Professional Documents

Culture Documents

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

Uploaded by

Tuan NguyenCopyright:

Available Formats

You might also like

- The Dictionary of Fashion HistoryDocument567 pagesThe Dictionary of Fashion Historytarnawt100% (6)

- Compromise Agreement With Waiver, Release and Quitclaim-AvesDocument2 pagesCompromise Agreement With Waiver, Release and Quitclaim-AvesChristopher JuniarNo ratings yet

- Personal Scorecard - 4CL ResurreccionDocument2 pagesPersonal Scorecard - 4CL ResurreccionkairankairanNo ratings yet

- International TradeDocument5 pagesInternational TradeAsif Nawaz ArishNo ratings yet

- The Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel LojeskiDocument9 pagesThe Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel Lojeskiyogstr1No ratings yet

- 2019 01 22 JNJ Earning ReportDocument2 pages2019 01 22 JNJ Earning ReportTuan NguyenNo ratings yet

- Corporate Factbook Altria - MODocument9 pagesCorporate Factbook Altria - MOTom RobertsNo ratings yet

- IBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsDocument2 pagesIBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsTuan NguyenNo ratings yet

- Data Overview: TobaccoDocument10 pagesData Overview: Tobaccoderek_2010No ratings yet

- Big Lots, Inc.: Price, Consensus & SurpriseDocument1 pageBig Lots, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Analisa FundamentalDocument29 pagesAnalisa FundamentalChokoretoNo ratings yet

- Strides Arcolab: Mylan Claim Settlement - A Long-Drawn Out ProcessDocument6 pagesStrides Arcolab: Mylan Claim Settlement - A Long-Drawn Out ProcessrohitNo ratings yet

- Bakrie Sumatra Plantation: Perplexing End To A Confusing YearDocument5 pagesBakrie Sumatra Plantation: Perplexing End To A Confusing YearerlanggaherpNo ratings yet

- Amphastar Pharmaceuticals, Inc.: Price, Consensus & SurpriseDocument1 pageAmphastar Pharmaceuticals, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Cipla Ltd.Document25 pagesCipla Ltd.namithakb271480% (1)

- English Edition - 11 December, 2020, 09:02 PM ISTDocument7 pagesEnglish Edition - 11 December, 2020, 09:02 PM ISTRANAJAY PALNo ratings yet

- Case Study (Group) United Continental Holdings 2011Document4 pagesCase Study (Group) United Continental Holdings 2011msaru08No ratings yet

- Data Overview: Medical - Generic DrugsDocument10 pagesData Overview: Medical - Generic Drugsderek_2010No ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Data Overview: Large Cap PharmaceuticalsDocument12 pagesData Overview: Large Cap Pharmaceuticalsderek_2010No ratings yet

- Sanofi IndiaDocument9 pagesSanofi IndiaAshish RathoreNo ratings yet

- Abiomed, Inc.: Price, Consensus & SurpriseDocument1 pageAbiomed, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Biotelemetry, Inc.: Price, Consensus & SurpriseDocument1 pageBiotelemetry, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- CVS Health Corporation: Data OverviewDocument10 pagesCVS Health Corporation: Data Overviewderek_2010No ratings yet

- JS-OMCs 05JAN24Document3 pagesJS-OMCs 05JAN24BahrianNo ratings yet

- Forest Laboratories, Inc.Document4 pagesForest Laboratories, Inc.sommer_ronald5741No ratings yet

- Dabur Vs ITC FinancialsDocument6 pagesDabur Vs ITC Financialssarthak.ladNo ratings yet

- Mylan AssignmentDocument1 pageMylan AssignmentAdam SchlossNo ratings yet

- Quarter Report Q2.18Document3 pagesQuarter Report Q2.18DEButtNo ratings yet

- FSA AssignmentDocument5 pagesFSA AssignmentNaman BishtNo ratings yet

- Aarti Drugs Fair Wealth 27-05-10Document3 pagesAarti Drugs Fair Wealth 27-05-10sandipgargNo ratings yet

