Professional Documents

Culture Documents

For More Information Contact: 211 381111/0971-281111 Revenue House: P O Box 35710 Lusaka, Zambia

For More Information Contact: 211 381111/0971-281111 Revenue House: P O Box 35710 Lusaka, Zambia

Uploaded by

Rogers PalamattamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For More Information Contact: 211 381111/0971-281111 Revenue House: P O Box 35710 Lusaka, Zambia

For More Information Contact: 211 381111/0971-281111 Revenue House: P O Box 35710 Lusaka, Zambia

Uploaded by

Rogers PalamattamCopyright:

Available Formats

·VAT @ 16% =K5,500.

01

·Carbon Tax (Above 3001CC) =K200 ·Carbon Tax (Above 3001CC) =K200.00

·Total Tax Payable =K16, 162.00

·Total Tax payable =K72,476,2.00

A pick-up imported from South Africa with the following

values;

· Cost =ZAR 20.000.00 1.0 Clearance Points

· Insurance =ZAR 1,200.00

· Freight/other costs (up to L/tone) =ZAR 3,500.00 Currently full Customs clearance facilities are available at

the following ports:

· CIF Living stone =ZAR 24,700.00

Livingstone, Nakonde, Chirundu, K i t w e , Lusaka,

·Given exchange rate at time of importation is K0.5214 Ndola, Mwami, Kariba and Chanida

for ZAR1.

All motor vehicles are final cleared at the entry ports,

· VDP (CIF X rate of exchange) except for those on which permission is granted to be final

·(ZAR 24,700.00X K0.521.39) =K12, 878.33 cleared at inland ports. Payment of assessed taxes for

·Customs duty @ 15% is K1, 931.75 therefore the importation of motor vehicles may be made at any Zambia

specific duty rate of K2, 000, is applicable. Revenue Authority office countrywide where

·Value for Excise purposes AsycudaWorld exists.

·(K12, 878.33 + K2, 000.00) =K14, 878.33

·Excise duty @ 10% =K1, 487.83 Motor vehicles allowed to be cleared at inland ports are

·Value for VAT purposes removed in bond (RIB) from the entry ports to the

·(K14, 878.33+K1, 487.83) =K16, 366.16 appointed customs area where they are detained until they

·VAT @ 16% =K2, 618.59 are cleared for consumption.

·Carbon Tax (2001-3000CC) =K150.00

All imports, including motor vehicles, must be cleared

·Total Tax Payable =K6,188.17 within 15 days after importation, failure to which the

goods will be liable for seizure.

A 30-ton truck is imported from USA with the following

values; MOTOR VEHICLE TAX CALCULATOR

· Cost =US$ 45,200.00 visit www.zra.org.zm to access the motor vehicle

· Insurance =US$ 1,200.00 calculator for estimated taxes.

· Freight =US$ 5,000.00

· Other costs (up to Chirundu) =US$ 215.00

· CIF Chirundu =US$51,615.00

·Given exchange rate at time of importation is K4.1925

for US$1.

·VDP (CIF X rate of exchange)

For more information contact:

·(US$51,615.00 X K4.1925) =K216,395.89

211 381111/0971-281111

·Customs Duty @ 15% =K32, 459.38

Email us at: advice@zra.org.zm

·Value for VAT purposes

Website: www.zra.org.zm

·(K216, 395.89 +K32, 459.38 =K248,855.27

Revenue House: P O Box 35710

·VAT @16% =K39,816.84 Lusaka, Zambia

Introduction The revaluation process aims at arriving at values, which Duty and VAT calculations

in the opinion of the Customs Division form the VDP, and

This leaflet lists the requirements for the clearance of this is achieved by referring to values on identical or The following are examples of how the taxes are

motor vehicles imported into Zambia. It gives a step by similar vehicles. calculated:

step guidance of the process in clearance of motor

vehicles. 4.0 Duty Rates A Toyota Corolla (car) with cylinder capacity of 1600 is

Note: This leaflet should be regarded as a guide only, as imported from Japan with the following value;

final assessment is given by the Zambia Revenue ²

The customs duty rates for motor vehicles described

Authority at time of clearance at the border. in the table below are expressed as percentages or at ·Cost = US$ 1,300.00

specific rates if the VDP for a vehicle does not exceed ·Insurance =US$ 100.00

1.0 Documentation required at importation K8, 000.00 for category (a) or K13, 333.33 for ·Freight (up to Durban) =US$ 1,100.00

categories (b). ·C.I.F. =US$ 2,500.00

The following documents are required at time of ²

Excise Duty is a percentage of the sum of VDP and

·Other costs (Up to Chirundu) =US$ 400.00

importation: the applicable Customs Duty.

