Professional Documents

Culture Documents

Preferential Taxation

Preferential Taxation

Uploaded by

PrankyJellyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preferential Taxation

Preferential Taxation

Uploaded by

PrankyJellyCopyright:

Available Formats

Preferential Taxation [1]

Preferential Taxation

Senior Citizens (R.A. 9994)

exemption from the payment of individual income taxes of senior citizens who are considered to be minimum wage earners in

accordance with Republic Act No. 9504

the grant of twenty percent (20%) discount and exemption from the value -added tax (VAT), if applicable, on the sale of the

following goods and services from all establishments, for the exclusive use and enjoyment or availment of the senior citizen

o on the purchase of medicines, including the purchase of influenza and pnuemococcal vaccines, and such other

essential medical supplies, accessories and equipment to be determined by the Department of Health (DOH).

o on the professional fees of attending physician/s in all private hospitals, medical facilities, outpatient clinics and home

health care services

o on the professional fees of licensed professional health providing home health care services as endorsed by private

hospitals or employed through home health care employment agencies

o on medical and dental services, diagnostic and laboratory fees in all private hospitals, medical facilities, outpatient

clinics, and home health care services, in accordance with the rules and regulations to be issued by the DOH, in

coordination with the Philippine Health Insurance Corporation (PhilHealth)

o in actual fare for land transportation travel in public utility buses (PUBs), public utility jeepneys (PUJs), taxis, Asian

utility vehicles (AUVs), shuttle services and public railways, including Light Rail Transit (LRT), Mass Rail Transit

(MRT), and Philippine National Railways (PNR)

o in actual transportation fare for domestic air transport services and sea shipping vessels and the like, based on the

actual fare and advanced booking

o on the utilization of services in hotels and similar lodging establishments, restaurants and recreation centers

o on admission fees charged by theaters, cinema houses and concert halls, circuses, leisure and amusement

o on funeral and burial services for the death of senior citizens

Disabled Persons (R.A. 10754)

Republic Act (RA) No. 10754 granting PWDs additional benefits such as exemption from value-added tax (VAT) on the

purchase of particular goods and services on top of the 20% discount

o Charges of hotels and other similar lodging establishments, restaurants and recreation centers;

o Admission fees by theaters, cinema houses, concert halls, circuses, carnivals and other similar places of culture,

leisure and amusement;

o Purchase of medicines in all drugstores;

o Medical and dental services and professional fees of attending doctors in all government facilities and in all private

hospitals and facilities, subject to the guidelines to be issued by the Department of Health, in coordination with the

Philippine Health Insurance Corporation;

o Transportation fares; and

o Funeral and burial services.

Further, those caring for and living with qualified PWD, up to the fourth civil degree of consanguinity or affinity, can claim an

additional tax exemption of P25,000 against their annual income tax. Under the RA, the PWD, regardless of age, may be

considered a qualified dependent subject to additional exemption under Section 35 (b) of the Tax Code provided that the PWD

is not gainfully employed and is chiefly dependent upon the taxpayer.

Special Economic Zone Act (R.A. 7915)

Enterprises locating or operating within the ecozones shall register with the Philippine Export Zone Authority (PEZA)

Income tax holiday (ITH) (3/4/6) and subject to extension under certain conditions. This ITH does not extend to the real

property tax on land owned by developers.

Upon expiration of ITH they shall pay a tax equivalent to five percent (5%) of their gross income. (5% Special Income tax)

Exemption from taxes and duties on imported equipment, raw materials and supplies directly needed for its operations

Zero percent VAT purchase for use on registered activity.

Omnibus Investment Code (E.O. 226)

Tax Exemptions

o Income Tax Holiday (ITH)

o Exemption from Taxes and Duties on Imported Spare Parts

o Exemption from Wharfage Dues and Export Tax, Duty, Impost and Fees

o Tax Exemption on Breeding Stocks and Genetic Materials

Tax credits

o For agricultural producers, 10-years tax credit equivalent to one hundred percent (100%) of the value of national

internal revenue taxes and customs duties on domestic breeding stocks and genetic materials.

o Tax credit equivalent to the national internal revenue taxes and duties paid on raw materials, supplies and semi-

manufacture of export products and forming part thereof.