- Market Outlook For 01 Mar - Cautiously OptimisticDocument5 pagesMarket Outlook For 01 Mar - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Fra Assignment 231223 1100Document12 pagesFra Assignment 231223 1100mfarrukhfbNo ratings yet

- Quarter Report Q2.19Document3 pagesQuarter Report Q2.19DEButtNo ratings yet

- Why Need Performance MeasurementDocument8 pagesWhy Need Performance MeasurementKhalil ManiarNo ratings yet

- Johnson and Johnson, Inc.: Data OverviewDocument11 pagesJohnson and Johnson, Inc.: Data Overviewderek_2010No ratings yet

- 1Q20 Earnings - J&J PDFDocument17 pages1Q20 Earnings - J&J PDFAlexNo ratings yet

- Or No Shutdown?Document6 pagesOr No Shutdown?Andre_Setiawan_1986No ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- Cipla LTD: Key Financial IndicatorsDocument4 pagesCipla LTD: Key Financial IndicatorsMelwyn MathewNo ratings yet

- 2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsDocument8 pages2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsKelvin FuNo ratings yet

- Orporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Document5 pagesOrporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Andre SetiawanNo ratings yet

- Stock Daily Report TemplateDocument39 pagesStock Daily Report Templatesanjana petwalNo ratings yet

- Organ Oseph: Constar International, Inc. (CNST)Document6 pagesOrgan Oseph: Constar International, Inc. (CNST)Alex DiazNo ratings yet

- ICRA Credit Rating Rationale - KaruturiDocument7 pagesICRA Credit Rating Rationale - KaruturiTj BlogsNo ratings yet

- Abbott ABT PDFDocument39 pagesAbbott ABT PDFuygh g100% (1)

- OBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Document3 pagesOBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Nate TobikNo ratings yet

- Images of MC DonaldsDocument12 pagesImages of MC Donaldsakash786rathiNo ratings yet

- Jubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Document10 pagesJubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Shashanka HollaNo ratings yet

- Financial Analysis Sample 5Document10 pagesFinancial Analysis Sample 5throwawayyyNo ratings yet

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementssiddharthrajNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- TTK Prestige Research ReportDocument22 pagesTTK Prestige Research Reportsujay85No ratings yet

- Renewable Energy Industry Research ReportDocument51 pagesRenewable Energy Industry Research ReportinfoNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Phpe 9 K OTYDocument5 pagesPhpe 9 K OTYfred607No ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsViren DeshpandeNo ratings yet

- MonsantoDocument7 pagesMonsantozbarcea99No ratings yet

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaNo ratings yet

- 3Q16 Earnings PresentationDocument19 pages3Q16 Earnings PresentationZerohedgeNo ratings yet

- Buy Bio Con LTDDocument6 pagesBuy Bio Con LTDshashi_svtNo ratings yet

- EVI Stock SummaryDocument1 pageEVI Stock SummaryOld School ValueNo ratings yet

- 04 - Tutorial 4 - Week 6 SolutionsDocument8 pages04 - Tutorial 4 - Week 6 SolutionsJason ChowNo ratings yet

- Mineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryFrom EverandMineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryNo ratings yet

- 2019 01 22 JNJ Earning ReportDocument2 pages2019 01 22 JNJ Earning ReportTuan NguyenNo ratings yet

- IBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsDocument2 pagesIBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsTuan NguyenNo ratings yet

- Earnings Call CalendarDocument25 pagesEarnings Call CalendarTuan NguyenNo ratings yet

- Logistics Lifecycle Within The Product LifecycleDocument4 pagesLogistics Lifecycle Within The Product LifecycleTuan NguyenNo ratings yet

