Professional Documents

Culture Documents

Opp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017

Opp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017

Uploaded by

Sunshine Computers0 ratings0% found this document useful (0 votes)

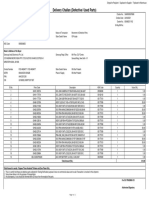

15 views2 pagesThis document is a GSTR-3B form filed by Sunshine Computers for the month of October 2017. It summarizes the company's outward supplies of Rs. 83,548.24 with CGST of Rs. 7,905.88 and SGST of Rs. 7,905.88. It also details eligible input tax credits of Rs. 4,608 for IGST, Rs. 14,055.83 for CGST and Rs. 14,055.83 for SGST. Finally, it shows payment of CGST and SGST utilizing the eligible ITC and no other taxes being payable or paid in cash.

Original Description:

GST Number

Original Title

Form (Oct) Gstr-3b

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a GSTR-3B form filed by Sunshine Computers for the month of October 2017. It summarizes the company's outward supplies of Rs. 83,548.24 with CGST of Rs. 7,905.88 and SGST of Rs. 7,905.88. It also details eligible input tax credits of Rs. 4,608 for IGST, Rs. 14,055.83 for CGST and Rs. 14,055.83 for SGST. Finally, it shows payment of CGST and SGST utilizing the eligible ITC and no other taxes being payable or paid in cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views2 pagesOpp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017

Opp. OBC Bank, Bank Road, Dhuri - 148024: For October, 2017

Uploaded by

Sunshine ComputersThis document is a GSTR-3B form filed by Sunshine Computers for the month of October 2017. It summarizes the company's outward supplies of Rs. 83,548.24 with CGST of Rs. 7,905.88 and SGST of Rs. 7,905.88. It also details eligible input tax credits of Rs. 4,608 for IGST, Rs. 14,055.83 for CGST and Rs. 14,055.83 for SGST. Finally, it shows payment of CGST and SGST utilizing the eligible ITC and no other taxes being payable or paid in cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Sunshine Computers

Opp. OBC Bank, Bank Road, Dhuri - 148024

FORM GSTR-3B

For October,2017

'GSTIN :03CSBPM1673A1ZC Legal Name of registered person : Sunshine Computers |

'3.1 Details of Outward Supplies and inward supplies liable to reverse charge

'========================================================================================================================

' Nature of Supplier | Txbl.Value| IGST| CGST| State/UT Tax| Cess|

'========================================================================================================================

'(a)Outward txbl. supplies(other than | 83,548.24| | 7,905.88| 7,905.88| |

'zero rated, nil rated and exempted) | | | | | |

'(b)Outward taxable supplies(zero rated)| | | | | |

'(c)Other outward supp.(Nil rated,exmptd| | | | | |

'(d)Inward supp.(liable to Rev. charge) | | | | | |

'(e)Non-GST outward supplies | | | | | |

' Total| 83,548.24| 0.00| 7,905.88| 7,905.88| 0.00|

'------------------------------------------------------------------------------------------------------------------------

'3.2 Of the Supplies shown in 3.1(a) above, details of inter-State supplies made to unregisteres persons, composition

' taxable persons and UIN holders

'========================================================================================================================

' | Place of Supply(State/UT) | Total Taxable Value| Amount of IGST |

'========================================================================================================================

'Supplies made to UnReg. Persons | | | |

' | Total| 0.00| 0.00|

'Supp. made to Composition Dealers| | | |

' | Total| 0.00| 0.00|

'Supplies made to UIN holders | | | |

' | Total| 0.00| 0.00|

'------------------------------------------------------------------------------------------------------------------------

'4. Eligible ITC

'========================================================================================================================

' Details | Integrated Tax| Central Tax| State/Ut Tax| Cess|

'========================================================================================================================

'(A) ITC Available(whether in full | | | | |

'or part) | | | | |

' (1)Import of goods | | ------- | ------- | |

' (2)Import of services | | ------- | ------- | |

' (3)Inward supplies liable to reverse | | | | |

' (other than 1 & 2 above) | | | | |

' (4)Inward supplies from ISD | | | | |

' (5)All other ITC | 4,608.00| 14,055.83| 14,055.83| |

'(B) ITC Reversed | | | | |

' (1)As per rules 42 & 43 of CGST Rules| | | | |

' (2)Others | | | | |

'(C) Net ITC Available(A)-(B) | 4,608.00| 14,055.83| 14,055.83| |

'(D) Ineligible ITC | | | | |

' (1)As per section 17(5) | | | | |

' (2)Others | | | | |

'------------------------------------------------------------------------------------------------------------------------

