A. Total cash paid to partners, P 736,000

B. Non-cash assets were sold for P 600,000

C. Minnie received P 66,800

D. Katie’s share in loss on realization of non-cash assets, 22,000

19. A balance sheet for the September Partnership, who shares profits in the ratio of 50:25:25 for partners SEP,

TEM, and BER, respectively shows the following balances just before liquidation:

Cash P 648,000

Other Assets 3,213,000

Liabilities 1,080,000

SEP, Capital 1,188,000

TEM, Capital 837,000

BER, Capital 756,000

ON the first month of liquidation, certain assets are sold for P 1,728,000. Liquidation expenses of P 54,000 are

paid and additional liquidation expenses are anticipated. Liabilities are paid amounting to P 291,600 and

sufficient cash is retained to ensure the payment to creditors before making first payment to partners, Partner

SEP receives P 337,500

Calculate the amount of cash withheld for anticipated liquidation expenses

A. P 162,000

B. P 950,400

C. P 278,400

D. 0

Prepared by: Aldrin R. Calimlim,CPA Page 5

20. HELEN, IRENE and JESSA were partners with capital balances on January 2, 1018 of P 560,000, P 672,000, and P

496,000, respectively. Their profit or loss ratio is 3:5:2. On August 1, 2018, HELEN retires from the partnership. On

the date of retirement, the partnership net loss from January to 2 is P 384,000 and the partners agreed to revalue

inventories to P 296,000 (from the carrying amount of P 272,000). The payment to HELEN in settlement of her

interest is to be P 454,800

Upon the retirement of HELEN, which of the following will result?

A. Bonus to IRENE of P 2,000

B. Bonus to JESSA of P 800

C. Goodwill to JESSA of P 2,800

D. IRENE’s capital is P 66,800 more than JESSA’s

21. A local partnership was considering the possibility of liquidation since one of the partners (Ding) was

insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis,

respectively.

Ding, capital $ 60,000

Laurel, capital 67,000

Ezzard, capital 17,000

Tillman, capital 96,000

Ding's creditors filed a $25,000 claim against the partnership's assets. At that time, the partnership held assets reported at

$360,000 and liabilities of $120,000.

If the assets could be sold for $228,000, what is the minimum amount that Ding's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,720.

E) $67,250.

22. A local partnership was considering the possibility of liquidation since one of the partners (Ding) was

insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis,

respectively.

Ding, capital $ 60,000

Laurel, capital 67,000

Ezzard, capital 17,000

Tillman, capital 96,000

Ding's creditors filed a $25,000 claim against the partnership's assets. At that time, the partnership held assets reported at

$360,000 and liabilities of $120,000.

If the assets could be sold for $228,000, what is the minimum amount that Laurel's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,250.

E) $67,250.

Prepared by: Aldrin R. Calimlim,CPA Page 6

23. A local partnership was considering the possibility of liquidation since one of the partners (Ding) was

insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis,

respectively.

Ding, capital $ 60,000

Laurel, capital 67,000

Ezzard, capital 17,000

Tillman, capital 96,000

Ding's creditors filed a $25,000 claim against the partnership's assets. At that time, the partnership held assets reported at

$360,000 and liabilities of $120,000.

If the assets could be sold for $228,000, what is the minimum amount that Ezzard's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,250.

E) $67,250.

24. A local partnership was considering the possibility of liquidation since one of the partners (Ding) was

insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis,

respectively.

Ding, capital $ 60,000

Laurel, capital 67,000

Ezzard, capital 17,000

Tillman, capital 96,000

Ding's creditors filed a $25,000 claim against the partnership's assets. At that time, the partnership held assets reported at

$360,000 and liabilities of $120,000.

If the assets could be sold, for $228,000 what is the minimum amount that Tillman's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,250.

E) $67,250.

25. Dancey, Reese, Newman, and Jahn were partners who shared profits and losses on a 4:2:2:2 basis,

respectively. They were beginning to liquidate their business. At the start of the process, capital balances

were as follows:

Dancey, capital $ 72,000

Reese, capital 32,000

Newman, capital 52,000

Jahn, capital 24,000

Which one of the following statements is true?

A) The first available $16,000 would go to Newman.

B) The first available $16,000 would go to Dancey.

C) The first available $8,000 would go to Jahn.

D) The first available $8,000 would go to Reese.

E) The first available $4,000 would go to Jahn.