- LogDocument7 pagesLograjbirprince3265No ratings yet

- SCM in A NutshellDocument2 pagesSCM in A NutshellTuan NguyenNo ratings yet

- Tesco's KPIDocument10 pagesTesco's KPIHuy BachNo ratings yet

- Meditech SurgicalDocument6 pagesMeditech SurgicalTuan NguyenNo ratings yet

- East Asia Institute of Management: E-Commerce With LogisticsDocument14 pagesEast Asia Institute of Management: E-Commerce With LogisticsTuan NguyenNo ratings yet

- Mudarabah by Sheikh Muhammad Taqi UsmaniDocument5 pagesMudarabah by Sheikh Muhammad Taqi UsmaniMUSALMAN BHAINo ratings yet

- Second Story Final VersionDocument7 pagesSecond Story Final Versionapi-629877096No ratings yet

- A Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntDocument377 pagesA Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntLe Po100% (3)

- People v. MadsaliDocument3 pagesPeople v. MadsaliNoreenesse SantosNo ratings yet

- DOJ CRT Press Release FINAL 7-12-13 Pdf0Document3 pagesDOJ CRT Press Release FINAL 7-12-13 Pdf0jchristianadamsNo ratings yet

- UP08 Labor Law 01Document56 pagesUP08 Labor Law 01jojitus100% (2)

- Koustuv AssignmentsDocument5 pagesKoustuv AssignmentsKoustuv PokhrelNo ratings yet

- Answer - Tutorial - Record Business TransactionDocument10 pagesAnswer - Tutorial - Record Business TransactiondenixngNo ratings yet

- Heritage Christian Academy Family Handbook: Able OF OntentsDocument37 pagesHeritage Christian Academy Family Handbook: Able OF OntentsNathan Brony ThomasNo ratings yet

- Euro Cup 2024 A Drive Through The Superb Euro 2024 Host ArenasDocument8 pagesEuro Cup 2024 A Drive Through The Superb Euro 2024 Host Arenasworldticketsandhospitality.11No ratings yet

- General FAQs For The New SABBMobileDocument3 pagesGeneral FAQs For The New SABBMobileSajad PkNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Energy Management in An Automated Solar Powered Irrigation SystemDocument6 pagesEnergy Management in An Automated Solar Powered Irrigation Systemdivya1587No ratings yet

- Buseval Week 10Document54 pagesBuseval Week 10aligaealadinNo ratings yet

- More About Percentages: Let 'S ReviewDocument23 pagesMore About Percentages: Let 'S ReviewJason Lam LamNo ratings yet

- The Eleusinian MysteriesDocument104 pagesThe Eleusinian MysteriesKieran McKennaNo ratings yet

- Types of Retailers-Delivering Value Through Retail FormatsDocument50 pagesTypes of Retailers-Delivering Value Through Retail FormatsShubham DixitNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- Upload Documents For Free AccessDocument3 pagesUpload Documents For Free AccessNitish RajNo ratings yet

- Nayeri 2018Document8 pagesNayeri 2018api-708991468No ratings yet

- Tut Topic 1 QADocument3 pagesTut Topic 1 QASiow WeiNo ratings yet

- ShowfileDocument179 pagesShowfileSukumar NayakNo ratings yet

- Ap Human Geography Key Geography Concepts and ModelsDocument3 pagesAp Human Geography Key Geography Concepts and Modelsapi-314084641No ratings yet

- Bhakti - TheologiansDocument9 pagesBhakti - TheologiansHiviNo ratings yet

- ICT Empowerment-Technologies Q1 Module1Document18 pagesICT Empowerment-Technologies Q1 Module1Luckyluige Nagbuya100% (1)

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

Uploaded by

Tuan NguyenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

ABT Abbott Laboratories: Health Care Equipment & Services Health Care Equipment

Uploaded by

Tuan NguyenCopyright:

Available Formats

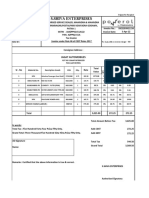

Stock Profile and Earning Report

1/23/2019

Ticker: ABT Abbott Laboratories

Combo Rank (Nov 30, 18) 77.4% Health Care Equipment & Services Health Care Equipment

