Professional Documents

Culture Documents

SSS R1A Form (Blank)

SSS R1A Form (Blank)

Uploaded by

JustinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSS R1A Form (Blank)

SSS R1A Form (Blank)

Uploaded by

JustinCopyright:

Available Formats

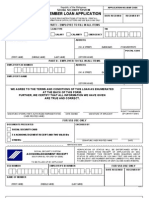

R-1A Republic of the Philippines

SOCIAL SECURITY SYSTEM

REV. 01-2001 EMPLOYMENT REPORT

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

Republic of the Philippines

SOCIAL SECURITY SYSTEM R-1A

EMPLOYMENT REPORT REV. 01-2001

(Please read instructions/reminders at the back. Print all information in black ink.)

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME TAXPAYER IDENTIFICATION NO.

TELEPHONE NUMBER ADDRESS POSTAL CODE

Name of Employee Date of Birth Date of Employment Remarks

SS Number Position Monthly Salary

(Surname) (Given Name) (MI) (MMDDYYYY) (MMDDYYYY) FOR SSS USE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

CERTIFIED CORRECT: FOR SSS USE RECEIVED BY/DATE:

TOTAL NO. OF PROCESS BY/DATE: REVIEW BY/DATE: ENCODE BY/DATE:

REPORTED

EMPLOYEES Signature Over Printed Name

of Authorized Signature

Page of Page/s

Official Designation Date

INSTRUCTIONS/REMINDERS

1. Submit in two (2) copies with properly accomplished SS Form R-1 (Employer Registration), if the

employer is not yet registered with the SSS.

2. Submit in two (2) copies to report newly hired/rehired employee/s and present SS Employer ID Card, if

the employer is already registered with the SSS.

3. The employer is obliged to report all its employees for coverage through this form regardless of the

actual amount of monthly earnings rounded off to the last peso.

4. The owner of a single proprietorship business is disqualified to be reported as employee thereof.

However, he may register as a self-employed, provided he is not over 60 years old and is currently not

an employee member.

5. Write "Nothing Follows" immediately after the last reported employee

You might also like

- SSS R1A FormDocument20 pagesSSS R1A FormAna Padrillan50% (10)

- Employer Data Change Request: This Form Is Not For SaleDocument2 pagesEmployer Data Change Request: This Form Is Not For SaleHR ZMCNo ratings yet

- FPF060 Membership Contributions Remittance Form (MCRF)Document2 pagesFPF060 Membership Contributions Remittance Form (MCRF)Mathenie David56% (9)

- Employers Data Form 2019Document2 pagesEmployers Data Form 2019Michelle Hernandez50% (2)

- PFF002 EmployersDataForm V06Document2 pagesPFF002 EmployersDataForm V06hitme bensiNo ratings yet

- Compensation and RewardsDocument26 pagesCompensation and RewardsvarshmurheNo ratings yet

- Employment Report: Social Security SystemDocument2 pagesEmployment Report: Social Security SystemMariecon MarzanNo ratings yet

- SSS - R1A - Form (EDocFind - Com)Document40 pagesSSS - R1A - Form (EDocFind - Com)percy_naranjo_20% (1)

- SSS R1aDocument2 pagesSSS R1aLern PecadizoNo ratings yet

- Sss R-1A FORM PDFDocument2 pagesSss R-1A FORM PDFAnna Maucesa Lopez83% (6)

- Social Security System Contribution Collection ListDocument4 pagesSocial Security System Contribution Collection Listjessa maeNo ratings yet

- Employment Report: Social Security SystemDocument2 pagesEmployment Report: Social Security SystemRENEE BUENAFLORNo ratings yet

- Form ADocument2 pagesForm APrateek BaruahNo ratings yet

- EC Medical Reimbursement Application Form 1Document2 pagesEC Medical Reimbursement Application Form 1GaryNo ratings yet

- SSSForms Contribution Collection ListDocument2 pagesSSSForms Contribution Collection ListCNo ratings yet

- Contribution Collection List: Social Security SystemDocument2 pagesContribution Collection List: Social Security SystemmareiosaNo ratings yet