Prepared by: Aldrin R. Calimlim,CPA Page 7

26. On May 1, 2015, Frances and Marella formed a partnership and agreed to share profits and losses in the ratio of 3:7,

respectively. Frances contributed a parcel of land that cost P 10,000. Marella contributed P 40,000 cash. The land was

sold for P 18,000 on May 1, 2015, immediately after formation of partnership. What amount should be recorded in

Frances’s capital account on formation of the partnership?

A. P 15,000

B. P 10,000

C. P 14,700

D. P 18,000

27. Charlotte has P 220,000 net assets in her business before formation. Charlotte admitted Amigo and Baltimore into his

business. The partners agreed to a total partnership capital of P 600,000 and that no intangibles will be recognize. The

partners Amigo, Baltimore, and Charlotte will have 20%, 40%, and 40% capital interest, respectively. If in pursuant to

their agreement, Amigo and Baltimore contributed P 100,000 and P 280,000 for their respective capital interest, which

statement is correct?

A. Amigo will be credited for P 20,000 bonus

B. Baltimore will be debited for P 32,000 goodwill

C. Charlotte will be debited for a bonus of P 8,000

D. Amigo and Charlotte will be credited for a P 24,000 and P 8,000 bonus respectively.

28. January 1, 2013, Kim, Judith and Nathalie formed a partnership with profit or loss sharing agreement of 2:3:5.

Kim contributed a land with assessed value from city assessor in the amount of P 1,000,000. The land is subject to

real estate mortgage which is annotated to the title of the land in the amount of P 800,000 and will be assumed by the

partnership. The appraised value of the land is P 2,400,000. Judith contributed a building with a cost of P 2,000,000

and accumulated depreciation of P 1,500,000. The fair value of the building is P 800,000. Nathalie contributed

investment in trading securities with historical cost of P 6,000,000. The trading securities have quoted price in active

market of P 3,000,000.

The partners decided to bring their capital balances in accordance with their profit or loss sharing agreement. The total

agreed capitalization of the new partnership is P 10,000,000.

Which of the following statement is correct?

A. The agreed capital of Nathalie is P 500,000

B. Kim should contribute additional capital in the amount of P 1,800,000

C. Judith should contribute additional capital in the amount of P 2,200,000

D. Nathalie is entitled to withdraw in the amount of P 1,000,000

29. The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance

sheet:

Cash $ 16,000 Liabilities $ 150,000

Noncash assets 434,000 Abrams, capital 80,000

Bartle, capital 90,000

Creighton, capital 130,000

Total $ 450,000 Total $ 450,000

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be

$12,000.

If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

A) $43,200.

B) $46,800.

C) $40,000.

D) $42,400.

E) $43,100.

Prepared by: Aldrin R. Calimlim,CPA Page 8

30. The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance

sheet:

Cash $ 16,000 Liabilities $ 150,000

Noncash assets 434,000 Abrams, capital 80,000

Bartle, capital 90,000

Creighton, capital 130,000

Total $ 450,000 Total $ 450,000

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be

$12,000.

The noncash assets were sold for $134,000. Which partner(s) would have had to contribute assets to the partnership to

cover a deficit in his or her capital account?

A) Abrams.

B) Bartle.

C) Creighton.

D) Abrams and Creighton.

E) Abrams and Bartle.

31. The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance

sheet:

Cash $ 16,000 Liabilities $ 150,000

Noncash assets 434,000 Abrams, capital 80,000

Bartle, capital 90,000

Creighton, capital 130,000

Total $ 450,000 Total $ 450,000

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be

$12,000.

After the liquidation expenses of $12,000 had been paid and the noncash assets sold, Creighton had a deficit of $8,000.

For what amount were the noncash assets sold?

A) $170,000.

B) $264,000.

C) $158,000.

D) $146,000.

E) $185,000.

32. The Keaton, Lewis, and Meador partnership had the following balance sheet just before entering liquidation:

Cash $ 10,000 Liabilities $ 130,000

Noncash assets 300,000 Keaton, capital 60,000

Lewis, capital 40,000

Meador, capital 80,000

Total $ 310,000 Total $ 310,000

Keaton, Lewis, and Meador share profits and losses in a ratio of 2:4:4. Noncash assets were sold for $180,000.

Liquidation expenses were $10,000.

Prepared by: Aldrin R. Calimlim,CPA Page 9

Assume that Lewis was personally insolvent and could not contribute any assets to the partnership, while Keaton and

Meador were both solvent. What amount of cash would Keaton have received from the distribution of partnership assets?

A) $38,000.

B) $30,000.

C) $24,000.

D) $34,000.

E) $31,600.