FS Core 75.8% MOMENTUM 8.2% GROWTH 21.3% Tuan Nguyen

Free Cash Flow Yield 3.77 3y BetaMo 1.22 SlsGro% LTM 20.96

Oper CF Yld 5 Yr 3.49 StdDev Wkly 52W 3.54 SlsGro% 17' 31.35

Entrpr Value/ EBIT 55.76 6 MO % Pchg 13.61 SlsGro% 16' 2.20

FCF / EV 3.35 6Mo/6Mo ago % Pchg 6.46 SlsGro% 15' 0.78

Accurals per NDR 5.92 1Mo Chg% 2.29 NetIncGro% 3yr avg 1.24

Est Rev 3 mo FY1 -0.16 OCF PS Gro% 3 yr avg 0.22

Up/Down No. Est FY1 -4.35 VALUE 87.7% EPS Growth qoq% -0.06

Up/Dn LTG Estimate 4.35 FCF/Yield 0.04 EBITDA qoq% 0.12

Return on Avg Invest Capital 1.52 P/OCF ps 20.33 NetIncMgn% yoy -66.4 Abbott Laboratory (NYSE: ABT)

CF Ret on Tot Invest Capital 11.72 P/E Est 4Q forward 23.14 FCF 4Qyoy% 0.23

Net Income Margin 2.63 Price/Sls ps 4.13 LTG% 12.08

Common Equity %Total Assets 40.52 EV/ EBITDA 17.40 Abbott Laboratories discovers, develops,

Cash Oper / Tot Ass per shr 3.03 Price / Book Value 4.20 BAL SHT STRESS 47.0% manufactures, and sells a broad and diversified

EBIT / TA per shr 2.77 Cash vs LTD 0.3915

Gross Inc/ Tot Ass 20.38 REVISIONS 49.1% FCF v LTD 0.2543 line of health care products and services. The

Sls Gro Hist 3 yr 9.33 Buy - Sell Ratio 0.67 FCF v Sls 0.16 Company's products include pharmaceuticals,

Q2 EstRev -0.03 OCF v Dividend Paid 3.1781

BB Core 66.9% Q1 EstRev 0.00 EBITDA v Int Exp 9.7 nutritional, diagnostics, and vascular products.

2 MO EPS Revision Rank 706 EstRev FY2 3Mo 0.00 LTD / Mkt Cap 0.2 Abbott markets its products worldwide through

3 MO EPS Revision Rank 652 EstRev FY1 3m ago 0.00 LTD / TA 0.3

6 MO EPS Revision Rank 613 Up-Dn / Total -1.00 Altman Z Score 3.0 affiliates and distributors.

Oper Cashflow/ Assets Rank 937 SlsGd 3m ago #N/A Cash / TA 0.11

CAPEX / NET SALES Rank 942 OCF Rev 3mo ago% 0.006

Gross Profit / Total Assets Rank 1251 Gd EPS 3m% 0.000 SHARE ACIVITY 83.2% Business Segments: Established

Ebit / Total Assets Rank 1393 PrTgt 3moago% 0.01 Share Buyback 1.10 Pharmaceutical Products, Diagnostic Products,

ROIC Rank 1161 Gd Shr Repur #N/A

BB EST LT EPS Growth Rank 531 EFFICIENCY 75.2% Shr Rep Act #N/A Nutritional Products and Vascular Products.

