Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

99 viewsDebt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Debt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Uploaded by

Arun Shakthi GaneshThe document is a worksheet for calculating a business's debt service coverage ratio (DSCR). It provides instructions for entering annual business expenses, existing debt payments, revenue, and details of potential new loans. It then calculates the DSCR to determine if the business can afford loan payments. A DSCR over 1 means payments can be afforded, while under 1 means they cannot. Most lenders want a DSCR of at least 1.2. The worksheet provides an example calculation showing a DSCR of 5.93 for a 5-year term loan and 4.65 for a 10-year SBA loan, indicating the business can afford both.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Freight Agent AgreementDocument7 pagesFreight Agent AgreementNaveed Shehriyar BaigNo ratings yet

- Real Time Strategic Planning Compiled DocumentDocument17 pagesReal Time Strategic Planning Compiled DocumentSunita Bhanu PrakashNo ratings yet

- SBA Loan ChartDocument2 pagesSBA Loan ChartsbdcwtNo ratings yet

- Mastercard Transaction Dispute Form PDFDocument2 pagesMastercard Transaction Dispute Form PDFAshillinNo ratings yet

- Downloads Annuities-101Document19 pagesDownloads Annuities-101mario escottoNo ratings yet

- 2022 Getting Started in Government ContractingDocument12 pages2022 Getting Started in Government ContractingLisa harrNo ratings yet

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- How To Do Business With Network Contracting Office (NCO) 8Document12 pagesHow To Do Business With Network Contracting Office (NCO) 8SAMETampaBayNo ratings yet

- Marketing Plan - CARLDocument15 pagesMarketing Plan - CARLMichael HardingNo ratings yet

- 15 Steps To Get Rich (Ultimate Guide)Document2 pages15 Steps To Get Rich (Ultimate Guide)Sourav Singh100% (1)

- Vending - Services - Business Plan TemplateDocument40 pagesVending - Services - Business Plan TemplateAR DIXITNo ratings yet

- Chapter 5 Corporations NoteDocument5 pagesChapter 5 Corporations NoteLihui ChenNo ratings yet

- Mutual of Omaha - LTD 03 16Document2 pagesMutual of Omaha - LTD 03 16api-252555369No ratings yet

- Freight Broker Sample Business PlanDocument22 pagesFreight Broker Sample Business PlanGIRMAY BERHENo ratings yet

- Trust - Tax Planning - Estate Planning - Real Estate & ReitsDocument62 pagesTrust - Tax Planning - Estate Planning - Real Estate & ReitsAbhijeet PatilNo ratings yet

- How To Save MoneyDocument10 pagesHow To Save Moneymichellouise17No ratings yet

- Dispute Transaction FormDocument1 pageDispute Transaction FormAli Naeem SheikhNo ratings yet

- Bankruptcy Removal LetterDocument2 pagesBankruptcy Removal LetterAl DelkNo ratings yet

- Tax Cheat Sheet AY1415 Semester 2 V2Document3 pagesTax Cheat Sheet AY1415 Semester 2 V2Krithika NaiduNo ratings yet

- 3 "C'S" of Credit: Personal FinanceDocument43 pages3 "C'S" of Credit: Personal FinanceJack RichardsonNo ratings yet

- SBA and Women-Owned BusinessesDocument30 pagesSBA and Women-Owned BusinessesseritwoNo ratings yet

- Worksheet For The Month EndedDocument11 pagesWorksheet For The Month EndedMedelyn Parreño SampanNo ratings yet

- Clarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesDocument47 pagesClarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesBao PhamNo ratings yet

- Credit Cheat Sheet PDFDocument1 pageCredit Cheat Sheet PDFMichele RuehleNo ratings yet

- Margin TradingDocument5 pagesMargin TradingGeorgeNo ratings yet

- Financial Literacy For Women-The Money Matter FAQs-For WomenDocument13 pagesFinancial Literacy For Women-The Money Matter FAQs-For WomenUtkarshNo ratings yet