·CIF Chirundu =US$ 2,900.00

²

The Import value added tax (VAT) is a percentage of

the sum of VDP, customs duty and excise duty. ·Given exchange rate at time of importation is K4.1925

f

Invoice or letter of sale indicating the price paid;

f

Bill of Lading (for overseas imports) and/or road/rail for $1.

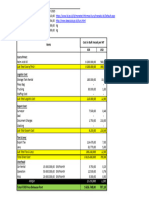

consignment note/manifest (for overland Description Custom Duty Excise Duty VAT

transportation) (a) VDP (CIF x rate of exchange) $2,900.00x K4.19250

(a) Motor cars and other motor vehicles 25% or K2, 000.00 1. With 1500cc and below - 20% 16% =K12, 158.25

f

Freight Statement (including overland costs from (including station wagons) principally per vehicle,

port);

2. Above 1500cc - 30% (b) Customs Duty @ 25% of VDP =K 3, 039.56

designed for the transport of less than whichever is the

f

Insurance Certificate; and (c) Value for Excise (a + b)

ten persons, including the driver greater

f

Any other documents relevant to the purchase, (12,158.25+K3, 039.56) =K15, 197.81

(b) Pick-ups and trucks/lorries with gross 15% or K2, 000. per 10% 16% (d) Excise Duty @ 30% of (a + b) =K 4, 559.34

acquisition, shipment or importation of the vehicle. weight not exceeding 20 tones. vehicle, whichever

These may include certificate of registration and is the greater

(e) Value for VAT purposes(c + d)

police clearance certificate. (K15, 197.81+K4,559.16) =K19,757.16

(c) Buses/coaches for the transport of more 15% or K2, 000 per 1. With seating capacity of ten 16% (f) VAT @16% of (e) =K 3, 161.15

than ten persons vehicle, whichever not exceeding 16 –25% (g) Carbon Tax (1600) =K100

2.0 Value For Duty Purposes (VDP) is the greater 2.Seating capacity exceeding 16 · Motor vehicle fee =K128.00

- 0%

The acceptable value for duty purposes (VDP) is always · Asycuda Processing Fee =K50.04

(d) Trucks/lorries with gross weight 15% 0% 16% · Total Tax Payable =K11,038.09

based on the total cost of the vehicle up to the point of entry exceeding 20 tonnes

into Zambia. This includes –

A 16-seater minibus imported from Japan with the following

f

The price paid or payable for the vehicle which is (e) Mechanical Horses(Road Tractors for 0% 0 16% values;

referred to as FOB (Free On Board); semi Trailers), Track Laying Tractors,

f

Insurance charges; etc ·Cost =US$ 3,500.00

f

Transport costs; and ·Insurance =US$ 200.00

f

Any other incidental costs incurred in importing the Note:Other motor vehicles not included in the table above

·Freight (up to Durban) =US$ 1,500.00

vehicle into Zambia. (i.e., ambulances) attract customs duty at 0% and

Import VAT at Zero rated 0%, and 0% excise duty. ·CIF Durban =US$ 5,200.00

·Other costs( up to Livingstone) =US$ 420.00

The Customs Value for imports is thus based on Cost, ·CIF Livingstone =US$ 5,620.00

Insurance, and Freight (CIF). Furthermore, the following additional tax known as Carbon

Emission Surtax is payable on all motor vehicles being

imported as below: ·Given exchange rate at time of importation isK4.2550

3.0 Valuation

The Zambia Revenue Authority reserves the right to ·VDP(CIFX Rate of exchange)

Engine Capacity in Cubic Surtax Rate ·(US$5620.00X K4. 2550) =K23, 913.10

revalue vehicles to determine the equitable transaction Centimeters

value in the country of supply where: ·Customs Duty @ 15% =K3, 586.97

1500cc and below 50.00

·Value for Excise Duty purposes

Between 1501cc and 100.00

f

The importer or Customs Clearing Agent provides ·(K23, 913.10+K3, 586.97) =K27, 500.07