Cash Position Rank 469 GrossInc Mgn 51.12 InsSel Cum3m ago #N/A

Accruals Ratio Rank 398 NetInc Mgn 2.63 Business Brands: FreeStyle Libre, Mitraclip,

R&D / Assets Rank 347 ROE 1.34 INCOME 82.7%

EV / Free Cash Flow Rank 1182 EPS/BV 0.03 Div Yield 1.8837 Alinity

Free Cash Flow Yield Rank 1045 ROIC 0.69 LTDebt /EBITDA 2.84

Operating Cash Flow Yield Rank 1257 ROTA 0.52 LTD /EBIT 5.60

EV / EBITDA Rank 1497 Net Sales/TA 0.42 FCF/Div Cov 2.5234

CFO/Sls LTM 0.20 CFO/ Div Cov 3.1781

PULSE 79.5% FCF/TA 0.07 Cash & ST /Div 3.8857

Days Held 127.92 SlsLTM /Empl 0.31 Div Payout 230.88

SIR %Flt 1.07 GrossMgn LTM Mom 1.01 Altman Z Score 2.39

SIR DTC 2.35 NetMgn LTM Mom 0.60 EBITDA Oper/ Int Exp 9.688

EBIT Int Cov 4.9046

EARNING REPORT

Revenues of $7.765 billion (up 2.3% year over year) was barely shy of the $7.815 billion consensus, and adjusted earnings per share of $0.81 (up

9.5% year over year) matched the consensus. Additionally, fourth quarter organic sales growth of 6.4% was relatively in-line with expectations.

Management issued their 2019 financial outlook, and it included another year of double-digit earnings per share growth despite the difficult

macro/currency backdrop. Full year adjusted earnings per share is expected to be in the range of $3.15 to $3.25 (consensus $3.20), reflecting growth

of about 11% at the midpoint. Furthermore, organic sales are expected to increase in the range of 6.5% to 7.5% in 2019, in-line with the 7.0%

consensus.

EARNING COMMENTARIES

Nutrition sales of $1.777 billion (3.6% organic sales growth) came in slightly light to the $1.81 billion consensus. On the international side, White

noted on the conference call how in China there have been improvements in both the market and Abbott's own performance after the new food safety

regulations were put in place last year. Meanwhile in the United States, growth was driven by the Pediatric business and its above-market performing

Similac brand and the market-leading Pedialyte Brand.

In Diagnostics, sales of $1.961 billion (7.4% organic sales growth) in the quarter came in slightly ahead of the $1.938 billion consensus. Much of the

beat came from Rapid Diagnostics ($548 million sales vs. $513 million consensus), which is a derivative of the company's acquisition of Alere. Core

Laboratory also outperformed ($1.153 billion in sales vs. $1.142 billion expectation;9.4% organic sales growth), driven by the strength of Alinity in

Europe and in other International markets. As we look ahead to 2019, we expect big things to come from the opportunity Alinity has in the United

States.

At Established Pharmaceuticals, sales of $1.090 billion in the quarter (3.6% organic sales growth) was short of the $1.128 billion consensus. Impacting

the reported results was an unfavorable 8.4% effect of foreign exchange.

Medical Devices once again posted strong organic sales growth (9.0%), though sales of $2.920 billion slightly missed estimates of $2.925 billion.

Within Structural Heart, while current results are important, our attention is to when the MitraClip, which is a device for the minimally invasive repair

of the mitral valve, will receive an expanded indication approval by the FDA as mentioned above. Notably in Diabetes Care, the division that contains

Abbott's FreeStyle Libre continuous glucose monitor, sales were $530 million in the quarter, up 28.3% on a reported basis and 32.4% on an organic

basis.

STRICTLY PRIVATE AND CONFIDENTIAL

1

Stock Profile and Earning Report

1/23/2019

Bottom line: A mixed quarter with some headwinds in international segments for Nutrition and Pharma segments. However, the most growth segment

in Diagnostic and Medical Devices delivered with more strength coming in 2019. Alinity is expected to come online soon, with Mitraclip to receive

FDA approval soon and the Libre 2 for dibetes is increasing its adoption, ABT is in for growth in 2019. Maintain partial BUY for ABT.