- KInds of BusinessDocument8 pagesKInds of BusinessRoanNo ratings yet

- Amazon FbaDocument9 pagesAmazon Fbadata baseNo ratings yet

- 2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFDocument44 pages2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFpaul weichNo ratings yet

- ISO20022 MDRPart2 PaymentsClearingAndSettlement 2020 2021Document1,166 pagesISO20022 MDRPart2 PaymentsClearingAndSettlement 2020 2021Corzap Sharing100% (1)

- Ten Steps:: A Guide To Starting Your Business in Sonoma CountyDocument16 pagesTen Steps:: A Guide To Starting Your Business in Sonoma CountyawfahaddadinNo ratings yet

- Key Points: Tips and Hints To Complete Grant ApplicationsDocument3 pagesKey Points: Tips and Hints To Complete Grant ApplicationsSummer BradyNo ratings yet

- Business Plan Template EcomDocument27 pagesBusiness Plan Template EcomReflections DaysNo ratings yet

- The Future of Invoice FinancingDocument5 pagesThe Future of Invoice FinancingSingapore Green Building Council100% (1)

- IC Simple Fill in The Blank Business Plan 10809 - PDFDocument7 pagesIC Simple Fill in The Blank Business Plan 10809 - PDFNguyễn Minh HuyềnNo ratings yet

- Q. 8 Governments BondsDocument2 pagesQ. 8 Governments BondsMAHENDRA SHIVAJI DHENAKNo ratings yet

- Berkshire Hathaway 2023 Annual ReportDocument152 pagesBerkshire Hathaway 2023 Annual ReportThe Western JournalNo ratings yet

- Make Money OnlineDocument3 pagesMake Money OnlineAgustin RudasNo ratings yet

- Salem 2012-13 Budget Final in Depth Proposed 12-13Document14 pagesSalem 2012-13 Budget Final in Depth Proposed 12-13Statesman JournalNo ratings yet

- 5 Working CapitalDocument4 pages5 Working CapitalSoumyajit Das MazumdarNo ratings yet

- Explain The Sources of Funding For A Start-UpDocument6 pagesExplain The Sources of Funding For A Start-UpChandra KeerthiNo ratings yet

- Things Required For CompanyDocument6 pagesThings Required For CompanytestNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- CertificationDocument1 pageCertificationMs. KeaNo ratings yet

- Facebook Unlocked Course ItineraryDocument1 pageFacebook Unlocked Course Itineraryhiteshi patelNo ratings yet

- Securing Trademark Rights Ownership and Federal RegistrationDocument3 pagesSecuring Trademark Rights Ownership and Federal RegistrationCoyolesNo ratings yet

- Remittance Activity of Janata Bank PDFDocument90 pagesRemittance Activity of Janata Bank PDFMd Khaled NoorNo ratings yet

- Convert HTML To PDF in PHPDocument4 pagesConvert HTML To PDF in PHPzandiNo ratings yet

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNo ratings yet

- Eguide The Minimum Criteria Needed To Qualify For 8 Different Loan Products PDFDocument12 pagesEguide The Minimum Criteria Needed To Qualify For 8 Different Loan Products PDFbabu1438No ratings yet

- National 20tax 20deed 20directory 20 - 20onlineDocument65 pagesNational 20tax 20deed 20directory 20 - 20onlineJime Guevara100% (1)

- Simple Template GrayDocument1 pageSimple Template GrayJESELLA PAMARANNo ratings yet

- Mmm-Ii: Controlled Document Insurance - White PaperDocument62 pagesMmm-Ii: Controlled Document Insurance - White PapersheetalbhuvaNo ratings yet

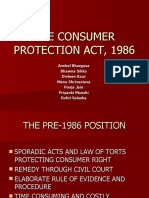

- The Consumer Protection Act, 1986Document28 pagesThe Consumer Protection Act, 1986Manu ShrivastavaNo ratings yet

- The BlueprintDocument11 pagesThe BlueprintCIO White PapersNo ratings yet

- AI Based E-Mail Scraper and Sending ToolDocument9 pagesAI Based E-Mail Scraper and Sending ToolIJRASETPublicationsNo ratings yet