'5. Values of exempt, nil-rated and non-GST inward supplies

'========================================================================================================================

' Nature of supplies | Inter-State supplies| Intra-State supplies|

'========================================================================================================================

'From a supplier under composition scheme, Exempt and Nil| | |

'rated supply | | |

'Non GST supply | | |

'------------------------------------------------------------------------------------------------------------------------

'6.1 Payment of tax

'========================================================================================================================

' Description | Tax | Paid through ITC | Tax Paid | Tax/Cess |Interest | Late |

' | payable | ----------------------------------------------- | TDS/TCS | paid in | | Fee |

' | | IGST | CGST |SGST/UTGST | Cess | | cash | | |

'========================================================================================================================

'Other than Reverse Charge |

'Integrated Tax| | | | | | | | | |

'Central Tax | 7,905.88| | 7,905.88| ------- | | | | | |

'State/UT Tax | 7,905.88| | ------- | 7,905.88| | | | | |

'Cess | | ------- | ------- | ------- | | | | | |

'------------------------------------------------------------------------------------------------------------------------

'Reverse Charge |

'Integrated Tax| | ------- | ------- | ------- | ------- | | | | |

'Central Tax | | ------- | ------- | ------- | ------- | | | | |

'State/UT Tax | | ------- | ------- | ------- | ------- | | | | |

'Cess | | ------- | ------- | ------- | ------- | | | | |

'------------------------------------------------------------------------------------------------------------------------

'6.2 TDS/TCS Credit

'========================================================================================================================

' Details | Integrated Tax | Central Tax | State/UT Tax |

'========================================================================================================================

'TDS | | | |

'TCS | | | |

'------------------------------------------------------------------------------------------------------------------------

'

You might also like

- Jurists Suggested Answers To The Taxation Law Mock Bar ExaminationDocument10 pagesJurists Suggested Answers To The Taxation Law Mock Bar ExaminationCindy-chan DelfinNo ratings yet

- IBM Payslip April 2012 PDFDocument1 pageIBM Payslip April 2012 PDFtaraivanNo ratings yet

- Get Payslip by Offset PDFDocument1 pageGet Payslip by Offset PDFanon_535796411100% (1)

- American ExpressDocument1 pageAmerican ExpressKolkata Jyote MotorsNo ratings yet

- Oct'21Document1 pageOct'21phanindra gaddeNo ratings yet

- DocumentDocument1 pageDocumentKen livingstonNo ratings yet

- The CompanyDocument1 pageThe Companyकपिल चौहानNo ratings yet

- Salary SlipDocument1 pageSalary SlipJohn HallNo ratings yet

- TAX-07-GROSS-INCOME (With Answers)Document12 pagesTAX-07-GROSS-INCOME (With Answers)Kendrew SujideNo ratings yet

- Gstr3b Dec 23Document2 pagesGstr3b Dec 23AbhishekSinghPatelNo ratings yet

- Excel GSTR 3b May 2020Document2 pagesExcel GSTR 3b May 2020Sanjay Mahajan AmritsarNo ratings yet

- JBS Formgstr-3bDocument2 pagesJBS Formgstr-3bmaxxban2306No ratings yet

- October2023 Sal - SlipDocument2 pagesOctober2023 Sal - SlipdevNo ratings yet

- Payslip - 2023 05 29Document1 pagePayslip - 2023 05 29ttamilpNo ratings yet

- MAY 2023 Sal - SlipDocument1 pageMAY 2023 Sal - SlipdevNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Payslip - 2019 09 30Document1 pagePayslip - 2019 09 30Khatija PinjrawalaNo ratings yet

- Payslip - 2024 03 28Document1 pagePayslip - 2024 03 28doc.plloan1No ratings yet

- December 2022 Sal - SLipDocument1 pageDecember 2022 Sal - SLipdevNo ratings yet