33. The Keaton, Lewis, and Meador partnership had the following balance sheet just before entering liquidation:

Cash $ 10,000 Liabilities $ 130,000

Noncash assets 300,000 Keaton, capital 60,000

Lewis, capital 40,000

Meador, capital 80,000

Total $ 310,000 Total $ 310,000

Keaton, Lewis, and Meador share profits and losses in a ratio of 2:4:4. Noncash assets were sold for $180,000.

Liquidation expenses were $10,000.

Assume that Keaton was personally insolvent with assets of $8,000 and liabilities of $60,000. Lewis and Meador were

both solvent and able to cover deficits in their capital accounts, if any. What amount of cash could Keaton's personal

creditors have expected to receive from partnership assets?

A) $30,000.

B) $0.

C) $52,000

D) $26,000

E) $34,000

34. The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account

balances:

Cash $ 90,000 Liabilities $ 60,000

Noncash assets 300,000 Henry, capital 80,000

Isaac, capital 110,000

Jacobs, capital 140,000

Total $ 390,000 Total $ 390,000

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

What amount of cash was available for safe payments, based on the above information?

A) $30,000.

B) $85,000.

C) $25,000.

D) $35,000.

E) $40,000.

Prepared by: Aldrin R. Calimlim,CPA Page 10

35. The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account

balances:

Cash $ 90,000 Liabilities $ 60,000

Noncash assets 300,000 Henry, capital 80,000

Isaac, capital 110,000

Jacobs, capital 140,000

Total $ 390,000 Total $ 390,000

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

Before liquidating any assets, the partners determined the amount of cash available for safe payments. How should the

cash be distributed?

A) in a ratio of 1:2:2 among the partners.

B) $18,333 to Henry and $16,667 to Jacobs.

C) in a ratio of 1:2 between Henry and Jacobs.

D) $15,000 to Henry and $10,000 to Jacobs.

E) $11,364 to Henry and $13,636 to Jacobs.

36. The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account

balances:

Cash $ 90,000 Liabilities $ 60,000

Noncash assets 300,000 Henry, capital 80,000

Isaac, capital 110,000

Jacobs, capital 140,000

Total $ 390,000 Total $ 390,000

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The

noncash assets were then sold for $120,000, and the liquidation expenses of $5,000 were paid. How much of the

$120,000 would be distributed to Henry?

A) $23,000. D) $27,000.

B) $24,000. E) $28,000.

C) $40.000.

37. The following account balances were available for the Perry, Quincy, and Renquist partnership just before it

entered liquidation:

Cash $ 90,000 Liabilities $ 170,000

Noncash assets 300,000 Perry, capital 70,000

Quincy, capital 50,000

Renquist, capital 100,000

Total $ 390,000 Total $ 390,000

Perry, Quincy, and Renquist had shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be

$8,000.

All partners were solvent. What would be the minimum amount for which the noncash assets must have been sold for, in

order for Quincy to receive some cash from the liquidation?

A) any amount in excess of $175,000.

B) any amount in excess of $117,000.

C) any amount in excess of $183,000.

D) any amount in excess of $198,667.

E) any amount in excess of $168,333.

Prepared by: Aldrin R. Calimlim,CPA Page 11

38. The following account balances were available for the Perry, Quincy, and Renquist partnership just before it

entered liquidation:

Cash $ 90,000 Liabilities $ 170,000

Noncash assets 300,000 Perry, capital 70,000

Quincy, capital 50,000

Renquist, capital 100,000

Total $ 390,000 Total $ 390,000

Perry, Quincy, and Renquist had shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to be

$8,000.

Assume that Quincy was insolvent and could not contribute assets to cover any deficit in her capital account. For what

amount must the noncash assets have been sold, so that Renquist would have received some cash from the liquidation?

A) any amount in excess of $108,000.

B) any amount in excess of $58,000.

C) any amount in excess of $201,600.

D) any amount in excess of $50,000.

E) any amount in excess of $104,000.

39. A local partnership was in the process of liquidating and reported the following capital balances:

Justice, capital (40% share of all profits and losses) $ 23,000

Zobart, capital (35%) 22,000

Douglass, capital (25%) ( 14,000)

Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining

partners asked to receive the $31,000 that was then available.

How much of this money should Justice receive?

A) $15,000.

B) $15,467.

C) $17,333.

D) $16,533.

E) $15,867.

40. A local partnership was in the process of liquidating and reported the following capital balances:

Justice, capital (40% share of all profits and losses) $ 23,000

Zobart, capital (35%) 22,000

Douglass, capital (25%) ( 14,000)

Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution. However, the two remaining

partners asked to receive the $31,000 that was then available.