- Sss-R1.employer Registration Form PDFDocument2 pagesSss-R1.employer Registration Form PDFElsie Mercado67% (6)

- Contribution Collection List: Quarter EndingDocument2 pagesContribution Collection List: Quarter EndingBevs Al-OroNo ratings yet

- PFF053 Member'SContributionRemittanceForm V03.1Document2 pagesPFF053 Member'SContributionRemittanceForm V03.1FA Marquez64% (11)

- SBWS TemplateDocument1 pageSBWS TemplateMarie SyNo ratings yet

- SSS Employer Registration.R1Document2 pagesSSS Employer Registration.R1blank.walls6387No ratings yet

- Pag - Ibig MDFDocument2 pagesPag - Ibig MDFvenemysamson50% (2)

- FPF060Members Registration Remittance FormDocument2 pagesFPF060Members Registration Remittance Formpipay_margaret7921100% (3)

- Employer's Data Form (EDF, HQP-PFF-002, V03.2) PDFDocument2 pagesEmployer's Data Form (EDF, HQP-PFF-002, V03.2) PDFPamela Angelica Obaniana FisicoNo ratings yet

- Employer's Data Form (EDF, HQP-PFF-002, V03.2)Document2 pagesEmployer's Data Form (EDF, HQP-PFF-002, V03.2)Roniel Cedeño100% (5)

- SSS R1aDocument4 pagesSSS R1aJean Cathylene SuarezNo ratings yet

- PFF002 - Employer's Data Form - V04 - PDF PDFDocument2 pagesPFF002 - Employer's Data Form - V04 - PDF PDFarlyn100% (1)

- SSS Member Loan Application FormDocument2 pagesSSS Member Loan Application FormJr Sam90% (49)

- Applicatio N of Registratio N: Appendix A-Management RequirementsDocument14 pagesApplicatio N of Registratio N: Appendix A-Management RequirementsKclyn FranciscoNo ratings yet

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- SSSForm SicMat PDFDocument2 pagesSSSForm SicMat PDFHoneylyne PlazaNo ratings yet

- Personal Record: Social Security SystemDocument5 pagesPersonal Record: Social Security Systembenzar amilNo ratings yet

- SbwsDocument1 pageSbwsDaniel VasquezNo ratings yet

- Sss Loan Application FormDocument4 pagesSss Loan Application FormSymphanie ChilesNo ratings yet

- Cs Form No. 2 Report On Appointments IssuedDocument2 pagesCs Form No. 2 Report On Appointments IssuedEilerol Ann Bascuña100% (1)

- Staff Engagement - Form - Smart Service Application - New ConnectDocument12 pagesStaff Engagement - Form - Smart Service Application - New Connectdiamondruby21No ratings yet

- Internet ReimbursementFormDocument1 pageInternet ReimbursementFormtax advisorNo ratings yet

- Membership FormDocument6 pagesMembership FormDebabrata DasNo ratings yet

- SSSForms Personal Record PDFDocument3 pagesSSSForms Personal Record PDFBea GenerNo ratings yet

- Udyam Ramakrishna CorporationDocument4 pagesUdyam Ramakrishna CorporationRAJESH DNo ratings yet

- APPLICATIONDocument3 pagesAPPLICATIONdilupandaitbhuNo ratings yet

- SIC - 01252 Sickness NotificationDocument3 pagesSIC - 01252 Sickness NotificationJeannylyn BurgosNo ratings yet

- R3 SSSDocument8 pagesR3 SSSWeng ButialNo ratings yet

- Employer'S Virtual Pag-Ibig Enrollment FormDocument2 pagesEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- DDMPR Q1 2021 Quarterly ReportDocument36 pagesDDMPR Q1 2021 Quarterly ReportChristian John RojoNo ratings yet

- Employer'S Data Form (Edf) : For Private Employers For Private EmployersDocument2 pagesEmployer'S Data Form (Edf) : For Private Employers For Private EmployersHRD-EFI PampangaNo ratings yet

- MM Quarterly Report Q2 2021Document36 pagesMM Quarterly Report Q2 2021PaulNo ratings yet