2000cc

insufficient or unsatisfactory information; ·Excise Duty @25% =K6, 875.02

f

The vehicle is acquired in circumstances other than Between 2001cc and 150.00

·Value for VAT purposes

in normal course of trade, e.g. gift or donation. 3000cc

3001cc and above 200.00 ·(K27, 500.16+K6, 875.00) =K34, 375.08

You might also like

- Vat On ImportationDocument21 pagesVat On ImportationBISEKO100% (1)

- Fundamentals of Computation of Duties and Taxes For Imported GoodsDocument2 pagesFundamentals of Computation of Duties and Taxes For Imported GoodsZy Depeña89% (9)

- Estimated Port Disbursement AccountDocument2 pagesEstimated Port Disbursement Accountmaruli100% (2)

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Document8 pagesThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNo ratings yet

- Tutorial 9Document5 pagesTutorial 9nhunghohoNo ratings yet

- Bangladesh Exporter GuidelinesDocument27 pagesBangladesh Exporter GuidelinesBaki HakimNo ratings yet

- JP 54Document8 pagesJP 54alehillarNo ratings yet

- Yona N.songelaheDocument13 pagesYona N.songelaheTimoth MbwiloNo ratings yet

- Estimated Duties and Taxes PDFDocument1 pageEstimated Duties and Taxes PDFDianne Bernadeth Cos-agonNo ratings yet

- Customs Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingDocument32 pagesCustoms Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingAneesh D'souzaNo ratings yet

- Frequently Imported Brochure 2018 - OFFICIAL PDFDocument14 pagesFrequently Imported Brochure 2018 - OFFICIAL PDFAnonymous P8A3C6PgiNo ratings yet

- Estimated Duties and Taxes - Beneco Water TurbinesDocument1 pageEstimated Duties and Taxes - Beneco Water TurbinesDianne Bernadeth Cos-agonNo ratings yet

- White Illustrative Creative Literature Project Presentation 20240526 144750 0000Document12 pagesWhite Illustrative Creative Literature Project Presentation 20240526 144750 0000Mariwin MacandiliNo ratings yet

- TM 314C Topic 1 BF and BCDocument25 pagesTM 314C Topic 1 BF and BCLicardo, Marc PauloNo ratings yet

- Taxable ChargesDocument10 pagesTaxable Chargesjoanna reignNo ratings yet

- Landed CostDocument2 pagesLanded CostReise MendozaNo ratings yet

- Customs ValuationDocument7 pagesCustoms ValuationJulliane Love A. Garcia50% (2)

- Chapter 5 Value Added Tax Importation of GoodsDocument3 pagesChapter 5 Value Added Tax Importation of GoodsMary Grace BaquiranNo ratings yet

- QUOTE# QBOG043440 Avery Dennison Retail Information Services Colombia S. A.SDocument2 pagesQUOTE# QBOG043440 Avery Dennison Retail Information Services Colombia S. A.SfernanadaNo ratings yet

- Illustrative Problems On VAT On ImportationDocument6 pagesIllustrative Problems On VAT On ImportationShamae Duma-anNo ratings yet

- Aggregate Costing For MatarbariDocument1 pageAggregate Costing For Matarbarihabib rahman100% (1)

- TQ 1Document4 pagesTQ 1robykanaelNo ratings yet

- Medlab 2018 Official TariffDocument12 pagesMedlab 2018 Official Tariffselva1965No ratings yet

- Final ExamDocument6 pagesFinal ExamMOCH. RAIHAN HIBATULLAHNo ratings yet

- Surabaya, Id Port Valencia, Es Port: Seafreight / Lumpsum 20'STD 40'STDDocument3 pagesSurabaya, Id Port Valencia, Es Port: Seafreight / Lumpsum 20'STD 40'STDRoy AnthonyNo ratings yet

- Cost Calculation Pome PAODocument2 pagesCost Calculation Pome PAOAULIA ANNANo ratings yet

- TAXABLE CHARGES 2nd SemDocument28 pagesTAXABLE CHARGES 2nd Semnicole gonzalesNo ratings yet

- Cost Calculation Pome CPODocument1 pageCost Calculation Pome CPOAULIA ANNANo ratings yet

- Computation PDFDocument10 pagesComputation PDFghag22909947No ratings yet

- How To Calculate Custom Duty: Compiled by DR Renu AggarwalDocument6 pagesHow To Calculate Custom Duty: Compiled by DR Renu AggarwalJibran SakharkarNo ratings yet

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDocument3 pagesCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg50% (2)

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (30)