- Screen Printing Business Plan ExampleDocument51 pagesScreen Printing Business Plan ExampleJoseph QuillNo ratings yet

- DIY Business Credit GuideDocument45 pagesDIY Business Credit GuideAnthony VinsonNo ratings yet

- Notary Business PlanDocument48 pagesNotary Business PlanJoseph QuillNo ratings yet

Debt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Debt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Uploaded by

Arun Shakthi Ganesh0 ratings0% found this document useful (0 votes)

99 views1 pageThe document is a worksheet for calculating a business's debt service coverage ratio (DSCR). It provides instructions for entering annual business expenses, existing debt payments, revenue, and details of potential new loans. It then calculates the DSCR to determine if the business can afford loan payments. A DSCR over 1 means payments can be afforded, while under 1 means they cannot. Most lenders want a DSCR of at least 1.2. The worksheet provides an example calculation showing a DSCR of 5.93 for a 5-year term loan and 4.65 for a 10-year SBA loan, indicating the business can afford both.

Original Description:

DSCR worksheet

Original Title

DSCR WorkSheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a worksheet for calculating a business's debt service coverage ratio (DSCR). It provides instructions for entering annual business expenses, existing debt payments, revenue, and details of potential new loans. It then calculates the DSCR to determine if the business can afford loan payments. A DSCR over 1 means payments can be afforded, while under 1 means they cannot. Most lenders want a DSCR of at least 1.2. The worksheet provides an example calculation showing a DSCR of 5.93 for a 5-year term loan and 4.65 for a 10-year SBA loan, indicating the business can afford both.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

99 views1 pageDebt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Debt Service Coverage Ratio (DSCR) Worksheet: 5 Year Term Loan 10 Year SBA Loan

Uploaded by

Arun Shakthi GaneshThe document is a worksheet for calculating a business's debt service coverage ratio (DSCR). It provides instructions for entering annual business expenses, existing debt payments, revenue, and details of potential new loans. It then calculates the DSCR to determine if the business can afford loan payments. A DSCR over 1 means payments can be afforded, while under 1 means they cannot. Most lenders want a DSCR of at least 1.2. The worksheet provides an example calculation showing a DSCR of 5.93 for a 5-year term loan and 4.65 for a 10-year SBA loan, indicating the business can afford both.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Debt Service Coverage Ratio (DSCR) Worksheet

Use this worksheet to calculate your debt service coverage ratio.

Enter your business expenses, existing debt payments, and revenue below. If you plan on

borrowing additional funds, you can enter that balance below, too.

DSCR is used by lenders to determine your ability to make loan payments. Under 1 means you can

not afford the loan payment. Over 1 means you can afford the loan payment. Most lenders want to

see a DSCR of 1.2 or higher.

5 Year Term Loan 10 Year SBA loan

Annual Gross Income $2,000,000 $ 1,500,000.00

Expenses - Entered as Annual Costs

Rent $ 20,000.00 $ 20,000.00

Utilities $ 5,000.00 $ 5,000.00

Payroll $ 350,000.00 $ 350,000.00

Taxes

Inventory $ 500,000.00 $ 500,000.00

Supplies $ 35,000.00 $ 35,000.00

Credit Card Payments

Short Term Loan Payments $ 80,000.00 $ 80,000.00

Merchant Cash Advance Payments $ 150,000.00 $ 150,000.00

Miscellaneous Business Expenses $ 50,000.00 $ 50,000.00

Annual Operating Expenses $ 1,190,000.00 $ 1,190,000.00

Net Operating Income $ 810,000.00 $ 310,000.00

Total Capital in New Loan

$ 500,000.00 $ 500,000.00

(including additional funding)

Typical Interest Rate 13% 6%

Origination Fees of New Loan (Assuming 5%) $ 25,000.00 $ 25,000.00

Total Annual Loan Payments of New Loan

$ 136,518.44 $ 66,612.30

(Debt Service)