Additional Deductions

Preferential Taxation [2]

o 5-years additional deduction for labor expense, equivalent of fifty percent (50%) of the wages of additional skilled and

unskilled workers in the direct labor force. This incentive shall be granted only if the enterprise meets a prescribed

capital to labor ratio and shall not be availed simultaneously with ITH.

o Registered enterprises locating in LDAs or in areas deficient in infrastructure, public utilities and other facilities may

deduct from taxable income an amount equivalent to the expenses incurred in the development of necessary and

major infrastructure works. This privilege is not granted to mining and forestry-related projects.

Barangay Micro Business Enterprises (BMBE) (R.A. 9178)

The Barangay Micro Business Enterprises Act of 2002, or RA 9178, is a law that (theoretically) allows businesses with assets

worth less than 3 million pesos to be exempted from paying income tax.

BMBE, refers to any business entity or enterprise engaged in the production, processing or manufacturing of products or

commodities, including agro-processing, trading and services, whose total assets including those arising from loans but

exclusive of the land on which the particular business entity’s office, plant and equipment are situated, shall not be more than

Three Million Pesos (P3, 000,000.00).

o BMBEs are first approved by the municipal hall, before BIR can grant the exemption. (Note: Just because you are

approved as a BMBE by the municipal/city hall does not necessarily mean you will be granted income tax exemption

by the BIR.)

o The exemption is for INCOME TAX, the business is still liable for Business Tax

In lieu of an income tax return, an income tax exempt BMBE is required to submit an Annual Information Return. This is filed

on or before the 15th day of the 4th month after the close of the taxable year with an Account Information Form, which contains

data from its financial statement and Sworn Statement of Assets Owned and/or Used.

END

You might also like

- Volkswagen Golf Manual PDF Mk6 WordpresscomDocument2 pagesVolkswagen Golf Manual PDF Mk6 WordpresscomSergio Pereira43% (7)

- Taxation 2 Midterm NotesDocument42 pagesTaxation 2 Midterm NotesTet Legaspi100% (1)

- Preferential TaxationDocument9 pagesPreferential TaxationAnna Mae Sanchez100% (4)

- Magna Carta For Senior Citizens and PWDS: Declaration of Policies and ObjectivesDocument12 pagesMagna Carta For Senior Citizens and PWDS: Declaration of Policies and ObjectivesLumingNo ratings yet

- Man-Force Dumpers - Parts Catlouge.Document577 pagesMan-Force Dumpers - Parts Catlouge.Bujjibabu Katta83% (6)

- 15Document10 pages15mariyha PalangganaNo ratings yet

- Exempt Versus Zero Rated TransactionsDocument20 pagesExempt Versus Zero Rated TransactionsRachel Pepito BaladjayNo ratings yet

- Chapter 14Document47 pagesChapter 14darylleNo ratings yet

- Lesson 9Document22 pagesLesson 9Iris Lavigne RojoNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Bantillo, Cheska Kate M. Cid, Manuel Lionel MDocument47 pagesBantillo, Cheska Kate M. Cid, Manuel Lionel MCHESKAKATE BANTILLO100% (1)

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Bir Revenue Regulations No - 7 - 2010Document14 pagesBir Revenue Regulations No - 7 - 2010guecorandyNo ratings yet

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesRieva Jean Pacina100% (1)

- Investment Incentives From The Government Read More... : Why The Philippines Economic Zone ActDocument5 pagesInvestment Incentives From The Government Read More... : Why The Philippines Economic Zone ActEumell Alexis PaleNo ratings yet

- Expanded Senior Citizens Act of 2010Document17 pagesExpanded Senior Citizens Act of 2010Kimboy Elizalde PanaguitonNo ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- Preferential TaxationDocument9 pagesPreferential TaxationMNo ratings yet