- February 2023 Sal - SlipDocument1 pageFebruary 2023 Sal - SlipdevNo ratings yet

- Payslip 00037846Document1 pagePayslip 00037846Monti SiwachNo ratings yet

- 21566340Document1 page21566340AYUSH PRADHANNo ratings yet

- Sept. Sal - SlipDocument1 pageSept. Sal - SlipdevNo ratings yet

- Mar 2021Document1 pageMar 2021Srinivas HkNo ratings yet

- January 2023 Sal - SlipDocument1 pageJanuary 2023 Sal - SlipdevNo ratings yet

- Paystub 202205Document2 pagesPaystub 202205Sandeep RakholiyaNo ratings yet

- 8ebda9db-ca4e-4b59-a33c-d19736a0183bDocument1 page8ebda9db-ca4e-4b59-a33c-d19736a0183bVenkata RajaNo ratings yet

- March 23Document1 pageMarch 23princeupadhyay95No ratings yet

- IBM Payslip April 2012Document1 pageIBM Payslip April 2012NARESH KESAVANNo ratings yet

- April 24Document1 pageApril 24omp67157No ratings yet

- Dec'13Document1 pageDec'13ashish10mca9394100% (1)

- CombinepdfDocument19 pagesCombinepdfYashodhaNo ratings yet

- Payslip - 2024 01 29Document1 pagePayslip - 2024 01 29doc.plloan1No ratings yet

- DecDocument1 pageDecnegishilpa051No ratings yet

- Apr 21Document1 pageApr 21pavan kumarNo ratings yet

- Sept 23Document1 pageSept 23cocblackx10No ratings yet

- UnknownDocument1 pageUnknownPriyaprasad PandaNo ratings yet

- October 2023Document1 pageOctober 2023Vikeshsharma. IabmNo ratings yet

- 001 F 1 F 7441653639019Document1 page001 F 1 F 7441653639019Prateeksha MishraNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedarunshinde408No ratings yet

- July 1 Neha Agarwal 07 07 2Document1 pageJuly 1 Neha Agarwal 07 07 2Kolkata Jyote MotorsNo ratings yet

- Annexure 630430Document3 pagesAnnexure 630430mohammadNo ratings yet

- Payslip - 2022 08 29Document1 pagePayslip - 2022 08 29SHIVARAM KULKARNINo ratings yet

- Payslip 202310Document1 pagePayslip 202310st376213No ratings yet

- March Salary SlipDocument1 pageMarch Salary SlipPrem ShankarNo ratings yet

- 001I7D7441643896296Document1 page001I7D7441643896296Shamantha ManiNo ratings yet

- Blce 3Document4 pagesBlce 3Cri5tobalNo ratings yet

- Araling Panlipunan 1Document1 pageAraling Panlipunan 1Ricardo Cal ParadelaNo ratings yet

- June 24Document1 pageJune 24omp67157No ratings yet

- 1 30Document2 pages1 30Jocelyn Requillo FlordelizNo ratings yet

- Pay Stub (1) - 09.30.2021Document1 pagePay Stub (1) - 09.30.2021Houssem MdaghiNo ratings yet

- Oct2023 PSDocument1 pageOct2023 PSRavi KanheNo ratings yet

- Payslip 202304Document1 pagePayslip 202304vineethpowerstarNo ratings yet

- PeopleFirstPDF 2023 04 06T12 19 18Document1 pagePeopleFirstPDF 2023 04 06T12 19 18swamiacademy2023No ratings yet

- PeopleFirstPDF 2023 04 06T12 19 37Document1 pagePeopleFirstPDF 2023 04 06T12 19 37swamiacademy2023No ratings yet

- May 24Document1 pageMay 24omp67157No ratings yet

- Payslip January, 2024Document1 pagePayslip January, 2024negishilpa051No ratings yet

- Form No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Document2 pagesForm No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Ankit SijariyaNo ratings yet

- $valueDocument1 page$valueBIJAY KRUSHNA MOHANTYNo ratings yet

- 10011385Document1 page10011385schandramohan10No ratings yet

- INV0001Document1 pageINV0001Sunshine ComputersNo ratings yet

- Delivery Challan (Defective/ Used Parts) : Name & Address of The SupplierDocument2 pagesDelivery Challan (Defective/ Used Parts) : Name & Address of The SupplierSunshine ComputersNo ratings yet