Estimated Monthly Payments $ 11,376.54 $ 5,551.03

Debt Service Coverage Ratio 5.93 4.65

You might also like

- Freight Agent AgreementDocument7 pagesFreight Agent AgreementNaveed Shehriyar BaigNo ratings yet

- Real Time Strategic Planning Compiled DocumentDocument17 pagesReal Time Strategic Planning Compiled DocumentSunita Bhanu PrakashNo ratings yet

- SBA Loan ChartDocument2 pagesSBA Loan ChartsbdcwtNo ratings yet

- Mastercard Transaction Dispute Form PDFDocument2 pagesMastercard Transaction Dispute Form PDFAshillinNo ratings yet

- Downloads Annuities-101Document19 pagesDownloads Annuities-101mario escottoNo ratings yet

- 2022 Getting Started in Government ContractingDocument12 pages2022 Getting Started in Government ContractingLisa harrNo ratings yet

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- How To Do Business With Network Contracting Office (NCO) 8Document12 pagesHow To Do Business With Network Contracting Office (NCO) 8SAMETampaBayNo ratings yet

- Marketing Plan - CARLDocument15 pagesMarketing Plan - CARLMichael HardingNo ratings yet

- 15 Steps To Get Rich (Ultimate Guide)Document2 pages15 Steps To Get Rich (Ultimate Guide)Sourav Singh100% (1)

- Vending - Services - Business Plan TemplateDocument40 pagesVending - Services - Business Plan TemplateAR DIXITNo ratings yet

- Chapter 5 Corporations NoteDocument5 pagesChapter 5 Corporations NoteLihui ChenNo ratings yet

- Mutual of Omaha - LTD 03 16Document2 pagesMutual of Omaha - LTD 03 16api-252555369No ratings yet

- Freight Broker Sample Business PlanDocument22 pagesFreight Broker Sample Business PlanGIRMAY BERHENo ratings yet

- Trust - Tax Planning - Estate Planning - Real Estate & ReitsDocument62 pagesTrust - Tax Planning - Estate Planning - Real Estate & ReitsAbhijeet PatilNo ratings yet

- How To Save MoneyDocument10 pagesHow To Save Moneymichellouise17No ratings yet

- Dispute Transaction FormDocument1 pageDispute Transaction FormAli Naeem SheikhNo ratings yet

- Bankruptcy Removal LetterDocument2 pagesBankruptcy Removal LetterAl DelkNo ratings yet

- Tax Cheat Sheet AY1415 Semester 2 V2Document3 pagesTax Cheat Sheet AY1415 Semester 2 V2Krithika NaiduNo ratings yet

- 3 "C'S" of Credit: Personal FinanceDocument43 pages3 "C'S" of Credit: Personal FinanceJack RichardsonNo ratings yet

- SBA and Women-Owned BusinessesDocument30 pagesSBA and Women-Owned BusinessesseritwoNo ratings yet

- Worksheet For The Month EndedDocument11 pagesWorksheet For The Month EndedMedelyn Parreño SampanNo ratings yet

- Clarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesDocument47 pagesClarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesBao PhamNo ratings yet

- Credit Cheat Sheet PDFDocument1 pageCredit Cheat Sheet PDFMichele RuehleNo ratings yet

- Margin TradingDocument5 pagesMargin TradingGeorgeNo ratings yet

- Financial Literacy For Women-The Money Matter FAQs-For WomenDocument13 pagesFinancial Literacy For Women-The Money Matter FAQs-For WomenUtkarshNo ratings yet

- KInds of BusinessDocument8 pagesKInds of BusinessRoanNo ratings yet

- Amazon FbaDocument9 pagesAmazon Fbadata baseNo ratings yet

- 2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFDocument44 pages2020 12-07-03938038 0 0000 AppelleeSecretaryOfStateKatieH PDFpaul weichNo ratings yet

- ISO20022 MDRPart2 PaymentsClearingAndSettlement 2020 2021Document1,166 pagesISO20022 MDRPart2 PaymentsClearingAndSettlement 2020 2021Corzap Sharing100% (1)