- TaxationDocument34 pagesTaxationPrincess akisha GumaruNo ratings yet

- SUMMARY OF TAX TABLES AND RATES Train LawDocument5 pagesSUMMARY OF TAX TABLES AND RATES Train LawErnest Christopher Viray GonzaludoNo ratings yet

- PT, Excise and DST NotesDocument10 pagesPT, Excise and DST NotesFayie De LunaNo ratings yet

- Value Added TaxDocument114 pagesValue Added TaxDa Yani ChristeeneNo ratings yet

- Policy Analysis On Ra 10963 (Train Law) : Written Report Applied Public Management and Policy Analysis (MPA 205)Document12 pagesPolicy Analysis On Ra 10963 (Train Law) : Written Report Applied Public Management and Policy Analysis (MPA 205)Meynard MagsinoNo ratings yet

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

- Coke Is An Important Industrial Product, Used Mainly in Iron Ore Smelting, But Also As A Fuel in Stoves and Forges When Air Pollution Is A ConcernDocument6 pagesCoke Is An Important Industrial Product, Used Mainly in Iron Ore Smelting, But Also As A Fuel in Stoves and Forges When Air Pollution Is A ConcernGf NavarroNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Preferential TaxationDocument8 pagesPreferential TaxationMary Jane PabroaNo ratings yet

- Fiscal Incentives Available To TEZ Operators and Registered EnterprisesDocument2 pagesFiscal Incentives Available To TEZ Operators and Registered EnterprisesJCNo ratings yet

- Special Tax Laws PDFDocument34 pagesSpecial Tax Laws PDFJAY AUBREY PINEDANo ratings yet

- Special Tax Laws Senior CitizensDocument35 pagesSpecial Tax Laws Senior CitizensMariaNo ratings yet

- Fiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZDocument2 pagesFiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZjerson_xx6816No ratings yet

- Module 5. Preferential TaxationDocument6 pagesModule 5. Preferential TaxationYolly DiazNo ratings yet

- Bus Tax Chap 2Document11 pagesBus Tax Chap 2David LijaucoNo ratings yet

- Vat On Sale of Services AND Use or Lease of PropertyDocument67 pagesVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesNo ratings yet

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesNo ratings yet

- TAX 302 VAT Exempt Transactions 1Document6 pagesTAX 302 VAT Exempt Transactions 1Jeen JeenNo ratings yet

- Handouts 56Document11 pagesHandouts 56Omar CabayagNo ratings yet

- Business Tax NotesDocument5 pagesBusiness Tax NotesRizzle RabadillaNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Lebanon TaxationDocument5 pagesLebanon TaxationShashank VarmaNo ratings yet

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- Jude Feliciano: What Are VAT Exempt Transactions in The Philippines?Document10 pagesJude Feliciano: What Are VAT Exempt Transactions in The Philippines?Michelle NacisNo ratings yet

- Special Individual Taxpayers: Investments Code)Document6 pagesSpecial Individual Taxpayers: Investments Code)shrineNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- Preferential TaxationDocument10 pagesPreferential TaxationAlex OngNo ratings yet

- Income Tax On CorporationDocument4 pagesIncome Tax On CorporationNikolai DanielovichNo ratings yet

- Vat Exempt TransactionDocument3 pagesVat Exempt TransactionDe Leon Patricia A.No ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- RR 11-18Document55 pagesRR 11-18Cuayo JuicoNo ratings yet

- Incotax Ho2021-11Document5 pagesIncotax Ho2021-11Jiaan HolgadoNo ratings yet

- Vat Exempt Transactions: Page 3 of 6Document4 pagesVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaNo ratings yet

- Special Tax LawsDocument33 pagesSpecial Tax LawsValerieNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- Summarized Updates From CREATE LawDocument3 pagesSummarized Updates From CREATE LawJansel ParagasNo ratings yet