How much of this money should Zobart receive?

A) $15,000.

B) $14,467.

C) $17,333.

D) $15,633.

E) $15,867.

Prepared by: Aldrin R. Calimlim,CPA Page 12

You might also like

- JAMDocument76 pagesJAMArvin AbyadangNo ratings yet

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- This Study Resource Was: Problem 4-17Document3 pagesThis Study Resource Was: Problem 4-17Jamaica David100% (1)

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- Retirement of A Partner 1Document1 pageRetirement of A Partner 1Vonna TerribleNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- AdFAR.701 - Partnership Accounting - OnlineDocument6 pagesAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocument4 pagesModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNo ratings yet

- Batohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossDocument7 pagesBatohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossivankingbachoNo ratings yet

- Name: Date: Subject: Section and Time:: Problem 1Document16 pagesName: Date: Subject: Section and Time:: Problem 1Marie GarpiaNo ratings yet

- AFAR - 1.0 Ul Cpa Review Center R.D.BalocatingDocument18 pagesAFAR - 1.0 Ul Cpa Review Center R.D.Balocatingfghhnnnjml100% (1)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- Building An Organization Capable of Good Strategy ExecutionDocument11 pagesBuilding An Organization Capable of Good Strategy Executionhendry noven100% (1)

- Digital Marketing Swot AnalysisDocument47 pagesDigital Marketing Swot AnalysisGolamRabbane100% (2)

- Commerce Stage 5 Scope and Sequence 2020Document3 pagesCommerce Stage 5 Scope and Sequence 2020api-505729019No ratings yet

- Quiz in PartnershipDocument13 pagesQuiz in PartnershipDonalyn BannagaoNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationBianca Iyiyi0% (1)

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument56 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionGwen Cabarse Pansoy100% (1)

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Session 2 - Partnership Operations - Problems January 29, 2016Document10 pagesSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingGennia Mae MartinezNo ratings yet

- Prelim Take-Home ExamDocument8 pagesPrelim Take-Home ExamMelanie SamsonaNo ratings yet

- CH 07Document99 pagesCH 07baldoewszxcNo ratings yet

- Partnership Reviewer 2021Document78 pagesPartnership Reviewer 2021Miquel Villamarin100% (1)

- ILLUSTRATION 3: Held-To-Maturity Investments: Date Interest Received Interest Income Amortization Present ValueDocument1 pageILLUSTRATION 3: Held-To-Maturity Investments: Date Interest Received Interest Income Amortization Present ValueALMA MORENANo ratings yet

- Partnership FormationDocument4 pagesPartnership FormationAlyssa Quiambao50% (2)

- Afar 01 P'ship Formation QuizDocument3 pagesAfar 01 P'ship Formation QuizJohn Laurence Loplop0% (1)

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- Module 3Document6 pagesModule 3trixie maeNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- 8901 - Partnership FormationDocument3 pages8901 - Partnership FormationRica Jane Santos Marcelo100% (1)

- Afar 2 Module CH 4 PDFDocument20 pagesAfar 2 Module CH 4 PDFRazmen Ramirez PintoNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- This Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Document2 pagesThis Study Resource Was: Afar de Leon/De Leon/De Leon Quiz 2 Set A Batch: M A Y 2018Jamaica DavidNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- This Study Resource Was: Problem 1-PatentDocument6 pagesThis Study Resource Was: Problem 1-PatentJan JanNo ratings yet

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Multiple Choices QuestionsDocument10 pagesMultiple Choices QuestionsChristopher Price0% (1)

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDocument13 pagesA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossDanielle Nicole MarquezNo ratings yet

- Partnership Formation and OperationDocument43 pagesPartnership Formation and OperationRay DonovanNo ratings yet

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- FORMATIONDocument2 pagesFORMATIONBianca IyiyiNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- Partnership Operations Enabling AssessmentDocument3 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Set ADocument5 pagesSet ASomersNo ratings yet

- AST MidtermsDocument12 pagesAST MidtermsRica Regoris100% (1)

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- PartnershipDocument4 pagesPartnershipComan Nocat Eam83% (6)

- Problem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Document6 pagesProblem Solving: A: Purchasing 20% Capital Which of The Following Statements Is Correct?Actg SolmanNo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- Problem Solving: A: Purchasing Which of The Following Statements Is CorrectDocument6 pagesProblem Solving: A: Purchasing Which of The Following Statements Is CorrectActg SolmanNo ratings yet