- Final Notification DP World Melbourne - Ancillary Charges From 2 February 2023Document6 pagesFinal Notification DP World Melbourne - Ancillary Charges From 2 February 2023Tuyền Nguyễn ThanhNo ratings yet

- VAT Training Day 3Document31 pagesVAT Training Day 3iftekharul alamNo ratings yet

- Local Charges 2017/2018: Updated 28 November 2017Document9 pagesLocal Charges 2017/2018: Updated 28 November 2017paulinNo ratings yet

- Tax.102 2 Other Percentage Taxes EEsDocument11 pagesTax.102 2 Other Percentage Taxes EEsJoana Lyn GalisimNo ratings yet

- Cmacgm Inmun Gncky ST 20220604 Qspot1197431Document2 pagesCmacgm Inmun Gncky ST 20220604 Qspot1197431Gagan Kumar JhaNo ratings yet

- MDB Schedule of Charges Foreign Trade NRB Banking 2015Document8 pagesMDB Schedule of Charges Foreign Trade NRB Banking 2015Mohammad Ariful Hoque ShuhanNo ratings yet

- Uttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsDocument8 pagesUttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsSãbbìŕ RàhmâñNo ratings yet

- Part 3Document12 pagesPart 3rajeshkandel345No ratings yet

- 423 Special DutiesDocument35 pages423 Special DutiesJoyce Ann Ramos BaquiNo ratings yet

- Other Percentage Taxes Summary: From UnderDocument4 pagesOther Percentage Taxes Summary: From UnderZee GuillebeauxNo ratings yet

- Email Covering LetterDocument3 pagesEmail Covering LetterAbdul Rahman Mohamed RifkhanNo ratings yet

- Inventory: Chap 13 Ias 2Document28 pagesInventory: Chap 13 Ias 2Tanatswa MatendaNo ratings yet

- Customs Valuation ExerciseDocument16 pagesCustoms Valuation ExerciseScribdTranslationsNo ratings yet

- Computation With Dumping Duty (R.A 8752)Document11 pagesComputation With Dumping Duty (R.A 8752)Mariel BoncatoNo ratings yet

- Motor Vehicle Tax CalculatorDocument1 pageMotor Vehicle Tax CalculatorSidney MusondaNo ratings yet

- Air Freight Rate - Informal/Formal Entry: Forwarding Charges Amount Local ChargesDocument2 pagesAir Freight Rate - Informal/Formal Entry: Forwarding Charges Amount Local ChargesCarmelita BulawanNo ratings yet

- LLAVE Final Coaching Handouts 2013 PDFDocument220 pagesLLAVE Final Coaching Handouts 2013 PDFshiplusNo ratings yet

- Dubai Airport Free Zone Set Up ChargesDocument3 pagesDubai Airport Free Zone Set Up ChargesAndrea FuentesNo ratings yet

- Tutorial 5Document5 pagesTutorial 5Lê Thiên Giang 2KT-19No ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- MFT CT 005 Tax Rates FuelsDocument18 pagesMFT CT 005 Tax Rates Fuelsmr.bentata.hichamNo ratings yet

- 18 Offering Price for Kassam Canada - ( CIF ) SolusindoDocument6 pages18 Offering Price for Kassam Canada - ( CIF ) SolusindoGatot Bayu WibowoNo ratings yet

- Valentyn Yanivets 1492 3 Practical WorkDocument4 pagesValentyn Yanivets 1492 3 Practical WorkReplаyMePleaseNo ratings yet

- Quotation - Golden HopeDocument3 pagesQuotation - Golden HopeAnifa OthmanNo ratings yet

- Annexure IV: EXS-Freight and Commercials: The Rates Shall Be Applicable From The Effective DateDocument1 pageAnnexure IV: EXS-Freight and Commercials: The Rates Shall Be Applicable From The Effective DateRamakanta Padhan HinduNo ratings yet

- Gss Codacon PLCDocument2 pagesGss Codacon PLCHenok MebrateNo ratings yet

- Cmacgm Inmun Bgboj ST 20220813 Qspot1740912Document2 pagesCmacgm Inmun Bgboj ST 20220813 Qspot1740912Gagan Kumar JhaNo ratings yet

- Schedule of Charges CorporateDocument13 pagesSchedule of Charges CorporateRimiJhimiNo ratings yet

- NB Standard Drop Impact Testing of CompositesDocument16 pagesNB Standard Drop Impact Testing of CompositesRogers PalamattamNo ratings yet