- Value Added Tax (VAT) : Sec. 105 To 115Document52 pagesValue Added Tax (VAT) : Sec. 105 To 115Alice WuNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Tax 302 - Vat-Exempt TransactionsDocument6 pagesTax 302 - Vat-Exempt TransactionsiBEAYNo ratings yet

- VAT On ImportationDocument24 pagesVAT On ImportationShamae Duma-anNo ratings yet

- Kinds of Taxes in The PhilippinesDocument11 pagesKinds of Taxes in The PhilippinesARCHIE AJIASNo ratings yet

- Peza PDF FreeDocument15 pagesPeza PDF FreeIce Voltaire Buban GuiangNo ratings yet

- AN ALTERNATIVE GOVERNMENT SYSTEM: NEW PROVISIONAL INCOME TAX SYSTEM NEW ELECTION AND VOTING SYSTEMFrom EverandAN ALTERNATIVE GOVERNMENT SYSTEM: NEW PROVISIONAL INCOME TAX SYSTEM NEW ELECTION AND VOTING SYSTEMNo ratings yet

- 1st - LawDocument23 pages1st - LawPrankyJellyNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- Test I Test Ii Test IiiDocument2 pagesTest I Test Ii Test IiiPrankyJellyNo ratings yet

- Dahon CompanyDocument2 pagesDahon CompanyPrankyJellyNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Time Value of MoneyDocument5 pagesTime Value of MoneyPrankyJellyNo ratings yet

- BCDocument3 pagesBCPrankyJelly0% (1)

- Finance Can Be Defined AsDocument6 pagesFinance Can Be Defined AsPrankyJellyNo ratings yet

- D. Any of The Above, Depending Upon The Partnership AgreementDocument1 pageD. Any of The Above, Depending Upon The Partnership AgreementPrankyJellyNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- Salomon V. FrialDocument2 pagesSalomon V. FrialPrankyJellyNo ratings yet

- Stock AcquisitionDocument5 pagesStock AcquisitionPrankyJellyNo ratings yet

- EDocument12 pagesEPrankyJellyNo ratings yet

- Case Consti BBBBDocument2 pagesCase Consti BBBBPrankyJellyNo ratings yet

- Investment in EquityDocument1 pageInvestment in EquityPrankyJellyNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- Isap Accountancy Promotion and Retention: ST NDDocument2 pagesIsap Accountancy Promotion and Retention: ST NDPrankyJellyNo ratings yet

- Central Bank Employees Assoc V. BSPDocument6 pagesCentral Bank Employees Assoc V. BSPPrankyJellyNo ratings yet

- Derivatives and HedgingDocument3 pagesDerivatives and HedgingPrankyJellyNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocument10 pagesQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNo ratings yet

- Case 1: Use The Following Information For The Next Six ItemsDocument2 pagesCase 1: Use The Following Information For The Next Six ItemsPrankyJellyNo ratings yet

- Stat ConDocument3 pagesStat ConPrankyJellyNo ratings yet

- Cases ConstiDocument111 pagesCases ConstiPrankyJellyNo ratings yet

- Banking LawsDocument24 pagesBanking LawsPrankyJellyNo ratings yet

- Tax On PartnershipDocument3 pagesTax On PartnershipPrankyJellyNo ratings yet

- Second PreboardDocument3 pagesSecond PreboardPrankyJellyNo ratings yet

- Administrative Rules and RegulationsDocument2 pagesAdministrative Rules and RegulationsPrankyJellyNo ratings yet

- Calibration IDDocument8 pagesCalibration IDYuhin WuNo ratings yet

- r2004 01 105Document5 pagesr2004 01 105ihce2004No ratings yet

- ISCC 205 GHG Emissions 3.0Document43 pagesISCC 205 GHG Emissions 3.0imran.teknikkimiaNo ratings yet

- Lfbo Touuluse ChartDocument29 pagesLfbo Touuluse ChartAlpha DeltaNo ratings yet

