Professional Documents

Culture Documents

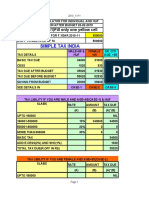

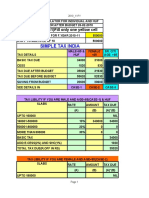

For The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018

For The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018

Uploaded by

Willy Lagula0 ratings0% found this document useful (0 votes)

2 views1 pageThe document outlines the new income tax rates in the Philippines from 2018-2022 according to the TRAIN law. It provides the tax rates for different income brackets, which are 0% for incomes up to 250,000 pesos, then 20%, 25%, 30%, 32%, and 35% for higher income brackets. It also shows examples of calculating the tax owed for different income levels based on the rates.

Original Description:

Original Title

willy and kristel.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the new income tax rates in the Philippines from 2018-2022 according to the TRAIN law. It provides the tax rates for different income brackets, which are 0% for incomes up to 250,000 pesos, then 20%, 25%, 30%, 32%, and 35% for higher income brackets. It also shows examples of calculating the tax owed for different income levels based on the rates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageFor The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018

For The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018

Uploaded by

Willy LagulaThe document outlines the new income tax rates in the Philippines from 2018-2022 according to the TRAIN law. It provides the tax rates for different income brackets, which are 0% for incomes up to 250,000 pesos, then 20%, 25%, 30%, 32%, and 35% for higher income brackets. It also shows examples of calculating the tax owed for different income levels based on the rates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

WILLY M.

LAGULA

11 - ABM

NEW TRAIN INCOME TAX TABLE

For the years 2018- 2022

Under the approved TRAIN Tax Law effective January 1, 2018

DATA:

ANNUAL INCOME TAX RATE

250,000 and below 0%

250,000 – 400,000 20% of excess over 250,000

400,000 – 800,000 30,000 + 25% excess over 400,000

800,000 – 2,000,000 130,000 + 30% excess over 800,000

2,000,000 – 8,000,000 490,000 + 32% excess over 8,000,000

8,000,000 and above 2,410,000 + 35% excess over 8,000,000

SOLVE FOR THE TAX RATE:

400,000 – 250,000 = 150,000 x 0.2 = 30,000

800,000 – 400,000 = 400,000 x 0.25 = 100,000 + 30,000 = 130,000

2,000,000 – 800,000 = 1,200,000 x 0.3 = 360,000 + 130,000 = 490,000

8,000,000 – 2,000,000 = 6,000,000 x 0.32 = 1,920,000 + 490,000 = 2,410,000

IDENTIFYING X & Y:

Independent Variable (X) Dependent Variable (Y)

250,000 0

250,000 – 400,000 30,000

400,000 – 800,000 130,000

800,000 – 2,000,000 490,000

2,000,000 – 8,000,000 2,410,000

Above 8,000,000 y

EQUATION:

(250,000)0

(400,000 – 250,000) 0.2

(800,000 – 400,000) 0.25 + 30,000

(2,000,000 – 800,000) 0.3 + 130,000

(8,000,000 – 2,000,000) 0.32 + 490,000

(x – 8,000,000) 0.35 + 2,410,000

You might also like

- Eco AssignmentDocument9 pagesEco AssignmentCIAO TRAVELNo ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- CorpoDocument2 pagesCorpoKhyle Ferrile EligioNo ratings yet

- Mil+35% of Excess Over 8 Million. Make A Piecewise Function The Represents TheDocument2 pagesMil+35% of Excess Over 8 Million. Make A Piecewise Function The Represents TheRince BerjenoNo ratings yet

- 3DMC Income Tax Assignment 1Document30 pages3DMC Income Tax Assignment 1Sato TsuyoshiNo ratings yet

- Tugas 3 Ekonomi MakroDocument2 pagesTugas 3 Ekonomi MakroMuhammad IrsyadNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Syam ReddyNo ratings yet

- TRAIN (Changes) ???? Pages 1, 4, 7, 8Document4 pagesTRAIN (Changes) ???? Pages 1, 4, 7, 8blackmail1No ratings yet

- Tax TablesDocument1 pageTax TablesEmman NepacenaNo ratings yet

- INCOME TAX QuizDocument12 pagesINCOME TAX QuizZhane KimNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Retaining Wall 21.9.21Document44 pagesRetaining Wall 21.9.21kamal kumar MallikarjunaNo ratings yet

- Prueba Del Logro-PnlDocument9 pagesPrueba Del Logro-Pnleduardo atocheNo ratings yet

- 02c Analysis of FADocument12 pages02c Analysis of FASaad ZamanNo ratings yet

- Tax Scale Rate YA2022 Category Chargeable Income Calculations (RM) Rate % Tax (RM)Document1 pageTax Scale Rate YA2022 Category Chargeable Income Calculations (RM) Rate % Tax (RM)Amira SyahiraNo ratings yet