STRICTLY PRIVATE AND CONFIDENTIAL

2

You might also like

- The Dictionary of Fashion HistoryDocument567 pagesThe Dictionary of Fashion Historytarnawt100% (6)

- Compromise Agreement With Waiver, Release and Quitclaim-AvesDocument2 pagesCompromise Agreement With Waiver, Release and Quitclaim-AvesChristopher JuniarNo ratings yet

- Personal Scorecard - 4CL ResurreccionDocument2 pagesPersonal Scorecard - 4CL ResurreccionkairankairanNo ratings yet

- International TradeDocument5 pagesInternational TradeAsif Nawaz ArishNo ratings yet

- The Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel LojeskiDocument9 pagesThe Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel Lojeskiyogstr1No ratings yet

- 2019 01 22 JNJ Earning ReportDocument2 pages2019 01 22 JNJ Earning ReportTuan NguyenNo ratings yet

- Corporate Factbook Altria - MODocument9 pagesCorporate Factbook Altria - MOTom RobertsNo ratings yet

- IBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsDocument2 pagesIBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsTuan NguyenNo ratings yet

- Data Overview: TobaccoDocument10 pagesData Overview: Tobaccoderek_2010No ratings yet

- Big Lots, Inc.: Price, Consensus & SurpriseDocument1 pageBig Lots, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Analisa FundamentalDocument29 pagesAnalisa FundamentalChokoretoNo ratings yet

- Strides Arcolab: Mylan Claim Settlement - A Long-Drawn Out ProcessDocument6 pagesStrides Arcolab: Mylan Claim Settlement - A Long-Drawn Out ProcessrohitNo ratings yet

- Bakrie Sumatra Plantation: Perplexing End To A Confusing YearDocument5 pagesBakrie Sumatra Plantation: Perplexing End To A Confusing YearerlanggaherpNo ratings yet

- Amphastar Pharmaceuticals, Inc.: Price, Consensus & SurpriseDocument1 pageAmphastar Pharmaceuticals, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Cipla Ltd.Document25 pagesCipla Ltd.namithakb271480% (1)

- English Edition - 11 December, 2020, 09:02 PM ISTDocument7 pagesEnglish Edition - 11 December, 2020, 09:02 PM ISTRANAJAY PALNo ratings yet

- Case Study (Group) United Continental Holdings 2011Document4 pagesCase Study (Group) United Continental Holdings 2011msaru08No ratings yet

- Data Overview: Medical - Generic DrugsDocument10 pagesData Overview: Medical - Generic Drugsderek_2010No ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Data Overview: Large Cap PharmaceuticalsDocument12 pagesData Overview: Large Cap Pharmaceuticalsderek_2010No ratings yet

- Sanofi IndiaDocument9 pagesSanofi IndiaAshish RathoreNo ratings yet

- Abiomed, Inc.: Price, Consensus & SurpriseDocument1 pageAbiomed, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Biotelemetry, Inc.: Price, Consensus & SurpriseDocument1 pageBiotelemetry, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- CVS Health Corporation: Data OverviewDocument10 pagesCVS Health Corporation: Data Overviewderek_2010No ratings yet

- JS-OMCs 05JAN24Document3 pagesJS-OMCs 05JAN24BahrianNo ratings yet

- Forest Laboratories, Inc.Document4 pagesForest Laboratories, Inc.sommer_ronald5741No ratings yet

- Dabur Vs ITC FinancialsDocument6 pagesDabur Vs ITC Financialssarthak.ladNo ratings yet

- Mylan AssignmentDocument1 pageMylan AssignmentAdam SchlossNo ratings yet

- Quarter Report Q2.18Document3 pagesQuarter Report Q2.18DEButtNo ratings yet

- FSA AssignmentDocument5 pagesFSA AssignmentNaman BishtNo ratings yet

- Aarti Drugs Fair Wealth 27-05-10Document3 pagesAarti Drugs Fair Wealth 27-05-10sandipgargNo ratings yet