- Fillable Node Form - 2020Document4 pagesFillable Node Form - 2020Sunshine ComputersNo ratings yet

- United India Insurance Company Limited: This Document Is Digitally SignedDocument3 pagesUnited India Insurance Company Limited: This Document Is Digitally SignedSunshine ComputersNo ratings yet

- Fully Taxable Allowances Dearness Allowance or Dearness PayDocument7 pagesFully Taxable Allowances Dearness Allowance or Dearness PayDeeksha KapoorNo ratings yet

- Differences, Advantages and Disadvantages: LLP vs. LLCDocument12 pagesDifferences, Advantages and Disadvantages: LLP vs. LLCChintan Patel100% (1)

- Aptiv DRodDocument4 pagesAptiv DRodRajesh TipnisNo ratings yet

- SIDBI Sammelan 2023Document1 pageSIDBI Sammelan 2023assmexellenceNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- Checklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFDocument1 pageChecklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFCavinti LagunaNo ratings yet

- Presentation DR Ali BeyDocument26 pagesPresentation DR Ali Beymucahidkaplan1907No ratings yet

- Module 6Document4 pagesModule 6Rachelle Mae NagalesNo ratings yet

- Star DeltaDocument1 pageStar DeltaBilalArifNo ratings yet

- Rfbt1 Oblico Lecture NotesDocument40 pagesRfbt1 Oblico Lecture NotesGizel BaccayNo ratings yet

- (Circular E), Employer's Tax Guide: Future DevelopmentsDocument48 pages(Circular E), Employer's Tax Guide: Future DevelopmentsradhakrishnaNo ratings yet

- Key Considerations in Filing ITR and 29B FinalDocument85 pagesKey Considerations in Filing ITR and 29B FinalCorman LimitedNo ratings yet

- Direct Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5Document23 pagesDirect Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5JayNo ratings yet

- Caltex v. COA - DigestDocument2 pagesCaltex v. COA - DigestKing Badong100% (1)

- CN No. CN Date Inv - No. Pkgs Truck No. Reporting Date Delivery Date Wt. Rate Total FreightDocument1 pageCN No. CN Date Inv - No. Pkgs Truck No. Reporting Date Delivery Date Wt. Rate Total FreightRohit Parmar (Computer Operator, Bangalore)No ratings yet

- Total: RD16672718115062477 Nov 1st 2022, 8:47 AM Ride ID Time of RideDocument21 pagesTotal: RD16672718115062477 Nov 1st 2022, 8:47 AM Ride ID Time of Ridevijay kumarNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Cash in Bank Register - (2ND QUARTER) - JUNEDocument8 pagesCash in Bank Register - (2ND QUARTER) - JUNEDaise Oacub100% (1)

- Acropolis Price Sheet Regular 04-04-2019 - LatestDocument1 pageAcropolis Price Sheet Regular 04-04-2019 - Latestkumar KumarNo ratings yet

- Solved The Following Budget Data Are For A Country Having Both PDFDocument1 pageSolved The Following Budget Data Are For A Country Having Both PDFM Bilal SaleemNo ratings yet

- 1 Valuation of Perquisites 05 CRCDocument44 pages1 Valuation of Perquisites 05 CRCpratyush1200No ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document23 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Md.Shadid Ur RahmanNo ratings yet

- Sheet 1 Eca Rics Daywork Electrical April 2020Document1 pageSheet 1 Eca Rics Daywork Electrical April 2020ZzzdddNo ratings yet

- Digest RR 12-2018Document5 pagesDigest RR 12-2018Jesi CarlosNo ratings yet

- 60 Revenue - ReceiptsDocument270 pages60 Revenue - ReceiptsMARUTHUPANDINo ratings yet

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917No ratings yet

- First Lepanto Taisho Insurance Corporation vs. BirDocument5 pagesFirst Lepanto Taisho Insurance Corporation vs. Birlaw mabaylabayNo ratings yet

- Plotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Document3 pagesPlotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Ravi RanjanNo ratings yet