- Inland Revenue Board of Malaysia: Eng MalDocument6 pagesInland Revenue Board of Malaysia: Eng Malathirah jamaludinNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11subhodattNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11bablooraiNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11dhuvad.2004No ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Ravi ChandraNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Priyanshu SharmaNo ratings yet

- Considering The Opportunity Cost: AccountingDocument6 pagesConsidering The Opportunity Cost: AccountingBenzon Agojo OndovillaNo ratings yet

- Grafik LendutanDocument19 pagesGrafik LendutanAbdul MalikNo ratings yet

- Bir Tax Table Salary Range (Annual) Income Tax RateDocument1 pageBir Tax Table Salary Range (Annual) Income Tax RatejamesNo ratings yet

- Group 2 Cash Budget N4ba2503Document3 pagesGroup 2 Cash Budget N4ba2503nuraz3169No ratings yet

- Tutorial 8 Solution Managerial Decisions For Firms With Market PowerDocument8 pagesTutorial 8 Solution Managerial Decisions For Firms With Market PowerFathimath ShaheeraNo ratings yet

- Contemporary Taxation: COMSATS University IslamabadDocument4 pagesContemporary Taxation: COMSATS University IslamabadRabia EmanNo ratings yet

- Cases That Quantify The Impact of Value Stream MappingDocument2 pagesCases That Quantify The Impact of Value Stream MappingEnzamamul HaqueNo ratings yet

- TaxationDocument11 pagesTaxationkhowcatherine2000No ratings yet

- RQ.22.17 O1 O2 Sales Variable Cost ContributionDocument6 pagesRQ.22.17 O1 O2 Sales Variable Cost ContributionDiana D'souzaNo ratings yet

- Practical Test Finance & AccountingDocument7 pagesPractical Test Finance & AccountingAlbert CandraNo ratings yet

- Taxation 2 (Maika Notes)Document30 pagesTaxation 2 (Maika Notes)Maria Acepcion DelfinNo ratings yet

- Aggregate Demand and Its ComponentsDocument7 pagesAggregate Demand and Its Componentssairamsrinivasan36No ratings yet

- Activity 1Document5 pagesActivity 1Santiago Lucas MartínezNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- Tech Tune Pvt. Ltd. BalancesDocument3 pagesTech Tune Pvt. Ltd. BalancesHEMAL SHAHNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Latihan - TM9 - Cost BehaviorDocument33 pagesLatihan - TM9 - Cost Behavior16Made Jodi SaindraNo ratings yet

- Presto ProductsDocument3 pagesPresto ProductsReign Imee NortezNo ratings yet

- Taxation Question 2019 MarchDocument13 pagesTaxation Question 2019 MarchAlice DesiraeeNo ratings yet

- Kena Bizuneh Damessa Individual Assignment RiskDocument8 pagesKena Bizuneh Damessa Individual Assignment Riskdagneabera13No ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- Test Bondad de AjusteDocument21,503 pagesTest Bondad de AjusteconstanzaNo ratings yet

- Investment in Debt SecuritiesDocument21 pagesInvestment in Debt SecuritiesAlarich CatayocNo ratings yet

- Reward ProgramDocument8 pagesReward ProgramMercie AzarconNo ratings yet

- Tac Wom Perjuni2023Document20 pagesTac Wom Perjuni2023Rizqi ArbaqiNo ratings yet

- Recitation 9 Answer KeyDocument5 pagesRecitation 9 Answer KeyMaríaNo ratings yet

- Tax CalculatorDocument2 pagesTax CalculatorMart ManaloNo ratings yet

- Shaan Ques 01Document1 pageShaan Ques 01ayaan madaarNo ratings yet

- Plantilla Modos de Vibracion PrincipalDocument43 pagesPlantilla Modos de Vibracion PrincipalBERLYN AQUILES CALLE CAMPOSNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- Assignment - Economics 1docxDocument30 pagesAssignment - Economics 1docxMohamed MustefaNo ratings yet

- TOPIC 1-Tax LesgislationDocument23 pagesTOPIC 1-Tax LesgislationNURUL NUHA BINTI AZIZ HILMI / UPMNo ratings yet

- Ejemplo Matricial Casos Especiales 3-18-19Document18 pagesEjemplo Matricial Casos Especiales 3-18-19Oscar RamírezNo ratings yet

- Static File Tanzania Common20Files TariffGuideNotice2023Document2 pagesStatic File Tanzania Common20Files TariffGuideNotice2023edward mpangileNo ratings yet

- Cash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RentDocument4 pagesCash Loan Supply Expense Tools Salary Expense Down Payment Bills Paypable Tool Expense Services Telephone Ex Office Supplies Petrol Ex Recieable RenttanimaNo ratings yet