- Market Outlook For 01 Mar - Cautiously OptimisticDocument5 pagesMarket Outlook For 01 Mar - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Fra Assignment 231223 1100Document12 pagesFra Assignment 231223 1100mfarrukhfbNo ratings yet

- Quarter Report Q2.19Document3 pagesQuarter Report Q2.19DEButtNo ratings yet

- Why Need Performance MeasurementDocument8 pagesWhy Need Performance MeasurementKhalil ManiarNo ratings yet

- Johnson and Johnson, Inc.: Data OverviewDocument11 pagesJohnson and Johnson, Inc.: Data Overviewderek_2010No ratings yet

- 1Q20 Earnings - J&J PDFDocument17 pages1Q20 Earnings - J&J PDFAlexNo ratings yet

- Or No Shutdown?Document6 pagesOr No Shutdown?Andre_Setiawan_1986No ratings yet

- Financial Analysis of P & GDocument25 pagesFinancial Analysis of P & Ghitesh_mahajan_3No ratings yet

- Cipla LTD: Key Financial IndicatorsDocument4 pagesCipla LTD: Key Financial IndicatorsMelwyn MathewNo ratings yet

- 2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsDocument8 pages2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsKelvin FuNo ratings yet

- Orporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Document5 pagesOrporate Ews: .DJI 12,214.38 .SPX 1,321.82 .IXIC 2,765.77Andre SetiawanNo ratings yet

- Stock Daily Report TemplateDocument39 pagesStock Daily Report Templatesanjana petwalNo ratings yet

- Organ Oseph: Constar International, Inc. (CNST)Document6 pagesOrgan Oseph: Constar International, Inc. (CNST)Alex DiazNo ratings yet

- ICRA Credit Rating Rationale - KaruturiDocument7 pagesICRA Credit Rating Rationale - KaruturiTj BlogsNo ratings yet

- Abbott ABT PDFDocument39 pagesAbbott ABT PDFuygh g100% (1)

- OBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Document3 pagesOBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Nate TobikNo ratings yet

- Images of MC DonaldsDocument12 pagesImages of MC Donaldsakash786rathiNo ratings yet

- Jubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Document10 pagesJubilant Life Sciences: CMP: INR596 TP: INR800 (+34%)Shashanka HollaNo ratings yet

- Financial Analysis Sample 5Document10 pagesFinancial Analysis Sample 5throwawayyyNo ratings yet

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementssiddharthrajNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- TTK Prestige Research ReportDocument22 pagesTTK Prestige Research Reportsujay85No ratings yet

- Renewable Energy Industry Research ReportDocument51 pagesRenewable Energy Industry Research ReportinfoNo ratings yet

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587No ratings yet

- Phpe 9 K OTYDocument5 pagesPhpe 9 K OTYfred607No ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsViren DeshpandeNo ratings yet

- MonsantoDocument7 pagesMonsantozbarcea99No ratings yet

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaNo ratings yet

- 3Q16 Earnings PresentationDocument19 pages3Q16 Earnings PresentationZerohedgeNo ratings yet

- Buy Bio Con LTDDocument6 pagesBuy Bio Con LTDshashi_svtNo ratings yet

- EVI Stock SummaryDocument1 pageEVI Stock SummaryOld School ValueNo ratings yet

- 04 - Tutorial 4 - Week 6 SolutionsDocument8 pages04 - Tutorial 4 - Week 6 SolutionsJason ChowNo ratings yet

- Mineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryFrom EverandMineral Classifying, Flotation, Separating, Concentrating, Cleaning Equipment World Summary: Market Sector Values & Financials by CountryNo ratings yet

- 2019 01 22 JNJ Earning ReportDocument2 pages2019 01 22 JNJ Earning ReportTuan NguyenNo ratings yet

- IBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsDocument2 pagesIBM International Business Machines Corporation: $21.76 Billion, vs. $21.71 Billion As Expected by AnalystsTuan NguyenNo ratings yet