- Ten Steps:: A Guide To Starting Your Business in Sonoma CountyDocument16 pagesTen Steps:: A Guide To Starting Your Business in Sonoma CountyawfahaddadinNo ratings yet

- Key Points: Tips and Hints To Complete Grant ApplicationsDocument3 pagesKey Points: Tips and Hints To Complete Grant ApplicationsSummer BradyNo ratings yet

- Business Plan Template EcomDocument27 pagesBusiness Plan Template EcomReflections DaysNo ratings yet

- The Future of Invoice FinancingDocument5 pagesThe Future of Invoice FinancingSingapore Green Building Council100% (1)

- IC Simple Fill in The Blank Business Plan 10809 - PDFDocument7 pagesIC Simple Fill in The Blank Business Plan 10809 - PDFNguyễn Minh HuyềnNo ratings yet

- Q. 8 Governments BondsDocument2 pagesQ. 8 Governments BondsMAHENDRA SHIVAJI DHENAKNo ratings yet

- Berkshire Hathaway 2023 Annual ReportDocument152 pagesBerkshire Hathaway 2023 Annual ReportThe Western JournalNo ratings yet

- Make Money OnlineDocument3 pagesMake Money OnlineAgustin RudasNo ratings yet

- Salem 2012-13 Budget Final in Depth Proposed 12-13Document14 pagesSalem 2012-13 Budget Final in Depth Proposed 12-13Statesman JournalNo ratings yet

- 5 Working CapitalDocument4 pages5 Working CapitalSoumyajit Das MazumdarNo ratings yet

- Explain The Sources of Funding For A Start-UpDocument6 pagesExplain The Sources of Funding For A Start-UpChandra KeerthiNo ratings yet

- Things Required For CompanyDocument6 pagesThings Required For CompanytestNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- CertificationDocument1 pageCertificationMs. KeaNo ratings yet

- Facebook Unlocked Course ItineraryDocument1 pageFacebook Unlocked Course Itineraryhiteshi patelNo ratings yet

- Securing Trademark Rights Ownership and Federal RegistrationDocument3 pagesSecuring Trademark Rights Ownership and Federal RegistrationCoyolesNo ratings yet

- Remittance Activity of Janata Bank PDFDocument90 pagesRemittance Activity of Janata Bank PDFMd Khaled NoorNo ratings yet

- Convert HTML To PDF in PHPDocument4 pagesConvert HTML To PDF in PHPzandiNo ratings yet

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNo ratings yet

- Eguide The Minimum Criteria Needed To Qualify For 8 Different Loan Products PDFDocument12 pagesEguide The Minimum Criteria Needed To Qualify For 8 Different Loan Products PDFbabu1438No ratings yet

- National 20tax 20deed 20directory 20 - 20onlineDocument65 pagesNational 20tax 20deed 20directory 20 - 20onlineJime Guevara100% (1)

- Simple Template GrayDocument1 pageSimple Template GrayJESELLA PAMARANNo ratings yet

- Mmm-Ii: Controlled Document Insurance - White PaperDocument62 pagesMmm-Ii: Controlled Document Insurance - White PapersheetalbhuvaNo ratings yet

- The Consumer Protection Act, 1986Document28 pagesThe Consumer Protection Act, 1986Manu ShrivastavaNo ratings yet

- The BlueprintDocument11 pagesThe BlueprintCIO White PapersNo ratings yet

- AI Based E-Mail Scraper and Sending ToolDocument9 pagesAI Based E-Mail Scraper and Sending ToolIJRASETPublicationsNo ratings yet

- Screen Printing Business Plan ExampleDocument51 pagesScreen Printing Business Plan ExampleJoseph QuillNo ratings yet

- DIY Business Credit GuideDocument45 pagesDIY Business Credit GuideAnthony VinsonNo ratings yet

- Notary Business PlanDocument48 pagesNotary Business PlanJoseph QuillNo ratings yet