- Issuer'S Quarterly Information Return For Mortgage Credit Certificates (MCCS)Document2 pagesIssuer'S Quarterly Information Return For Mortgage Credit Certificates (MCCS)IRSNo ratings yet

- A Narrative Report On Government Agency and Other Agency Related Establishments On-The-Job Training ProgramDocument18 pagesA Narrative Report On Government Agency and Other Agency Related Establishments On-The-Job Training ProgramBenj Jamieson Jocson DuagNo ratings yet

- Tourist Visa: Application FormDocument2 pagesTourist Visa: Application FormMahmud Arman KibriaNo ratings yet

- Organizational Theory Structure and Design - AssignmentDocument8 pagesOrganizational Theory Structure and Design - AssignmentAkshatNo ratings yet

- Ra 9173Document2 pagesRa 9173Aira_Mae_Canla_1724No ratings yet

- Training & Development, Education Increasing Employee SatisfactionDocument73 pagesTraining & Development, Education Increasing Employee SatisfactionAshok KumarNo ratings yet

- Thesis Unemployment PhilippinesDocument5 pagesThesis Unemployment Philippinescassandrasirateantioch100% (2)

- TQMDocument3 pagesTQMUmar SheikhNo ratings yet

- Ceb Math 0 PDFDocument77 pagesCeb Math 0 PDFPhilBoardResultsNo ratings yet

- Jobs Discussion QuestionsDocument5 pagesJobs Discussion QuestionsSadiki FltaNo ratings yet

- Downsizing Vs RightsizingDocument6 pagesDownsizing Vs RightsizingsamyukthaNo ratings yet

- A Level Business Studies Made Easy (Repaired) (Repaired) 1Document225 pagesA Level Business Studies Made Easy (Repaired) (Repaired) 1Munesuishe ChambokoNo ratings yet

- Employment Connection 2013 Annual ReportDocument16 pagesEmployment Connection 2013 Annual ReportemploymentconnectionNo ratings yet

- 1.1.1 Conceptual Framework of Quality of Work LifeDocument3 pages1.1.1 Conceptual Framework of Quality of Work LifeNasir AbbasNo ratings yet

- Resume SayaDocument3 pagesResume SayaJeffrey CoxNo ratings yet

- In The Two Decades Between 1910 and 1930Document3 pagesIn The Two Decades Between 1910 and 1930ssweetgirl786No ratings yet

- Department of Health: Chief of Hospital IIDocument9 pagesDepartment of Health: Chief of Hospital IICha GabrielNo ratings yet

- LeaderDocument7 pagesLeaderKomal Shujaat100% (2)

- IFAP Newsletter April 2011Document54 pagesIFAP Newsletter April 2011Shakir Mahboob KhanNo ratings yet

- HR Manual II Award Staff PDFDocument158 pagesHR Manual II Award Staff PDFSri369No ratings yet

- MGT351 QTI Term-PaperDocument16 pagesMGT351 QTI Term-PapernahidNo ratings yet

- Resource For Development and Delivery of Training To WorkersDocument52 pagesResource For Development and Delivery of Training To WorkersAsifNo ratings yet

- EDM 22O Theories and Principles of Educational ManagementDocument4 pagesEDM 22O Theories and Principles of Educational Managementjester mabutiNo ratings yet

- Personal Public Service Number: Your Own DetailsDocument2 pagesPersonal Public Service Number: Your Own DetailsPetru BurcaNo ratings yet

- Dependence of Developing Countries On Developed CountriesDocument33 pagesDependence of Developing Countries On Developed Countriesdeepak67% (6)

- Resume 2Document1 pageResume 2api-354535474No ratings yet

- This Study Resource Was: Organizational Behaviour Case StudiesDocument9 pagesThis Study Resource Was: Organizational Behaviour Case StudiesVaibhavi JainNo ratings yet

- The Mediating Effects of Job Satisfaction On Role Stressors and Affective CommitmentDocument13 pagesThe Mediating Effects of Job Satisfaction On Role Stressors and Affective CommitmentOmer MalikNo ratings yet

- MarketNexus Editor: Teri Buhl Character LetterDocument2 pagesMarketNexus Editor: Teri Buhl Character LetterTeri BuhlNo ratings yet