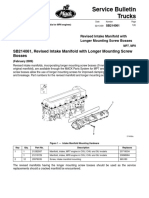

- Service Bulletin Trucks: SB214061, Revised Intake Manifold With Longer Mounting Screw BossesDocument2 pagesService Bulletin Trucks: SB214061, Revised Intake Manifold With Longer Mounting Screw BossesCEVegaONo ratings yet

- PorscheCroatia 2017 0109Document5,256 pagesPorscheCroatia 2017 0109Mihael CigićNo ratings yet

- Production of Ferro Metals (In Millipoints Per KG)Document7 pagesProduction of Ferro Metals (In Millipoints Per KG)Corina Cristina ConstantinescuNo ratings yet

- Chicco KidFit 2-In-1 Belt Positioning Booster Car Seat - Atmosphere BabyDocument1 pageChicco KidFit 2-In-1 Belt Positioning Booster Car Seat - Atmosphere Babyaline zimmermannNo ratings yet

- Triumph 2005 Rocket 3Document104 pagesTriumph 2005 Rocket 3dd241974100% (1)

- Maglev Train PPT 1Document12 pagesMaglev Train PPT 1Shelly Yadav100% (1)

- 001-MV. Ella 1.21.00001Document1 page001-MV. Ella 1.21.00001Slamet HandokoNo ratings yet

- GSFC MBA Porject Report Prince DudhatraDocument94 pagesGSFC MBA Porject Report Prince DudhatrapRiNcE DuDhAtRa100% (1)

- Convention/ Protocol ChartDocument2 pagesConvention/ Protocol ChartNurul BhuiyanNo ratings yet

- Gen 9 14R4 Spec SheetDocument1 pageGen 9 14R4 Spec SheetPfhfNo ratings yet

- Air India ExpressDocument10 pagesAir India ExpressGia TrungNo ratings yet

- 2 Libros General Training Module - 98 HojasDocument98 pages2 Libros General Training Module - 98 HojasHY YilianNo ratings yet

- 01 Autumn Full Line 2009Document81 pages01 Autumn Full Line 2009cdprofesionalNo ratings yet

- The Drive The Left. Not, They Don't. Yes, They DoDocument5 pagesThe Drive The Left. Not, They Don't. Yes, They DoBriggitte natalie Beltran torresNo ratings yet

- Solution Manual For Transportation A Global Supply Chain Perspective 9th Edition Robert A Novack Brian Gibson John J Coyle 2Document36 pagesSolution Manual For Transportation A Global Supply Chain Perspective 9th Edition Robert A Novack Brian Gibson John J Coyle 2beswikemysteryy6rp100% (53)

- Bill of Lading Not Negotiable: Shipper Provided Short Form OriginalDocument1 pageBill of Lading Not Negotiable: Shipper Provided Short Form OriginalGora PribadiNo ratings yet

- Construction - Traffic Management On Construction SitesDocument4 pagesConstruction - Traffic Management On Construction SitesTony_candyNo ratings yet

- Yth2042 TwinDocument44 pagesYth2042 TwinTiago ZeferinoNo ratings yet

- Fujairah National Shipping BrochureDocument6 pagesFujairah National Shipping BrochureChris RowlandNo ratings yet

- FAR 117 and Pilot Fatigue Guide REV 4 Oct 2014Document32 pagesFAR 117 and Pilot Fatigue Guide REV 4 Oct 2014raverj225805No ratings yet

- MSG97AL 722 Product Data BrochureDocument2 pagesMSG97AL 722 Product Data BrochureYAKOVNo ratings yet

- Artisan A4 Specification Sheet EnglishDocument9 pagesArtisan A4 Specification Sheet EnglishPiero Fabrizzio Mendoza FuenteNo ratings yet

- Analysis of Odd EvenDocument7 pagesAnalysis of Odd EvenMuhammad Edo FadhliNo ratings yet

- Mazda Guidelines For Factory Scheduled MaintenanceDocument3 pagesMazda Guidelines For Factory Scheduled MaintenancebeyondteckNo ratings yet