- Manufacturing Trends Globalization1Document15 pagesManufacturing Trends Globalization1Rogers PalamattamNo ratings yet

- 2010 12 Sartre Car Platoon Road Video PDFDocument2 pages2010 12 Sartre Car Platoon Road Video PDFRogers PalamattamNo ratings yet

- Damage Factor Estimation of Crane-Hook (A Database Approach With Image, Knowledge and Simulation)Document14 pagesDamage Factor Estimation of Crane-Hook (A Database Approach With Image, Knowledge and Simulation)Rogers PalamattamNo ratings yet

- OWM2B Practical 0 Specification 2011Document1 pageOWM2B Practical 0 Specification 2011Rogers PalamattamNo ratings yet

- Question 1. What Is CIF Contract? Judicial Definition of A CIF Contract. AnswerDocument3 pagesQuestion 1. What Is CIF Contract? Judicial Definition of A CIF Contract. AnswerSubaNo ratings yet

- CÂU HỎI LÝ THUYẾT CUỐI KỲ TACN2Document30 pagesCÂU HỎI LÝ THUYẾT CUỐI KỲ TACN2Anh Ngoc NguyenNo ratings yet

- Intl FormsDocument3 pagesIntl FormsdiggmarsNo ratings yet

- Documentary SaleDocument23 pagesDocumentary Saleanon_292350546100% (1)

- QQ 2427285 02 - MuDocument4 pagesQQ 2427285 02 - Musmlvl01No ratings yet

- SFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDocument3 pagesSFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDeby Aprilucia Farahdevira100% (1)

- Draft Contract Zhongshang-Xxxx GCV (Ar) - R1Document25 pagesDraft Contract Zhongshang-Xxxx GCV (Ar) - R1RonaldNo ratings yet

- Price Steel AssesmentDocument15 pagesPrice Steel AssesmentDamar WibisonoNo ratings yet

- Definition of Invoice: InvoicesDocument1 pageDefinition of Invoice: Invoicesএকজন নিশাচরNo ratings yet

- Assignment 1 - Ester Angelina Sitepu (2005081053)Document25 pagesAssignment 1 - Ester Angelina Sitepu (2005081053)Ester Angelina SitepuNo ratings yet

- Incoterms® 2020 Explained - The Complete GuideDocument1 pageIncoterms® 2020 Explained - The Complete GuideMohammednur A.H100% (1)

- AKBs ENG September2009Document23 pagesAKBs ENG September2009roseNo ratings yet

- Chapter 7Document31 pagesChapter 7Manoj SolankarNo ratings yet

- ExercisesDocument4 pagesExercisesLuân Nguyễn Đình ThànhNo ratings yet

- ITB - Modernized Forest NurseryDocument88 pagesITB - Modernized Forest NurseryGerald Ace CuicoNo ratings yet

- Foreign Exchange Manual (March 2020)Document561 pagesForeign Exchange Manual (March 2020)Mehmood Ul HassanNo ratings yet

- Import Export Contract Terms OnSales ContractDocument4 pagesImport Export Contract Terms OnSales ContractalamcoalamcoNo ratings yet

- Mid Term International Payments 2022Document2 pagesMid Term International Payments 2022Nam Anh VũNo ratings yet

- 6b.spare Parts Sale TermsDocument3 pages6b.spare Parts Sale Termsshujad77No ratings yet

- CábasaDocument7 pagesCábasatrangNo ratings yet

- Sale and Purchase AgreementDocument9 pagesSale and Purchase AgreementDipendu SarkarNo ratings yet

- Service & Rate GUIDE 2018: IndiaDocument21 pagesService & Rate GUIDE 2018: IndiashrishNo ratings yet

- Final 1111Document106 pagesFinal 1111Kalpesh PatilNo ratings yet

- This Question Has Been Answered: Find Study ResourcesDocument3 pagesThis Question Has Been Answered: Find Study ResourcesYasir SiddiquiNo ratings yet

- J 1bae Antiga1Document22 pagesJ 1bae Antiga1hunter.correaNo ratings yet

- DHL Express Rate Transit Guide Qa en 2016Document18 pagesDHL Express Rate Transit Guide Qa en 2016Sharif Sayyid Al-MahdlyNo ratings yet

- Abdul Vahid Internship ReportDocument64 pagesAbdul Vahid Internship ReportnihucehNo ratings yet