- Earnings Call CalendarDocument25 pagesEarnings Call CalendarTuan NguyenNo ratings yet

- Logistics Lifecycle Within The Product LifecycleDocument4 pagesLogistics Lifecycle Within The Product LifecycleTuan NguyenNo ratings yet

- LogDocument7 pagesLograjbirprince3265No ratings yet

- SCM in A NutshellDocument2 pagesSCM in A NutshellTuan NguyenNo ratings yet

- Tesco's KPIDocument10 pagesTesco's KPIHuy BachNo ratings yet

- Meditech SurgicalDocument6 pagesMeditech SurgicalTuan NguyenNo ratings yet

- East Asia Institute of Management: E-Commerce With LogisticsDocument14 pagesEast Asia Institute of Management: E-Commerce With LogisticsTuan NguyenNo ratings yet

- Mudarabah by Sheikh Muhammad Taqi UsmaniDocument5 pagesMudarabah by Sheikh Muhammad Taqi UsmaniMUSALMAN BHAINo ratings yet

- Second Story Final VersionDocument7 pagesSecond Story Final Versionapi-629877096No ratings yet

- A Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntDocument377 pagesA Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntLe Po100% (3)

- People v. MadsaliDocument3 pagesPeople v. MadsaliNoreenesse SantosNo ratings yet

- DOJ CRT Press Release FINAL 7-12-13 Pdf0Document3 pagesDOJ CRT Press Release FINAL 7-12-13 Pdf0jchristianadamsNo ratings yet

- UP08 Labor Law 01Document56 pagesUP08 Labor Law 01jojitus100% (2)

- Koustuv AssignmentsDocument5 pagesKoustuv AssignmentsKoustuv PokhrelNo ratings yet

- Answer - Tutorial - Record Business TransactionDocument10 pagesAnswer - Tutorial - Record Business TransactiondenixngNo ratings yet

- Heritage Christian Academy Family Handbook: Able OF OntentsDocument37 pagesHeritage Christian Academy Family Handbook: Able OF OntentsNathan Brony ThomasNo ratings yet

- Euro Cup 2024 A Drive Through The Superb Euro 2024 Host ArenasDocument8 pagesEuro Cup 2024 A Drive Through The Superb Euro 2024 Host Arenasworldticketsandhospitality.11No ratings yet

- General FAQs For The New SABBMobileDocument3 pagesGeneral FAQs For The New SABBMobileSajad PkNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Energy Management in An Automated Solar Powered Irrigation SystemDocument6 pagesEnergy Management in An Automated Solar Powered Irrigation Systemdivya1587No ratings yet

- Buseval Week 10Document54 pagesBuseval Week 10aligaealadinNo ratings yet

- More About Percentages: Let 'S ReviewDocument23 pagesMore About Percentages: Let 'S ReviewJason Lam LamNo ratings yet

- The Eleusinian MysteriesDocument104 pagesThe Eleusinian MysteriesKieran McKennaNo ratings yet

- Types of Retailers-Delivering Value Through Retail FormatsDocument50 pagesTypes of Retailers-Delivering Value Through Retail FormatsShubham DixitNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- Upload Documents For Free AccessDocument3 pagesUpload Documents For Free AccessNitish RajNo ratings yet

- Nayeri 2018Document8 pagesNayeri 2018api-708991468No ratings yet

- Tut Topic 1 QADocument3 pagesTut Topic 1 QASiow WeiNo ratings yet

- ShowfileDocument179 pagesShowfileSukumar NayakNo ratings yet

- Ap Human Geography Key Geography Concepts and ModelsDocument3 pagesAp Human Geography Key Geography Concepts and Modelsapi-314084641No ratings yet

- Bhakti - TheologiansDocument9 pagesBhakti - TheologiansHiviNo ratings yet

- ICT Empowerment-Technologies Q1 Module1Document18 pagesICT Empowerment-Technologies Q1 Module1Luckyluige Nagbuya100% (1)