- SVCC - QUIZ Part 2 Practical PrelimsDocument4 pagesSVCC - QUIZ Part 2 Practical PrelimsJessaNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- Internship Report of IFIC BankDocument40 pagesInternship Report of IFIC BankJāfri WāhidNo ratings yet

- Form B1 DTP Canal Vyara Ghata.Document135 pagesForm B1 DTP Canal Vyara Ghata.Tenderwizard HelpdeskNo ratings yet

- Process CostingDocument13 pagesProcess CostingRajendran KajananthanNo ratings yet

- Accounting ContractDocument4 pagesAccounting ContractLarry NopreNo ratings yet

- Removal P1Document6 pagesRemoval P1hmvhNo ratings yet

- MWW Annual ReportDocument14 pagesMWW Annual ReportMWWNo ratings yet

- Usage: Standardization Is The Process of Developing and Agreeing UponDocument3 pagesUsage: Standardization Is The Process of Developing and Agreeing Uponl1s08mbam0072No ratings yet

- CP575Notice 1687280684508Document3 pagesCP575Notice 1687280684508Кайлие Лйнн СтеинNo ratings yet

- School of Business, Economics and Management Student Name: Alex Nkole MulengaDocument6 pagesSchool of Business, Economics and Management Student Name: Alex Nkole MulengaAlex Nkole MulengaNo ratings yet

- ALTEC - Antonio Pedro Da Costa e Silva LimaDocument13 pagesALTEC - Antonio Pedro Da Costa e Silva LimaAntônio Pedro da Costa e Silva LimaNo ratings yet

- Inclusions, Exclusions and Deductions of Net IncomeDocument5 pagesInclusions, Exclusions and Deductions of Net IncomeMHERITZ LYN LIM MAYOLANo ratings yet

- To, Rakesh Marwah Aditya Dispomed Products Pvt. LTD.: Quotation No.: LBPL/PH/2020/051 Date: 10 Feb 2020Document4 pagesTo, Rakesh Marwah Aditya Dispomed Products Pvt. LTD.: Quotation No.: LBPL/PH/2020/051 Date: 10 Feb 2020rakesh marwahNo ratings yet

- CH 7 Formation of A Company Class 11 BSTDocument12 pagesCH 7 Formation of A Company Class 11 BSTRaman SachdevaNo ratings yet

- ISO 9001-2008 To ISO 9001-2015 Migration Updradation and Transition With MyEasyISO - R00 - 03082017Document5 pagesISO 9001-2008 To ISO 9001-2015 Migration Updradation and Transition With MyEasyISO - R00 - 03082017kaushal_sutariaNo ratings yet

- Training and Development at BPOLANDDocument6 pagesTraining and Development at BPOLANDHimanshu GoyalNo ratings yet

- WIF Operational GuidelinesDocument18 pagesWIF Operational GuidelinesSmriti GargNo ratings yet

- Set A - Costquiz 4Document4 pagesSet A - Costquiz 4Keanne ArmstrongNo ratings yet

- CSF Analysis Telecom IndustryDocument20 pagesCSF Analysis Telecom IndustryAbinash Biswal100% (1)

- 14 Blach Wieczorek-Kosmala Gorczynska Dos Innovations... 02Document17 pages14 Blach Wieczorek-Kosmala Gorczynska Dos Innovations... 02Bachisse Mohamed AmineNo ratings yet

- Unit Ii: Audit of IntangiblesDocument13 pagesUnit Ii: Audit of IntangiblesMarj ManlagnitNo ratings yet

- Bill of LadingDocument28 pagesBill of LadingPankaj KhandelwalNo ratings yet

- Winter Report 69Document21 pagesWinter Report 69Teja YadavNo ratings yet

- BIOCON Case StudyDocument5 pagesBIOCON Case StudyShreya AnturkarNo ratings yet

- Engagement Rankings of The World's Most Valuable BrandsDocument19 pagesEngagement Rankings of The World's Most Valuable BrandsRitu100% (5)

- Continuous Assessment # 1 Case Analysis: Bitstream Subject: People ManagementDocument8 pagesContinuous Assessment # 1 Case Analysis: Bitstream Subject: People ManagementAmrinder SinghNo ratings yet

- Aman Shah (CASE STUDY OF DARAZNP) - 221108 - 055614 - 221109 - 180048Document36 pagesAman Shah (CASE STUDY OF DARAZNP) - 221108 - 055614 - 221109 - 180048Aman ShahNo ratings yet

- Understanding Federal Contracting ProposalsDocument39 pagesUnderstanding Federal Contracting ProposalsMark Aspinall - Good Price CambodiaNo ratings yet